Archived -

Annex 1

Details of Economic and Fiscal Projections

On this page:

1.1 Economic Projections

The average of private sector forecasts has been used as the basis for economic and fiscal planning since 1994, helping to ensure objectivity and transparency, and introducing an important element of independence into the government's economic and fiscal forecast. The economic forecast presented in this section is based on a survey of a group of private sector economists conducted in September 2023.

The September survey includes the views of 12 private sector economists:

- BMO Capital Markets;

- Caisse de dépôt et placement du Québec;

- CIBC World Markets;

- The Conference Board of Canada;

- Desjardins;

- Industrial Alliance Insurance and Financial Services Inc.;

- Laurentian Bank Securities;

- National Bank Financial Markets;

- Royal Bank of Canada;

- Scotiabank;

- TD Bank Financial Group; and,

- The University of Toronto (Policy and Economic Analysis Program).

Overall, the September survey suggests that the Canadian economy will avoid a recession but see a period of subdued growth in the coming quarters as the impacts of higher interest rates continue to build. This economic resilience and more persistent inflation will also lead to higher interest rates over the medium term.

Private sector economists have revised their 2023 forecasts since Budget 2023. The Canadian economy is now expected to avoid a recession, and instead see subdued growth in the coming quarters as the impacts of higher interest rates continue to build. A gradual recovery is then expected over the course of 2024. Overall, private sector economists expect real GDP growth to be 1.1 per cent in 2023—up from the 0.3 per cent projected in Budget 2023. Growth of 0.4 per cent is now expected for 2024, compared to 1.5 per cent projected in Budget 2023, with growth projected to reach 2.2 per cent in 2025 (Table A1.1).

As the economy slows, the unemployment rate is expected to rise to 6.5 per cent in the second quarter of next year, remaining historically low and far below the peaks experienced during past recessions. Given solid population growth is expected, much of the adjustment would reflect a slower pace of hiring, rather than a large number of layoffs. The unemployment rate should settle at an average of 6.2 per cent in 2025 and continue to gradually decline to 5.7 per cent by 2028.

Private sector economists expect Consumer Price Index (CPI) inflation to remain at or above 3 per cent through the first quarter of 2024, with annual averages of 3.8 per cent in 2023 and 2.5 per cent in 2024, consistent with higher global energy prices and recent data suggesting that underlying inflation remains persistent. Inflation is expected to reach 2 per cent by the end of 2024.

Interest rates are projected to be higher than in Budget 2023, reflecting the economy's resilience, ongoing elevated inflation, and the Bank of Canada's mid-summer 2023 resumption of interest rate hikes. Short-term interest rates have been revised up to 4.8 per cent in 2023 and more substantially to 4.3 per cent in 2024, compared to, respectively, 4.4 per cent and 3.3 per cent in Budget 2023. Short-term interest rates are expected to settle at 2.6 per cent at the end of the five-year forecast horizon, above the pre-pandemic peak of 1.75 per cent. Long-term interest rates were expected to average 3.3 per cent in both 2023 and 2024 and have also been revised up by about 0.2 percentage points on average per year over the 2023-27 period.

Private sector economists expect crude oil prices to average about US$78 per barrel in both 2023 and 2024 and to remain around that level in the following years. This outlook is about US$2 per barrel lower on average per year compared to Budget 2023.

As a result of persistent elevated inflation, the outlook for GDP inflation (the broadest measure of economy-wide price inflation) has been revised slightly up to 0.8 per cent in 2023 and by about 0.1 percentage points, on average per year, over the remainder of the forecast horizon.

Largely reflecting Canada's stronger economic growth this year, nominal GDP in 2023 is expected to be $32 billion higher than Budget 2023 projections. With economic growth expected to slow, this nominal GDP level difference with Budget 2023 narrows to zero in 2024 and is lower by $2 billion in 2025. Nominal GDP is then expected to be about $17 billion higher on average per year over 2026 and 2027 compared to Budget 2023 projections, reflecting a better outlook for real GDP and higher GDP inflation in the outer years.

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2023-27 | |

|---|---|---|---|---|---|---|---|

| Real GDP growth1 | |||||||

|

Budget 2023

|

0.3 | 1.5 | 2.3 | 2.2 | 1.9 | --- | 1.7 |

|

2023 Fall Economic Statement

|

1.1 | 0.4 | 2.2 | 2.4 | 2.2 | 2.0 | 1.7 |

| GDP inflation1 | |||||||

|

Budget 2023

|

0.6 | 2.0 | 1.9 | 1.9 | 1.9 | --- | 1.7 |

|

2023 Fall Economic Statement

|

0.8 | 2.0 | 2.0 | 2.1 | 2.1 | 2.1 | 1.8 |

| Nominal GDP growth1 | |||||||

|

Budget 2023

|

0.8 | 3.6 | 4.3 | 4.1 | 3.9 | --- | 3.4 |

|

2023 Fall Economic Statement

|

2.0 | 2.4 | 4.3 | 4.5 | 4.3 | 4.2 | 3.5 |

| Nominal GDP level (billions of dollars)1 | |||||||

|

Budget 2023

|

2,837 | 2,938 | 3,066 | 3,192 | 3,317 | --- | |

|

2023 Fall Economic Statement

|

2,868 | 2,938 | 3,063 | 3,202 | 3,341 | 3,481 | |

|

Difference between Budget 2023 and

2023 Fall Economic Statement |

32 | 0 | -2 | 10 | 25 | --- | 13 |

| 3-month treasury bill rate | |||||||

|

Budget 2023

|

4.4 | 3.3 | 2.6 | 2.4 | 2.4 | --- | 3.0 |

|

2023 Fall Economic Statement

|

4.8 | 4.3 | 2.9 | 2.7 | 2.6 | 2.6 | 3.5 |

| 10-year government bond rate | |||||||

|

Budget 2023

|

3.0 | 2.9 | 3.0 | 3.1 | 3.1 | --- | 3.0 |

|

2023 Fall Economic Statement

|

3.3 | 3.3 | 3.1 | 3.2 | 3.2 | 3.3 | 3.2 |

| Exchange rate (US cents/C$) | |||||||

|

Budget 2023

|

74.7 | 76.8 | 78.3 | 79.0 | 79.3 | --- | 77.6 |

|

2023 Fall Economic Statement

|

74.3 | 75.2 | 77.4 | 78.6 | 78.7 | 79.1 | 76.8 |

| Unemployment rate | |||||||

|

Budget 2023

|

5.8 | 6.2 | 6.0 | 5.7 | 5.7 | --- | 5.9 |

|

2023 Fall Economic Statement

|

5.4 | 6.4 | 6.2 | 5.9 | 5.8 | 5.7 | 5.9 |

| Consumer Price Index inflation | |||||||

|

Budget 2023

|

3.5 | 2.1 | 2.1 | 2.1 | 2.1 | --- | 2.4 |

|

2023 Fall Economic Statement

|

3.8 | 2.5 | 2.1 | 2.1 | 2.1 | 2.1 | 2.5 |

| U.S. real GDP growth | |||||||

|

Budget 2023

|

0.8 | 1.4 | 2.1 | 2.0 | 1.9 | --- | 1.6 |

|

2023 Fall Economic Statement

|

2.1 | 0.7 | 1.9 | 2.0 | 1.9 | 1.8 | 1.7 |

| West Texas Intermediate crude oil price ($US per barrel) | |||||||

|

Budget 2023

|

81 | 81 | 79 | 77 | 78 | --- | 79 |

|

2023 Fall Economic Statement

|

77 | 78 | 77 | 77 | 77 | 79 | 77 |

|

Note: Forecast averages may not equal average of years due to rounding. Numbers may not add due to rounding. 1 Previously published figures have been restated to reflect the historical revisions in the Canadian System of National Accounts and the 2022 Provincial and Territorial Economic Accounts. Sources: Statistics Canada; for Budget 2023, Department of Finance Canada February 2023 survey of private sector economists, which has been adjusted to incorporate the actual results of the National Accounts for the fourth quarter of 2022 released on February 28, 2023; for the 2023 Fall Economic Statement, Department of Finance Canada September 2023 survey of private sector economists. Both surveys have been adjusted to reflect the historical revisions in the 2022 Provincial and Territorial Economic Accounts. |

|||||||

1.2 Changes to Fiscal Projections Since Budget 2023

The tables that follow present changes to the fiscal outlook since Budget 2023. This includes the impact of government policy actions taken since Budget 2023, measures in this Fall Economic Statement, year-to-date financial results, and updated economic projections provided by both the private sector survey and under the Department of Finance upside and downside scenarios.

Changes to the Fiscal Outlook Since Budget 2023

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Budgetary balance – Budget 2023 | -43.0 | -40.1 | -35.0 | -26.8 | -15.8 | -14.0 | |

|

Impact of September private sector survey and other fiscal

developments

|

7.7 | 2.7 | -0.1 | -7.3 | -7.6 | -6.4 | |

| Budgetary balance before policy actions and measures | -35.3 | -37.4 | -35.1 | -34.1 | -23.3 | -20.4 | -15.1 |

|

Policy actions since Budget 2023

|

-2.0 | -2.8 | -1.8 | -0.1 | 0.0 | -0.7 | |

|

2023 Fall Economic Statement measures (by

chapter)

|

|||||||

|

Canada's Housing Action Plan

|

0.0 | -0.1 | -0.9 | -1.8 | -1.9 | -1.6 | |

|

Supporting a Strong Middle Class

|

-0.3 | 0.1 | 0.2 | -0.2 | 0.0 | 0.0 | |

|

Building an Economy That Works for All Canadians

|

-0.6 | -0.7 | -2.1 | -2.3 | -2.1 | -1.6 | |

|

Effective Government, a Fair Tax System, and a Stable

Financial Sector

|

0.1 | 0.2 | 0.5 | 0.5 | 0.6 | 0.6 | |

| Total – Policy actions since Budget 2023 and 2023 Fall Economic Statement measures | -2.7 | -3.4 | -4.2 | -3.8 | -3.4 | -3.3 | |

| Budgetary balance | -35.3 | -40.0 | -38.4 | -38.3 | -27.1 | -23.8 | -18.4 |

| Budgetary balance (per cent of GDP) | -1.3 | -1.4 | -1.3 | -1.2 | -0.8 | -0.7 | -0.5 |

| Federal debt (per cent of GDP) | 41.7 | 42.4 | 42.7 | 42.2 | 41.2 | 40.2 | 39.1 |

| Budgetary balance – Upside Scenario | -35.3 | -35.2 | -32.0 | -31.4 | -21.6 | -19.4 | -15.0 |

| Budgetary balance (per cent of GDP) | -1.3 | -1.2 | -1.1 | -1.0 | -0.7 | -0.6 | -0.4 |

| Federal debt (per cent of GDP) | 41.7 | 42.0 | 41.6 | 41.1 | 40.1 | 39.1 | 38.1 |

| Budgetary balance – Downside Scenario | -35.3 | -45.1 | -51.2 | -50.6 | -36.4 | -29.7 | -24.2 |

| Budgetary balance (per cent of GDP) | -1.3 | -1.6 | -1.8 | -1.7 | -1.1 | -0.9 | -0.7 |

| Federal debt (per cent of GDP) | 41.7 | 42.7 | 44.2 | 44.0 | 42.9 | 41.8 | 40.8 |

| Budgetary balance – Budget 2023 | -43.0 | -40.1 | -35.0 | -26.8 | -15.8 | -14.0 | |

| Budgetary balance (per cent of GDP) | -1.5 | -1.4 | -1.2 | -0.9 | -0.5 | -0.4 | |

| Federal debt (per cent of GDP) | 42.4 | 43.5 | 43.2 | 42.2 | 41.1 | 39.9 | |

|

Note: Totals may not add due to rounding. A negative number implies a deterioration in the budgetary balance (lower revenue or higher expenses). A positive number implies an improvement in the budgetary balance (higher revenue or lower expenses). |

|||||||

Economic and Fiscal Developments Since Budget 2023

| Projection | ||||||

|---|---|---|---|---|---|---|

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | |

| Economic and fiscal developments by component1 | ||||||

| Change in budgetary revenues | ||||||

| (1.1) Income taxes | 6.7 | -1.8 | -1.0 | -1.5 | -0.9 | 0.0 |

| (1.2) Excise taxes and duties | 1.2 | 1.0 | 0.3 | 0.3 | 0.4 | 0.7 |

| (1.3) Proceeds from the pollution pricing framework | 0.4 | 0.6 | 0.9 | 1.5 | 1.8 | 2.3 |

| (1.4) Employment insurance premiums | 0.1 | 0.6 | 0.7 | 0.1 | -0.1 | -0.2 |

| (1.5) Other revenues2 | 2.2 | -0.8 | 3.7 | 3.0 | 2.9 | 3.1 |

| (1) Total budgetary revenues | 10.6 | -0.4 | 4.6 | 3.3 | 4.1 | 5.9 |

| Change in program expenses | ||||||

| (2.1) Major transfers to persons | 1.1 | 5.2 | -0.7 | -1.1 | -1.7 | -2.0 |

| (2.2) Major transfers to other orders of government3 | 0.2 | -0.8 | -0.9 | -0.9 | -0.8 | -0.8 |

| (2.3) Proceeds from the pollution pricing framework returned | -0.1 | 0.0 | -0.2 | -2.2 | -2.3 | -2.7 |

| (2.4) Direct program expenses | -3.8 | 2.5 | 1.3 | -1.6 | -2.7 | -2.5 |

| (2) Total program expenses, excluding net actuarial losses | -2.6 | 6.9 | -0.5 | -5.8 | -7.6 | -8.0 |

| (3) Public debt charges | -0.5 | -2.6 | -5.8 | -4.9 | -4.1 | -4.5 |

| (4) Net actuarial losses (gains) | 0.2 | -1.2 | 1.5 | 0.2 | 0.0 | 0.2 |

| (5) Total economic and fiscal developments | 7.7 | 2.7 | -0.1 | -7.3 | -7.6 | -6.4 |

|

1 A negative number implies a deterioration in the budgetary balance (lower revenues or higher spending). A positive number implies an improvement in the budgetary balance (higher revenues or lower spending). 2 Includes other taxes in this table only for presentation purposes. 3 Includes a reclassification of long-term care funding from direct program expenses for 2023-24 to 2027-28. |

||||||

The outlook for budgetary revenues has improved relative to Budget 2023, reflecting strength in non-tax revenue components, particularly in interest rate-related revenues.

- Income tax revenues are expected to be lower by approximately $1.0 billion per year on average over the forecast horizon due to recent declines in corporate profits and year-to-date corporate income tax receipts, as well as lower employment and wage growth relative to Budget 2023.

- The outlook for excise taxes and duties has been revised up largely due to the carry-forward of better-than-expected 2022-23 results, as well as continued strength in consumer spending.

- Proceeds from the federal pollution pricing framework from the provinces and territories that are a part of the federal backstop (Ontario, Nova Scotia, New Brunswick, Manitoba, Prince Edward Island, Saskatchewan, Alberta, Newfoundland and Labrador, Yukon, and Nunavut) are projected to be higher. The adjustment is largely due to revised emission estimates and the addition of New Brunswick to the framework. Direct proceeds will continue to be fully returned to Canadians and businesses in the provinces or territories where they are generated, ensuring that the pollution pricing framework remains revenue neutral.

- Revenues generated from Employment Insurance (EI) premiums are projected to be slightly higher over the near term, due to stronger employment numbers driven by a growing labour force and supported by a slightly higher premium rate in 2024. The EI premium rate is determined by the Chief Actuary every year to ensure the sustained ability of the EI Operating Account to deliver important EI benefits to Canadians.

- Other projected revenues have been revised up over the forecast horizon due to greater projected interest revenue on lending to Crown corporations, tax debt, and net foreign exchange account holdings. This increase is offset in the near term by a downward revision to expected earnings of the Bank of Canada due to the impact of higher interest rates, and lower anticipated offshore oil and gas royalties.

Program expenses have been revised down in 2023-24 relative to Budget 2023, reflecting lower-than-expected major transfers to persons. However, program expenses are expected to be higher beginning in 2024-25, reflecting an expectation of higher major transfers to persons, proceeds from the pollution pricing framework returned to Canadians and direct program expenses.

- Relative to Budget 2023, major transfers to persons are lower in 2023-24, largely due to an increase in expected recoveries from benefit overpayments for emergency COVID‑19 income supports. Over the remainder of the forecast horizon, the outlook for major transfers to persons has been revised upwards to reflect increased payments for benefits that are indexed to CPI inflation, including Old Age Security, the Guaranteed Income Supplement, and the Canada Child Benefit. Employment Insurance benefits contribute to the upward projection as a result of expected minor increases to the unemployment rate, which is currently near historical lows.

- Compared to Budget 2023, projected major transfers to other orders of government have been revised upwards primarily due to the reclassification of long-term care as transfers to other orders of government. These were previously classified as direct program expenses.

- Proceeds from the pollution pricing framework returned are revised up across the horizon due to higher fuel consumption estimates in Ontario and Alberta, as well as the addition of New Brunswick to the framework.

- Direct program expenses have been adjusted downward in 2023-24 and 2024-25 and upward in later years relative to the Budget 2023 forecast. Across the horizon, higher expenses are driven by increased projected public service pension and benefit service costs, due to changes in actuarial assumptions; public service wage growth under recent collective agreements; and higher refundable tax credits, such as the Canada Workers Benefit, based on a carry-forward of 2022-23 results. Offsetting impacts, especially in the early years, come from lower anticipated offshore oil and gas royalties returned to provinces, lower anticipated Crown corporation spending, revised timing and spending against previously announced measures, and the reclassification of long-term care amounts as discussed above.

Net actuarial losses, which represent changes in the measurement of the government's obligations for pensions and other employee future benefits accrued in previous fiscal years and pension fund assets, are expected to be higher in 2023-24 relative to Budget 2023. This increase is largely a result of the amortization of 2022-23 losses on Royal Canadian Mounted Police and veterans benefit plans resulting from changes to actuarial assumptions, including claim intake and the indexation of benefits. These losses are offset in 2024-25 due to forecast gains resulting from higher projected interest rates used to measure the present value of the obligations.

Relative to Budget 2023, public debt charges are higher in all years of the forecast primarily due to higher short- and long-term interest rates as forecasted by private sector economists, as well as higher inflation impacts on Real Return Bonds in 2023-24 and 2024-25.

Summary Statement of Transactions

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Budgetary revenues | 447.8 | 456.2 | 483.4 | 502.4 | 527.4 | 551.0 | 573.8 |

| Program expenses, excluding net actuarial losses | 438.6 | 442.2 | 466.8 | 484.8 | 499.4 | 515.5 | 534.1 |

| Public debt charges | 35.0 | 46.5 | 52.4 | 53.3 | 55.1 | 58.4 | 60.7 |

| Total expenses, excluding net actuarial losses | 473.5 | 488.7 | 519.2 | 538.1 | 554.5 | 573.9 | 594.8 |

| Budgetary balance before net actuarial losses | -25.7 | -32.5 | -35.8 | -35.7 | -27.1 | -22.8 | -20.9 |

| Net actuarial gains (losses) | -9.6 | -7.6 | -2.6 | -2.6 | 0.0 | -0.9 | 2.5 |

| 2023 Fall Economic Statement budgetary balance | -35.3 | -40.0 | -38.4 | -38.3 | -27.1 | -23.8 | -18.4 |

| Financial Position | |||||||

|

Total liabilities

|

1,925.0 | 1,999.7 | 2,102.8 | 2,213.8 | 2,306.3 | 2,398.6 | 2,476.6 |

|

Financial assets

|

642.3 | 670.1 | 730.8 | 799.4 | 862.9 | 930.2 | 988.5 |

|

Net debt

|

1,282.8 | 1,329.6 | 1,372.0 | 1,414.4 | 1,443.4 | 1,468.4 | 1,488.1 |

|

Non-financial assets

|

109.7 | 113.4 | 117.4 | 121.5 | 123.3 | 124.6 | 126.0 |

| Federal debt1 | 1,173.0 | 1,216.2 | 1,254.6 | 1,292.9 | 1,320.0 | 1,343.8 | 1,362.2 |

| Per cent of GDP | |||||||

| Budgetary revenues | 15.9 | 15.9 | 16.5 | 16.4 | 16.5 | 16.5 | 16.5 |

| Program expenses, excluding net actuarial losses | 15.6 | 15.4 | 15.9 | 15.8 | 15.6 | 15.4 | 15.3 |

| Public debt charges | 1.2 | 1.6 | 1.8 | 1.7 | 1.7 | 1.7 | 1.7 |

| Budgetary balance | -1.3 | -1.4 | -1.3 | -1.2 | -0.8 | -0.7 | -0.5 |

| Federal debt | 41.7 | 42.4 | 42.7 | 42.2 | 41.2 | 40.2 | 39.1 |

|

1 The projected level of federal debt for 2023-24 includes an estimate of other comprehensive losses of $0.2 billion for enterprise Crown corporations and other government business enterprises, and an estimate of $3.0 billion for net remeasurement losses on financial instruments, including swap agreements and foreign exchange forward agreements, in accordance with a suite of new accounting standards for financial instruments that came into effect in 2022-23. For further details regarding these new standards, see Note 3 of the Condensed Consolidated Financial Statements of the Government of Canada in the Annual Financial Report of the Government of Canada 2022-2023, available on the Department of Finance website. |

|||||||

Outlook for Budgetary Revenues

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Income tax revenues | |||||||

|

Personal income tax

|

207.9 | 218.0 | 224.2 | 234.3 | 245.7 | 257.8 | 269.6 |

|

Corporate income tax

|

93.9 | 79.8 | 85.1 | 86.9 | 89.3 | 92.6 | 95.0 |

|

Non-resident income tax

|

13.2 | 13.4 | 13.5 | 13.4 | 13.5 | 13.9 | 14.3 |

|

Total

|

315.0 | 311.2 | 322.8 | 334.6 | 348.4 | 364.3 | 378.9 |

| Excise tax and duty revenues | |||||||

|

Goods and Services Tax

|

46.0 | 52.1 | 53.6 | 54.9 | 56.6 | 58.7 | 61.0 |

|

Customs import duties

|

6.1 | 6.2 | 6.5 | 6.8 | 7.2 | 7.5 | 7.7 |

|

Other excise taxes and duties

|

12.2 | 12.5 | 12.8 | 12.9 | 13.0 | 13.2 | 13.3 |

|

Total

|

64.2 | 70.8 | 72.9 | 74.7 | 76.8 | 79.3 | 82.0 |

| Other taxes | 0.0 | 0.1 | 1.7 | 1.0 | 3.8 | 3.4 | 3.1 |

| Total tax revenues | 379.2 | 382.1 | 397.4 | 410.3 | 429.0 | 446.9 | 464.0 |

| Proceeds from the pollution pricing framework | 8.0 | 10.4 | 12.9 | 15.1 | 17.1 | 19.4 | 21.3 |

| Employment Insurance premium revenues | 26.9 | 28.9 | 29.7 | 30.0 | 30.9 | 31.9 | 33.2 |

| Other revenues | |||||||

|

Enterprise Crown corporations

|

6.5 | 3.7 | 9.8 | 13.6 | 16.3 | 18.1 | 19.6 |

|

Other programs

|

25.9 | 28.2 | 30.4 | 29.5 | 30.2 | 30.8 | 31.7 |

|

Net foreign exchange

|

1.3 | 2.9 | 3.2 | 3.9 | 3.9 | 4.0 | 4.1 |

|

Total

|

33.6 | 34.8 | 43.4 | 47.0 | 50.4 | 52.8 | 55.4 |

| Total budgetary revenues | 447.8 | 456.2 | 483.4 | 502.4 | 527.4 | 551.0 | 573.8 |

| Per cent of GDP | |||||||

| Total tax revenues | 13.5 | 13.3 | 13.5 | 13.4 | 13.4 | 13.4 | 13.3 |

| Proceeds from the pollution pricing framework | 0.3 | 0.4 | 0.4 | 0.5 | 0.5 | 0.6 | 0.6 |

| Employment Insurance premium revenues | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

| Other revenues | 1.2 | 1.2 | 1.5 | 1.5 | 1.6 | 1.6 | 1.6 |

| Total budgetary revenues | 15.9 | 15.9 | 16.5 | 16.4 | 16.5 | 16.5 | 16.5 |

|

Note: Totals may not add due to rounding. |

|||||||

Table A1.5 above provides an overview of projected budgetary revenues by major component.

Income Tax Revenues

Personal income tax revenues—the largest component of budgetary revenues at 46 per cent in 2022-23—are projected to increase to $218.0 billion in 2023-24, or 4.9 per cent, based on revised estimates for household incomes, particularly due to increased labour income from higher levels of employment and rising wages. For the remainder of the forecast horizon, personal income tax revenue growth is expected to average 4.3 per cent, in line with projected nominal GDP growth.

Corporate income tax revenues are projected to decrease by 15.1 per cent, to $79.8 billion in 2023-24, due to the projected slowdown in economic growth, lower year-to-date corporate income tax receipts and lower corporate profits in 2023-24, particularly in the non-financial sector. Beyond this, corporate income tax revenues are expected to grow by 3.5 per cent per year for the remainder of the forecast horizon.

Income taxes paid by non-residents on Canadian-sourced income, notably dividends and interest payments, are expected to grow slightly in 2023-24, up 1.5 per cent to $13.4 billion in 2023-24. Over the remainder of the forecast horizon, growth in non-resident income tax revenues is expected to average 1.4 per cent, reflecting the expected slowdown in corporate profits growth.

Excise Tax and Duty Revenues

Goods and Services Tax (GST) revenues are projected to grow 13.4 per cent to $52.1 billion in 2023-24. The high year-over-year growth rate is due to the impact of the additional GST rebates paid in fiscal year 2022-23, which reduced recorded revenues that year. Over the remainder of the projection period, GST revenues are expected to grow on average by 3.2 per cent per year, reflecting the outlook for taxable consumption.

Customs import duties are forecast to increase 2 per cent in 2023-24, lower than projected in Budget 2023 due to weaker year-to-date results driven in part by the British Columbia port strike. Over the remainder of the forecast horizon, growth will average 4.6 per cent in line with projected growth in imports.

Other excise taxes and duties are expected to increase by 2.5 per cent to $12.5 billion in 2023-24, reflecting year-to-date data, particularly for the air travel security surcharge, as demand for air travel returns to pre-pandemic levels. These revenues are projected to grow at an average annual rate of 1.2 per cent over the remainder of the forecast period.

Other taxes include revenues from the Underused Housing Tax, announced in the 2021 Economic and Fiscal Update, and from the two-pillar international tax reform, which was agreed to in October 2021 and includes 138 members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting. Revenues from these taxes are projected to grow to $3.1 billion by 2028-29, primarily reflecting the projected new revenues from Pillar Two of the international tax reform, which would ensure that multinational enterprises are subject to a minimum level of tax of at least 15 per cent, no matter where their profits are earned.

Proceeds From the Pollution Pricing Framework

Growth in the proceeds from the federal pollution pricing framework will be driven primarily by the increasing carbon price and the joining of New Brunswick to the frameworkFootnote 1. Direct proceeds will continue to be fully returned to Canadians, Indigenous communities, and emissions-intensive, trade-exposed small- and medium-sized enterprises in the provinces or territories where they are generated.

Employment Insurance Premium Revenues

Employment Insurance (EI) premium revenues are projected to grow at 7.2 per cent in 2023-24 due to projected growth in the workforce and a slight increase in the premium rate according to the legislated premium-rate setting mechanism from $1.63 in 2023 to $1.66 in 2024. The 2024 EI premium rate is 22 cents lower than it was under the previous government from 2013 to 2016 ($1.88). Growth in EI premium revenues is expected to slow in 2024-25 and 2025-26 due in part to a projected reduction in the premium rate back to $1.63 in 2025. The EI premium rate will have greater stability and is less likely to see substantial increases through 2031 because of the government's Budget 2021 measure to inject $26.8 billion into the EI Operating Account, in order to compensate the account for the cost of COVID emergency benefits. The reduction in the projected premium rate reflects the outlook for the account based on the September 2023 private sector survey. These projections are subject to change and the actual rate for future years will be determined by the Chief Actuary using data available at that time. For the remainder of the forecast, EI premium revenues are projected to grow at an average of 3.5 per cent. (See box for details of the outlook for the EI Operating Account.)

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| EI premium revenues | 26.9 | 28.9 | 29.7 | 30.0 | 30.9 | 31.9 | 33.2 | |||

| EI benefits1 | 21.8 | 22.2 | 26.5 | 27.1 | 27.4 | 28.0 | 29.1 | |||

| EI administration and other expenses2 | 2.8 | 2.8 | 2.5 | 2.1 | 2.1 | 2.0 | 2.0 | |||

| 20223 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| EI Operating Account annual balance | 1.2 | 4.7 | 1.5 | 1.1 | 2.0 | 2.4 | 2.8 | 2.8 | 3.1 | 4.4 |

| EI Operating Account cumulative balance | -24.7 | -20.0 | -18.5 | -17.4 | -15.4 | -13.0 | -10.2 | -7.4 | -4.3 | 0.14 |

| Projected premium rate | ||||||||||

| (per $100 of insurable earnings) | 1.58 | 1.63 | 1.66 | 1.63 | 1.63 | 1.63 | 1.63 | 1.63 | 1.63 | 1.63 |

|

1 EI benefits include regular EI benefits, sickness, maternity, parental, compassionate care, fishing and work-sharing benefits, and employment benefits and support measures. EI benefits exclude EI-Emergency Response Benefit costs in line with the government's commitment to credit the EI Operating Account. To date, the government has credited $26.8 billion for this purpose. 2 The remaining EI costs relate mainly to administration and are included in direct program expenses. 3 Values for 2022 are actual data. Values for 2023 and future years are a projection. 4 The EI Operating Account cumulative balance does not reach exactly zero at the end of the seven-year period as projected EI rates are rounded to the nearest whole cent per $100 of insurable earnings, in accordance with the Employment Insurance Act. |

||||||||||

The Employment Insurance Operating Account operates within the Consolidated Revenue Fund. As such, EI-related revenues and expenses that are credited and charged to the Account, respectively, in accordance with the Employment Insurance Act, are consolidated with those of the government, and affect the budgetary balance. For consistency with the EI premium rate, which is set on a calendar-year basis with the objective of having the Account break even over time, the annual and cumulative balances of the Account are also presented on a calendar-year basis.

The EI Operating Account is expected to continue to record annual surpluses, which began in 2022. Based on the economic outlook provided by the September 2023 survey of private sector forecasters, the premium rate is expected to decline to $1.63 per $100 of insurable earnings in 2025, which would see the account balanced in 2031, consistent with the legislated seven-year break-even rate-setting mechanism. The actual premium rate for 2025 will be set according to the legislated premium-rate setting mechanism in the fall of 2024, incorporating the recommendation of the EI Commission based on projections provided by the Office of the Chief Actuary.

Other Revenues

Other revenues consist of three broad components: net income from enterprise Crown corporations; other program revenues from returns on investments, proceeds from the sales of goods and services, and other miscellaneous revenues; and net foreign exchange revenues.

- Enterprise Crown corporation revenues are projected to decline in 2023-24, largely reflecting Bank of Canada net losses, as interest expense paid on deposits held by the Bank at variable interest rates has grown faster than revenues on the Bank's fixed-rate investments in the rising interest rate environment. Starting in 2024-25, growth in enterprise Crown corporation revenues reflects the Bank's expected gradual return to profitability and the outlook for other enterprise Crown corporations, as well as interest revenues from increased lending to enterprise Crown corporations.

- Other program revenues are affected by consolidated Crown corporation revenues, interest rates, inflation, and exchange rate movements (which affect the Canadian-dollar value of foreign-denominated assets). These revenues are projected to increase by an average of 8.2 per cent in 2023-24 and 2024-25 primarily due to an increase in interest and penalty revenue on tax debt as a result of higher interest rates. Over the remainder of the forecast horizon, other program revenues are projected to continue to grow by 1.1 per cent.

- Net foreign exchange revenues, which consist mainly of returns on Canada's official international reserves held in the Exchange Fund Account, are volatile and sensitive to fluctuations in foreign exchange rates and foreign interest rates. Assets in the Exchange Fund Account are mainly invested in debt securities of sovereigns and their agencies, and are held to aid in the control and protection of the external value of the Canadian dollar and to provide a source of liquidity for the government, if required. These revenues are projected to increase as a result of higher rates of return and smaller net losses on sales of securities in the near term, as well as growth in reserves over the forecast horizon.

Outlook for Expenses

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Major transfers to persons | |||||||

| Elderly benefits | 69.4 | 75.5 | 81.1 | 86.2 | 91.4 | 96.3 | 101.3 |

| Employment Insurance benefits1 | 21.8 | 22.2 | 26.5 | 27.1 | 27.4 | 28.0 | 29.1 |

| COVID-19 Income Support for Workers2 | -3.5 | -2.6 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Canada Child Benefit3 | 24.6 | 25.6 | 27.3 | 28.9 | 30.2 | 31.3 | 32.2 |

| Total | 112.2 | 120.6 | 134.9 | 142.2 | 149.0 | 155.6 | 162.5 |

| Major transfers to other orders of government | |||||||

| Canada Health Transfer | 47.1 | 49.4 | 52.1 | 54.7 | 57.4 | 60.3 | 62.9 |

| Canada Social Transfer | 15.9 | 16.4 | 16.9 | 17.4 | 17.9 | 18.5 | 19.0 |

| Equalization | 21.9 | 24.0 | 25.3 | 26.0 | 27.0 | 28.1 | 29.4 |

| Territorial Formula Financing | 4.6 | 4.8 | 5.2 | 5.4 | 5.5 | 5.7 | 5.8 |

| Health agreements with provinces and territories4 | 1.2 | 4.3 | 4.3 | 4.3 | 4.3 | 3.1 | 2.5 |

| Canada-wide early learning and child care | 4.5 | 5.6 | 6.6 | 7.9 | 7.9 | 7.7 | 7.7 |

| Canada Community-Building Fund | 2.3 | 2.4 | 2.4 | 2.5 | 2.5 | 2.6 | 2.6 |

| Other fiscal arrangements5 | -6.7 | -6.6 | -7.1 | -7.4 | -7.8 | -8.2 | -8.5 |

| Total | 90.8 | 100.3 | 105.6 | 110.7 | 114.7 | 117.8 | 121.3 |

| Proceeds from the pollution pricing framework returned | 7.0 | 11.2 | 13.3 | 15.7 | 17.7 | 19.8 | 21.5 |

| Direct program expenses | |||||||

| Other transfer payments | 98.9 | 84.2 | 91.0 | 94.5 | 96.1 | 99.6 | 102.6 |

| Operating expenses | 129.6 | 125.9 | 121.9 | 121.7 | 121.8 | 122.7 | 126.1 |

| Total | 228.5 | 210.1 | 213.0 | 216.2 | 218.0 | 222.2 | 228.7 |

| Total program expenses, excluding net actuarial losses | 438.6 | 442.2 | 466.8 | 484.8 | 499.4 | 515.5 | 534.1 |

| Public debt charges | 35.0 | 46.5 | 52.4 | 53.3 | 55.1 | 58.4 | 60.7 |

| Total expenses, excluding net actuarial losses | 473.5 | 488.7 | 519.2 | 538.1 | 554.5 | 573.9 | 594.8 |

| Net actuarial losses (gains) | 9.6 | 7.6 | 2.6 | 2.6 | 0.0 | 0.9 | -2.5 |

| Total expenses | 483.1 | 496.3 | 521.9 | 540.7 | 554.5 | 574.8 | 592.2 |

| Per cent of GDP | |||||||

| Major transfers to persons | 4.0 | 4.2 | 4.6 | 4.6 | 4.7 | 4.7 | 4.7 |

| Major transfers to other orders of government | 3.2 | 3.5 | 3.6 | 3.6 | 3.6 | 3.5 | 3.5 |

| Direct program expenses | 8.1 | 7.3 | 7.2 | 7.1 | 6.8 | 6.7 | 6.6 |

| Total program expenses, excluding net actuarial losses | 15.6 | 15.4 | 15.9 | 15.8 | 15.6 | 15.4 | 15.3 |

| Total expenses | 17.2 | 17.3 | 17.8 | 17.7 | 17.3 | 17.2 | 17.0 |

|

Note: Totals may not add due to rounding. 1 EI benefits include regular EI benefits, sickness, maternity, parental, compassionate care, fishing and work-sharing benefits, and employment benefits and support measures. Remaining EI costs relate mainly to administration and are part of operating expenses. 2 Includes the Canada Emergency Response Benefit, the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit, the Canada Recovery Sickness Benefit, and the Canada Worker Lockdown Benefit. 3 Includes the Child Disability Benefit. 4 Includes new Tailored Bilateral Agreements, Home and Community Care and Mental Health and Addictions Services Agreements, and long-term care. 5 Other fiscal arrangements include the Quebec Abatement (offsetting amounts to reflect the historical transfer of tax points and resulting reduction in federal tax collected for the Youth Allowances Recovery and Alternative Payments for Standing Programs); statutory subsidies; payments under the Canada-Nova Scotia Arrangement on Offshore Revenues; payments for the transfer of Hibernia Net Profits Interest and Incidental Net Profits Interest (INPI) net revenues to Newfoundland and Labrador; and Fiscal Stabilization payments. |

|||||||

Table A1.6, above, provides an overview of the projection for total expenses by major component.

Major Transfers to Persons

Major transfers to persons consist of elderly benefits, which includes Old Age Security and the Guaranteed Income Supplement; Employment Insurance (EI) benefits; the Canada Child Benefit; as well as previous COVID-19 income support for workers.

Elderly benefits are projected to reach $75.5 billion in 2023-24, up 8.8 per cent. Over the forecast horizon, elderly benefits are forecast to grow by 6.1 per cent on average annually, reaching more than $100 billion in 2028-29. Growth in elderly benefits is due to the increasing population of seniors and projected consumer price inflation, to which benefits are fully indexed.

EI benefits are projected to increase by 1.5 per cent to reach $22.2 billion in 2023-24, largely reflecting slightly higher unemployment rate projections for 2023 and 2024. Over the remainder of the forecast horizon, EI benefits are expected to increase as a result of strong growth in the population of the labour force and a slightly higher unemployment rate, which begins to decline in 2025.

Canada Child Benefit payments are projected to increase 4.2 per cent to $25.6 billion in 2023-24, largely reflecting the indexation of benefits to inflation. Payments are then expected to grow by 6.8 per cent in 2024-25 and 6.0 in 2025-26 due to indexation and a slowdown in household incomes, before moderating to an average 3.6 per cent growth over the remainder of the forecast horizon.

The government also provided important emergency pandemic support to Canadians through the Canada Emergency Response Benefit, the Canada Recovery Benefit, the Canada Recovery Sickness Benefit, the Canada Recovery Caregiving Benefit, and the Canada Worker Lockdown Benefit. These temporary programs are now closed, with forecasted amounts in 2023-24 mainly reflecting expected recoveries of benefit overpayments.

Major Transfers to Other Orders of Government

Major transfers to other orders of government, which include the Canada Health Transfer (CHT), the Canada Social Transfer (CST), Equalization, Territorial Formula Financing, health agreements with provinces and territories, Canada-wide early learning and child care, the Canada Community-Building Fund, and other fiscal arrangements, are expected to increase from $100.3 billion in 2023-24 to $121.3 billion in 2028-29, largely due to projected nominal GDP growth.

The CHT growth guarantee of 5 per cent per year for five years, to be paid through annual top-ups as required, will see CHT support increase from $49.4 billion in 2023-24 to $62.9 billion in 2028-29. The CST is legislated to grow at 3 per cent per year, from $16.4 billion in 2023-24 to $19.0 billion in 2028-29.

Equalization is projected to increase from $24.0 billion in 2023-24 to $29.4 billion in 2028-29, in line with a three-year moving average of nominal GDP growth. Territorial Formula Financing is projected to increase from $4.8 billion in 2023-24 to $5.8 billion in 2028-29 mainly due to growth in provincial/local expenditures, which are major components of the formula. Canada Community-Building Fund payments will increase from $2.4 billion in 2023-24 to $2.6 billion in 2028-29 as they are indexed at 2 per cent per year, with increases applied in $100 million increments.

Health agreements with provinces and territories total $4.3 billion per year from 2023-24 to 2026-27 which includes $2.5 billion per year for tailored bilateral agreements, $1.2 billion per year for the 10-year Home and Community Care and Mental Health and Addictions Services Agreements that expire in 2026-27, and $600 million per year for long-term care that expires in 2027-28.

Canada-wide early learning and child care transfer payments are expected to increase from $5.6 billion in 2023-24 to $7.7 billion in 2028-29, and include funding of $625 million over four years, beginning in 2023‑24, for an Early Learning and Child Care Infrastructure Fund. Investments in Canada-wide early earning and child care will create more child care spaces so more families can benefit from $10-a-day child care.

Other fiscal arrangements are projected to decrease from -$6.6 billion in 2023-24 to -$8.5 billion in 2028-29 primarily due to the Quebec Abatement. This reflects the value of the historical transfer of tax points to Quebec in the 1960s and 1970s, which results in a commensurate reduction in cash transfers to the province.

Proceeds From the Pollution Pricing Framework Returned

Proceeds from the pollution pricing framework returned represent the return of all direct proceeds from the federal fuel charge and Output Based Pricing System to Canadians and businesses in the jurisdiction from which they were collected. Proceeds from the pollution pricing framework returned are expected to be $11.2 billion in 2023-24, increasing to $21.5 billion by 2028-29, reflecting a higher price on carbon pollution.

Direct Program Expenses

Direct program expenses consist of other transfer payments administered by departments, and operating expenses.

Other transfer payments administered by departments are projected to decline to $84.2 billion in 2023-24 due primarily to lower expected contingent liabilities. After 2023-24, other transfer payments are projected to increase from $91 billion in 2024-25 to $102.6 billion in 2028-29. Projected growth reflects recent measures with growing profiles, such as the Canadian Dental Care Plan, support for electric vehicle battery manufacturing, and refundable clean economy investment tax credits.

Operating expenses reflect the cost of doing business for more than 100 government departments, agencies, and Crown corporations. Operating expenses are forecasted to decline to $125.9 billion in 2023-24 and $121.7 billion in 2025-26, before growing to $126.1 billion in 2028-29. Decreases in the early years are driven by lower expected contingent liabilities, public service pensions and benefits, and a tapering off of expenses from therapeutics and vaccines. Growth over the outer years of the horizon is driven in part by wages for federal employees and the ongoing implementation of Strong, Secure, Engaged, modernization of NORAD, and investments in Continental Defence, offset in part by planned expenditure reduction actions including those announced in Budget 2023 and this Fall Economic Statement.

Net Actuarial Losses

Net actuarial losses, which represent changes in the measurement of the government's obligations for pensions and other employee future benefits, are expected to decline over the forecast horizon, from a projected loss of $7.6 billion in 2023-24 to a projected net actuarial gain of $2.5 billion in 2028-29, reflecting higher expected interest rates used to measure the present value of the obligations.

Public Debt Charges

Public debt charges are expected to increase from $46.5 billion in 2023-24 to $60.7 billion in 2028-29, due primarily to the rise in short- and long-term interest rates. Debt charges also reflect incremental borrowing associated with the Government of Canada's purchase of Canada Mortgage Bonds (CMBs). However, the CMB purchases are expected to generate sufficient revenues to completely offset any incremental debt charges. As a share of GDP, public debt charges are expected to rise from 1.6 per cent in 2023-24 to 1.7 per cent by 2028-29, still near historic lows, and well below the peak of 6.5 per cent of GDP in the 1990s and 2.1 per cent in 2007-08 before the financial crisis.

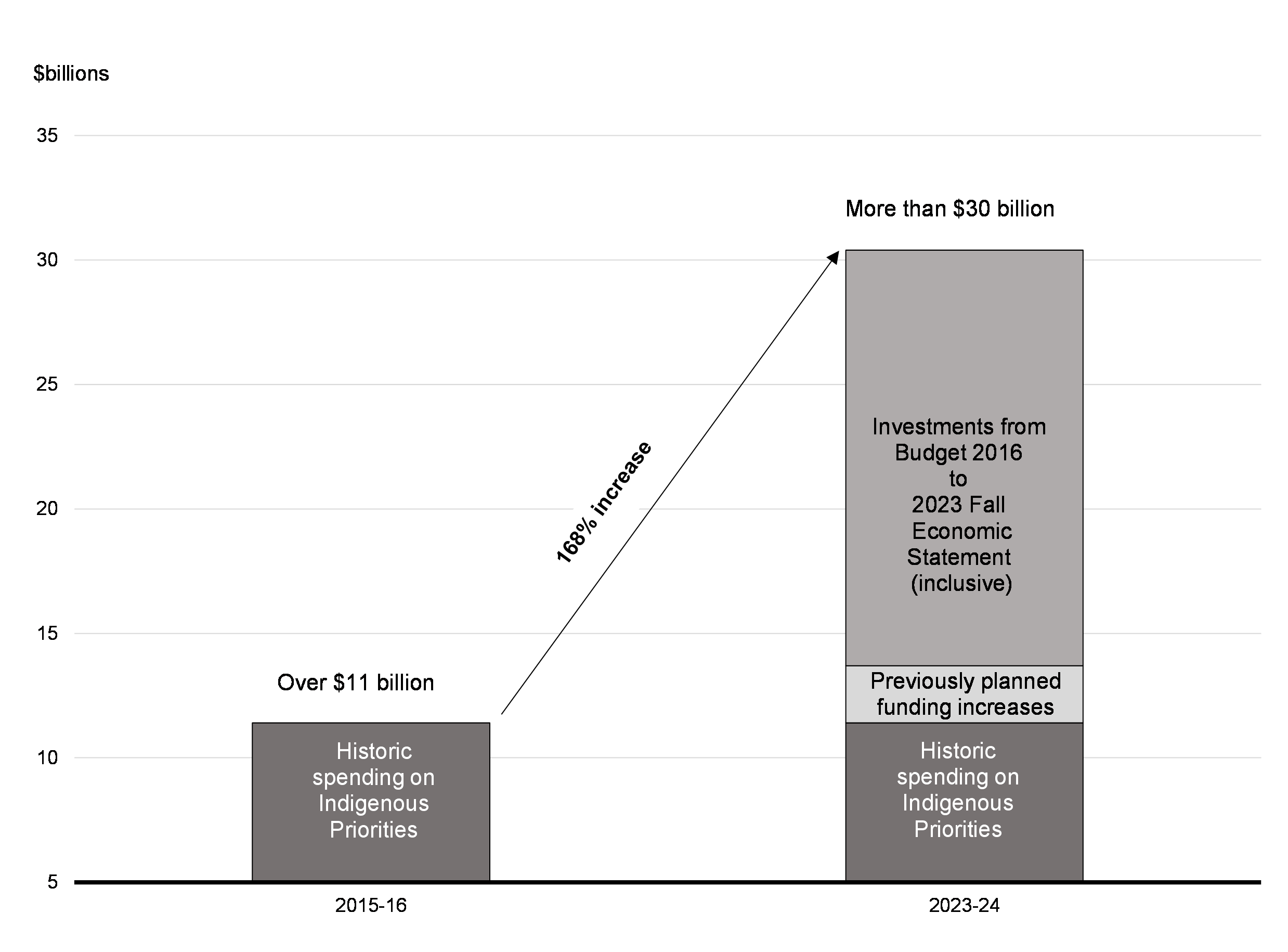

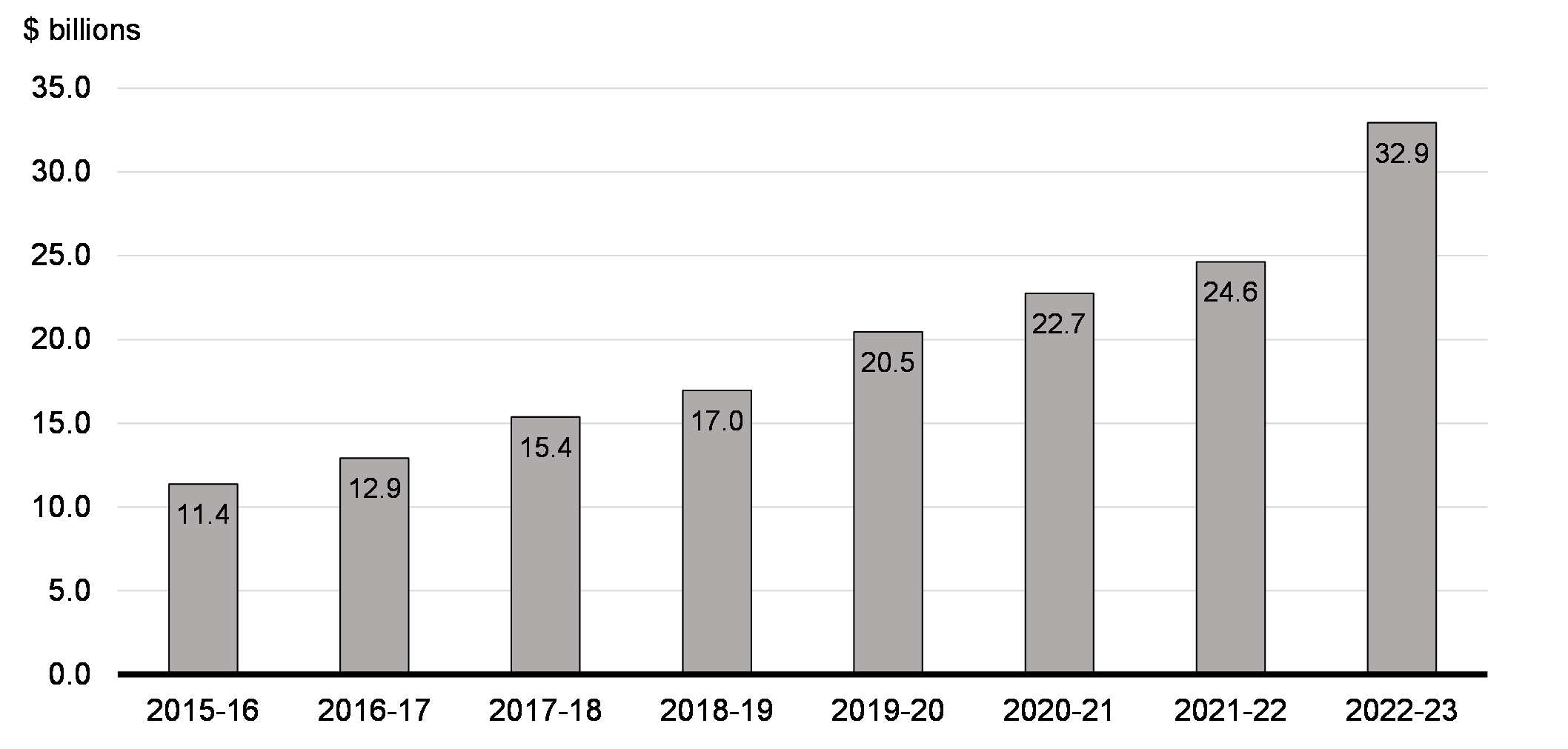

In 2015, the federal government committed to doing the work necessary to meaningfully advance truth and reconciliation with Indigenous Peoples. Since then, the federal government has worked to renew its nation-to-nation, government-to-government, and Inuit-Crown relationships. This has required the federal government to change how it works, including making record investments in Indigenous communities.

The federal government has invested more than $185 billion in Indigenous priorities since 2015, representing an annual spending increase of 168 per cent since 2015-2016 (from $11 billion in 2015-16, to more than $30 billion in 2023-24).

168 Per Cent Increase in Investments in Indigenous Priorities Since 2015-16

These investments have contributed to substantial progress, including the elimination of 143 long-term drinking water advisories in First Nations communities; the establishment of several child welfare agreements; new schools, health care services, and homes; the resolution of historical wrongs; and opening paths to self-determination.

Annual Investments in Indigenous Priorities

In addition to these investments, Canada has acknowledged its obligations with recorded liabilities having increased from $11 billion in 2015-16 to $76 billion in 2022-23, the vast majority of which relate to Indigenous claims. This reflects the progress the federal government has made to advance reconciliation—fulfilling treaty promises, implementing rights, resolving historical wrongs, and reinvigorating the modern treaty process.

Most recently, as reported in the 2022-23 Public Accounts, the government recorded approximately $26 billion to resolve past injustices. Absent these expenses, the 2022-23 budgetary deficit would have been roughly $9 billion, or 0.3 per cent of GDP. The federal government will continue its efforts to work with Indigenous partners to collaboratively resolve litigation and implement negotiated settlements to support reconciliation.

Canadians have witnessed generational change and expect continued progress. The Government of Canada remains committed to reconciliation with Indigenous Peoples—we still have work to do.

Financial Source/Requirement

The financial source/requirement measures the difference between cash coming into the government and cash going out. In contrast, the budgetary balance is presented on a full accrual basis of accounting, meaning that government revenues and expenses are recorded when they are earned or incurred, regardless of when the cash is received or paid.

Table A1.7 provides a reconciliation of the two measures, starting with the budgetary balance. Non-budgetary transactions shown in the table reflect the reversal of certain revenues and expenses included in the budgetary balance that have no impact on cash flows in the year, such as the amortization of non-financial assets. They also include the addition of changes in asset and liability balances that have no accrual impact in a year but do result in the inflow or outflow of cash, such as the payment of accounts payable. An increase in a liability or decrease in an asset represents a financial source, whereas a decrease in a liability or increase in an asset represents a financial requirement. The sum of the budgetary balance and changes in asset and liability balances reflected under non-budgetary transactions is equal to the government's net source of (+), or requirement for (-), cash.

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2022-23 | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

| Budgetary balance | -35.3 | -40.0 | -38.4 | -38.3 | -27.1 | -23.8 | -18.4 |

| Non-budgetary transactions | |||||||

|

Pensions and other accounts

|

12.8 | 10.9 | 5.7 | 5.0 | 1.9 | 2.3 | -1.8 |

|

Non-financial assets

|

-5.0 | -3.7 | -4.0 | -4.1 | -1.8 | -1.3 | -1.3 |

|

Loans, investments, and advances

|

|||||||

|

Enterprise Crown corporations

|

-5.7 | -21.0 | -43.9 | -50.1 | -49.1 | -45.5 | -39.1 |

|

Other

|

1.2 | 14.1 | -5.7 | -5.4 | -1.2 | -6.2 | -4.0 |

|

Total

|

-4.5 | -6.9 | -49.6 | -55.5 | -50.3 | -51.7 | -43.1 |

|

Other transactions

|

|||||||

|

Accounts payable, receivable, accruals, and allowances

|

-18.4 | -32.7 | -16.1 | -6.8 | -7.2 | -9.0 | -7.9 |

|

Foreign exchange activities and derivatives

|

-15.8 | -9.6 | -8.5 | -8.4 | -7.7 | -7.7 | -7.7 |

|

Total

|

-34.2 | -42.2 | -24.5 | -15.2 | -14.9 | -16.7 | -15.6 |

| Total non-budgetary transactions | -30.8 | -41.9 | -72.4 | -69.8 | -65.2 | -67.4 | -61.9 |

| Financial source (requirement) | -66.2 | -81.9 | -110.9 | -108.0 | -92.3 | -91.1 | -80.3 |

As shown in Table A1.7 a financial requirement is projected in each year over the forecast horizon, reflecting financial requirements associated with the projected budgetary deficits, as well as forecast requirements from non-budgetary activities.

A financial source is projected for pensions and other accounts for most years over the forecast horizon. Pensions and other accounts include a variety of employee future benefit plans, such as health care and dental plans, disability, and other benefits for veterans and others, as well as the activities of the Government of Canada's employee pension plans, and those of federally appointed judges and Members of Parliament. A financial source for pensions and other accounts reflects the difference between non-cash pension and benefit expenses recorded as part of the budgetary balance to reflect the value of benefits earned by employees during a fiscal year and the annual cash outflows for benefit payments.

Financial requirements for non-financial assets mainly reflect the difference between cash outlays for the acquisition of new tangible capital assets and the amortization of capital assets included in the budgetary balance. They also include disposals of tangible capital assets and changes in inventories and prepaid expenses. Financial requirements are projected in each year over the forecast horizon, reflecting forecast net growth in non-financial assets.

Loans, investments, and advances include the government's investments in enterprise Crown corporations, including the Canada Mortgage and Housing Corporation, Export Development Canada, the Business Development Bank of Canada, and Farm Credit Canada, as well as financial requirements associated with the government's purchase of Canada Mortgage Bonds (see Annex 2 for details). They also include loans, investments, and advances to national and provincial governments and international organizations, and under government programs, including the Canada Emergency Business Account (CEBA). The projected financial source for other loans, investments, and advances in 2023-24 is due to the expected repayment of CEBA loans, given the January 2024 forgiveness repayment date.

In general, loans, investments, and advances are expected to generate additional revenues for the government in the form of interest or additional net profits of enterprise Crown corporations, which are reflected in projections of other revenues. These revenues partly offset debt charges associated with these borrowing requirements.

Other transactions include the payment of tax refunds and other accounts payable, the collection of taxes and other accounts receivable, the conversion of other accrual adjustments included in the budgetary balance into cash, as well as foreign exchange activities and derivatives. Projected cash requirements over the forecast horizon mainly reflect the payment of accounts payable and forecast increases in the government's official international reserves held in the Exchange Fund Account.

Economic Scenarios Analysis

As discussed in the Economic Overview, while the September 2023 survey continues to provide a reasonable basis for economic and fiscal planning, the economic outlook is clouded by a number of key uncertainties, all of which could impact the trajectory of inflation, interest rates and economic growth.

Data on economic growth and inflation released since the survey have been consistent with private sector economists' forecasts. However, decisions by Saudi Arabia and Russia to cut oil supply have also led to an increase in global energy prices, reversing some of the previous decreases in Canada's headline inflation. Oil prices remain volatile, reflecting a sharp tightening in global financial conditions and new geopolitical uncertainty stemming from the eruption of a conflict between Israel and Hamas following the Hamas terrorist attacks perpetrated against Israel.

Long-term interest rates rose steeply in September in the U.S. and other advanced economies, including Canada, though have since retreated. The increase reflected, in part, market uncertainty over how long interest rates may need to remain elevated in order to bring down inflation.

To facilitate prudent economic and fiscal planning, the Department of Finance has developed scenarios that incorporate some of these recent developments and consider faster or slower growth tracks relative to the September survey (Table A1.8 and A1.9).

Downside Scenario

The downside scenario considers the economic repercussions should interest rates remain higher than expected in the September survey, as a combination of resilient domestic demand, elevated inflation expectations, and ongoing more frequent and larger price increases by companies lead to more persistent elevated core inflation. Prolonged elevated interest rates and the cumulative effects of monetary policy tightening lead to more adverse effects on confidence, household wealth, and consumer and business activity. At the same time, the U.S. also sees persistent inflation, higher rates, and subsequently slower growth. The overall result is a shallow recession in Canada, with real GDP in Canada contracting by 1.7 per cent from peak to trough compared to a period of subdued growth expected in the survey.

- CPI inflation is 0.5 percentage points above the September survey, on average, in 2023 and 2024. CPI inflation stays above 3 per cent until the last quarter of 2024—about four quarters longer than in the survey—before reaching about 2 per cent by the end of 2025.

- In response to persistent CPI inflation, the Bank of Canada increases its target rate by another 25 basis points in the fourth quarter of 2023. Short-term interest rates remain high for most of 2024, then start declining in the fourth quarter of the year (rather than the second quarter as in the survey) to reach 4 per cent by the end of 2025 (well above the 2.7 per cent in the survey). They are expected to decline to 3 per cent by the end of 2026 and remain at that level over the rest of the forecast horizon (compared to 2.6 per cent in the survey).

- As a result of higher interest rates and weaker global activity, the Canadian economy experiences a shallow recession that is expected to last until the first quarter of 2024. Real GDP contracts by 1.7 per cent from peak to trough, compared to subdued growth in the survey. On an annual basis, real GDP growth is negative at -1.0 per cent in 2024 and slower than anticipated in 2025, before picking up in 2026 and 2027.

- Consistent with weaker economic activity, the unemployment rate rises to a peak of 7.1 per cent in the second quarter of 2024 and is 0.6 percentage points higher than the survey, on average, in 2024.

- Despite higher CPI inflation, GDP inflation is lower than in the survey in 2024 as weaker global growth expectations and uncertainties weigh on commodity prices. WTI crude oil prices decline to US$66 per barrel in 2024 (down from US$78 per barrel in the survey) and gradually converge close to the survey outlook by 2027.

- Together, slower real GDP growth and lower GDP inflation reduce the level of nominal GDP by $33 billion, on average per year, compared to the survey.

Upside Scenario

In the upside scenario, the Canadian economy sees underlying inflation fall faster than expected in the September survey. This allows interest rate cuts to occur sooner. Meanwhile, the healthy labour market and strong household balance sheets continue to support strong consumer demand, leading to economic growth picking up in the second half of 2023 and into 2024. Global demand proves more resilient as China avoids persistent deflation, and resilience in the U.S. labour market supports stronger growth, providing a boost to global growth and commodity prices.

- As a result of rapid improvements in core inflation, lower interest rates, and strong domestic demand, the Canadian economy continues to expand at a modest pace over the course of 2023 and into 2024. On an annual basis, real GDP growth is 1.3 per cent in 2023 (up 0.2 percentage points from the September survey) and 1.5 per cent in 2024 (up 1.1 percentage points).

- With a stronger economy, the unemployment rate rises by less than expected, reaching a peak of 6.0 per cent and averaging 0.5 percentage points below the survey in 2024.

- Core CPI inflation falls faster than expected in 2023 and 2024 as the economy moves into better balance without much of a negative impact on the labour market. However, overall CPI inflation remains in line with the survey as higher crude oil prices offset the decline in core CPI inflation, averaging 0.1 percentage points below the survey in 2024.

- In response to lower core CPI inflation, short-term interest rates start to decline in the first quarter of 2024—about one quarter sooner than in the survey—and are 0.1 percentage points below the survey in 2024.

- Despite slightly lower CPI inflation, GDP inflation is higher than in the survey as stronger global activity results in higher commodity prices. WTI crude oil prices average US$88 per barrel in 2024 (up from US$78 per barrel in the survey) and remain US$8 per barrel above the survey over the rest of the forecast horizon.

- Together, faster real GDP growth and higher GDP inflation raise the level of nominal GDP by $28 billion, on average per year, compared to the survey.

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2023-28 | |

|---|---|---|---|---|---|---|---|

| Real GDP growth | |||||||

|

2023 Fall Economic Statement

|

1.1 | 0.4 | 2.2 | 2.4 | 2.2 | 2.0 | 1.7 |

|

Downside Scenario

|

0.9 | -1.0 | 2.0 | 3.0 | 2.6 | 2.1 | 1.6 |

|

Upside Scenario

|

1.3 | 1.5 | 1.9 | 1.9 | 2.0 | 2.0 | 1.8 |

| GDP inflation | |||||||

|

2023 Fall Economic Statement

|

0.8 | 2.0 | 2.0 | 2.1 | 2.1 | 2.1 | 1.8 |

|

Downside Scenario

|

0.9 | 1.6 | 2.5 | 2.3 | 2.2 | 2.1 | 1.9 |

|

Upside Scenario

|

1.1 | 2.2 | 1.9 | 2.0 | 2.1 | 2.0 | 1.9 |

| Nominal GDP growth | |||||||

|

2023 Fall Economic Statement

|

2.0 | 2.4 | 4.3 | 4.5 | 4.3 | 4.2 | 3.6 |

|

Downside Scenario

|

1.7 | 0.5 | 4.5 | 5.3 | 4.9 | 4.3 | 3.5 |

|

Upside Scenario

|

2.4 | 3.7 | 3.9 | 4.0 | 4.1 | 4.0 | 3.7 |

| Nominal GDP level (billions of dollars) | |||||||

|

2023 Fall Economic Statement

|

2,868 | 2,938 | 3,063 | 3,202 | 3,341 | 3,481 | |

|

Downside Scenario

|

2,861 | 2,877 | 3,007 | 3,166 | 3,321 | 3,463 | |

|

Upside Scenario

|

2,882 | 2,989 | 3,105 | 3,230 | 3,361 | 3,497 | |

|

Difference between 2023 Fall Economic Statement and

Downside Scenario

|

-7 | -61 | -57 | -36 | -21 | -19 | -33 |

|

Difference between 2023 Fall Economic Statement and

Upside Scenario

|

13 | 51 | 41 | 27 | 20 | 16 | 28 |

| 3-month treasury bill rate | |||||||

|

2023 Fall Economic Statement

|

4.8 | 4.3 | 2.9 | 2.7 | 2.6 | 2.6 | 3.3 |

|

Downside Scenario

|

4.9 | 5.2 | 4.4 | 3.4 | 3.0 | 3.0 | 4.0 |

|

Upside Scenario

|

4.8 | 4.2 | 2.8 | 2.7 | 2.7 | 2.6 | 3.3 |

| Unemployment rate | |||||||

|

2023 Fall Economic Statement

|

5.4 | 6.4 | 6.2 | 5.9 | 5.8 | 5.7 | 5.9 |

|

Downside Scenario

|

5.5 | 7.0 | 6.9 | 6.5 | 6.2 | 6.1 | 6.4 |

|

Upside Scenario

|

5.4 | 5.9 | 5.7 | 5.7 | 5.6 | 5.6 | 5.7 |

| Consumer Price Index inflation | |||||||

|

2023 Fall Economic Statement

|

3.8 | 2.5 | 2.1 | 2.1 | 2.1 | 2.1 | 2.4 |

|

Downside Scenario

|

4.0 | 3.2 | 2.3 | 2.1 | 2.0 | 2.0 | 2.6 |

|

Upside Scenario

|

3.9 | 2.4 | 2.0 | 2.1 | 2.1 | 2.1 | 2.4 |

| West Texas Intermediate crude oil price ($US per barrel) | |||||||

|

2023 Fall Economic Statement

|

77 | 78 | 77 | 77 | 77 | 79 | 78 |

|

Downside Scenario

|

78 | 66 | 67 | 72 | 76 | 78 | 73 |

|

Upside Scenario

|

81 | 88 | 87 | 86 | 86 | 86 | 86 |

|

Note: Forecast averages may not equal average of years due to rounding. Numbers may not add due to rounding. Sources: Statistics Canada; Department of Finance Canada September 2023 survey of private sector economists; Department of Finance Canada calculations. The September 2023 survey of private sector economists has been adjusted to reflect the historical revisions in the 2022 Provincial and Territorial Economic Accounts. |

|||||||

| FES 2023 | FES 2023 Downside Scenario | Budget 2023 Downside Scenario | 1980s Recession | 1990s Recession | 2008-09 Recession | COVID-19 Recession | |

|---|---|---|---|---|---|---|---|

| Peak-to-trough decline in real GDP | n.a. | -1.7 | -1.9 | -5.4 | -3.4 | -4.4 | -12.8 |

| Worst q/q annualized decline in real GDP | -0.3 | -3.5 | -3.5 | -4.6 | -5.6 | -8.7 | -37.1 |

| Peak in the quarterly unemployment rate | 6.5 | 7.1 | 6.9 | 13.0 | 11.7 | 8.6 | 13.4 |

| Trough-to-peak increase in the quarterly unemployment rate (percentage points) | 1.5 | 2.1 | 1.8 | 5.8 | 4.3 | 2.7 | 7.7 |

|

Sources: Statistics Canada; Department of Finance Canada September 2023 survey of private sector economists; Department of Finance Canada calculations. |

|||||||

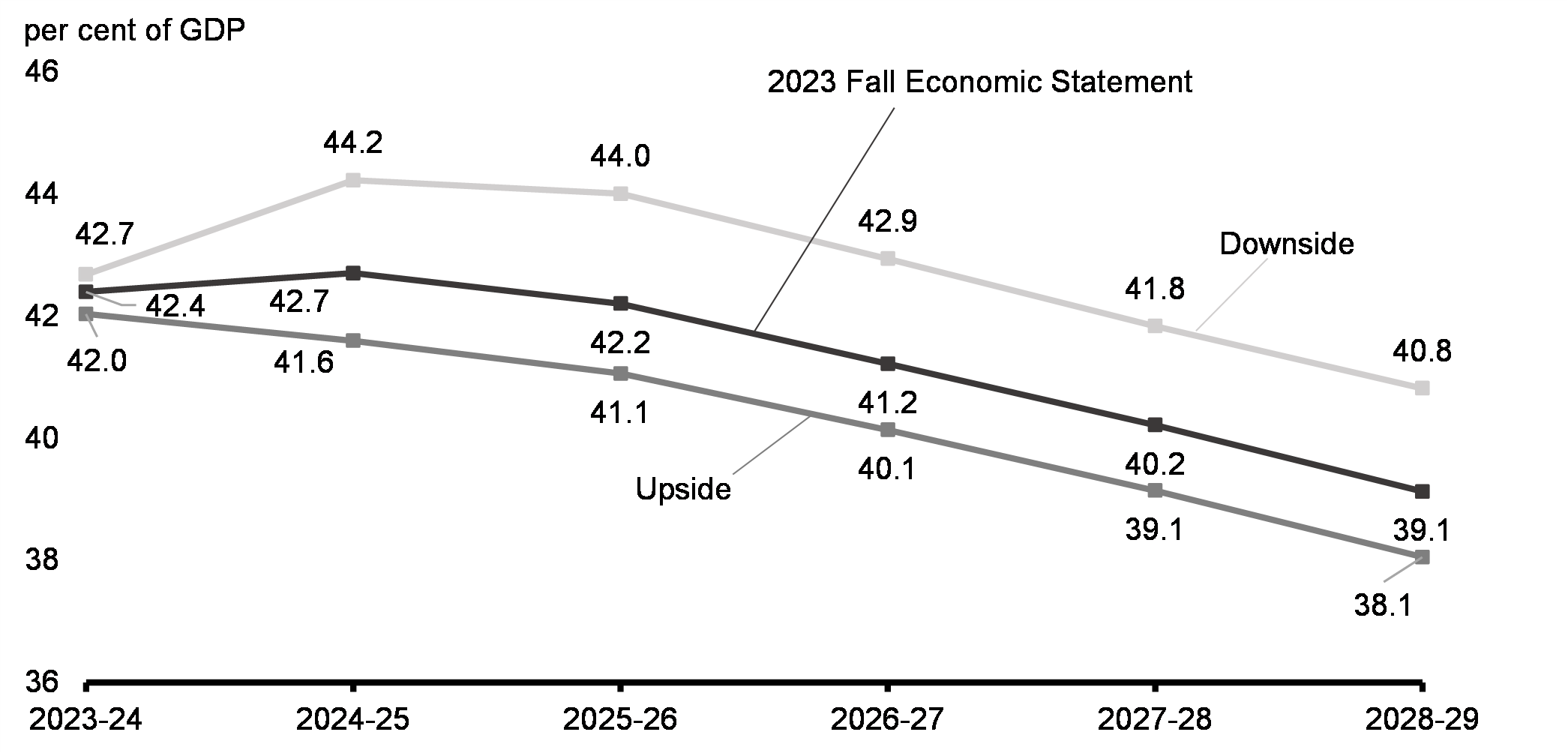

Fiscal Impacts of Economic Scenarios

The potential impact of the two economic scenarios on the projected federal debt-to-GDP ratio is shown in Chart A1.3 below.

Federal Debt-to-GDP Ratio Under Economic Scenarios

Downside Scenario

In the downside scenario, the deficit would increase by about $8.5 billion annually on average over the planning horizon. The weakened outlook for nominal GDP would entail somewhat weaker tax revenues, which is somewhat offset by higher interest rates raising revenues on interest sensitive revenue components (e.g., interest revenues on tax debts and from the Exchange Fund Account). Overall, revenues are down on average by $2.8 billion annually. Higher projected CPI inflation and interest rates lead to higher costs stemming from inflation-indexed programs (program spending is up on average by about $1.5 billion annually) and higher public debt charges (up by about $5.5 billion on average). Smaller actuarial losses, resulting from higher interest rates used to discount long-term liabilities, offsets some of the overall deterioration in the budgetary balance (down $1.2 billion on average).

As a result of the higher deficits and weaker nominal GDP growth, the federal debt-to-GDP ratio would be expected to rise to 44.2 per cent by 2024-25, before declining to 40.8 per cent by 2028-29.

Upside Scenario

In the upside scenario, the deficit would improve by an average of $5.2 billion per year. Stronger nominal GDP growth results in higher income tax revenues, and the improved outlook for consumption results in higher projected GST revenues. Overall, revenues are projected to be $4.5 billion higher annually, on average, in this scenario. On the expense side, the slightly lower projected CPI inflation means modestly lower expenses for CPI-indexed programs. Program spending is down by $0.3 billion on average per year over the forecast horizon. Slightly lower interest rates and reduced borrowing requirements resulting from smaller deficits mean that public debt charges would also be lower by $0.6 billion annually on average under this scenario. Actuarial losses are essentially unchanged given the small change in interest rates in this scenario.

As a result of the lower deficits and stronger nominal GDP growth, the federal debt-to-GDP ratio would fall in every year of the forecast horizon, reaching 38.1 per cent by 2028-29.

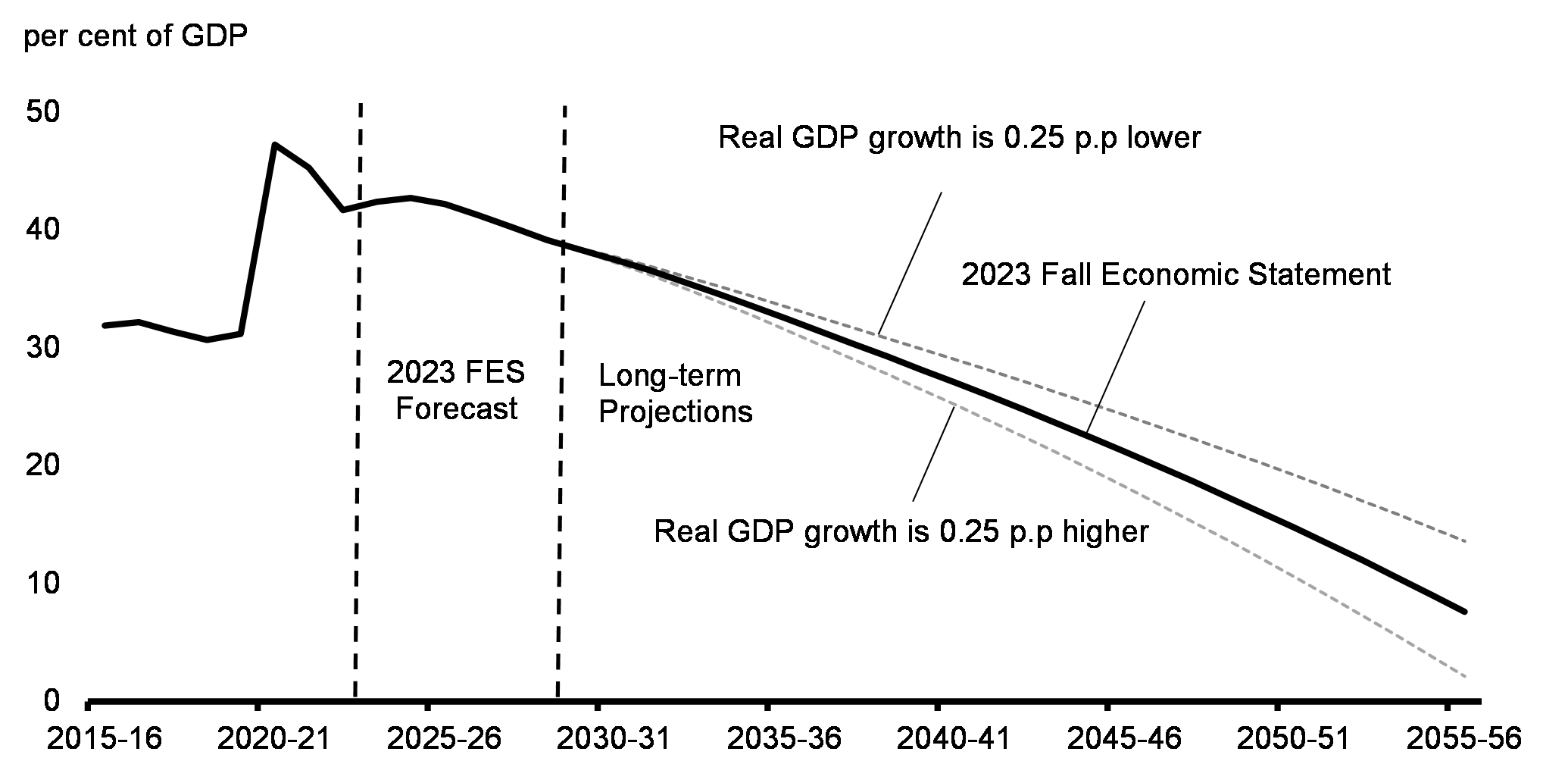

Long-Term Debt Projections

As with any projection that extends over several decades, the long-term debt-to-GDP ratio projections presented in the 2023 Fall Economic Statement are subject to a high degree of uncertainty and are sensitive to assumptions. They should not be viewed as predictions of the future, but instead as modelling scenarios based on a set of reasonable economic and demographic assumptions, assuming no future changes in policies.

Building on the 2023 Fall Economic Statement forecasts, the long-term fiscal projections continue to indicate that federal public finances are sustainable beyond the usual forecast horizon (Chart A1.4). This is despite adverse demographic trends, assumed modest future productivity growth rates, and projected increases in interest rates. As discussed in more detail below, this conclusion is also robust to changes in assumptions, including, for example, the projected growth rate of real GDP.

Keeping the federal debt-to-GDP ratio on a downward trend over the medium- and long-term will help ensure that future generations are not burdened with debt and that fiscal room remains available to face future challenges and risks that are not accounted for in this projection. These include, among others, climate change, the transition to net-zero, recessions, and geopolitical risk.

Long-Term Projections of the Federal Debt

To form the long-term economic projections, the medium-term (2023 to 2028) economic forecasts presented in the 2023 Fall Economic Statement are extended to 2055 using the Department of Finance Canada's long-term economic projection model. In this model, annual real GDP growth depends on labour productivity growth (1 per cent per year), which is calibrated over its 1974-2019 historical average, and labour supply growth (average of 0.6 per cent per year), which is based on demographic projections produced by Statistics Canada and projections for the labour force participation rate and average hours worked using econometric models developed by the Department. Assuming a constant 2 per cent annual rate for GDP inflation, nominal GDP is projected to grow by an average of 3.6 per cent per year from 2029 to 2055 (Table A1.10).

| 1970–2022 | 2023–2028 | 2029–2055 | |

|---|---|---|---|

| Real GDP growth | 2.6 | 1.7 | 1.6 |

| Contributions of (percentage points): | |||

|

Labour supply growth

|

1.5 | 1.0 | 0.6 |

|

Working-age population

|

1.5 | 1.6 | 0.8 |

|

Labour force participation

|

0.2 | -0.4 | -0.2 |

|

Unemployment rate

|

0.0 | -0.1 | 0.0 |

|

Average hours worked

|

-0.2 | -0.1 | -0.1 |

|

Labour productivity growth

|

1.1 | 0.7 | 1.0 |

| Nominal GDP growth | 6.9 | 3.6 | 3.6 |

|

Note: Contributions may not add up due to rounding. Sources: Statistics Canada; Department of Finance Canada calculations. |

|||

The long-term federal debt projections are obtained through an accounting model in which each revenue and expense category is modelled as a function of its underlying demographic and economic variables, with the relationships defined by a mix of current government policies and assumptions. The key assumptions underlying fiscal projections from 2029-30 through 2055-56 are the following:

- All tax revenues, as well as direct program expenses, grow broadly with nominal GDP, with the exception of a number of measures that will no longer be available after a certain date, such as the clean economy investment tax credits and funding to support clean electricity projects, which are incorporated based on their projected costs.

- The Canada Health Transfer, Canada Social Transfer, and Equalization grow with their respective legislated escalators. The remaining federal transfers to other orders of government, depending on the transfer, grow with nominal GDP, the targeted populations, inflation, and current legislation or agreements.

- The Old Age Security (OAS) program and Canada Child Benefit (CCB) grow with the targeted populations and inflation. Employment Insurance (EI) benefits grow in line with the number of beneficiaries and the growth in average weekly earnings. The EI premium rate grows according to current program parameters.

- The effective interest rate on interest-bearing federal debt is assumed, under the baseline scenario, to gradually increase from about 2.9 per cent in 2028–29 to 3.4 per cent by 2055-56.

Sensitivity analysis shows that the long-term fiscal projections are robust to some changes to key assumptions (Tables A1.11 and A1.12).

| Baseline2 | High | Low | |

|---|---|---|---|

| Demographic: | |||

|

Fertility rate (average births per woman)

|

1.5 births | +0.5 births | -0.5 births |

|

Immigration (per cent of population)

|

0.9 | +0.25 p.p. | -0.25 p.p. |

|

Life expectancy at 65

|

23.1 years | +3 years | -3 years |

| Economic: | |||

|

Total labour force participation rate (per cent)

|

62.6 | +2.0 p.p. | -2.0 p.p. |

|

Average weekly hours worked (hours)

|

32.7 | +1.0 hour | -1.0 hour |

|

Unemployment rate (per cent)

|

5.7 | +1.0 p.p. | -1.0 p.p. |

|

Labour productivity (per cent)

|

1.0 | +0.25 p.p. | -0.25 p.p. |

|

Interest rates (per cent)

|

3.3 | +1.0 p.p. | -1.0 p.p. |

|

Note: p.p. = percentage point. 1 These alternative assumptions are applied starting in 2029 except for changes in life expectancy, which are gradually applied over the projection horizon. 2 Baseline shown as the average over the period 2029 to 2055. |

|||

| Baseline | High | Low | ||||

|---|---|---|---|---|---|---|

| Budgetary Balance | Debt | Budgetary Balance | Debt | Budgetary Balance | Debt | |

| Demographic: | ||||||

|

Fertility rate

|

1.2 | 7.6 | 0.9 | 11.6 | 1.4 | 3.5 |

|

Immigration

|

1.2 | 7.6 | 1.5 | 2.6 | 0.7 | 13.5 |

|

Life expectancy at 65

|

1.2 | 7.6 | 0.8 | 11.2 | 1.5 | 4.6 |

| Economic: | ||||||

|

Total labour force participation rate

|

1.2 | 7.6 | 1.4 | 3.0 | 0.9 | 12.7 |

|

Average weekly hours worked

|

1.2 | 7.6 | 1.4 | 3.2 | 0.9 | 12.4 |

|

Unemployment rate

|

1.2 | 7.6 | 1.1 | 9.2 | 1.3 | 6.0 |

|

Labour productivity

|

1.2 | 7.6 | 1.6 | 2.1 | 0.7 | 13.6 |

|

Interest rates

|

1.2 | 7.6 | 0.7 | 15.6 | 1.4 | 1.4 |

Supplementary Information

Policy Actions Taken Since Budget 2023

Since 2016, the government has provided a transparent overview of all policy actions taken between budgets and updates. These measures, listed in Table A1.13, ensure that Canadians are continually well-served by the programs they rely on and that government operations carry on.

| Dept. | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

|---|---|---|---|---|---|---|---|

| Innovation, Infrastructure and Transport | 44 | 122 | 154 | 38 | 18 | 17 | |

| Sustaining the Government of Canada's Satellite Capability | CSA | 3 | 21 | 55 | 30 | 11 | 10 |

| Selecting the Next Contractor to Manage Canadian Nuclear Laboratories | AECL | 6 | 6 | 1 | 0 | 0 | 0 |

| Funding for the Research and Knowledge Initiative to Support Data and Research on Infrastructure and Housing Needs | INFC | 3 | 4 | 4 | 0 | 0 | 0 |

| Operating Funding for the Windsor-Detroit Bridge Authority | WDBA | 0 | 79 | 85 | 1 | 1 | 1 |

| Supporting Negotiations to Repatriate and Rehabilitate the Quebec Bridge1 | INFC | 4 | 3 | 0 | 0 | 0 | 0 |

| Accommodation Measures for Roberts Bank Terminal 2 Project1,2 | CIRNAC, IAAC | 25 | 0 | 1 | 3 | 3 | 3 |

| Procurement of a Ferry to Enhance Ferry Service Between Prince Edward Island and Nova Scotia1 | TC | 3 | 4 | 3 | 3 | 3 | 3 |

| Enhancing Transparency and Accountability in the Transportation System Act | CTA | 0 | 6 | 5 | 0 | 0 | 0 |

| Reconciliation and Communities | 1,499 | 1,718 | 794 | 0 | 0 | 0 | |

| Supporting Indigenous Economic Participation in Major Projects | FIN | 20 | 0 | 0 | 0 | 0 | 0 |

| Qikiqtani Truth Commission1 | CIRNAC | 19 | 0 | 0 | 0 | 0 | 0 |

| Support for First Nations Children Through Jordan's Principle | ISC | 778 | 807 | 0 | 0 | 0 | 0 |

| Increased Funding for First Nations Elementary and Secondary Education1 | ISC | 110 | 0 | 0 | 0 | 0 | 0 |

| Renewing Funding for Specific Claims Research by First Nations | CIRNAC | 0 | 8 | 8 | 0 | 0 | 0 |

| Ensuring Access to Safe Drinking Water and Treated Wastewater in First Nations Communities | ISC | 0 | 777 | 777 | 0 | 0 | 0 |

| Funding for the Federal Indian Day Schools Settlement (McLean)1,3 | CIRNAC | 0 | 30 | 0 | 0 | 0 | 0 |

| Implementation of An Act respecting First Nations, Inuit and Métis Children, Youth and Families4 | ISC | 37 | 24 | 0 | 0 | 0 | 0 |

| Renewal of the First Nations Health Authority Funding Agreement in British Columbia | ISC | 268 | 294 | 321 | 350 | 381 | 414 |

|

Less: Funds Previously Provisioned in the Fiscal

Framework

|

-268 | -294 | -321 | -350 | -381 | -414 | |

| Support for Emergency Management Response and Recovery Activities on Reserve | ISC | 260 | 0 | 0 | 0 | 0 | 0 |

| Increasing the Canada Student Grants5 | ESDC | 680 | 0 | 0 | 0 | 0 | 0 |

|

Less: Funds Previously Provisioned in the Fiscal

Framework

|

-605 | 0 | 0 | 0 | 0 | 0 | |

| Increasing the Ceiling of the Immigration Loans Program | IRCC | 1 | 0 | 0 | 0 | 0 | 0 |

| Income Support for 10,000 Newcomers Arriving on a Humanitarian Basis from the Americas | IRCC | 6 | 6 | 6 | 0 | 0 | 0 |

| Enhancing Immigration and Refugee Legal Aid | JUS | 28 | 0 | 0 | 0 | 0 | 0 |

| Eliminating Forced and Child Labour from Supply Chains | PS | 2 | 3 | 3 | 0 | 0 | 0 |

| Advancing the Collection of Banned Assault-Style Firearms | PS, RCMP | 27 | 62 | 0 | 0 | 0 | 0 |

| Supporting Western Canadian Farmers Impacted by Drought and Wildfires1 | AAFC | 186 | 33 | 0 | 0 | 0 | 0 |

|

Less: Funds Previously Provisioned in the Fiscal

Framework

|

-50 | -33 | 0 | 0 | 0 | 0 | |

| Canada in the World | 914 | 874 | 941 | 110 | -354 | 92 | |

| Military Assistance for Ukraine1 | DND, GAC, CSIS, CSEC | 816 | 318 | 197 | 0 | 0 | 0 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

-55 | 0 | 0 | 0 | 0 | 0 | |

| Renewal and Expansion of Operation REASSURANCE1 | DND | 417 | 802 | 872 | 178 | 178 | 178 |

|

Less: Funds Previously Provisioned in the Fiscal

Framework

|

-312 | -270 | -142 | -68 | -532 | -87 | |

| Security Assistance for Haiti1 | GAC, DND, RCMP | 41 | 30 | 7 | 0 | 0 | 0 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

-2 | -18 | -5 | 0 | 0 | 0 | |

| Sanction-Related Seizure of Physical Assets6 | GAC | 7 | 11 | 11 | 0 | 0 | 0 |

| Business Women in International Trade | GAC | 2 | 2 | 2 | 0 | 0 | 0 |

| Effective Government, Financial Sector Policy, and Tax Fairness | 67 | 119 | 87 | 29 | 2 | -2 | |

| Licenses to Support the Integrity of Client Registration and Authentication Processes | ESDC | 3 | 3 | 3 | 3 | 3 | 0 |

|

Less: Projected Revenues

|

-1 | -2 | -2 | -2 | -2 | -2 | |

| Faster Services for Veterans | VAC, RCMP | 0 | 55 | 82 | 28 | 0 | 0 |

| Statistics Canada Cloud Computing Platform1 | StatCan | 40 | 39 | 39 | 0 | 0 | 0 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

0 | 0 | -39 | 0 | 0 | 0 | |

| Supporting Change and Renewal of the Federal Public Service | PCO | 2 | 2 | 1 | 1 | 1 | 1 |

|

Less: Funds Sourced from Existing Departmental

Resources

|

-1 | -1 | 0 | 0 | 0 | 0 | |

| Public Inquiry into Foreign Interference | PCO | 10 | 22 | 3 | 0 | 0 | 0 |

| Competition Tribunal Payment Order for Rogers-Shaw Merger | ISED | 13 | 0 | 0 | 0 | 0 | 0 |

| Annex 2: Debt Management Strategy (Canada Mortgage Bond Issuance) | -3 | -82 | -211 | -340 | -469 | -596 | |

| (Net) Fiscal Impact of Non-Announced Measures7 | -504 | 16 | 84 | 308 | 802 | 1,166 | |

| Net Fiscal Impact – Total Policy Actions Since Budget 2023 | 2,017 | 2,767 | 1,850 | 145 | -1 | 677 | |

|