Archived -

Chapter 2

Supporting a Strong Middle Class

On this page:

A strong economy depends on a strong middle class. But for too long, governments in Canada forgot that.

That is why, since 2015, the federal government's economic plan has invested in the middle class, strengthened Canada's social safety net, and worked to build an economy where everyone has a real and fair chance at success.

A key pillar of the government's plan has been a focus on making life more affordable for Canadians—because when people have the support they need to thrive, they can contribute to the economy, build a better life for themselves and their family, and play an active role in their communities.

The federal government has cut taxes for the middle class by asking the very wealthiest Canadians to pay more.

A new Canada-wide system of early learning and child care is making life more affordable for families and creating child care spaces across the country, while also helping a record number of women join the labour force.

Enhancements to Old Age Security, the Canada Pension Plan, and the Guaranteed Income Supplement are allowing more seniors to enjoy the comfortable and dignified retirements they deserve and worked for their whole lives. The federal government will continue standing up for the Canada Pension Plan, which is essential to the retirements of millions of Canadians from coast to coast to coast.

To help Canadians keep up with the cost of living, benefits that millions of Canadians count on are indexed to inflation—including the Canada Child Benefit, the Goods and Services Tax (GST) Credit, the Canada Pension Plan, Old Age Security, and the Guaranteed Income Supplement. Veterans' benefits, such as the Disability Pension and the Pain and Suffering Compensation, are also indexed to inflation.

While inflation has fallen significantly from its peak, higher prices are still putting pressure on Canadians. That is why, over the past year, the federal government has taken further action to make life more affordable for those who need it most.

These measures have included:

-

Doubling the GST Credit for six months in the fall of 2022;

-

A new Grocery Rebate in July 2023, which provided hundreds of dollars in targeted inflation relief to 11 million Canadians and families;

-

Delivering the first enhanced, quarterly Canada Workers Benefit payments on July 28, 2023 to our lowest-paid—and often most essential—workers, with a family receiving up to $2,461 this year;

-

Making it more affordable to go to college and university by permanently eliminating interest on Canada Student Loans and Canada Apprentice Loans, and increasing up-front Canada Student Grants from $3,000 to $4,200 for the 2023 school year;

-

A tax-free payment of $500 to help low-income Canadians who are struggling with the cost of rent; and,

-

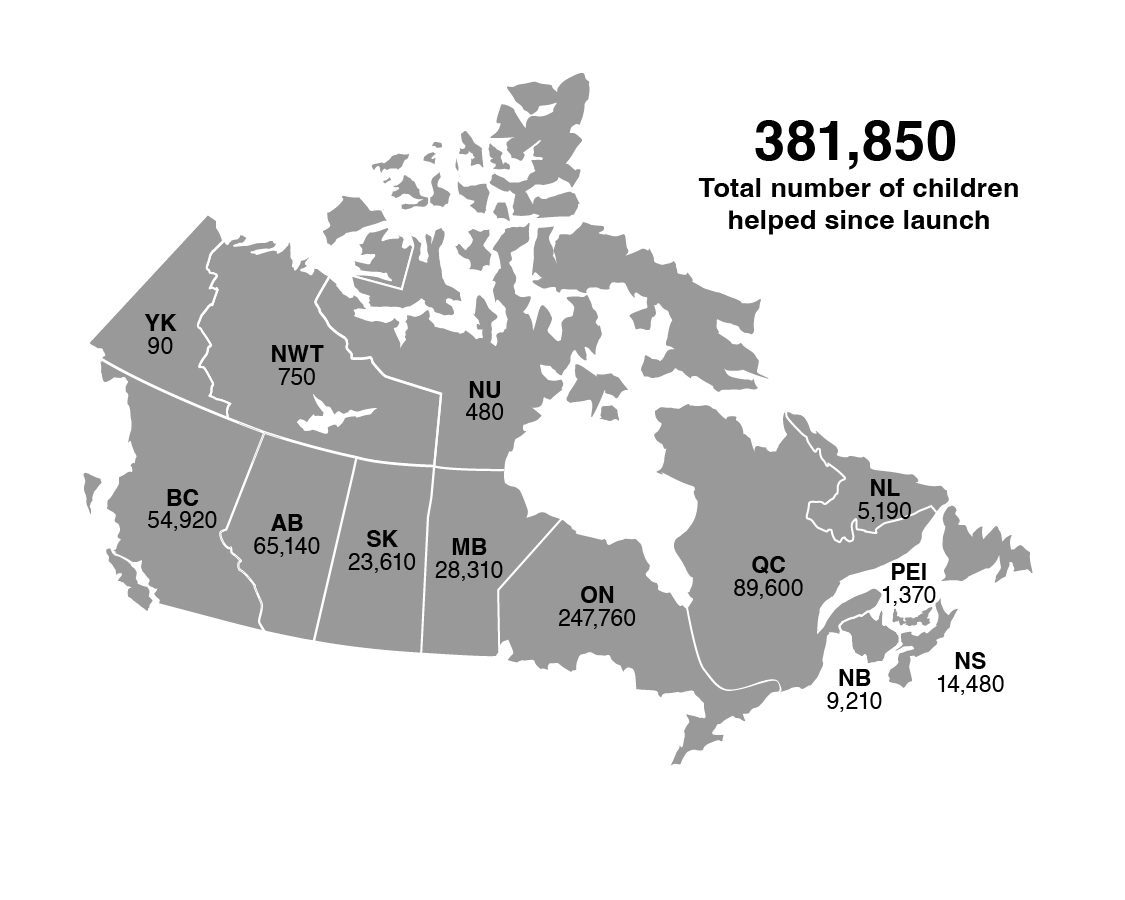

Direct, tax-free payments of up to $1,300 per child over two years through the Canada Dental Benefit for uninsured families earning less than $90,000 per year to cover the cost of dental care for kids under 12, supporting more than 380,000 children to date.

The 2023 Fall Economic Statement continues to deliver on the government's economic plan by introducing new measures to support Canadians, while also making important progress on commitments the government has already made to help make life more affordable for people from coast to coast to coast.

This Fall Economic Statement also provides an update on the federal government's significant investments to ensure Canadians receive the universal public health care they deserve, as well as on the roll-out of the new Canadian Dental Care Plan, which will make sure that no Canadian ever has to choose between taking care of their teeth and putting food on the table.

This year, Canadians will continue to benefit from the federal government's efforts since 2015 to make life more affordable. For example:

-

A family with two children in British Columbia, with an income of $88,000 in 2023, could benefit from about $17,700 as a result of reduced child care costs, the Canada Child Benefit, the Canada Dental Benefit, and tax relief from the increased Basic Personal Amount.

-

A single Canadian without children in Alberta, with an income of $23,000 in 2023, could benefit from $2,200 as a result of enhancements to the Canada Workers Benefit, the Grocery Rebate, tax relief from the increased Basic Personal Amount, and increased pollution price rebates (Climate Action Incentive Payments), and up to $750 from the Canada Training Credit if they attended a short-duration training program.

-

A 78 year-old senior in Quebec with a maximum Guaranteed Income Supplement (GIS) entitlement could receive more than $2,000 in additional support in 2023, thanks to the Grocery Rebate, the GIS top-up increase for single seniors, and the 10 per cent increase in the Old Age Security pension for seniors aged 75 and up.

-

A low-income student in Nova Scotia could receive more than $5,800 in additional support in 2023 thanks to increased Canada Student Grants and interest-free Canada Student Loans, the Grocery Rebate, and pollution price rebates. If they have a disability or dependants, they could receive an additional $12,800 in specialized student grants, plus an extra $640 per dependant, and up to $20,000 towards devices that support their learning. After graduating, all of their federal student loans will remain interest-free, with repayment assistance available until their income surpasses $40,000 per year.

Since being announced in Budget 2021, the federal government's Canada-wide system of affordable early learning and child care has delivered real results for middle class families across Canada, saving them thousands of dollars every month—while also supporting a record 85.7 per cent labour force participation rate for women in their prime working years as of July 2023. By strengthening Canada's labour force, affordable early learning and child care is giving kids the best possible start in life and helping to fight inflation by filling labour shortages from coast to coast to coast.

Six provinces and territories are already providing regulated child care for an average of just $10-a-day or less, and all other provinces and territories remain on track to deliver $10-a-day child care by March 2026, significantly ahead of schedule. In Quebec, which has been a leader in affordable child care since 1997, federal investments are ensuring that more families can access affordable child care through the creation of more than 30,000 new spaces. In total, the federal government is supporting the creation of nearly 250,000 new child care spaces across the country, with more than 50,000 new spaces already created across Canada. Agreements with provinces and territories also include a commitment to develop and fund an inclusion plan to support children with disabilities.

The federal government has also invested in the heart of the system—early childhood educators—with $420 million provided to provinces and territories in 2021-22 to help fund the training and development opportunities needed to support educators' growth and the growth of the system as a whole.

The Indigenous Early Learning and Child Care Framework is also enabling Indigenous-led approaches to child care so that Indigenous children and families benefit from a comprehensive and coordinated system anchored in self-determination and grounded in culture. Through strong partnerships with Indigenous governments and organizations, investments are reaching more than 35,000 children in 463 childcare sites in First Nations and Inuit communities, 341 Aboriginal Head Start programs on reserve, and 133 Aboriginal Head Start programs in urban and northern communities.

Province / Territory |

Status of Fee Reduction | Estimated Federal Transfers for the Canada-Wide Early Learning and Child Care System Over 5 Years Starting in 2021-221 | Estimated 2023 Annual Savings per Child (Gross, Annual)2 |

|---|---|---|---|

| BC | 50 per cent on average reduction achieved as of December 2022 | $3.21 billion | Savings of up to $6,600 per child |

| AB | 50 per cent on average reduction achieved as of January 2022 | $3.8 billion | Savings of up to $10,3303 per child |

| SK | $10-a-day effective April 1, 2023 | $1.1 billion | Savings of up to $6,9004 per child |

| MB | $10-a-day effective April 2, 2023 | $1.2 billion | Savings of up to $2,610 per child |

| ON | 50 per cent on average reduction achieved as of December 2022 | $10.23 billion | Savings of up to $8,5005 per child |

| NB | 50 per cent on average reduction achieved as of June 2022 | $492 million | Savings of up to $3,900 per child |

| PEI | 50 per cent on average reduction achieved as of October 2022 | $118 million | Savings of up to $2,000 per child |

| NS | 50 per cent on average reduction achieved as of December 2022 | $605 million | Savings of up to $6,0006 per child |

| NL | $10-a-day achieved as of January 1, 2023 | $306 million | Savings of up to $6,300 per child |

| YK |

Yukon committed to a $10-a-day average fee prior to Budget 2021 | $42 million | Savings of up to $7,300 per child |

| NWT | 50 per cent on average reduction achieved as of January 2022 | $51 million | Savings of up to $4,950 per child |

| NU | $10-a-day achieved as of December 2022 | $66 million | Savings of up to $14,300 per child |

| QC7 | $8.85 per day as of January 1, 20238 | $5.96 billion | Under its asymmetrical agreement, Quebec identified the creation of more than 30,000 new child care spaces by March 2026 as a priority. This includes the close to 20,500 additional subsidized spaces already created since the launch of the "Grand chantier pour les familles" in October 2021. |

|

1 Initial notional funding amounts when the bilateral Canada-wide Early Learning and Child Care Agreements were signed. Actual funding amounts are subject to annual adjustments based on provincial/territorial shares of Canada's 0-12 year old population. 2 Estimated savings for BC, AB, SK, ON, NB, PEI, NS, NL, and NWT are provincial and territorial estimates. Remaining savings calculations (MB, YK, and NU) are Employment and Social Development Canada estimates and are illustrative only. All estimates are relative to 2019 levels unless updated data is provided by provinces and territories. All estimates are based on out-of-pocket parent fees excluding amounts that would be recovered through provincial/territorial tax credits or the federal child care expense deduction at tax time, or changes to provincial/territorial or federal benefits as a result of lower child care expenses. Actual savings for families will vary based on factors such as actual fees paid prior to reductions. Provincial and territorial methodologies and data for calculating estimated savings may vary. 3 Based on Alberta's savings scenario of a family earning $130,000/year previously paying $1,200/month for infant care and now paying $339/month. 4 Based on Saskatchewan's average savings estimate of $573/month for full-time infant care as of April 2023. 5 Based on Ontario's savings scenario of a family paying $62-a-day per child at the beginning of 2022 and $29.30-a-day effective December 31, 2022. 6 Based on Nova Scotia's savings scenario for an infant in full-time licensed child care. 7 The Government of Canada has entered into an asymmetrical agreement with the province of Quebec that will allow for further improvements to its early learning and child care system, where parents with a subsidized, reduced contribution space already pay a single fee of less than $10-a-day 8 This amount is indexed and may increase with inflation or the growth rate of the cost of subsidized spaces. Parents of children in non-subsidized spaces are entitled to a refundable tax credit for child care expenses covering between 67-78 per cent of all expenses paid, depending on family income, with a maximum eligible expense of $43 per day in 2023. |

|||

2.1 Making Life More Affordable

Strengthening Competition to Help Stabilize Prices in Canada

More competition means lower prices, more choice, and more innovative products and services for Canadians. To further enhance competition in Canada, the federal government is taking action by amending the Competition Act and the Competition Tribunal Act to ensure Canadians can have more choice in where they take their business.

-

The government is proposing amendments to the Competition Act in order to:

- Strengthen the tools and powers available to the Competition Bureau to enable it to crack down on abuses of dominance by bigger companies, such as predatory pricing;

- Further modernize merger reviews, including by empowering the Competition Bureau to better detect and address "killer acquisitions" and other anti-competitive mergers;

- Enhance protections for consumers, workers, and the environment, including by prohibiting misleading "greenwashing" claims and improving the focus on worker impacts in competition analysis;

- Empower the Commissioner of Competition to review a wider selection of anti-competitive collaborations and seek meaningful remedies to ensure that harmful conduct is not repeated; and,

- Broaden the reach of the law by enabling more private parties to bring cases before the Competition Tribunal and receive payment if they are successful.

-

The 2023 Fall Economic Statement also proposes amendments to the Competition Tribunal Act to ensure legal cost awards during case adjudication do not prohibit a robust defence of competition.

This proposed comprehensive modernization of Canada's competition regime builds on significant recent reforms, including those in Bill C-56. Together, these represent significant, generational changes, which will help bring Canada into alignment with international best practices to ensure that our marketplaces promote fairness, affordability, and innovation.

Right to Repair

Every day, Canadians are frustrated by throwing out items because they can't find proper repairs. From appliances, to yard equipment, to electronics, throwing out these valuable goods wastes money and creates unnecessary waste for landfills.

-

In support of Canadians' right to repair, the federal government will also amend the Competition Act in order to prevent manufacturers from refusing to provide the means of repair of devices and products in an anti-competitive manner.

Making Groceries More Affordable

In the face of global inflation and the high cost of food, the federal government is taking action to help stabilize food prices for Canadians and deliver relief at the checkout counter. New measures announced this fall to help make groceries more affordable include:

-

Amending the Competition Act through Bill C-56, the Affordable Housing and Groceries Act to enhance competition in the grocery sector, which will help bring down costs and ensure Canadians have more choice in where they buy their groceries.

-

Securing commitments from Canada's five largest grocery chains, which represent 76 per cent of the grocery market, to help stabilize prices for Canadians.

-

Establishing a Grocery Task Force, which is supervising the big grocers' work to stabilize prices, as well as monitoring and investigating other practices in the grocery sector, such as "shrinkflation."

In the weeks and months to come, the government will ensure that Canada's largest grocers are keeping their commitments to stabilize prices, and is not ruling out any new measures, including possible tax measures, to support the grocery price stability that Canadians deserve.

Cracking Down on Junk Fees

Every single Canadian has dealt with unfair fees. Whether they are excessive roaming fees, excess banking fees, or being charged extra to sit with your kids on an airplane, these fees add up.

In the 2023 Fall Economic Statement, the federal government is taking further action to crack down on junk fees—and in the months to come, the government will continue working to reduce even more of the junk fees that Canadians deal with every single day.

-

The 2023 Fall Economic Statement announces that:

- The government will work with the Canadian Transportation Agency to amend the Air Passenger Protection Regulations to ensure that airlines seat all children under the age of 14 next to their accompanying adult at no extra cost.

- The Canadian Radio-television and Telecommunications Commission will conduct a prompt investigation of international mobile roaming charges, and will provide an update and concrete next steps in 2024.

- The government will provide an update by Budget 2024 on the steps that it is taking to reduce the non-sufficient funds fees charged by banks. These fees, which can currently be as high as $50, disproportionately impact low-income Canadians or those who may not have access to overdraft protection due to their credit history.

-

The 2023 Fall Economic Statement also announces that the Office of Consumer Affairs will support ongoing efforts to crack down on junk fees across Canada, including by supporting independent research on this issue.

Further action to crack down on junk fees will be announced in the months ahead. The President of the Treasury Board and the Minister of Innovation, Science and Industry will continue to lead these important efforts.

| Action Taken | How It Is Lowering Costs for Canadians | New Actions the Federal Government Will Take |

|---|---|---|

| Stronger laws across the economy: It is now against the law to falsely advertise the price of a product or service. | Canadians can trust that when they are making purchases, the price they see advertised is the total cost. | Modernize the Competition Framework: The government will further reform the existing competition regime in order to enhance competition in Canada. |

| Passenger rights: The Air Passenger Protection Regulations (APPR) now detail obligations that airlines have to treat passengers fairly. | Ensures clear, consistent passenger rights by establishing minimum requirements, standards of treatment, and, in some situations, compensation that carriers must provide to Canadians when their travel does not go as planned.

|

Reduce fees for families sitting together on flights: The government will work with the Canadian Transportation Agency to amend the Air Passenger Protection Regulations to ensure that airlines seat all children under the age of 14 next to their accompanying adult at no extra cost. |

| Fair cellphone and internet bills: The Internet Code (2019) was established as a mandatory code of conduct for internet providers, building on the revised Wireless Code. | Canadians have a clearer understanding of their service contracts, which prevents bill shock from overage fees and price increases. This includes:

|

Work on international mobile roaming fees: The Canadian Radio-television and Telecommunications Commission will conduct an expeditious investigation of international mobile roaming rates and will provide an update and concrete next steps in 2024. |

| Banking protections: The Financial Consumer Protection Framework was introduced to offer protection for bank customers. | To help Canadians avoid surprise fees, under the Financial Consumer Protection Framework banks must now send electronic alerts when a customer is close to exceeding the funds available in their account or going over their credit limit. | Lower non-sufficient funds (NSF) fees: The government will take action to reduce the non-sufficient funds fees charged by banks. |

Delivering Support for Canadians on Energy Bills

As global market forces and inflation continue to affect Canadians, too many families are feeling the pressure on their monthly energy bills. To put more money back in the pockets of Canadians, while ensuring there is less pollution in our air, the federal government is helping more households make the switch to clean, affordable home heating options. To support this measure, the federal government is doubling the pollution price rural top-up and temporarily pausing the pollution price on heating oil.

Doubling the Rural Top-up for Eligible Canadians

Putting a price on pollution is the most efficient and affordable way of reducing our emissions. In provinces where the federal fuel charge applies, eight out of ten households get more money back than they pay through their quarterly pollution price rebate. In small and rural communities, where energy costs are often higher and people have fewer alternatives, the federal government also provides a rural supplement.

To further support rural Canadians, the federal government proposed on October 26, 2023, to increase the rural top-up from 10 per cent to 20 per cent, effective April 2024.

The government will announce pollution price rebate amounts for 2024-25 in the coming months.

| AB | MB | ON | SK | NL | NS | PEI1 | NB | |

|---|---|---|---|---|---|---|---|---|

| Family of Four | $386 | $264 | $244 | $340 | $328 | $248 | $240 | $184 |

| Payment Dates2 | April 2023 July 2023 October 2023 January 2024 |

July 2023 October 2023 January 2024 |

October 2023 January 2024 |

|||||

|

1 Residents of small and rural communities in AB, MB, NB, NL, NS, ON, and SK are eligible for the 10-per-cent rural supplement. As all PEI residents are considered to be living in a small and rural community, amounts are not specified for urban versus rural individuals. The amounts for PEI can thus be considered as reflecting the rural supplement. 2 The fuel charge came into force in NL, NS, PEI, and NB on July 1, 2023. Residents of NB received a double payment in October 2023 for the July to September 2023 and October to December 2023 periods, and will receive a single payment in January 2024. |

||||||||

Helping More Households Make the Switch to Electric Heat Pumps

Switching to an electric heat pump can help many Canadians save thousands of dollars a year on energy bills, while also reducing their emissions.

To support Canadians with the upfront costs of buying and installing a heat pump, the federal government has proposed to allocate $500 million over four years, starting 2023-24, to enhance the Oil to Heat Pump Affordability program. The program currently provides grants of up to $10,000 for low- to median-income households across Canada to switch from oil heating to an electric heat pump. Under the enhanced program, in provinces and territories that partner with the federal government to provide support for heat pump installation, eligible households could receive up to $15,000 in federal grants, plus additional support from provinces and territories. This level of support will make the cost of switching to a heat pump free for most Canadians who need one. Additionally, a $250 payment will be available as an incentive for these households to make the switch.

The federal government is also considering options to streamline eligibility requirements under the Canada Greener Homes Initiative to make it easier for Canadians in every part of the country to switch to a heat pump, including if they currently heat their home with propane or natural gas.

Temporarily Pausing the Federal Pollution Price on Heating Oil

In addition to supporting Canadians with the installation of an electric heat pump, the federal government is temporarily pausing the federal fuel charge from deliveries of heating oil while work is underway to replace heating oil furnaces. Heating oil is used by 1.1 million homes in Canada, including 267,000 in Ontario and 287,000 across Atlantic Canada. Heating oil is highly polluting and particularly expensive, costing two to four times as much as natural gas to heat a home.

This temporary pause is a targeted measure to address that reality while support rolls out to help Canadians switch to a clean, affordable electric heat pump. This temporary pause will last from November 9, 2023, to March 31, 2027.

Enhancing Low-Cost and No-Cost Bank Accounts

Canadians no longer bank the same way they did a decade ago. Today, most Canadians are using online banking to pay bills and transfer money, and debit transactions are far more common than paying in cash—particularly since the pandemic. Some banks have already agreed to provide Canadians with low-cost and no-cost banking services. However, these agreements were reached a decade ago, and are no longer sufficient for the realities of banking in 2023.

To make banking more affordable and meet the evolving banking needs of Canadians, the federal government has directed the Financial Consumer Agency of Canada (FCAC) to work with banks to improve the features of low- and no-cost accounts to reflect the realities of modern banking, such as providing additional debit transactions, online bill payments, and e-transfers with no extra fees. FCAC will also work to expand low- and no-cost accounts to more Canadians, including by making more Canadians eligible for no-cost accounts and making affordable banking options available at more banks.

The government will provide an update on its progress in the coming months.

An Independent Ombudsman for Canadians Dealing With Their Banks

For too long, banks have been able to choose who adjudicated complaints that Canadians have had with their bank. Canadians deserve an impartial advocate that will work on their behalf, which is why the government recently designated the Ombudsman for Banking Services and Investments (OBSI) as the single external complaints body for Canada's banking sector. An independent and transparent not-for-profit organization, OBSI will have jurisdiction to resolve complaints at all Canadian banks starting November 1, 2024.

Consumer-Driven Banking

Consumer-driven banking, also known as open banking or consumer-driven finance, refers to systems that allow people and businesses to securely transfer their financial data to different financial services providers, such as apps that use data to provide automated budgeting and savings advice. While these data-driven services can play an important role in helping Canadians manage their finances, in order to access them, Canadians must currently share their banking credentials with financial technology companies. This unsecure, unregulated practice leaves Canadians open to security, privacy, and liability risks in the event of data breaches or losses.

-

The 2023 Fall Economic Statement announces that the federal government will introduce legislation through Budget 2024 to establish a consumer-driven banking framework that would regulate access to financial data. This framework will ensure that Canadians and small businesses have safe and secure access to financial services and products that help them manage and improve their finances.

Concurrent to this announcement, the government is releasing a policy statement outlining its position on key policy objectives and core framework elements, including governance, scope, accreditation, common rules, and technical standards. This policy statement will help guide industry as the consumer-driven banking framework is implemented. Canada is proposing a framework that aligns with those of its largest trading partners, including the United States, which sees Canadians cross the border, work, and do business in both countries every day.

The implementation of a consumer-driven banking framework will:

-

Empower Canadians to securely access and share their financial data.

-

Ensure that Canadians are not subject to fees when accessing and sharing their data.

-

Protect Canadians and the financial system from risky practices like screen-scraping.

-

Ensure parties at fault are liable for any damages or data breaches.

-

Allow Canadians to safely access innovative products and services that can help them improve their financial outcomes. For example:

- Apps that build credit scores using transaction data.

- Account aggregators that provide a fuller financial picture and support improved decision making.

- Budgeting tools that monitor spending and provide insights to improve financial well-being.

- Platforms that provide automated financial advice, tailored to a consumer's unique financial situation, and needs.

Supporting Canada's Payments Modernization

The federal government is committed to promoting the safety and integrity of Canada's financial system. On November 22, 2023, the government will be releasing final regulations under the Retail Payment Activities Act, which will make payments services safer and more secure for Canadians and businesses.

-

The 2023 Fall Economic Statement announces the government's intention to amend the Canadian Payments Act to expand membership eligibility in Payments Canada to payment service providers supervised by the Bank of Canada, credit union locals that are members of a credit union central, and operators of designated clearing houses. This modernization will allow for lower transaction costs and faster, more secure payments for Canadians.

Supporting Small Businesses

Small businesses make up 98 per cent of all businesses in Canada, and they play an essential role in our communities.

During the pandemic, the federal government focused relentlessly on jobs—on keeping businesses afloat and Canadians employed. As part of the government's historic emergency spending, the Canada Emergency Business Account (CEBA) provided $49 billion in interest-free, partially forgivable loans of up to $60,000 to nearly 900,000 small businesses and not-for-profit organizations. To further support these businesses and organizations, the government recently announced the following changes:

-

The repayment deadline for CEBA loans to qualify for partial loan forgiveness of up to $20,000 is being extended from December 31, 2023, to January 18, 2024, recognizing that the end of December is a busy time for many Canadian businesses. This follows the government's previous one-year extension announced in January 2022.

-

For CEBA loan holders who apply for refinancing with the financial institution that provided their CEBA loan by January 18, 2024, the repayment deadline to qualify for partial loan forgiveness now includes a refinancing extension until March 28, 2024. This will allow more small businesses and not-for-profits to access relief and give them more time to hear back from their financial institutions on refinancing applications.

-

As of January 19, 2024, outstanding loans, including those that are captured by the refinancing extension, will convert to three-year term loans, subject to interest of five per cent per annum, with the term loan repayment date extended by an additional year from December 31, 2025, to December 31, 2026. Put simply, small businesses and not-for-profits will automatically have access to a three-year, low-interest loan of up to $60,000 if they have not repaid or refinanced their loan. This will provide those who are unable to secure refinancing or generate enough cashflow to repay their loans by the forgiveness deadline with an additional year to continue repayment at a low borrowing cost. CEBA loan holders also have the ability to repay the principal at any time throughout the three-year term, meaning far greater flexibility for businesses.

Repayment on or before the new deadline of January 18, 2024 (or March 28, 2024 if a refinancing application is submitted prior to January 18, 2024 at the financial institution that provided their CEBA loan) will result in loan forgiveness of $10,000 for a $40,000 loan and $20,000 for a $60,000 loan. The above changes also apply to CEBA-equivalent lending through the Regional Relief and Recovery Fund.

Mikaela owns a small refrigeration company in New Brunswick. She has a $60,000 CEBA loan and is unable to repay $40,000 to benefit from $20,000 in partial loan forgiveness by January 18, 2024. Her $60,000 CEBA loan will turn into a three-year term loan on January 19, 2024, with a 5 per cent annual interest rate payable monthly (up to $250 per month) with the principal of $60,000 due on Dec 31, 2026.

Tyler owns a small landscaping business in British Columbia and has a $40,000 CEBA loan. He applies for refinancing for $30,000 with the financial institution holding his CEBA loan. With the new extension, he has until March 28, 2024 to receive a response and secure refinancing to pay off his CEBA loan and benefit from $10,000 in partial loan forgiveness.

Removing the GST/HST From Psychotherapy and Counselling

Therapy and counselling play an important role in the lives and mental health care of millions of Canadians, but they can be expensive. To ensure that Canadians can receive the support they need, the federal government is taking action to make these essential services more affordable for Canadians.

-

The 2023 Fall Economic Statement proposes to exempt professional services rendered by psychotherapists and counselling therapists from the GST/HST.

A New Employment Insurance Adoption Benefit

Employment Insurance (EI) maternity and parental benefits are key supports for new parents. Currently, adoptive parents can access EI parental benefits, but they cannot access the 15 weeks of EI maternity benefits. Too often, adoptive parents are left with too little time to meet the demands of the adoption process, attach, and welcome their child into their new home.

-

The 2023 Fall Economic Statement proposes to introduce a new 15-week shareable EI adoption benefit, at an estimated cost of $48.1 million over six years, starting in 2023-24, and $12.6 million ongoing. The benefit is expected to provide approximately 1,700 Canadian families each year with additional time and flexibility as they welcome a new child in their home. Surrogate parents will also be eligible for this benefit.

-

The 2023 Fall Economic Statement also proposes to make amendments to the Employment Insurance Act, as well as corresponding changes to the Canada Labour Code, to ensure that workers in federally regulated industries have the job protection they need while receiving the EI adoption benefit.

Enhancing Employment Insurance Supports for Seasonal Workers

Many seasonal workers—including in fishing and tourism—rely on Employment Insurance (EI) for the support they need between work seasons. However, the recent anomalies in regional unemployment rates has meant that many seasonal workers risk experiencing a longer income gap this year.

-

In response to this year's specific and atypical economic circumstance, the 2023 Fall Economic Statement proposes up to four additional weeks of EI regular benefits to eligible seasonal workers in 13 economic regions. This new measure is expected to cost an estimated $69.8 million over three years, starting in 2023-24.

This temporarily enhanced support would be available for claims established between September 10, 2023, to September 7, 2024.

2.2 Stronger Health Care

Delivering Dental Care for Canadians

Seeing a dentist is important for our health—but it can be expensive. Currently, more than a third of people in Canada do not have dental insurance. To make dental care more affordable, the federal government committed to provide dental coverage for uninsured Canadians with a family income of less than $90,000 annually, starting with children under 12.

In September 2022, the government announced the Canada Dental Benefit as the first stage of this plan. Applications opened in December 2022 to provide eligible parents or guardians with direct, up-front, tax-free payments of up to $1,300 over two years, per child, to cover the cost of dental care. To date, the Canada Dental Benefit has helped more than 380,000 children receive the dental care they need.

The government is also continuing to prepare for the launch of the Canadian Dental Care Plan. Once fully implemented, the Canadian Dental Care Plan will support up to 9 million uninsured Canadians who have an annual family net income of less than $90,000 in getting the oral health care they need, with no co-pays for those with family incomes under $70,000. Further information on the plan, which is expected to begin rolling out by the end of 2023, will be communicated by Health Canada in the coming weeks.

Canada Dental Benefit Payments, by Province and Territory

(December 1, 2022 to October 19, 2023)

Strengthening Public Health Care

A strong and effective public health care system is at the heart of what it means to be Canadian. It is essential to our well-being, and it is an important foundation of a growing and healthy economy.

On February 7, 2023, the federal government announced an investment of nearly $200 billion over ten years to improve health care services for Canadians. Through that plan, the government has already provided a $2 billion top-up to the Canada Health Transfer so that provinces and territories could reduce backlogs and respond to urgent pressures, including in pediatric hospitals, emergency rooms, and operating rooms.

The government has also made progress towards negotiating tailored bilateral agreements with provinces and territories to address their unique health needs. Agreements in principle have been signed with all provinces and territories, except for Quebec. The first formal bilateral agreement was also reached, with British Columbia, on October 10. These bilateral agreements, which will provide $25 billion in additional funding over ten years, will address individual provincial and territorial health system needs, such as expanding access to health services, supporting health workers, reducing backlogs, increasing mental health and substance use support, improving licensing and credential recognition, and modernizing health systems. To receive funding for 2023‑24 through tailored bilateral agreements, provinces and territories must sign a bilateral agreement by March 31, 2024.

The government is also working with Indigenous partners to provide additional support for Indigenous health priorities by providing $2 billion over ten years, which will be distributed on a distinctions basis through the Indigenous Health Equity Fund.

The nearly $200 billion incremental investment in health care announced in February 2023 will provide important support to Canadians over the next ten years:

- GDP-Driven Growth: As the Canada Health Transfer's escalator is based on gross domestic product (GDP) growth, an additional $146.0 billion is projected over the next ten years through the Canada Health Transfer, over and above the $45.2 billion provided in 2022-23.

- Canada Health Transfer Top-Up: On June 30, 2023, the federal government provided a $2 billion top-up to address immediate pressures on the health care system, especially in pediatric hospitals, emergency rooms, and operating rooms.

- Canada Health Transfer Five Per Cent Guarantee: The federal government will provide top-up payments to achieve Canada Health Transfer increases of at least five per cent for five years, to provinces and territories that commit to improve collection and management of health data. The last top-up payment will be rolled into the Canada Health Transfer base at the end of the five-year period, resulting in a permanent funding increase. This represents an estimated $17.5 billion over ten years in additional funding through the Canada Health Transfer.

- Tailored Bilateral Agreements: These agreements will provide $25 billion in additional flexible funding over ten years that provinces and territories can use to address the unique needs of their populations and geography, on top of an existing $7.8 billion for bilateral agreements in home care, mental health, and long-term care.

- Personal Support Worker Wage Support: The federal government will provide $1.7 billion over five years to support hourly wage increases for personal support workers and related professions.

- Territorial Health Investment Fund: The federal government will provide $350 million over ten years in recognition of medical travel and the higher cost of delivering health care in the territories.

Table 2.4 provides the provincial and territorial allocations of the funding over ten years:

Province/Territory |

New Funding | Ten Year Total Incremental Funding Over 2022-23 levels |

|---|---|---|

| Newfoundland and Labrador | $987 million | $2.36 billion |

| Prince Edward Island | $375 million | $1.06 billion |

| Nova Scotia | $1.51 billion | $5.18 billion |

| New Brunswick | $1.29 billion | $3.95 billion |

| Quebec | $9.02 billion | $38.35 billion |

| Ontario | $16.07 billion | $78.61 billion |

| Manitoba | $1.92 billion | $7.23 billion |

| Saskatchewan | $1.71 billion | $6.31 billion |

| Alberta | $5.27 billion | $25.72 billion |

| British Colombia | $6.05 billion | $29.05 billion |

| Nunavut | $93 million | $314 million |

| Northwest Territories | $93 million | $313 million |

| Yukon | $95 million | $333 million |

| Total | $46.17 billion | $200.49 billion |

|

Notes: 1 Funding for personal support workers has yet to be allocated but is included in total. 2 Provincial/territorial allocations are based on internal population projections and Statistics Canada modelling. 3 All Canada Health Transfer amounts starting in 2024-25 are notional, estimated based on December private sector nominal GDP forecast, and are subject to change. 4 Values may not equal total due to rounding. |

||

| 2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

2027- 2028 |

2028- 2029 |

Total | |

|---|---|---|---|---|---|---|---|

| 2.1. Making Life More Affordable | 264 | -93 | -225 | 180 | 21 | 21 | 168 |

| Helping More Households Make the Switch to Electric Heat Pumps* | 40 | 140 | 160 | 160 | 0 | 0 | 500 |

Less: Funds Sourced from Existing Resources |

-40 | -300 | -160 | 0 | 0 | 0 | -500 |

| Temporarily Pausing the Federal Pollution Price on Heating Oil* | 255 | 0 | -255 | 0 | 0 | 0 | 0 |

| Removing the GST/HST From Psychotherapy and Counselling | 0 | 10 | 10 | 10 | 10 | 10 | 50 |

| A New Employment Insurance Adoption Benefit | 0 | 8 | 8 | 10 | 11 | 11 | 48 |

| Enhancing Employment Insurance Supports for Seasonal Workers | 9 | 49 | 12 | 0 | 0 | 0 | 70 |

| Chapter 2 - Net Fiscal Impact | 264 | -93 | -225 | 180 | 21 | 21 | 168 |

|

Note: Numbers may not add due to rounding. *As announced on October 26, 2023. |

|||||||

Page details

- Date modified: