Archived - Chapter 8:

Safe and Inclusive Communities

Now more than ever, we need to stand up in support of Canadian values and ideals. We need to stand up for diversity and multiculturalism and ensure we are building a truly inclusive society. We need to promote Canadian stories and Canadian story-telling, including through our arts and culture sector and the talented people who work in it.

We need to continue to tackle the systemic discrimination and racism which is still a lived reality for too many Canadians. We need to continue taking steps to make our communities safer for everyone.

Budget 2022 includes important measures to effect needed and positive change and to continue to promote the values that have made Canada the diverse and prosperous country that it is today.

Key Ongoing Actions

Budget 2022 builds on recent steps that the federal government has taken to ensure opportunities for all Canadians to thrive, to protect our communities, and to support the recovery of our arts and culture sector. These include:

-

$601.3 million over five years to advance a new National Action Plan to End Gender-Based Violence;

-

Banning assault-style firearms and investing more than $920 million to protect Canadians from gun violence;

-

$200 million to establish the Black-led Philanthropic Endowment Fund, which will create a sustainable source of funding to support Black communities;

-

Creating the Black Entrepreneurship Program—a partnership between the government, Black-led business organizations, and financial institutions—with an investment of up to $265 million over four years;

-

$141.1 million to make federal disability programs, child care centres, communities, and workplaces more accessible;

-

$500 million for the recovery of the arts, culture, heritage, and sports sectors, and to support community-level festivals and other in-person cultural events;

-

$15 million over three years to establish the new LGBTQ2 Projects Fund;

-

$172 million over five years to enhance our ability to collect disaggregated data, especially on diverse populations, to bring more equity, fairness, and inclusion into federal government decision making; and

-

$408.3 million to promote official languages and support the modernization of the Official Languages Act, as introduced on March 1, 2022 by the Government of Canada, in order to achieve the substantive equality of Canada’s official languages, including improvements designed to meet the challenges facing official language minority communities.

8.1 A Diverse and Inclusive Canada

For generations, newcomers from around the world have helped build a Canada that is as vibrant and prosperous as it is today.

In Canada, diversity is a fact, but inclusion is a choice—and there is still work to be done to make Canada a country that is truly equal for everyone. The past two years, in particular, have reminded us of the systemic barriers and vulnerabilities faced by Black and racialized Canadians, Indigenous peoples, persons with disabilities, women, seniors, and LGBTQ2 Canadians.

Budget 2022 introduces new measures to promote a more equitable, more inclusive Canada, and to build communities where everyone is empowered to succeed.

A Federal LGBTQ2 Action Plan View the impact assessment

While Canada has made significant progress since same-sex marriage was legalized in 2005, many LGBTQ2 Canadians still face discrimination on the basis of their sexual orientation, gender identity, or gender expression, which continues to result in persistent health, social, and economic inequities.

-

Budget 2022 proposes to provide $100 million over five years, starting in 2022-23, to support the implementation of the forthcoming Federal LGBTQ2 Action Plan, which will support a fairer and more equal Canada for LGBTQ2 Canadians.

Fighting Systemic Racism, Discrimination, and Hate View the impact assessment

Racism has no place in Canada. Our society and our economy are made stronger every day by Canada’s remarkable cultural, linguistic, and ethnic diversity. While as a country we have made real progress, racism continues to be an everyday experience for many Canadians, as evidenced by a sharp rise in anti-Asian racism, anti-Black racism, anti-Semitic hate, and a number of horrific Islamophobic attacks in recent years.

In 2019, the federal government launched an Anti-Racism Strategy to fund important community projects, to promote understanding across Canada, and to reduce the incidence of racism and discrimination.

-

Recognizing that Canada’s fight against racism is far from over, Budget 2022 proposes to provide $85 million over four years, starting in 2022-23, to the Department of Canadian Heritage to support the work underway to launch a new Anti-Racism Strategy and National Action Plan on Combatting Hate. This funding will support community projects that ensure that Black and racialized Canadians, and religious minorities have access to resources that support their full participation in the Canadian economy, while also raising awareness of issues related to racism and hate in Canada.

-

To push back against religious discrimination, hateful rhetoric and racism at home and abroad, Budget 2022 proposes to provide $11.2 million over five years, starting in 2022-23, with $2.4 million ongoing, to the Department of Canadian Heritage and Global Affairs Canada as follows:

- $5.6 million over five years, with $1.2 million ongoing to support the Special Envoy on Preserving Holocaust Remembrance and Combatting Antisemitism.

- $5.6 million over five years, with $1.2 million ongoing to support the new Special Representative on Combatting Islamophobia.

To keep alive the memory of those murdered during the Holocaust and combat both historical distortions and Holocaust denial:

-

Budget 2022 proposes to provide $20 million in 2022-23 to the Department of Canadian Heritage to support the construction of the new Holocaust Museum in Montréal; and an investment of $2.5 million for the Sarah and Chaim Neuberger Holocaust Education Centre, as has been approved through the Canada Cultural Spaces Fund and Museum Assistance Program.

This funding builds on important investments made since 2015 to fight racism in Canada. This includes initiatives supported as part of the Anti-Racism Strategy and investments announced in Budget 2021 to support the Canadian Race Relations Foundation and communities at risk of hate-motivated crimes. Previous investments have also enhanced community support for Black Canadian youth and expanded research to develop more culturally focused mental health programs and care. The government remains committed to working with local faith based and cultural communities to advance important projects.

Supporting Black Canadian Communities View the impact assessment

Data continues to show that Black Canadians face more precarious employment, and an unjust prevalence of low-income households as a result of anti-Black racism that has a detrimental impact on the socio-economic well-being of many Black Canadians. The federal government is committed to continue closing the systemic inequities faced by Black Canadian communities.

-

Budget 2022 proposes to provide $50 million over two years, starting in 2022-23, to Employment and Social Development Canada for the Supporting Black Canadian Communities Initiative, to continue empowering Black-led and Black-serving community organizations and the work they do to promote inclusiveness.

-

The Minister of Families, Children and Social Development will explore further options to continue supporting capacity building within Black-led and Black-serving community organizations in the long term.

Federal Funding for the Jean Augustine Chair in Education, Community and Diaspora

In 1993, the Honourable Jean Augustine made history as the first Black Canadian woman to be elected to the House of Commons and later became the first Black Canadian to be appointed to the Federal Cabinet. Ms. Augustine has also had a distinguished career as a social justice activist and educator. The Jean Augustine Chair in Education, Community and Diaspora, housed at York University, is focused on addressing the systemic barriers and racial inequalities in the Canadian education system to improve educational outcomes for Black students.

-

Budget 2022 proposes to provide $1.5 million in 2022-23 to the Department of Canadian Heritage for a federal contribution towards an endowment which would support the ongoing activities of the Jean Augustine Chair in Education, Community and Diaspora.

Supporting the Muslims in Canada Archive

For too long, Muslim communities in Canada have had their representations, stories, and identities publicly shaped by predominantly non-Muslim media sources. These depictions are often burdened by narratives of terrorism, war, violence, Islamophobia, and extremism.

The Muslims in Canada Archive, a collaborative initiative of the Institute of Islamic Studies at the University of Toronto, provides an opportunity to reshape these narratives and provide Canada’s robust and diverse Muslim community a chance to tell their own stories in their own words.

-

Budget 2022 proposes to provide $4 million in 2022-23 to the Department of Canadian Heritage to help support the Muslims in Canada Archive. This funding will allow the Archive to continue its work with national archival and Muslim community organizations to acquire, organize, preserve, and make accessible records of and about Muslim people and organizations in Canada.

Building the Jewish Community Centre of Greater Vancouver

For generations, the Jewish Community Centre of Greater Vancouver has provided leadership in cultural, recreational, educational, and social activities to families from all backgrounds. Today, the existing facilities are aging and the centre’s services are over-subscribed. A significant redevelopment project is planned, which will see a modernized community centre that will serve diverse communities with new arts, culture, seniors, and recreational facilities. The project will also make a significant contribution to addressing affordability in Vancouver through the creation of hundreds of new affordable rental housing units and child care spaces. The government intends to announce funding for the Jewish Community Centre of Greater Vancouver in the future.

Ensuring Fair Compensation for News Media in the Digital News Ecosystem

Accurate, diverse, and relevant news contributes to a thriving and functioning democracy in Canada. As readers change habits and get increasingly more of their information online, it is important that news media continue to be independent and reliable. In order for that to happen, news media businesses must be able to receive fair compensation when their content is shared online.

-

Budget 2022 proposes to provide $8.5 million over two years, starting in 2022-23, to the Canadian Radio-television and Telecommunications Commission to establish a new legislative and regulatory regime to require digital platforms that generate revenues from the publication of news content to share a portion of their revenues with Canadian news outlets.

Supporting Local and Diverse Journalism

The diversity of media and news stories in Canada should reflect the diversity of Canadians. As digital technologies have fundamentally restructured the economic foundations of the news media sector—both decreasing access and diversity of perspectives—it is important, now more than ever, for Canadians to have reliable information from and about their own communities.

-

To support diverse and local stories in news media, Budget 2022 proposes to provide $15 million in 2023-24 to Canadian Heritage as follows:

- $10 million in 2023-24 for the Local Journalism Initiative to continue to support the production of local journalism for underserved communities across Canada.

- $5 million in 2023-24 to launch a new Changing Narratives Fund to break down systemic barriers in the media and cultural sectors and help racialized and religious minority journalists, creators, and organizations have their experiences and perspectives better represented.

-

Budget 2022 also proposes to provide $40 million over three years, starting in 2022-23, to Canadian Heritage for the Canada Periodical Fund to support the availability of journalistic content and to help these publications adapt to the continually evolving technology and media consumption habits of Canadians.

Creating a Safer Sport System View the impact assessment

Canada’s high performance athletes should feel safe in an environment that is free from abuse, harassment, and discrimination. However, many Canadian athletes have brought forward evidence of unsafe environments in competitive sports.

-

Budget 2022 proposes to provide $16 million over three years, starting in 2022-23, to the Department of Canadian Heritage, to support actions to create a safer sport system. This will include funding for the Sport Dispute Resolution Centre of Canada for the implementation of the new Independent Safe Sport Mechanism, and funding to ensure national sport policies and practices reduce the risk of harassment, abuse, and discrimination and create a safer and more inclusive sport system.

Supporting Special Olympics Canada View the impact assessment

Special Olympics is a global movement that provides programs and competition opportunities to enrich the lives of millions of people with intellectual disabilities around the world through sport—including in communities across Canada.

-

Budget 2022 proposes to provide $1.8 million in ongoing funding, starting in 2022-23, as an extension to the $16 million investment in Special Olympics Canada through Budget 2018. This funding will support more than 45,000 children, youth, and adults through its strong network of 21,000 volunteers.

Supporting Our Seniors View the impact assessment

Canada owes our seniors a great deal and the federal government plays the leading role in providing seniors with much-needed income support.

The Old Age Security (OAS) program—consisting of the OAS pension, the Guaranteed Income Supplement (GIS), and the Allowances—is Canada’s largest non-pandemic federal program and it is forecasted to provide $68.2 billion in support to seniors in 2022-23, growing to $87.2 billion in 2026-27. As of February 2022, there were close to 6.9 million OAS recipients, including 2.2 million GIS recipients, plus about 72,000 Allowance recipients.

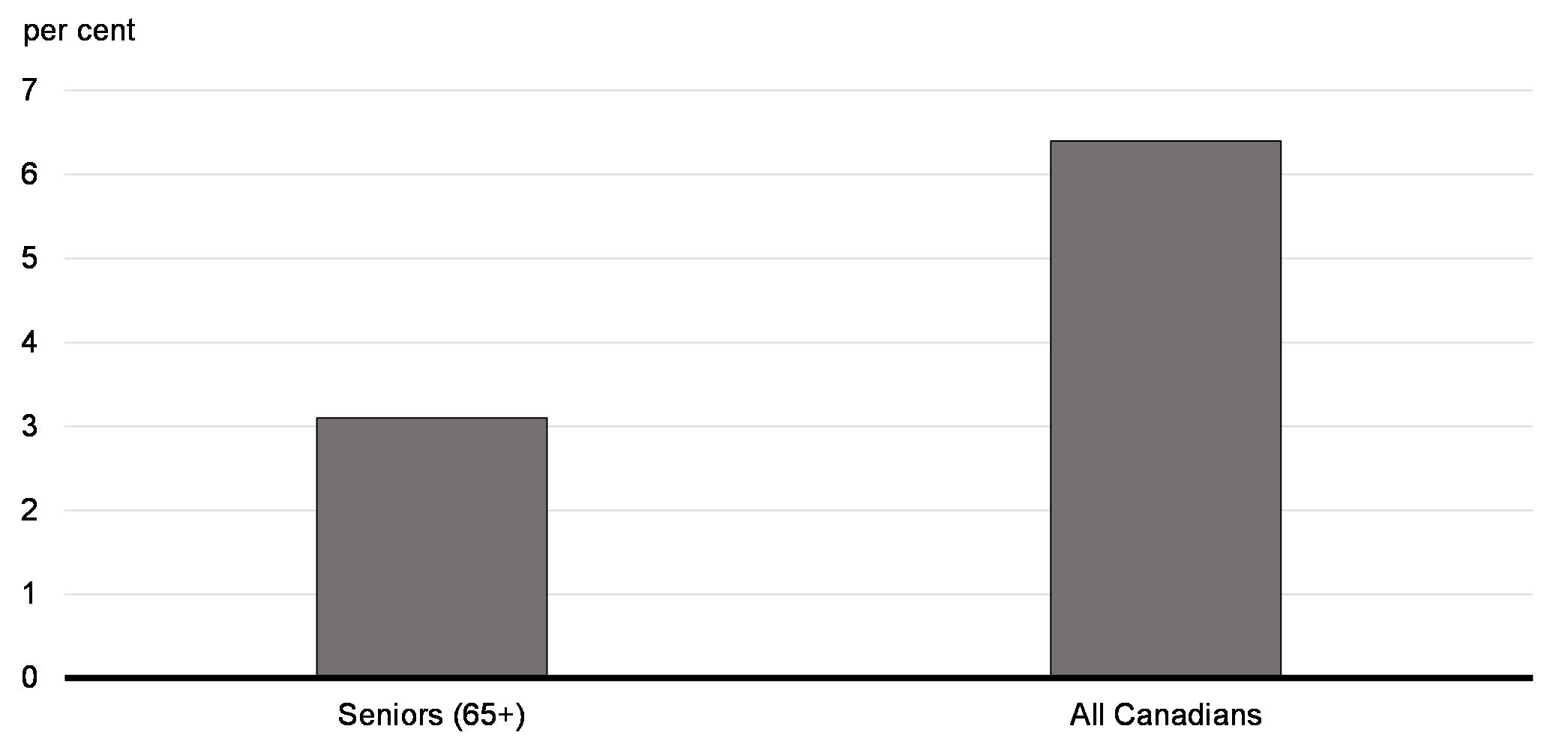

With OAS and GIS benefits indexed quarterly to the Consumer Price Index, seniors do not have to worry about the value of their benefits keeping pace with inflation, and the level and indexation of these benefits means that the share of seniors in poverty is only about half that of the overall population.

Percentage of Persons in Poverty

Since 2016, the federal government has taken significant action to further support our seniors. This has included:

-

A ten per cent increase to the maximum GIS benefit for single seniors;

-

Reversing the announced increase to the eligibility age for OAS and GIS back to age 65 from 67; and

-

Beginning this July, a ten per cent increase to the OAS pension for seniors age 75 and over, which will provide additional benefits of over $766 to full pensioners in the first year.

Many seniors prefer to stay in their own homes for as long possible. The federal government provides significant support for aging in place, including, as of 2017, through $6 billion over ten years to provinces and territories for the delivery of home care services.

Seniors also want to stay active and engaged in their communities as they age, and the New Horizons for Seniors Program—which has supported more than 33,500 projects in hundreds of communities across Canada since 2004—helps them do so.

As the government assesses any further increase to the GIS, Budget 2022 seeks to expand on the important programs above, and to continue to support the quality of life for our seniors as they age.

-

Budget 2022 proposes the creation of an expert panel to study the idea of an Aging at Home Benefit. The panel will report to the Minister of Seniors and the Minister of Health. More details will be provided in the months to come.

-

Budget 2022 proposes $20 million over two years, beginning in 2022-23, for an expanded New Horizons for Seniors Program to support more projects that improve the quality of life for seniors and help them continue to fully participate in their communities.

Doubling the Home Accessibility Tax Credit

Seniors and persons with disabilities deserve the opportunity to live and age at home, but renovations and upgrades that make homes safe and accessible can be costly. The Home Accessibility Tax Credit provides support to offset some of these costs. But with the increased costs of home renovations, many seniors and persons with disabilities are often finding it hard to afford the home improvements that would allow them to continue living safely at home.

-

Budget 2022 proposes to double the qualifying expense limit of the Home Accessibility Tax Credit to $20,000 for the 2022 and subsequent tax years. This will mean a tax credit of up to $3,000—an increase from the previous tax credit of up to $1,500—for important accessibility renovations or alterations.

Doubling the credit’s annual limit will help make more significant alterations and renovations more affordable, including:

- The purchase and installation of wheelchair ramps, walk-in bathtubs, and wheel-in showers;

- Widening doorways and hallways to allow for the passage of a wheelchair or walker;

- Building a bedroom or a bathroom to permit first-floor occupancy; and

- Installing non-slip flooring to help avoid falls.

National School Food Policy

Ensuring that the most vulnerable children have the healthy, nutritious food they need to grow and learn is vitally important. However, nearly two million children in Canada are at risk of going to school hungry on any given day.

-

Over the next year, the Minister of Agriculture and Agri-Food and the Minister of Families, Children and Social Development will work with provinces, territories, municipalities, Indigenous partners, and stakeholders to develop a National School Food Policy and to explore how more Canadian children can receive nutritious food at school.

Support for Workers Experiencing Miscarriage or Stillbirth View the impact assessment

A miscarriage or stillbirth is a profoundly tragic event in someone’s life, and can cause physical and psychological trauma.

In 2021, the federal government took steps to support federally regulated employees who experience pregnancy loss by introducing new bereavement leave provisions under the Canada Labour Code. These provisions provide up to eight weeks of unpaid leave for employees who lose a child or experience a stillbirth. The first three days will be paid for employees who have completed three months of continuous employment.

-

The government intends to introduce legislative amendments to the Canada Labour Code in the coming year to provide additional support to federally regulated employees who experience a miscarriage or stillbirth.

8.2 Keeping Canadians Safe

Canadians should always feel secure in their homes and communities, but gun violence can threaten the safety of Canadians in too many towns and cities across the country.

Budget 2022 reaffirms the federal government’s commitment to tackle gun violence in Canada by ensuring that assault-style weapons are no longer in our communities. It also announces new funding to better prepare Canada for emergency events, address gender-based violence in partnership with provinces and territories, and ensure that our courts are able to provide the timely access to justice that Canadians deserve.

Developing a Buy-Back Program for Assault Weapons

Gun violence continues to pose a very real threat in communities across Canada, particularly to women and girls.

Since 2016, the federal government has invested more than $920 million to address gun violence and keep guns out of the hands of gangs and criminals. These investments are supporting work with provinces and territories to deliver gun and gang violence prevention and intervention initiatives; increase law enforcement and prosecution capacity; and crack down on gun smuggling at our border. On May 1, 2020, the government announced a ban on more than 1,500 models and variants of assault-style firearms. The government will implement a mandatory buy-back program to ensure these weapons are safely removed from our communities, for good.

Working with Provinces and Territories to Advance the National Action Plan to End Gender-Based Violence View the impact assessment

The government is committed to working with provinces and territories, as well as stakeholders and Indigenous partners, to prevent and address gender- based violence in Canada. Building on investments to date—including over $600 million over five years provided through Budget 2021—the government is now moving forward with provinces and territories to ensure a coordinated, national response to end gender-based violence across Canada.

-

Budget 2022 proposes to provide $539.3 million over five years, starting in 2022-23, to Women and Gender Equality Canada to enable provinces and territories to supplement and enhance services and supports within their jurisdictions to prevent gender-based violence and support survivors.

This investment will support provinces and territories in their efforts to implement the forthcoming National Action Plan to End Gender-Based Violence. Further details on the National Action Plan will be provided in the months ahead.

Preparing for Emergencies

Recent events, like the COVID-19 pandemic and the devastating wildfires and flooding in British Columbia, have reminded us of the importance of Canada being prepared for any emergency when lives and communities are at stake.

-

Budget 2022 proposes to provide $24.7 million over five years, starting in 2022-23, with $0.3 million in remaining amortization, and $5.4 million ongoing for the Privy Council Office to establish a secretariat to support the Minister of Emergency Preparedness and to enhance federal coordination of emergency responses.

Supporting Recovery and Completing the Rail Bypass in Lac-Mégantic

In July 2013, a train carrying crude oil derailed, causing 47 fatalities in Lac-Mégantic, Quebec. To support the community’s recovery from this tragedy, in February 2014 the federal government committed to share the costs with the Government of Quebec for response, recovery, and decontamination efforts, and to date, the federal government has provided $120 million to support that vitally important work.

In 2018, the Governments of Canada and Quebec also committed to build a bypass to divert rail traffic around the town. Since then, significant progress has been made to move the project forward. The federal government remains committed to completing the bypass in partnership with the Government of Quebec, with both parties providing their fair share of funding to realize the project.

-

Budget 2022 proposes to provide $13.2 million in 2022-23 to Public Safety Canada for the final federal payment through the Lac-Mégantic Contribution Program.

-

Budget 2022 also proposes to provide $237.2 million over five years, starting in 2022-23, to Transport Canada to complete the construction of the Lac-Mégantic rail bypass. The federal government will continue to advance elements of the project while a cost-sharing agreement with the Government of Quebec is reached.

These investments will help the community to rebuild and recover from this tragic incident.

Increasing the Capacity of Superior Courts View the impact assessment

Superior court delays can impede Canadians’ access to justice and prevent timely resolutions. To address and prevent delays, the government is committed to both creating new judicial positions and to increasing the capacity of our superior courts.

-

Budget 2022 proposes to amend the Judges Act, the Federal Courts Act, and the Tax Court of Canada Act to add 24 new superior court positions, including new Associate Chief Justices for the Court of Queen’s Bench for Saskatchewan and for the Court of Queen’s Bench for New Brunswick. This will mean more opportunities to appoint diverse candidates who can better represent the communities they serve.

-

Budget 2022 also proposes to provide $83.8 million over five years, starting in 2022-23, and $17.8 million ongoing, for these 24 additional superior court positions.

Enhancing Legal Aid for Those Who Need It Most View the impact assessment

All Canadians should have access to a fair justice process. The federal government helps fund criminal legal aid services, in partnership with provinces and territories, to support access to justice for Canadians who are unable to pay for legal support. In Canada, Indigenous peoples, Black and racialized Canadians, and those with mental health issues disproportionately go before criminal courts. In order to ensure that no one is disadvantaged before the courts and that every Canadian receives a fair hearing, more support is needed.

-

Budget 2022 proposes to provide $60 million in 2023-24 to increase the federal contribution to criminal legal aid services.

8.3 Supporting Artists and Charities in Our Communities

Growing and vibrant communities help make Canada the best place in the world to live, work, and raise a family.

The past two years have reminded us that we are all better off when we look out for each other. Budget 2022 will make it easier for Canada’s charities to do their important work and ensure that Canadians—and people around the world—can benefit from their generosity.

As we come through the pandemic and Canadians get back on their feet, our performing arts sector is continuing to feel the impact of the closures and capacity limits of the past two years. Budget 2022 will continue to support the recovery of the performing arts sector that brings Canadians together.

Supporting Canada’s Performing Arts and Heritage Sectors

Canada’s performing arts, including our world-class theatre sector, have been devastated by closures and capacity restrictions during the pandemic. Today, both the number of productions and the employment levels in the performing arts sector remain significantly below pre-pandemic levels.

Budget 2021 provided $500 million over two years to support the reopening and recovery of Canada’s arts, culture, heritage, and sports sectors. This includes funding to support Canadian festivals, outdoor theatres, and local museums in delivering in-person experiences and events to draw visitors to our communities and encourage the safe return of in-person audiences.

The federal government has been there to support artists and performing arts organizations and workers throughout the pandemic. Critical investments in Budget 2021, including $250 million to be delivered in 2022-23, will continue to support Canada’s performing arts, and the talented Canadians who make up our arts, culture, and heritage sectors.

In addition, the 2021 Economic and Fiscal Update provided $62.3 million in 2022-23 to create a temporary program aimed at directly supporting performing artists and behind-the-scenes workers who were financially impacted by public health restrictions and closures. Funding is expected to be disbursed to these workers by summer 2022.

-

To complement previous initiatives, Budget 2022 proposes to provide $12.1 million over two years, starting in 2022-23, to the National Arts Centre to support the creation, co-production, promotion, and touring of productions with Canadian commercial and not-for-profit performing arts companies.

-

To compensate Canadian arts, culture, and heritage organizations for revenue losses due to public health restrictions and capacity limits, Budget 2022 proposes to provide an additional $50 million in 2022-23 to the Department of Canadian Heritage, the Canada Council for the Arts, and Telefilm Canada.

Supporting a More Inclusive Arts Training Sector

As the arts sector recovers from the COVID-19 pandemic, its continued vitality and success will depend, in large part, on the next generation of Canadian artists. The Canada Arts Training Fund helps build this next generation of Canadian creators and cultural leaders by supporting the training of artists with high potential.

While support for equity and inclusion is embedded in the delivery of the Fund, additional support for Indigenous and racialized arts training organizations will increase the participation, promotion, and representation of historically underserved communities.

-

To continue to support the arts sector’s recovery from the COVID-19 pandemic and to address historic inequities in funding levels for Indigenous and racialized arts training organizations, Budget 2022 proposes to provide $22.5 million over five years starting in 2022-23, and $5 million ongoing, to Canadian Heritage for the Canada Arts Training Fund.

Stronger Partnerships in the Charitable Sector

Canadian charities carry out a wide range of important work, including vital international development and relief activities around the world and providing direct support to Canadians here at home. Canada’s tax rules should support their work and minimize their administrative burdens, while still ensuring accountability for how charitable resources are used.

Both the charitable sector and parliamentarians have put forward a number of proposals to achieve these goals, while allowing greater flexibility for charities to support non-profit groups that may not have the ability to pursue charitable status of their own. The government supports these efforts.

-

To ensure sufficient flexibility for charities to carry out their work, Budget 2022 proposes to amend the Income Tax Act to allow a charity to provide its resources to organizations that are not qualified donees, provided that the charity meets certain requirements designed to ensure accountability. This is intended to implement the spirit of Bill S-216, the Effective and Accountable Charities Act, which is currently being considered by Parliament.

Boosting Charitable Spending in Our Communities

Every year, charities are required to spend a minimum amount based on the value of their investment assets. This is known as the “disbursement quota” and it ensures that charitable donations are being invested into our communities.

-

Following consultations with the charitable sector in 2021, Budget 2022 proposes to introduce a new graduated disbursement quota rate for charities. For investment assets exceeding $1 million, the rate of the disbursement quota will be increased from 3.5 per cent to 5 per cent.

This new, higher rate will boost support for the charitable sector while being set at a level that is sustainable, ensuring the continued availability of funding over the longer term.

These changes will be effective in respect of a charity’s fiscal period beginning on or after January 1, 2023, and will be reviewed after five years.

The Canada Revenue Agency will also improve the collection of information from charities, including whether charities are meeting their disbursement quota, and on information related to investments and donor-advised funds held by charities.

| 2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| 8.1. A Diverse and Inclusive Canada | 3 | 126 | 145 | 92 | 61 | 31 | 458 |

| A Federal LGBTQ2 Action Plan | 0 | 18 | 26 | 30 | 14 | 12 | 100 |

| Fighting Systemic Racism, Discrimination, and Hate – Launching the New Anti-Racism Strategy and National Action Plan on Combatting Hate | 0 | 4 | 27 | 27 | 27 | 0 | 85 |

| Fighting Systemic Racism, Discrimination, and Hate – Special Envoy on Preserving Holocaust Remembrance and Combatting Antisemitism and Special Representative on Combatting Islamophobia |

0 | 2 | 2 | 2 | 2 | 2 | 11 |

| Fighting Systemic Racism, Discrimination, and Hate – Montreal Holocaust Museum | 0 | 20 | 0 | 0 | 0 | 0 | 20 |

| Supporting Black Canadian Communities | 0 | 25 | 25 | 0 | 0 | 0 | 50 |

| Federal Funding for the Jean Augustine Chair in Education, Community and Diaspora | 0 | 2 | 0 | 0 | 0 | 0 | 2 |

| Supporting the Muslims in Canada Archive | 0 | 4 | 0 | 0 | 0 | 0 | 4 |

| Ensuring Fair Compensation for News Media in the Digital News Ecosystem | 0 | 4 | 4 | 4 | 4 | 4 | 20 |

Less: Projected Revenues |

0 | 0 | 0 | -4 | -4 | -4 | -11 |

| Supporting Local and Diverse Journalism | 0 | 15 | 27 | 13 | 0 | 0 | 55 |

| Creating a Safer Sport System | 0 | 6 | 6 | 4 | 0 | 0 | 16 |

| Supporting Special Olympics Canada | 0 | 2 | 2 | 2 | 2 | 2 | 9 |

| Supporting our Seniors | 0 | 10 | 10 | 0 | 0 | 0 | 20 |

| Doubling the Home Accessibility Tax Credit | 3 | 15 | 15 | 15 | 15 | 15 | 78 |

| 8.2. Keeping Canadians Safe | 0 | 44 | 255 | 235 | 220 | 204 | 958 |

| Working with Provinces and Territories to Advance the National Action Plan to End Gender-Based Violence | 0 | 2 | 78 | 153 | 153 | 153 | 539 |

| Preparing for Emergencies | 0 | 4 | 5 | 5 | 5 | 5 | 25 |

| Supporting Recovery and Completing the Rail Bypass in Lac-Mégantic |

0 | 21 | 96 | 61 | 44 | 28 | 250 |

| Increasing the Capacity of Superior Courts | 0 | 17 | 16 | 17 | 17 | 17 | 84 |

| Enhancing Legal Aid for Those Who Need It Most | 0 | 0 | 60 | 0 | 0 | 0 | 60 |

| 8.3. Supporting Artists and Charities in Our Communities | 0 | 64 | 25 | 40 | 50 | 70 | 250 |

| Supporting Canada’s Performing Arts and Heritage Sectors | 0 | 54 | 8 | 0 | 0 | 0 | 62 |

| Supporting a More Inclusive Arts Training Sector | 0 | 3 | 4 | 5 | 5 | 5 | 22 |

| Stronger Partnerships in the Charitable Sector | 0 | 7 | 13 | 35 | 45 | 65 | 165 |

| Additional Investments – Safe and Inclusive Communities | 0 | 8 | 8 | 12 | 12 | 12 | 54 |

| Funding for Access to Reading and Published Works for Canadians with Print Disabilities View the impact assessment | 0 | 2 | 3 | 7 | 7 | 7 | 25 |

| Funding proposed for Employment and Social Development Canada to support the production and distribution of alternative format materials by the Centre for Equitable Library Access and the National Network for Equitable Library Service; conduct research to better understand gaps in availability of accessible reading materials; and launch a new Equitable Access to Reading Program to boost the production of accessible format reading materials through innovative part- nerships. This will promote the economic and social inclusion of persons with print disabilities and help to create a barrier-free Canada. | |||||||

| Enhancing the Biology Casework Analysis Contribution Program View the impact assessment | 0 | 6 | 5 | 6 | 6 | 6 | 29 |

| Funding proposed for Public Safety Canada to enhance the Biology Casework Analysis Contribu- tion Program, which supports the provincial forensic laboratories of Ontario and Quebec. | |||||||

| Chapter 8 - Net Fiscal Impact | 3 | 243 | 434 | 380 | 343 | 318 | 1,720 |

|

Note: Numbers may not add due to rounding. |

|||||||

Report a problem on this page

- Date modified: