Archived - Chapter 9:

Tax Fairness and Effective Government

An economy that works for everyone is an economy where everyone plays by the same set of rules. Since 2015, the federal government has worked to ensure that the wealthiest people and businesses pay their fair share; that sophisticated tax planning does not allow anyone to avoid paying the taxes they owe; and that tax measures disproportionately benefiting the wealthiest at the expense of everyone else are eliminated.

At the same time, Canadians expect their tax dollars to be put to good use by an efficient and responsible federal government.

Budget 2022 proposes additional measures that will make the tax system more fair, and new steps to ensure that the federal government is delivering the effective programs and services that Canadians deserve.

Key Ongoing Actions

Significant steps that the federal government has announced since 2015 to promote fairness and integrity in the tax system include:

-

Raising taxes on the wealthiest one per cent of Canadians, and cutting taxes for 20 million low- and middle-income Canadians;

-

New taxes on luxury goods, like yachts and private jets;

-

A tax on vacant or underused housing owned by non-resident, non-Canadians;

-

Reforming the tax treatment of employee stock options to ensure it does not disproportionately benefit the very wealthy;

-

Limiting excessive interest deductions to ensure that large companies pay their fair share;

-

Restricting the ability of large financial institutions to use complicated financial transactions to create artificial tax deductions;

-

Implementing all minimum standards from the OECD’s Base Erosion and Profit Shifting project to tackle international tax avoidance; and

-

Ensuring that the GST/HST applies in a fair and effective manner to the growing digital economy.

The federal government has also taken steps to reinforce the Canada Revenue Agency (CRA) as it works to unravel tax avoidance schemes. Investments announced in the 2020 Fall Economic Statement and Budget 2021 have included:

-

Strengthening the CRA’s ability to fight tax crimes such as money laundering and terrorist financing by upgrading its tools and increasing international cooperation;

-

Increasing the CRA’s offshore audit capacity to focus on people who avoid taxes by hiding income and assets abroad;

-

Modernizing GST/HST risk assessment systems to review high-risk refund and rebate claims prior to payment;

-

Improving the CRA’s ability to collect outstanding taxes; and

-

Providing legal resources to support audits and to defend against appeals to the courts by wealthy taxpayers motivated to spend large amounts on litigation.

These efforts, which began in 2021-22, are expected to support the recovery of $2.3 billion in revenues, and the collection of $5 billion in taxes assessed but remaining outstanding over five years.

9.1 A Fair Tax System

Canada’s public programs and services—from public health care to infrastructure to national defence—are built on a robust national tax base where those who live and do business in Canada pay their fair share.

The federal government’s response to COVID-19 allowed our economy to weather the pandemic better than almost any in the world. Canada has seen the fastest jobs recovery in the G7—recouping 112 per cent of the jobs lost at the outset of the pandemic. Fiscal support was necessary, and it has paid off. However, the cost of that support was also significant.

As previously committed, the government is requiring the largest banking and life insurance groups to help pay a portion of the costs of the pandemic response they benefited from.

Budget 2022 is also taking action to close tax loopholes, to work with our international partners, and to strengthen tax enforcement that will stop wealthy Canadians and businesses from sheltering their money overseas.

Requiring Financial Institutions to Help Pay for the Recovery

The COVID-19 pandemic has been the greatest public health challenge in a generation. It has threatened the lives and livelihoods of Canadians, and it posed an existential threat to the Canadian economy.

To protect Canadians and keep our economy afloat through the darkest days of the pandemic, the federal government provided unprecedented financial support. Significant investments in our health care system and a world-leading vaccination campaign saved thousands of Canadian lives. Programs like the Canada Emergency Response Benefit (CERB), the Canada Emergency Business Account (CEBA), and the Canada Emergency Wage Subsidy (CEWS) helped millions of Canadians make ends meet, and tens of thousands of our small businesses to remain open.

While the federal government’s support worked, it came at a high price—more than $350 billion in total for health and safety and direct support measures.

While many sectors continue to recover, Canada’s major financial institutions made significant profits during the pandemic and have recovered faster than other parts of our economy—in part due to the federal pandemic supports for people and businesses that helped de-risk the balance sheets of some of Canada’s largest financial institutions. The federal government is accordingly proposing two measures to ensure those large financial institutions help support Canada’s broader recovery.

- Budget 2022 proposes to introduce a temporary Canada Recovery Dividend, under which banking and life insurers’ groups (as determined under Part VI of the Income Tax Act) will pay a one-time 15 per cent tax on taxable income above $1 billion for the 2021 tax year. The Canada Recovery Dividend will be paid in equal installments over five years.

- Budget 2022 also proposes to permanently increase the corporate income tax rate by 1.5 percentage points on the taxable income of banking and life insurance groups (as determined under Part VI of the Income Tax Act) above $100 million, such that the overall federal corporate income tax rate above this income threshold will increase from 15 per cent to 16.5 per cent.

Together, these measures are expected to raise $6.1 billion over five years, with the 1.5 per cent permanent tax on banking and life insurance groups expected to raise $445 million ongoing.

Preventing the Use of Foreign Corporations to Avoid Canadian Tax

Currently, some people are manipulating the Canadian-controlled private corporation (CCPC) status of their corporations to avoid paying the additional refundable corporate income tax that they would otherwise pay on investment income earned in their corporations. This may be done in a number of ways, such as by moving a corporation into a foreign low-tax jurisdiction, by using foreign shell companies, or by moving passive portfolios to an offshore corporation.

- Budget 2022 proposes targeted amendments to the Income Tax Act to ensure that, for taxation years that end on or after April 7, 2022, investment income earned and distributed by private corporations that are, in substance, CCPCs is subject to the same taxation as investment income earned and distributed by CCPCs.

This measure would increase federal revenues by $4.2 billion over five years starting in 2022-23.

Next Steps Towards a Minimum Tax for High Earners

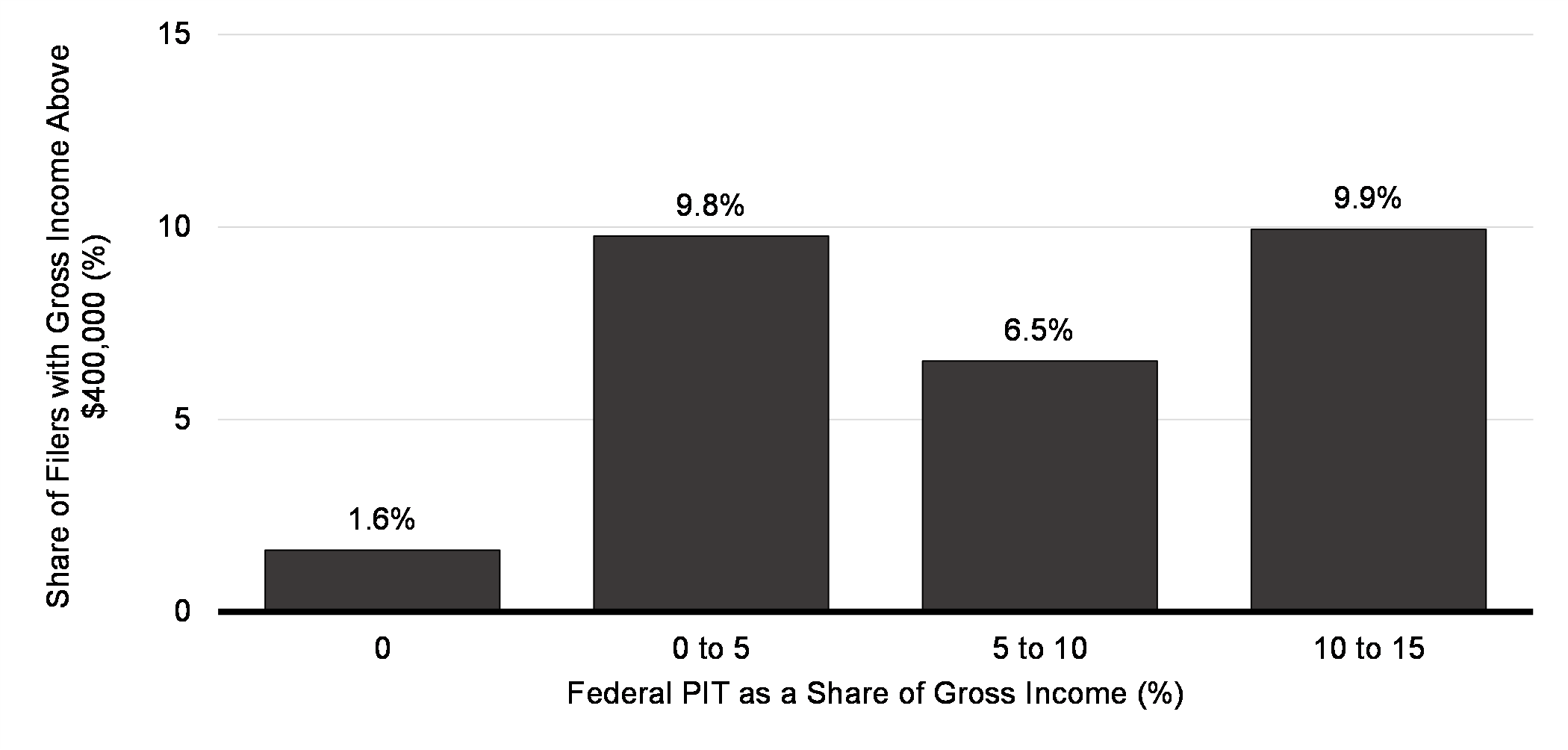

The federal government has taken significant steps to increase the fairness of the tax system, including by increasing taxes on the wealthiest one per cent of Canadians. However, some high-income Canadians still pay relatively little in personal income tax (PIT) as a share of their income—28 per cent of filers with gross income above $400,000 pay an average federal PIT rate of 15 per cent or less, which is less than some middle class Canadians pay. These Canadians make significant use of deductions and tax credits, and typically find ways to have large amounts of their income taxed at lower rates.

Proportion of People With Gross Income Over $400,000 Who Are Paying Less Than 15 Per Cent in Federal Tax, 2019

The Alternative Minimum Tax (AMT), which has been in place since 1986, plays a role in ensuring that the wealthiest Canadians do not take advantage of the tax system to lower their federal tax bill.

However, the AMT has not been substantially updated since its introduction, and there are still thousands of wealthy Canadians who pay little to no personal income tax each year. That is unfair, and the federal government is committed to changing it.

- Budget 2022 announces the government’s commitment to examine a new minimum tax regime, which will go further towards ensuring that all wealthy Canadians pay their fair share of tax. The government will release details on a proposed approach in the 2022 fall economic and fiscal update.

Limiting Aggressive Tax Avoidance by Financial Institutions

The government expects federally regulated financial institutions to demonstrate an exemplary level of corporate behaviour.

- Budget 2022 proposes to examine potential changes to the financial transaction approval process to limit the ability of federally regulated financial institutions to use corporate structures in tax havens to engage in aggressive tax avoidance.

Closing the Double-Deduction Loophole

Some Canadian financial institutions have been using hedging and short selling arrangements in aggressive tax planning strategies. Put simply, two different parts of an institution take different positions in relation to a Canadian dividend-paying stock—one short, or betting against the stock; one long, or betting on the stock—to take advantage of special treatment that those Canadian stocks receive.

- Budget 2022 proposes to amend the Income Tax Act to deny the deduction for a dividend received where the taxpayer has entered into such transactions.

This measure would increase federal revenues by $635 million over five years starting in 2022-23, and by $150 million ongoing.

Expanding Anti-Avoidance Tax Rules

Interest coupon stripping is a way that some taxpayers avoid paying tax on cross-border interest payments. Due to differences between Canada’s various tax treaties, the interest received from Canadian residents is often subject to different tax rates depending on where the recipient resides. Interest coupon stripping arrangements exploit these differences and allow some to pay less in taxes.

- To improve the fairness of Canada’s international tax system, Budget 2022 proposes to create a specific anti-avoidance rule in the Income Tax Act to ensure that the appropriate amount of tax is paid when an interest coupon stripping arrangement is used.

This measure will increase federal revenues by $640 million over the next six years, and by $150 million ongoing.

Strengthening the General Anti-Avoidance Rule

The general anti-avoidance rule (GAAR) is intended to prevent abusive tax avoidance transactions, while not interfering with legitimate commercial and family transactions. If abusive tax avoidance is established, the GAAR applies to deny the tax benefit that was unfairly created.

- Budget 2022 proposes to amend the Income Tax Act to provide that the GAAR can apply to transactions that affect tax attributes that have not yet been used to reduce taxes.

- The government intends to release in the near future a broader consultation paper on modernizing the GAAR, with a consultation period running through the summer of 2022, and with legislative proposals to be tabled by the end of 2022.

International Tax Reform

Canada strongly supports international efforts to end the corporate tax race to the bottom, ensure that all corporations pay their fair share, and level the playing field for Canadians and Canadian businesses.

Canada is one of 137 members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting that joined a two-pillar plan for international tax reform agreed to in October 2021.

Pillar One (Reallocation of Taxing Rights)

Pillar One of the plan will ensure that the largest and most profitable global corporations, including large digital corporations, pay their fair share of tax in the jurisdictions where their users and customers are located.

This is a long-overdue updating of international tax rules to reflect the way business works in today’s digitalized and globalized economy. The federal government is actively working with its international partners to develop the multilateral convention and model rules required to establish the new Pillar One tax framework and bring the new rules into effect.

The government is encouraged by the progress being made and will continue to press forward and be prepared to introduce implementing legislation after the terms are multilaterally agreed. To ensure that Canadians’ interests are protected in any circumstance, the government is prepared to advance legislation for a Digital Services Tax to ensure that corporations in all sectors, including digital corporations, pay their fair share of tax on that money they earn by doing business in Canada. It is Canada’s sincere hope that the timely implementation of the new international system will make this unnecessary.

Pillar Two (Global Minimum Tax)

Pillar Two would ensure that large multinational enterprises are subject to a minimum effective tax rate of 15 per cent on their profits in every jurisdiction in which they operate. This will help end the race to the bottom in corporate taxation.

The Pillar Two framework is now largely finalized and countries are taking steps towards their own domestic implementation. The members of the European Union are discussing a draft directive that would require member states to implement Pillar Two in their own countries in 2023. The U.K. has similarly announced its intention to implement Pillar Two in 2023. Recent U.S. legislative proposals would more closely align its minimum tax with Pillar Two, ensuring a more level playing field.

- In light of these developments, Budget 2022 proposes to implement Pillar Two in Canada, along with a domestic minimum top-up tax. The primary charging rule and domestic minimum top-up tax would be effective in 2023, with the secondary charging rule effective not before 2024.

- Budget 2022 is also launching a public consultation on the implementation of Pillar Two and the domestic minimum top-up tax in Canada. Details can be found in Supplementary Information: Tax Measures.

International Accounting Standards for Insurance Contracts

On January 1, 2023, IFRS 17—a new international accounting standard for insurance contracts—will substantially change the financial reporting for Canadian insurers. Changes to the Income Tax Act are required to address the impact of the new international accounting standard, and are consistent with the proposals for implementation that were consulted on last year. These changes will ensure income is recognized when key economic activities occur, as under the current rules generally.

- Budget 2022 proposes legislative amendments to confirm support of the use of IFRS 17 accounting standards for income tax purposes, with the exception of a new reserve known as the contract service margin, subject to some modifications. Without this exception, profits embedded in the new reserve would be deferred for income tax purposes.

It is estimated that this measure will increase federal revenues by $2.35 billion over the next five years. Relieving transitional rules and consequential changes to protect the minimum tax base are also proposed.

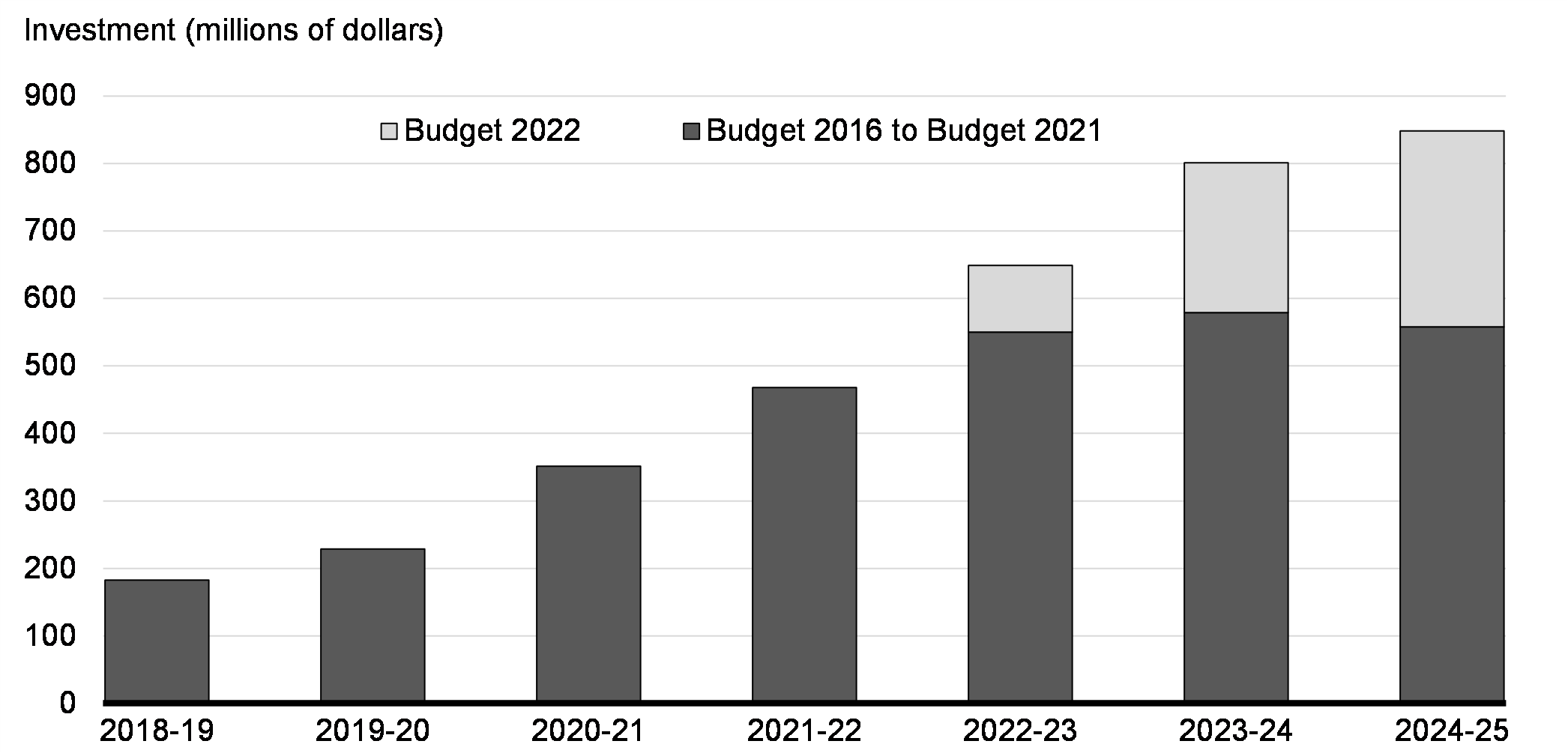

Reinforcing the Canada Revenue Agency

Canadians understand the importance of everyone paying their fair share. The federal government has invested in strengthening the ability of the Canada Revenue Agency (CRA) to target a full spectrum of compliance work, including initial verification, uncovering aggressive planning schemes, and prosecuting criminal tax evasion.

- Building on recent investments, Budget 2022 proposes to provide $1.2 billion over five years, starting in 2022-23, for the CRA to expand audits of larger entities and non-residents engaged in aggressive tax planning; increase both the investigation and prosecution of those engaged in criminal tax evasion; and to expand its educational outreach.

These measures are expected to recover $3.4 billion in revenues over five years, with additional benefits to be realized by provinces and territories whose tax revenues will also increase as a result of these initiatives.

This investment builds on the previous $2.2 billion in resources provided to the CRA since Budget 2016 which has yielded a return of five dollars to each dollar invested until 2020-21.

Additional Investments in CRA Compliance Activities by Budget and Fiscal Year

Eliminating Excise Duty on Low-Alcohol Beer

Currently, low-alcohol beer—beer with no more than 0.5 per cent alcohol by volume—is subject to excise duty, while low-alcohol wine and spirits are not.

- Budget 2022 proposes to eliminate excise duty on low-alcohol beer, effective as of July 1, 2022. This will bring the tax treatment of low-alcohol beer into line with the treatment of wine and spirits with the same alcohol content, and make Canada’s practices consistent with those in other G7 countries.

Bill C-208 Follow-up

The Income Tax Act contains a rule to prevent people from converting dividends into lower-taxed capital gains using certain self-dealing transactions—a practice referred to as “surplus stripping.” Private Member’s Bill C-208, which received Royal Assent on June 29, 2021, introduced an exception to this rule in order to facilitate intergenerational business transfers. However, the exception may unintentionally permit surplus stripping without requiring that a genuine intergenerational business transfer takes place.

- Budget 2022 announces a consultation process for stakeholders to share their views as to how the existing rules could be strengthened to protect the integrity of the tax system while continuing to facilitate genuine intergenerational business transfers. The government is committed to bringing forward legislation, as necessary to address this specific issue, which could be included in a bill to be tabled in the fall after conclusion of the consultation process.

9.2 Effective Government

Like most organizations across Canada and around the world, the COVID-19 pandemic has forced the federal government to adapt and change the way it works.

Budget 2022 proposes actions that will improve how the government operates and ensure that it continues to effectively and to efficiently serve Canadians.

Reducing Planned Spending in the Context of a Stronger Recovery

Supporting Canadians and businesses through the COVID-19 pandemic required extraordinary, time-limited government supports and programs. The government remains committed to unwinding COVID-related special measures and normalizing the overall level of program spending. In this context, the government will launch a process to re-examine previously announced spending plans to ensure government programs are fit to changing circumstances, including a stronger than anticipated economic recovery.

- In this context, Budget 2022 announces the government’s intention to review previously announced spending plans with a view to reducing the pace and scale of spending that has yet to occur by up to $3 billion over the next four years.

An update on the progress of this initiative will be outlined in the 2022 fall economic and fiscal update.

Strategic Policy Review

The government remains focused on managing public finances in a prudent and responsible manner. This requires ongoing review to ensure Canadians' tax dollars are being used effectively and to ensure that government programs are delivering the intended results.

-

To support these efforts, Budget 2022 announces the launch of a comprehensive Strategic Policy Review. Led by the President of the Treasury Board, the review will include two streams:

- Stream 1 will assess program effectiveness in meeting the government’s key priorities of strengthening economic growth, inclusiveness, and fighting climate change.

- Stream 2 will identify opportunities to save and reallocate resources to adapt government programs and operations to a new post-pandemic reality. Further areas of focus could include real property, travel, and increased digital service delivery, based in part on key lessons taken from how the government adapted during the pandemic, such as through increased virtual or remote work arrangements.

These efforts would target savings of $6 billion over five years, and $3 billion annually by 2026-27. Budget 2023 will provide an update on the review’s progress.

Council of Economic Advisors

Strengthening Canada’s prospects for long-term economic growth is essential for achieving continued improvements to living standards and the quality of life of all Canadians. To reinforce the government’s access to expert advice and provide policy options for harnessing new opportunities and navigating increasingly complex economic challenges, the government intends to establish a permanent Council of Economic Advisors.

The government will announce further details on the makeup of the Council in the coming months.

Addressing the Digitalization of Money

A safe and secure financial system is a cornerstone of our economy. However, the digitalization of money, assets, and financial services—which is transforming financial systems and challenging democratic institutions around the world—creates a number of challenges that need to be addressed.

In the last several months, for example, there have been a number of high-profile examples—both around the world and here in Canada—where digital assets and cryptocurrencies have been used to avoid global sanctions and fund illegal activities.

Budget 2022 includes measures that will help maintain the integrity of the financial system, promote fair competition, and protect both the finances of Canadians and our national security.

- Budget 2022 announces the government’s intention to launch a financial sector legislative review focused on the digitalization of money and maintaining financial sector stability and security. The first phase of the review will be directed at digital currencies, including cryptocurrencies and stablecoins.

- Budget 2022 also proposes $17.7 million over five years, starting in 2022-23, to the Department of Finance to lead the review.

The review will examine, among other factors: how to adapt the financial sector regulatory framework and toolbox to manage new digitalization risks; how to maintain the security and stability of the financial system in light of these evolving business models and technological capabilities; and the potential need for a central bank digital currency in Canada.

Separately, the government is investing in the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and will develop legislative proposals to strengthen the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, the Criminal Code, and other legislation, to investigate and prosecute financial crimes, manage emerging threats, such as those posed by the digitalization of money, and ensure the government has the tools necessary to preserve financial integrity and economic security in Canada.

A Fairer Banking Complaints Handling System for Canadians

Canadians deserve a fair and impartial process to address unresolved complaints with their banks. Banks should not be able to choose the complaints handling body they participate in, and the system should not be run on a for-profit basis. To strengthen Canada’s external complaints handling process and enhance consumer confidence in the system:

- Budget 2022 announces the government’s intention to introduce targeted legislative measures to strengthen the external complaints handling system and to put in place a single, non-profit, external complaints body to address consumer complaints involving banks.

Embracing Digital Government

The federal government is committed to accelerating and expanding the offering of digital services to Canadians and to improving the ease-of-use, accessibility, security, consistency, and reliability of government services.

- Budget 2022 confirms the government's intent to introduce legislative amendments to the Financial Administration Act to enable the Canadian Digital Service to provide its digital platform services more broadly, including to other jurisdictions in Canada, and to clarify its responsibilities under the Privacy Act and Access to Information Act with respect to the services it provides.

Public Sector Pension Plan Governance

The federal government is committed to continuously improving the governance, transparency, and accountability of its pension plans.

- Budget 2022 announces the government’s intent to expand the Public Sector Pension Investment Board from 11 to 13 members, with the board’s new additional seats to be filled by representatives of federal public service bargaining agents. The government will consult all federal bargaining agents in determining an appropriate process for the selection of these new members.

Review of the Public Servants Disclosure Protection Act

The government is committed to continuing to take action to improve government worker whistleblower protections and supports:

- Budget 2022 proposes to provide $2.4 million over five years, starting in 2022-23, to Treasury Board of Canada Secretariat to launch a review of the Public Servants Disclosure Protection Act.

| 2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| 9.1. A Fair Tax System | 0 | -1,931 | -3,220 | -3,537 | -3,643 | -3,780 | -16,111 |

| Requiring Financial Institutions to Help Pay for the Recovery – Canada Recovery Dividend | 0 | -810 | -810 | -810 | -810 | -810 | -4,050 |

| Requiring Financial Institutions to Help Pay for the Recovery – Additional Tax on Banks and Life Insurers | 0 | -290 | -460 | -430 | -430 | -445 | -2,055 |

| Preventing the Use of Foreign Corporations to Avoid Canadian Tax | 0 | -735 | -965 | -885 | -825 | -825 | -4,235 |

| Closing the Double-Deduction Loophole | 0 | -65 | -135 | -140 | -145 | -150 | -635 |

| Expanding Anti-Avoidance Tax Rules | 0 | -80 | -125 | -140 | -145 | -150 | -640 |

| International Accounting Standards for Insurance Contracts | 0 | 0 | -575 | -630 | -565 | -580 | -2,350 |

| Reinforcing the Canada Revenue Agency | 0 | 99 | 222 | 291 | 304 | 320 | 1,235 |

Less: Projected Revenues |

0 | -51 | -374 | -794 | -1,029 | -1,142 | -3,390 |

| Eliminating Excise Duty on Low- Alcohol Beer | 0 | 1 | 2 | 2 | 2 | 2 | 9 |

| 9.2. Effective Government | 0 | 4 | -746 | -1,746 | -2,746 | -3,746 | -8,980 |

| Reducing Planned Spending in the Context of a Stronger Recovery | 0 | 0 | -750 | -750 | -750 | -750 | -3,000 |

| Strategic Policy Review | 0 | 0 | 0 | -1,000 | -2,000 | -3,000 | -6,000 |

| Addressing the Digitalization of Money | 0 | 3 | 4 | 4 | 3 | 3 | 18 |

| Review of the Public Servants Disclosure Protection Act | 0 | 1 | 1 | 1 | 0 | 0 | 2 |

| Additional Actions – Tax Fairness and Effective Government | 0 | -15 | -65 | -65 | -89 | -101 | -335 |

| Funding Related to the Implementation of the Western Arctic Offshore Oil and Gas Accord | 0 | 26 | 1 | 1 | 0 | 0 | 28 |

| Proposed one-time payment of $25.8 million to the Government of Yukon and Government of the Northwest Territories to fulfill Canada’s commitment under the 1993 Accord, and $2.5 million to support the Inuvialuit Regional Corporation’s participation in the implementation of the new Western Arctic Offshore Oil and Gas Accord. | |||||||

| Employment and Social Development Canada Rent Price Adjustment | 0 | 3 | 3 | 3 | 3 | 3 | 17 |

Less: Funds From CPP Account |

0 | -1 | -1 | -1 | -1 | -1 | -4 |

| Funding proposed for Employment and Social Development Canada to cover rent increases related to its national network of service centres and offices. |

|||||||

| Reporting Requirements for RRSPs and RRIFs | 0 | 0 | 0 | 0 | -20 | -30 | -50 |

| Administrative Costs | 0 | 1 | 2 | 2 | 3 | 5 | 13 |

| The Canada Revenue Agency’s enhanced risk-assessment activities related to RRSPs and RRIFs are expected to generate additional audit revenues. | |||||||

| WTO Settlement on the 100-per- cent Canadian Wine Exemption | 0 | -55 | -80 | -80 | -85 | -90 | -390 |

| Repeal of the 100-per-cent Canadian wine excise duty exemption effective as of June 30, 2022. | |||||||

| GST/HST Health Care Rebate | 0 | 3 | 3 | 3 | 3 | 4 | 16 |

| This measure proposes to amend the GST/HST eligibility rules for the expanded hospital rebate so that to be eligible for the expanded hospital rebate, a charity or non-profit organization must deliver the health care service with the active involvement of, or on the recommendation of, either a physician or a nurse practitioner, irrespective of their geographical location. This measure would generally apply to rebate claim periods ending after Budget Day in respect of tax paid or payable after that date. |

|||||||

| Enhancing Privy Council Office Capacity |

0 | 7 | 7 | 7 | 7 | 7 | 35 |

| Funding to support the Privy Council Office, including to enhance analysis of key government priorities, and to support government transparency through the timely production of documents for Access to Information requests. | |||||||

| Supporting the Modern Senate | 0 | 0 | 1 | 1 | 1 | 1 | 3 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | 0 | -1 | -1 | -1 | -1 | -3 |

| Budget 2022 proposes to amend the Parliament of Canada Act and other Acts to support a more independent, non-partisan, transparent, and accountable Senate. Since the federal government established the Independent Advisory Board for Senate Appointments in 2016, 60 senators have been appointed to the Senate and three new non-partisan groups have formed. The proposed amendments would provide allowances for senators occupying leadership positions in parties or groups beyond only the Government and Opposition and authorize participation in certain senate committees. |

|||||||

| Chapter 9 - Net Fiscal Impact | 0 | -1,942 | -4,031 | -5,347 | -6,479 | -7,627 | -25,426 |

|

Note: Numbers may not add due to rounding. |

|||||||

Report a problem on this page

- Date modified: