Archived - Chapter 4:

Economic Growth for Every Generation

On this page:

Impacts report

Find out more about the expected gender and diversity impacts for each measure in Chapter 4: Economic Growth for Every Generation

To ensure every Canadian succeeds in the 21st century, we must grow our economy to be more innovative and productive. One where every Canadian can reach their full potential, where every entrepreneur has the tools they need to grow their business, and where hard work pays off. Building the economy of the future is about creating jobs: jobs in the knowledge economy, jobs in manufacturing, jobs in mining and forestry, jobs in the trades, jobs in clean energy, and jobs across the economy, in all regions of the country.

To do this, the government's economic plan is investing in the technologies, incentives, and supports critical to increasing productivity, fostering innovation, and attracting more private investment to Canada. This is how we'll build an economy that unlocks new pathways for every generation to earn their fair share.

The government is targeting investments to make sure Canada continues to lead in the economy of the future, and these are already generating stronger growth and meaningful new job opportunities for Canadians. New jobs—from construction to manufacturing to engineering—in clean technology, in clean energy, and in innovation, are just the start. All of this, helping to attract further investment to create more opportunities, will raise Canada's productivity and competitiveness. This will create more good jobs, and in turn, raise the living standards of all Canadians.

We are at a pivotal moment where we can choose to renew and redouble our investments in the economy of the future, to build an economy that is more productive and more competitive—or risk leaving an entire generation behind. We will not make that mistake. We owe it to our businesses, to our innovators, and most of all, to the upcoming generations of workers, to make sure that the Canadian economy is positioned to thrive in a changing world.

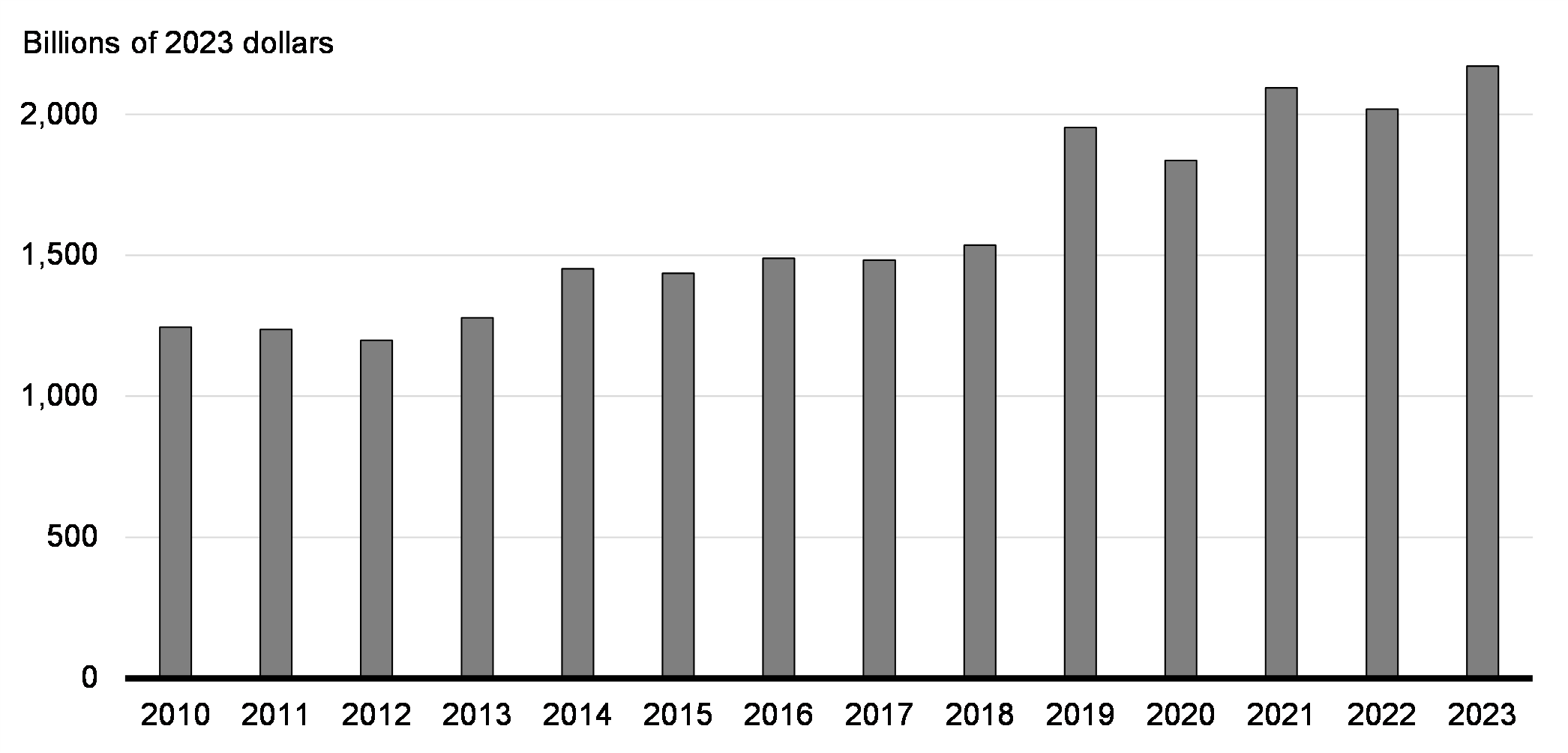

Canada has the best-educated workforce in the world. We are making investments to ensure every generation of workers has the skills the job market, and the global economy, are looking for—and this will help us attract private investment to grow the economy (Chart 4.1). Building on our talented workforce, we are delivering, on a priority basis, our $93 billion suite of major economic investment tax credits to drive growth, secure the future of Canadian businesses in Canada, and create good jobs for generations to come.

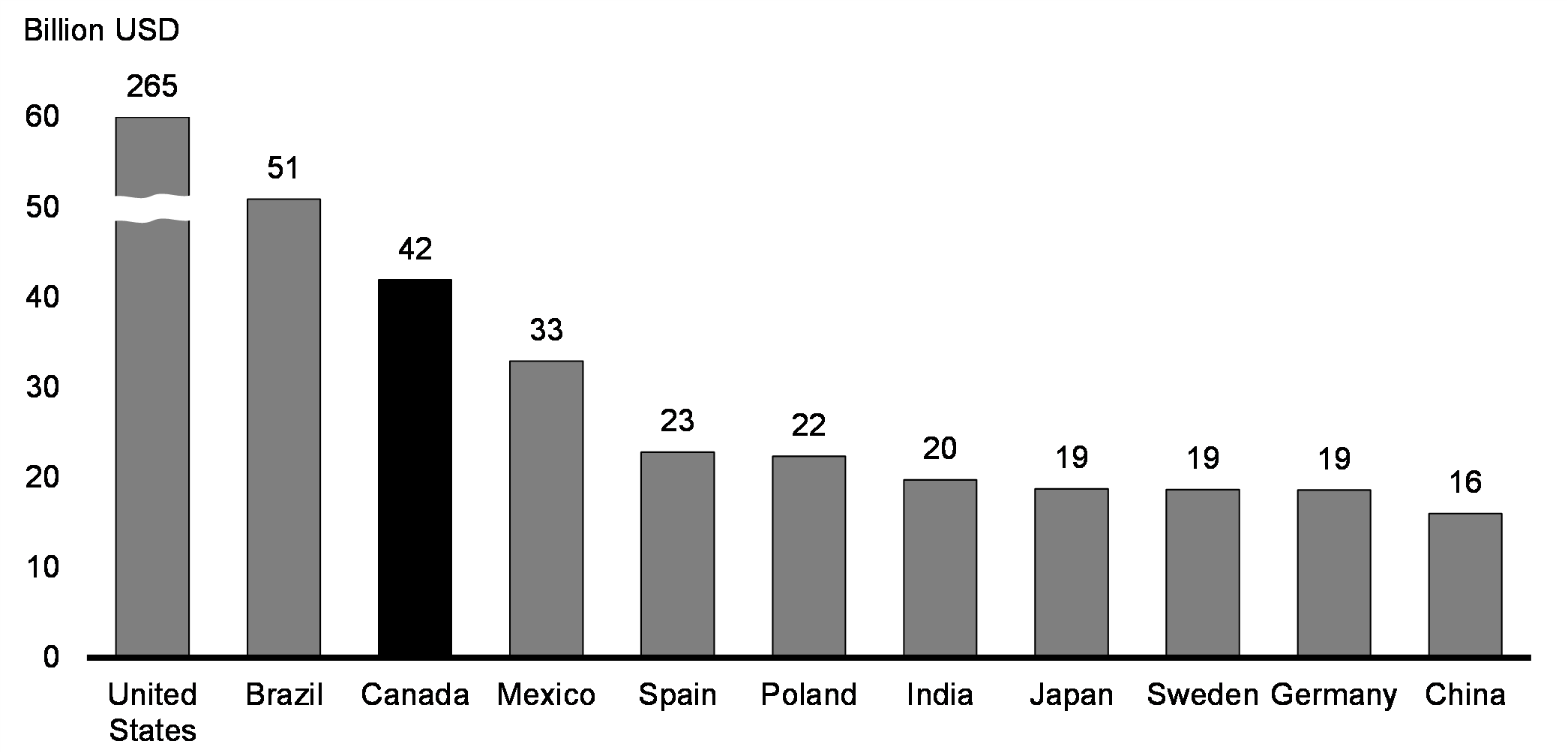

In the first three quarters of 2023, Canada had the highest level of foreign direct investment (FDI) on a per capita basis among G7 countries, and ranked third globally in total FDI, after the U.S. and Brazil (Chart 4.2).

Stock of Foreign Direct Investment into Canada

Canada Attracted the Third Most Foreign Direct Investment in 2023

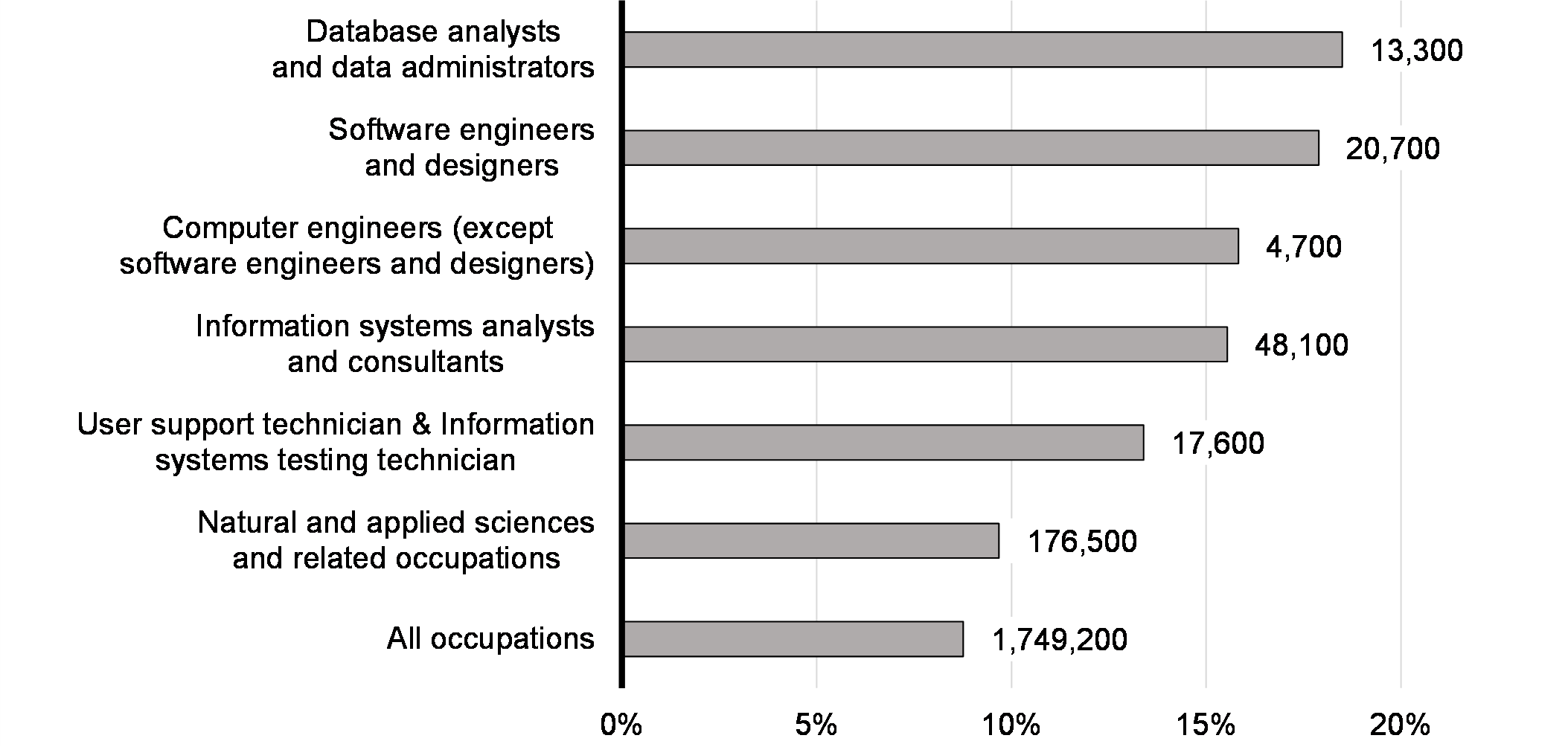

Projected Skilled Employment Growth, 2023-2031

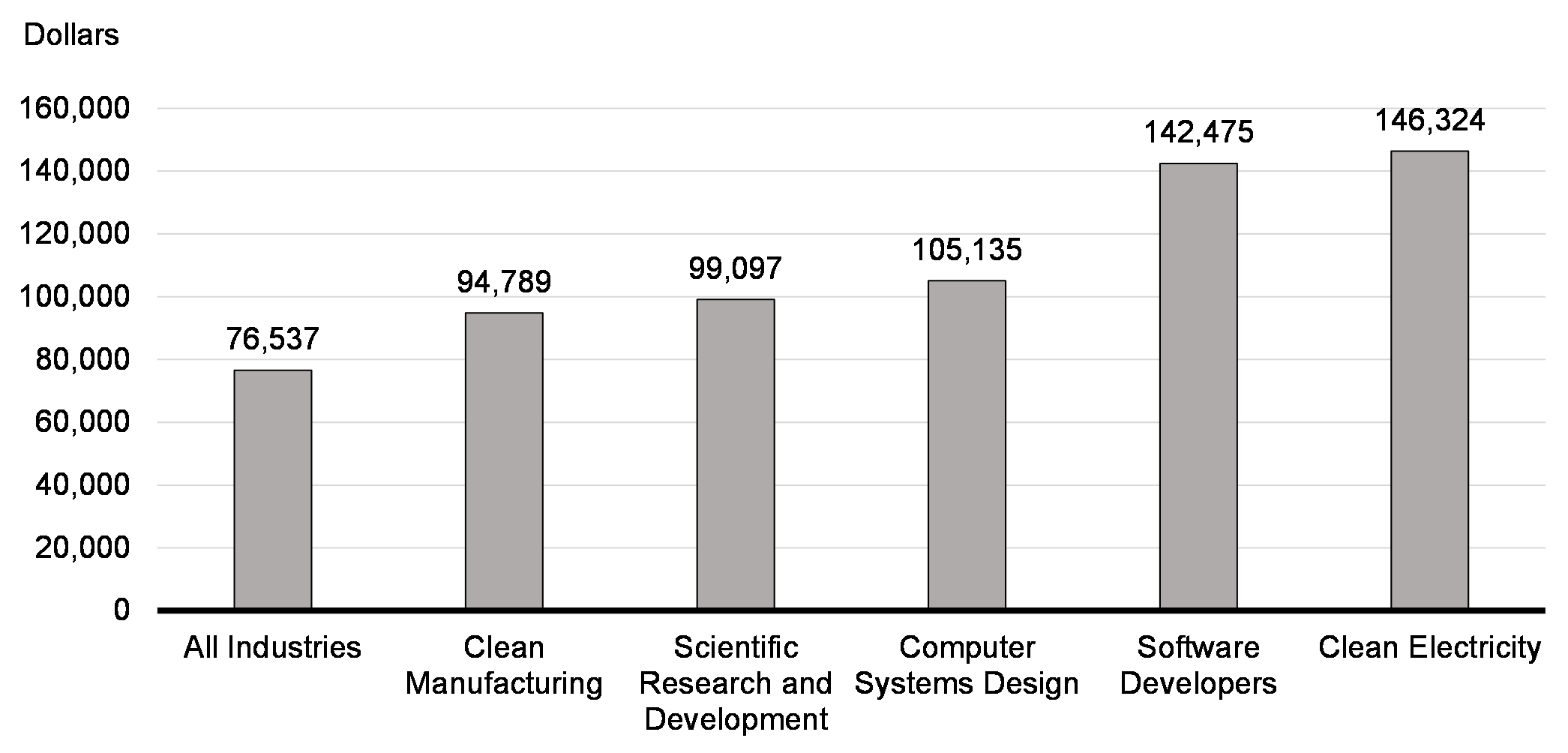

The Canadian economy is adding new, high-paying jobs, in high-growth sectors, like clean tech, clean electricity, and scientific research and development (Chart 4.4). Budget 2024 will continue this momentum by making strategic investments that create opportunities for workers today—driving productivity and economic growth for generations to come.

Average Annual Wages in Select Industries, 2022

4.1 Boosting Research, Innovation, and Productivity

Canada's skilled hands and brilliant minds are our greatest resource. Capitalizing on their ideas, innovations, and hard work is an essential way to keep our place at the forefront of the world's advanced economies. Our world-class innovators, entrepreneurs, scientists, and researchers are solving the most pressing challenges of today, and their discoveries help launch the businesses of tomorrow.

Canadian researchers, entrepreneurs, and companies are the driving force of this progress—from scientific discovery to bringing new solutions to market. They also train and hire younger Canadians who will become the next generation of innovators. New investments to boost research and innovation, including enhancing support for graduate students and post-doctoral fellows, will ensure Canada remains a world leader in science and new technologies, like artificial intelligence.

By making strategic investments today in innovation and research, and supporting the recruitment and development of talent in Canada, we can ensure Canada is a world leader in new technologies for the next generation. In turn, this will drive innovation, growth, and productivity across the economy.

Key Ongoing Actions

-

Supporting scientific discovery, developing Canadian research talent, and attracting top researchers from around the planet to make Canada their home base for their important work with more than $16 billion committed since 2016.

-

Supporting critical emerging sectors, through initiatives like the Pan-Canadian Artificial Intelligence Strategy, the National Quantum Strategy, the Pan-Canadian Genomics Strategy, and the Biomanufacturing and Life Sciences Strategy.

-

Nearly $2 billion to fuel Canada's Global Innovation Clusters to grow these innovation ecosystems, promote commercialization, support intellectual property creation and retention, and scale Canadian businesses.

-

Investing $3.5 billion in the Sustainable Canadian Agricultural Partnership to strengthen the innovation, competitiveness, and resiliency of the agriculture and agri-food sector.

-

Flowing up to $333 million over the next decade to support dairy sector investments in research, product and market development, and processing capacity for solids non-fat, thus increasing its competitiveness and productivity.

Strengthening Canada's AI Advantage

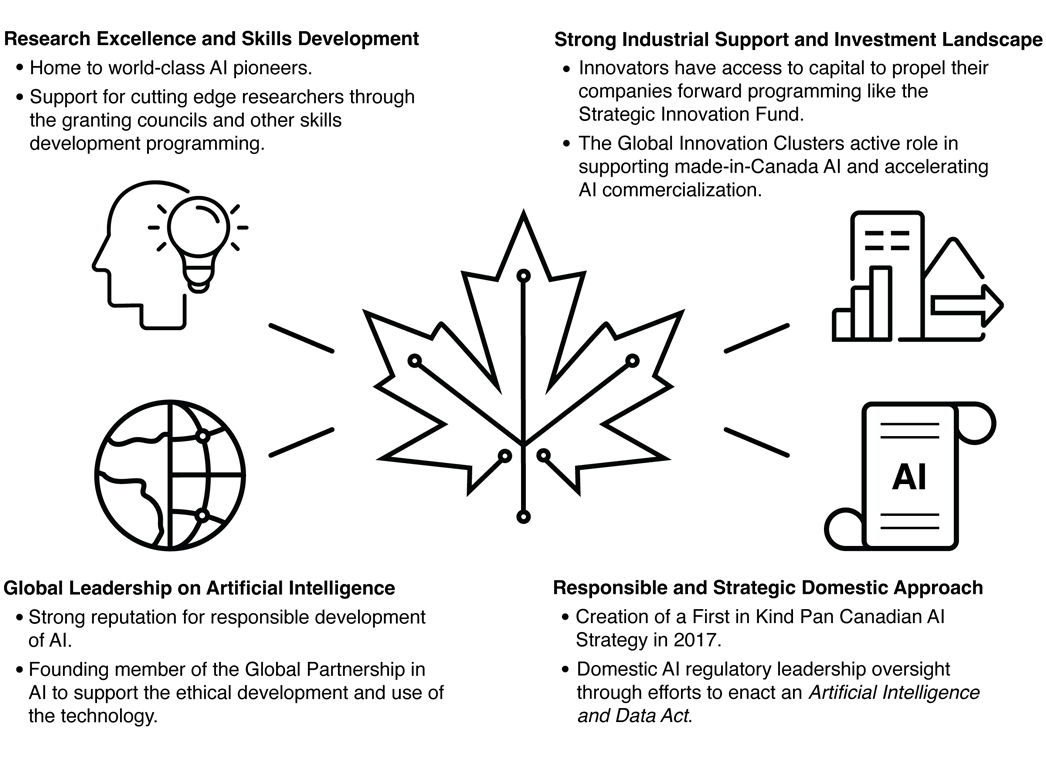

Canada's artificial intelligence (AI) ecosystem is among the best in the world. Since 2017, the government has invested over $2 billion towards AI in Canada. Fuelled by those investments, Canada is globally recognized for strong AI talent, research, and its AI sector.

Today, Canada's AI sector is ranked first in the world for growth of women in AI, and first in the G7 for year-over-year growth of AI talent. Every year since 2019, Canada has published the most AI-related papers, per capita, in the G7. Our AI firms are filing patents at three times the average rate in the G7, and they are attracting nearly a third of all venture capital in Canada. In 2022-23, there were over 140,000 actively engaged AI professionals in Canada, an increase of 29 per cent compared to the previous year. These are just a few of Canada's competitive advantages in AI and we are aiming even higher.

To secure Canada's AI advantage, the government has already:

-

Established the first national AI strategy in the world through the Pan-Canadian Artificial Intelligence Strategy;

-

Supported access to advanced computing capacity, including through the recent signing of a letter of intent with NVIDIA and a Memorandum of Understanding with the U.K. government; and,

-

Scaled-up Canadian AI firms through the Strategic Innovation Fund and Global Innovation Clusters program.

Building on Canada's AI Advantage

AI is a transformative economic opportunity for Canada and the government is committed to doing more to support our world-class research community, launch Canadian AI businesses, and help them scale-up to meet the demands of the global economy. The processing capacity required by AI is accelerating a global push for the latest technology, for the latest computing infrastructure.

Currently, most compute capacity is located in other countries. Challenges accessing compute power slows down AI research and innovation, and also exposes Canadian firms to a reliance on privately-owned computing, outside of Canada. This comes with dependencies and security risks. And, it is a barrier holding back our AI firms and researchers.

We need to break those barriers to stay competitive in the global AI race and ensure workers benefit from the higher wages of AI transformations; we must secure Canada's AI advantage. We also need to ensure workers who fear their jobs may be negatively impacted by AI have the tools and skills training needed in a changing economy.

To secure Canada's AI advantage Budget 2024 announces a monumental increase in targeted AI support of $2.4 billion, including:

-

$2 billion over five years, starting in 2024-25, to launch a new AI Compute Access Fund and Canadian AI Sovereign Compute Strategy, to help Canadian researchers, start-ups, and scale-up businesses access the computational power they need to compete and help catalyze the development of Canadian-owned and located AI infrastructure.

-

$200 million over five years, starting in 2024-25, to boost AI start-ups to bring new technologies to market, and accelerate AI adoption in critical sectors, such as agriculture, clean technology, health care, and manufacturing. This support will be delivered through Canada's Regional Development Agencies.

-

$100 million over five years, starting in 2024-25, for the National Research Council's AI Assist Program to help Canadian small- and medium-sized businesses and innovators build and deploy new AI solutions, potentially in coordination with major firms, to increase productivity across the country.

-

$50 million over four years, starting in 2025-26, to support workers who may be impacted by AI, such as creative industries. This support will be delivered through the Sectoral Workforce Solutions Program, which will provide new skills training for workers in potentially disrupted sectors and communities.

The government will engage with industry partners and research institutes to swiftly implement AI investment initiatives, fostering collaboration and innovation across sectors for accelerated technological advancement.

Safe and Responsible Use of AI

AI has tremendous economic potential, but as with all technology, it presents important considerations to ensure its safe development and implementation. Canada is a global leader in responsible AI and is supporting an AI ecosystem that promotes responsible use of technology. From development through to implementation and beyond, the government is taking action to protect Canadians from the potentially harmful impacts of AI.

The government is committed to guiding AI innovation in a positive direction, and to encouraging the responsible adoption of AI technologies by Canadians and Canadian businesses. To bolster efforts to ensure the responsible use of AI:

-

Budget 2024 proposes to provide $50 million over five years, starting in 2024-25, to create an AI Safety Institute of Canada to ensure the safe development and deployment of AI. The AI Safety Institute will help Canada better understand and protect against the risks of advanced and generative AI systems. The government will engage with stakeholders and international partners with competitive AI policies to inform the final design and stand-up of the AI Safety Institute.

-

Budget 2024 also proposes to provide $5.1 million in 2025-26 to equip the AI and Data Commissioner Office with the necessary resources to begin enforcing the proposed Artificial Intelligence and Data Act.

-

Budget 2024 proposes $3.5 million over two years, starting in 2024-25, to advance Canada's leadership role with the Global Partnership on Artificial Intelligence, securing Canada's leadership on the global stage when it comes to advancing the responsible development, governance, and use of AI technologies internationally.

Using AI to Keep Canadians Safe

AI has shown incredible potential to toughen up security systems, including screening protocols for air cargo. Since 2012, Transport Canada has been testing innovative approaches to ensure that air cargo coming into Canada is safe, protecting against terrorist attacks. This included launching a pilot project to screen 10 to 15 per cent of air cargo bound for Canada and developing an artificial intelligence system for air cargo screening.

-

Budget 2024 proposes to provide $6.7 million over five years, starting in 2024-25, to Transport Canada to establish the Pre-Load Air Cargo Targeting Program to screen 100 per cent of air cargo bound for Canada. This program, powered by cutting-edge artificial intelligence, will increase security and efficiency, and align Canada's air security regime with those of its international partners.

Incentivizing More Innovation and Productivity

Businesses that invest in cutting-edge technologies are a key driver of Canada's economic growth. When businesses make investments in technology—from developing new patents to implementing new IT systems—it helps ensure Canadian workers put their skills and knowledge to use, improves workplaces, and maximizes our workers' potential and Canada's economic growth.

The government wants to encourage Canadian businesses to invest in the capital—both tangible and intangible—that will help them boost productivity and compete productively in the economy of tomorrow.

-

To incentivize investment in innovation-enabling and productivity-enhancing assets, Budget 2024 proposes to allow businesses to immediately write off the full cost of investments in patents, data network infrastructure equipment, computers, and other data processing equipment. Eligible investments, as specified in the relevant capital cost allowance classes, must be acquired and put in use on or after Budget Day and before January 1, 2027. The cost of this measure is estimated at $725 million over five years, starting in 2024-25.

Boosting R&D and Intellectual Property Retention

Research and development (R&D) is a key driver of productivity and growth. Made-in-Canada innovations meaningfully increase our gross domestic product (GDP) per capita, create good-paying jobs, and secure Canada's position as a world-leading advanced economy.

To modernize and improve the Scientific Research and Experimental Development (SR&ED) tax incentives, the federal government launched consultations on January 31, 2024, to explore cost-neutral ways to enhance the program to better support innovative businesses and drive economic growth. In these consultations, which closed on April 15, 2024, the government asked Canadian researchers and innovators for ways to better deliver SR&ED support to small- and medium-sized Canadian businesses and enable the next generation of innovators to scale-up, create jobs, and grow the economy.

-

Budget 2024 announces the government is launching a second phase of consultations on more specific policy parameters, to hear further views from businesses and industry on specific and technical reforms. This includes exploring how Canadian public companies could be made eligible for the enhanced credit. Further details on the consultation process will be released shortly on the Department of Finance Canada website.

-

Budget 2024 proposes to provide $600 million over four years, starting in 2025-26, with $150 million per year ongoing for future enhancements to the SR&ED program. The second phase of consultations will inform how this funding could be targeted to boost research and innovation.

On January 31, 2024, the government also launched consultations on creating a patent box regime to encourage the development and retention of intellectual property in Canada. The patent box consultation closed on April 15, 2024. Submissions received through this process, which are still under review, will help inform future government decisions with respect to a patent box regime.

Enhancing Research Support

Since 2016, the federal government has committed more than $16 billion in research, including funding for the federal granting councils—the Natural Sciences and Engineering Research Council (NSERC), the Canadian Institutes of Health Research (CIHR), and the Social Sciences and Humanities Research Council (SSHRC).

This research support enables groundbreaking discoveries in areas such as climate change, health emergencies, artificial intelligence, and psychological health. This plays a critical role in solving the world's greatest challenges, those that will have impacts for generations.

Canada's granting councils already do excellent work within their areas of expertise, but more needs to be done to maximize their effect. The improvements we are making today, following extensive consultations including with the Advisory Panel on the Federal Research Support System, will strengthen and modernize Canada's federal research support.

-

To increase core research grant funding and support Canadian researchers, Budget 2024 proposes to provide $1.8 billion over five years, starting in 2024-25, with $748.3 million per year ongoing to SSHRC, NSERC, and CIHR.

-

To provide better coordination across the federally funded research ecosystem, Budget 2024 announces the government will create a new capstone research funding organization. The granting councils will continue to exist within this new organization, and continue supporting excellence in investigator-driven research, including linkages with the Health portfolio. This new organization and structure will also help to advance internationally collaborative, multi-disciplinary, and mission-driven research. The government is delivering on the Advisory Panel's observation that more coordination is needed to maximize the impact of federal research support across Canada's research ecosystem.

-

To help guide research priorities moving forward, Budget 2024 also announces the government will create an advisory Council on Science and Innovation. This Council will be made up of leaders from the academic, industry, and not-for-profit sectors, and be responsible for a national science and innovation strategy to guide priority setting and increase the impact of these significant federal investments.

-

Budget 2024 also proposes to provide a further $26.9 million over five years, starting in 2024-25, with $26.6 million in remaining amortization and $6.6 million ongoing, to the granting councils to establish an improved and harmonized grant management system.

The government will also work with other key players in the research funding system—the provinces, territories, and Canadian industry—to ensure stronger alignment, and greater co-funding to address important challenges, notably Canada's relatively low level of business R&D investment.

More details on these important modernization efforts will be announced in the 2024 Fall Economic Statement.

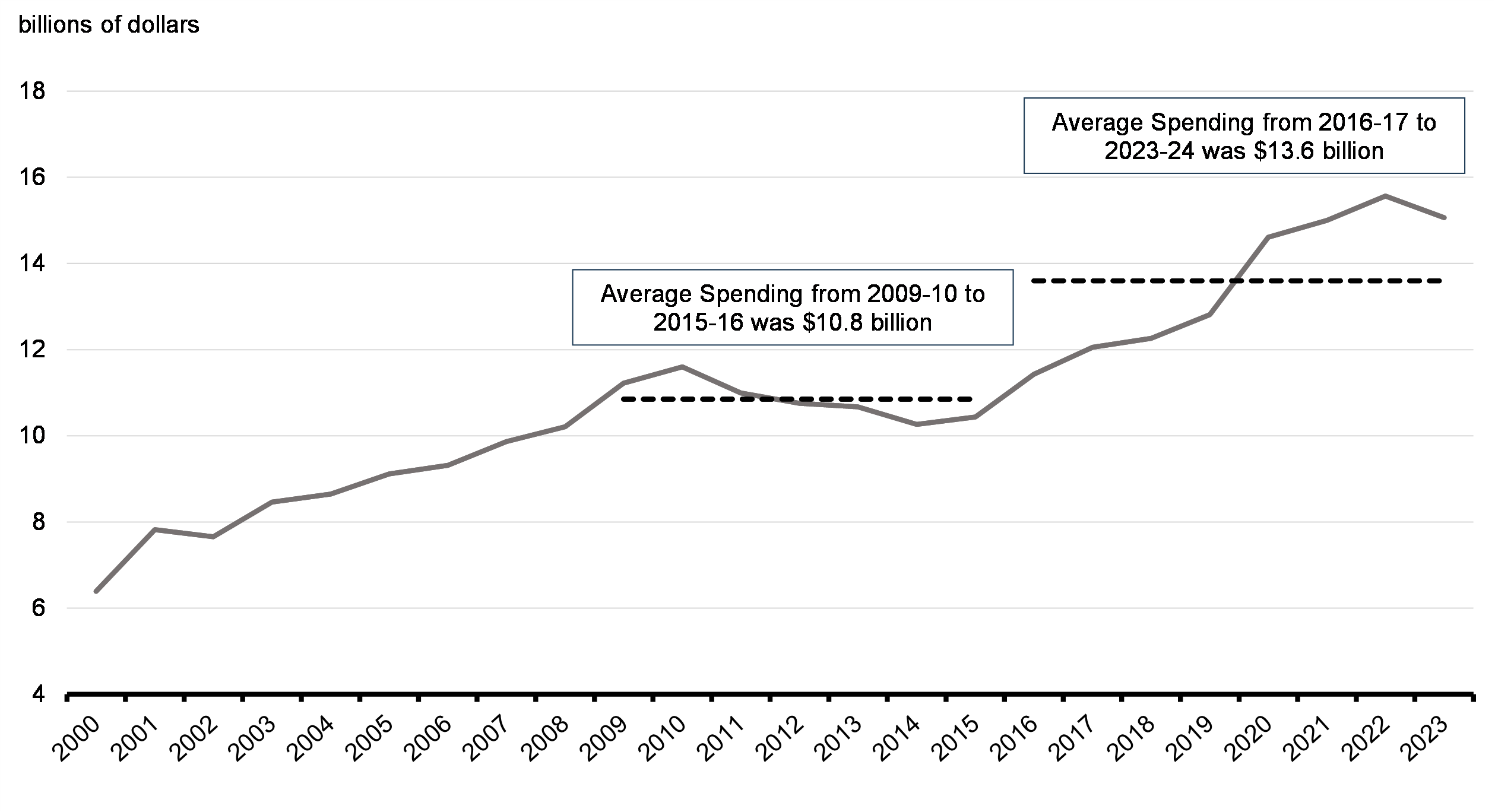

World-Leading Research Infrastructure

Modern, high-quality research facilities and infrastructure are essential for breakthroughs in Canadian research and science. These laboratories and research centres are where medical and other scientific breakthroughs are born, helping to solve real-world problems and create the economic opportunities of the future. World-leading research facilities will attract and train the next generation of scientific talent. That's why, since 2015, the federal government has made unprecedented investments in science and technology, at an average of $13.6 billion per year, compared to the average from 2009-10 to 2015-16 of just $10.8 billion per year. But we can't stop here.

To advance the next generation of cutting-edge research, Budget 2024 proposes major research and science infrastructure investments, including:

-

$399.8 million over five years, starting in 2025-26, to support TRIUMF, Canada's sub-atomic physics research laboratory, located on the University of British Columbia's Vancouver campus. This investment will upgrade infrastructure at the world's largest cyclotron particle accelerator, positioning TRIUMF, and the partnering Canadian research universities, at the forefront of physics research and enabling new medical breakthroughs and treatments, from drug development to cancer therapy.

-

$176 million over five years, starting in 2025‑26, to CANARIE, a national not-for-profit organization that manages Canada's ultra high-speed network to connect researchers, educators, and innovators, including through eduroam. With network speeds hundreds of times faster, and more secure, than conventional home and office networks, this investment will ensure this critical infrastructure can connect researchers across Canada's world-leading post-secondary institutions.

-

$83.5 million over three years, starting in 2026-27 to extend support to Canadian Light Source in Saskatoon. Funding will continue the important work at the only facility of its kind in Canada. A synchrotron light source allows scientists and researchers to examine the microscopic nature of matter. This specialized infrastructure contributes to breakthroughs in areas ranging from climate-resistant crop development to green mining processes.

-

$45.5 million over five years, starting in 2024-25, to support the Arthur B. McDonald Canadian Astroparticle Physics Research Institute, a network of universities and institutes that coordinate astroparticle physics expertise. Headquartered at Queen's University in Kingston, Ontario, the institute builds on the legacy of Dr. McDonald's 2015 Nobel Prize for his work on neutrino physics. These expert engineers, technicians, and scientists design, construct, and operate the experiments conducted in Canada's underground and underwater research infrastructure, where research into dark matter and other mysterious particles thrives. This supports innovation in areas like clean technology and medical imaging, and educates and inspires the next wave of Canadian talent.

-

$30 million over three years, starting in 2024-25, to support the completion of the University of Saskatchewan's Centre for Pandemic Research at the Vaccine and Infectious Disease Organization in Saskatoon. This investment will enable the study of high-risk pathogens to support vaccine and therapeutic development, a key pillar in Canada's Biomanufacturing and Life Sciences Strategy. Of this amount, $3 million would be sourced from the existing resources of Prairies Economic Development Canada.

These new investments build on existing federal research support:

-

The Strategic Science Fund, which announced the results of its first competition in December 2023, providing support to 24 third-party science and research organizations starting in 2024-25;

-

Canada recently concluded negotiations to be an associate member of Horizon Europe, which would enable Canadians to access a broader range of research opportunities under the European program starting this year; and,

-

The steady increase in federal funding for extramural and intramural science and technology by the government which was 44 per cent higher in 2023 relative to 2015.

Federal Investments in Science and Technology

Investing in Homegrown Research Talent

Canada's student and postgraduate researchers are tackling some of the world's biggest challenges. The solutions they come up with have the potential to make the world a better place and drive Canadian prosperity. They are the future Canadian academic and scientific excellence, who will create new innovative businesses, develop new ways to boost productivity, and create jobs as they scale-up companies—if they get the support they need.

To build a world-leading, innovative economy, and improve our productive capacity, the hard work of top talent must pay off; we must incentivize our top talent to stay here.

Federal support for master's, doctoral, and post-doctoral students and fellows has created new research opportunities for the next generation of scientific talent. Opportunities to conduct world-leading research are critical for growing our economy. In the knowledge economy, the global market for these ideas is highly competitive and we need to make sure talented people have the right incentives to do their groundbreaking research here in Canada.

-

To foster the next generation of research talent, Budget 2024 proposes to provide $825 million over five years, starting in 2024-25, with $199.8 million per year ongoing, to increase the annual value of master's and doctoral student scholarships to $27,000 and $40,000, respectively, and post-doctoral fellowships to $70,000. This will also increase the number of research scholarships and fellowships provided, building to approximately 1,720 more graduate students or fellows benefiting each year. To make it easier for students and fellows to access support, the enhanced suite of scholarships and fellowship programs will be streamlined into one talent program.

-

To support Indigenous researchers and their communities, Budget 2024 also proposes to provide $30 million over three years, starting in 2024-25, to support Indigenous participation in research, with $10 million each for First Nation, Métis, and Inuit partners.

| Current Programs Annual Award | New Talent Program Annual Award | ||

|---|---|---|---|

| Canada Graduate Scholarships – Master's | $17,500 | Master's | $27,000 |

| SSHRC Doctoral Fellowships | $20,000 | ||

| NSERC Postgraduate Scholarships | $21,000 | ||

| CIHR Doctoral Foreign Study Award | $35,000 | Doctoral | $40,000 |

| Canada Graduate Scholarships – Doctoral | $35,000 | ||

| Vanier Canada Graduate Scholarships | $50,000 | ||

| SSHRC Post-doctoral Fellowships | $45,000 | ||

| NSERC Post-doctoral Fellowships | $45,000 | Post-doctoral | $70,000 |

| CIHR Fellowship | $40,000-$60,000 | ||

| Banting Post-doctoral Fellowships | $70,000 | ||

Boosting Talent for Innovation

Advanced technology development is a highly competitive industry and there is a global race to attract talent and innovative businesses. Canada must compete to ensure our economy is at the forefront of global innovation.

To spur rapid growth in innovation across Canada's economy, the government is partnering with organizations whose mission it is to train the next generation of innovators. This will ensure innovative businesses have the talent they need to grow, create jobs at home, and drive Canada's economic growth.

-

Budget 2024 announces the government's intention to work with Talent for Innovation Canada to develop a pilot initiative to build an exceptional research and development workforce in Canada. This industry-led pilot will focus on attracting, training, and deploying top talent across four key sectors: bio-manufacturing; clean technology; electric vehicle manufacturing; and microelectronics, including semiconductors.

Advancing Space Research and Exploration

Canada is a leader in cutting-edge innovation and technologies for space research and exploration. Our astronauts make great contributions to international space exploration missions. The government is investing in Canada's space research and exploration activities.

-

Budget 2024 proposes to provide $8.6 million in 2024-25 to the Canadian Space Agency for the Lunar Exploration Accelerator Program to support Canada's world-class space industry and help accelerate the development of new technologies. This initiative empowers Canada to leverage space to solve everyday challenges, such as enhancing remote health care services and improving access to healthy food in remote communities, while also supporting Canada's human space flight program.

-

Budget 2024 announces the establishment of a new whole-of-government approach to space exploration, technology development, and research. The new National Space Council will enable the level of collaboration required to secure Canada's future as a leader in the global space race, addressing cross-cutting issues that span commercial, civil, and defence domains. This will also enable the government to leverage Canada's space industrial base with its world-class capabilities, workforce, and track record of innovation and delivery.

Accelerating Clean Tech Intellectual Property Creation and Retention

Canadian clean technology companies are turning their ideas into the solutions that the world is looking for as it races towards net-zero. Encouraging these innovative companies to maintain operations in Canada and retain ownership of their intellectual property secures the future of their workforce in Canada, helping the clean economy to thrive in Canada.

As part of the government's National Intellectual Property Strategy, the not-for-profit organization Innovation Asset Collective launched the patent collective pilot program in 2020. This pilot program is helping innovative small- and medium-sized enterprises in the clean tech sector with the creation and retention of intellectual property.

-

To ensure that small- and medium-sized clean tech businesses benefit from specialized intellectual property support to grow their businesses and leverage intellectual property, Budget 2024 proposes to provide $14.5 million over two years, starting in 2024-25, to Innovation, Science and Economic Development Canada for the Innovation Asset Collective.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 4.1 Boosting Research, Innovation, and Productivity

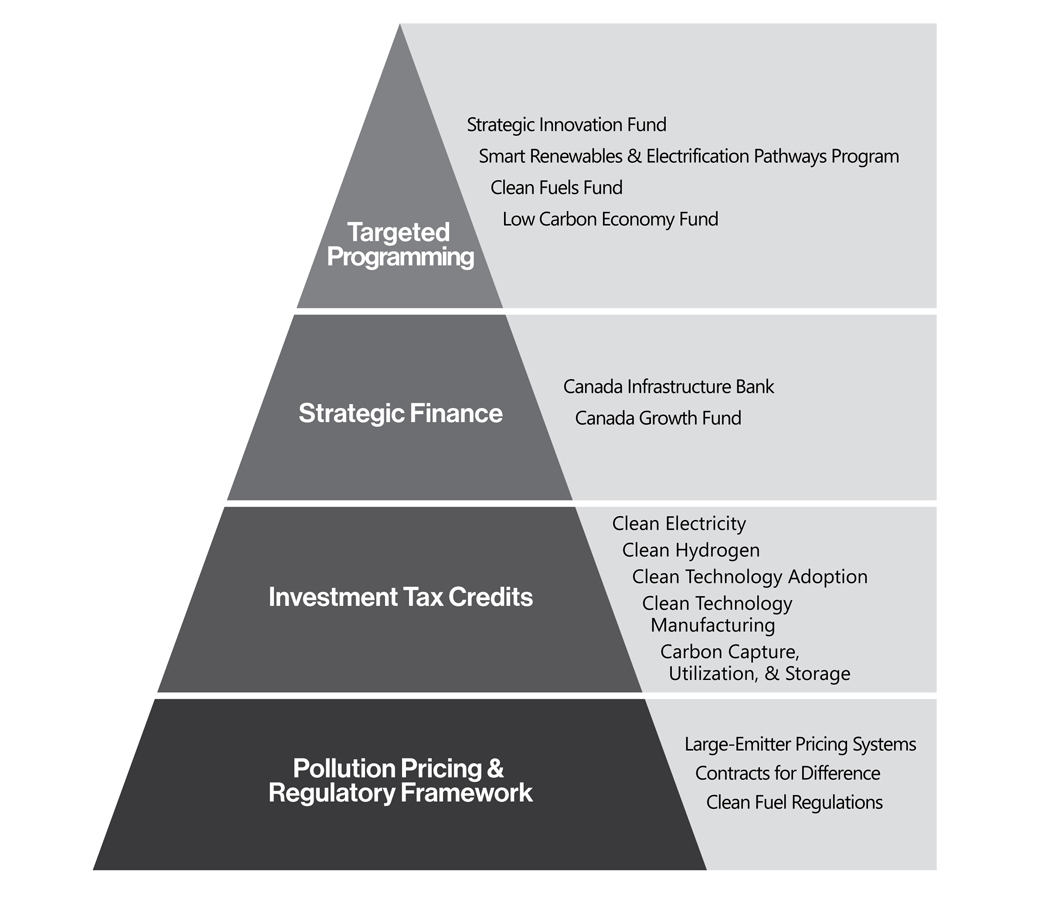

4.2 Attracting Investment for a Net-Zero Economy

In the 21st century, a competitive economy is a clean economy. There is no greater proof than the $2.4 trillion worth of investment made around the world, last year, in net-zero economies. Canada is at the forefront of the global race to attract investment and seize the opportunities of the clean economy, with the government announcing a net-zero economic plan that will invest over $160 billion. This includes an unprecedented suite of major economic investment tax credits, which will help attract investment through $93 billion in incentives by 2034-35.

All told, the government's investments will crowd in more private investment, securing Canadian leadership in clean electricity and innovation, creating economic growth and more good-paying jobs across the country.

Investors at home and around the world are taking notice of Canada's plan. In defiance of global economic headwinds, last year public markets and private equity capital flows into Canada's net-zero economy grew—reaching $14 billion in 2023, according to RBC. Proof that Canada's investments are working—driving new businesses to take shape, creating good jobs, and making sure that we have clean air and clean water for our kids, grandkids, and for generations to come.

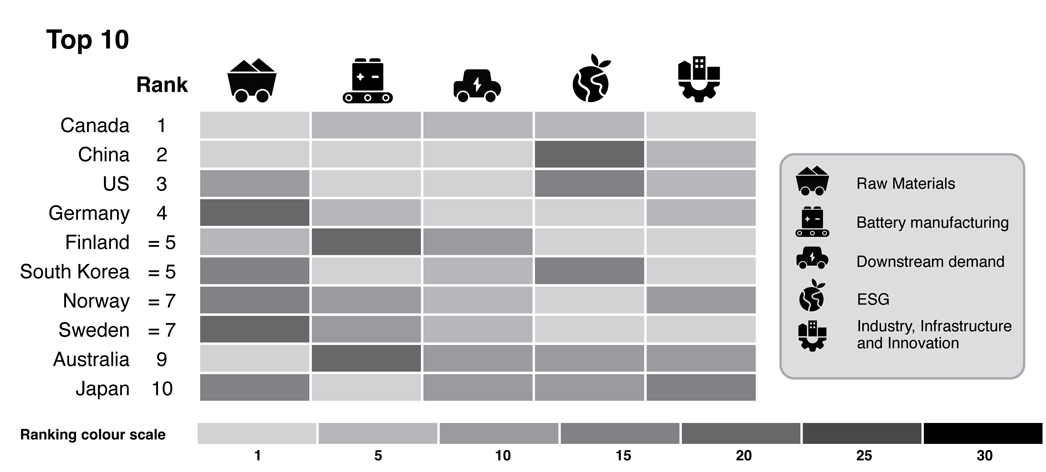

Canada's Net-Zero Economy Strategy

Earlier this year, BloombergNEF ranked Canada's attractiveness to build electric vehicle (EV) battery supply chains first in the world, surpassing China which has held the top spot since the ranking began. From resource workers mining the critical minerals for car batteries, to union workers on auto assembly lines, to the truckers that get cars to dealerships, Canada's advantage in the supply chain is creating high-skilled, good-paying jobs across the country, for workers of all ages.

Bloomberg, Annual Ranking of Lithium-Ion Battery Supply Chains

This first place ranking of Canada's EV supply chains is underpinned by our abundant clean energy, high labour standards, and rigorous standards for consultation and engagement with Indigenous communities. That's what Canada's major economic investment tax credits are doing—seizing Canada's full potential, and doing it right.

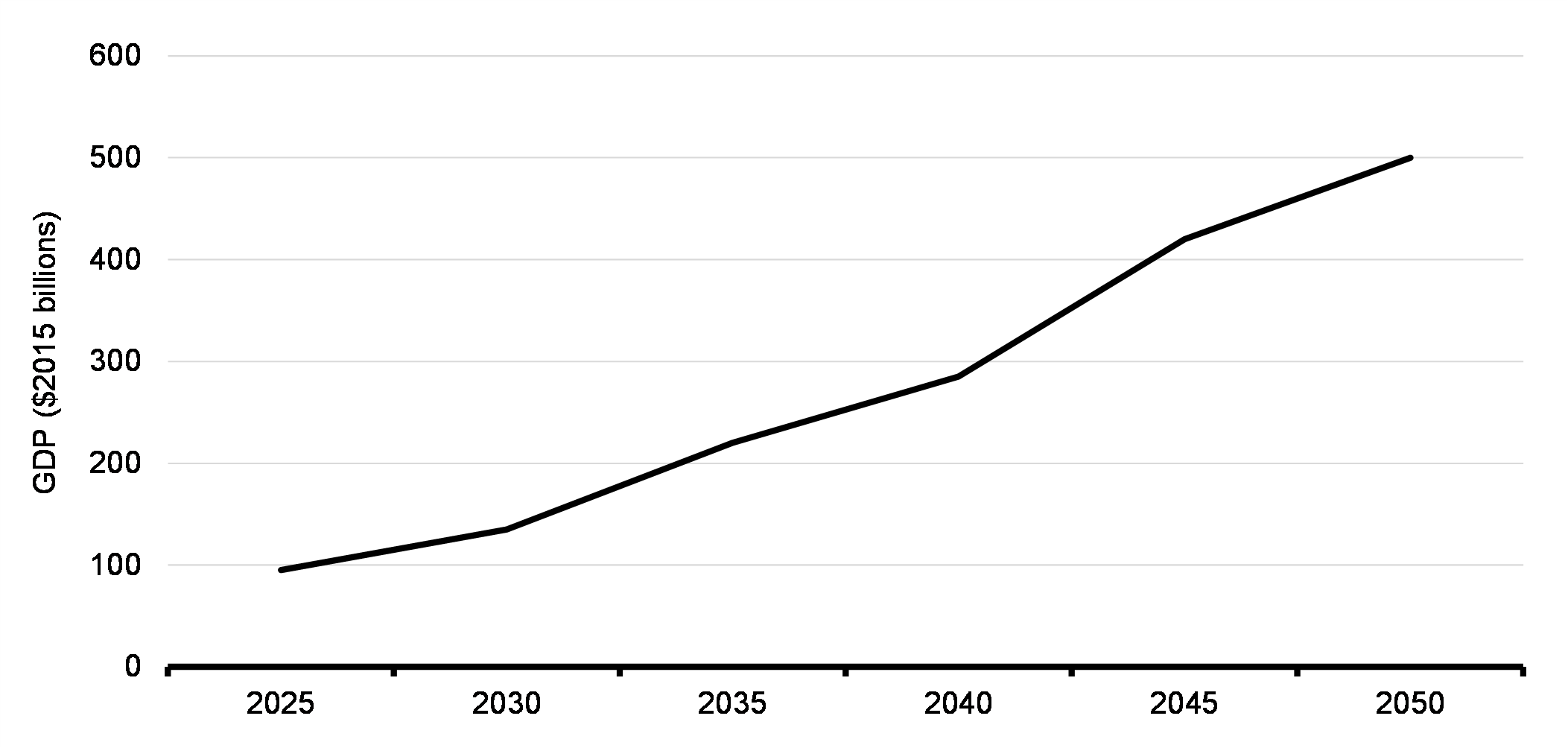

By 2050, clean energy GDP could grow fivefold—up to $500 billion, while keeping Canada on track to reach net-zero by 2050. Proof, once again, that good climate policy is good economic policy.

Clean Energy GDP Growth, 2025-2050

Helping innovative Canadian firms scale-up is essential to increasing the pace of economic growth in Canada. Already, the Cleantech Group's 2023 list of the 100 most innovative global clean technology companies featured 12 Canadian companies, the second highest number of any country, behind only the U.S. The government is investing in clean technology companies to ensure their full capabilities are unlocked.

Budget 2024 announces the next steps in the government's plan to attract even more investment to Canada to create good-paying jobs and accelerate the development and deployment of clean energy and clean technology.

Key Ongoing Actions

-

Delivering the new major economic investment tax credits, by the end of 2024, to create jobs and keep Canada on track to reduce pollution and reach net-zero by 2050:

- Carbon Capture, Utilization, and Storage investment tax credit;

- Clean Technology investment tax credit;

- Clean Hydrogen investment tax credit;

- Clean Technology Manufacturing investment tax credit; and

- Clean Electricity investment tax credit.

-

Catalyzing private investment in low-carbon projects, technologies, businesses, and supply chains through the Canada Growth Fund, a $15 billion, arm's length investment fund led by a world-leading team of public sector pension investment professionals.

- Since the federal government launched the Canada Growth Fund last year, $1.34 billion of capital has been committed to a world-leading geothermal energy technology company, the world's first of its kind carbon contract for difference; and to clean tech entrepreneurs and innovators through a leading Canadian-based climate fund.

-

Working with industry, provinces, and Indigenous partners to build an end-to-end electric vehicle battery supply chain, including by securing major investments in 2023.

-

Building major clean electricity and clean growth infrastructure projects with investments of at least $20 billion from the Canada Infrastructure Bank.

-

$3.8 billion for Canada's Critical Minerals Strategy, to secure our position as the world's supplier of choice for critical minerals and the clean technologies they enable.

-

$3 billion to recapitalize the Smart Renewables and Electrification Pathways Program, which builds more clean, affordable, and reliable power, and to support innovation in electricity grids and spur more investments in Canadian offshore wind.

A New EV Supply Chain Investment Tax Credit

The automotive industry is undergoing a major transformation. As more and more electric vehicles are being produced worldwide, it is essential that Canada's automotive industry has the support it needs to retool its assembly lines and build new factories to seize the opportunities of the global switch to electric vehicles. With our world-class natural resource base, talented workforce, and attractive investment climate, Canada will be an electric vehicle supply chain hub for all steps along the manufacturing process. This is an opportunity for Canada to secure its position today at the forefront of this growing global supply chain and secure high-quality jobs for Canadian workers for a generation to come.

Businesses that manufacture electric vehicles and their precursors would already be able to claim the 30 per cent Clean Technology Manufacturing investment tax credit on the cost of their investments in new machinery and equipment, as announced in Budget 2023. Providing additional support to these businesses so they choose Canada for more than one stage in the manufacturing process would secure more jobs for Canadians and help cement Canada's position as a leader in this sector.

-

Budget 2024 announces the government's intention to introduce a new 10 per cent Electric Vehicle Supply Chain investment tax credit on the cost of buildings used in key segments of the electric vehicle supply chain, for businesses that invest in Canada across three supply chain segments:

- electric vehicle assembly;

- electric vehicle battery production; and,

- cathode active material production.

For a taxpayer's building costs in any of the specified segments to qualify for the tax credit, the taxpayer (or a member of a group of related taxpayers) must claim the Clean Technology Manufacturing investment tax credit in all three of the specified segments, or two of the three specified segments and hold at least a qualifying minority interest in an unrelated corporation that claims the Clean Technology Manufacturing tax credit in the third segment. The building costs of the unrelated corporation would also qualify for the new investment tax credit.

The EV Supply Chain investment tax credit would apply to property that is acquired and becomes available for use on or after January 1, 2024. The credit would be reduced to 5 per cent for 2033 and 2034, and would no longer be in effect after 2034.

The EV Supply Chain investment tax credit is expected to cost $80 million over five years, starting in 2024-25, and an additional $1.02 billion from 2029-30 to 2034-35.

The design and implementation details of the EV Supply Chain investment tax credit will be provided in the 2024 Fall Economic Statement. Its design would incorporate elements of the Clean Technology Manufacturing investment tax credit, where applicable.

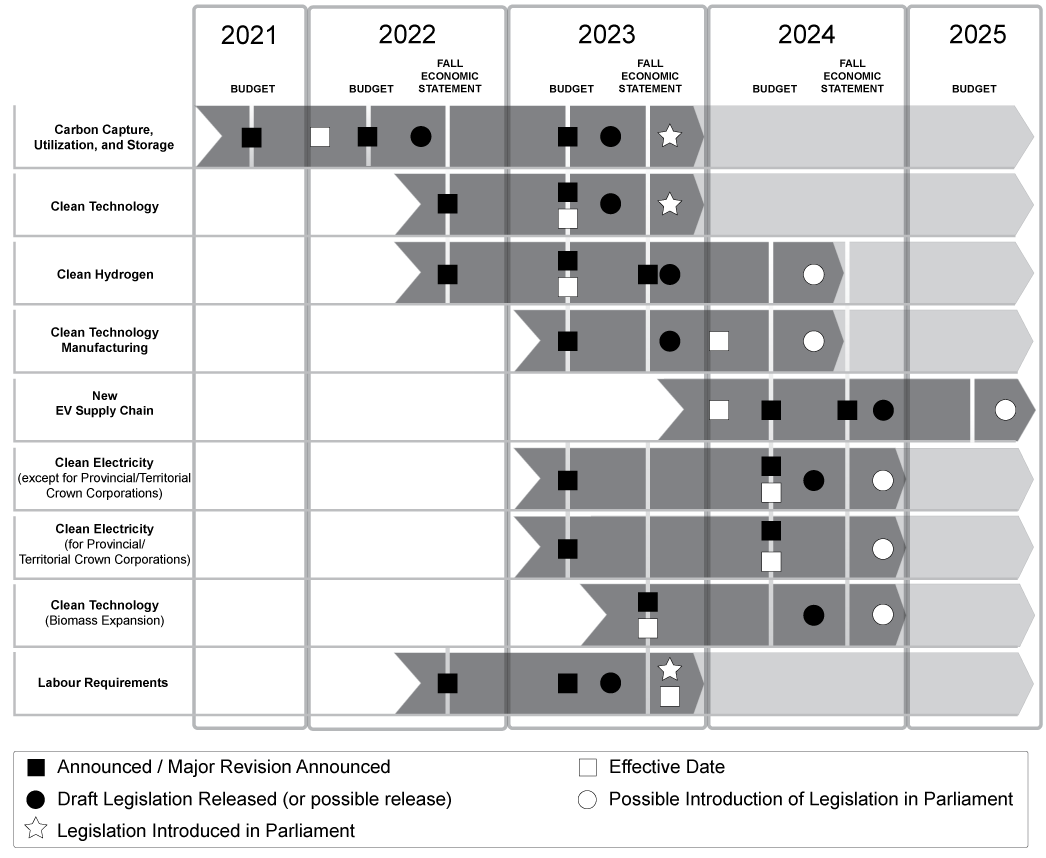

Delivering Major Economic Investment Tax Credits

To seize the investment opportunities of the global clean economy, we are delivering our six major economic investment tax credits. These will provide businesses and other investors with the certainty they need to invest and build in Canada. And they are already attracting major, job-creating projects, ensuring we remain globally competitive.

From new clean electricity projects that will provide clean and affordable energy to Canadian homes and businesses, to carbon capture projects that will decarbonize heavy industry, our major economic investment tax credits are moving Canada forward on its track to achieve a net-zero economy by 2050.

In November 2023, the government introduced Bill C-59 to deliver the first two investment tax credits and provide businesses with the certainty they need to make investment decisions in Canada today. Bill C-59 also includes labour requirements to ensure workers are paid prevailing union wages and apprentices have opportunities to gain experience and succeed in the workforce. With the support and collaboration of Parliamentarians, the government anticipates Bill C-59 receiving Royal Assent before June 1, 2024.

-

Carbon Capture, Utilization, and Storage investment tax credit: would be available as of January 1, 2022;

-

Clean Technology investment tax credit: would be available as of March 28, 2023; and,

-

Labour Requirements: effective as of November 28, 2023, which must be met to receive the maximum tax credit rate for the following investment tax credits:

- Carbon Capture, Utilization, and Storage investment tax credit;

- Clean Technology investment tax credit;

- Clean Hydrogen investment tax credit; and,

- Clean Electricity investment tax credit.

The government will soon introduce legislation to deliver the next two investment tax credits:

- Clean Hydrogen investment tax credit: available as of March 28, 2023; and,

- Clean Technology Manufacturing investment tax credit: available as of January 1, 2024.

As a priority, the government will work on introducing legislation for the remaining investment tax credits, including the new EV Supply Chain investment tax credit, as well as proposed expansions and enhancements:

- Clean Electricity investment tax credit: would be available as of the day of Budget 2024, for projects that did not begin construction before March 28, 2023;

- Expanding Eligibility for the Clean Technology and Clean Electricity investment tax credits to support using waste biomass to generate heat and electricity:

- The expansion of the Clean Technology investment tax credit would be available as of November 21, 2023; and,

- The expansion of the Clean Electricity investment tax credit would be available from the day of Budget 2024, for projects that did not begin construction before March 28, 2023.

- Clean Technology Manufacturing investment tax credit enhancements to provide new clarity and improve access for critical minerals projects. Draft legislation will be released for consultation in summer 2024 and the government targets introducing legislation in fall 2024.

- The EV Supply Chain investment tax credit: would be available as of January 1, 2024.

Given that the major economic investment tax credits will be available, including retroactively, from their respective coming into force dates, businesses are already taking action to break ground on projects that will reduce emissions, create jobs, and grow the economy. Passing the major economic investment tax credits into law will secure a cleaner, more prosperous future for Canadians today, and tomorrow.

Delivery Timeline for Major Economic Investment Tax Credits

Implementing the Clean Electricity Investment Tax Credit

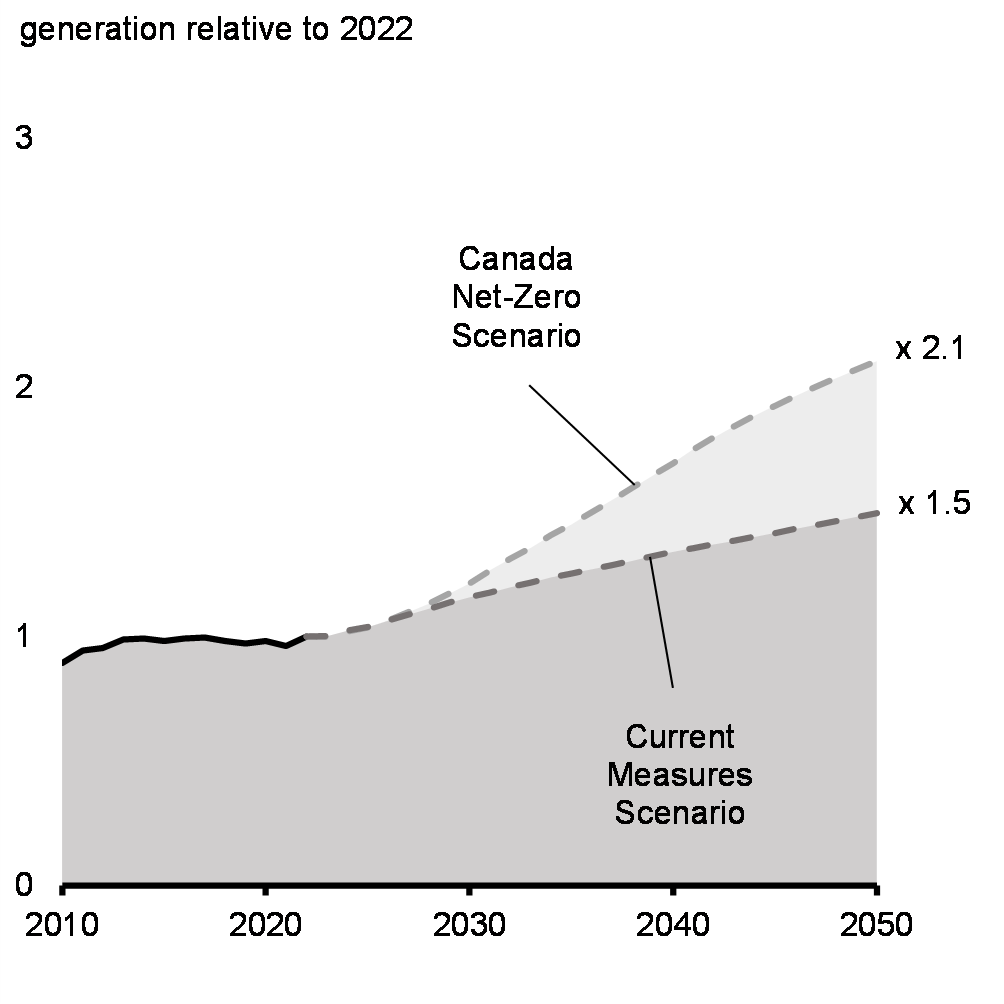

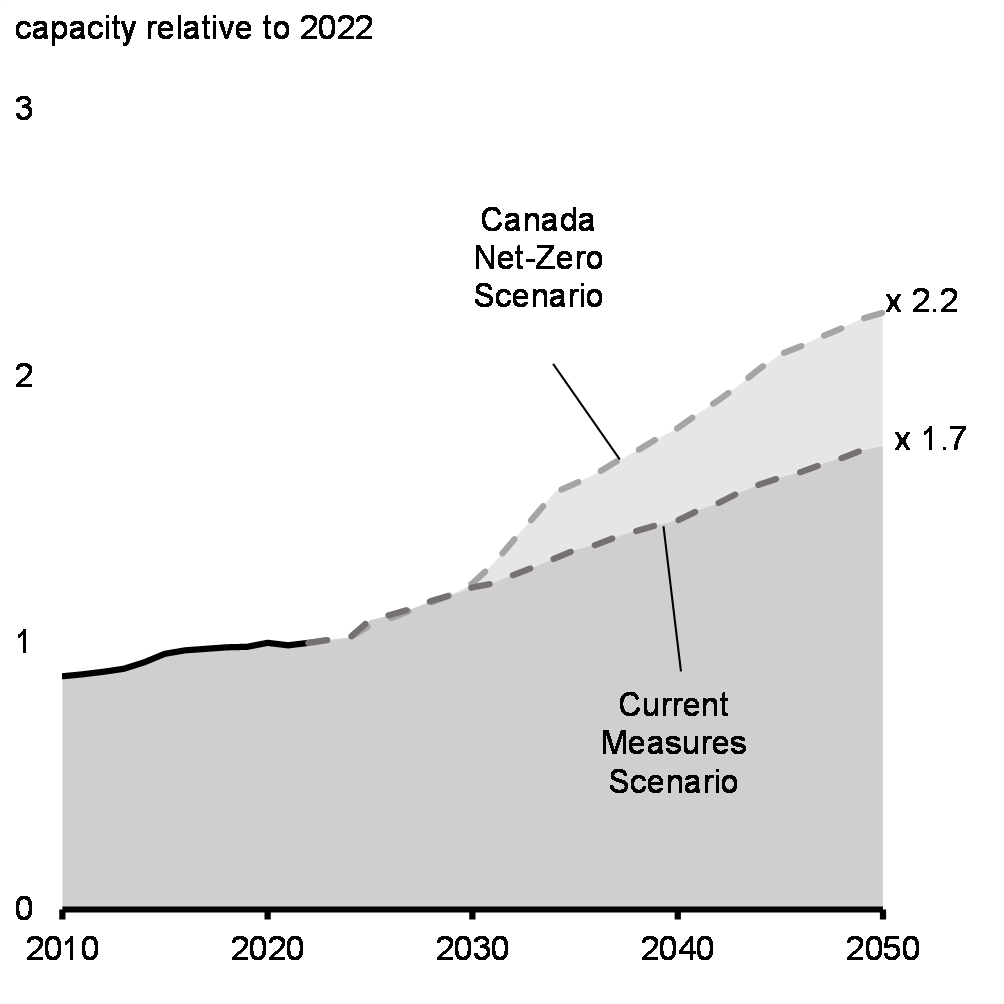

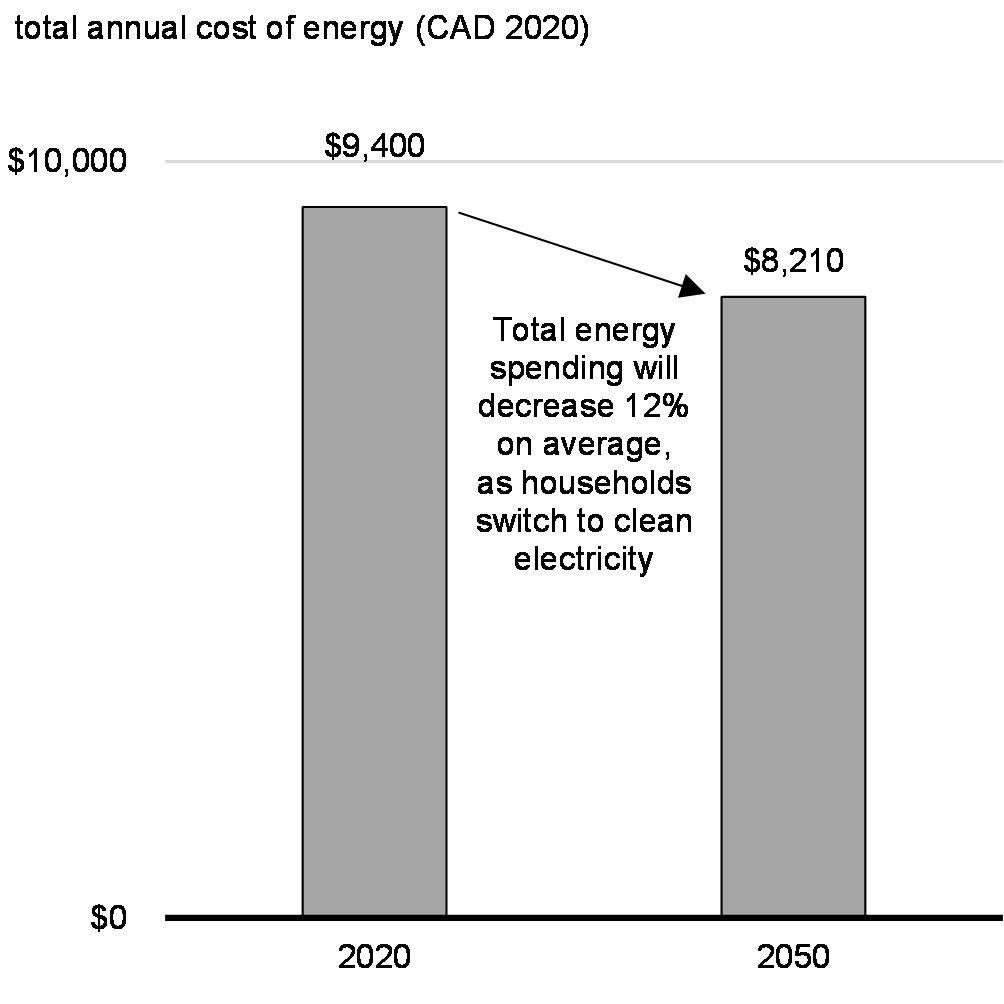

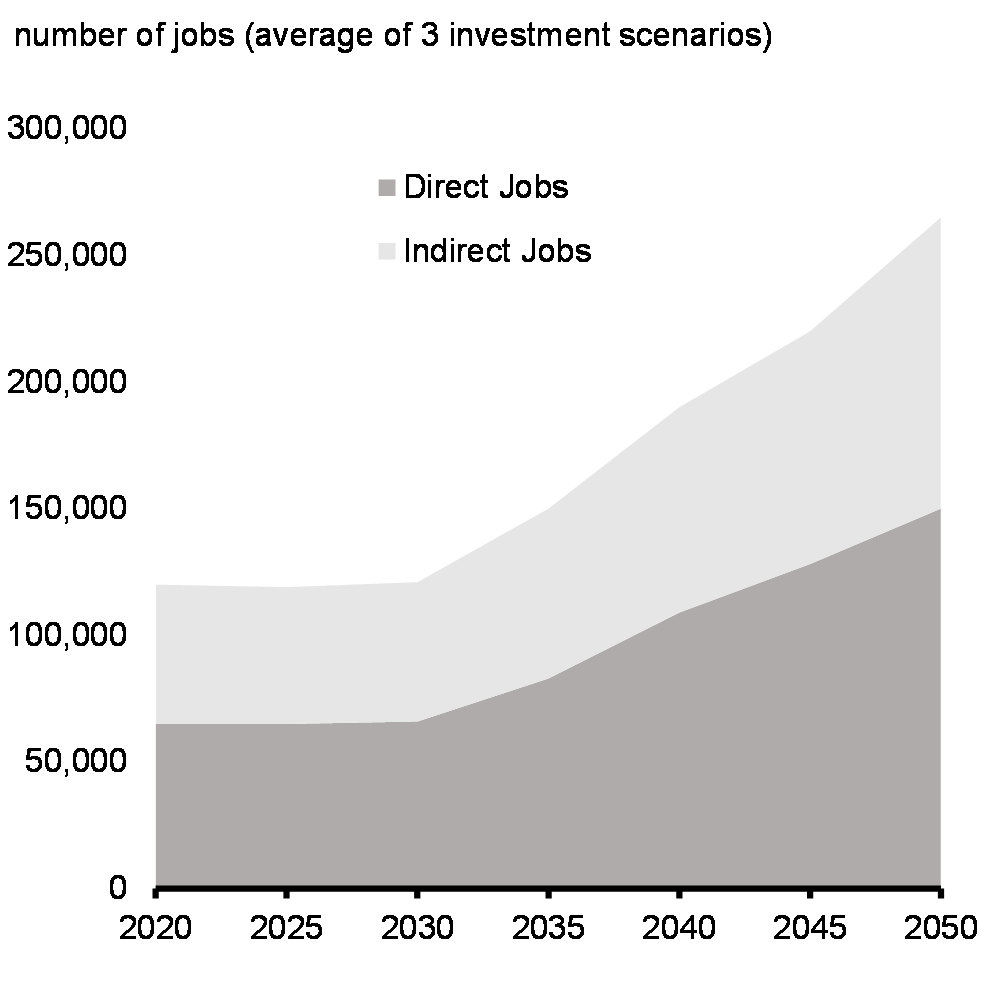

As the economy grows, Canada's electricity demand is expected to double by 2050 (Chart 4.7). To meet this increased demand with a clean, reliable, and affordable grid, our electricity capacity must increase by 1.7 to 2.2 times compared to current levels (Chart 4.8). Investing in clean electricity today will reduce Canadians' monthly energy costs by 12 per cent (Chart 4.9) and create approximately 250,000 good jobs by 2050 (Chart 4.10).

Electricity Generation Requirements, 2022-2050

Electricity Capacity Requirements, 2022-2050

Average Annual Household Energy Spending, 2020 and 2050

Job Creation in Clean Electricity, 2020-2050

Canada already has one of the cleanest electricity grids in the world, with 84 per cent of electricity produced by non-emitting sources of generation. Quebec, British Columbia, Manitoba, Newfoundland and Labrador, and Yukon are already clean electricity leaders and generate nearly all of their electricity from non-emitting hydropower—and have more untapped clean electricity potential. Other regions of Canada will require major investments to ensure clean, reliable electricity grids, and the federal government is stepping up to support provinces and territories with these investments.

In Budget 2023, the government announced the new Clean Electricity investment tax credit to deliver broad-based support to implement clean electricity technologies and accelerate progress towards a Canada-wide net-zero electricity grid.

-

Budget 2024 announces the design and implementation details of the Clean Electricity investment tax credit with the following design features:

- A 15 per cent refundable tax credit rate for eligible investments in new equipment or refurbishments related to:

- Low-emitting electricity generation systems using energy from wind, solar, water, geothermal, waste biomass, nuclear, or natural gas with carbon capture and storage.

- Stationary electricity storage systems that do not use fossil fuels in operation, such as batteries and pumped hydroelectric storage.

- Transmission of electricity between provinces and territories.

- The Clean Electricity investment tax credit would be available to certain taxable and non-taxable corporations, including corporations owned by municipalities or Indigenous communities, and pension investment corporations.

- Provided that a provincial and territorial government satisfies additional conditions, outlined below, the tax credit would also be available to provincial and territorial Crown corporations investing in that province or territory.

- Robust labour requirements to pay prevailing union wages and create apprenticeship opportunities will need to be met to receive the full 15 per cent tax credit.

- A 15 per cent refundable tax credit rate for eligible investments in new equipment or refurbishments related to:

The Clean Electricity investment tax credit is expected to cost $7.2 billion over five years starting in 2024-25, and an additional $25 billion from 2029-30 to 2034-35.

The Clean Electricity investment tax credit would apply to property that is acquired and becomes available for use on or after the day of Budget 2024 for projects that did not begin construction before March 28, 2023. The credit would no longer be in effect after 2034. Similar rules would apply for provincial and territorial Crown corporations, with modifications outlined below.

Provincial and Territorial Crown Corporations

The federal government is proposing that, for provincial and territorial Crown corporations to access to the Clean Electricity investment tax credit within a jurisdiction, the government of that province or territory would need to:

- Publicly commit to:

- Work towards a net-zero electricity grid by 2035; and,

- Provincial and territorial Crown corporations passing through the value of the Clean Electricity investment tax credit to electricity ratepayers in their province or territory to reduce ratepayers' bills.

- Direct provincial and territorial Crown corporations claiming the credit to publicly report, on an annual basis, on how the tax credit has improved ratepayers' bills.

If a provincial or territorial government satisfies all the conditions by March 31, 2025, then provincial or territorial Crown corporations investing in that jurisdiction would be able to access the Clean Electricity investment tax credit for property that is acquired and becomes available for use on or after the day of Budget 2024 for projects that did not begin construction before March 28, 2023.

If a provincial or territorial government does not satisfy all the conditions by March 31, 2025, then provincial or territorial Crown corporations investing in that jurisdiction would not be able to access the Clean Electricity investment tax credit until all the conditions have been satisfied. In this case, the Clean Electricity investment tax credit would apply to property that is acquired and becomes available for use from the date when the conditions are deemed to have been satisfied for projects that did not begin construction before March 28, 2023.

The Department of Finance Canada will consult with provinces and territories on the details of these conditions before legislation is introduced this fall.

Additional design and implementation details for the tax credit can be found in the Budget Tax Measures Supplementary Information, under "Clean Electricity investment tax credit."

Delivering Clean Electricity with Indigenous, Northern, and Remote Communities

The government has announced significant measures to advance clean electricity projects nationwide. These initiatives include the Clean Electricity investment tax credit, the Smart Renewables and Electrification Pathways Program, and strategic financing through the Canada Infrastructure Bank. Understanding the energy goals and challenges in Indigenous, Northern, and remote communities—such as moving away from diesel—the government has offered unique assistance for projects in these areas, including for planning and feasibility stages. Recent federal investments to support projects with these communities include:

-

Up to $535 million in Canada Infrastructure Bank financing and $50 million in funding from the Smart Renewables and Electrification Pathways Program for the 250-MW Oneida Energy storage project in Ontario, which is the largest battery storage project in the country.

-

$173 million in Canada Infrastructure Bank financing and $50 million in funding from the Smart Renewables and Electrification Pathways Program for the Bekevar Wind Power project, an Indigenous-led wind power project in Saskatchewan.

-

$14.4 million in funding to explore the feasibility of the Kivalliq Hydro Fibre Link, an innovative project that would connect northern Manitoba to southeastern Nunavut to provide electricity and internet access to five communities and one existing mine, helping to transition Northern communities off of diesel and connect them to the rest of Canada.

-

$9 million in funding from the Smart Renewables and Electrification Pathways Program for the Salay Prayzaan Solar project, which is 100 per cent owned by the Métis Nation of Alberta.

Implementing the Major Economic Investment Tax Credits

The government's suite of major economic investment incentives is unprecedented in Canadian history, and the government is delivering these supports on a priority basis to attract investment, create good-paying jobs, and grow the economy, while continuing to make progress in the fight against climate change.

To deliver the major economic investment tax credits, without delay, the government is boosting resources to the Canada Revenue Agency, Natural Resources Canada, and the Department of Finance Canada, which each have a role to play in delivering these support measures. To this end:

-

Budget 2024 proposes to provide the Canada Revenue Agency up to $90.9 million over 11 years, starting in 2024-25, to administer the new major economic investment tax credits.

-

Budget 2024 proposes to provide Natural Resources Canada $7.4 million over five years, starting in 2024-25, to provide expert technical advice on engineering and scientific matters related to the major economic investment tax credits and to support the administration of certain investment tax credits with the Canada Revenue Agency.

-

Budget 2024 proposes to provide the Department of Finance Canada $21.4 million over 11 years, starting in 2024-25, to complete the implementation, including legislation, of the major economic investment tax credits, ensure ongoing evaluation and response to emerging issues, and propose appropriate legislative amendments to the Income Tax Act and Income Tax Regulations.

The Canada Growth Fund

The Canada Growth Fund is a $15 billion arm's length public investment vehicle launched by the federal government to attract private capital and invest in Canadian projects and businesses, which is led by Canada's world-leading public sector pension professionals. The Canada Growth Fund investments in clean energy and clean technology are already building Canada's strong, clean economy and creating good-paying jobs across the country:

- On October 25, 2023, the Canada Growth Fund made its first investment—a $90 million investment in a groundbreaking geothermal energy company, Calgary's Eavor Technologies Inc., that is creating meaningful employment opportunities for Albertans and securing the Canadian future of a company at the leading-edge of the global economy.

- The Canada Growth Fund's second investment was announced on December 20, 2023—a $200 million direct investment, plus complementary carbon contract offtake agreement, in a world-leading carbon capture and sequestration company, Calgary's Entropy Inc. to support the reduction of up to one million tonnes of carbon per year. This major investment will support 1,200 good jobs for Albertans and grow the company's Canadian-based activities.

- The Canada Growth Fund's third investment was announced on March 25, 2024—a $50 million commitment into the Idealist Climate Impact Fund, a clean tech investment fund led by the Montréal-based Idealist Capital. The clean tech fund will manage equity investments into innovative entrepreneurs and businesses that are creating good-paying jobs and accelerating the energy transition.

Carbon Contracts for Difference

A price on pollution is the foundation of Canada's plan to build a prosperous net-zero economy. It is a system that is fair and that promotes market-driven solutions. The government recognizes the substantial demand from industry and other stakeholders for carbon contracts for difference (CCFDs) as a tool to accelerate investment in decarbonization and clean growth technologies by providing certainty around carbon pricing.

The 2023 Fall Economic Statement announced that the Canada Growth Fund will be the principal federal entity to issue CCFDs, including allocating, on a priority basis, up to $7 billion to issue all forms of contracts for difference and offtake agreements. The Canada Growth Fund is fulfilling this important role as a federal issuer of CCFDs. Building on its initial success, the Canada Growth Fund is assessing the opportunity to expand its carbon contract offerings and is developing approaches that can best serve the different carbon credit markets across Canada:

-

Budget 2024 announces that the Canada Growth Fund is developing an expanded range of CCFD offerings tailored to different markets and their unique risks and opportunities. The Canada Growth Fund will continue offering bespoke CCFDs and carbon offtake agreements, with a focus on provinces contributing significantly to greenhouse gas emissions reductions.

-

Building on the insights gained from these transactions, Budget 2024 announces the Canada Growth Fund will explore ways to broaden its approach, for example, by developing off-the-shelf contracts for certain jurisdictions and ways to offer these contracts on a competitive basis for a set amount of emissions reductions.

-

The Canada Growth Fund has around $6 billion remaining to continue issuing, on a priority basis, all forms of CCFDs and carbon offtake agreements. Budget 2024 announces the government will ensure that the Canada Growth Fund continues to have the resources it needs to fulfill its role as federal issuer of CCFDs. The government is also evaluating options to enhance the Canada Growth Fund's capacity to offer CCFDs, including by exploring the possibility of a government backstop of certain CCFD liabilities of the Canada Growth Fund.

CCFDs can help develop robust carbon credit markets, and the federal government has taken action to ensure their success. For example, in 2022, Environment and Climate Change Canada worked with Alberta to ensure that their TIER market was sufficiently stringent so that the projected demand for carbon credits exceeded projected supply, ensuring robust credit demand even as more major decarbonization projects get built and more credits are generated.

Credit markets are largely the responsibility of provinces, and there are opportunities to improve how these markets function. For example, commitments to maintain their industrial carbon pricing systems over the long-term, tighten the stringency of systems as necessary to avoid an oversupply of credits, publishing the price of carbon credits, and recommitting to maintain a price signal of $170 per tonne by 2030 could help improve carbon price expectations for investors. Increased credit price transparency would greatly improve market functioning and provide greater investment certainty, unlocking more decarbonization projects. It would also facilitate the Canada Growth Fund's efforts to develop off-the-shelf CCFDs and deliver more deals, much quicker across provincial carbon markets.

-

Budget 2024 announces that Environment and Climate Change Canada will work with provinces and territories to improve the functioning of carbon credit markets, in order to help unlock additional decarbonization projects throughout Canada.

Getting Major Projects Done

Putting Canada on a path to net-zero requires significant and sustained private sector investment in clean electricity, critical minerals, and other major projects. For these investments to be made, Canada's regulatory system must be efficient and quicker—it shouldn't take over a decade to open a new mine and secure our critical minerals supply chains.

To that end, Budget 2023 announced an intention to develop a plan to improve the efficiency of the impact assessment and permitting processes for major projects. The Ministerial Working Group on Regulatory Efficiency for Clean Growth Projects was launched to coordinate this work, and drive positive, pro-growth culture change throughout government, to ensure major project approvals come quicker. New major projects create thousands of new, good-paying jobs for Canadians, and the government is focused on getting more done.

-

Budget 2024 announces measures to help clarify and reduce timelines for major projects, so they can get built faster:

- Provide $9 million over three years, starting in 2024-25, to the Privy Council Office's Clean Growth Office to implement the recommendations of the Ministerial Working Group and reduce interdepartmental inefficiencies, including preventing fixation on well-studied and low-risk impacts, ensuring new permitting timelines are upheld throughout departments, and improving data sharing between departments to reduce redundant studies.

- Launch work to establish a new Federal Permitting Coordinator within the Privy Council Office's Clean Growth Office.

- Set a target of five years or less to complete federal impact assessment and permitting processes for federally designated projects, and a target of two years or less for permitting of non-federally designated projects;

- Issue a Cabinet Directive to drive culture change, achieve new targets, and set out clear federal roles and responsibilities within and across departments with the objective of getting clean growth projects built in a timely and predictable manner;

- Build a Federal Permitting Dashboard that reports on the status of large projects which require permits, to improve predictability for project proponents, and increase the federal government's transparency and accountability to Canadians; and,

- Set a three-year target for nuclear project reviews, by working with the Canadian Nuclear Safety Commission and Impact Assessment Agency of Canada, and consider how the process can be better streamlined and duplications reduced between the two agencies.

-

To advance the principle of "one project, one review", Budget 2024 proposes to:

- Amend the Impact Assessment Act to respond to the October 2023 Supreme Court of Canada decision that ruled that elements of the Act are unconstitutional. The proposed amendments will ensure the Act is constitutionally sound, facilitating efficient project reviews while advancing Canada's clean growth and protecting the environment. An amended Act will provide certainty for businesses and investors through measures that include increasing flexibility in substitution of assessments to allow for collaboration and avoid interjurisdictional duplication, clarifying when joint federal-provincial review panels are possible, and allowing for earlier Agency screening decisions as to whether a full impact assessment is required after the Planning phase. The amended Act will remain consistent with the United Nations Declaration on the Rights of Indigenous Peoples Act;

- Enhance coordination across orders of government using the tools available under the Impact Assessment Act and permitting coordination mechanisms, to reduce duplication and minimize the burden of regulatory processes on project proponents and Indigenous groups; and,

- Engage Northern Premiers, Indigenous communities, industry, and other partners to discuss transformative changes to their unique project review frameworks, to ensure the North is also prepared to assess and build clean growth projects.

-

To improve engagement and partnerships, including with Indigenous partners, Budget 2024 also announces the government will:

- Advance Indigenous participation in major projects, through the Indigenous Loan Guarantee Program detailed in Chapter 6, which will provide more opportunities for Indigenous communities to benefit from the significant number of natural resource and energy projects proposed to take place in their territories;

- Work to establish a Crown Consultation Coordinator to ensure efficient and meaningful Crown consultation with Indigenous peoples on the issuance of federal regulatory permits to projects that do not undergo federal impact assessments. The government will consult First Nations, Inuit, Métis, and Modern Treaty and Self-Governing Indigenous partners on the design of the Crown Consultation Coordinator. The Impact Assessment Agency of Canada will continue to be the Crown consultation body for all federal decisions related to projects that undergo federal impact assessments; and,

- Improve Indigenous capacity for consultation by advancing the co-development and implementation of consultation protocol agreements and resource centres, led by Crown-Indigenous Relations and Northern Affairs Canada.

More details on the Ministerial Working Group's recommendations will be published in an Action Plan in spring 2024. Additionally, further analysis of opportunities for improving the efficiency of the impact assessment process will be undertaken as part of the five-year review of the Impact Assessment Act's designated project list, which will occur later this year, following coming into force of the amended Act. This review will be undertaken in consultation with the public, including with Indigenous partners.

Getting major projects built means more jobs, in more regions across Canada, and more opportunities for the next generation of workers.

Securing the Canadian Biofuels Industry

Biofuels and biogas are renewable energy sources sustainably made from plants or biowaste, such as canola crops and landfill emissions. Not only do they generate fewer greenhouse gas emissions compared to fossil fuels, they also represent a unique opportunity for the Canadian economy. The industry supports agriculture and forestry jobs and can help decarbonize key sectors like marine, aviation, rail, and heavy industry. Canada's Clean Fuel Regulations, in place since 2022, are helping drive the production and adoption of specific biofuels in Canada.

The government is proposing new measures to support biofuels production in Canada, with a focus on renewable diesel, sustainable aviation fuel, and renewable natural gas, aiming to capitalize on the increasing demand for these fuels and strengthen Canada's position in the market. Budget 2024 announces:

-

The government's intention to disburse up to $500 million per year from Clean Fuel Regulations compliance payment revenues to support biofuels production in Canada, subject to sufficient compliance payments being made to the federal government. More details will be announced in the 2024 Fall Economic Statement.

-

The government will also retool the Clean Fuels Fund to deliver funding faster, and extend the Fund for an additional four years, until 2029-30. With reprofiled funding proposed through this extension, a total of $776.3 million will be available to be deployed from 2024-25 to 2029-30 to support clean fuel projects. The program will shift to a continuous intake process, and streamlined negotiations and decision-making processes will expedite delivery. By the end of this year, Natural Resources Canada will launch another call for proposals under the extended Clean Fuels Fund.

-

The Canada Infrastructure Bank will invest at least $500 million in biofuels production under its green infrastructure investment stream.

Advancing Nuclear Energy, Nuclear Research, and Environmental Remediation

Non-emitting, nuclear energy is one of the key tools in helping the world reach net-zero emissions by 2050. Canada stands out as one of the few countries to have developed and deployed its own nuclear technology, the CANDU. And the robust Canadian supply chains built around CANDU not only generate high-skilled jobs and foster research and development but also play a role in creating affordable and clean electricity. Canada's nuclear sector also produces medical isotopes essential for radiation therapy and diagnosing heart disease.

Canada is a Global Nuclear Energy Leader

Over the last few years, the government has announced significant investments and action to advance nuclear energy:

Large Reactors:

-

Canada has committed up to $3 billion in export financing to Romania to support the construction of two new CANDU reactors, reducing Romania's reliance on Russian energy while boosting their own energy security and their neighbours', all while supporting Canadian jobs. Canadian supply chains will participate in the construction and maintenance of these reactors over their multi-decade operating life.

-

The government announced $50 million in funding to support Bruce Power's large nuclear expansion.

Small Modular Reactors (SMRs):

-

The Canada Infrastructure Bank announced a $970 million investment to support Ontario Power Generation in building the first grid-scale SMR among G7 nations at Darlington.

-

The Strategic Innovation Fund has committed $94.7 million to accelerate the development of three different next generation SMR designs.

-

The government announced $74 million in funding to support SaskPower's SMR development.

-

The government announced $120.6 million to enable the deployment of SMRs through various activities such as building regulatory capacity.

Major Economic Investment Tax Credits:

-

The Clean Electricity and Clean Technology Manufacturing investment tax credits announced in Budget 2023 would support investments in nuclear electricity generation, nuclear power supply chains, and nuclear fuel production, which are part of the solution for a clean economy transition.

Sustainable Finance:

-

The government updated its Green Bond Framework to make certain nuclear energy expenditures eligible.

Budget 2024 is announcing new measures to help get nuclear projects built in a timely, predictable, and responsible fashion.

Canadian Nuclear Laboratories conducts nuclear science research that helps advance clean energy and medical technologies, as well as environmental remediation and waste management of historic nuclear sites. This work is overseen by Atomic Energy of Canada Limited, a Crown corporation responsible for enabling nuclear science and technology and ensuring environmental protection at nuclear sites.

-

Budget 2024 proposes to provide $3.1 billion over 11 years, starting in 2025-26, with $1.5 billion in remaining amortization, to Atomic Energy of Canada Limited to support Canadian Nuclear Laboratories' ongoing nuclear science research, environmental protection, and site remediation work.

Canada-U.S. Energy Transformation Task Force

On March 24, 2023, the Canada-U.S. Energy Transformation Task Force was launched by Prime Minister Trudeau and President Biden, as a one-year joint initiative to support our collective energy security and economic growth as we transition to a clean energy future. Canada is pleased to announce the renewal of the Energy Transformation Task Force for an additional year.

Since its creation, the Energy Transformation Task Force has driven significant progress towards more secure and resilient Canada-U.S. supply chains for critical minerals, nuclear fuels, and green steel and aluminum.

Canada is a global leader in the supply of responsibly sourced critical minerals. The government is investing $3.8 billion through the Canadian Critical Minerals Strategy to further develop Canadian value chains for critical minerals needed for our green and digital economy, including the new Critical Mineral Exploration Tax Credit. The Strategy will be further enabled by enhancements to the Clean Technology Manufacturing investment tax credit, and Canada's new Electric Vehicle Supply Chain investment tax credit.

Canada is building on our strong partnership with the U.S. on critical minerals, underpinned by the Canada-U.S. Joint Action Plan on Critical Minerals Collaboration. Under the Energy Transformation Task Force, we have redoubled efforts to address issues of mutual concern such as bolstering supply security for critical minerals. Our government will continue to work in close collaboration with industry partners and our allies to support cross-border priority critical mineral projects that advance our shared interests.

Nuclear energy will play a key role in achieving net-zero greenhouse gas emissions. Canada is a Tier-1 nuclear nation with over 70 years of technological leadership, including our own national reactor technology, and a strong domestic supply chain that includes the world's largest deposit of high-grade natural uranium. Our government is taking action to support the growth of nuclear energy, including through the Clean Electricity investment tax credit, the Clean Technology Manufacturing investment tax credit, the Strategic Innovation Fund, the Canada Infrastructure Bank, and an updated Green Bond Framework that includes certain nuclear expenditures.

At COP28, the government and likeminded partners reaffirmed their commitment to triple nuclear energy capacity and promote public-private investment to strengthen supply chains and reduce reliance on non-allied countries for nuclear fuel needed for advanced and conventional nuclear energy. Through the Energy Transformation Task Force, Canada will continue to engage industry and international partners with a view to announcing concrete measures later this spring to bolster North American nuclear fuel supply chains.

Canadian steel and aluminum—among the greenest in the world—are important pillars of integrated North American manufacturing supply chains and key products to support the net-zero transition. We have invested significantly to further decarbonize our steel and aluminum sectors and to maintain their competitiveness in the green economy. As well, earlier this year, our government announced actions to increase the transparency of steel import data that will help provide more details on the origins of imported steel and align our practice with the U.S. We will continue to collaborate with the U.S. to promote common approaches for trade in low emissions green steel and aluminum goods.

Canada will continue to advance its work in partnership with the U.S., to reduce our shared exposure to production and supply chains controlled by non-likeminded countries, including by attracting investment in EV supply chains, solar, and more.

Clean Growth Hub

The Clean Growth Hub is the federal government's main source of information and advice on federal funding and other supports for clean technology projects in Canada. It directly supports up to 1,100 companies and organizations every year, ranging from emerging small businesses to Canada's world-leading clean tech companies.

Together, Innovation, Science and Economic Development Canada and Natural Resources Canada partner with 16 other departments and agencies to offer this one-stop shop to help businesses seeking to invest in Canada and create net-zero growth navigate the federal government's numerous clean economy programs and incentives—unlocking new investment and creating good jobs for Canadian workers.

-

To continue supporting clean technology stakeholders to identify and access relevant support and advice, Budget 2024 proposes to provide $6.1 million over two years, starting in 2024-25, for the Clean Growth Hub.

Made-in-Canada Sustainable Investment Guidelines

The government recognizes the importance of promoting credible climate investment and combating greenwashing, to protect the integrity and fairness of the clean economy. This is critical for fostering investor confidence and mobilizing the private investment that Canada needs to help achieve a net-zero by 2050 economy.

As announced in the 2023 Fall Economic Statement, the Department of Finance Canada is working with Environment and Climate Change Canada and Natural Resources Canada to undertake next steps, in consultation with regulatory agencies, the financial sector, industry, and independent experts, to develop a taxonomy that is aligned with reaching net-zero by 2050.

This work is being informed by the Sustainable Finance Action Council's Taxonomy Roadmap Report, which provided the government with recommendations on the design of a taxonomy to identify economic activities that the financial sector could label as "green" or "transition." The government will provide an update on the development of a Canadian taxonomy later this year.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 4.2 Attracting Investment for a Net-Zero Economy

4.3 Growing Businesses to Create More Jobs

Small- and medium-sized businesses are an integral engine of Canada's economy, and they employ about 64 per cent of Canadian workers. Entrepreneurs, local small business, start-ups, growing medium-sized businesses—everywhere in Canada, there are people with good ideas, ready to grow their businesses and create good jobs. The government is ensuring Canada's investment climate sets businesses up for success.

For economic growth to reach the pace that is needed, existing businesses need support to stay competitive and scale-up. The government is taking action to help businesses scale-up their technological innovations, and implement productivity-raising technology across the economy. By cutting red tape, new and existing businesses can grow faster. Boosting access to financing from financial Crown corporations and encouraging Canada's large public pension funds to put their investments to work here at home will unlock new growth opportunities for Canadian businesses.

Through Budget 2024, the government is making it easier for new businesses to start-up and for existing businesses to grow by cutting red tape, and providing the tools businesses need to scale-up. The government is also taking steps to have Canadian public institutions and Crown corporations put their capital to work here at home and seize opportunities to increase Canada's growth and productivity.

Key Ongoing Actions

The federal government has set up a range of programs and initiatives to help small and medium businesses thrive, and foster economic growth, including:

-

Supporting small- and medium-sized businesses to hire 55,000 first year apprentices in construction and manufacturing Red Seal Trades through a grant of $5,000 towards upfront costs, such as salaries and training.

-

Maintaining the lowest marginal effective tax rate (METR) in the G7, and a 5.2 percentage point competitive advantage over the average U.S. METR, to ensure Canada is a competitive place to do business.

-

Secured commitments with Visa and Mastercard to lower credit card interchange fees for small businesses while protecting reward programs for consumers. These reductions are expected to save eligible Canadian small businesses approximately $1 billion over five years.

-

Budget 2022 cut taxes for Canada's growing small businesses by more gradually phasing out their access to the small business tax rate.

-

Ongoing support for small- and medium-sized businesses through Canada's seven Regional Development Agencies, including over $3.7 billion since 2018 to help businesses scale-up and innovate through the Regional Economic Growth through Innovation program.

-

Almost $7 billion since 2018 for the Women Entrepreneurship Strategy to help women-owned businesses access the financing, networks, and expertise they need to start-up, scale-up, and access new markets.

-

Enhancements to the Canada Small Business Financing Program, increasing annual financing to small businesses by an estimated $560 million.

-

Up to $265 million for the Black Entrepreneurship Program to help Black business owners and entrepreneurs succeed and grow their businesses.

-

$150 million investment in the Indigenous Growth Fund, to help recruit other investors, and in turn provide a long-term source of capital to support continued success for Indigenous businesses.

-

$49 billion in interest-free, partially forgivable loans of up to $60,000 to nearly 900,000 small businesses and not-for-profit organizations through the Canada Emergency Business Account (CEBA).

National Regulatory Alignment

Barriers to internal trade are preventing Canada from reaching its economic potential. These barriers, most commonly the 13 different sets of regulations for each province and territory, hold back businesses from trading across provincial and territorial borders, restrict workers from moving between provinces and territories, and can increase costs for businesses as they work to overcome regulatory hurdles.

By addressing barriers to internal trade, including harmonizing regulations between provinces and territories, we can create more opportunities for Canadian businesses to grow and make life more affordable for all Canadians through greater competition and consumer choice. According to the International Monetary Fund, Canada could increase its gross domestic product (GDP) per capita by as much as 4 per cent—or $2,900 per capita estimated in 2023 dollars through the reduction of internal trade barriers for interprovincial trade of goods.

In 2022, the federal government launched the Federal Action Plan to Strengthen Internal Trade, which is guiding work with the provinces and territories to cut red tape. This includes a rigorous assessment of remaining federal exceptions in the Canadian Free Trade Agreement (CFTA) and important investments in trade data and research.

Two significant milestones have now been reached, with further actions upcoming in 2024:

-

The removal and streamlining of one third of all federal exceptions in the CFTA. This means the removal of 14 exceptions related to procurement that will provide Canadian businesses more opportunities to compete to deliver government goods and services. By the end of 2024, the federal government will publicly release the rationale for all remaining exceptions, and encourages provinces and territories to do the same.

-

The launch of the new Canadian Internal Trade Data and Information Hub on April 3, 2024. The Hub is an open and accessible data platform that will provide governments, businesses, and workers with timely, free information to help them make choices about where to invest and where to work. The Hub will help shine a light on where labour mobility barriers are highest and where unnecessary red tape costs businesses time and money.

The federal government is committed to working with provinces and territories to ensure goods, services, and workers move seamlessly across the country by advancing the mutual recognition of regulatory standards and eliminating unnecessary red tape for full labour mobility in the construction, health, and child care sectors.

-