Archived -

Chapter 1

Canada’s Housing Action Plan

On this page:

For generations, Canada has been a place where, if you went to school, worked hard, and saved some money, there would be a home that you could afford. Today, for too many Canadians—whether in big cities or small towns—the dream of home ownership feels out of reach, and the rising cost of rent is making it difficult to find an affordable place to call home.

Put simply: Canada does not have enough homes—and we need to build more of them, fast. The Canada Mortgage and Housing Corporation estimates that Canada needs to build 3.5 million more homes by 2030—over and above the current rate of construction—to restore housing affordability for Canadians. This challenge is not something that the federal government can solve on its own.

Building the homes that Canada needs will require a great national effort—and it is an effort that the federal government is leading.

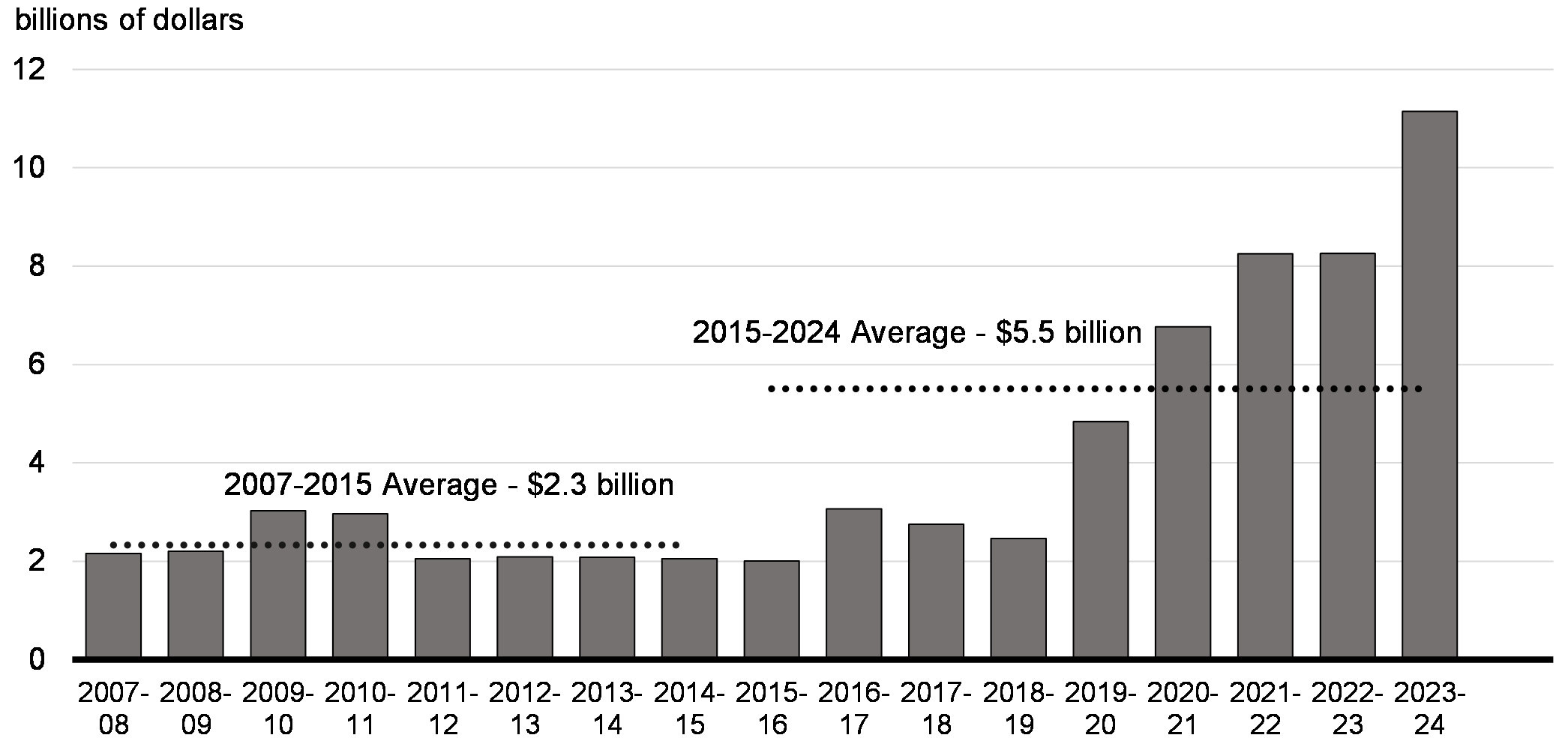

Federal investments are already jumpstarting housing construction across the country. Both Toronto and Vancouver have seen record numbers of housing starts in 2023, supported by accelerated rental construction. This year, federal investment in housing is $9 billion higher than it was in 2013-14. Since 2015, the average annual federal housing investment has more than doubled compared to the previous government.

Federal Housing Investments Since the 2008 Global Financial Crisis

Building on these significant federal investments made since 2015 to increase Canada's housing supply, federal, provincial, territorial, and municipal governments must work together, in partnership with home builders, financiers, community housing providers, post-secondary institutions, and Indigenous organizations and governments.

No single measure will solve Canada's housing challenge.

That is why the federal government is changing how communities build housing; making the math work for builders so more projects move forward; training, attracting, and retaining the construction workers who will build more homes; and ensuring low-income and vulnerable Canadians have safe, affordable housing options.

As part of this work, in the 2023 Fall Economic Statement, the federal government is introducing new measures to incentivize the construction of new rental housing, protect renters and homeowners, and make it easier for Canadians to get those first keys of their own.

In the months to come, the federal government will continue to take significant action to accelerate housing construction and lower prices for Canadian buyers and renters—and is calling on provinces, territories, and municipalities to do everything they can to build more homes, faster.

National Housing Strategy Investments Are Delivering Real Results

Investments from November 2017 to September 2023

1.1 Building More Homes, Faster

Increasing housing supply requires the removal of the zoning, financial, and regulatory barriers that disincentivize construction, particularly for rental and affordable housing. Outdated and unnecessary zoning restrictions delay development and increase costs—and in too many cities across the country, they prevent housing from being built at all. The federal government is working with governments across Canada to help them cut red tape, speed up permitting approvals, lift zoning restrictions, and build more homes, faster. To date, this includes:

-

The $4 billion Housing Accelerator Fund, which is already using federal funding to encourage municipalities to make transformative changes by removing prohibitive zoning barriers and incentivizing building, with the goal of creating at least 100,000 net new homes across Canada;

-

Over $25 billion in low-cost financing to build more than 71,000 new rental homes in Canadian cities through the Rental Construction Financing Initiative;

-

Over $13 billion through the National Housing Co-Investment Fund to build 60,000 new affordable homes and repair 240,000 homes;

-

$4 billion through the Rapid Housing Initiative, which is building more than 12,000 affordable homes for people experiencing homelessness or in severe housing need;

-

Over $200 million through the Federal Lands Initiative to build 4,500 new homes by repurposing surplus federal lands and buildings to housing providers at low or no cost;

-

Over $750 million through the Affordable Housing Innovation Fund to support innovative solutions for the next generation of housing in Canada; and,

-

$6.7 billion for housing for First Nations on reserve, and Inuit, Métis, and First Nations Self-Governing and Modern Treaty communities.

There are early indicators that these measures are working. Housing starts are above pre-pandemic levels—particularly in Ontario and British Columbia, where housing prices are higher than in other parts of the country.

Building on this progress, the 2023 Fall Economic Statement includes further actions to increase housing supply by making the math work for home builders and breaking down outdated zoning and regulatory barriers.

Accelerating How Communities Build Housing

To build more homes, faster, local governments have the power to remove obstacles. The federal government is working with provinces, territories, and municipalities across Canada to break down local zoning barriers and create the conditions that will help to rapidly increase Canada's housing supply.

In March 2023, the government launched the $4 billion Housing Accelerator Fund to help cut red tape and fast-track the creation of at least 100,000 new homes across Canada. The Housing Accelerator Fund is already delivering results—and on its current trajectory, is expected to exceed 100,000 new homes.

With agreements already announced with London, Vaughan, Hamilton, Brampton, and Kitchener, Ontario; Halifax, Nova Scotia; Kelowna, British Columbia, Calgary, Alberta; and Moncton, New Brunswick, the Housing Accelerator Fund has already made progress to cut red tape and fast-track over 21,000 more homes in growing cities over the next three years alone, with many more agreements on the way.

On November 9, 2023, the federal government signed an agreement with Quebec for a joint contribution of $1.8 billion. The $900 million provided by the federal government—nearly 23 per cent of all Housing Accelerator Funding—will help to cut red tape and build more homes for Quebecers. The federal government will continue working with Quebec to build on the bold reforms it has committed to in the new Housing Accelerator Fund bilateral agreement to make housing more affordable for Quebecers.

The Housing Accelerator Fund helps cut red tape and fast-track new homes for people in towns, cities, and Indigenous communities across the country. The federal government has already signed agreements with nine cities and the province of Quebec:

London, Ontario – 2,000 homes

-

Agreement announced on September 13, 2023, to deliver $74 million in federal funding.

-

Allow for high-density development without the need for re-zoning.

-

Allow up to four units to be built on a single property in low-density neighbourhoods.

-

Dispose of city-owned land for more development.

-

Create partnerships with non-profit housing providers to build more affordable homes.

Vaughan, Ontario – 1,700 homes

-

Agreement announced on October 5, 2023, to deliver $59 million in federal funding.

-

Allow for high-density development near public transit, including GO train and subway stations.

-

Prioritize building apartments and affordable housing.

-

Fix outdated permitting systems to speed up development.

-

Allow for the construction of up to four residential units on one lot.

Hamilton, Ontario – 2,600 homes

-

Agreement announced on October 10, 2023, to deliver $93.5 million in federal funding.

-

Allow for high-density development near rapid transit, including the future Hamilton LRT stations.

-

Make city-owned lands and brownfields available for development.

-

Expand as-of-right zoning permission for housing, including amending a zoning by-law to allow for the construction of four residential units on one lot.

Halifax, Nova Scotia – 2,600 homes

-

Agreement announced on October 12, 2023, to deliver $79.3 million in federal funding.

-

Improve permitting processes and reduce upfront costs for permitting.

-

Incentivize the use of pre-approved building plans.

-

Develop an incentive program for conversions of commercial to residential.

-

Create incentives for small scale residential construction.

-

Encourage development along transit corridors.

-

Expand the current Affordable Housing Grant program.

-

Update the heritage preservation policy.

-

Resource a program to identify surplus land for affordable housing.

Brampton, Ontario – 3,150 homes

-

Agreement announced on October 20, 2023, to deliver $114 million in federal funding.

-

Allow for high-density development near the city's transit corridors.

-

Reduce barriers to the development of housing in key areas of the city—such as urban centres, boulevards, and major public transit stations.

-

Create new incentive programs for affordable housing.

-

Expand the as-of-right zoning permission for housing, including permitting four residential units and four storeys within 800 metres of transit.

Kelowna, British Columbia – 950 homes

-

Agreement announced on October 25, 2023, to deliver $31.5 million in federal funding.

-

Allow for higher-density development along rapid transit corridors.

-

Make city-owned lands available for affordable housing development in partnership with non-profits.

-

Expand the use of technology to streamline building permit applications.

-

Expand as-of-right zoning for more infill housing in Kelowna's core.

Kitchener, Ontario – 1,200 homes

-

Agreement announced on November 3, 2023, to deliver $42.4 million in federal funding.

-

Encourage high and medium density around Kitchener's Light Rail Transit stations by making planning regulations more permissive.

-

Permit four units as-of-right.

-

Make affordable housing easier to build by making land and incentives available to affordable housing providers.

Province of Quebec

-

Agreement announced on November 9, 2023, to deliver $900 million in federal funding, or nearly 23 per cent of the Housing Accelerator Fund.

-

Secure a matching investment of $900 million from the Province of Quebec, for a combined total of $1.8 billion in new funding for housing construction.

-

Lead to the creation of 8,000 social and affordable housing units, 500 of which will be earmarked for people who are homeless or at risk of homelessness.

-

Continue to pursue efforts to accelerate the construction of residential units in Quebec, based on the Act respecting land use planning and development and other provisions.

-

Set up an interdepartmental project acceleration unit in co-operation with Quebec municipalities.

-

Adopt new government policies for land use planning, with housing construction indicators on which municipalities will have to base their targets.

-

Propose legislative amendments, subject to adoption by the National Assembly, to improve urban densification and facilitate the authorization of residential building construction, thus reducing related delays.

Calgary, Alberta – 6,800 homes

-

Agreement announced on November 14, 2023, to deliver $228 million in federal funding.

-

Expand upon the city's office space conversion program.

-

Create homes on City-owned land in proximity to transit stations.

-

Increase density through promoting Missing Middle Land Use Districts, allowing for more rowhouses and townhouses.

-

Enable growth by allowing infill housing in established neighbourhoods.

-

Incentivize secondary suites.

Moncton, New Brunswick – 490 homes

-

Agreement announced on November 16, 2023, to deliver $15.5 million in federal funding.

-

Permit four units as-of-right in all residential zones.

-

Encourage missing middle development, accessory dwelling units, and support non-profit housing developers.

-

Develop building plan templates for energy-efficient multi-unit residential buildings.

Leveraging Federal Funding to Build More Homes

The federal government provides billions of dollars in funding each year to provinces, territories, and municipalities to help build stronger communities across the country. It is important for all governments to do their part to keep up with the housing needs of Canadians.

-

The 2023 Fall Economic Statement reaffirms the federal government's intention to tie access to federal infrastructure funding to actions by provinces, territories, and municipalities to increase housing supply where it makes sense to do so.

The federal government is committed to working collaboratively to support communities that embrace ambitious home-building, including through the Housing Accelerator Fund.

Removing the GST From New Co-op Rental Housing

Today, about a third of all Canadians rent their homes. But the supply of rental apartments—and all types of housing—has not increased at the same pace with Canadians' housing needs. From students to families to seniors to newcomers, people are finding it difficult to find the types of rental homes they need at prices they can afford. Rental supply must increase to ensure that renters can find an affordable place to call home.

The federal government is creating the financial incentives to build more homes, faster, by removing the Goods and Services Tax (GST) from new purpose-built rental housing projects, such as apartment buildings, student housing, and seniors' residences. To expedite the rapid construction of new homes, the removal of the GST would apply only to projects that begin construction between September 14, 2023, and the end of 2030, and that complete construction before 2036.

-

The 2023 Fall Economic Statement announces that co-operative housing corporations that provide long-term rental accommodation would also be eligible for the removal of the GST on new rental housing, provided the other conditions have been met. The measure is not intended to apply to co-operative housing corporations where occupants have an ownership or equity interest.

To protect Canadian renters from renovictions, the removal of GST will not apply to substantial renovations of existing residential complexes. This measure is intended to stimulate new supply, not take supply off the market. The federal government has also called on provinces that apply sales tax on new rental housing, or goods and services used in their construction, to likewise remove their provincial taxes. To date, Ontario, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador have all announced plans to provide this tax relief. Currently, Manitoba and British Columbia exempt some rental construction costs from provincial sales taxes. To get more rentals built, faster, the federal government encourages all provinces that still impose sales taxes to remove their financial barriers to rental housing construction.

More Financing for Apartment Construction

The supply of rental housing in Canada needs to keep pace with our growing communities. To achieve this, builders need access to the low-cost financing which makes it possible to build more homes, faster. The federal government has already taken action to make the math work for builders, but there remains a need for more of this financing.

The more than $25 billion Apartment Construction Loan Program, previously known as the Rental Construction Financing Initiative, boosts the construction of rental housing by providing low-cost financing to builders and developers. Since 2017, the program has committed over $17 billion in loans to support more than 46,000 new rental homes (Table 1.1), and is on track to support a total of 71,000 new rental homes by 2027-28.

-

To build more rental apartments, faster, the 2023 Fall Economic Statement announces an additional $15 billion in new loan funding, starting in 2025-26, for the Apartment Construction Loan Program, bringing the program's total to over $40 billion in loan funding. This investment will support more than 30,000 additional new homes across Canada, bringing the program's total contribution to over 101,000 new homes supported by 2031-32.

The federal government recognizes that building strong communities includes building important community supports for new residents, such as child care. For instance, British Columbia is currently working on delivering more homes for the middle class, with community amenities nearby. The federal government is open to leveraging this program's funding to encourage provincial and territorial governments to develop ambitious housing plans that serve the needs of people and the communities they live in. The Apartment Construction Loan Program will be available to provinces and territories ready to deliver thousands of new homes for the middle class, along with the community supports, such as affordable early learning and child care, that families depend on to get ahead.

| Region | New Homes |

|---|---|

| Prairies | 2,035 |

| Territories | 87 |

| Atlantic | 2,125 |

| Ontario | 20,687 |

| Quebec | 8,281 |

| British Columbia | 13,753 |

| Total New Homes | 46,968 |

|

Note: As of September 2023. "New Rental Homes" represent units expected to be built as a result of committed funding. |

|

Building More Affordable Housing

Affordable and community housing play critical roles by providing the most vulnerable Canadians with a place to call home. People experiencing or at risk of homelessness, women and children fleeing violence, seniors, Black and racialized people, Indigenous people, and persons with disabilities, are among those who benefit the most from affordable housing investments. The federal government has been taking action to make investments that build and repair these types of homes.

Within its first six years, the Affordable Housing Fund, previously known as the National Housing Co-Investment Fund, has already committed funding to repair or renew nearly 129,000 homes, while supporting the construction of more than 31,500 new homes.

-

To build more affordable housing for the most vulnerable Canadians, the 2023 Fall Economic Statement announces an additional $1 billion over three years, starting in 2025-26, for the Affordable Housing Fund. This investment will support non-profit, co-op, and public housing providers to build more than 7,000 new homes by 2028. This top-up is to be supported by $631 million previously intended for the one-time top-up to the Canada Housing Benefit.

The federal government intends to announce reforms to the Affordable Housing Fund and the Apartment Construction Loan Program in early 2024. These reforms will seek to make the programs even more accessible, with faster approvals and other improvements to meet the needs of vulnerable populations.

Unlocking $20 Billion in Low-Cost Rental Financing

The apartments that renters need are not getting built fast enough, in part because the builders who would like to build more currently don't have access to enough of the financing needed to make rental projects financially viable. The Canada Mortgage and Housing Corporation (CMHC), by providing mortgage loan insurance and securitization, provides low-cost financing for builders to build new rental housing.

As announced on September 26, 2023, the government is increasing CMHC's annual limit of support for low-cost financing by $20 billion per year and designating the increased amount for funding mortgages on multi-unit rental projects insured by CMHC. Eligible rental projects must have at least five rental units and can include apartment buildings, student housing, and senior residences.

This measure will unlock the low-cost financing needed to build more rental projects and help build up to 30,000 more rental apartments per year.

Speeding Up Financing Approvals to Build More Homes, Faster

Simple and rapid access to federal funding programs that help build more housing now are more important than ever. While CMHC requires some processing time to ensure investments meet the right policy criteria and risk level, things can and need to be done faster.

In 2023, CMHC received an unprecedented volume of applications for multi-unit mortgage loan insurance. CMHC has made significant progress to accelerate approvals by doubling its processing rate over the course of the year, and will resolve its backlog of applications by the end of 2023. By speeding up its processes, CMHC will continue to play a key role in supporting the availability and diversity of financing options available for rental housing.

CMHC will make further improvements by streamlining and simplifying requirements and application processes, and by fast-tracking shovel-ready projects and applications from trusted partners.

Repurposing More Federal Lands for Housing

The Government of Canada owns and manages the largest real estate portfolio in Canada—and some of that land can be used to build more homes for people who need a place to call home. Through the Canada Lands Company—a Crown corporation which has supported the construction of over 10,300 new homes since 2016—more than 29,000 new homes are set to be built on surplus federal lands by 2029.

On November 7, 2023, the federal government announced that six surplus federal properties will be developed into more than 2,800 new homes in Edmonton, Calgary, St. John's, and Ottawa. By March 2024, the Canada Lands Company will help deliver the following surplus federal properties:

- Edmonton: 711 homes, at the Village at Griesbach, including 93 affordable homes;

- Calgary: 516 homes at Currie;

- St. John's: 34 homes at Pleasantville; and,

- Ottawa: 307 homes at Wateridge Village, 600 homes at Carling Avenue, and 710 homes on Booth Street, including 221 affordable homes.

Not only does Canada need more homes, we need more homes that are affordable. That is why the Canada Lands Company also announced a new minimum affordable housing target of 20 per cent across projects in its pipeline. The new affordability requirement would apply in communities where a municipal minimum requirement of affordable housing is lower or does not already exist.

As work continues to identify further assets that can be repurposed for housing, the federal government intends to introduce further measures to speed up this process and to identify more opportunities to build more housing.

The federal government's commitment to build more affordable housing is also why, in 2018, the government launched the Federal Lands Initiative—a $200 million program that is working with the Canada Lands Company and other holders of federal land to heavily discount the sale of federal properties to home builders who want to build affordable units. Since its creation in 2018, the Federal Lands Initiative has helped the government dispose of more than 20 parcels of land for housing—with more to come. Overall, results to date represent more than 3,900 new or repaired units in financial or conditional commitments—more than 1,700 of them affordable. With these and other upcoming projects, the Federal Lands Initiative is on track to support 4,500 units, at least 30 per cent of which will be affordable.

Strengthening the Co-operative Housing Development Program

For generations, housing co-operatives have offered quality, affordable housing to Canadians. This unique community-oriented housing model empowers residents through inclusive environments, personal development, and long-term stability of having a place to live in a welcoming community for years to come.

The federal government recognizes the value of co-ops, and in Budget 2022, made the largest investment in this space in more than 30 years. With the Fall Economic Statement, the government is going even further to build co-op housing across Canada.

-

The 2023 Fall Economic Statement announces an investment of $309.3 million in new funding for the Co-operative Housing Development Program, which was announced in Budget 2022. In collaboration with the Co-operative Housing Federation of Canada and other co-op housing partners, CMHC is working to launch the co-developed program in early 2024.

Leveraging the Canada Infrastructure Bank to Support More Housing

In delivering the new infrastructure required to build more homes, communities across Canada currently face financing challenges. This can include the costs of building new water and power lines, wastewater treatment plants, roads, public transit, and internet cables. Without this infrastructure, communities have trouble growing—and new homes don't get built.

Since 2017, the Canada Infrastructure Bank has made investment commitments of $10 billion in 48 infrastructure projects—for a total capital cost of nearly $28 billion—across the country. These investments include fibre optic internet for rural communities in Ontario and Manitoba, the Port Stalashen Wastewater Treatment Plant in British Columbia, and the Darlington Small Modular Reactor in Ontario.

Building on this track record and its expertise in leveraging private and institutional capital to support infrastructure projects, the Canada Infrastructure Bank is exploring further ways to support the needs of communities seeking to develop the infrastructure required to build more homes. Details on this work will be announced by Budget 2024.

Update on Indigenous Housing and the Urban, Rural, and Northern Indigenous Housing Strategy

The Government of Canada is committed to working with Indigenous communities, governments, and organizations to ensure that Indigenous people have access to adequate housing. Since 2015, the government has committed more than $10.7 billion to support First Nations, Inuit, and Métis housing. This includes, as announced in Budget 2022, $4 billion for housing for First Nations on-reserve, and Inuit, Métis, and First Nations Self-Governing and Modern Treaty communities.

Indigenous Peoples continue to face unique barriers in accessing safe and affordable housing in urban, rural, and northern communities across Canada. According to a 2021 report by the Parliamentary Budget Officer, 57 per cent of Indigenous households with core housing needs reside in large urban centres, and one-third of Indigenous renters in urban, rural, and northern areas experience core housing need.

To close these housing gaps, Budget 2023 announced the $4 billion Urban, Rural, and Northern Indigenous Housing Strategy—following a for Indigenous, by Indigenous approach. The federal government is working with various Indigenous partners—including First Nations, Inuit, and Métis governments and organizations—to co-develop and launch the Urban, Rural, and Northern Indigenous Housing Strategy in 2024.

Establishing the Department of Housing, Infrastructure and Communities

Growing and vibrant Canadian communities require affordable homes as well as other infrastructure like public transit, modern water and wastewater systems, and community centres.

-

In recognition of the link between housing and infrastructure, the government proposes to introduce legislation to establish the Department of Housing, Infrastructure and Communities (currently Infrastructure Canada). Through this legislation, the government will clarify the department's powers, duties and functions as the federal lead for improving housing outcomes and enhancing public infrastructure.

The Department of Housing, Infrastructure and Communities will support the government in delivering on Canada's housing priorities.

1.2 More Construction Workers to Build More Homes

Across the country, thousands of skilled tradespeople go to work every day to build the homes Canadians need. But to keep up with the pace and scale required to build more homes, faster, our growing country needs to attract even more of the skilled tradespeople and workers who can build the homes required to meet our ambitious housing targets.

Every Canadian community, particularly rural communities, faces unique hiring and retention challenges in their local construction sector, and too many are limited by labour shortages. While some of these challenges are temporary, others are structural and the result of many hard-working construction workers reaching retirement age.

The federal government is taking action to both attract the talent our economy needs from abroad, as well as to train and retain Canadians and permanent residents who are ready to find well-paying and meaningful jobs in the construction sector.

Breaking Down Barriers to Internal Labour Mobility

From construction to health care and child care, ensuring Canadian tradespeople, health care professionals, and early childhood educators can move between provinces is essential to ensuring we can build the homes and deliver the health care and affordable child care that Canadians need. However, too many people are currently held back by barriers to interprovincial labour mobility. The federal government has already taken action to make it easier for Canadians to work across the country, including through the new labour mobility tax deduction introduced in Budget 2022, which covers up to $4,000 per year in temporary relocation expenses for tradespeople.

The federal government has also demonstrated leadership by enhancing the Foreign Credential Recognition Program, which helps newcomers find Canadian work experience, provides financial assistance for exams and classes, and co-ordinates with provinces and territories to make credential recognition more seamless, across the country. Since 2018, over 9,000 skilled newcomers have received direct employment supports, such as work placements and wage subsidies, and another 20,000 workers have received loans or support services to help manage the costs and other requirements associated with foreign credential recognition.

However, many businesses, especially home builders, are still struggling to hire the workers they need, which is slowing the construction of more homes and limiting economic growth opportunities across Canada. For Canada's universal public health care system, provincial barriers are also impeding the delivery of better health care for Canadians.

-

The 2023 Fall Economic Statement announces that in the coming months, the federal government will advance the next phase of its work to remove the barriers to internal labour mobility, including by leveraging federal transfers, and other funding, to encourage provinces and territories to cut the red tape that impedes the movement of workers, particularly in construction, health care and child care, within Canada. This work will include:

-

Working with provinces and territories towards full interprovincial labour mobility for construction and health care workers to meet labour market needs;

-

Expanding on the success of the Red Seal Program to improve the mobility of tradespeople and eliminate further barriers, such as duplicative credential recognition; and,

-

Ensuring provinces and territories welcome health care professionals from anywhere in Canada by leveraging the nearly $200 billion federal health care funding deal announced in February 2023.

-

-

The 2023 Fall Economic Statement alsoannounces that the federal government is working to eliminate other barriers to internal trade by removing unnecessary federal exceptions in the Canadian Free Trade Agreement. The federal government reiterates that the Canadian Free Trade Agreement, which all provinces and territories have signed, provides qualified workers with the privilege to work in any province or territory, without facing significant additional barriers.

This complements the federal government's ongoing work to strengthen public health care in Canada, as detailed in Chapter 2, Supporting a Strong Middle Class.

Prioritizing Construction Workers for Permanent Residency

Canada's labour shortage in the construction industry can also be filled, in part, by new talent from around the world.

To meet our country's home building demands, the federal government launched in May 2023 a new selection process under the Express Entry immigration system to prioritize permanent residency applicants with specific skills, work experience, education, or certifications, including in the construction sector. Since May, 1,500 workers with experience in the trades have been invited to call Canada home. Following extensive engagement with unions, the government has focused this year's application process on candidates with work experience including in carpentry, electrical, welding, plumbing, contracting, and other trades that can help build more homes, faster.

Bringing in skilled workers to fill labour market gaps in the construction sector is key to delivering on Canada's ambitious residential construction targets, but these objectives must be balanced against pressures on housing, health care and infrastructure. The government announced on November 1, 2023, stabilized immigration targets as part of its 2024-2026 Immigration Levels Plan that will continue to support economic growth, meet humanitarian commitments, and ensure sustainable population growth.

1.3 Supporting Renters, Buyers, and Homeowners

Homes should be for Canadians to live in—not a speculative financial asset class for investors. The federal government is taking action to curb investor activity that drives up the cost of housing, while also helping Canadians buy and stay in their homes.

Cracking Down on Non-Compliant Short-Term Rentals

In Montréal, Toronto, and Vancouver alone, there were an estimated 18,900 homes being used as short-term rental properties in 2020—a number that has almost surely increased in recent years. These are not spare bedrooms in someone's home—they are entire houses and apartments that are being used for tourists to rent—in many cases, only for a few days a week. Canada needs more long-term housing for Canadians to live in, and the federal government is taking action to crack down on these short-term rentals which are keeping homes for Canadians off the market. Some provinces, including Quebec and British Columbia, and municipalities such as Toronto, Montréal, and Vancouver, have already taken action, and the federal government is taking steps to support their work.

-

The 2023 Fall Economic Statement announces that the federal government intends to deny income tax deductions for expenses incurred to earn short-term rental income, including interest expenses, in provinces and municipalities that have prohibited short-term rentals.

-

The 2023 Fall Economic Statement also announces that the federal government intends to deny income tax deductions when short-term rental operators are not compliant with the applicable provincial or municipal licensing, permitting, or registration requirements.

These measures would apply to deny all expenses incurred on or after January 1, 2024.

-

In addition, the federal government is taking action to support municipalities that are cracking down on non-compliant short-term rentals. The 2023 Fall Economic Statement proposes $50 million over three years, starting in 2024-25, to support municipal enforcement of restrictions on short-term rentals. This will support municipalities with strict regulatory regimes that are having a significant and measurable impact in returning short-term rentals back to the long-term housing market.

Removing the ability to deduct short-term rental expenses and providing support to municipal enforcement provides a strong incentive for operators of non-compliant short-term rentals to return these properties to the long-term housing market, while also supporting the work of provinces and municipalities to ban or restrict the use of residential properties as short-term rentals.

To better understand the short-term rental landscape in Canada and inform future housing policy, the federal government will explore options to collect data on short-term rentals.

An investor who is resident in Quebec owns three condos in downtown Montréal, but does not live in these condos; instead they rent them out, year-round, on a digital short-term rental platform. They know their condos are located in an area of Montréal that only permits the occasional short-term rental of a primary residence, but still decide to go ahead with listing the condos as short-term rentals. They charge about $250 per night and make about $120,000 per year in income from renting the three condos to tourists.

The investor's expenses on the condos—mortgage interest, cable and internet bills, property insurance, condo fees, property taxes, and capital cost allowance—are about $120,000, which means they don't pay any tax on the $120,000 in short-term rental income coming in. And they expect the value of the condos will grow significantly over time. Meanwhile, three families in Montréal are prevented from renting these condos.

As a result of a crackdown on short-term rentals announced in the 2023 Fall Economic Statement, the investor would no longer be permitted to deduct the $120,000 of expenses because they are not properly registered or licensed by the Ville de Montréal or the Government of Quebec. Moving forward, they would have to pay tax on the $120,000 in short-term rental revenue, which would cost about $33,100 in additional federal tax per year. The increase in tax payable would provide a strong incentive to stop using these properties as short-term rentals and return them to the long-term housing market.

The New Canadian Mortgage Charter

Canadians work hard to be able to afford their home, but high interest rates are leaving too many people concerned about their increasing mortgage payments. The federal government believes that when someone has put their savings and earnings into their home, they should be protected, especially when interest rates have risen at a rate faster than seen in a generation. In the 2023 Fall Economic Statement, the government is taking action to ensure Canadians know of the mortgage relief they can seek and receive from their financial institutions, and announces new measures to provide tailored mortgage relief.

-

The 2023 Fall Economic Statement announces the new Canadian Mortgage Charter, which builds on the government's existing guidance and expectations for how financial institutions are to work with Canadians to provide tailored relief and ensure payments are reasonable for borrowers. Mortgage holders in financial difficulty on their principal residence can expect to receive fair, reasonable, and timely mortgage relief measures from their federally-regulated financial institutions, which are expected to proactively reach out to vulnerable borrowers and make full use of available tools to quickly and efficiently support borrowers through difficult times.

These measures will support more Canadians through the temporary financial stress caused by elevated interest rates and help them stay in their homes. The federal government will continue to closely monitor financial institutions' implementation of and compliance with relief measures, including the Financial Consumer Agency of Canada's guideline.

The Canadian Mortgage Charter

Canadians can expect:- Allowing temporary extensions of the amortization period for mortgage holders at risk;

- Waiving fees and costs that would have otherwise been charged for relief measures;

- Not requiring insured mortgage holders to requalify under the insured minimum qualifying rate when switching lenders at mortgage renewal;

- Contacting homeowners four to six months in advance of their mortgage renewal to inform them of their renewal options;

- Giving homeowners at risk the ability to make lump sum payments to avoid negative amortization or sell their principal residence without any prepayment penalties; and,

- Not charging interest on interest in the event that mortgage relief measures result in a temporary period of negative amortization.

Malcolm and Galen are a young couple living in a home they purchased a few years ago. As a result of elevated interest rates, they've seen their monthly mortgage payment increase to more than $3,000. After several months of higher payments, Malcom and Galen began experiencing financial hardship, and started drawing on a line of credit to pay for everyday expenses. Consistent with the new Canadian Mortgage Charter, their bank suggested a temporary increase in their mortgage loan amortization period, which decreases the amount of principal they pay but lowers their mortgage payments by $400 per month. Malcolm and Galen are able to stay in their home as a result of these lower payments, giving them the time to develop a plan to restore the amortization to its original period without the stress of losing their home.

The federal government introduced the Tax-Free First Home Savings Account in Budget 2022 to help Canadians get on track towards achieving their dreams of homeownership.

The new Tax-Free First Home Savings Account is a registered savings account that allows Canadians to contribute up to $8,000 per year, and up to a lifetime limit of $40,000, towards their first down payment. To help Canadians reach their savings goals, First Home Savings Account contributions are tax deductible on annual income tax returns, like a Registered Retirement Savings Plan (RRSP). And, like a Tax-Free Savings Account (TFSA), withdrawals to purchase a first home—including any investment income on contributions—are non-taxable. Tax-free in; tax-free out.

As of October 31, more than 250,000 Canadians have already opened a Tax-Free First Home Savings Account to save for their first down payment—putting homeownership back within reach across the country and helping them reach their savings goals sooner.

Tax-Free First Home Savings Accounts are currently available at more than 20 financial institutions across the country, and more institutions are continuing their work to launch Tax-Free First Home Savings Accounts soon.

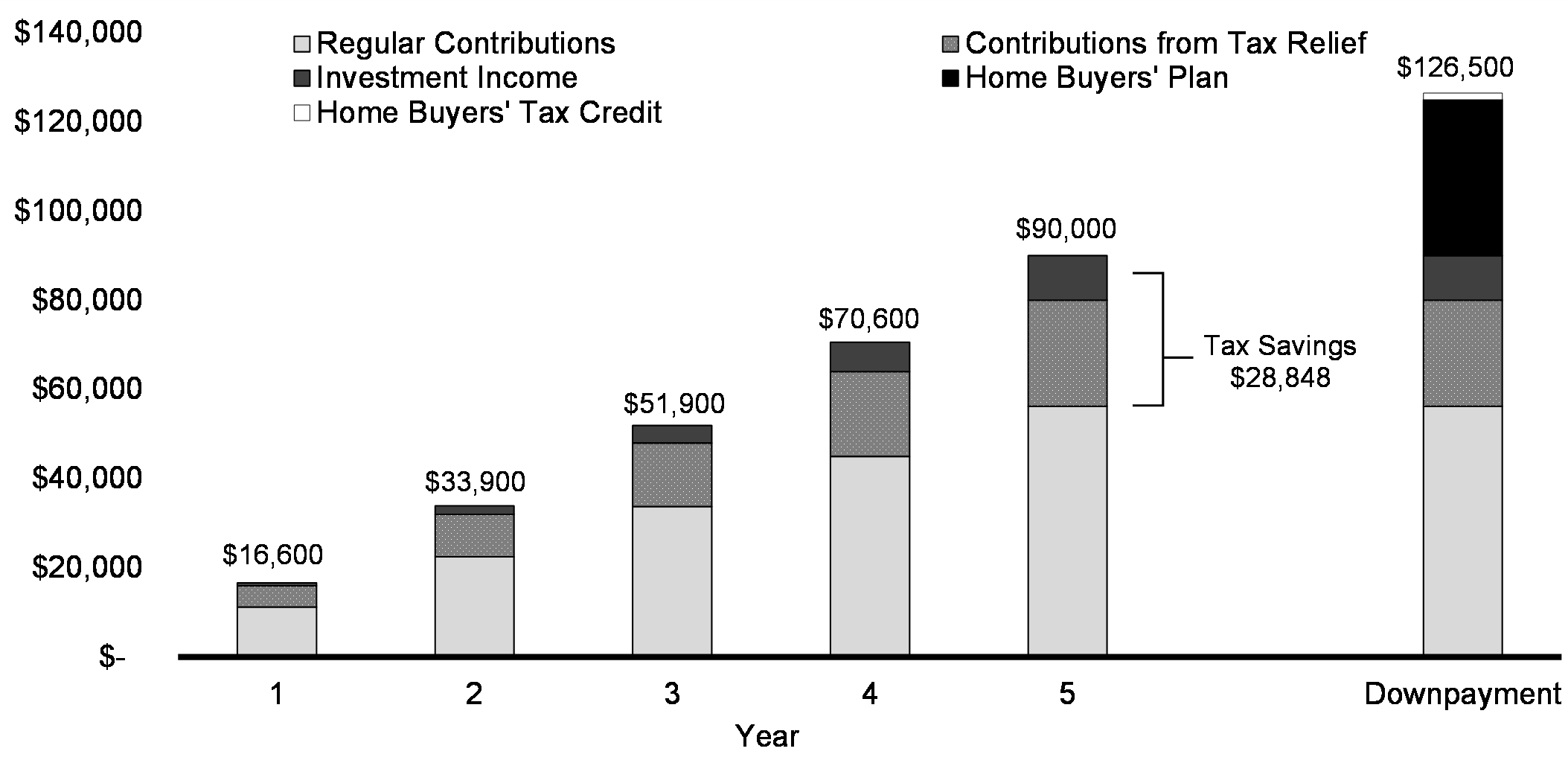

Brooke and Fabrice want to buy a home. Starting April 1, 2023, they began to save the maximum $8,000 per year in their Tax-Free First Home Savings Account, which they can deduct from their income at tax time. They both make between $70,000 and $100,000, and the Tax-Free First Home Savings Account allows them each to receive an annual federal tax refund of $1,640. After four years of saving, Brooke and Fabrice have saved a combined $90,000, including tax-free investment income, in their Tax-Free First Home Savings Account, which they can use towards a down payment on their first home. They can withdraw their down payment tax-free, saving thousands of dollars that can be put towards their new home. In addition, they will claim the First-Time Home Buyers' Tax Credit, which will provide an additional $1,500 in tax relief.

The combined value of federal-provincial tax relief offered by the Tax-Free First Home Savings Account, compared to a taxable account for a couple living in Ontario, earning about $80,000 and each contributing $8,000 annually is detailed in Chart 1.2. Also shown is the maximum downpayment this couple could make with assistance from the Tax-Free First Home Savings Account, Home Buyers' Plan, and the Home Buyers' Tax Credit.

Tax-Free First Home Savings Account Tax Relief by Contribution Amount

Housing International Students and Protecting Them From Fraud

International students bring significant social, cultural, and economic benefits to Canada, while enriching the academic experience of domestic students. They also continue to bring long-term benefits to Canada, as many international students transition to permanent residency, and eventually, citizenship.

Canada is a top destination of choice for international students, thanks to our high-quality educational institutions; our welcoming, diverse society; and the opportunities to work or immigrate permanently after graduation. While international students have contributed to life on campuses across the country, some have also experienced challenges.

To help ensure the protection of international students, the federal government is enhancing the Letter of Acceptance verification tool to help crack down on the fraudulent organizations that take advantage of international students wishing to pursue legitimate post-secondary educational opportunities in Canada.

Working with provinces, territories, and post-secondary designated learning institutions, the federal government will also put in place a Recognized Institutions Framework that would reward learning institutions with high standards around selecting, supporting—including by providing access to housing—and retaining international students. Additional details on these measures to help protect international students will be provided in the coming months.

| 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | Total | |

|---|---|---|---|---|---|---|---|

| 1.1. Building More Homes, Faster | -37 | 126 | 867 | 1,747 | 1,859 | 1,637 | 6,199 |

| Removing the GST From New Rental Housing* | 5 | 145 | 645 | 1,065 | 1,250 | 1,455 | 4,565 |

| More Financing for Apartment Construction | 0 | 0 | 41 | 41 | 96 | 164 | 342 |

| Building More Affordable Housing | 0 | 0 | 54 | 473 | 473 | 0 | 1,000 |

| Strengthening the Co-operative Housing Development Program** | 0 | 0 | 70 | 165 | 30 | 9 | 274 |

Year-Over-Year Reallocation of Funding |

-42 | -19 | 58 | 3 | 11 | 9 | 18 |

| 1.3. Supporting Renters, Buyers, and Homeowners | 0 | 15 | 18 | 18 | 0 | 0 | 50 |

| Cracking Down on Non-Compliant Short-Term Rentals | 0 | 15 | 18 | 18 | 0 | 0 | 50 |

| Chapter 1 - Net Fiscal Impact | -37 | 141 | 885 | 1,765 | 1,859 | 1,637 | 6,249 |

|

Note: Numbers may not add due to rounding. * As announced on September 14, 2023. ** An additional $35.6 million is proposed to be provided in future years. |

|||||||

Page details

- Date modified: