Archived - A Plan for the Coming Months: Supporting Canadians through the Pandemic

Helping families and businesses as we fight a second wave.

The Fall Economic Statement highlights targeted and flexible measures that offer direct support to Canadians so that they can pay their rent and mortgages and feed their families, and scalable support to businesses to help bridge them through the crisis and keep Canadians healthy, safe and solvent. Together, these form a comprehensive and complementary safety net, which will be in place through to the summer of 2021, offering economic certainty to Canadians and Canadian businesses in a turbulent and difficult time.

An Unprecedented Economic Shock

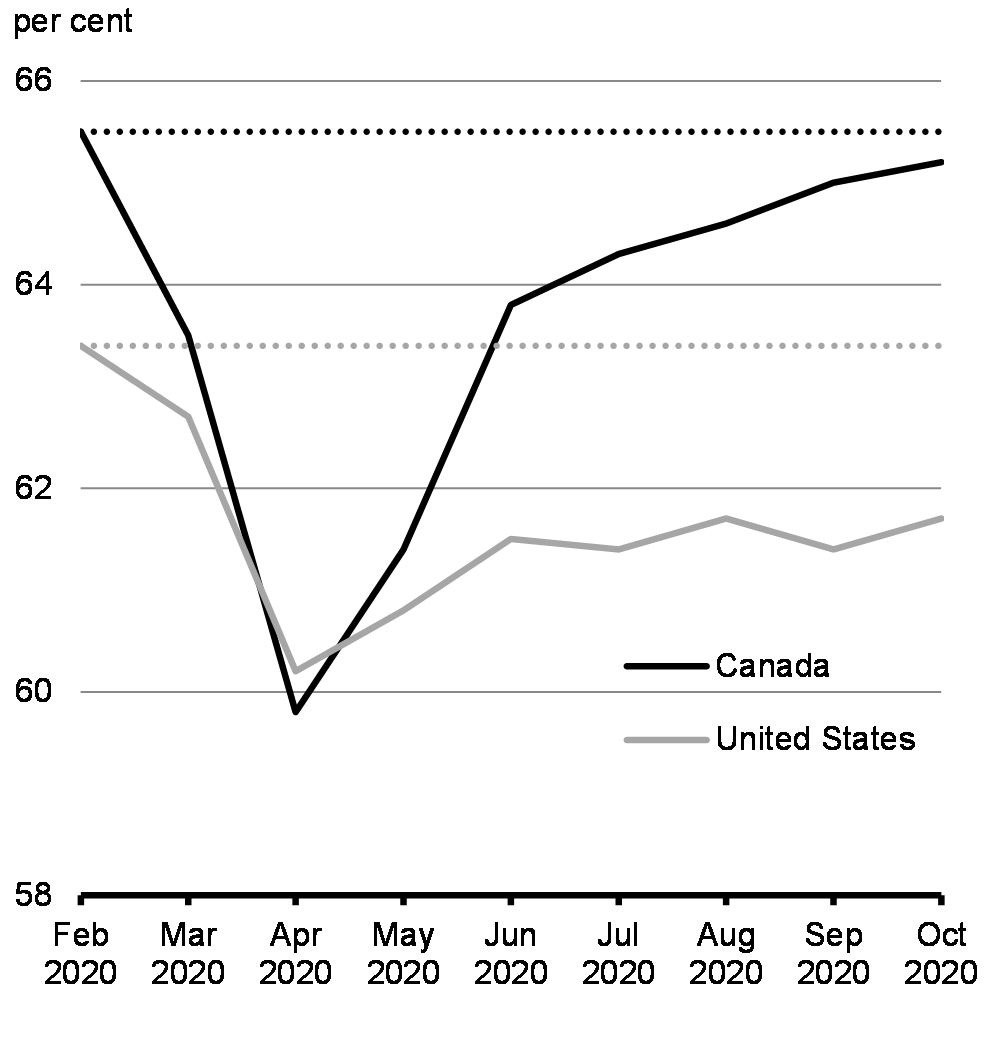

The COVID-19 pandemic has brought about the deepest and fastest recession, worldwide, since the Great Depression. Here at home, the shock to the Canadian economy caused by the spread of COVID-19 was historically sudden and deep. The decline in real gross domestic product (GDP) in the second quarter was, by far, the largest on record, with much of the damage occurring over a very short time from mid-March to the end of April. Over this period, more than 3 million Canadians lost their jobs and the employment rate for Canadians aged 15 to 64 fell from record highs to record lows.

Government supports have stabilized the economy

Since this crisis began, the government has invested $407 billion – nearly 19 per cent of Canada’s GDP – to support our public health care systems, provide direct income benefits to Canadians, and bridge businesses through the crisis and deep into 2021, creating certainty for people and businesses when it’s needed most.

Direct support measures are expected to result in economic activity being 4.6 per cent higher in 2020 and 4.4 per cent higher in 2021 compared to a scenario without support measures. This means about 1.2 million full-time equivalent jobs created or supported in 2020, and an unemployment rate 6 percentage points lower than without this support.

Government support has helped increase household disposable income and savings

Government transfers have meant that, combined with reduced spending opportunities, many people have actually increased their savings, a feature of this recession that is unlike others. These savings helped fuel a quick rebound in retail and consumer spending, and positions Canadian households to be a central force within our economic recovery.

Key Points

-

The substantial support provided by the government has worked to protect Canadians’ health, Canadians’ jobs, and Canadians’ businesses, and positioned Canada’s economy for a robust and lasting recovery.

-

After seeing its deepest decline on record this past spring, Canada’s economy strongly rebounded in the third quarter with an annualized increase in real GDP of likely over 45 per cent, while almost 80 per cent of the more than 3 million jobs lost at the outset of the pandemic have been recouped.

-

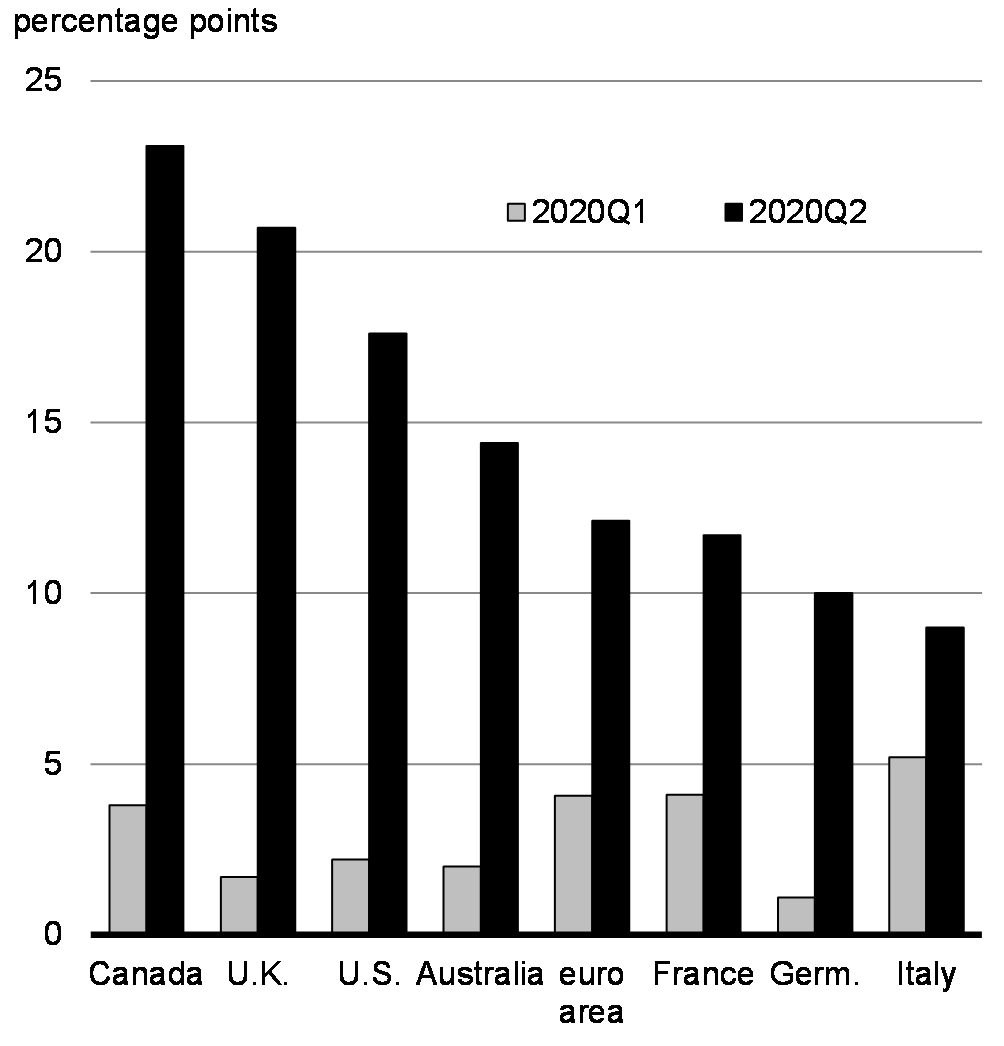

Overall, the Department of Finance estimates that support measures offset about half of the negative economic effects of COVID-19 on the unemployment rate by the second quarter and about a quarter of the negative effects on real GDP.

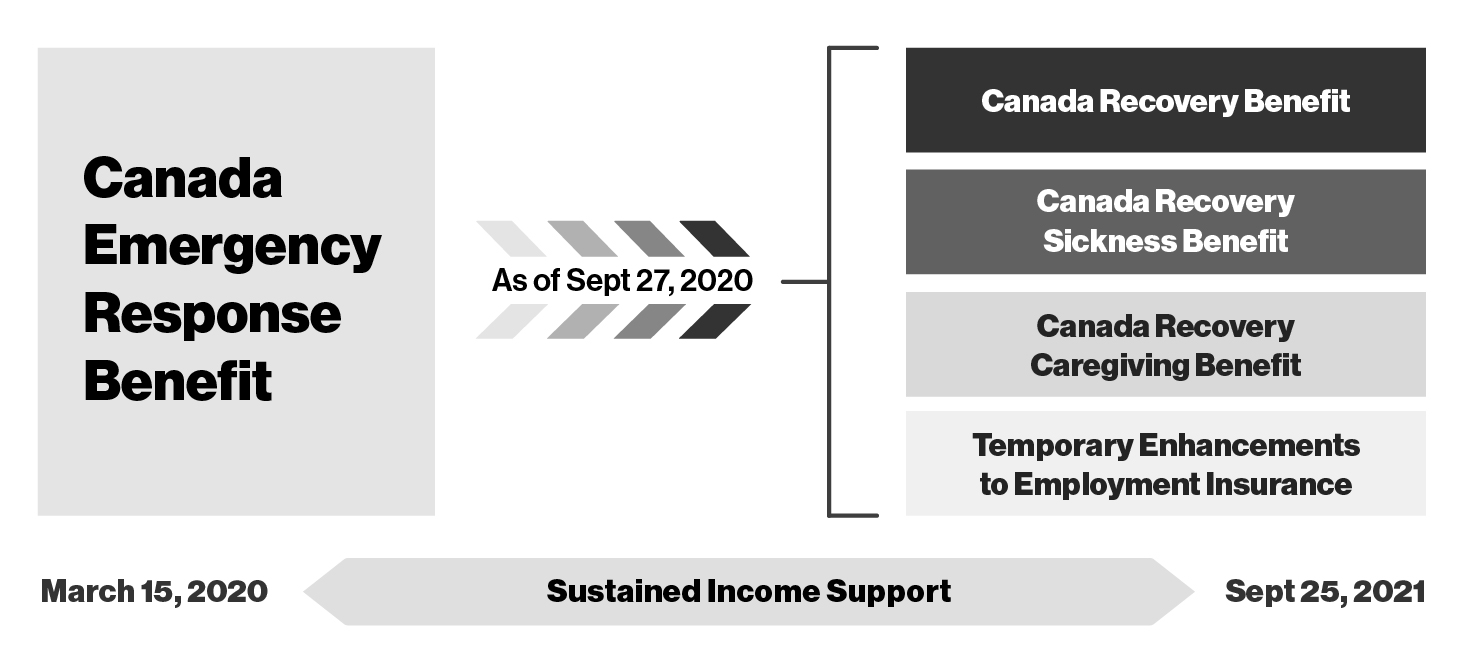

Transitioning Income Support from the CERB

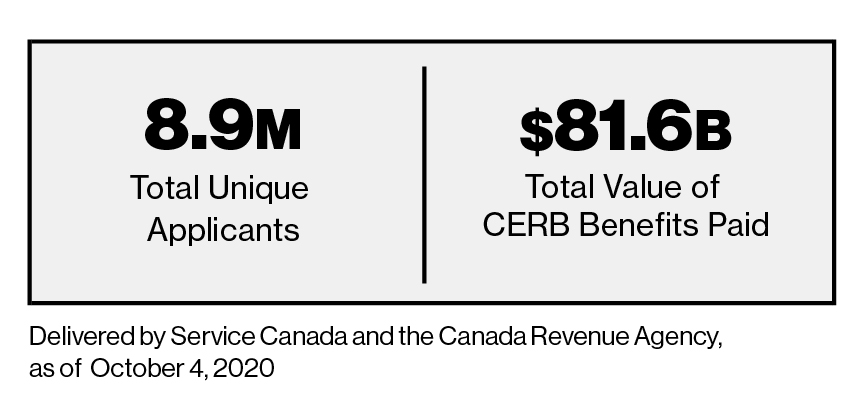

The Canada Emergency Response Benefit provided emergency income support to millions of Canadians. Since the end of the program, more than 2 million claimants have applied to the simplified Employment Insurance system, but many Canadians were still not eligible.

The government launched three new income support benefits for these workers – those who continued to be unable to work for reasons related to COVID-19 such as providing care to a relative. These temporary recovery benefits are available to self-employed Canadians and gig workers, as well as workers who have not lost their job but have seen significant income loss due to COVID-19.

- A Canada Recovery Benefit of $500 per week for up to 26 weeks is supporting Canadians who have not returned to work due to COVID-19 or whose income has dropped by at least 50 per cent.

- A Canada Recovery Sickness Benefit of $500 per week for up to two weeks is available for workers who are unable to work for at least 50 per cent of the week because they are sick or must self-isolate for reasons related to COVID-19.

- A Canada Recovery Caregiving Benefit of $500 per week for up to 26 weeks per household is available for workers unable to work for at least 50 per cent of the week because they must care for a child under the age of 12 or family member who requires supervised care.

Enhanced Employment Insurance

To ensure that Canadians have the support they need, the government announced temporary changes for one year that have made the Employment Insurance program more simple, flexible and generous, including the following:

- Canadians with 120 hours of insurable work or more can now qualify for regular and special benefits, wherever they live in Canada.

- Canadians receiving EI are now eligible for a benefit rate of at least $500 per week, or $300 per week for extended parental benefits.

- Canadians claiming EI benefits for a job loss are now eligible for at least 26 weeks of benefits.

A Plan for the Coming Months

Across Canada, COVID-19 cases continue to rise. As the crisis has evolved, so too have the government’s support measures. Canadians and Canadian businesses can rest assured that for as long as the pandemic lasts, the federal government will provide the support they need.

The Canada Emergency Wage Subsidy

Given the ferocity of the second wave and its expected economic impact, the government is proposing to increase the maximum subsidy rate to 75 per cent for the period beginning December 20, 2020 and to extend this rate until March 13, 2021.

The government proposes to extend the Canada Emergency Wage Subsidy until June 2021 – to support workers to stay connected to their jobs and help businesses remain open or re-open.

The Canada Emergency Rent Subsidy

The new Canada Emergency Rent Subsidy provides direct and easy-to-access rent and mortgage support until June 2021 for qualifying organizations affected by COVID-19. The rent subsidy will be provided directly to eligible tenants and property owners, supporting businesses, charities, and non-profits that have suffered a revenue drop. The government is proposing to extend the current subsidy rates, meaning that a maximum subsidy rate of 65 per cent will be available on eligible expenses until March 13, 2021.

Lockdown Support

Organizations that are subject to a lockdown and must shut their doors or significantly restrict their activities under a public health order can qualify for an additional 25 per cent top-up, in addition to the Canada Emergency Rent Subsidy base subsidy of up to 65 per cent. This means hard-hit businesses can receive up to 90 per cent support for rent.

The government is proposing to extend the rate of 25 per cent for the Lockdown Support until March 13, 2021.

Supporting Canadians Who Are Now Working from Home

-

Simplifying the Home Office Expense Deduction

Millions of Canadians are unexpectedly working from home because of COVID-19. While Canadians can already deduct certain home office expenses for tax purposes, to simplify the process for both taxpayers and businesses, the Canada Revenue Agency will allow eligible Canadians to claim up to $400, based on the amount of time working from home, without the need to track detailed expenses.

Support for Business

The Canada Emergency Business Account

Small businesses are the heart of our communities and employ millions of Canadians. The government has provided partially forgivable loans to help them through the pandemic, initially providing interest-free loans of up to $40,000, with $10,000 forgivable. The Canada Emergency Business Account will soon be expanded, allowing qualifying businesses to access an additional interest-free loan of $20,000, based on need. Half of this additional amount, or $10,000, would be forgivable if repaid by December 31, 2022. The Fall Economic Statement announced the extension of the application deadline to March 31, 2021.

Indigenous Community Business Fund

The government launched the Indigenous Community Business Fund to provide $117 million in non-repayable financial contributions to help support operating costs for First Nation, Inuit and Métis community- or collectively-owned businesses. The government also announced $306.8 million to help small and medium-sized Indigenous businesses, and Aboriginal Financial Institutions that offer financing to these businesses.

Regional Relief and Recovery Fund

Businesses, workers, and communities in every corner of Canada have been impacted by COVID-19. To help support those businesses unable to access other federal pandemic support programs, the government created the Regional Relief and Recovery Fund, providing significant funding through Canada’s Regional Development Agencies. Through the program the government has made $1.5 billion in support available.

To date, this program has protected over 102,000 jobs and supported over 14,700 businesses, including over 8,500 clients in rural areas and 5,100 women-owned businesses.

Proposed Investments

-

A top-up of up to $500 million, on a cash basis, to Regional Development Agencies and the Community Futures Network of Canada, bringing total funding to over $2.0 billion in this fund.

-

The government is also proposing to provide up to $3 million to the Canadian Northern Economic Development Agency for foundational economic development projects that will support small businesses growth in Canada’s territories.

Support for Highly Affected Sectors

Some businesses, particularly those in highly affected sectors, have struggled to access sufficient financing. To help address this challenge and bridge these businesses through the crisis, the government will work with financial institutions in the near term to create the Highly Affected Sectors Credit Availability Program (HASCAP) – a new program for the hardest hit businesses, including those in sectors like tourism and hospitality, hotels, arts and entertainment. This stream will offer 100 per cent government-guaranteed financing for heavily impacted businesses, and provide low-interest loans of up to $1 million over extended terms, up to ten years. Rates will be lower than those offered in the Business Credit Availability Program and beneath typical market rates for hard hit sectors.

Support for Workers in the Live Events and Arts Sectors

The COVID-19 pandemic has resulted in the near complete suspension of live events and arts presentations, affecting thousands of self-employed and freelance artists and event workers across the country. The pandemic has also resulted in the drastic reduction of advertising revenues for Canadian broadcasting companies.

The government understands that certain major live events and festivals will require unique support. The government will work with industry to prevent the closure of unique and irreplaceable flagship events and festivals across Canada, and to ensure the survival of key, globally recognized assets in this sector.

Proposed Investments

-

$181.5 million in 2021-22 to the Department of Canadian Heritage and the Canada Council for the Arts to support planning and presentation of COVID-19 safe events and the arts. This includes a one-year renewal of funding provided in Budget 2019 for the Building Communities Through Arts and Heritage program, the Canada Arts Presentation Fund and the Canada Music Fund.

-

The government will provide relief to local television and radio stations by waiving broadcasting Part II licence fees in 2020-21, which are collected annually by the Canadian Radio-television and Telecommunications Commission. This will provide up to $50 million in relief to these companies.

Support for the Air Travel Sector

The government is committed to ensuring that Canada’s air sector continues to connect Canadians and Canadian marketplaces, as part of a dynamic aerospace industry. Since the beginning of the pandemic, the government has announced $192 million to support essential air services to remote and northern communities. Overall, Canada’s air travel system directly employs over 100,000 Canadians. The government is establishing a process with major airlines regarding financial assistance. As part of this process, the government will ensure Canadians are refunded for cancelled flights.

Proposed Investments

To further support Canada’s air sector, the government proposes to:

-

provide up to $206 million over two years to support regional air transportation;

-

provide $186 million over two years to support small and regional airports in making critical investments in health and safety infrastructure;

-

provide $500 million over six years to support large airports in making critical investments in safety, security and transit infrastructure;

-

support the operations of Canada’s major airports by extending $229 million in additional rent relief to 21 airport authorities, with comparable treatment for Ports Toronto, which operates Billy Bishop Toronto City Airport; and

-

provide $65 million in additional financial support to airport authorities.

More Information

Report a problem on this page

- Date modified: