Archived - Chapter 8:

Tax Fairness

for Every Generation

On this page:

Impacts report

Find out more about the expected gender and diversity impacts for each measure in Chapter 8: Tax Fairness for Every Generation

Canada is one of the wealthiest countries in the world. For generations, this has meant Canada is a place where everyone could secure a better future for themselves and their children. This is in no small part is due to our commitment to progressive taxation, investments in Canada's strong social safety net, and an effective, efficient government. Together, Canada's tax and benefit systems have supported equality of opportunity for generations of Canadians.

In the last few decades, the pathways enjoyed by generations of Canadians to build a middle class life have come under pressure. From the pandemic's disruptions of the global economy to chronic underinvestment in housing by previous governments, the cost of living crisis and the global shift to a winner-take-all digital economy, those at the top have been getting richer while younger generations struggle to buy a first home and afford to start a family.

Today, younger Canadians—through no fault of their own—are too often finding that their hard work is not paying off. That's not fair.

Canada's potential must be leveraged to fix this; we must invest to ensure younger generations have the same opportunities as those before them.

That is why the federal government is taking action to build a fairer future, with transformative investments in housing, innovation, the clean economy, and in younger generations. We'll unlock the promise of Canada, so every generation can build a better life, as their parents and grandparents did before them. It is crucial that the government make sure younger Canadians can afford to get a good education and in-demand skills, buy a home, raise a family, and build a good middle class life.

Canada's fiscally responsible economic plan and our AAA credit rating are the foundation for the stability of our economy. They make Canada a safe and attractive destination for investment and create business certainty. Financing the investment we need through more debt would be unfair to young Canadians—we want them to inherit prosperity, not our unpaid bills.

We have a better, fairer option. We are making the responsible choice.

The government is asking the wealthiest Canadians to pay their fair share.

Budget 2024 proposes new measures that will make the tax system more fair and generate $21.9 billion in revenue over five years to invest in building more homes, faster, creating good-paying jobs, and incentivizing economic growth that delivers fairness for every generation.

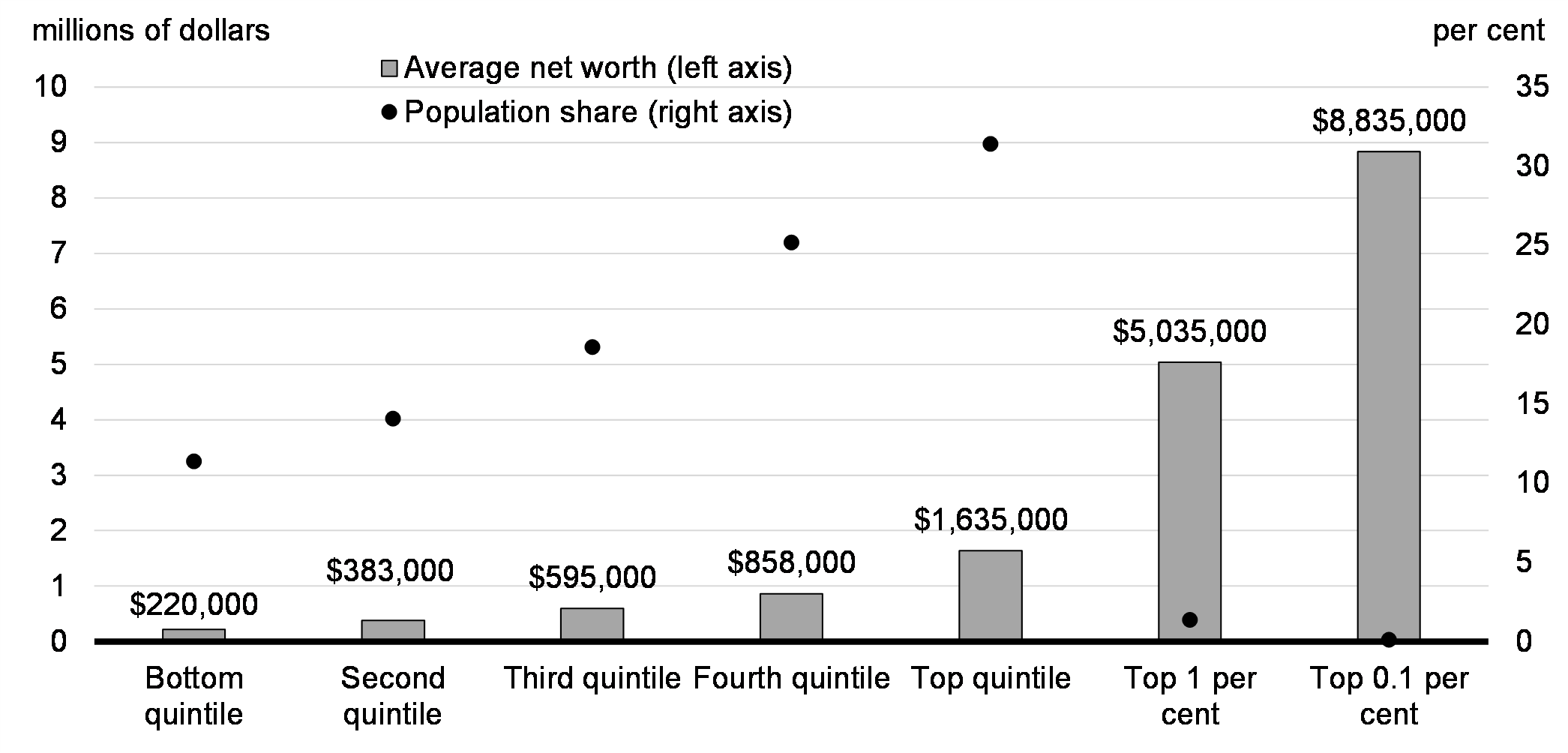

Analysis by the Parliamentary Budget Officer shows that in 2019 the top 1 per cent held 24.9 per cent of

Canada's household wealth.

At a time when middle class Canadians are struggling to get ahead, when their hard work isn't paying off,

the government is improving the fairness of the tax system. We are asking the wealthiest Canadians to contribute

a bit more, so that we can make investments to ensure a fair chance for every generation.

Average Family Net Worth by Income Group, 2019

8.1 Tax Fairness

Key Ongoing Actions

-

Lowering taxes on the middle class by cutting the second income tax bracket rate and by increasing the basic personal amount, to save more than 20 million middle class Canadians more than $450 on average in 2024, compared to before these middle class tax cuts.

-

Ensuring the wealthiest pay their fair share by introducing a top tax bracket of 33 per cent for the wealthiest Canadians.

-

Modernizing the Alternative Minimum Tax, which had not been significantly revised since 1986, to ensure the wealthiest Canadians pay their fair share and cannot excessively use deductions, credits, and other tax preferences to reduce tax.

-

Boosting benefits that are delivered through the tax system such as the Canada Child Benefit and the Canada Workers Benefit, to provide income support to families with children and low-income workers.

-

Introducing a two-per-cent tax on share buybacks by public corporations in Canada, to raise revenue while encouraging large corporations to re-invest in their workers and businesses.

-

Introducing a new luxury tax on private jets, yachts, and luxury vehicles.

-

To unlock homes for Canadians to live in, instead of being used as a speculative asset class by investors, since January 1, 2023, ensuring capital gains from property flipping are treated as business income.

Tax-sheltered savings plans enable most Canadians to earn their investment income tax free. An eligible Canadian with taxable income of $100,000 in 2023 can contribute up to $18,000 to their Registered Retirement Savings Plan (RRSP), $8,000 to their Tax-Free First Home Savings Account (FHSA), and $7,000 to their Tax-Free Savings Account (TFSA) in 2024 is in addition to any unused saving room from prior years.

- Investment income, including capital gains, earned in an RRSP, FHSA, or TFSA is not taxed.

- Contributions made to an RRSP or FHSA can be deducted from a person's income in the year they are made, reducing taxes.

- Withdrawals from an FHSA are tax-free.

Hard work should pay off. And Canada's tax system should be fair. By investing in housing, students, researchers, post-secondary institutions, child care, and good-paying job opportunities, we can restore the value of hard work and unlock the full potential of Canada's younger generations. Canada's future success depends on their success. It is only fair that these important investments are funded by those who have benefited the most from all the opportunity that Canada has to offer, including the top 1 per cent.

Canada's tax system can be more fair. The wealthy are currently able to benefit from tax advantages that middle class Canadians and, especially, younger Canadians are rarely able to benefit from. And, due to the global corporate tax race to the bottom, the biggest multinational corporations do not always pay their fair share.

Canada's potential must be leveraged to fix this; we must invest to ensure younger generations have the same opportunities as those before them and to ensure the way we fund these generational investments is fundamentally fair— to Canadians today, and tomorrow.

Our tax system needs to work better for nurses, teachers, construction workers, servers, labourers, and young professionals—those in the middle class, and those working hard to join it.

Those with the greatest ability to pay should contribute more to help fund the social safety net that benefits all Canadians. To grow the middle class and invest in younger Canadians—while keeping their taxes lower—new generational investments in Budget 2024 will be supported by contributions from the wealthiest Canadians.

Improving Tax Fairness

Canadians pay tax on the income from their job. But currently, they only pay taxes on 50 per cent of capital gains, which is the profit generally made when an asset, such as stocks, is sold. This is the capital gains tax advantage.

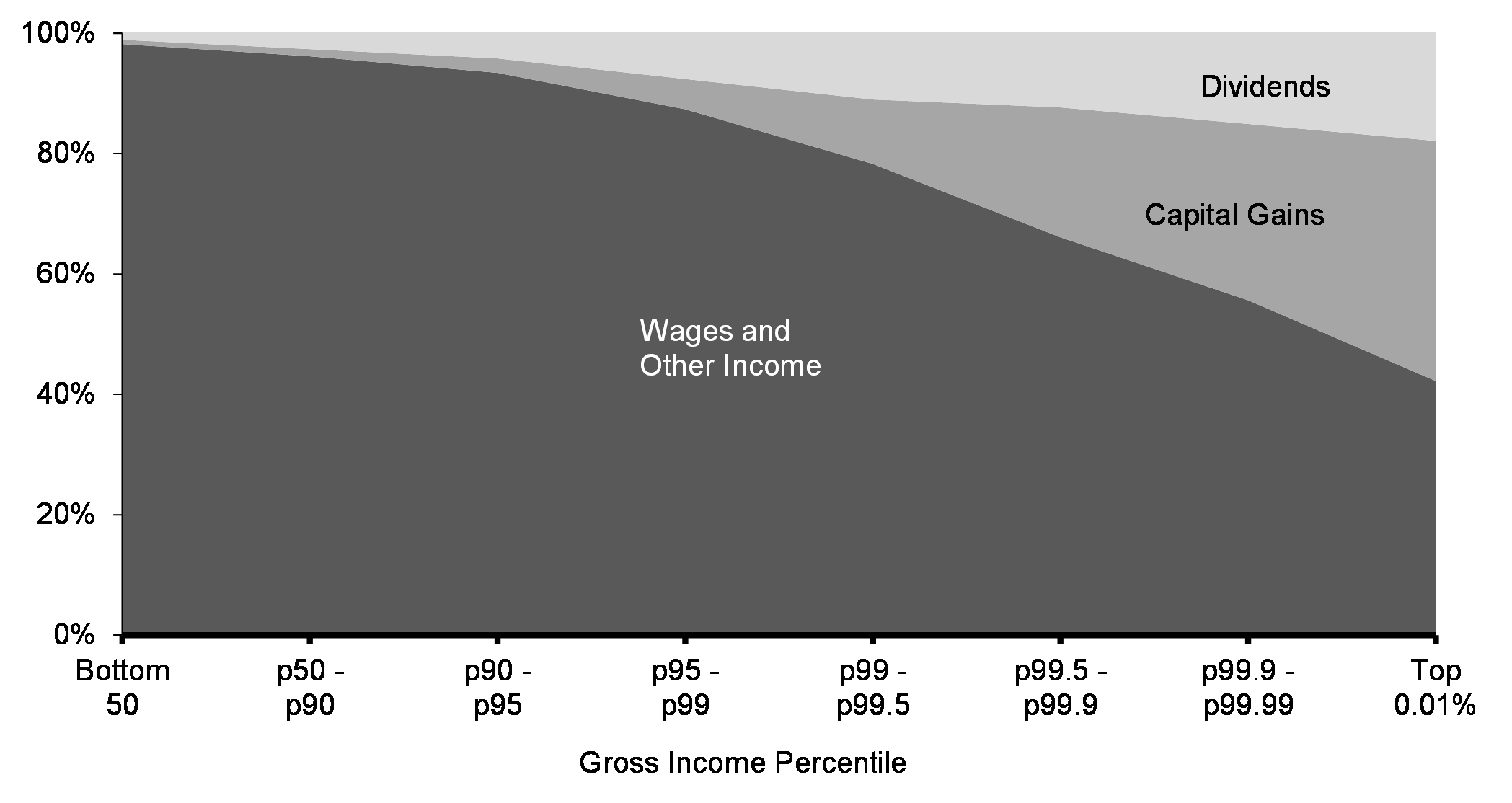

While all Canadians can benefit from the capital gains tax advantage, the wealthy, who tend to earn relatively more income from capital gains, disproportionately benefit compared to the middle class (Chart 8.2). In 2021, the top 1 per cent earned 10.4 per cent of all income in Canada; when capital gains are factored in, this jumps to 13.4 per cent.

Tax fairness is important for every generation, and it is particularly significant for younger Canadians. In 2021, only about 5 per cent of Canadians under 30 had any capital gains at all.

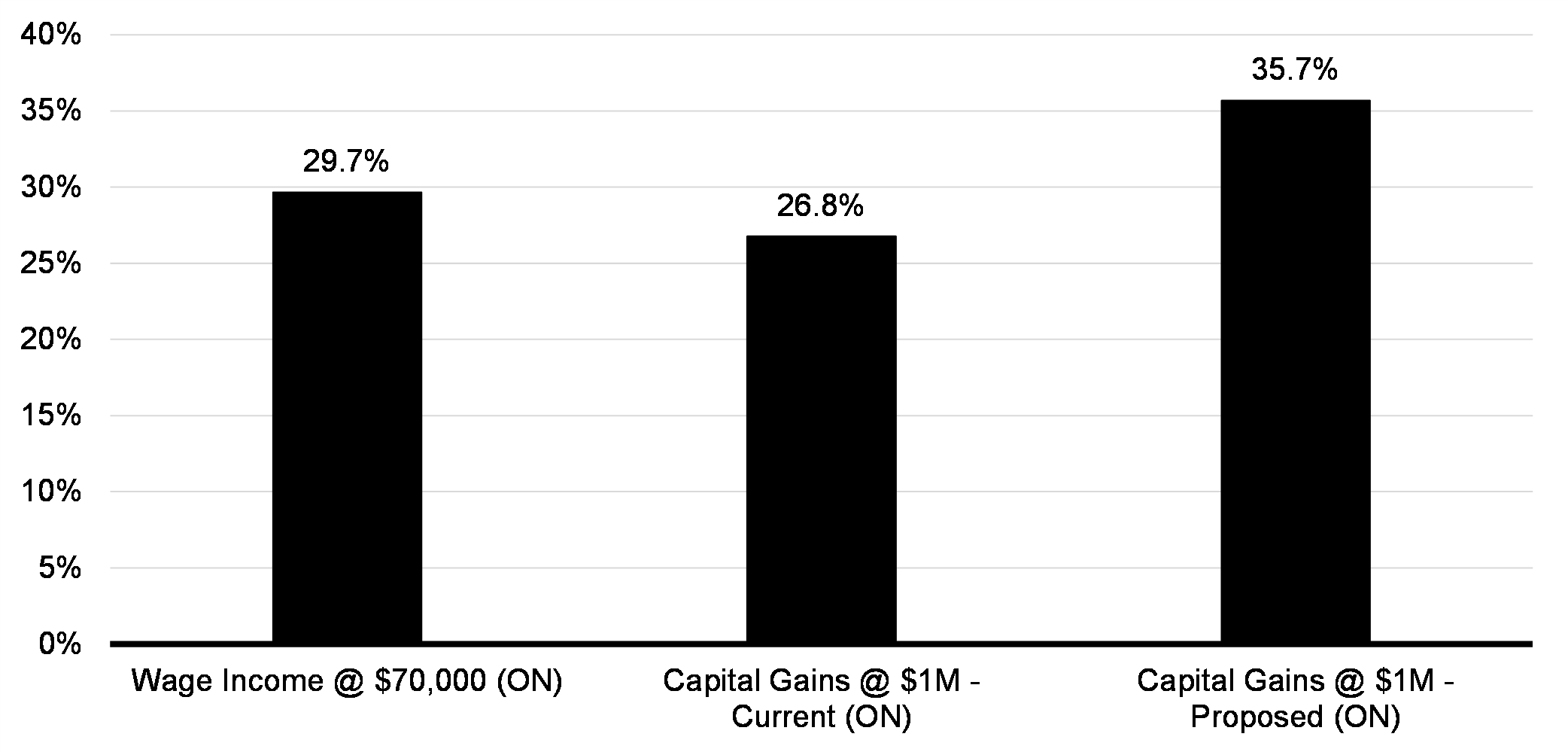

The current regime may result in situations where wealthy individuals face a lower marginal tax rate on their capital gains than what a middle class worker would face on their earnings. For instance, a nurse in Ontario earning $70,000 would face a combined federal-provincial marginal tax rate of 29.7 per cent. In comparison, a wealthy individual in Ontario with $1 million of income would face a marginal tax rate of 26.8 per cent on their capital gains.

Differences in taxation rates between income earned from wages, capital gains, and dividends currently favour the wealthiest among us.

Capital Gains as a Share of Gross Income by Income Percentile

The government is committed to a fair and progressive tax system. By increasing the capital gains inclusion rate, we will tackle one of the most regressive elements in Canada's tax system. Our government is proud to be reducing this inequity. Taxing capital gains is not an inherently partisan idea. It is an idea that everyone who cares about fairness can support.

In fact, the idea of taxing capital gains in Canada first got traction with the government of Prime Minister John Diefenbaker and the Royal Commission on taxation, chaired by Kenneth Carter. In the Royal Commission's report, Carter declared that fairness should be the foremost objective of the tax system, famously insisting "a buck is a buck is a buck". As of 1990, the government of Prime Minister Brian Mulroney had raised the capital gains inclusion rate to 75 per cent.

To make Canada's tax system more fair, the government is proposing an increase in taxes on capital gains.

-

Budget 2024 announces the government's intention to increase the inclusion rate on capital gains realized annually above $250,000 by individuals and on all capital gains realized by corporations and trusts from one-half to two-thirds, by amending the Income Tax Act, effective June 25, 2024.

- The inclusion rate for capital gains realized annually up to $250,000 by individuals will continue to be one-half.

- The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small business shares and farming and fishing property. This tax-free limit will be increased to $1.25 million, effective June 25, 2024, and will continue to be indexed to inflation thereafter. In 2025, Canadians with eligible capital gains of below $2.25 million will be better off under these changes.

- The government will maintain the exemption for capital gains from the sale of a principal residence to ensure Canadians do not pay capital gains taxes when selling their home. Any amount you make when you sell your home will remain tax-free.

- To ensure homes are for Canadians to live in, not a speculative asset class for investors, since January 1, 2023, capital gains from property flipping—properties bought and sold within 1 year—have been treated as business income. Exemptions exist for many common life situations; these exemptions will remain. This is central to the promise of Canada.

- To encourage entrepreneurship, the government is proposing the Canadian Entrepreneurs' Incentive which will reduce the inclusion rate to 33.3 per cent on a lifetime maximum of $2 million in eligible capital gains. Combined with the enhanced lifetime capital gains exemption, when this incentive is fully rolled out, entrepreneurs will have a combined exemption of at least $3.25 million when selling all or part of a business.

The proposed higher inclusion rate on capital gains would result in more equitable marginal tax rates across revenue sources and income levels. In particular, the proposal would increase the average federal-provincial marginal tax rate on capital gains above $250,000 of someone earning $1 million a year, to 35.7 per cent (chart 8.3).

Marginal Tax Rates on Wages versus Capital Gains

To ensure this increase in the capital gains inclusion rate is concentrated among the wealthiest, while keeping taxes lower on the middle class, the first $250,000 of capital gains income earned by Canadians each year will not be subject to the new two-thirds inclusion rate. Business owners will have access to this exemption from the increased inclusion rate as individuals.

Next year, 28.5 million Canadians are not expected to have any capital gains income, and 3 million are expected to earn capital gains below the $250,000 annual threshold. Only 0.13 per cent of Canadians with an average income of $1.4 million are expected to pay more personal income tax on their capital gains in any given year (Table 8.1).

As a result of this, for 99.87 per cent of Canadians, personal income taxes on capital gains will not increase.

| Number of people1 | Share of all people | Average gross income, including capital gains | |

|---|---|---|---|

| Capital gains above $250,000 | 40,000 | 0.13% | $1,411,000 |

| No capital gains or less than $250,000 | 31,531,000 | 99.87% | $60,000 |

Notes: Population is projected share of T1 filers. Does not account for behavioural responses to increase in capital gains inclusion rate. 1 Capital gains are net of those for which the Lifetime Capital Gains Exemption is claimed. |

|||

In addition to the $250,000 threshold for the new rate, middle class Canadians will continue to benefit from tax-free savings accounts, the principal residence exemption, and exemptions for registered pension plans. The following examples of tax-sheltered middle class savings will not be impacted by reducing the capital gains tax advantage:

-

Capital gains from selling your principal residence.

-

Income, including capital gains, earned in a tax-sheltered savings account, such as an RRSP, RRIF, TFSA, FHSA, or RESP.

-

Pension income or the capital gains earned by the registered pension plans you or your spouse are a member of including your workplace pension plan, and the CPP or QPP.

-

Up to $250,000 every year in capital gains from selling a cottage, investment property, or other taxable investments, such as stocks, beyond the generous limits of tax-sheltered savings account.

For Canadian businesses, only a small minority will be affected by these changes: in 2022, only 12.6 per cent of Canada's over two million corporations had capital gains (Table 8.2).

| Number of corporations | Share of all corporations | Average taxable income1 | |

|---|---|---|---|

| Capital gains | 307,000 | 12.6% | $702,000 |

| No capital gains | 2,124,000 | 87.4% | $174,000 |

Notes: 1 Data do not adjust for income of related corporations. |

|||

The proposal would reduce the tax rate differentials that currently exist between the various sources of income, for instance between dividends and capital gains. A more neutral system in this regard has the additional advantage of reducing tax planning incentives.

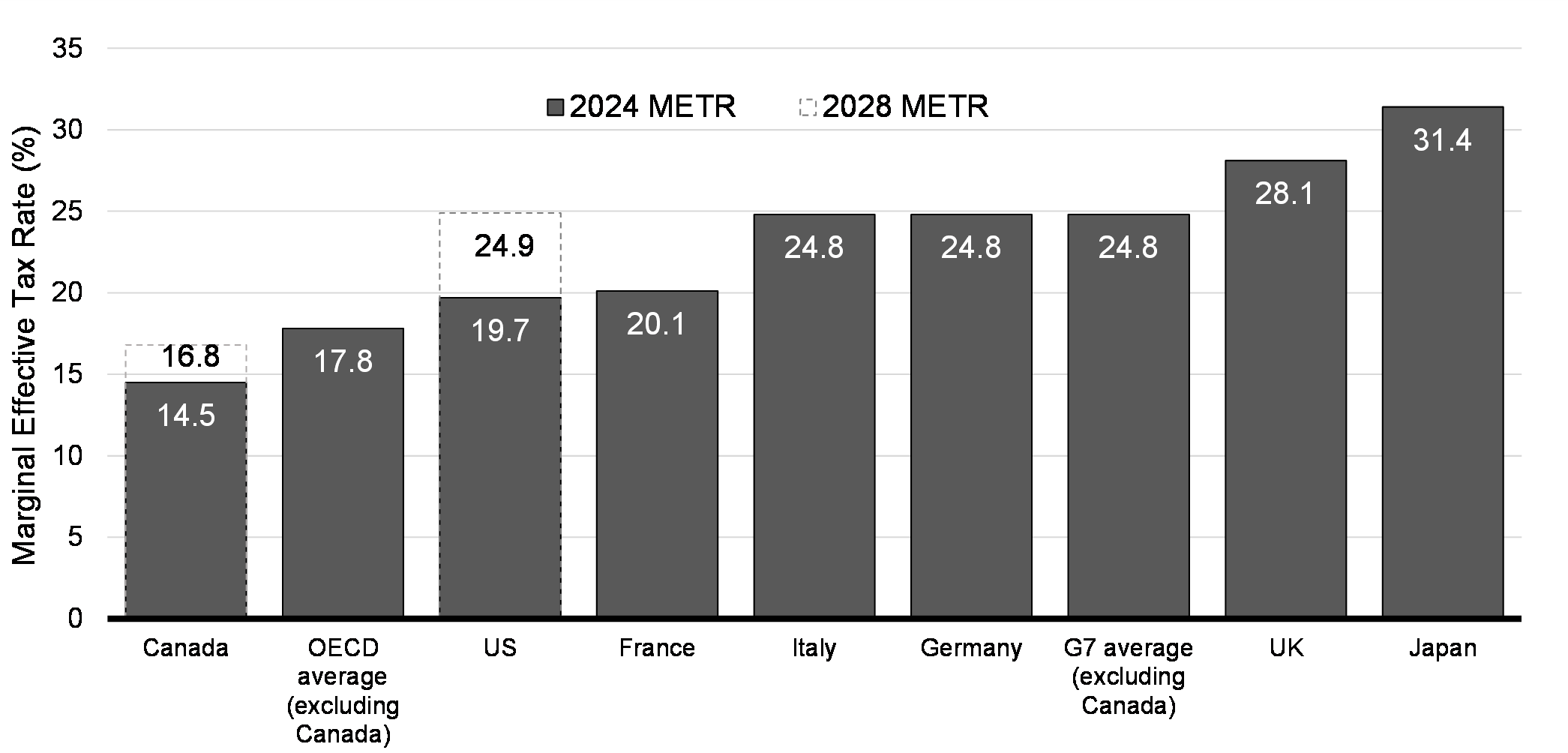

Increasing the capital gains inclusion rate is not expected to hurt Canada's business competitiveness. The Marginal Effective Tax Rate (METR) is an estimate of the level of taxation on a new business investment, accounting for federal, provincial, and territorial taxation, as well as investment tax credits, and capital cost allowances. It is one of the main metrics for comparing the level of taxation on a new business investment between countries. Maintaining a competitive METR is important for Canada's attractiveness as an investment destination.

Canada's average METR is the best in the G7, and far more advantageous than in the U.S. and other OECD countries. Increasing the fairness of capital gains taxation will not impact Canada's METR score.

Canada Has the Lowest Marginal Effective Tax Rate in the G7

It is estimated that this measure would increase federal revenues by $19.4 billion over five years starting in 2024-25.

Increasing the inclusion rate on capital gains is also expected to generate significant new revenue for provincial and territorial governments, equivalent to up to 60 per cent of the new federal revenue. For provinces and territories, this new revenue can be used to lift up every generation by making transformative investments in housing, health care, education, child care, infrastructure, and more.

A Tax Break for Entrepreneurs

To start and scale-up a business, entrepreneurs need access to capital. In the early growth stages, accessing the necessary capital to make investments in their workforce, cutting-edge technologies, and new offices, labs, or manufacturing facilities can be difficult. While some entrepreneurs rely on venture capital or loans, the government recognizes funding is not available to all entrepreneurs, and even when available, may not be sufficient.

Entrepreneurs need more support to drive Canada's economic growth, increase productivity, patent new innovations, and create good-paying jobs. Providing a partial lifetime capital gains exemption for entrepreneurs will enable them to recycle more capital towards their next goal, whether it be a new company, an investment in a promising start-up, or a comfortable retirement.

-

To encourage entrepreneurship, the government is proposing the Canadian Entrepreneurs' Incentive which will reduce the inclusion rate to 33.3 per cent on a lifetime maximum of $2 million in eligible capital gains. When this incentive is fully rolled out, entrepreneurs will have a combined exemption of at least $3.25 million when selling all or part of a business.

- The incentive will result in a one-third inclusion rate, and the limit will increase by $200,000 each year, starting in 2025, until it reaches $2 million in 2034.

- This additional $2 million incentive will be available to founding investors in certain sectors who own at least 10 per cent of shares in their business, and where the company has been their principal employment for at least five years.

Ultimately, when the Canadian Entrepreneurs' Incentive is fully implemented, and combined with the increased total lifetime capital gains exemption of $1.25 million, entrepreneurs will benefit from at least $3.25 million in total and partial lifetime capital gains exemptions. Entrepreneurs with eligible capital gains of up to $6.25 million will be better off under these changes. In practice, these numbers will likely be higher to reflect the inflation adjustment for the lifetime capital gains exemption and the ability to spread capital gains over multiple years.

Ensuring entrepreneurs benefit from their innovations

Kate founded a fintech start-up several years ago, and decides to accept an offer to sell her company to a large fintech company, which will use its resources to scale-up her technology. She earns $2 million in capital gains on this sale.

Kate has already used her increased lifetime capital gains exemption of $1.25 million when she sold some of her business shares to a business partner.

Currently, Kate would pay tax on $1 million—or 50 per cent of her $2 million in capital gains.

When the Canadian Entrepreneurs' Incentive is fully implemented, Kate would only pay tax on 33 per cent of the $2 million—$667,000. The incentive reduces her taxable income by $333,000 when selling her business.

Ensuring Global and Digital Corporations Pay Their Fair Share

The global corporate tax race to the bottom undermines Canada's ability to make investments at home that help restore fairness for every generation. Our tax base needed to pay for a sustainable social safety net is weakened, and responsibility to fund these programs is unfairly distributed and passed on to the next generation. This must change to ensure fairness for younger Canadians today, and tomorrow.

In Canada, we are laser focused on making sure the largest global corporations pay their fair share. That's why Canada strongly supports the two-pillar tax reform plan agreed to in 2021 by members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting.

Pillar One and the Digital Services Tax

Pillar One would ensure that the largest and most profitable global corporations, including large digital corporations, pay their fair share of tax in the jurisdictions where their users and customers are located.

Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing. However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action.

In October 2021, the government agreed to pause the implementation of Canada's Digital Services Tax, first announced in 2020, until the end of 2023, to give time for Pillar One negotiations to conclude. Meanwhile, at least seven other countries (Austria, France, India, Italy, Spain, Türkiye, and the United Kingdom) continue to apply their Digital Services Taxes.

The government is moving ahead with its longstanding plan to enact a Digital Services Tax. This will ensure digital businesses that monetize the data and content of Canadian users are paying their fair share, and that Canada is not at a disadvantage relative to other countries. Implementing legislation is currently before Parliament in Bill C-59.

Consistent with Canada's position since 2021, and subject to Parliamentary approval of the legislation, the tax would begin to apply for calendar year 2024, with that first year covering taxable revenues earned since January 1, 2022.

Canada is committed to continue working with international partners in view of its preference for an internationally agreed approach.

It is estimated that the Digital Services Tax will increase revenues by $5.9 billion over five years starting in 2024-25.

Pillar Two and the Global Minimum Tax

Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business. The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act. The government intends to soon introduce this legislation in Parliament.

It is estimated that the global minimum tax, which will apply for fiscal years of taxpayers that begin on or after December 31, 2023, will increase revenues by $6.6 billion over three years starting in 2026-27.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 8.1 Tax Fairness

8.2 Modernizing Canada's Tax System and Better Services for Canadians

Each day, millions of Canadians interact with the government when they access the services and benefits, including those delivered through the tax system, that have important roles in improving their quality of life and building a stronger, more competitive Canada. Canadians should be able to count on efficient, timely, and high-quality services from the federal government. That is why the government has been making sustained investments to make the tax system and other services easier to use and more convenient for Canadians.

Budget 2024 proposes new investments to simplify tax services and deliver benefits and services through modern technologies that are designed to meet the evolving needs of Canadians, including over ten million Canadians receiving benefits worth over $150 billion annually from Old Age Security, Employment Insurance, and the Canada Pension Plan.

Key Ongoing Actions

-

Launching an automatic tax filing pilot program for people with lower incomes, to make it easier to get the benefits you are entitled to.

-

Preventing wealthy Canadians from using foreign shell companies to avoid paying Canadian tax.

-

Returning to advertised passport processing times for 10-day in-person and 20-day mail-in applications, with processing now faster than pre-pandemic.

-

Improving call centre and benefit delivery wait times for Old Age Security and Employment Insurance, through $1.5 billion in the 2022 Fall Economic Statement to accelerate claims processing and reduce backlogs.

-

Reducing backlogs and improving service and benefit delivery for veterans and RCMP members, with $321.1 million since Budget 2023.

-

Improving Old Age Security benefit delivery for over seven million seniors each year by upgrading IT systems with $123.9 million from Budget 2023.

-

Hiring additional officers to alleviate border pressures, as well as help prevent prohibited or restricted goods from entering Canada, with $137 million in the 2022 Fall Economic Statement.

Automatic Tax Filing for Low-Income Canadians

Canadians should be able to easily and quickly receive the benefits to which they are entitled. However, lower-income Canadians, as well as younger Canadians, may not receive their benefits—such as the Canada Child Benefit and Canada Carbon Rebate which make life more affordable—because of the difficulty of filing a tax return.

In February 2024, the Canada Revenue Agency (CRA) increased the number of eligible Canadians for SimpleFile by Phone (formerly File My Return) to 1.5 million people, more than double the number of people eligible last year. The CRA is on track to increase this number to two million by 2025.

-

In summer 2024, the CRA will pilot new automatic filing services, SimpleFile Digital and SimpleFile by Paper, to help more Canadians who do not currently file their taxes receive their benefits.

The CRA will engage leading experts and industry to identify further opportunities to help more Canadians receive the benefits designed to support them. CRA will provide an update on this work in fall 2024.

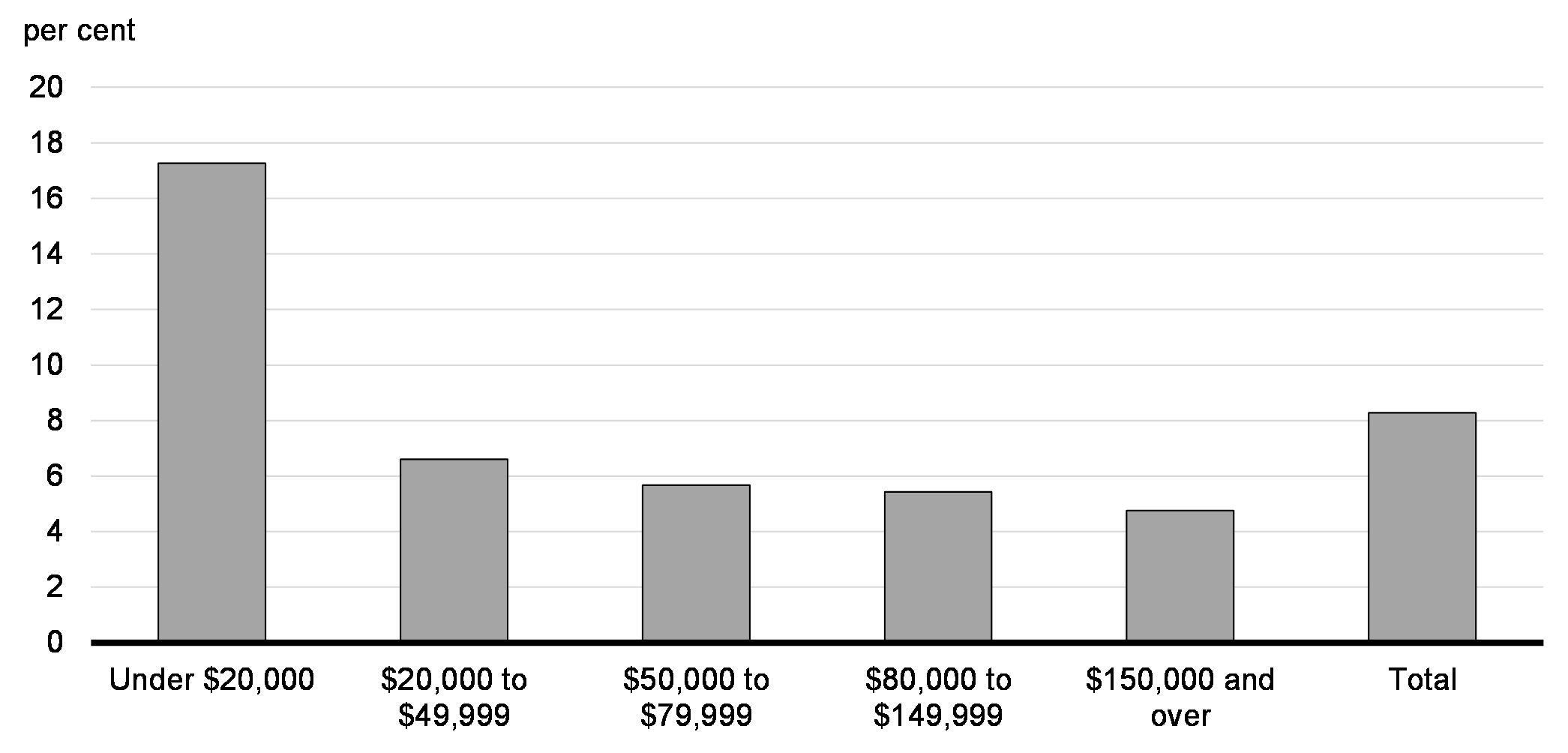

Non-Filing Rates by Income Group, 2020

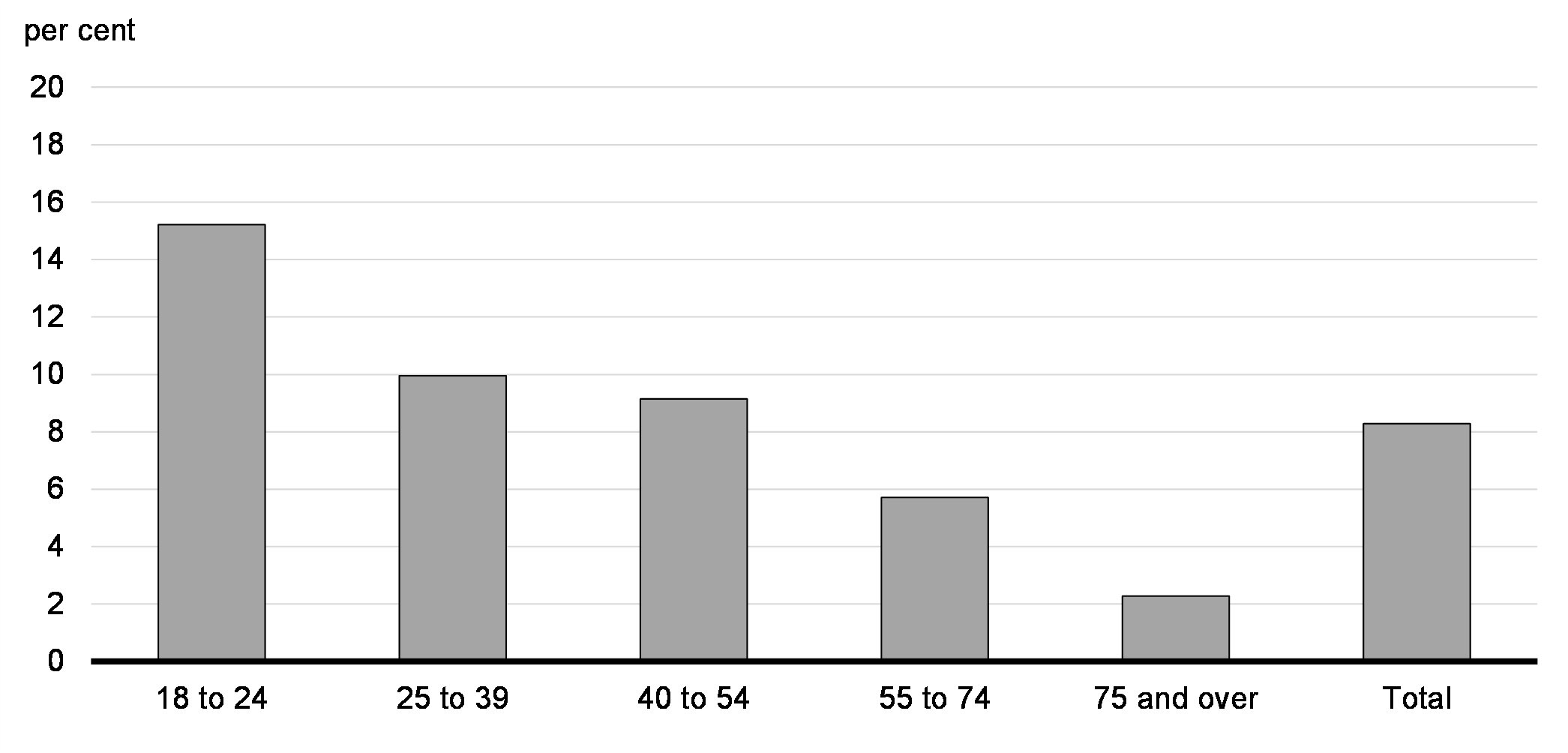

Non-Filing Rates by Age Group, 2020

Automatic tax filing pilot

Johnny lives in Manitoba and has never filed a tax return, and as a result is missing out on benefits such as the GST Credit, Canada Carbon Rebate, provincial rent credits, and possibly others that help make life more affordable.

Johnny's primary source of income is social assistance, which means he may be invited to participate in the SimpleFile pilot. Johnny would not have to fill out complex forms. The CRA would use the information it has on hand for him and his responses to a series of short simple questions, including information on his rent payments which the CRA does not otherwise have, to complete and file his tax return, thereby unlocking the government support to which he is entitled.

Reducing CRA Call Centre Wait Times

Canadians deserve high-quality and timely access to government services. However, when calling the Canada Revenue Agency (CRA), Canadians often face long wait times—which delay Canadians from getting help with filing their taxes and receiving the benefits they are entitled to.

To ensure Canadians get timely answers to their tax questions, the government is continuing to support CRA call centre operations.

-

Budget 2024 proposes to provide $336 million over two years, starting in 2024-25, to the Canada Revenue Agency to maintain call centre resources and improve the efficiency of its call centres.

A Single Sign-In Portal for Government Services

Canadians and businesses shouldn't have to remember multiple passwords to access the services and programs they rely on. However, there are currently over 60 different Government of Canada systems each requiring their own separate log-in and passwords to access. That is too many.

Fast and efficient delivery of government services and programs is critical to ensuring Canadians and businesses are supported as intended.

-

To establish a modern, single sign-in portal for federal government services, Budget 2024 proposes to provide $25.1 million over five years, starting in 2024-25, with $13.5 million in remaining amortization, to Employment and Social Development Canada.

Expanding Tax Transparency to Crypto-Assets

Just as crypto-assets pose financial risks to middle class Canadians, the rapid growth of crypto-asset markets poses significant risks of tax evasion. Regulation and the international exchange of tax information must keep pace with tax evasion threats in order to ensure a fair tax system.

The OECD has agreed to a new reporting framework for crypto-asset transactions and improvements to the Common Reporting Standard to ensure that new digital technologies cannot be used to avoid existing reporting requirements.

-

Budget 2024 announces the government's intention to implement the OECD-agreed Crypto-Asset Reporting Framework, including consequential amendments to the Common Reporting Standard, effective as of 2026 to permit exchanges under the new and amended reporting requirements beginning in 2027.

-

Budget 2024 proposes to provide $51.6 million over five years, starting in 2024-25, and $7.3 million per year ongoing to the Canada Revenue Agency for the implementation and administration of these initiatives.

Towards a Healthier, Nicotine-Free Generation

Enticed by appealing marketing, Millennials and Gen Z are picking up new forms of old bad habits, vaping nearly as frequently as the baby boomers smoked cigarettes. The government is taking action to protect the next generation from harmful, cancer-causing habits.

Nothing is more valuable than a long and healthy life. Smokers could live about ten years less than the general population. This is, in part, because people who smoke are 25 times more likely to die from lung cancer compared to someone who has never smoked. Treating preventable diseases puts a heavy burden on our universal public health care systems—a burden all Canadians pay for through taxes and longer wait times.

In addition to raising revenues, a more robust federal excise duty framework for tobacco and vaping products could help to lower smoking rates towards Canada's target of less than five per cent tobacco use by 2035, as well as lower vaping rates among younger Canadians.

-

Budget 2024 proposes to increase the tobacco excise duty by $4 per carton of 200 cigarettes, in addition to the automatic inflation adjustment of $1.49 per carton of 200 cigarettes that took effect on April 1, 2024. Starting the day after this budget, the total tobacco excise duties increase will be $5.49 per carton. It is estimated that this measure would increase federal revenues by $1.36 billion over five years starting in 2024-25.

-

Budget 2024 also proposes to increase the vaping excise duty rates by 12 per cent. This increase is the equivalent of 12 cents per typical vape pod in a non-participating jurisdiction, or 24 cents per typical vape pod in a participating jurisdiction. This measure would take effect on July 1, 2024, along with the implementation of a coordinated taxation regime in Ontario, Quebec, the Northwest Territories, and Nunavut. It is estimated that this measure would increase federal revenues by $310 million over five years starting in 2024-25.

Improving Benefit Delivery

Canadians deserve efficient and easy access to their federal benefits, such as Old Age Security and Employment Insurance. However, the IT systems used to deliver these benefits are aging.

After years of underinvestment and deferred modernization, the government has taken action in recent years to make critical IT upgrades. These will ensure that benefits are delivered quickly, reliably, and securely to the millions of Canadians collecting benefits today, as well as to those who will collect benefits in the decades to come.

-

Budget 2024 proposes to provide a total of $2.9 billion over five years, starting in 2024-25, on a cash basis, to Employment and Social Development Canada to migrate Old Age Security and Employment Insurance onto a secure, user-friendly platform.

The government also remains committed to implementing an ePayroll solution which would reduce the reporting burden on Canadian businesses, especially small businesses, while modernizing and improving how benefits are provided through the Employment Insurance and tax systems.

Canada Child Benefit for Grieving Families

Grieving families should not be worried about their finances during the most difficult of life circumstances.

However, some families who have lost a child may currently receive correspondence from the government requiring

them to repay any Canada Child Benefit amount received after their child's death.

To support parents who have lost a child, the government is providing new support through the Canada Child

Benefit to ensure they can focus on what matters most—healing.

-

In recognition of the burdens on grieving parents, Budget 2024 announces the government's intention to amend the Income Tax Act to continue to pay the Canada Child Benefit for six months after a child's death, as of January 2025.

This proposed change is expected to cost $15 million over five years, starting in 2024-25, and $4 million per year ongoing.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 8.2 Modernizing Canada's Tax System and Better Services for Canadians

8.3 Effective, Efficient Government

To focus spending on what matters most—investing in Canadians, unlocking opportunity for younger Canadians, and restoring fairness for every generation—the government must ensure the operations of government are cost effective.

As our country grows and demographics shift, such as Millennials recently overtaking baby boomers as the largest age group, the government must adapt to the changing needs of Canadians. That's why the government is continuously evaluating demand for services and programs, and adjusting investments accordingly—ensuring Canadians have the support they need, when they need it.

Budget 2024 announces new measures to ensure the effective operation of federal government programs and services, and ensuring that Canadians' tax dollars are being used efficiently on the programs that matter most to them.

Responsible Government Spending

Budget 2023 and the 2023 Fall Economic Statement announced a total of $15.8 billion in savings over five years, and $4.8 billion ongoing, to be refocused towards the priorities that matter most to Canadians today, including health care, dental care, and investments in Canada's economic plan.

Over the past year, the government carried out the first phase of refocusing government spending, identifying areas of duplication, low value for money, or lack of alignment with government priorities, with a particular focus on travel and consulting. Care was taken to ensure that departments and agencies could meet their reallocation targets without impacting direct benefits and service delivery to Canadians; direct transfers to other orders of government and Indigenous communities; and the Canadian Armed Forces. Results of this first phase are outlined in the Main Estimates, 2024-25 and the 2024-25 Departmental Plans.

-

To implement the second phase of refocusing government spending, Budget 2024 announces the government will seek to achieve savings primarily through natural attrition in the federal public service.

- Starting on April 1, 2025, federal public service organizations will be required to cover a portion of increased operating costs through their existing resources.

- Over the next four years, based on historical rates of natural attrition, the government expects the public service population to decline by approximately 5,000 full-time equivalent positions from an estimated population of roughly 368,000 as of March 31, 2024.

- Altogether, this will achieve the remaining savings of $4.2 billion over four years, starting in 2025-26, and $1.3 billion ongoing towards the refocusing government spending target.

Canadians know how important it is to responsibly manage a budget while at the same time contending with rising costs, and they rightly expect the government to do the same. This measure will not impact the delivery of benefits to Canadians and will be implemented in a way that continues to support regional representation and a diverse public service workforce.

Going forward, the government will continue to review spending across departments and on key initiatives to ensure the government operates effectively and efficiently for Canadians. Ongoing reviews of government spending and programming are an important component of managing public finances in a prudent and responsible manner.

Strengthening Integrity in the Public Service

The government is taking action to enforce and uphold the highest standards of procurement to ensure sound stewardship of public funds. This work is critical to ensuring Canadians trust that federal institutions are efficient and effective. As part of this work, the government has recently implemented additional robust standards to strengthen oversight and hold public servants to the highest of ethical standards.

On March 20, 2024, the Minister of Public Services and Procurement and the President of the Treasury Board announced a series of new actions to strengthen the government's procurement and conflict of interest regimes:

-

Releasing, last month, updated procurement guidance for managers to reinforce the prudent use of public funds, including examining human resources and staffing strategies before procuring professional services, strict evaluation criteria when a supplier is selected, clear due diligence protocols to ensure no conflict of interest, and ensuring all contractual obligations are upheld by third-party vendors;

-

Launching, earlier this month, government-wide audits to ensure governance, decision-making, and controls associated with professional service contracts, including IT, uphold the highest ethical standards, with audit results expected by December 2024;

-

Launching, in the coming months, a new Risk and Compliance Process to ensure government-wide trends, risks, and departmental performance meet the highest standards, and take corrective actions wherever necessary, as soon as possible;

-

Bringing forward, in the next month, strengthened accountability guidelines for managers when procuring professional services, including robust validation that a potential contractor is the optimal approach to meet operational requirements; and,

-

Committing to publishing more detailed contracting information on the Open Data portal in a clear, accurate, and more user-friendly manner.

These actions will ensure transparency in contracting and leverage data analytics to identify and immediately take action to resolve any potential anomalies in billing. These changes will also ensure that public servants clearly understand and abide by their responsibilities with respect to engaging in outside employment.

Government Procurement to Boost Innovation

Public procurement can be a tool to drive innovation and support Canadian businesses bringing new, cutting-edge solutions to market. Federal purchasing power can and should be leveraged to better support small businesses and innovators to grow the economy and create more good jobs for Canadians.

-

Budget 2024 announces the government's intention to propose legislated procurement targets for small- and medium-sized businesses and innovative firms. The government will consult with industry stakeholders, and innovation organizations, as well as evaluate international best practices in developing a proposal.

A proposal for targets will be outlined in the 2024 Fall Economic Statement.

Strengthening Cyber Security

Cyber security is more important than ever as Canadians increasingly interact with and receive benefits from the government via digital services. The government is strengthening its tools to maintain digital services, protect Canadians' information, and improve the resilience of federal agencies in the face of emerging cyber threats.

-

Budget 2024 proposes to provide $11.1 million over five years, starting in 2024-25, to the Treasury Board of Canada Secretariat to implement a whole-of-government cyber security strategy. This will help ensure the government is best equipped to combat cyber threats, and quickly and effectively resolve any vulnerabilities across digital government services.

-

Budget 2024 also proposes to provide $27 million over five years, starting in 2024-25, and $2.3 million ongoing to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to enhance its cyber resiliency and ensure the implementation of additional data security safeguards over the long-term.

-

To ensure a common understanding of cyber security best practices and identify areas for priority action to build cyber resiliency, the government also proposes to launch a data governance review of federal financial sector agencies, to be led by the Department of Finance Canada.

Deposit Insurance Review

The federal deposit insurance framework protects the stability of the financial system in Canada by protecting

Canadians' savings and ensuring access to financial services in the unlikely event of a bank failure.

Maintaining the effectiveness of the deposit insurance framework requires ongoing assessment to adapt to the

evolving financial system and marketplace.

-

To uphold Canada's robust deposit insurance framework and protect Canadians' savings, Budget 2024 announces the government's intention to undertake a review of the federal deposit insurance framework, starting in 2024.

-

This work will be led by the Department of Finance Canada, in collaboration with the Canada Deposit Insurance Corporation and other financial sector agencies. The government will hold consultations later in 2024 and explore what changes to the depositor protection framework, if any, are necessary to best support the evolving needs of Canadians and uphold financial stability.

Predictable Capital Funding for Federal Assets

Federal real property and information technology systems are integral to everything the government does, from delivering programs and services to Canadians, to supporting the economy and communities, and realizing broader government objectives of accessibility and reducing emissions. Predictable capital funding for Public Services and Procurement Canada to manage these assets provides long-term value and better enables the government to serve Canadians.

-

Budget 2024 proposes to provide $6.7 billion over 20 years, starting in 2024-25, to Public Services and Procurement Canada in support of managing its portfolio of assets.

- This includes support for Laboratories Canada facility upgrades, the rehabilitation of the Alaska Highway, continuing restorations within the Parliamentary Precinct, modernizing the Receiver General information technology systems that make over 300 million payments to Canadians each year, and advancing the necessary rehabilitation of the Supreme Court of Canada building.

Asylum System Stability and Integrity

Around the world, the number of people displaced by political instability, conflict, poverty, and climate change continues to rise. According to the UN Refugee Agency, in 2022, the worldwide number of new individual asylum applications increased by 83 per cent compared to 2021. Canada is not immune to these dynamics, and more than ever before, people come to Canada in search of safety and stability.

Canada's asylum system, including the processes and rules guiding the work of the border officers,

immigration officials, and members of the Immigration and Refugee Board who process, investigate, and adjudicate

asylum claims, has struggled to keep up with the unprecedented number of asylum claims. This has resulted in

longer periods of uncertainty for those in legitimate need of protection and delayed removals of those with

denied claims.

To uphold the integrity and fairness of the asylum system:

-

Budget 2024 proposes to provide Immigration, Refugees and Citizenship Canada, the Canada Border Services Agency, and the Immigration and Refugee Board with $743.5 million over five years, starting in 2024-25, with $0.9 million in remaining amortization, and $159.5 million ongoing, to support the stability and integrity of Canada's asylum system. Of this amount, $72 million over two years, starting in 2027-28, and $36 million ongoing would be sourced from existing departmental resources.

-

Budget 2024 also proposes to introduce changes to the Immigration and Refugee Protection Act to simplify and streamline the claims process in support of faster decisions and quicker removals.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 8.3 Effective, Efficient Government

| 2023-2024 | 2024-2025 | 2025-2026 | 2026-2027 | 2027-2028 | 2028-2029 | Total | |

|---|---|---|---|---|---|---|---|

| 8.1. Tax Fairness | 0 | -6,715 | -3,015 | -5 | -3,285 | -4,670 | -17,690 |

| Improving Tax Fairness | 0 | -6,900 | -3,370 | -375 | -3,660 | -5,050 | -19,355 |

| A Tax Break for Entrepreneurs | 0 | 185 | 355 | 370 | 375 | 380 | 1,665 |

| 8.2. Modernizing Canada's Tax System and Better Services for Canadians | 0 | 6 | -153 | -263 | -252 | -185 | -847 |

| Automatic Tax Filing for Low-Income Canadians1 | 0 | 10 | 11 | 11 | 11 | 11 | 54 |

| Reducing CRA Call Centre Wait Times | 0 | 249 | 87 | 0 | 0 | 0 | 336 |

| A Single Sign-In Portal for Government Services | 0 | 6 | 7 | 8 | 2 | 2 | 25 |

| Expanding Tax Transparency to Crypto-Assets1 | 0 | 6 | 6 | 11 | 15 | 12 | 52 |

| Toward a Healthier, Nicotine-Free Generation | 0 | -325 | -350 | -340 | -330 | -320 | -1,665 |

| Improving Benefit Delivery2 | 0 | 60 | 87 | 51 | 53 | 113 | 364 |

|

Less: Funds From CPP Account

|

0 | -2 | -5 | -7 | -7 | -7 | -27 |

| Canada Child Benefit for Grieving Families | 0 | 1 | 3 | 3 | 4 | 4 | 15 |

| 8.3. Effective, Efficient Government | 0 | 141 | 336 | 176 | 237 | 188 | 1,077 |

| Strengthening Cyber Security | 0 | 14 | 14 | 15 | 3 | 3 | 49 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

0 | -1 | -1 | -1 | 0 | 0 | -3 |

|

Less: Costs to be Recovered

|

0 | 0 | -4 | -2 | -1 | -1 | -8 |

| Predictable Capital Funding for Federal Assets | 0 | 44 | 114 | 23 | 120 | 66 | 368 |

| Asylum System Stability and Integrity | 0 | 83 | 213 | 142 | 150 | 156 | 743 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

0 | 0 | 0 | 0 | -36 | -36 | -72 |

| Additional Investments – Tax Fairness for Every Generation | 35 | 77 | -162 | -179 | -220 | -238 | -687 |

| Manipulating Bankrupt Status | 0 | -85 | -85 | -85 | -85 | -85 | -425 |

| Budget 2024 announces the government's intention to amend the Income Tax Act to address planning that involves the manipulation of the bankrupt status of an insolvent corporation as outlined in "Tax Measures: Supplementary Information". | |||||||

| CRA Funding to Administer Previously Announced Measures | 0 | 19 | 18 | 17 | 14 | 14 | 81 |

| Funding proposed for the CRA and the CBSA to administer previously announced tax and other measures including the changes to the disbursement quota for charities, the federal fuel charge in the four Atlantic provinces, the vaping excise duty framework, and the short-term rentals measure. | |||||||

| Changes to the Alternative Minimum Tax Reform | 35 | 131 | 122 | 113 | 113 | 108 | 622 |

| Budget 2024 announces the government's intention to revise the Budget 2023 Alternative Minimum Tax proposal as outlined in "Tax Measures: Supplementary Information". | |||||||

| Improving Ability to Address Aggressive Tax Planning Schemes | 0 | 3 | 4 | 4 | 4 | 4 | 18 |

|

Less: Projected Tax Revenue

|

0 | -100 | -100 | -100 | -100 | -100 | -500 |

| Funding proposed for FIN to improve the integrity of the tax system. The resulting increase in development of tax legislation is estimated to provide additional federal revenues for the fiscal framework totaling $500 million over five years. | |||||||

| Enhancing the Security Posture of the Privy Council Office | 0 | 8 | 9 | 9 | 9 | 5 | 40 |

| Funding proposed for PCO to enhance physical and cyber security and expand access to secure communication technologies for senior leaders in the government. | |||||||

| Public Service Occupational Health | 0 | 8 | 8 | 8 | 0 | 0 | 23 |

| Funding proposed for HC for the Public Service Occupational Health Program to ensure federal organizations meet occupational health obligations under the Canada Labour Code. | |||||||

| Expediting Access to Information | 0 | 22 | 28 | 28 | 3 | 3 | 84 |

| Funding proposed for TBS and LAC to maintain the Access to Information and Privacy regime. | |||||||

| Investing in Operating the Canadian Coast Guard Fleet of the Future | 0 | 49 | 78 | 86 | 92 | 93 | 397 |

| Funding proposed for DFO to ensure the Canadian Coast Guard has the necessary training capacity, seagoing crew, support staff, and provisions to operate its future marine vessel fleet. | |||||||

| Government Human Resources and Pay Strategy | 0 | 135 | 0 | 0 | 0 | 0 | 135 |

| Funding proposed for PSPC and TBS to improve public service human resources and pay systems, including continuing work on a potential next generation pay solution. | |||||||

| An Accessible, Diverse, Equitable and Inclusive Federal Public Service | 0 | 8 | 7 | 1 | 1 | 1 | 17 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

0 | -1 | 0 | 0 | 0 | 0 | -1 |

| Funding proposed for TBS and PSC to support the Office of Public Service Accessibility, the Federal Internship Program for Canadians with Disabilities, and improve recruitment and assessment processes for persons with disabilities. | |||||||

| Support for the Office of the Public Sector Integrity Commissioner | 0 | 1 | 1 | 1 | 1 | 1 | 5 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

0 | 0 | 0 | 0 | 0 | 0 | -1 |

| Funding proposed for the OPSIC to continue to deliver on its mandate of investigating disclosures and complaints under the federal government worker whistleblower regime. | |||||||

| Employment Insurance Revenues for Measures Included in Budget 2024 | 0 | -119 | -250 | -261 | -271 | -281 | -1,182 |

| Includes Employment Insurance revenue for Extending Temporary Support for Seasonal Workers in section 4.2, Improving Benefit Delivery in section 8.2, and Employment and Social Development Canada Rent Price Adjustment in Table A1.16. | |||||||

| Chapter 8 - Net Fiscal Impact | 35 | -6,492 | -2,995 | -271 | -3,520 | -4,905 | -18,147 |

Note: Numbers may not add due to rounding. A glossary of abbreviations used in this table can be found at the end of Annex 1. 1 Administrative costs for the Canada Revenue Agency. 2 Measure partially reimbursed by increased Employment Insurance premiums. |

|||||||

Page details

- Date modified: