Archived - A prudent fiscal plan

Bridging Canadians through the crisis while preserving Canada’s fiscal advantage.

Canada entered this crisis in a strong fiscal position, allowing the government to take decisive action to put in place the support necessary for people and businesses to weather the storm. The economic shock of COVID-19 is unlike any previous economic crisis. It is the result of a public health emergency that changed our lives overnight. The pandemic has imposed great hardship on Canadians, and has laid bare and even exacerbated inequities that have made certain groups more vulnerable to economic challenges. It is incumbent upon governments to step in with significant support. Canadians should not have to take on debt that their government can better shoulder. That’s what the Government of Canada has done since the beginning.

Bridging Canadians through the Crisis

The federal government has provided more than 8 out of every 10 dollars spent in Canada to fight COVID-19 and support Canadians. By providing Canadian businesses and families with a financial lifeline to pull them through the crisis, the government is helping Canada avoid an even deeper downturn: one that could bring widespread business and personal bankruptcies, and negatively impact generations of Canadians.

Government Support has Prevented Worse Outcomes

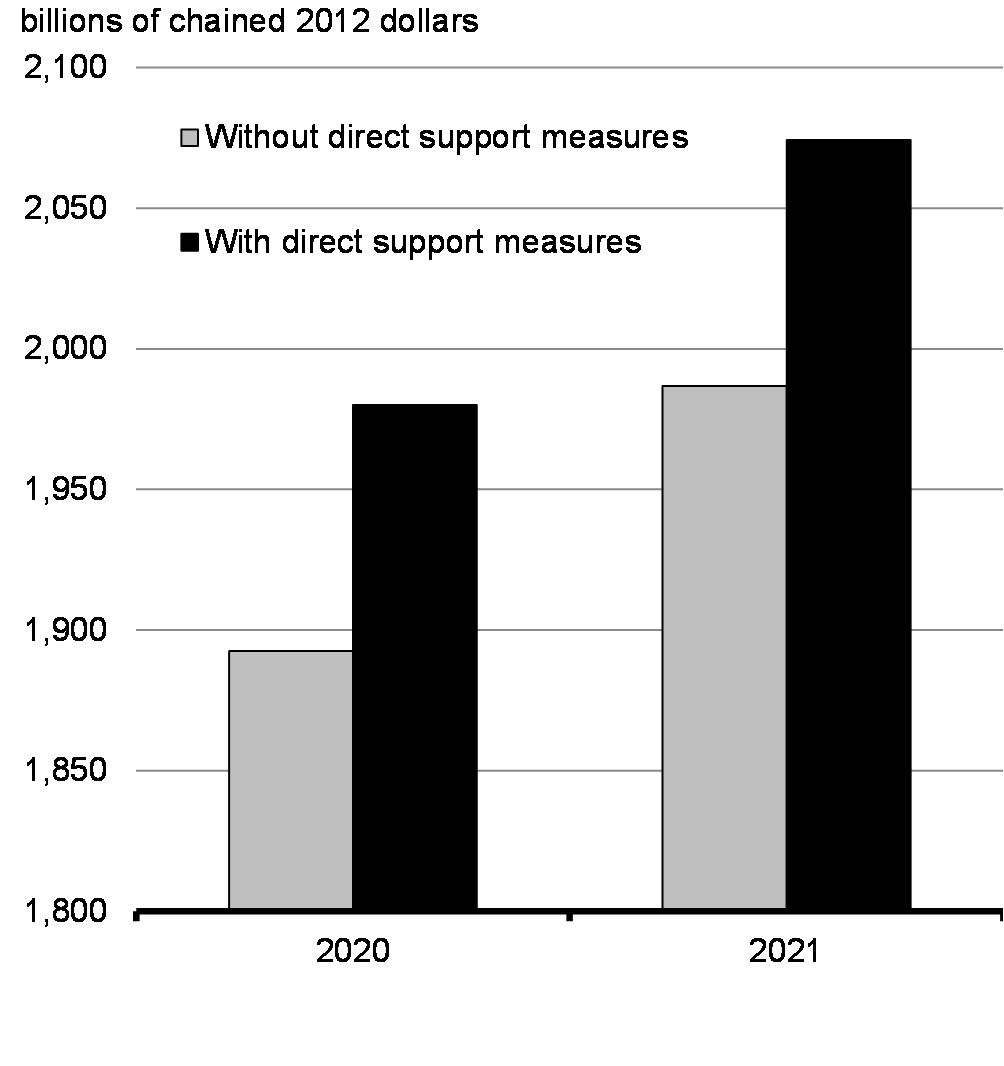

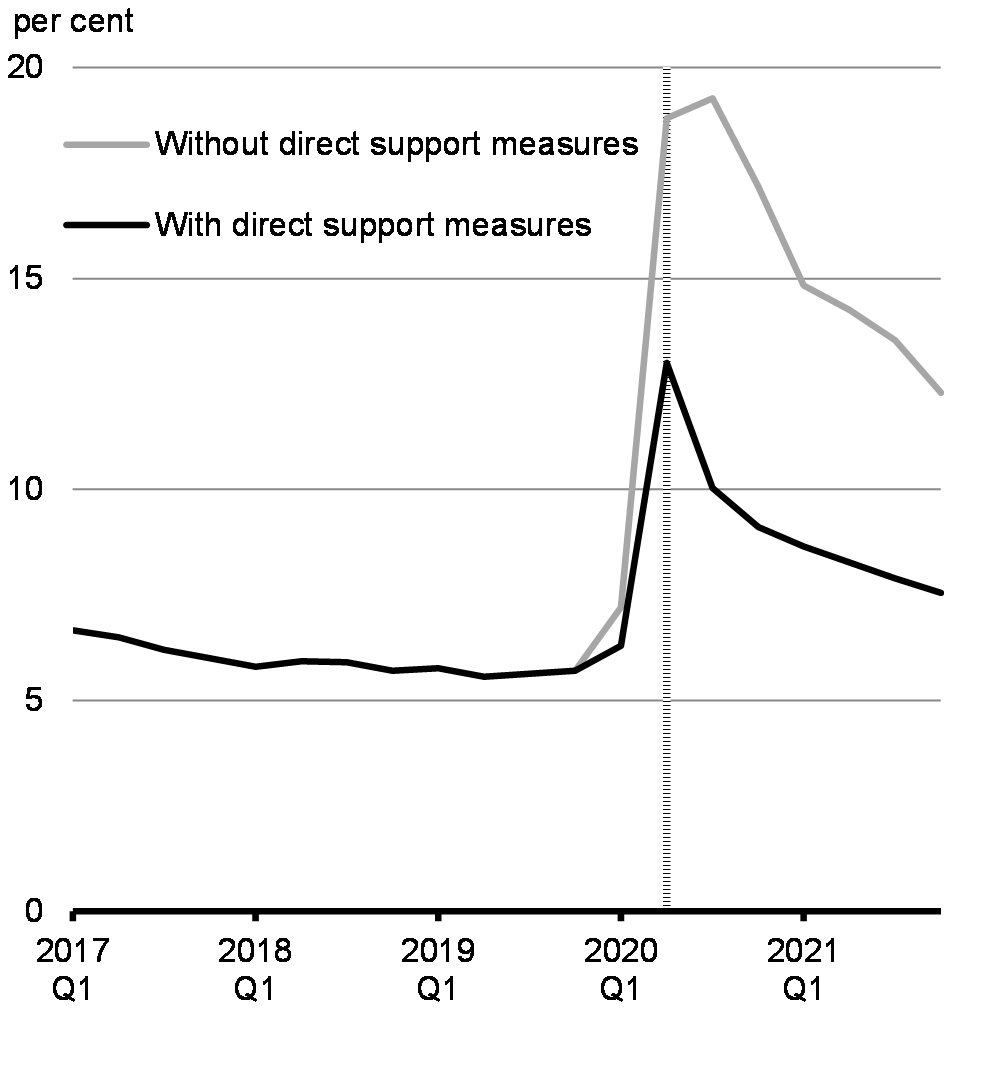

These measures offset about half of the negative economic effects of the pandemic on the unemployment rate by the second quarter, and about a quarter of the negative effects on real gross domestic product (GDP). The swift, decisive and substantial support provided by the federal government has worked to protect Canadians’ health, Canadians’ jobs and Canadians’ businesses, positioning Canada’s economy for a robust and lasting recovery once the virus is conquered. Government support will help lay the foundation for the economic recovery.

The Plan for a Robust and Resilient Recovery

-

The government will work with Canadians over the coming months to design a stimulus recovery plan that will invest to build a stronger, more inclusive and more resilient economy, setting aside between 3 and 4 per cent of GDP – up to $100 billion – over the next three years. Stimulus will focus on investments capable of both having a real, tangible impact on jobs and demand in the short term, while also strengthening Canada’s competitiveness and productivity in the longer term.

-

The government will draw upon lessons learned from the 2008-09 financial crisis and during recoveries from earlier deep recessions suggesting that economies that withdrew fiscal support too quickly experienced slower growth afterwards. Canada will follow the advice of the International Monetary Fund and Organisation for Economic Co-operation and Development (OECD) who have urged governments to maintain substantial fiscal support through the crisis and over the recovery phase.

Fiscal Guardrails

Fiscal guardrails will help establish when recovery stimulus will be wound down. Uncertainties about the timing of the pandemic and global economic developments mean that the timeline for the recovery should not be locked into a rigid pre-determined calendar. Instead, the government will track progress against several related indicators, recognizing that no one data point is a perfect representation of the health of the economy. These indicators include the employment rate, total hours worked and the level of unemployment in the economy. An approach which is guided by economic data will help ensure the recovery is appropriately tailored to the needs of Canadians and the circumstances at hand. These data-driven triggers will let us know when the job of building back from the COVID-19 recession is accomplished, and we can bring one-off stimulus spending to an end, returning to a prudent and responsible fiscal path, based on a long-term fiscal anchor we will outline when the economy is more stable.

The COVID-19 Recession: A Unique Economic Challenge

The economic shock of COVID-19 is unlike any previous economic crisis. It is the result of a public health emergency that changed our lives overnight. The speed, scale and breadth of the contraction in economic activity during the COVID-19 crisis are unmatched by anything we have seen since the Great Depression. Nearly all sectors of the Canadian economy saw historic declines pushing overall GDP to its deepest fall in 90 years. The economic shock has been both unusually deep and incredibly fast. More jobs were lost from mid-March to late April than were created since the end of the 2008 recession.

Preserving Canada’s Fiscal Advantage

Canada’s Economy is Showing Resilience

Economic Developments since the Summer

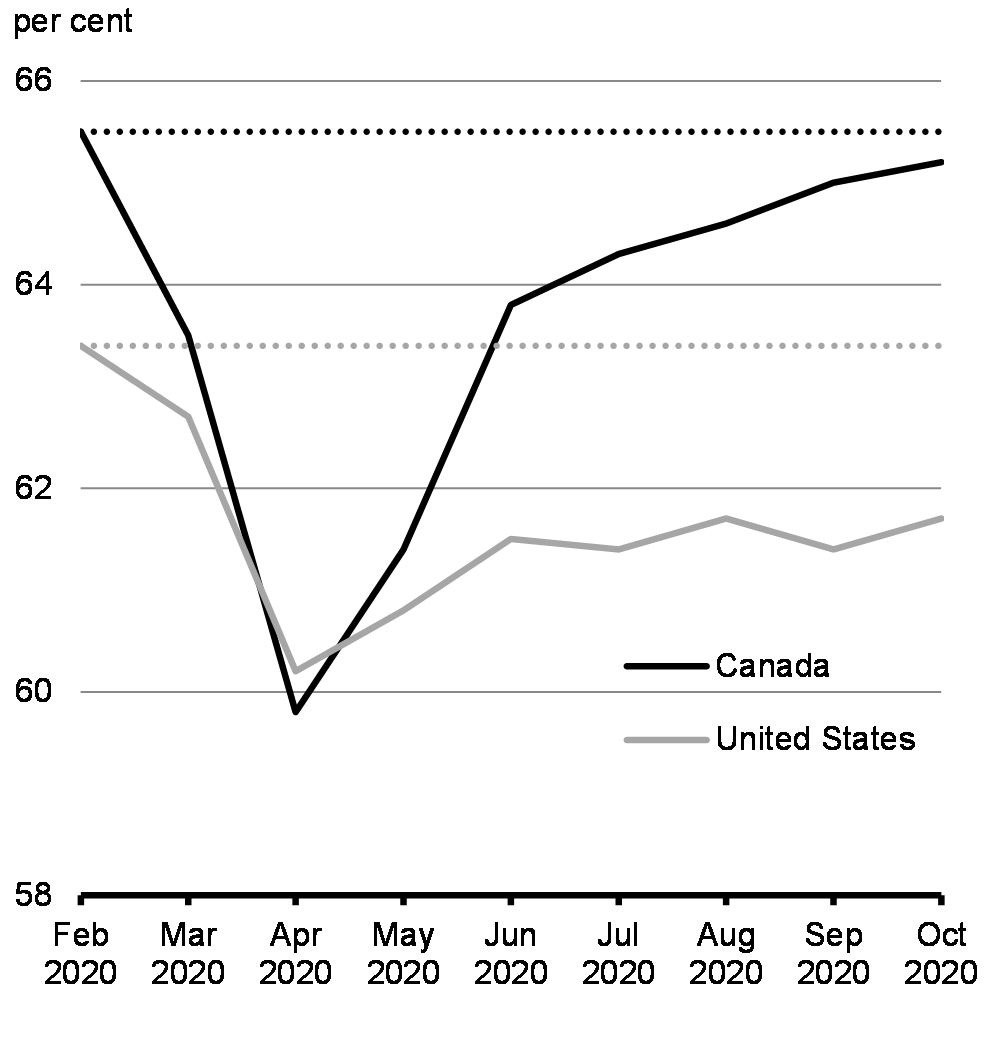

Canada has experienced a faster and stronger rebound than originally forecast in the Economic and Fiscal Snapshot in July, and a job recovery that has been faster and stronger than that of the United States. Canada has recovered almost eight in ten of the lost jobs compared to just over half in the United States.

Downside Risks of a Resurgent Virus

While this indicates a continuing economic rebound over the forecast horizon, this outlook is consistent with relatively low levels of ongoing community transmission of the virus. In recognition of the unique and evolving global economic situation, the Department of Finance Canada analyzed alternative scenarios in the event of a more severe resurgence of the virus and its effect on the Canadian economy and public finances. This analysis suggests downside risks to the near-term outlook, with the recovery slowing in the final quarter of 2020 and even possibly declining heading into 2021, reducing the projected rebound in 2021 to an increase of between 2.9 to 4.1 per cent compared to the 4.8 per cent increase expected in the September survey.

Canada’s Debt is Affordable

Historically Low Public Debt Charges

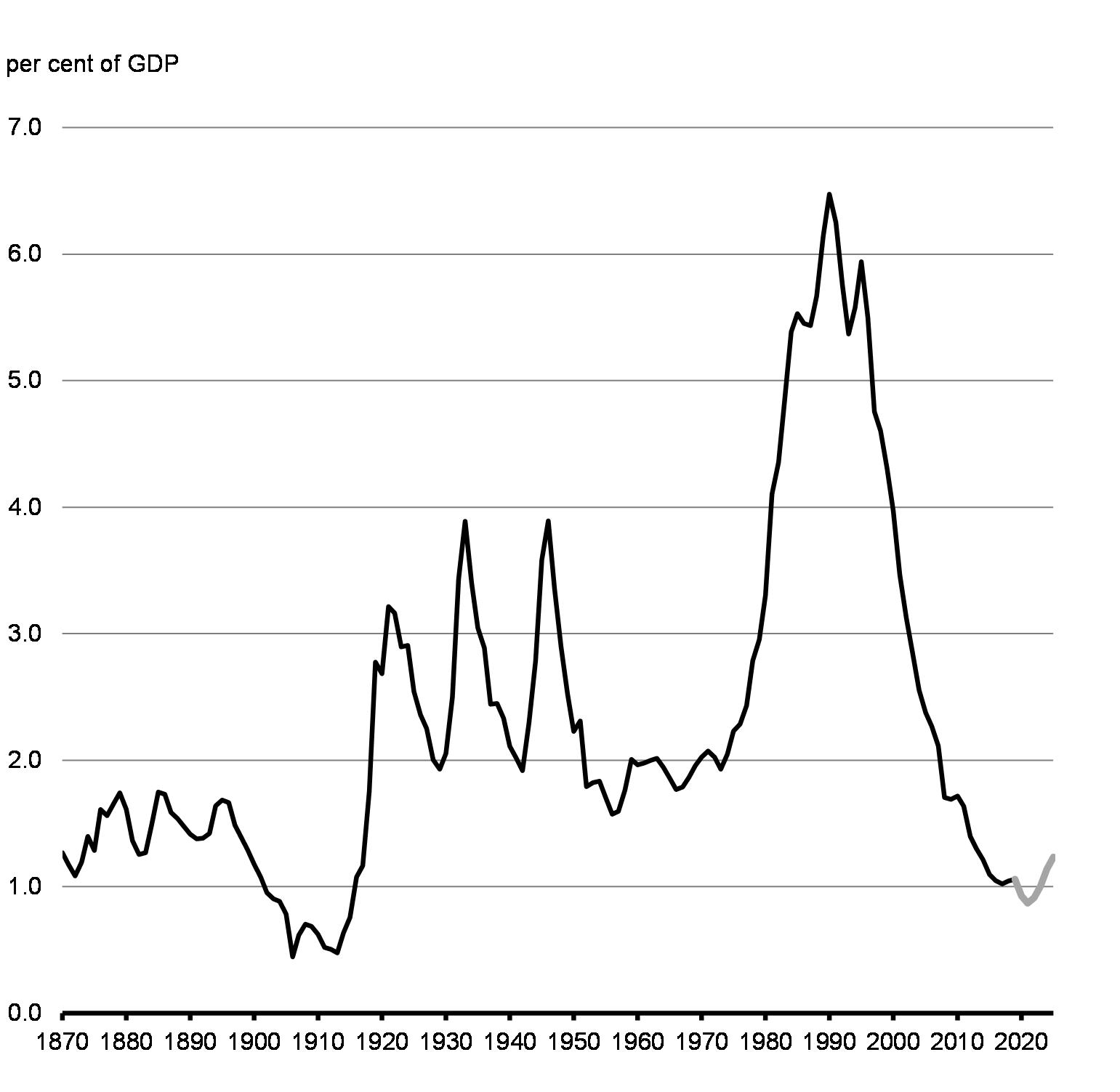

While the federal debt will be significantly higher than in recent years, this is not the 1990s when it was at its historic peak. Debt-servicing costs exceeded 6 per cent of GDP at that time – compared to under 1 per cent of GDP in 2020-21, the lowest level in over a century. The government is taking advantage of these historically low rates to lock in debt at affordable rates for decades to come.

Highlights of Fiscal Outlook

-

Including additional measures announced in this Statement and since the July Snapshot, the deficit is projected to reach $381.6 billion in 2020-21.

-

To ensure a robust and resilient recovery, the government is developing the details of a plan to help Canada build back better, by preparing to invest up to between $70 billion and $100 billion over the next three fiscal years – roughly valued at between 3 to 4 per cent of GDP. A package of this size would be broadly comparable to those planned so far by international peers.

A Tax System for the Digital Economy

Under current rules, foreign-based digital businesses can sell their goods and services to Canadians without charging the Goods and Services Tax/Harmonized Sales Tax (GST/HST), which puts the burden on Canadian consumers to remit the sales tax. This gives foreign-based digital corporations an unfair advantage, and undercuts the competitiveness of Canadian companies. It also deprives the government of tax revenues that could be used to better the lives of everyone.

The government proposes a number of changes to level the playing field.

Proposed Measures

-

To ensure fair taxation of cross-border digital products and services, the government proposes that foreign-based vendors selling digital products or services to consumers in Canada be required to register for, collect and remit the GST/HST on their taxable sales to Canadian consumers, effective July 1, 2021.

-

To ensure fair taxation of goods supplied through fulfillment warehouses, the government proposes to apply the GST/HST on all sales to Canadians of goods that are located in Canadian fulfillment warehouses, effective July 1, 2021.

-

To ensure fairness across the accommodation sector, the government proposes applying the GST/HST to all platform-based short-term rental accommodation supplied in Canada, effective July 1, 2021.

International Corporate Tax and Digitalization

Corporations in all sectors, including digital corporations, must pay their fair share of taxes in Canada. Canada has been working with our international partners in a process led by the OECD, with a view to developing a coordinated approach by mid-2021. The government remains committed to a multilateral solution, but is concerned about the delay in arriving at consensus. The government therefore proposes to implement a tax on corporations providing digital services, with effect from January 1, 2022, which would apply until such time as an acceptable common approach comes into effect.

Improving Tax Fairness

Canada’s well-funded public services have been critical to protecting the well-being of all Canadians. With Fall Economic Statement 2020, the government is setting out its next steps to make sure the wealthy pay their fair share and everyone gets a fair deal.

Proposed New Actions

-

Employee Stock Options

The government is proposing changes to limit the employee stock option deduction for high-income Canadians who work in large, established companies. The proposed approach will make the employee stock option tax regime fairer and more equitable for Canadians while ensuring that start-ups and emerging Canadian businesses that are creating jobs can continue to grow and expand.

-

Taxing the Unproductive Use of Canadian Residential Real Estate by Foreign Non-Resident Owners

Speculative demand from foreign non-resident investors is contributing to higher housing prices, making it difficult for many Canadians to buy their first home. Over the coming year, the government will take steps to implement a national, tax-based measure targeting the underuse of domestic housing that is owned by non-resident, non-Canadians whose ownership acts to remove these assets from the domestic housing supply.

More Information

Report a problem on this page

- Date modified: