How our economic plan can help you

We’re turbocharging the construction of homes across the country, and protecting the rights of renters, first-time buyers, and homeowners.

Tax-free First Home Savings Account

Over 750,000 Canadians have opened an account to save for their first down payment, and save faster with the help of tax relief.

Protecting Renters’ Rights

Our new Canadian Renters’ Bill of Rights will protect renters from unfair practices, make leases simpler, and increase price transparency.

Enhancing the Canadian Mortgage Charter

The Canadian Mortgage Charter is helping to protect homeowners who are struggling with rising mortgage payments. We are enhancing it to make it easier for younger Canadians to buy their first home, by making sure renters get credit for their rent payments and allowing up to 30-year mortgage amortizations on new builds for first-time home buyers.

Transforming Canada’s social safety net to help young parents with the cost of raising a family.

National School Food Program

A new National School Food Program will ensure that children have the nutritious meals they need to succeed and get a fair start in life.

More $10-a-day Child Care Spaces

We’re on track to securing Canada-wide $10-a-day child care in every province and territory by 2026, and fees have already been cut by 50 per cent everywhere, saving families thousands of dollars. We’re building more spaces and training more early childhood educators to ensure every family can access affordable child care.

Dental Care for Canadians Who Need It

The Canadian Dental Care Plan is already rolling out for uninsured Canadians with a family income of less than $90,000, to ensure everyone can afford the dental care they deserve. By 2025, nine million Canadians will be covered.

Creating new opportunities for younger Canadians to get the education and skills they need for good-paying jobs.

Increasing Interest-Free Student Loans

Increasing Canada Student and Apprentice Loans and Grants, because everyone who wants to go to school should have the support they need to cover the costs.

More Work Experience and Skills Training for Youth

Helping young Canadians develop the skills and gain the work experience they need to achieve their dreams and get a good-paying job.

Canadian Apprenticeship Strategy

Supporting skilled trades workers by tooling up training programs and creating more apprenticeship positions to ensure young apprentices succeed.

Helping Canadians keep more of their money and build a better life by stabilizing the cost of everyday essentials.

Stabilizing the Cost of Groceries

Enhancing competition and monitoring grocers’ work to help stabilize prices, and lowering costs for the farmers who grow our food.

National Pharmacare Program

New programs to help with the cost of going to the dentist and pharmacy, including the cost of contraceptives and insulin, will further ease the financial burden on Canadians.

Cheaper Internet, Home Phone, and Cell Phone Plans

Lowering costs of plans, reducing junk fees, and giving Canadians more choice to switch providers and find better deals.

After a lifetime of working hard—Canadians deserve to know they will be secure and comfortable in retirement.

A Stronger Canada Pension Plan

Enhancing the CPP to increase pension benefits by up to 50 per cent.

Supporting Long-Term Care

Advancing the Safe Long Term Care Act to support new national long-term care standards.

Bigger Benefits for Seniors

Increased Old Age Security and Guaranteed Income Supplement ensures seniors have the financial support they need in retirement.

Budget 2024 highlights

750,000+

Tax-Free First Home Savings Accounts opened

by Canadians

Solving the Housing Crisis:

Canada’s Housing Plan

Unlocking 3.87 million net new homes by 2031, to ensure everyone can find an affordable place to call home. And, we’re making it easier to rent while saving for that first home.

- Changing how we build homes

- Unlocking 250,000 new homes on public lands

- The strengthened Canadian Mortgage Charter

Learn more about making homes more affordable.

Fairness for younger generations

The government is helping restore fairness for Millennials and Gen Z by making education, housing, and the everyday costs of living more affordable.

- Increasing student grants and loans to keep up with the costs of an education

- Launching a new Youth Mental Health Fund for access to support they need

- Providing job placement and employment support opportunities through the Youth Employment and Skills Strategy

Learn more about the government’s plan to ensure fairness for younger generations.

90,000 new job opportunities for youth

Investing $2.4 billion to secure Canada’s AI advantage

Economic growth and productivity

Budget 2024 makes investments in innovation, growth, and increased productivity in Canada.

Budget 2024 includes new measures to accelerate job growth in Canada’s AI sector and beyond, boost productivity by helping researchers and businesses develop and adopt AI, and ensure this is done responsibly.

- Investing in Canada’s AI ecosystem

- Enhancing research support with $1.8 billion more in core research grant funding

- Creating the Canadian Entrepreneurs’ Incentive

Learn more about the government’s plan to enhance innovation and productivity in Canada.

Unlocking 3.87 million new homes by 2031.

Over 1.1 million more Canadians employed today than before the pandemic.

Affordable child care is supporting a record high 85.4% labour force participation rate for working aged women.

Economic and Fiscal Overview

The State of Canada’s Economy

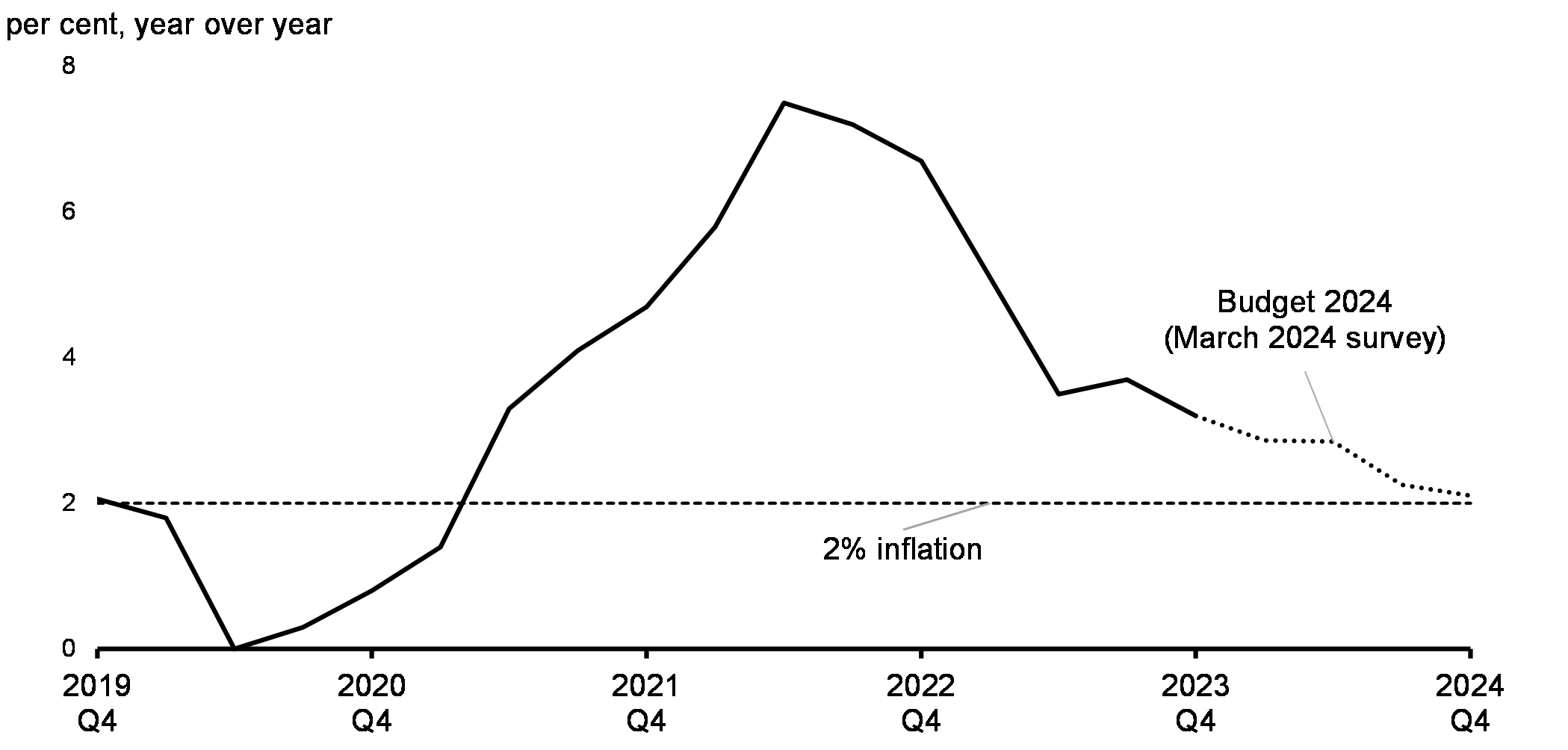

The Canadian economy is outperforming expectations. Both the IMF and the OECD project Canada to see the strongest economic growth in the G7 in 2025. In the face of higher interest rates, Canada has avoided the recession that some had predicted. Headline inflation has fallen significantly from its June 2022 peak of 8.1 per cent to 2.8 per cent in February 2024.

Chart 6

Consumer Price Inflation Outlook

Note: Last data point is 2024Q4.

Sources: Statistics Canada; Department of Finance Canada March 2024 survey of private sector economists.

Text Version

| Actual | Budget 2024 (March 2024 survey) |

2% inflation | |

|---|---|---|---|

| 2019 Q4 |

2.1 | 2.0 | |

| 2020 Q1 |

1.8 | 2.0 | |

| 2020 Q2 |

0.0 | 2.0 | |

| 2020 Q3 |

0.3 | 2.0 | |

| 2020 Q4 |

0.8 | 2.0 | |

| 2021 Q1 |

1.4 | 2.0 | |

| 2021 Q2 |

3.3 | 2.0 | |

| 2021 Q3 |

4.1 | 2.0 | |

| 2021 Q4 |

4.7 | 2.0 | |

| 2022 Q1 |

5.8 | 2.0 | |

| 2022 Q2 |

7.5 | 2.0 | |

| 2022 Q3 |

7.2 | 2.0 | |

| 2022 Q4 |

6.7 | 2.0 | |

| 2023 Q1 |

5.1 | 2.0 | |

| 2023 Q2 |

3.5 | 2.0 | |

| 2023 Q3 |

3.7 | 2.0 | |

| 2023 Q4 |

3.2 | 3.2 | 2.0 |

| 2024 Q1 |

2.9 | 2.0 | |

| 2024 Q2 |

2.8 | 2.0 | |

| 2024 Q3 |

2.3 | 2.0 | |

| 2024 Q4 |

2.1 | 2.0 | |

| 2025 Q1 |

2.0 | ||

| 2025 Q2 |

2.0 | ||

| 2025 Q3 |

2.0 | ||

| 2025 Q4 |

2.0 | ||

| 2026 Q1 |

2.0 | ||

| 2026 Q2 |

2.0 | ||

| 2026 Q3 |

2.0 | ||

| 2026 Q4 |

2.0 |

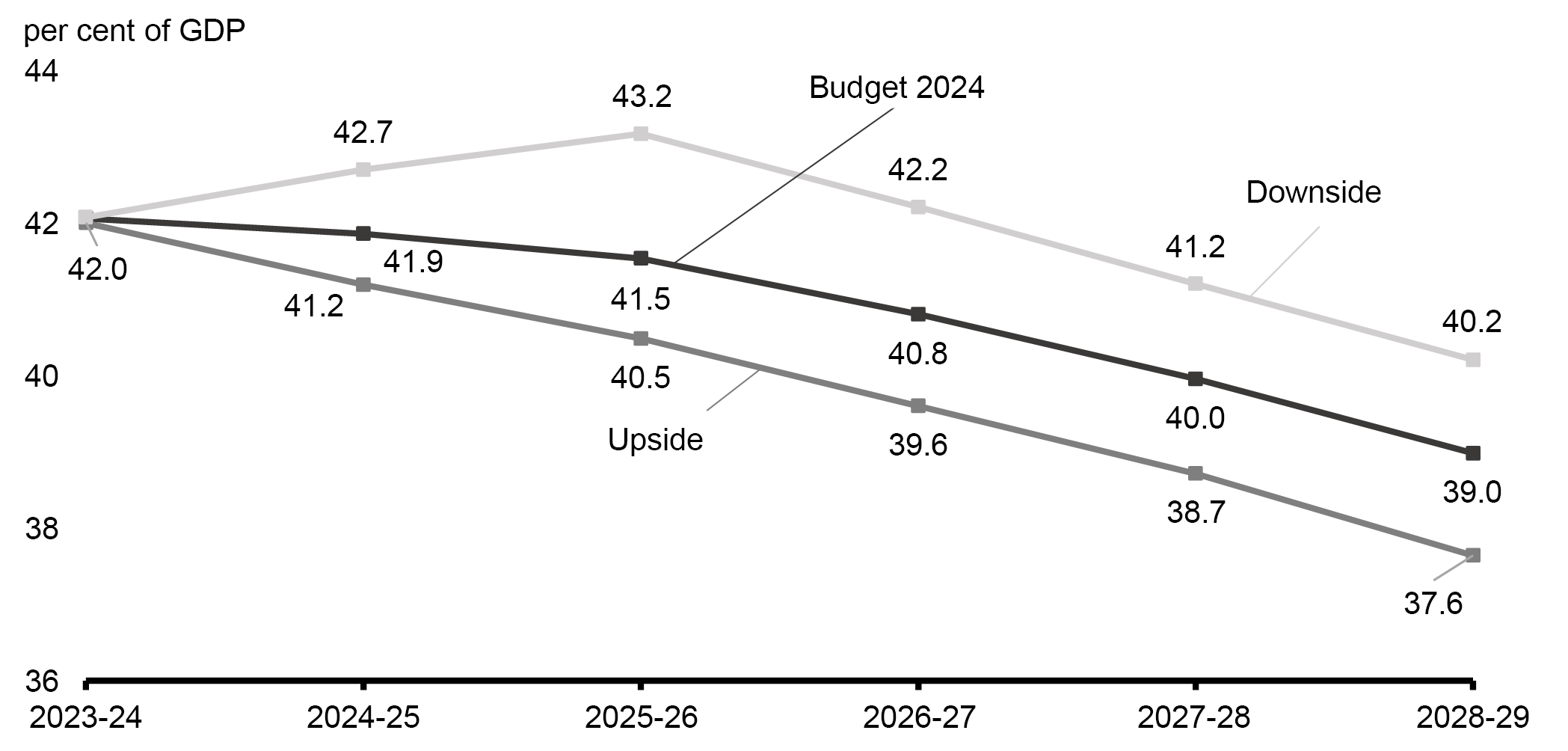

Economic and Fiscal Projections

We’re asking the wealthiest to pay a bit more, their fair share, to keep taxes lower on the middle class, and ensure the next generation inherits not more debt, but Canada’s prosperity.

Budget 2024 is investing in fairness for every generation while delivering on our fiscal objectives. Canada is maintaining the lowest net debt- and deficit-to-GDP ratios in the G7, preserving Canada’s long-term fiscal sustainability.

Chart 21

Federal Debt-to-GDP Ratio Under Economic Scenarios

Sources: Department of Finance Canada March 2024 survey of private sector economists; Department of Finance Canada calculations.

Text Version

| 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

|---|---|---|---|---|---|---|

| Budget 2024 | 42.1 | 41.9 | 41.5 | 40.8 | 40.0 | 39.0 |

| Upside | 42.0 | 41.2 | 40.5 | 39.6 | 38.7 | 37.6 |

| Downside | 42.1 | 42.7 | 43.2 | 42.2 | 41.2 | 40.2 |

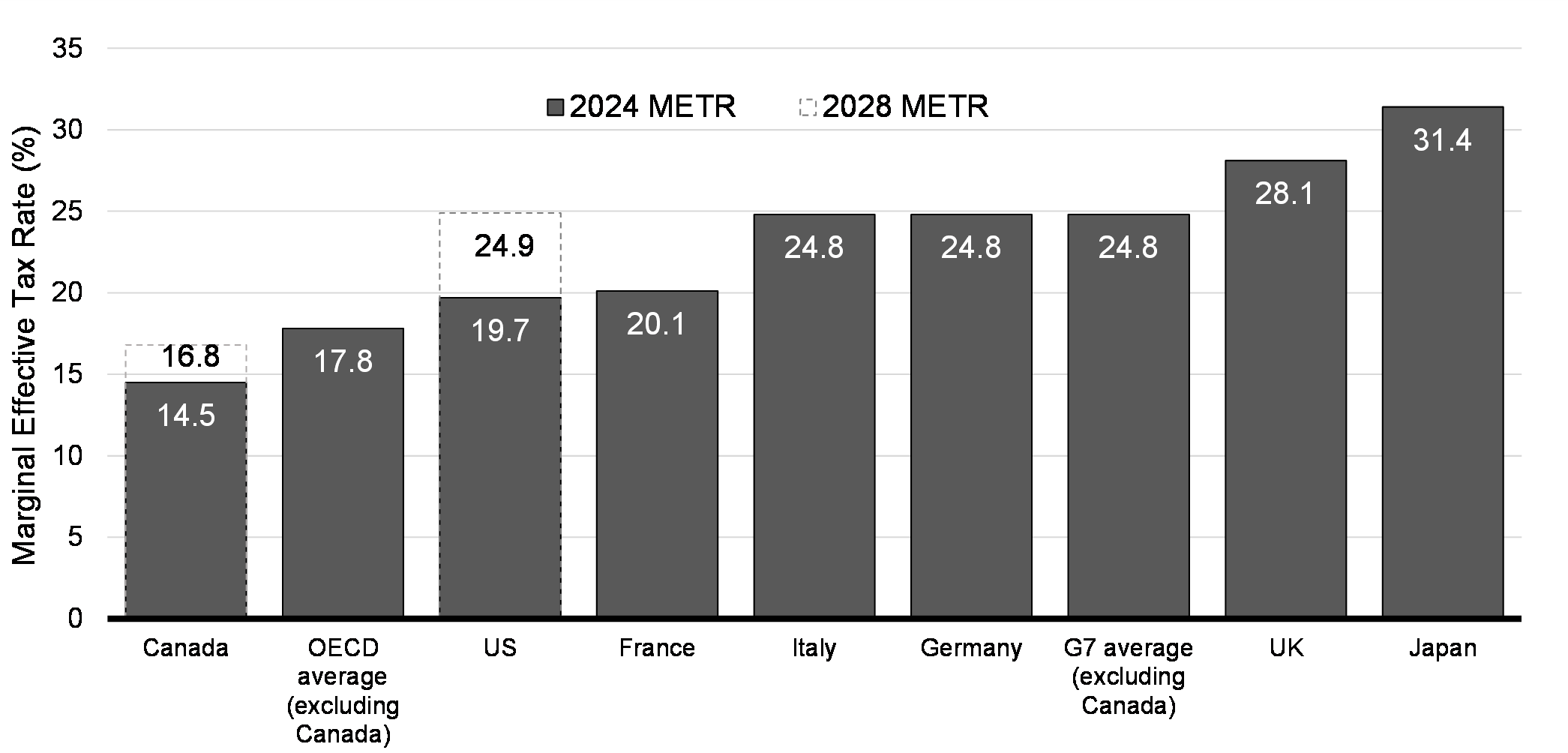

Improving Tax Fairness for Every Generation

Tax fairness is important for every generation, and it is particularly significant for younger Canadians.

To make the tax system more fair for 99.87 per cent of Canadians, the inclusion rate for capital gains—the portion on which tax is paid—for the wealthiest with more than $250,000 in capital gains in a year will increase from one-half to two-thirds. Only 0.13 per cent of Canadians with an average income of $1.42 million are expected to pay more personal income tax on their capital gains in any given year.

Principal residences will continue to be exempt from capital gains.

Chart 8.4

Canada Has the Lowest Marginal Effective Tax Rate in the G7

Text Version

| 2024 METR | 2028 METR | |

|---|---|---|

| Canada | 14.5 | 16.8 |

| OECD average (excluding Canada) | 17.8 | |

| US | 19.7 | 24.9 |

| France | 20.1 | |

| Italy | 24.8 | |

| Germany | 24.8 | |

| G7 average (excluding Canada) | 24.8 | |

| UK | 28.1 | |

| Japan | 31.4 |

Backgrounders

PDF downloads

Page details

- Date modified: