Archived -

Annex 2

Debt Management Strategy

On this page:

Introduction

As part of Budget 2023, the federal government released the 2023-24 Debt Management Strategy, which sets out the government's objectives, strategy, and borrowing plans for its domestic debt program and the management of its official international reserves. The 2023 Fall Economic Statement provides an update on the strategy and announces new measures to ensure the ongoing fiscal sustainability of Canada's debt management.

Highlights from the Consultations

In September 2023, the Department of Finance and the Bank of Canada held more than 30 external meetings to hear the views of market participants. These consultations, which are an integral part of the debt management process, specifically sought views on issues related to the design and operation of the Government of Canada's domestic debt program.

Overall, market participants said that the Canadian debt market continues to function well despite higher supply and periods of heightened volatility in the global bond market. There is generally a good supply-demand balance across different sectors, apart from the 30-year sector where market participants noted some increased demand pressure.

In the Treasury bill (t-bill) sector, market participants noted strong demand reflecting higher economic uncertainty. Market participants expressed a desire for the government to introduce a 1-month t-bill, at least temporarily, to support the transition from Bankers' Acceptance in the Canadian money market, which will be discontinued following the cessation of the Canadian Dollar Offered Rate (CDOR) in June 2024. Furthermore, market participants suggested that Canada should continue to support the growth of Canada's sustainable finance market.

Canada Mortgage Bond Issuance

Building more affordable housing for Canadians is one of the federal government's top priorities. Among the many initiatives the government has recently announced to unlock more rental financing is a $20 billion increase in Canada Mortgage Bond issuance. This will ensure home builders have access to the low-cost financing required to build more multi-unit projects and will support the construction of up to 30,000 more rental apartments per year.

In order to direct funding to affordable housing, Budget 2023 announced consultations on consolidating Canada Mortgage Bonds into the regular Government of Canada borrowing program and committed to return with an update in fall 2023. The government has since met with over 30 market participants, received additional written input from stakeholders, and heard from many market participants about the utility of the Canada Mortgage Bond Program, with mortgage lenders indicating a need for such a market-based instrument to hedge risks.

Reflecting the objective of supporting stable, cost-effective funding for mortgage lenders, as well as Canada's desire to generate net revenues for initiatives such as affordable housing, the government plans to start purchasing Canada Mortgage Bonds. The government will begin purchasing up to an annual maximum of $30 billion of Canada Mortgage Bonds, starting as early as February 2024. The remaining Canada Mortgage Bonds will continue to be available for market participants.

The government will communicate regularly with market participants and will ensure that the pace and volume of purchases are appropriate for market conditions and to address concerns where possible. The government would conduct additional consultations concerning any further government participation in Canada Mortgage Bonds.

Green Bond Program

To support the growth of the sustainable finance market in Canada, in March 2022 the government published a green bond framework and issued its inaugural $5 billion Canada Green Bond, which had an order book of over $11 billion from domestic and international investors.

In March 2023, the government published its inaugural allocation report on the distribution of green bond proceeds and Budget 2023 announced that the government is exploring global developments related to green investment taxonomies.

Since the introduction of Canada's Green Bond Framework, the European Union's Taxonomy for Sustainable Activities expressly included some nuclear activities as "green" until 2040-2045. The Sustainable Finance Action Council's Taxonomy Roadmap also considers certain nuclear expenditures to be green. Moreover, Bruce Power, Canada's largest nuclear electricity producer and Ontario Power Generation, have issued green bonds to fund their nuclear energy activities, which were well received by investors.

To align Canada's Green Bond Framework with Canada's 2030 Emissions Reduction Plan, updated taxonomies, international best practices and evolving investor preferences, the Government of Canada is releasing an updated Framework that includes certain nuclear energy expenditures. Specifically:

- investments in new reactors;

- refurbishment of existing facilities;

- research and development; and,

- some investments in Canada's nuclear supply chain

Sustainalytics, which provided the second party opinion on the initial Green Bond Framework, has provided an updated opinion for the revised framework that includes nuclear energy. The opinion states:

Sustainalytics is of the opinion that the Government of Canada Green Bond Framework is credible and impactful and aligns with the four core components of the Green Bond Principles 2021.

Green bonds issued under the initial Framework continue under that framework, and no proceeds from the first green bond issued in March 2022 will be allocated to nuclear related expenditures by the Government of Canada.

The government plans to issue another green bond under the updated Framework before the end of this fiscal year, subject to market conditions.

The updated framework and the associated Sustainalytics report will be made available on the government's website.

1-Month Treasury Bills

Bi-weekly issuance of 3-, 6-, and 12-month t-bills with auction sizes ranging from $14 billion to $30 billion support a liquid and well-functioning market for Canadian federal government treasury bills, which helps investors who need access to short-term, interest-bearing securities in lieu of cash.

As noted above, respondents to the consultation for the 2024-25 Debt Management Strategy recommended the introduction of a temporary 1-month t-bill to support the transition from Bankers' Acceptances in the Canadian money market.

The government is considering this proposal and will return to the market in advance of the Canadian Dollar Offered Rate (CDOR) transition.

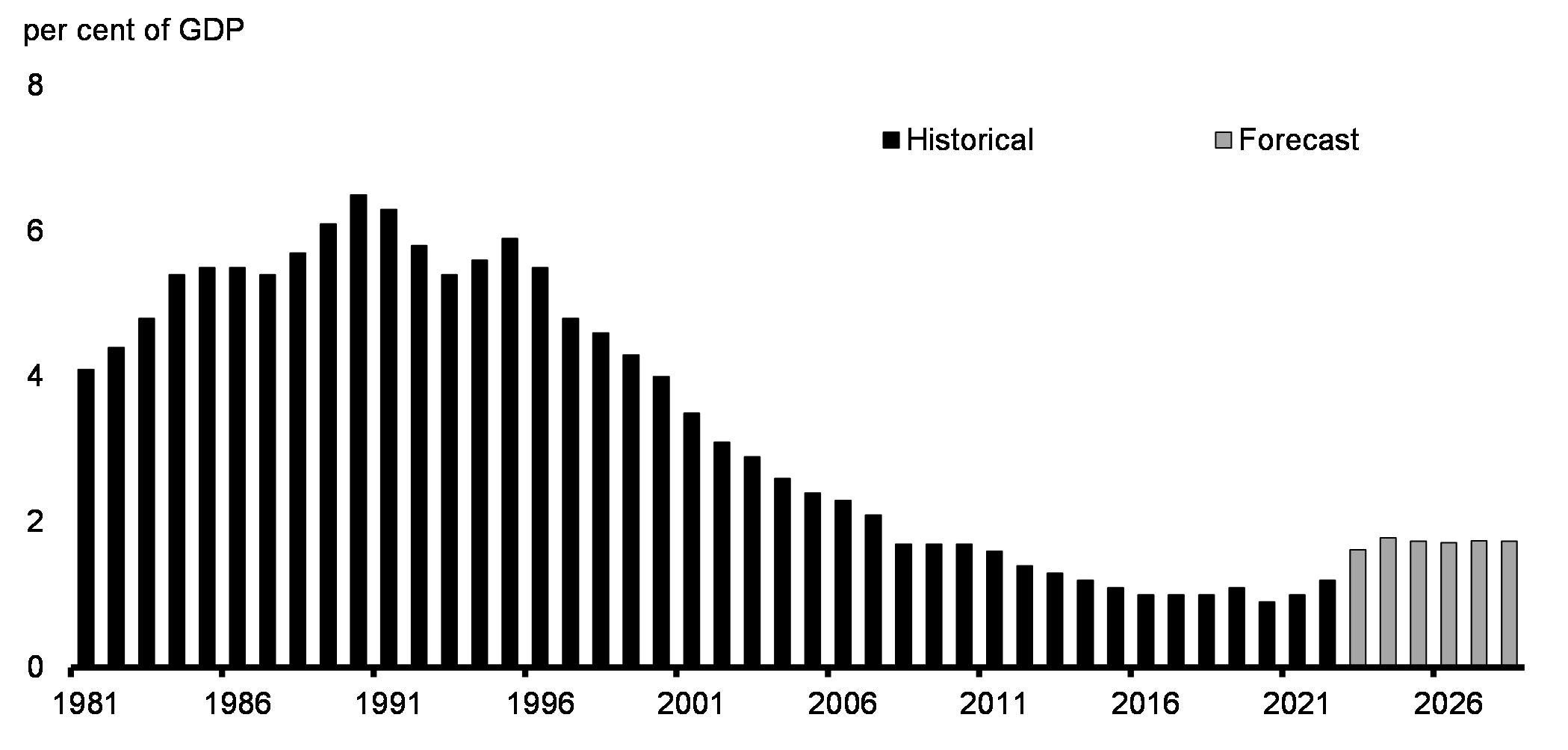

Outlook for Public Debt Charges

Reflecting higher interest rates relative to Budget 2023 projections, public debt charge estimates have increased over the current year and are now forecasted to reach $46.5 billion for 2023-24, or 1.6 per cent of GDP. Although rising interest rates mean that the ratio of public debt charges relative to the size of the economy has increased slightly over the forecast horizon from recent historic lows, the ratio remains well below the historical average of the past 40 years (Chart A2.1). This reflects the government's prudent debt management strategy.

Public Debt Charges

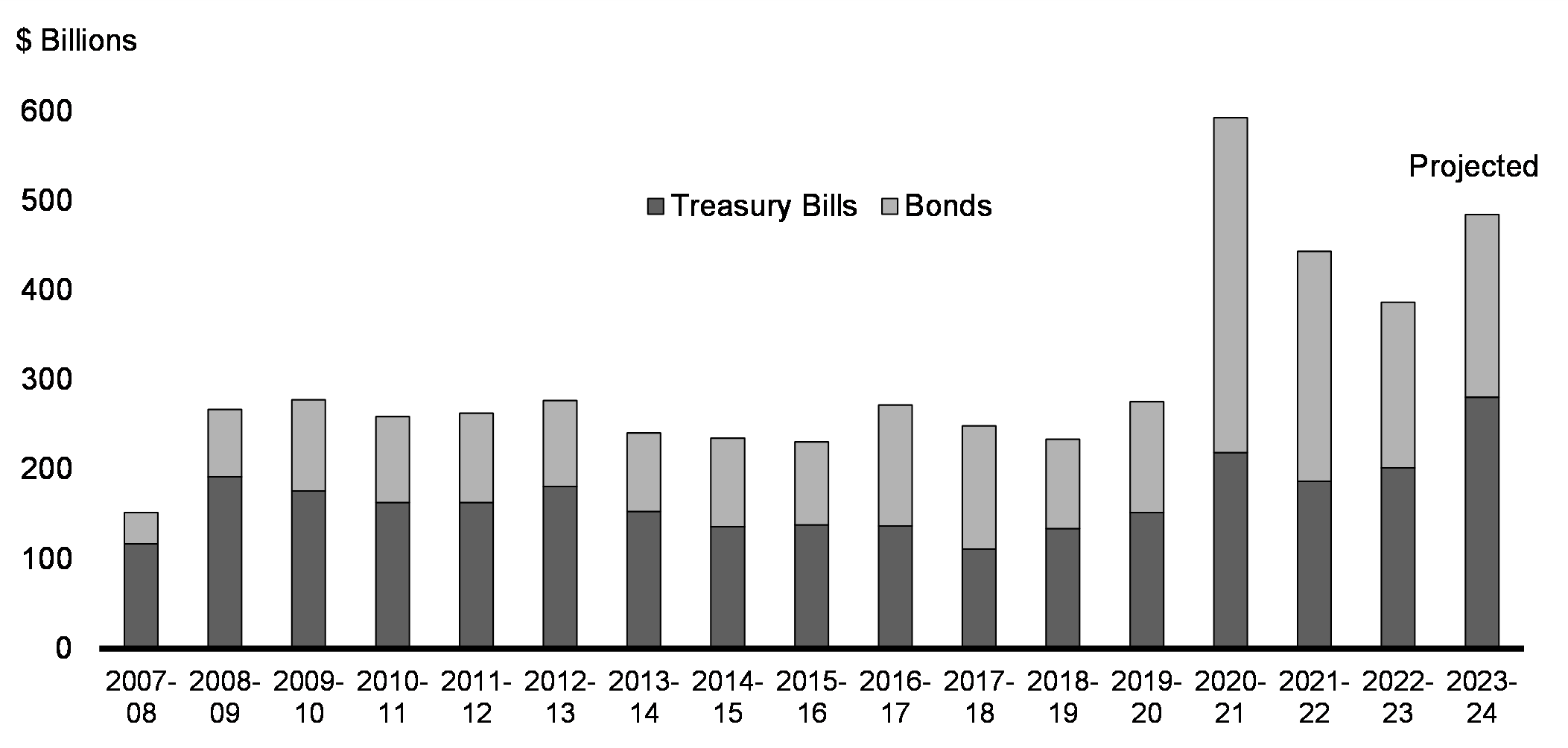

Adjustments to the 2023-24 Borrowing Plan

Reflecting increased borrowing requirements, and feedback received during the Debt Management Strategy consultation this fall, the government is adjusting bond issuances across all sectors and allocating a proportionally larger share in the 30-year sector to reflect strong market demand for longer-dated bonds. As a result, the proportion of bond issuance with a maturity of 10 years or more is expected to reach 30 per cent, up slightly from 29 per cent outlined in the Budget 2023.

The adjustments in the borrowing program have been implemented to ensure predictability in the Canadian debt program and support well-functioning markets across all sectors. As a result, the benchmark sizes in the 2-year and 10-year sectors have been increased. Similarly, the number of 5-year auctions have been increased to three, while the auction size in this sector has been slightly decreased.

Government of Canada Total Gross Treasury Bill and Bond Issuance by Fiscal Year

| 2022-23 Actual |

2023-24 Budget 2023 |

2023-24 Update |

Change from Budget 2023 | |

|---|---|---|---|---|

| Treasury Bills | 202 | 242 | 281 | 39 |

| 2-year | 67 | 76 | 86 | 10 |

| 3-year | 20 | 6 | 6 | 0 |

| 5-year | 31 | 40 | 47 | 7 |

| 10-year | 52 | 40 | 47 | 7 |

| 30-year | 14 | 10 | 14 | 4 |

| Green Bonds | - | 0 | 4 | 4 |

| Total Bonds | 185 | 172 | 204 | 32 |

| Total gross issuance | 387 | 414 | 485 | 71 |

| Share of Long bonds to Total Bonds | 36% | 29% | 30% | +1% |

|

Sources: Bank of Canada; Department of Finance Canada calculations. Notes: Numbers may not add due to rounding. Issuance decision subject to factors such as availability of eligible expenditures and market conditions. |

||||

| Feb. | Mar. | Apr. | May | June | Aug. | Sept. | Oct. | Nov. | Dec. | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2-year | 18-26 | 18-26 | 18-26 | 18-26 | ||||||

| 3-year | 8-12 | |||||||||

| 5-year | 18-26 | 18-26 | ||||||||

| 10-year | 18-26 | 18-26 | ||||||||

| 30-year | 20-30 | |||||||||

|

Source: Department of Finance Canada calculations. Note: These amounts do not include coupon payments. 1 Actual annual issuance may differ. |

||||||||||

Global Bond Issuance

Canada issues foreign currency bonds solely for the purpose of funding its liquid foreign currency reserves. In April 2023, Canada issued a 5-year, US$4 billion global bond. This global bond issuance was well received by markets, with an order book exceeding $13 billion—the largest for a Canada Global Bond since 2009—while being priced more tightly in terms of credit spreads than any US dollar global bond issued by Canada's peers in the same tenor since the beginning of 2023. Overall, this successful issuance reflects the ongoing strong global demand for investment opportunities backed by Canada's AAA credit ratings.

Page details

- Date modified: