Archived - Chapter 1:

More Affordable Homes

On this page:

Impacts report

Find out more about the expected gender and diversity impacts for each measure in Chapter 1: More Affordable Homes.

Fairness for every generation means making housing affordable for every generation.

For generations, one of the foundational promises of Canada's middle class dream was that if you found a good job, worked hard, and saved money, you could afford a home. For today's young adults, this promise is under threat.

Rising rents are making it hard to find an affordable place to call home and rising home prices are keeping homes out of reach for many first-time buyers. The ability of an entire generation of Canadians to achieve the promise of Canada is at risk, despite their sheer grit and hard work. Millennials and Gen Z are watching the middle class dream become less and less achievable. They worry that they won't ever be able to afford the kinds of homes they grew up in. They deserve the same opportunity to own a place of their own as was enjoyed by generations before them.

The government is taking action to meet this moment, and build housing at a pace and scale not seen in generations. We did it when soldiers returned home from the Second World War, and we can build homes like that again. And we can make sure that Canadians at every age can find an affordable home.

On April 12, the government released an ambitious plan to build homes by the millions, Solving the Housing Crisis: Canada's Housing Plan. It includes our plan to make it easier to afford rent and buy a home, and makes sure that the most vulnerable Canadians have support, too. At the heart of our plan is a commitment that no hard-working Canadian should spend more than 30 per cent of their income on housing costs.

Tackling the housing crisis isn't just about fairness, it's also about building a strong economy. When people can afford housing, they can also invest in their local community, supporting local businesses and jobs. When workers can afford to live near their jobs, short commutes turn into high productivity. Businesses want to establish new headquarters in cities where workers can afford to live. When people can more easily save for a down payment, they can pursue their dreams, like starting a business. Housing policy is economic policy.

Budget 2024 and Canada's Housing Plan lay out the government's bold strategy to unlock 3.87 million new homes by 2031, which includes a minimum of 2 million net new homes on top of the 1.87 million homes expected to be built anyway by 2031. Of the 2 million net new homes, we estimate that the policy actions taken in Budget 2024, Canada's Housing Plan, and in fall 2023 would support a minimum of 1.2 million net new homes.

Given the significant provincial, territorial, and municipal levers that control and influence new housing construction, we call on every order of government to step up, take action, and achieve an additional 800,000 net new homes, at minimum, over this same period.

To get this done, the government will work with every order of government, with for profit and non-profit homebuilders, with Indigenous communities, and with every partner necessary to build the homes needed for Team Canada to restore fairness for every generation.

Working together, we will reach at least 3.87 million new homes by the end of 2031.

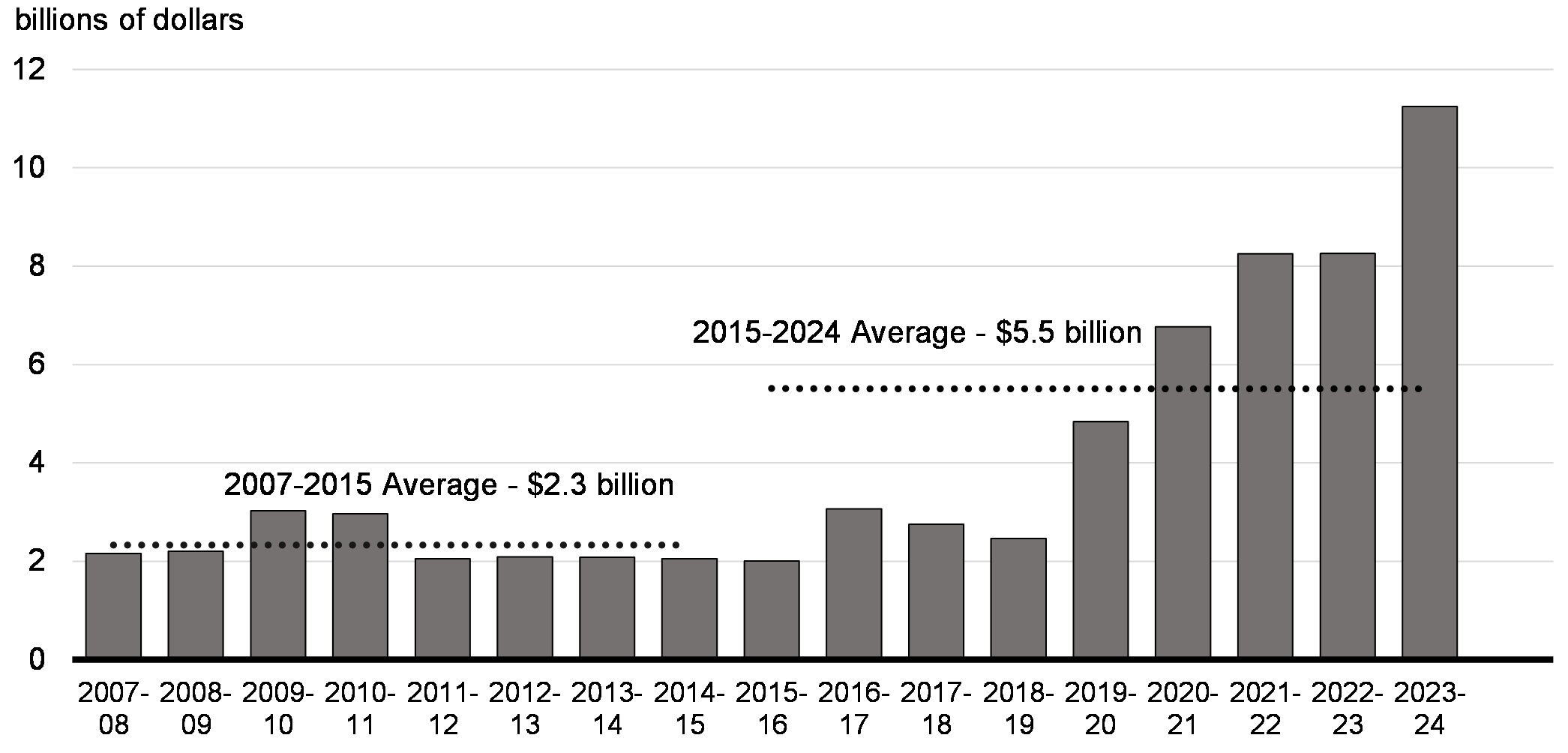

Federal Housing Investments Since the 2008 Global Financial Crisis

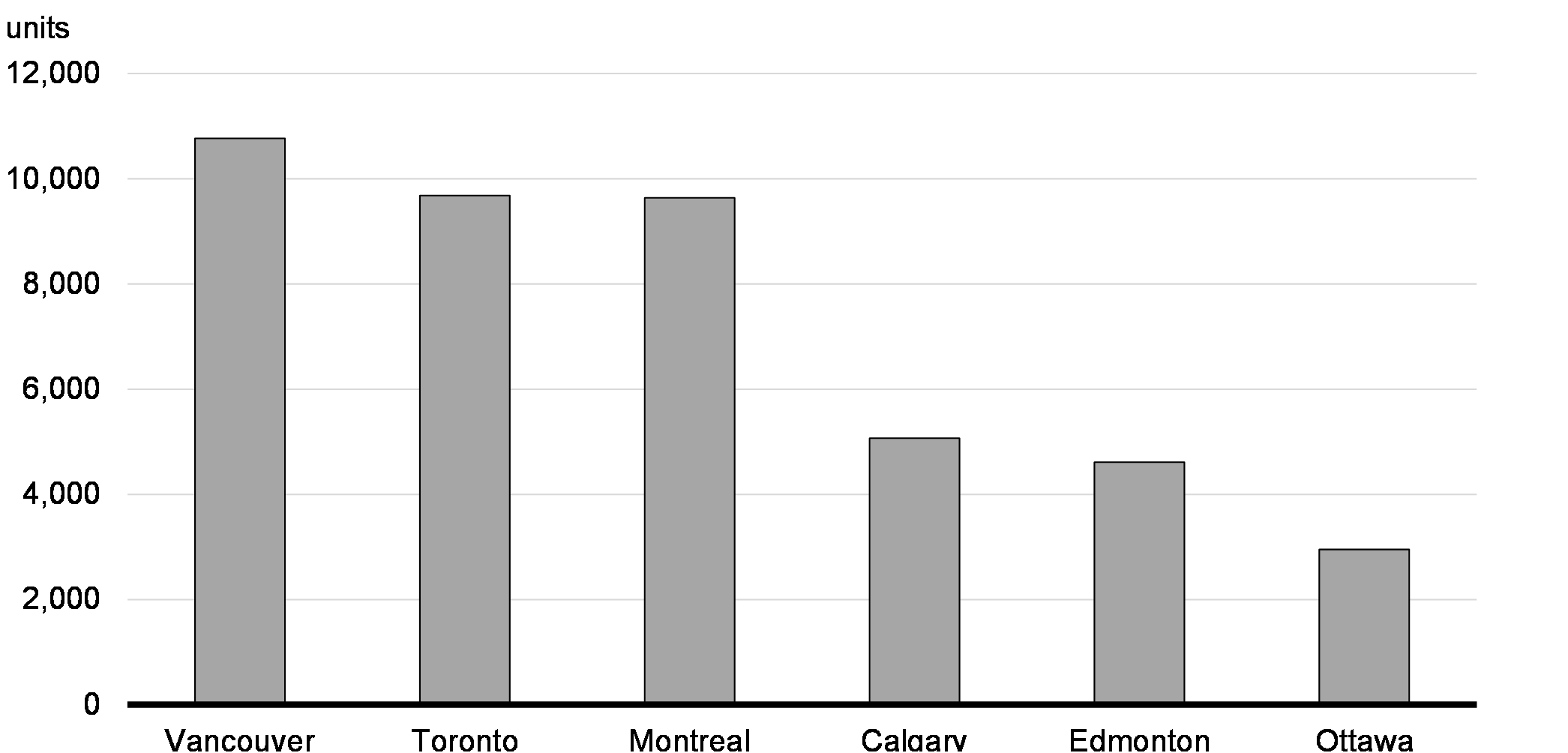

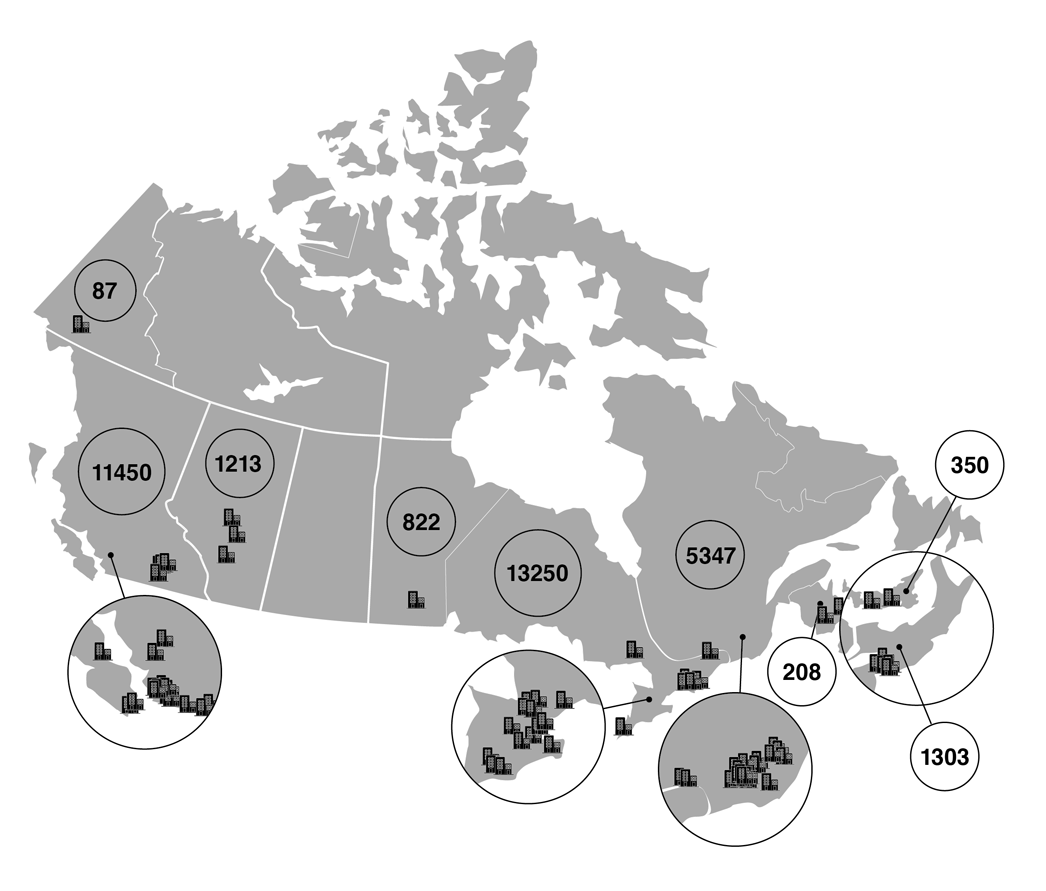

New Housing Starts of Purpose-Built Rentals by Census Metropolitan Area, 2023

Immigrants built Canada. And when new Canadians arrive today, our society is enriched. Canada, like other advanced economies, needs immigrants today more than ever, given our aging population. Immigrants are essential to maintaining a young and capable workforce, to ensuring we can find the doctors, construction workers, nurses, and early childhood educators that we need.

But our ability to successfully welcome new Canadians depends on having the physical capacity to do so properly—in particular having enough homes. That is why current housing pressures mean that Canada is taking a careful look to make sure immigration does not outpace our ability to supply housing for all.

It is important to note that Canada's immigration system has two parts: permanent and temporary.

Throughout Canada's history, permanent immigration has become subject to extensive consultation with communities, provinces, territories, and employers. It is planned and designed in collaboration with Canadian society.

However, temporary immigration, which includes our student and temporary worker programs, has traditionally been demand-driven, determined by the requests from international students and workers, and from employers in Canada.

Canada has recently undertaken a review process for our temporary resident programs, to better align with labour market needs, to protect against abuses in the system, and to match our capacity to build new homes. We will also be setting targets both for the number of permanent residents we welcome, and for temporary residents.

Starting this fall, for the first time, we will expand the Immigration Levels Plan to include both temporary resident admissions and permanent resident admissions.

Our ultimate goal is to ensure a well-managed, responsive, and sustainable immigration system to help balance housing supply with housing demand. We also need to be sure that our temporary worker programs do not create a disincentive for businesses to invest in productivity, or drive down wages in Canada, especially for low-wage workers.

Solving the Housing Crisis

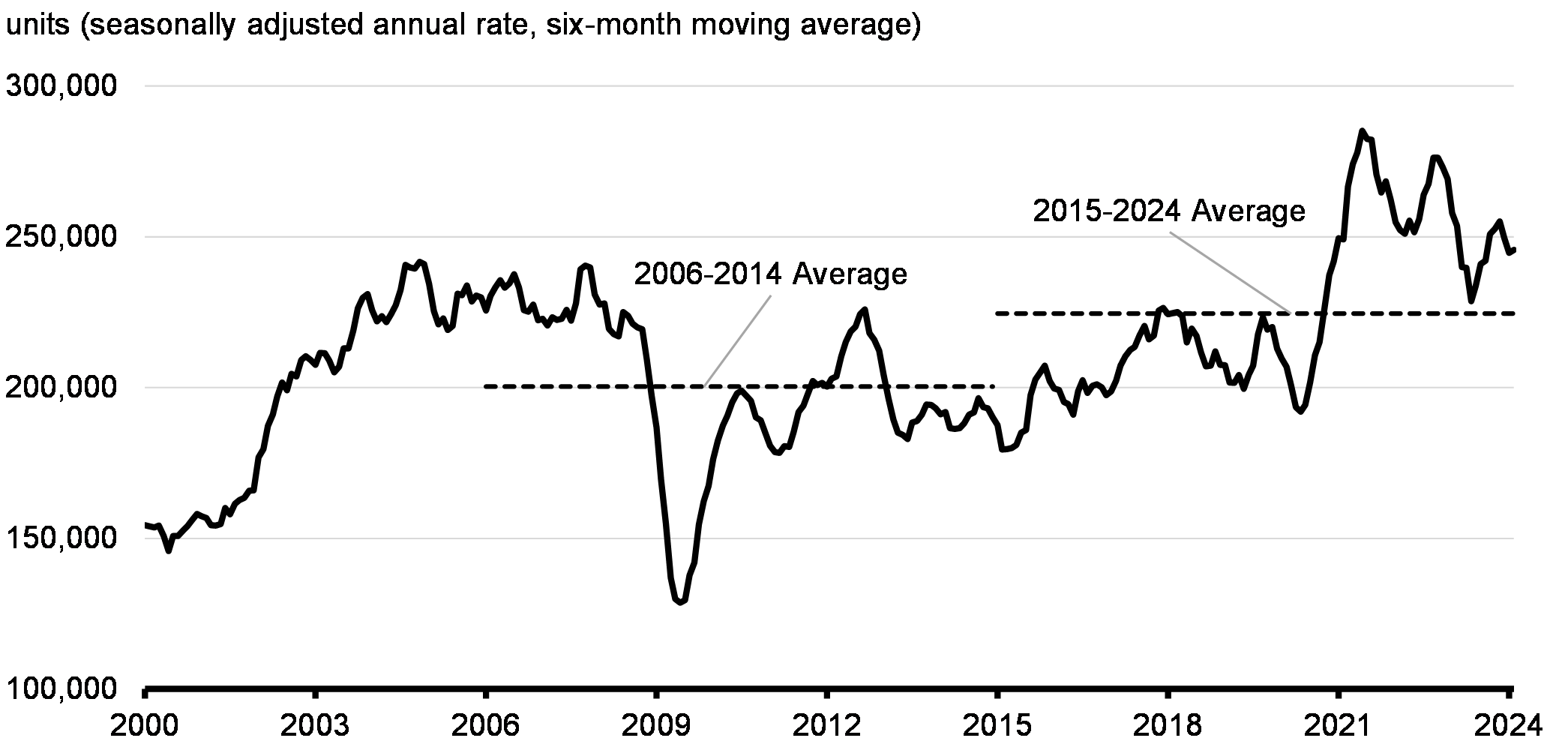

The federal government's plan starts with turbocharging the construction of new homes across the country because the best way to bring down home prices is to increase supply—and quickly. The government is already making the math work for homebuilders by breaking down regulatory and zoning barriers, providing direct low-cost financing, and making more land available. To ensure we have the workers and innovative construction methods needed to build more homes, faster, the government is training and recruiting the next generation of skilled trades workers, and transforming how homes are built to increase construction productivity.

Second, to make it easier to own or rent a home, Budget 2024 announces new action to support renters and lower the costs of homeownership. For renters, new action will help protect them from unfair practices like steep rent increases and renovictions, and unlock new pathways for them to become homeowners, including ensuring they get credit for rental payments. For first-time homebuyers, new support will make it easier to save for their down payment faster and get their first mortgage. And, existing homeowners with mortgages will benefit from new protections from rising payments through the strengthened Canadian Mortgage Charter.

Third, because everyone in Canada deserves a safe and affordable place to call home, this plan is unlocking more homes for Canadians in need. This includes building more affordable units for low- and middle-income Canadians by investing in affordable housing projects and partnering with non-profits, co-ops, the private sector, and other orders of government. This also means offering immediate support for Canadians without shelter and Canadians at risk of becoming homeless.

At the crux of this effort is ensuring that fiscal policy works in tandem with monetary policy, and that Canada's immigration policy works in tandem with housing policy. The government recently announced plans to adjust immigration programming which would lead to about 600,000 fewer temporary residents in Canada compared to current levels. These efforts are critical to creating the necessary conditions to lower interest rates, lower housing demand, and restore housing affordability.

1.1 Building More Homes

Building enough homes to restore fair prices and make sure everyone has a place to call home is going to take a Team Canada effort. All orders of government—federal, provincial, territorial, and municipal—need to work together to remove all barriers that often slow down the construction of new homes. This includes working together to overcome financial, zoning, and regulatory barriers.

Already, the $4 billion Housing Accelerator Fund is cutting red tape across the country, with 179 agreements with municipalities, provinces, and territories enabling the construction of over 750,000 new homes over the next decade. It is working, so we are topping it up with $400 million to build more homes, faster, in more communities.

Under a new Canada Builds approach, the federal government is offering to partner with provinces and territories that launch their own ambitious housing plans, with federal financing to help rapidly increase housing supply for Canadians in every province and territory.

We must use every possible tool to build homes at a scale and pace not seen since the Second World War. The federal government is announcing a range of new measures to make the math work for homebuilders, unlock the lands needed to build new homes, cut red tape that holds back new construction, attract and train skilled workers, and accelerate the implementation of innovative ways to build more homes, faster.

New Home Starts (6-month moving average)

Key Ongoing Actions

-

The Affordable Housing and Groceries Act, which is making it less expensive to build new homes by removing the GST on new purpose-built rental housing projects.

-

Over $40 billion through the Apartment Construction Loan Program, which is providing low-cost financing to build more than 101,000 new rental homes across Canada.

-

Over $14 billion through the Affordable Housing Fund to build 60,000 new affordable homes and repair 240,000 additional homes.

-

$4 billion through the Housing Accelerator Fund, which is incentivizing municipalities to make transformative changes by removing zoning barriers and ramping up housing construction. The Housing Accelerator Fund is already fast-tracking the construction of at least 100,000 homes over the next three years, and more than 750,000 homes across Canada over the next decade.

-

Unlocking $20 billion in new financing to build 30,000 more rental apartments per year by increasing the annual limit for Canada Mortgage Bonds from $40 billion to up to $60 billion.

Building Homes on Public Lands

The high cost and scarcity of land present key barriers that prevent key homes from being built. These barriers also contribute to higher costs of building, which are then passed on to Canadians.

Today, governments across Canada are sitting on surplus, underused, and vacant public lands, such as empty office towers or low-rise buildings that could be built on. By unlocking these lands for housing, governments can lower the costs of construction and build more homes, faster, at prices Canadians can afford.

Since 2016, Canada Lands Company has enabled the construction of more than 10,300 new homes on underused federal land, including more than 1,100 affordable homes. Over the next five years, Canada Lands Company currently aims to enable the construction of over 29,200 new homes, with a minimum of 20 per cent affordable units. Canada Lands Company is working to unlock new homes each day, but we need to do more, faster.

To ensure every Canadian has a safe and affordable place to call home, the government will transform its approach to federally owned land and lead a national, Team Canada effort to unlock public lands for housing.

Whenever possible, public land should be used for homes. Moving forward, the federal government will partner with the housing sector to build homes on every possible site across the federal portfolio. By leveraging new approaches to building homes on public lands, such as leasing, the federal government will also be able to maintain the strengths of its balance sheet.

By building homes on public lands,the federal government will lead a Team Canada effort to unlock federal, provincial, territorial, and municipal public lands across the country. The federal government will partner with homebuilders and housing providers to build homes on every possible site across the public portfolio.

With the new Public Lands for Homes Plan, the federal government is announcing an historic shift in its approach to unlock 250,000 new homes by 2031.

To get this done, Budget 2024 announces:

-

The federal government will use all tools available to convert public lands to housing, including leasing, acquiring other public lands for housing, and retaining ownership, whenever possible. Keeping land under public ownership and leasing it to builders—instead of selling to the highest bidder—will enable new homes to be affordable, forever. This effort will help housing providers avoid unnecessary upfront capital costs, allowing them to build more affordable housing, all while strengthening the federal government's balance sheet to unlock more homes.

-

The federal government is conducting a rapid review of its entire federal lands portfolio to identify more land for housing. As part of this effort, the government will:

- Review the entire portfolio of federally owned land and properties to rapidly identify sites where new homes can be built;

- Require departments and agencies to offer up specific parcels of land according to specified targets;

- Consult with municipal, provincial, and private sector partners to identify the most promising lands to be made available for housing;

- Publish a new Public Land Bank, encompassing an inventory of available lands, before fall 2024 to accelerate construction on public lands;

- Release a new geo-spatial mapping tool to help homebuilders more easily access and navigate public lands; and,

- Introduce legislation, as required, to facilitate the acquisition and use of public lands for homes, in partnership with other orders of government.

-

Budget 2024 proposes to provide $5 million over three years, starting in 2024-25, to support an overhaul of the Canada Lands Company to expand its activities to build more homes on public lands. These reforms will seek to:

- Cut approval times in half, while abiding by constitutional obligations;

- Initiate redevelopment processes early;

- Bundle multiple properties to be transferred at once;

- Provide leases, including long-term, low-cost leases, for housing providers;

- Transform underused government offices into multi-use properties;

- Transfer land from the federal government to Canada Lands Company for $1, whenever possible, to support more affordable housing;

- Enable housing development on actively used federal properties; and,

- Work with Crown corporations to redevelop their surplus, underutilized, or actively used properties for housing.

-

In addition to partnering with homebuilders, not-for-profits, and co-ops on federal sites, the federal government will partner with provinces, territories, and municipalities to unlock more public lands to build more homes. While the federal government owns a large portfolio of land, other orders of government can and should also contribute to this national effort by leveraging their own public land portfolios. Building on these sites can be done efficiently as existing infrastructure is already in place, such as transit, schools, roads, water, electricity, and parks. To support this effort and expand the federal government's land portfolio to build more homes, Budget 2024 proposes to provide:

- $500 million over five years, starting in 2024-25, on a cash basis, to Public Services and Procurement Canada to launch a new Public Lands Acquisition Fund, which will purchase land from other orders of government to help spur sustainable, mixed-market housing.

- $112.6 million over five years, starting in 2024-25, and $4.3 million in future years, for the Canada Mortgage and Housing Corporation to top up the Federal Lands Initiative to unlock more federal lands for affordable housing providers. This investment, which is expected to unlock a minimum of 1,500 homes, including 600 affordable homes, will also prioritize new approaches, such as leasing, to make federal lands available to affordable housing providers;

- $20 million over five years, starting in 2024-25, for Public Services and Procurement Canada to scale-up its centre of expertise on public lands; and,

- $15 million over five years, starting in 2024-25, for Public Services and Procurement Canada to work with Infrastructure Canada on delivering the new Public Land Bank and geo-spatial mapping tool.

-

To move forward immediately on its Public Lands for Homes Plan, the government is announcing today that it is urgently unlocking five federal properties that will be leased to housing providers to build over 800 new homes. These are:

- Nearly 100 homes at Currie in Calgary, Alberta;

- Nearly 500 homes at Wateridge Village in Ottawa, Ontario;

- Over 40 homes at the Village at Griesbach in Edmonton, Alberta;

- 100 homes at Arbo Neighbourhood in Toronto, Ontario; and,

- Over 100 homes at 3155 Chemin de la Côte-de-Liesse in Montréal, Quebec.

-

In addition, Budget 2024 proposes to provide $4 million over two years, starting in 2024-25, for Canada Lands Company to support new modular housing projects on four sites:

- Shannon Park, Dartmouth, Nova Scotia;

- Village at Griesbach, Edmonton, Alberta;

- Downsview, Toronto, Ontario; and,

- Wellington Basin, Montréal, Quebec.

-

The federal government will launch a new Public Lands Action Council this spring to spur collaboration and equip all players with the tools they need to build homes on public lands.

- The Public Lands Action Council will bring all players together to identify specific parcels of land across Canada with high potential for housing and take concerted action to accelerate construction on these lands. This group will also help shape the federal government's approach to building homes on public lands, including the design of the Public Lands Acquisition Fund.

- To support this work, Budget 2024 proposes to provide $1.8 million over two years, starting in 2024-25, for the Privy Council Office to create a Public Lands Action Council Secretariat.

The federal government recognizes that connecting existing federal financing to public lands can accelerate home construction and ensure deeper housing affordability. The federal government will explore leveraging its low-cost financing initiatives, including its new Canada Builds partnership and its new Canada Rental Protection Fund, to encourage housing providers to build more homes on public land.

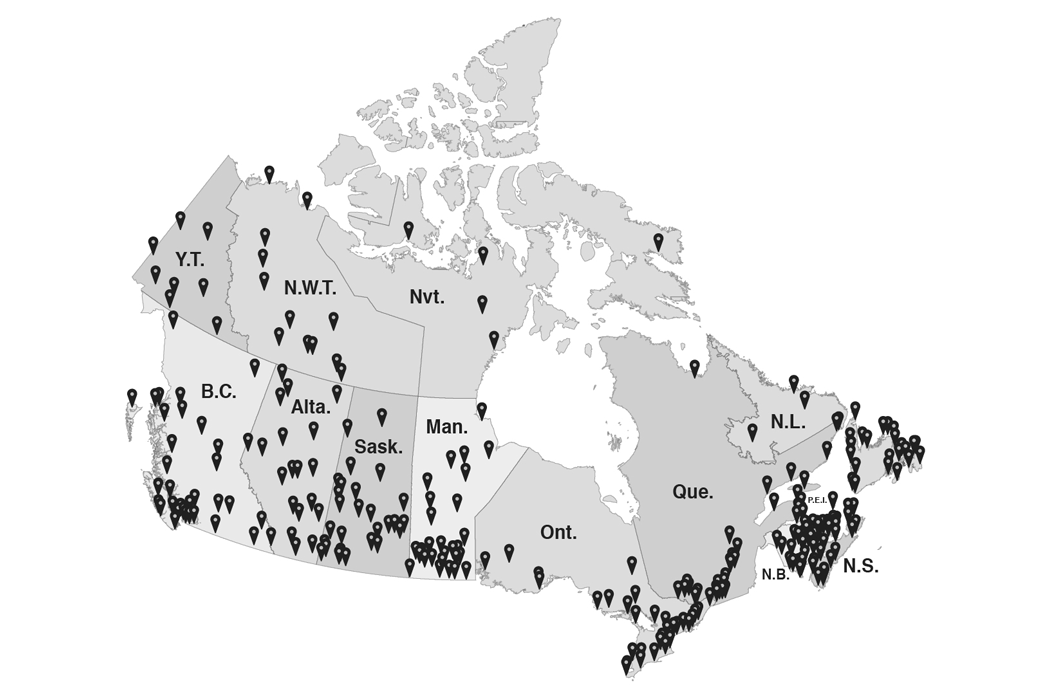

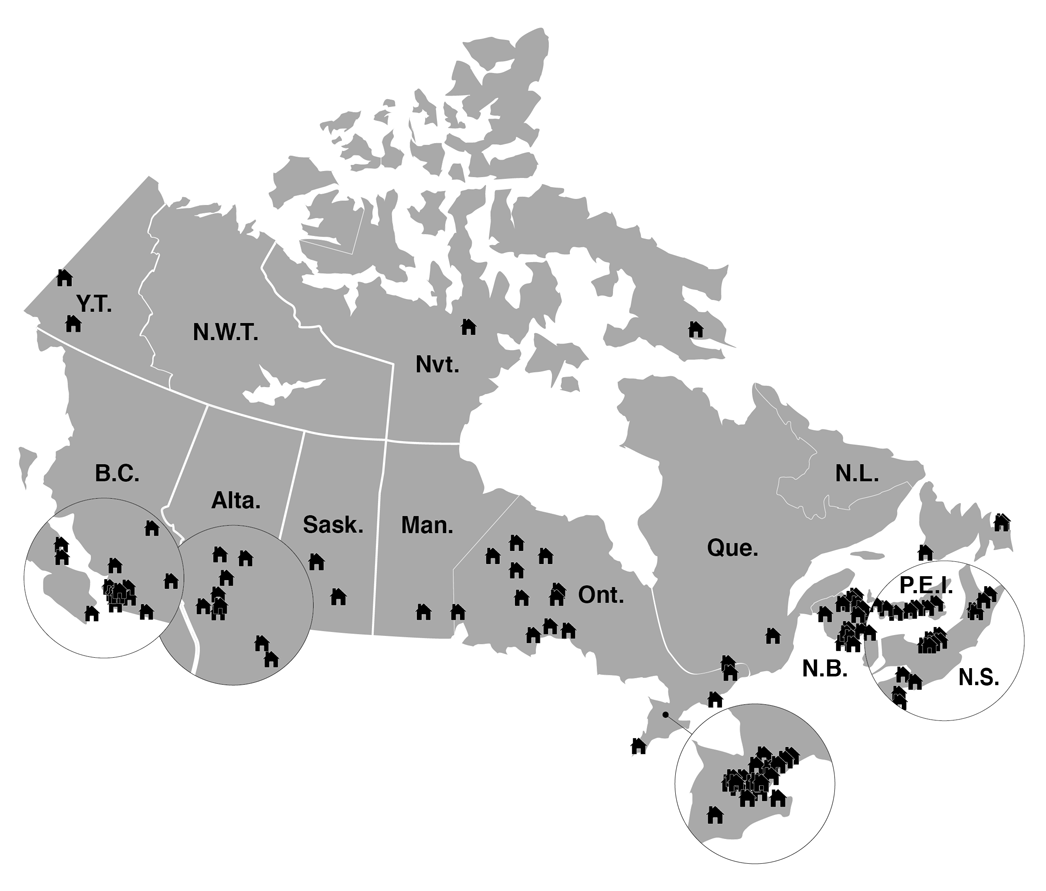

The Federal Government is Canada's Largest Landowner

Building homes on public lands will enable new non-profit housing

Housing Society Co. is a non-profit housing provider and homebuilder that wants to build an apartment building of 125 homes in Edmonton, with at least 30 per cent of its units to be affordable. However, the property Housing Society Co. wants to purchase costs $9 million—representing 25 per cent of total development costs.

Between the land, construction costs, and interest rates, the math just doesn't work to make the project viable. By building homes on public lands, Housing Society Co. will now be able to lease a parcel of land from the federal government at little to no cost upfront and can use rent proceeds to repay the lease over time.

As a result, Housing Society Co. will be able to go forward with the project, and charge affordable rents on a higher percentage of units than initially anticipated.

Building Homes on Canada Post Properties

Canada Post manages a large portfolio of land, including more than 1,700 post offices, in over 1,700 communities across the country. Many of these sites often house one-storey Canada Post buildings, which could be leveraged to build new homes across the country, while maintaining Canada Post services.

The following six Canada Post properties are being assessed for housing development potential:

- 1285 rue Notre-Dame Centre, Trois-Rivières, Quebec;

- 37 rue Saint-Laurent, Beauharnois, Quebec (recently listed for sale);

- 4 rue du Centre Commercial, Roxboro, Quebec;

- 9702 Hardin Street, Fort McMurray, Alberta (recently listed for sale);

- 120 Charles Street, North Vancouver, British Columbia; and,

- 45 Mary Street, Port Moody, British Columbia.

These six properties are just the start. Across Canada Post's portfolio, many more properties could be unlocked for housing, while maintaining high service standards for Canadians, including in rural communities.

-

Budget 2024 announces that Canada Post will continue to be a "service first" organization focused on delivering the mail. Additionally, the government will now consider leveraging Canada Post's portfolio of federal properties to contribute to housing supply. This strengthens the expectation that Canada Post embraces innovation to meet the needs of Canadians and their communities.

-

As part of its work to build homes on public lands, Budget 2024 announces that the government will take steps to enable Canada Post to prioritize leasing or divestment of post office properties and lands with high potential for housing, where doing so maintains high service standards for Canadians.

-

Budget 2024 also announces the government's intention to launch a new Canada Post Housing Program to support affordable housing providers to build on disposed or leased Canada Post properties. Details will be available later this year.

Sample Canada Post Properties That Could be Unlocked for Housing

Building Homes on National Defence Lands

National Defence owns 622 properties across every province and territory, totaling 2.2 million hectares, in addition to providing housing to many members of the Canadian Armed Forces. Many of these National Defence properties in cities and communities across Canada are not fully utilized and could be unlocked to build more homes for Canadian Armed Forces members, and civilians, to live in.

-

As part of its work to build homes on public lands, Budget 2024 announces that the government is exploring the redevelopment of National Defence properties in Halifax, Toronto, and Victoria that could be suitable for both military and civilian uses.

-

Budget 2024 also announces that the Department of National Defence is working with Canada Lands Company and other partners to divest 14 surplus properties that have potential for housing, and are not needed for National Defence operations. These properties include:

- The Amherst Armoury in Amherst, Nova Scotia;

- 96 D'Auteuil and 87 St-Louis in Québec City, Quebec;

- The National Defence Medical Centre in Ottawa, Ontario;

- The HMCS Armoury in Windsor, Ontario; and,

- The Brigadier Murphy Armoury in Vernon, British Columbia.

The review of federally owned lands and properties announced as part of the government's work to build homes on public lands is also expected to identify additional National Defence properties with a high potential for housing development.

Those who serve in the Canadian Armed Forces (CAF) stand ready to deploy and relocate in order to defend Canada. Wherever they are posted, service members and their families shouldn't have to worry about finding a suitable home.

Budget 2024 also proposes additional investments for the Department of National Defence to build and renovate housing for CAF personnel on bases across Canada. This would support the construction of up to 1,400 new homes and the renovation of an additional 2,500 existing units for CAF members on base in communities such as Esquimalt, Edmonton, Borden, Trenton, Kingston, Petawawa, Ottawa, Valcartier, and Gagetown. See Chapter 7 for additional details.

Building more on-base housing will not only help meet the housing needs of military personnel but also help address housing demand in surrounding communities, since fewer military personnel will require rentals in these areas.

Converting Underused Federal Offices Into Homes

Sparked by the pandemic, like many organizations in Canada and around the world, the federal government shifted to hybrid work. Today, Public Services and Procurement Canada has over 6 million square metres of office space, of which an estimated 50 per cent is underused or entirely vacant. This is not an effective use of resources, particularly at a time when Canada is facing a shortage of homes.

The federal government is moving forward with a significant disposal effort to reduce its office footprint. This would enable more office buildings, particularly in urban areas, to be converted into homes for Canadians, while also ensuring the responsible use of government resources.

-

Budget 2024 proposes to provide $1.1 billion over ten years, starting in 2024-25, to Public Services and Procurement Canada to reduce its office portfolio by 50 per cent. This funding, which is expected to be fully recovered through substantial short- and long-term cost savings, will help to accelerate the ending of leases and disposal of underused federal properties, and address deferred maintenance. Where applicable, the government will prioritize student and non-market housing in the unlocking of federal office properties.

Reducing the federal office footprint will generate substantial savings, expected to reach $3.9 billion over the next ten years, and $0.9 billion per year ongoing.

Taxing Vacant Lands to Incentivize Construction

At a time when we need to build as quickly as possible, it makes no sense that good land, in good areas, is sitting there, underused. As all orders of government put in place policies to tackle housing supply shortages, there is a concern that some landowners in Canada may be sitting on developable land, hoping to profit from rising land values when the land could instead be used for immediate residential development. Vacant land needs to be used, and it is best used to build homes.

The government is taking significant action to resolve Canada's housing crisis, and the federal government believes owners of vacant land in Canada must also do their part to unlock unused land for homes.

-

Budget 2024 announces that the government will consider introducing a new tax on residentially zoned vacant land. The government will launch consultations later this year.

Building Apartments, Bringing Rents Down

Building rental homes requires significant investment, even more so when interest rates and land prices are high, as in recent years. Access to low-cost financing can help homebuilders move a rental project from being financially unfeasible to feasible. To help more apartment buildings break ground, the government is investing heavily in its low-cost construction financing programs, ensuring homebuilders have the financing needed to keep building.

The Apartment Construction Loan Program plays a crucial role in filling Canada's housing supply shortage by providing developers with the necessary capital to build rental homes. This support accelerates the development of apartments in neighbourhoods where people want to live and work. This is good for people, good for communities, and good for our economy.

-

To build more rental apartments, faster, Budget 2024 announces an additional $15 billion in new loan funding, starting in 2025-26, for the Apartment Construction Loan Program, bringing the program's total to over $55 billion. This investment will help build more than 30,000 additional new homes across Canada, bringing the program's total contribution to over 131,000 new homes supported by 2031-32.

- Of this amount, at least $100 million will be used to build homes above existing shops and businesses, especially in big cities where land is scarce and where density is key.

-

To increase access to the program and make it easier for builders to build, Budget 2024 announces new reforms to the Apartment Construction Loan Program. These reforms include:

- Extending the terms of the loans offered;

- Extending access to financing to include housing projects for students and seniors;

- Introducing a portfolio approach so builders can move forward on multiple projects at once;

- Providing additional flexibility on affordability, energy efficiency, and accessibility requirements; and,

- Launching a new frequent builder stream to fast-track the application process for proven home builders.

These measures will make it easier, cheaper, and faster to build homes in Canada. For students, it will mean getting the keys to their first home and living close to campus. For young families, it will mean getting a good home near work, opportunity, and in a vibrant neighbourhood. And for seniors, it will mean an affordable place where you can downsize with security and dignity.

Federal financing is complemented by the government's community-building funding, from more early learning and child care spaces to housing-enabling infrastructure funding. This is how we build more affordable, liveable communities.

Homes Supported through the Apartment Construction Loan Program

Lowering costs to build more apartment buildings

Camille Homes Corp. is interested in building a 20-story rental building in Winnipeg, which is expected to cost tens of millions of dollars. Loans for such developments are typically not available through private lenders, unless syndicated through several lenders to diffuse risk, a process which adds significant complexity and time. Private financing, with a prime rate above 7 per cent, is just too costly to make this project viable. Camille Homes Corp. is considering abandoning this project, but instead decides to apply for low-cost financing from the Apartment Construction Loan Program.

The Apartment Construction Loan Program's favourable financing terms, which include competitive interest rates, insurance premiums covered by the program, and longer terms and amortization periods are reducing borrowers' building costs by millions of dollars when compared to private financing.

Low-cost financing and flexible terms, combined with tailored support to meet the project's needs, as well as CMHC's ability to act as a single lender, is making the math on rental buildings work for builders such as Camille Homes Corp. and helping to build more homes across Canada.

Launching Canada Builds

To build homes across the country, we need a Team Canada approach. Provinces and territories control a number of critical levers to unlocking more housing supply, such as zoning rules, development approvals, lands and land use planning, rules for tenants and landlords and the adoption of building codes and regulations.

The federal government is supporting a number of provincial and territorial-led initiatives through cost-shared bilateral housing agreements. Most recently, this includes partnering with British Columbia in support of the BC Builds initiative with $2 billion in low-cost financing through the Apartment Construction Loan Program.

The federal government's partnership with BC Builds is a testament to the progress possible when multiple orders of government work collaboratively to deliver thousands of new rental homes for people in communities across Canada.

-

Building on this momentum, Budget 2024 announces Canada Builds, the federal government's intention to leverage its $55 billion Apartment Construction Loan Program to partner with provinces and territories to build more rental housing across the country.

-

To access federal financing, provinces and territories will be expected to meet the benchmarks set by BC Builds and deliver action to unlock even more homes. These actions include:

- Complementing federal funds with provincial or territorial investments;

- Building on government, non-profit, community-owned, and vacant lands;

- Considering access to early learning and child care, and the expansion of non-profit child care, in the development process;

- Streamlining the process to cut development approval timelines to no longer than 12 to 18 months; and,

- Meeting the criteria of the Apartment Construction Loan Program, including affordability requirements.

The federal government will initiate discussions with provincial and territorial governments as soon as possible. This transformative approach links portfolios of underused land, homebuilders, and federal and provincial investments. This Team Canada mission will help pave the way for new housing supply across the country.

Topping-Up the Housing Accelerator Fund

In March 2023, the government launched the $4 billion Housing Accelerator Fund to work with municipalities to cut red tape and fast-track the creation of at least 100,000 new homes across Canada. Through 179 agreements signed to date, the government has committed nearly $4 billion to spur the construction of 750,000 new homes across the country over the next decade.

-

Building on this success, Budget 2024 proposes to provide an additional $400 million over four years, starting in 2024-25, to the Canada Housing and Mortgage Corporation, to top up the Housing Accelerator Fund. This will help fast track 12,000 new homes in the next three years.

Jurisdiction |

Federal Funding | New Homes Over 10 Years |

|---|---|---|

| London, Ontario | $74 million | 7,280 |

| Vaughan, Ontario | $59 million | 43,999 |

| Hamilton, Ontario | $93.5 million | 9,000 |

| Halifax, Nova Scotia | $79.3 million | 8,866 |

| Brampton, Ontario | $114 million | 24,100 |

| Kelowna, British Columbia | $31.5 million | 20,680 |

| Kitchener, Ontario | $42.4 million | 37,533 |

| Province of Quebec | $900 million | -- |

| Calgary, Alberta | $228 million | 35,950 |

| Moncton, New Brunswick | $15.5 million | 5,585 |

| Richmond Hill, Ontario | $31 million | 41,760 |

| Vancouver, British Columbia | $115 million | 40,300 |

| Mississauga, Ontario | $113 million | 35,215 |

| Burnaby, British Columbia | $43 million | 11,950 |

| Winnipeg, Manitoba | $122 million | 15,867 |

| Toronto, Ontario | $471 million | 53,000 |

| Iqaluit, Nunavut | $8.9 million | 1,450 |

| Nunavut Municipalities/Hamlets | $18.1 million | 1,697 |

| Summerside, Prince Edward Island | $5.8 million | 725 |

| Surrey, British Columbia | $95 million | 16,500 |

| Guelph, Ontario | $21.4 million | 9,450 |

| Burlington, Ontario | $21 million | 5,335 |

| St. Catharines, Ontario | $25.7 million | 12,417 |

| Saint John, New Brunswick | $9.1 million | 1,710 |

| Kingston, Ontario | $27.6 million | 4,867 |

| Ajax, Ontario | $22 million | 10,713 |

| Richmond, British Columbia | $35.9 million | 3,125 |

| Milton, Ontario | $22 million | 4,619 |

| Fredericton, New Brunswick | $10 million | 2,560 |

| Whitby, Ontario | $25 million | 18,030 |

| Squamish, British Columbia | $7.0 million | 1,350 |

| Waterloo, Ontario | $22 million | 15,391 |

| Regina, Saskatchewan | $35 million | 3,050 |

| Coquitlam, British Columbia | $25 million | 2,867 |

| Charlottetown, Prince Edward Island | $10 million | 1,050 |

| Abbotsford, British Columbia | $25.6 million | 2,326 |

| Ottawa, Ontario | $176.3 million | 32,600 |

| Victoria, Comox, Campbell River, British Columbia | $33.5 million | 16,256 |

| Channel – Port Aux Basques, Newfoundland and Labrador | $3.3 million | 390 |

| Banff, Sylvan Lake, Bow Island, Westlock, Duchess, Smoky Lake, Alberta | $13.8 million | 3,118 |

| Campbellton, New Brunswick | $4.5 million | 465 |

| Marathon, Ontario | $1.9 million | 305 |

| Edmonton, Alberta | $175 million | 22,300 |

| Wolfville, Nova Scotia | $1.8 million | 280 |

| Cape Breton Regional Municipality, Membertou First Nation, Nova Scotia | $13.3 million | 3,286 |

| Woolwich, Ontario | $6.7 million | 1,648 |

| New Glasgow, Pictou, Westville, Nova Scotia | $5.6 million | 2,160 |

| Cornwall, Prince Edward Island | $4.3 million | 522 |

| Mount Pearl, Newfoundland and Labrador | $6.1 million | 2,000 |

| Saskatoon, Saskatchewan | $41.3 million | 25,240 |

| Whitehorse, Yukon | $11 million | 3,984 |

| Thunder Bay, Ontario | $20.7 million | 6,669 |

| Shippagan, Caraquet, Tracadie, Bathurst (Pabineau), New Brunswick | $10.5 million | 3,196 |

| City of North Vancouver, British Columbia | $18.6 million | 3,170 |

| North Grenville, Ontario | $5.2 million | 1,700 |

| Cap-Acadie, New Brunswick | $2 million | 360 |

| Grand Bouctouche, Champdoré, Indian Island First Nation, New Brunswick | $7.1 million | 1,849 |

| Tecumseh, Ontario | $4.4 million | 5,850 |

| Airdrie, Alberta | $24.8 million | 3,534 |

| Pemberton, British Columbia | $2.7 million | 1,995 |

| Cambridge, Ontario | $13.3 million | 3,625 |

| Kings County, Lunenburg, Chester, Nova Scotia | $9.1 million | 1,845 |

| West Hants, Nova Scotia | $1 million | 1,500 |

| Markham, Ontario | $58.8 million | 6,635 |

| County of Antigonish, Town of Antigonish, Nova Scotia | $3.2 million | 276 |

| St. John's, Newfoundland and Labrador | $10.4 million | 4,138 |

| Gibsons, British Columbia | $2.1 million | 900 |

| Stratford, Prince Edward Island | $5 million | 2,017 |

| Barrie, Ontario | $25.6 million | 4,100 |

| Three Rivers, Prince Edward Island | $3.4 million | 410 |

| Grand Bay – Westfield, Harvey, Sussex, New Brunswick | $5.1 million | 1,129 |

| Bowen Island, British Columbia | $1.6 million | 114 |

| O'Leary, Wellington, Prince Edward Island | $1 million | 154 |

| Edmundston, New Brunswick | $4 million | 1,913 |

| East Hants, Nova Scotia | $5.8 million | 2,825 |

| Dawson, Carmacks, Haines Junction, Watson Lake, Yukon | $6.7 million | 1,036 |

| Red Rock Indian Band, Whitesands, Wapekeka, Webequie, Wunnumin, Aroland, Long Lake #58, Muskrat Dam Lake, Shoal Lake No.40 First Nations, Ontario | $15.3 million | 1,460 |

|

* The agreement with the Province of Quebec includes matching investments by the province, for a combined total of $1.8 billion in new funding for housing construction, which includes support for an additional 8,000 affordable homes. |

||

The Housing Accelerator Fund is Building More Homes Across Canada

Enabling Communities to Build More Homes

Building more homes in communities that people want to live in requires building more essential infrastructure, like power lines, transit stations, water and wastewater facilities, internet cables, libraries, and recreation centres. Without this infrastructure, communities have trouble growing, and new homes cannot get built.

The federal government is providing support to help growing communities build the infrastructure needed to build more homes, including through the Canada Infrastructure Bank. Budget 2024 also proposes new support for growing communities through a new Canada Housing Infrastructure Fund.

Further details on the federal government's infrastructure funding programs are outlined in Chapter 5.

A New Canada Housing Infrastructure Fund

Building more homes requires putting in place the essential infrastructure to support growing communities and denser, more vibrant, and liveable neighbourhoods.

In particular, communities must invest in effective and reliable water, wastewater, and stormwater infrastructure in order to keep pace with growth and encourage densification. These investments are critical as all orders of government work together to unlock more housing, faster.

-

Budget 2024 proposes to provide $6 billion over 10 years, starting in 2024-25, to Infrastructure Canada to launch a new Canada Housing Infrastructure Fund. The Fund will accelerate the construction and upgrading of housing-enabling water, wastewater, stormwater, and solid waste infrastructure that will directly enable new housing supply and help improve densification. This Fund will be comprised of:

- $1 billion available directly to municipalities to support urgent infrastructure needs that will directly enable housing supply.

- $5 billion for agreements with provinces and territories to support long-term priorities.

Provinces

and territories can only access this funding if they commit to key actions that increase housing

supply:

- Legalize more housing options by adopting zoning that allows four units as-of-right and that permits more "missing middle" homes, including duplexes, triplexes, townhouses, and small multi-unit apartments;

- Implement a three-year freeze on increasing development charges from April 2, 2024, levels for municipalities with a population greater than 300,000;

- Adopt forthcoming changes to the National Building Code to support more accessible, affordable, and climate-friendly housing options;

- Provide pre-approval for construction of designs included in the government's upcoming Housing Design Catalogue; and,

- Implement measures from the forthcoming Home Buyers' Bill of Rights and Renters' Bill of Rights.

- Provinces will have until January 1, 2025, to secure an agreement, and territories will have until April 1, 2025. If a province or territory does not secure an agreement by their respective deadlines, their funding allocation will be transferred to the municipal stream. The federal government will work with territorial governments to ensure the actions in their agreements are suitable to their distinct needs.

To ensure this funding reaches communities of all sizes and needs, provinces must dedicate at least 20 per cent of their agreement-based funding for northern, rural, and Indigenous communities.

Leveraging Transit Funding to Build More Homes

Many Canadians rely on public transit to go to school, to get to work, to see their friends, and to explore their communities. More homes need to be built closer to the services that Canadians count on. Transit that is more accessible and reliable means Canadians can spend more time with their friends and family. It's crucial that all orders of government work together to achieve this.

-

Budget 2024 announces that any community seeking to access long-term, predictable funding through the federal government's forthcoming permanent public transit fund will be required to take action that directly unlocks housing supply where it is needed most by:

- Eliminating all mandatory minimum parking requirements within 800 metres of a high-frequency transit line;

- Allowing high-density housing within 800 metres of a high-frequency transit line; and,

- Allowing high-density housing within 800 metres of post-secondary institutions.

- Completing a Housing Needs Assessment for all communities with a population greater than 30,000.

These are long overdue changes that will mean more people can live near transit to access the services and opportunities in their communities, and will allow home construction to happen faster and at more affordable prices.

The Canada Infrastructure Bank's Housing Initiative

As Canada's cities and towns build more homes, they need to build more infrastructure. From water and sewer infrastructure to public transit to high-speed internet, the federal government is providing municipalities with the tools they need to grow.

That is why, since 2017, the Canada Infrastructure Bank has made investment commitments of over $11 billion in more than 50 projects, and catalyzed over $31 billion in total investment, to address critical infrastructure gaps across the country. These include:

- $1.28 billion for the Réseau express métropolitain in Montréal;

- $1.3 billion for rural broadband internet in Ontario;

- $165 million for the City of Calgary to buy zero-emission buses;

- $138.2 million for energy storage to enable increased renewable electricity in Nova Scotia; and,

- Up to $80 million for the Atlin Hydroelectric Expansion in Yukon.

The 2023 Fall Economic Statement announced that the Canada Infrastructure Bank would be exploring further opportunities to support the needs of growing communities by helping to finance the infrastructure needed to build more homes.

In March 2024, the Canada Infrastructure Bank announced the launch of its Infrastructure for Housing Initiative to provide low-cost financing to enable municipalities and Indigenous communities to build housing-enabling infrastructure. Funding for this initiative is sourced from the CIB's existing funding envelope.

Building the infrastructure communities need to build more homes

The Canada Infrastructure Bank (CIB) has already made its first investment commitment under its Infrastructure for Housing Initiative, committing up to $140 million in financing for new and enhanced water and wastewater infrastructure in five communities in Manitoba, including the City of Brandon. The project will support cleaner water and better wastewater treatment, which will provide the enabling infrastructure to support an estimated 15,000 new housing units.

Fast growing communities, like the City of Brandon, require not only significant new home construction but also investments in water and wastewater systems and other local infrastructure. Paying for this new infrastructure can be challenging, especially where the up-front costs would burden existing residents. By lowering the cost of borrowing and taking on some of the risk associated with new development, the CIB's investment can help municipalities build the infrastructure needed to support thousands of new homes across the country.

Changing How We Build Homes

We have to build homes smarter, faster, and at prices Canadians can afford. That means investing in ideas and technology like prefabricated housing factories, mass timber production, panelization, 3D printing, and pre-approved housing design catalogues. We need to bring the same spirit of innovation that we are investing in across the economy, and build homes in a 21st century way.

-

To spur the development of innovative housing technologies, Budget 2024 proposes $50 million over two years, beginning in 2024-25, for Next Generation Manufacturing Canada (NGen)—one of Canada's Global Innovation Clusters—to launch a new Homebuilding Technology and Innovation Fund. NGen will seek to leverage an additional $150 million from the private sector, and other orders of government, to support a targeted $200 million investment in housing innovation in Canada. The first projects will aim to be announced this summer.

-

To scale-up more innovative housing solutions, Budget 2024 proposes $50 million over two years, beginning in 2024-25, on a cash basis, through Canada's Regional Development Agencies to support local innovative housing solutions across the country, such as designing and upscaling of modular homes, the use of 3D printing, mass timber construction, and panelized construction. This builds on the success of dozens of existing innovative projects already funded and underway in communities across the country, which includes:

- Grand River Modular Ltd., in Kitchener, Ontario, to support commercialization efforts to bring modular housing units to market, supported with $188,485 from the Federal Economic Development Agency for Southern Ontario;

- Structures KSM in Gatineau, Quebec, to acquire innovative, automated production equipment and software to improve the production capacity of roof truss manufacturing, supported with $200,000 from Canada Economic Development for Quebec Regions;

- Nunafab Corp., in Nunavut, to create a modular home production plant in the community of Cambridge Bay where homes can be rapidly built for local housing needs and shipped to other Nunavut communities, supported with $2.15 million from the Canadian Northern Economic Development Agency;

- Island Structural Systems, in Kensington, PEI, an automated facility that will improve the productivity of the PEI residential construction sector, supported with $2 million from the Atlantic Canada Opportunities Agency; and,

- Landmark Group of Companies Inc. and Promise Robotics Inc. in Edmonton, Alberta, to establish a mobile, robotic micro-factory to construct housing components, supported with $1 million from Prairies Economic Development Canada.

Any new innovative housing designs funded through the Regional Development Agencies and NGen will feed into the Canada Mortgage and Housing Corporation's work on the Housing Design Catalogue.

-

To help simplify the way Canada builds homes, Budget 2024 announces that the National Research Council will launch consultations with provinces, territories, industry, and fire safety experts to address regulatory barriers, including point block access and single egress designs, and streamline the inspection process. In addition, the National Research Council will identify ways to reduce duplication between factory inspections of modular home components and on-site building inspections, and support efforts to address regulatory barriers to help scale up factory-built housing across the country.

-

Budget 2024 also announces that the Apartment Construction Loan Program will earmark at least $500 million to homebuilders that use innovative construction techniques, such as modular housing, for new rental projects.

In the coming months, the government will engage with housing, construction, and building material sectors, along with labour unions, Indigenous housing experts, and other relevant stakeholders, to co-develop a Canadian industrial strategy for homebuilding. Together, we will explore all essential inputs into building homes in Canada, including raw and manufactured materials, supply chains, and building techniques to ensure that all orders of government and industry can achieve our ultimate goal of building homes smarter, faster, and at prices Canadians can afford.

Strengthening innovation and increasing productivity in the residential construction sector is critical to building more homes, faster. In addition to new measures in Budget 2024, the federal government is supporting homebuilders who use new, innovative ways to build more homes, faster.

Existing support to advance innovative construction includes:

-

Over $600 million through the Affordable Housing Innovation Fund to support innovative solutions for the next generation of housing in Canada.

-

$300 million through the Housing Supply Challenge to develop solutions to remove barriers that hinder housing supply.

-

$191.8 million over seven years and $7.1 million per year ongoing to conduct research and development on innovative construction materials and to revitalize national housing and building standards to encourage low-carbon construction solutions.

-

$38 million through the Green Construction through Wood program to encourage the use of innovative wood-based building technologies in construction projects.

-

$13.5 million per year to make the National Building Codes free to access and to modernize codes, including by reducing barriers to internal trade and aligning building codes across the country.

Further support available for housing and construction innovation and productivity includes:

-

The Industrial Research Assistance Program, which helps Canadian small- and medium-sized businesses increase their innovation capacity and take ideas to market.

-

The Regional Economic Growth through Innovation program, which helps businesses scale-up new innovative technologies.

-

The Strategic Innovation Fund, which helps attract and spur private investment in innovative projects across all regions and sectors of the economy.

Housing Design Catalogue

The government is reviving and modernizing its post-war housing design catalogue, which will provide blueprints that can be used across the country to speed up the construction of new homes.

-

Budget 2024 proposes to provide $11.6 million in 2024-25 to support the development of its Housing Design Catalogue for up to 50 housing designs, such as modular housing, row housing, fourplexes, sixplexes, and accessory dwelling units, that provinces, territories, and municipalities could use to simplify and accelerate housing approvals and builds.

This first phase of the catalogue will be published in fall 2024.

Modernizing Housing Data

To better understand the needs of local housing markets, we need better data. Every order of government should be committed to a data-driven response to the housing crisis.

-

To help modernize housing data, Budget 2024 proposes to provide $20 million over four years, starting in 2024-25 for Statistics Canada and the Canada Mortgage and Housing Corporation to modernize and enhance the collection and dissemination of housing data, including municipal-level data on housing starts and completions.

Adding Additional Suites to Single Family Homes

Many homeowners have extra space they could convert into rental suites, such as an unused basement, or a garage that could be converted into a laneway home. Historically, the cost of renovating, combined with municipal red tape, has made this both difficult and costly.

Recent municipal zoning reforms in Canada's major cities, including reforms through Housing Accelerator Fund agreements, are creating new opportunities for homeowners to add additional suites to their properties in support of densification. New rental suites would provide more homes for Canadians and could provide an important source of income for seniors, who would be able to afford continuing to age at home. New suites can also be purpose-built to be barrier-free, to accommodate physical impairments of an aging family member or a child with a disability.

The government is taking action to make it easier for homeowners to increase Canada's supply of housing by adding additional suites to their home.

-

Budget 2024 proposes to provide $409.6 million over four years, starting in 2025-26, to the Canada Mortgage and Housing Corporation to launch a new Canada Secondary Suite Loan Program, enabling homeowners to access up to $40,000 in low-interest loans to add secondary suites to their homes. Details of this program will be announced in the coming months.

-

Budget 2024 announces the government's intention to make targeted changes to mortgage insurance rules to encourage densification and support the efficient functioning of the housing finance market, by enabling homeowners to add more units to their homes. The government will consult stakeholders on proposed changes to regulations, including for refinancing, maximum loan and home price, as well as other mortgage insurance rules where homeowners are adding additional units.

Low-cost loans to build more secondary suites

Amena and Kareem are young working professionals looking to purchase their first home in Burnaby, British Columbia. They find a single-family home with a separate garage out back. With a single car between them, they think about converting the garage into a laneway home to generate additional income to help pay down their mortgage.

In addition to new flexibilities in mortgage insurance rules to enable Amena and Kareem to access mortgage insurance, for a property value that exceeds the current limit of $1 million, the new secondary suite loan program will help them convert their garage into an adjacent laneway home after the home is purchased.

They apply to the Canada Secondary Suite Loan Program for a low-cost loan of $40,000, to help cover their renovation costs, and once they find a tenant, are able to use new rental income to cover the cost of the loan.

New mortgage flexibilities to add secondary suites

Yuval owns a single-family home in St. John's, Newfoundland and Labrador. Despite having accumulated significant equity in his home, Yuval is feeling the strain of mortgage payments, property taxes and other expenses from higher living costs.

Targeted changes to mortgage insurance rules could allow Yuval to refinance his insured mortgage to access his home equity to convert part of his home into a rental suite. This could allow Yuval to earn rental income to offset his mortgage expenses and property taxes, while also providing a much-needed rental accommodation in his neighbourhood.

Accelerating Investment to Build More Apartments

Building on the success of removing 100 per cent of GST from new rental housing projects and providing more low-cost financing to move more apartment building projects forward, the government is taking further action to make the math work for homebuilders.

-

Budget 2024 proposes to introduce a temporary accelerated capital cost allowance, at a rate of 10 per cent for eligible new purpose-built rental projects that begin construction on or after Budget Day, and are available for residents to move in before January 1, 2036.

Increasing the capital cost allowance rate from 4 per cent to 10 per cent will incentivize builders by moving projects from unfeasible to feasible, through increased after-tax returns on investment.

The measure does not change the total amount of depreciation expenses being deducted over time, it simply accelerates it. Allowing homebuilders to deduct certain depreciation expenses over a shorter period of time allows homebuilders to recover more of their costs faster, enabling further investment of their money back into new housing projects.

This measure would cost an estimated $1.1 billion over five years, starting in 2024-25.

Building More Student Housing

As universities and colleges expand and attract more students, the demand for student housing is going up. Not every campus is equipped, and that means some students are struggling to afford local rents. And, student demand puts pressure on locals. Building more student housing is good for young people, and makes sure there is a fair rental market for everyone.

To encourage the construction of a wide variety of much needed long-term rental housing that meets the needs of Canadians, the federal government removed 100 per cent of GST from new rental housing built specifically for long-term rental accommodation. However, student residences, given their typically shorter-term and transient nature, may not currently meet the conditions for this rebate.

-

Budget 2024 announces that the eligibility conditions for the removal of GST on new student residences will be relaxed for not-for-profit universities, public colleges, and school authorities. This will incentivize Canada's educational institutions to build more student housing by ensuring they benefit from the removal of GST on new student residences. This measure is expected to cost $19 million over five years, starting in 2024-25, and $5 million per year ongoing.

The relaxed eligibility will apply to new student residences that begin construction on or after September 14, 2023, and before 2031, and that complete construction before 2036. Private institutions will not be eligible for this support.

This measure builds on the government's new reform to allow on- and off-campus student housing projects to access the $55 billion Apartment Construction Loan Program.

More Skilled Trades Workers Building Homes

People in the skilled trades are proudly stepping up as part of this generational effort to build housing. But to meet this challenge, Canada needs even more workers and it needs apprenticeships to remain affordable for young people starting their new careers. According to BuildForce Canada, the construction sector faces a shortage of over 60,000 workers by 2032, due to many hard-working construction workers reaching retirement age, combined with demand from accelerating home construction.

To encourage more people to pursue a career in the skilled trades, the federal government is creating apprenticeship opportunities to train and recruit the next generation of skilled trades workers.

-

Budget 2024 proposes to provide $100 million over two years, starting in 2024-25, to Employment and Social Development Canada for the following:

- $90 million over two years, starting in 2024-25, for the Apprenticeship Service to help create placements with small and medium-sized enterprises for apprentices. Of this amount, $10 million in 2025-26 would be sourced from existing departmental resources.

- $10 million over two years, starting in 2024-25, for the Skilled Trades Awareness and Readiness Program to encourage Canadians to explore and prepare for careers in the skilled trades. This funding would be sourced from existing departmental resources.

To make it easier for young people who hope to start a career in the skilled trades, in addition to interest-free Canada Apprentice Loan and Employment Insurance Regular Benefits for apprentices on full-time technical training, the government will continue explore options to make apprenticeships more affordable.

Further investments to build Canada's residential construction workforce, such as the recently launched Sustainable Jobs Training Fund, will help young workers gain the specialized skills needed to retrofit homes to increase energy efficiency and lower the costs of homeownership.

Training the next generation of construction workers

Emily is a high school student thinking of pursuing a career as a construction electrician. Through the Skilled Trades Awareness and Readiness Program, Emily can get access to career fairs, mentorship, and job shadowing to explore and prepare for a career in the construction industry.

Jai is a plumbing apprentice seeking to obtain Red Seal Certification. Jai can receive innovative, hands-on training designed to remove accessibility barriers at a small and medium-sized enterprise receiving support through the Apprenticeship Service to offer apprenticeship training opportunities.

Recognizing Foreign Construction Credentials and Improving Labour Mobility

Newcomers with the skills and experience needed to build new homes should be able to join the Canadian labour market without delays.

To enable skilled newcomers to maximize their potential as they build a new life in Canada, the Foreign Credential Recognition Program helps provide training, work placements, wage subsidies, and mentoring to newcomers. For six years, the program has helped over 9,000 skilled newcomers receive work placements and wage subsidies, and another 20,000 workers received low-cost loans and support services to minimize the costs and requirements associated with practicing their trade in Canada.

Building on Budget 2022's five-year $115 million investment in the Foreign Credential Recognition Program:

-

Budget 2024 proposes to provide $50 million over two years, starting in 2024-25, to Employment and Social Development Canada for the Foreign Credential Recognition Program. At least half of this amount will be to streamline foreign credential recognition in the construction sector to help skilled trades workers build more homes, and the remaining funding will support foreign credential recognition in the health sector. Similar to a recent agreement between federal, provincial and territorial health ministers to recognize foreign credentials for health care professionals, the federal government is calling on provinces and territories to expedite removal of their barriers to foreign credential recognition.

To reduce internal barriers for skilled workers in Canada, the federal government is also calling for provinces and territories to urgently streamline their trades certification standards for interprovincial consistency. This includes streamlining requirements in trades, or sub-trades, that have no or limited equivalents in other jurisdictions. The federal government will continue to collaborate with provincial and territorial apprenticeship authorities to improve labour mobility for workers in these trades.

Ensuring newcomer construction workers can help build more homes

Emmanuel is a newcomer to Canada, with significant experience in the construction sector abroad. Through investments made by the Foreign Credential Recognition Program, Emmanuel can access construction-related training and work opportunities to help him get his education and experience recognized, integrate into the residential construction sector in his province, and contribute to alleviating the housing crisis.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 1.1 Building More Homes.

1.2 Making it Easier to Own or Rent a Home

Homeownership is a big part of the middle class dream. If you work hard, and save your money, you should be able to buy a home. That was the deal for generations. But young adults feel like the possibility of owning a home like the one they grew up in is less and less likely, as increases in home prices continue to outpace their salaries and wages. The prospect of owning a home in Canada needs to be as real for young people today, as it was for any other generation.

And for the millions of Canadians who rent, including many who prefer the flexibility that comes with renting, drastic rent increases have pushed what was once an affordable option out of reach.

Canadians need help now, and Canada will work to make homeownership a reality for young Canadians and to protect renters, many of whom are Millennial and Gen Z, and are paying a much higher portion of their earnings towards rents than previous generations.

Budget 2024 takes action to unlock new pathways for young renters to become homeowners, and to protect middle class homeowners from rising mortgage payments.

Making it Easier to Buy a First Home

Key Ongoing Actions

-

The Canadian Mortgage Charter, which details the tailored mortgage relief that the government expects banks to provide borrowers who are facing financial difficulty with the mortgage on their principal residence.

-

The new Tax-Free First Home Savings Account, which is a registered savings account that allows Canadians to contribute up to $8,000 per year (up to a lifetime limit of $40,000) for their first down payment.

-

The recently doubled First-Time Home Buyers' Tax Credit, which provides up to $1,500 in direct support to home buyers to offset expensive closing costs involved in buying a first home.

-

Ensuring the profits from flipping residential real estate are subject to taxation, to unlock more homes for Canadians to live in—because homes are not a speculative financial asset class for investors.

-

Making assignment sales fully taxable to ensure homes remain available for Canadians to buy.

-

Over $750 million for the Oil to Heat Pump Affordability program, which has to date provided support for over 1,500 low- to median-income households to help them transition from expensive oil heating to more energy efficient, cost-saving electric heat pumps.

-

Over $6.7 billion, on a cash basis, for the Canada Greener Homes Grant and Loan programs, which to date have provided over 172,000 grants of up to $5,000 and 58,000 interest-free loans of up to $40,000 to help Canadians save money by making their homes more energy efficient.

Aligning Immigration With Housing Capacity

Immigration enriches Canada's society, our culture, and our economy, but the combination of temporary and permanent immigration experienced last year put strains on Canada's ability to properly welcome and integrate newcomers into Canadian society. The government has taken steps to better manage temporary migration pressures while moderating the pace of its levels plan.

Under the 2024–2026 Immigration Levels Plan, the government has carefully moderated the intake of new permanent residents, moving towards a long-term approach that seeks to strike a balance between meeting the economic imperatives and enhancing the ability of communities to effectively welcome and integrate immigrants.

The government has also recently announced that it will reduce the share of temporary residents to 5 per cent of the overall population over the next three years. This will lead to approximately 600,000 fewer temporary residents in Canada compared to current levels.

Normalizing permanent and temporary immigration levels is critical to ensuring that newcomers have the opportunities and social supports they need to succeed when coming to Canada.

Further, these changes will ensure that newcomers, and all Canadians, have an affordable place to call home. The scale of this reduction is significant in the context of housing demand: in recent years, Canada has built about 220,000 housing units annually.

The government has also taken steps to reduce the volume of asylum claims. In March 2023, Canada and the United States announced the expansion of the Safe Third Country Agreement, which requires asylum claimants to request protection in the first safe country they arrive in, unless they qualify for an exception to the Agreement. This has resulted in significantly fewer individuals claiming asylum at irregular crossings in between Canada's land ports of entry.

Also, on February 29, 2024, the government adjusted the travel requirements for Mexican citizens, who represented 17 per cent of all asylum claims in 2023. While the majority will continue to be able to travel visa-free to Canada, some Mexican nationals will now need to apply for a Canadian visitor visa. This responds to an increase in asylum claims made by Mexican citizens that are refused, withdrawn, or abandoned. In recent years, Mexican nationals represented the top source of asylum claims in Canada.

| Top Five Countries in 2023 | Total Claims |

|---|---|

| 1. Mexico | 23,910 |

| 2. India | 11,285 |

| 3. Nigeria | 9,155 |

| 4. Türkiye | 6,385 |

| 5. Colombia | 6,040 |

|

Source: Immigration, Refugees and Citizenship Canada, December 31, 2023. Data is preliminary and subject to change. |

|

Stabilizing International Student Intake to Alleviate Housing Pressures

To ensure every Canadian student can find an affordable place to live while pursuing their education, the federal government is taking action to stabilize international student intake across the country. By better aligning temporary immigration pressures to a moderate pace, Canada can ensure a better capacity to welcome newcomers.

In January 2024, the government announced a new cap on the number of study permit applications, which is expected to decrease approved study permits by up to 28 per cent in 2024 for the groups included under the cap. The government also announced new eligibility criteria for the Post-Graduation Work Permit. This will help ease housing demand growth, while also protecting international students from fraudulent institutions and unsafe living conditions.

This builds on the government's announcement last fall to reform the International Student Program. As committed in the 2023 Fall Economic Statement, by fall 2024, the government will launch a new Recognized Institutions Framework to reward post-secondary institutions with high standards around selecting, supporting—including by providing access to housing—and retaining international students.

Taken together, the measures aim to ensure post-secondary students receive the support they need for success, and balance the pressures on student housing by aligning the number of students arriving in Canada with the number of available homes. By alleviating student housing pressures, generations of Canadians and international students today, and tomorrow, will have a more affordable pathway to getting a good education.

Credit for Paying Rent

Every month, millions of Canadian renters pay their rent in full and on-time. The government thinks that should count towards their credit worthiness when applying for their first mortgage, seeking to refinance a mortgage and in many other situations that require credit evaluations. For young Canadians and newcomers to Canada, this is even more important as they have a more difficult time establishing credit history.

More Gen Z and Millennials are renting today than the generations that came before them, with over 54 per cent of people between 25 and 34 years old being renters—and that number jumps to 81 per cent for people under 24 years old. In comparison, 25 per cent of Canadians between 55 and 64 years old are renters today. By making renters' payments count, we can help younger Canadians get ahead.

In Budget 2024, the government is setting a firm expectation with lenders, through its strengthened Canadian Mortgage Charter, to take a renter's on-time payment history into account when performing credit evaluations for mortgage applications.

-

Budget 2024 announces that the government is calling on banks, fintechs, and credit bureaus to prioritize launching tools to allow renters to opt-in to reporting their rent payment history to credit bureaus, to strengthen their credit scores and unlock pathways for more renters to become homeowners.

Together, this ability to strengthen one's credit score with on-time rental payment history—and make it easier to qualify for a mortgage, or even a lower rate—works in parallel to the government's efforts to advance consumer-driven banking. Further details on Canada's Framework for Consumer-Driven Banking are in Chapter 3.

Protecting Renters' Rights

Renters face unique challenges to ensuring their homes are properly maintained and that their landlords follow provincial laws. Renters can have a hard time navigating different provincial laws and lack resources to fight disputes with landlords—whether it concerns faulty heating, an illegal rent increase, or an illegal eviction. Tenant organizing and legal services can help renters.

When renters' rights are upheld, it gives people stability and housing security. They can stay in their homes and in their community—taking their kids to the same schools, being close to the same parks, and staying in the same job. It also gives them bargaining power, helping them keep their rent affordable.

The federal government is committed to protecting tenant rights and ensuring that renting a home is fair, open, and transparent.

-

Budget 2024 proposes to provide $15 million over five years, starting in 2024-25, for a new Tenant Protection Fund, which will provide funding to organizations that provide legal and informational services to tenants, as well as for tenants' rights advocacy organizations to raise awareness of renters' rights.

-

Budget 2024 also proposes a new Canadian Renters' Bill of Rights, to be developed and implemented in partnership with provinces and territories, to protect renters from unfair practices, make leases simpler, and increase price transparency. The government intends to crack down on renovictions, introduce a nationwide standard lease agreement, and require landlords to disclose historical rent prices of apartments.

Free legal support and advocacy for renters

The heating system in Patrick's apartment breaks down during the winter, threatening his health and safety, but his landlord refuses to arrange urgent repairs because they are on extended vacation. Patrick pays for emergency repairs, but his landlord refuses to fully reimburse his expenses after returning from vacation.

Patrick accesses free, federally funded legal information and advice to navigate his province's tenant dispute resolution process and succeeds in being fully reimbursed for his expenses.

30-Year Amortizations for First-Time Buyers Purchasing New Builds

The high cost of mortgage payments is a barrier for many younger Canadians hoping to buy that first time. Extending mortgage amortizations for first-time buyers purchasing new builds brings that monthly cost down, making it more affordable for first-time buyers, many of whom are young people still working their way up the salary ladder.

To restore generational fairness in the housing market for younger Canadians, the government is strengthening the Canadian Mortgage Charter with new measures to unlock pathways for Millennials and Gen Z to get the keys to their first home.

-

Budget 2024 announces the government is strengthening the Canadian Mortgage Charter to allow 30-year mortgage amortizations for first-time home buyers purchasing newly constructed homes. Extending the amortization limits by five years for first-time buyers purchasing new builds will enable more younger Canadians to afford a mortgage and will encourage new supply. This new insured mortgage product will be available to first-time buyers starting August 1, 2024. The government will bring forward regulatory amendments to implement this proposal. Further details will be released in the coming months.

The government will monitor whether housing inflation and supply conditions permit expanding access to 30-year insured mortgage amortizations more broadly.

Combined with the Tax-Free First Home Savings Account to save for a down payment faster and helping renters build their credit score with their on-time rental payment history, new access to 30-year mortgage amortizations will help first-time buyers purchasing new builds to access mortgages with lower monthly payments, making it easier to unlock the door to their first home.

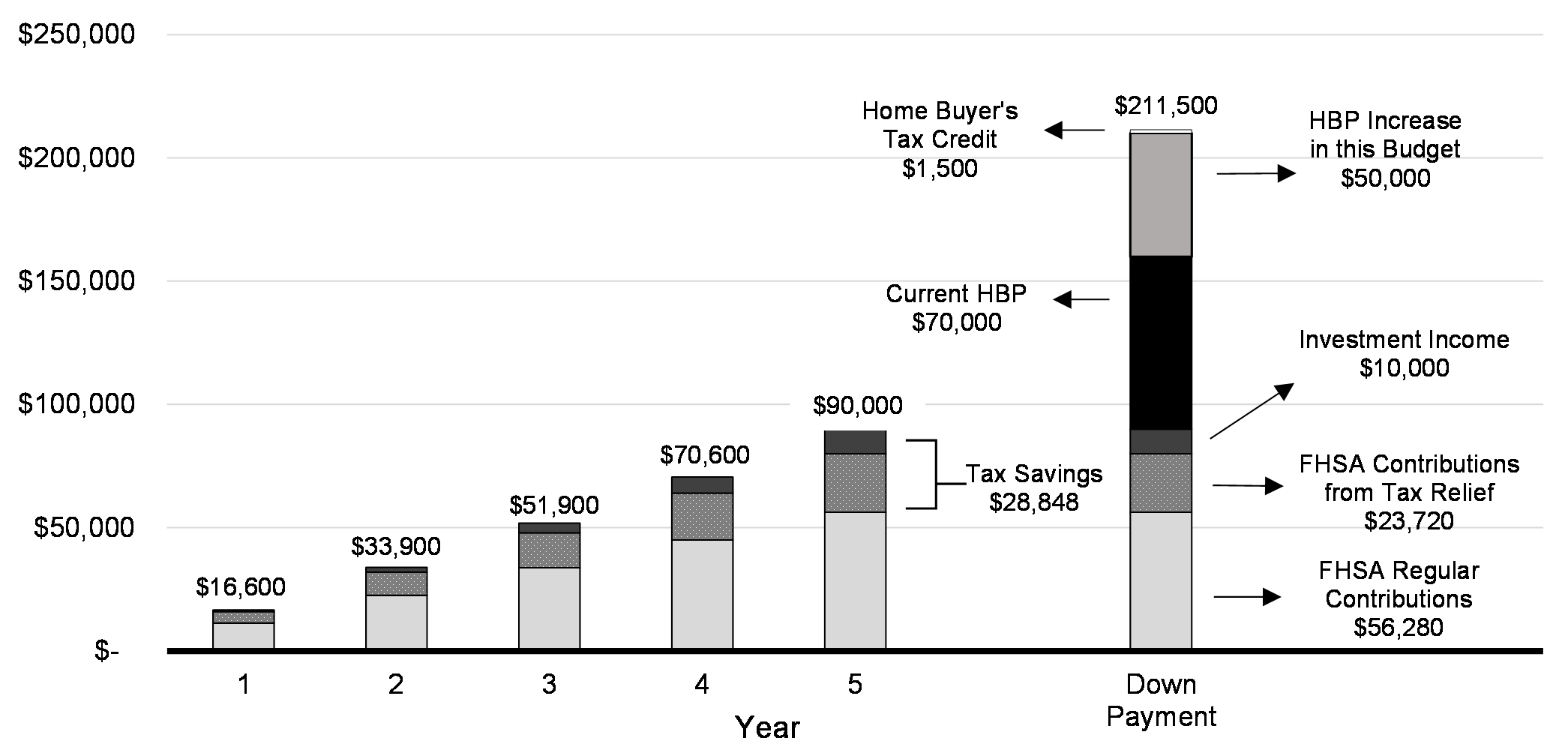

Enhancing the Home Buyers' Plan

As home prices go up and the cost of living rises, saving for a down payment is more and more difficult. The federal government is enhancing the tax savings plans that help young Canadians save for their first home.

Across the country, and particularly in Canada's major cities, home prices have gone up—steeply. Support to help first-time buyers save must keep pace with market prices. That is why the government launched the Tax-Free First Home Savings Account, and why in Budget 2024, it is enhancing the Home Buyers' Plan. While home prices have risen—and building more new homes will help to lower prices—the government is unlocking pathways to a down payment so more Canadians can buy a home and build a good middle class life.

-