Archived - Chapter 4:

Creating Good Middle Class Jobs

In the face of a pandemic that has changed all of our lives, workers in Canada have shown remarkable resilience. Whether adapting to work from home, restructuring entire businesses to manufacture personal protective equipment, or heading to their frontline job in the middle of a lockdown, the determination and ingenuity of Canada’s workforce has kept our economy moving during an unprecedented and challenging two years.

At the start of the pandemic, the federal government introduced significant economic support to allow our workers and businesses to make ends meet.

Those investments worked. Canada’s economy has recovered 112 per cent of the jobs lost at the outset of the pandemic. Our unemployment rate in February 2022 was at 5.5 per cent, which is lower than prior to the pandemic. Job creation is remarkably strong, and even our hardest-hit sectors are starting to get back up and running.

But with our unemployment rate hitting near-record lows, some businesses are still struggling to find workers. This is a problem in Canada and around the world. A strong and prosperous economy requires a diverse, talented, and constantly growing workforce. And yet too many Canadians—women with young children, new graduates, newcomers, Black and racialized Canadians, Indigenous peoples, and persons with disabilities among them—are facing barriers to finding meaningful and well-paid work.

In Budget 2022, the government is putting in place important measures that will help address those issues and meet the needs of our workers, our businesses, and the Canadian economy so that it can keep growing stronger for years to come.

Key Ongoing Actions

The federal government has made historic investments to help workers succeed and ensure that Canadian businesses have access to a diverse, skilled workforce. These include:

-

$30 billion over five years to build a Canada-wide early learning and child care system;

-

Expanding the Canada Workers Benefit to support an estimated one million additional Canadians, which could mean $1,000 more per year for a full-time, minimum-wage worker;

-

More than $3 billion over three years to support nearly 500,000 new job and training opportunities, including by helping mid-career workers transition to in-demand jobs, and helping young Canadians gain valuable work experience;

-

Making post-secondary education more accessible by doubling the Canada Student Grants amount until July 2023—meaning up to $6,000 per year in non-repayable aid for full-time students in need—and by waiving interest on Canada Student Loans through to March 2023;

-

Introducing a $15 per hour federal minimum wage and legislating 10 days of paid sick leave to improve the working conditions for the nearly one million workers in the federally-regulated private sector; and,

-

Increasing the length of Employment Insurance sickness benefits from 15 to 26 weeks, as of summer 2022.

4.1 Delivering on Child Care

Supporting Early Learning and Child Care View the impact assessment

In Budget 2021, the federal government made an historic and transformative investment of $30 billion over five years. Combined with previous investments announced since 2015, $9.2 billion ongoing will be invested in child care, including Indigenous Early Learning and Child Care, starting in 2025-26.

Child care is not just a social policy—it is an economic policy, too. Affordable, high-quality child care will grow our economy, allow more women to enter the workforce, and help give every Canadian child the best start in life.

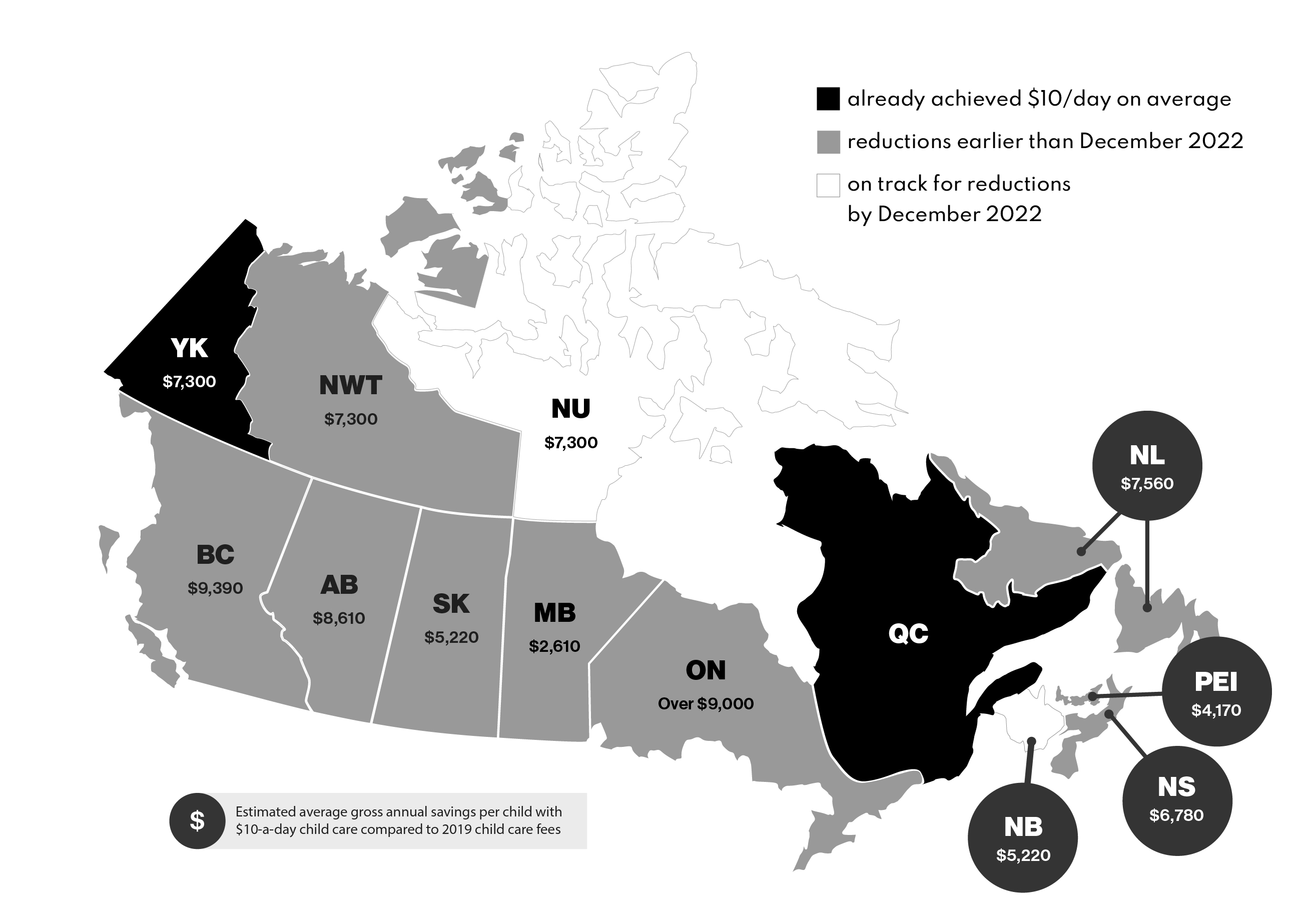

In less than a year, the federal government reached agreements with all 13 provinces and territories. This means, by the end of 2022, that Canadian families will have seen their child care fees reduced by an average of 50 per cent. By 2025-26, it will mean an average child care fee of $10-a-day for all regulated child care spaces across Canada. Most provinces and territories are also moving ahead with faster than anticipated initiatives to support access to affordable high-quality child care spaces (Figure 4.1).

Alberta, Saskatchewan, and the Northwest Territories have already cut child care fees in half. In Ontario, fees will be reduced by an initial 25 per cent retroactive to April 1, 2022. Yukon has already put in place a $10-a-day target for child care spaces as of April 1, 2021, five years ahead of schedule. Prince Edward Island is targeting $10-a-day spaces by the end of 2024.

Fee Reductions for Child Care Spaces Across Canada

As the federal government worked with provinces and territories on the completion and implementation of agreements, many raised that infrastructure funding was a challenge for non-profit and public providers where real estate costs were too high or building materials too expensive.

-

In response to requests from provinces and territories, and to support the implementation of the Canada-wide early learning and child care system, Budget 2022 proposes to provide $625 million over four years, beginning in 2023-24, to Employment and Social Development Canada for an Early Learning and Child Care Infrastructure Fund.

This funding will enable provinces and territories to make additional child care investments, including the building of new facilities.

As noted in Budget 2021, Quebec has been a pioneer in early learning and child care in Canada, and this new funding will be part of an asymmetrical agreement with the province of Quebec that will allow for Quebec to further enhance its child care system.Province/Territory and Date Agreement Announced |

Amount of Federal Investment (5 Year Allocation, $ millions)1 |

Estimated Average Savings per Child with 50% Average Fee Reduction (gross, annual)2 |

Estimated Average Savings per Child at $10/day (gross, annual)2 |

Child Care Spaces to be Created |

Estimated Early Childhood Educator Jobs to be Created3 |

|---|---|---|---|---|---|

| BC July 8, 2021 |

$3,212 | $6,000 (by end of 2022) |

$9,390 (by end of FY 2025-26) |

40,0004 | 8,000 to 10,000 |

| NS July 13, 2021 |

$605 | $4,690 (by end of 2022) |

$6,780 (by end of FY 2025-26) |

9,500 | 1,900 to 2,375 |

| YK July 23, 2021 |

$42 | Yukon committed to a $10/day average fee prior to Budget 2021 |

$7,300 (achieved) |

110 | 22 to 28 |

| PEI July 27, 2021 |

$118 | $3,390 (by end of 2022) |

$4,170 (by end of 2024) |

452 | 90 to 113 |

| NL July 28, 2021 |

$306 | $5,090 (by end of 2022) |

$7,560 (as early as January 2023) |

5,895 | 1,179 to 1,474 |

| QC5 August 5, 2021 |

$5,964 | Not applicable | Not applicable | 37,000 | 7,400 to 9,250 |

| MB August 9, 2021 |

$1,201 | $2,610 (by end of 2022) |

$2,610 (by end of FY 2022-23) |

23,000 | 4,600 to 5,750 |

| SK August 13, 2021 |

$1,099 | $3,910 (retroactive to July 2021) |

$5,220 (by end of FY 2025-26) |

28,000 | 5,600 to 7,000 |

| AB November 15, 2021 |

$3,797 | $5,610 (January 2022) |

$8,610 (by end of FY 2025-26) |

42,500 | 8,500 to 10,625 |

| NB December 13, 2021 |

$492 | $3,910 (by end of 2022) |

$5,220 (by end of FY 2025-26) |

3,400 | 680 to 850 |

| NWT December 15, 2021 |

$51 | $4,950 (by end of 2022) |

$7,300 (by end of FY 2025-26) |

300 | 60 to 75 |

| NU January 24, 2022 |

$66 | $4,950 (by end of 2022) |

$7,300 (by end of March 2024) |

238 | 48 to 60 |

| ON March 28, 2022 |

$10,235 | $6,000 (by end of 2022) |

over $9,0006 (by end of FY 2025-26) |

86,0007 | 14,000 to 15,0006 |

|

1 National Canada-wide early learning and childhood allocations are calculated based on projected 0-12 child population and include base funding of $2 million per province/territory per year. |

|||||

4.2 Immigration for Our Economy

Immigration is vital to our economy, our communities, and to our national identity as a country that is diverse and welcoming of everyone. Indeed, multiculturalism is one of Canada’s great success stories and an example to the world.

Throughout the pandemic, many newcomers have been on the front lines, working in key sectors like health care, transportation, the service sector, and manufacturing. Without them, Canada’s economy would not have overcome the challenges of the last two years.

In the decades to come, our economy will continue to rely on the talents of people from all over the world, just as we have in decades past. Our future economic growth will be bolstered by immigration. And Canada will remain a leader in welcoming newcomers fleeing violence and persecution.

In Budget 2022, the federal government is proposing investments to enhance our capacity to meet the immigration demands of our growing economy; to create opportunities for all newcomers; and to maintain Canada’s world-class immigration system.

Canada’s Ambitious Immigration Plan

Canada welcomed more than 405,000 new permanent residents in 2021—more than any year in Canadian history.

To meet the demands of our growing economy, the federal government’s 2022-24 Immigration Levels Plan—tabled in February 2022—sets an even higher annual target of 451,000 permanent residents by 2024—the majority of whom will be skilled workers, which will help to address persistent labour shortages.

This higher target—along with the government’s 2021 Economic and Fiscal Update investments to resolve delays and backlogs in processing and new investments proposed in this Budget—will help make our immigration system more responsive to Canada’s economic needs and humanitarian commitments.

The Immigration Levels Plan helps reunite family members with their loved ones, and allows us to continue to be home to the talents of those already in Canada by granting permanent status to temporary residents—including essential workers and international students.

The Immigration Levels Plan also includes firm global humanitarian commitments, including a plan to resettle at least 40,000 Afghan refugees in the coming years. On March 30, 2022, Canada marked an important milestone by welcoming the 10,000th Afghan refugee since August 2021. In addition, the government has introduced new immigration streams for Ukrainians, set out in Chapter 5.

-

To support the processing and settlement of new permanent residents to Canada as part of Canada’s Immigration Levels Plan—including the government’s increased commitment to Afghan refugees—the government has committed $2.1 billion over five years and $317.6 million ongoing in new funding.

As announced in Budget 2021, the government also intends to amend the Immigration and Refugee Protection Act to improve Canada’s ability to select applicants that match its changing and diverse economic and labour force needs. These people will be from among the growing pool of candidates seeking to become permanent residents through the Express Entry System.

Efficiently Welcoming Visitors, Students, and Workers to Canada

Every year, Canada welcomes millions of tourists, international students, and temporary foreign workers. Together, they inject billions of dollars into our economy; bring new ideas and energy to our schools and businesses; create lasting commercial and social ties; and fill openings in our workforce.

As the world recovers from the pandemic and travel restrictions are lifted, Canada can expect to see a growing number of temporary residence applications, visitor visas, and study permits.

-

Budget 2022 proposes to provide $385.7 million over five years, and $86.5 million ongoing, for Immigration, Refugees and Citizenship Canada, the Canada Border Services Agency, and the Canadian Security Intelligence Service to facilitate the timely and efficient entry of a growing number of visitors, workers, and students.

Securing the Integrity of Canada’s Asylum System View the impact assessment

Canada is a welcoming destination for those seeking refuge and each year takes in tens of thousands of people fleeing violence and persecution.

Around the world, the number of displaced people and families tragically continues to rise. In the months and years to come, many will seek to come to Canada.

Canada’s asylum system—the border officers, immigration officials, and members of the Immigration and Refugee Board who process, investigate, and adjudicate asylum claims—has recently benefited from enhanced temporary funding. As the COVID-19 situation in Canada continues to improve and border restrictions ease, the federal government is committed to ensuring that Canada’s asylum system has the long-term resources it needs.

-

Budget 2022 proposes to provide Immigration, Refugees and Citizenship Canada, the Canada Border Services Agency, the Immigration and Refugee Board, and the Canadian Security Intelligence Service with $1.3 billion over the next five years, and $331.2 million ongoing, to support the long-term stability and integrity of Canada’s asylum system.

-

The government is also proposing to introduce amendments to the Immigration and Refugee Protection Act to allow Immigration, Refugees and Citizenship Canada to require the electronic submission of asylum claims. Claims can currently be submitted either digitally or on paper, making it difficult to keep track of all information relevant to a file and ultimately leading to processing delays. This reform will help modernize and streamline the asylum process and reduce wait times for claimants.

Supporting Legal Aid for Asylum Seekers View the impact assessment

Each year, thousands fearing persecution seek refuge in Canada. After their arrival, asylum seekers have the right to a fair hearing to determine their legal status.

For those who cannot afford legal support, immigration and refugee legal aid can provide eligible asylum claimants with legal information, advice, and representation. These services, delivered in partnership with provinces, make the asylum system more efficient and help asylum seekers receive fair outcomes.

-

Budget 2022 proposes to provide $43.5 million in 2022-23 to maintain federal support for immigration and refugee legal aid services.

Improving Support Services for Immigrants and Visitors to Canada

As global demand to visit, study, and work in Canada increases—in addition to a growing number of permanent residents moving to Canada—so too must the government’s ability to provide accessible, timely, and responsive services.

-

Budget 2022 proposes to provide $187.3 million over five years, and $37.2 million ongoing, for Immigration, Refugees and Citizenship Canada to improve its capacity to respond to a growing volume of enquiries and to invest in the technology and tools required to better support people using their services.

Improving the Citizenship Program

Becoming a citizen allows new Canadians to fully participate in Canadian society, including through the ability to vote, to run for public office, and to travel under a Canadian passport.

To modernize the process of obtaining Canadian citizenship, the federal government recently launched new online services, which include the ability to submit applications electronically. However, current legislation limits the government’s ability to modernize the citizenship application process through digitization, meaning processing takes longer and online tools are limited.

-

To further improve the experience of applicants and to enable the Citizenship Program to accommodate higher levels of applications, the government intends to introduce legislative amendments to the Citizenship Act to enable automated and machine-assisted processing and the safe and secure collection and use of biometric information.

The 2021 Economic and Fiscal Update also provided funding in 2022-23 for citizenship processing, as part of an $85 million investment to reduce processing times and pandemic-related application backlogs.

4.3 A Workforce for the 21st Century Economy

Structural shifts in the global economy—including an increase in automation and a global transition to lower-emission industries and technologies—will require some workers in sectors across Canada to develop new skills and adjust the way they work.

“3.1 million Canadian jobs will change in some way over the next decade due to the climate transition”

The transition to a new career can be a difficult and stressful time—workers have bills to pay, families to take care of, and established roots in their communities. As our economy changes, Canada’s jobs and skills plan must be tailored to the needs of those workers and help them to meet the needs of growing businesses and sectors.

In recent years, the federal government has made significant investments to connect workers to jobs—including mid-career workers, young people, and underrepresented workers—with nearly 500,000 opportunities for skills development and in-demand jobs in Budget 2021.

Budget 2022 proposes to build on past investments, to work with provincial and territorial partners on improving how skills training is provided, to launch intensive engagement with labour groups on how Canada can better support skilled workers as they navigate a changing economy, and support union-led apprenticeship training for those who are underrepresented in the trades.

Modernizing Labour Market Transfer Agreements

Every year, the federal government provides more than $3 billion in funding to provinces and territories to provide training and employment support through the Labour Market Transfer Agreements. These investments help more than one million Canadians every year prepare for their next job through programs ranging from skills training and wage subsidies, to career counselling and job search assistance.

The federal government is taking steps to renew this partnership with provinces and territories in order to be more responsive to the needs of workers, businesses, and the economy.

-

Budget 2022 proposes to amend Part II of the Employment Insurance Act to ensure more workers are eligible for help before they become unemployed, and that employers can receive direct support to re-train their workers.

Over the coming year, the government also intends to intensify work with provinces and territories to modernize these agreements, reflecting the changing needs and challenges of both the current and future Canadian labour market. This will include working together to support mid-career workers in transitioning to new sectors and help local economies adapt and prosper.

Bringing Workers to the Decision-Making Table

Canada’s long-term economic success depends on matching workers with the right skills to employers in growing sectors. For some workers, having the right skills could mean a small change, like learning a new method. For others, it might mean deeper training towards a career in a new field, such as the skilled trades or clean technologies.

The future of work should be led by workers—and unions need to be at the forefront of our planning for the jobs of tomorrow.

-

Budget 2022 proposes to provide $2.5 million in 2022-23 for Employment and Social Development Canada to launch a new union-led advisory table that brings together unions and trade associations. In the coming year, the table will advise the government on priority investments to help workers navigate the changing labour market, with a particular focus on skilled, mid-career workers in at-risk sectors and jobs. Further details will be announced in the coming weeks.

The results will be used to inform future actions and investments to help workers make the transition to the jobs and sectors that need them.

Doubling the Union Training and Innovation Program View the impact assessment

The skilled trades are vital to the future of the Canadian economy and offer workers rewarding careers in fields ranging from carpentry to electricians and boilermakers. The federal government wants to provide more women, newcomers, persons with disabilities, Indigenous peoples, and racialized Canadians with the chance to have good-quality jobs in high-paying skilled trades, and unions play a critical role in training skilled trades workers.

Since 2017, the Union Training and Innovation Program has supported union-based apprenticeship training in the Red Seal trades, including through investments in training, equipment, and materials, as well as in support for innovative approaches to address barriers facing apprentices.

-

Budget 2022 proposes to provide $84.2 million over four years to double funding for the Union Training and Innovation Program. Each year, the new funding would help 3,500 apprentices from underrepresented groups begin and succeed in careers in the skilled trades through mentorship, career services, and job-matching.

Sustainable Jobs

Workers will always be at the heart of the government’s plan to build a strong economy and a bright future for Canadians. As the world moves to a net-zero emissions future, we must ensure that everyone has a real and fair chance to succeed and that no region gets left behind. Already, the federal government has made progress towards building a just transition for workers through sustainable jobs and have undertaken public consultations on legislation that will support workers and communities in the shift to a low-carbon future. This work continues.

In March, in the 2030 Emissions Reduction Plan: Canada’s Next Steps for Clean Air and a Strong Economy, the government committed to skills training, including through a new Futures Fund for Alberta, Saskatchewan, and Newfoundland and Labrador. Along with the government’s commitment to a new Clean Jobs Training Centre, this will help workers have the tools to succeed. The federal government will also continue to work with its partners, including labour unions, to design programs that take into account current barriers and underrepresentation, so that there is a level playing field for everyone.

Canada’s long-term success depends on workers. From engineers, scientists, farmers, construction workers, tradespeople, resource workers, energy workers, researchers, and more, everyone will have a role to play in the economy of tomorrow.

4.4 Connecting Workers to Good Jobs

With record lows in unemployment as Canada emerges from the pandemic, employers across the country—especially in rural Canada—are finding it difficult to hire the workers they need.

Budget 2022 proposes to grow our workforce by addressing barriers faced by mothers, Black and racialized Canadians, newcomers, persons with disabilities, young Canadians, and other people who are underrepresented in Canada’s workforce. This will include improving labour mobility and foreign credential recognition, and creating opportunities for persons with disabilities.

The government also intends to engage with experts on the role that a Career Extension Tax Credit could play in boosting the labour force participation of seniors who want to continue to work later in life.

Labour Mobility Deduction for Tradespeople

Canada is growing, and that means more homes, roads, and important infrastructure projects need to be built. Skilled trades workers are essential to Canada’s success and we need them to be able to get to the job site—no matter where it is.

Workers in the construction trades often travel to take on temporary jobs—frequently in rural and remote communities—but their associated expenses do not always qualify for existing tax relief.

Improving labour mobility for workers in the construction trades can help to address labour shortages and ensure that important projects, like housing, can be completed across the country.

-

Budget 2022 proposes to introduce a Labour Mobility Deduction, which would provide tax recognition on up to $4,000 per year in eligible travel and temporary relocation expenses to eligible tradespersons and apprentices. This measure would apply to the 2022 and subsequent taxation years.

Supporting Foreign Credential Recognition in the Health Sector View the impact assessment

The pandemic has only worsened the labour shortages in our health care sector. Internationally-trained health care professionals can help fill these gaps and ensure that Canadians receive the quality health care they deserve.

The Foreign Credential Recognition Program helps skilled newcomers secure meaningful, well-paying jobs by funding provinces, territories, and organizations to improve foreign credential recognition processes and by providing direct support to skilled newcomers. This support includes mentoring, job placements, and financial assistance for exams and classes.

-

Budget 2022 proposes to provide $115 million over five years, with $30 million ongoing, to expand the Foreign Credential Recognition Program and help up to 11,000 internationally trained health care professionals per year get their credentials recognized and find work in their field. It will also support projects—including standardized national exams, easier access to information, faster timelines, and less red tape—that will reduce barriers to foreign credential recognition for health care professionals.

An Employment Strategy for Persons With Disabilities View the impact assessment

Persons with disabilities should be fully included in Canada’s economic recovery. However, despite being ready and willing to work, their employment rates are much lower than those of Canadians without disabilities—59 per cent versus 80 per cent, according to the 2017 Canadian Survey on Disability. The federal government is steadfast in its commitment to an inclusive recovery—and we cannot leave persons with disabilities behind.

-

Budget 2022 proposes to provide $272.6 million over five years to Employment and Social Development Canada to support the implementation of an employment strategy for persons with disabilities through the Opportunities Fund. This will help to address labour market shortages through increased participation by persons with disabilities and make workplaces more inclusive and accessible. Of this funding, $20 million will be allocated to the Ready, Willing and Able program to help persons with Autism Spectrum Disorder or intellectual disabilities find employment.

This measure will also form an important part of the government’s Disability Inclusion Action Plan, which will aim to improve the quality of life for persons with disabilities, and build on more than $1.1 billion in funding that the federal government has committed to advance the inclusion of persons with disabilities since 2015.

Improving the Temporary Foreign Worker Program

The Temporary Foreign Worker (TFW) program allows foreign nationals to work in Canada on a temporary basis in order to fill jobs that Canadians are unavailable or unwilling to take. The workers that come to Canada through the TFW program contribute to the labour in a range of sectors, including agriculture and fish and other food processing.

As employers across the country face difficulties in finding workers, the TFW program is experiencing a growing demand. However, additional steps need to be taken to ensure the health, safety, and quality of life of those who come to work in Canada—the importance of which has been reinforced by the unacceptable experience of some temporary foreign workers during the pandemic.

Budget 2022 proposes a number of measures to increase protections for workers, to reduce administrative burdens for trusted repeat employers, and to ensure employers can quickly bring in workers to fill short-term labour market gaps. These include:

-

$29.3 million over three years to introduce a Trusted Employer Model that reduces red tape for repeat employers who meet the highest standards for working and living conditions, protections, and wages in high-demand fields. Further details on this program will be announced in the coming year.

-

$48.2 million over three years, with $2.8 million in remaining amortization, to implement a new foreign labour program for agriculture and fish processing, tailored to the unique needs of these employers and workers. The program will be regularly reviewed by the Minister of Employment, Workforce Development and Disability Inclusion for its impact on local labour markets to maximize the employment of Canadians and permanent residents and to ensure the program is not negatively impacting wages for Canadians and permanent residents.

-

$64.6 million over three years to increase capacity to process employer applications within established service standards.

-

$14.6 million in 2022-23, with $3 million in remaining amortization, to make improvements to the quality of employer inspections and hold employers accountable for the treatment of workers.

Completing the Employment Equity Act Review

Through the Employment Equity Act, the government promotes and improves equality and diversity in federally regulated workplaces. Since the introduction of the Employment Equity Act, continued progress has been made to address inequalities but some workers are still facing barriers to employment and promotion and many federal workplaces fail to reflect the full diversity of Canada’s population. That is why, on July 14, 2021, the government launched an arm’s length Task Force to review the Act and advise on how to modernize the federal employment equity framework.

-

Budget 2022 proposes to provide $1.9 million in 2022-23 in order to complete the Employment Equity Act Review in coming months. A final report will be publicized in fall 2022.

4.5 Towards A Better Employment Insurance System

Over the last two years, millions of Canadians’ livelihoods have been interrupted by lockdowns, illness, or the need to care for loved ones. At the start of the pandemic, the government responded by introducing emergency income support that ensured workers and their families could continue to make ends meet, even as the pandemic prevented them from working.

As Canada’s economy continues to recover from the pandemic and emergency programs wind down, the Minister of Employment, Workforce Development and Disability Inclusion is consulting with Canadians on what needs to be done to build an Employment Insurance (EI) system that better meets the current and future needs of workers and employers. This includes simpler and fairer rules for workers, new ways to support experienced workers transitioning to a new career, and coverage for self-employed and gig workers.

The government will release its long-term plan for the future of EI after the consultations conclude.

Extending Temporary Support for Seasonal Workers

In certain regions of the country, seasonal industries—including fishing and tourism in Atlantic Canada and British Columbia—are the lifeblood of local economies. The Employment Insurance (EI) system is critical to ensuring that the workers these industries count on have the support they need between work seasons.

In 2018, to address gaps in EI support between seasons, the government introduced a pilot project in 13 regions of the country to provide up to five additional weeks—for a maximum of 45 weeks—for eligible seasonal workers. The temporary support was extended in Budget 2021 to ensure continued support during the pandemic.

-

Budget 2022 proposes to extend these rules until October 2023 as the government considers a long-term solution that best targets the needs of seasonal workers. The cost of this measure is estimated at $110.4 million over three years, starting in 2022-23.

-

As part of this extension, the government proposes to maintain a recently introduced legislative fix to ensure that the timing of COVID-19 benefits does not affect future EI eligibility under the rules of the program.

| 2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| 4.1. Delivering on Child Care | 0 | 0 | 75 | 150 | 200 | 200 | 625 |

| Supporting Early Learning and Child Care | 0 | 0 | 75 | 150 | 200 | 200 | 625 |

| 4.2. Immigration for Our Economy | 0 | 564 | 913 | 921 | 782 | 813 | 3,993 |

| Canada’s Ambitious Immigration Plan1 | 0 | 398 | 484 | 473 | 345 | 357 | 2,058 |

| Efficiently Welcoming Visitors, Students, and Workers to Canada | 0 | 75 | 86 | 86 | 86 | 86 | 421 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -35 | 0 | 0 | 0 | 0 | -35 |

| Securing the Integrity of Canada’s Asylum System | 0 | 57 | 312 | 305 | 312 | 332 | 1,318 |

| Supporting Legal Aid for Asylum Seekers |

0 | 44 | 0 | 0 | 0 | 0 | 44 |

| Improving Support Services for Immigrants and Visitors to Canada | 0 | 25 | 31 | 56 | 37 | 37 | 187 |

| 4.3. A Workforce for the 21st Century Economy | 0 | 12 | 25 | 25 | 25 | 0 | 87 |

| Bringing Workers to the Decision-Making Table | 0 | 3 | 0 | 0 | 0 | 0 | 3 |

| Doubling the Union Training and Innovation Program | 0 | 9 | 25 | 25 | 25 | 0 | 84 |

| 4.4. Connecting Workers to Good Jobs |

25 | 194 | 245 | 256 | 212 | 217 | 1,149 |

| Labour Mobility Deduction for Tradespeople | 25 | 110 | 110 | 115 | 115 | 120 | 595 |

| Administrative Costs | 0 | 1 | 1 | 1 | 1 | 1 | 6 |

| Supporting Foreign Credential Recognition in the Health Sector | 0 | 5 | 20 | 30 | 30 | 30 | 115 |

| An Employment Strategy for Persons with Disabilities | 0 | 39 | 65 | 65 | 65 | 65 | 299 |

Less: Year-Over- Year Reallocation of Funding |

0 | -26 | 0 | 0 | 0 | 0 | -26 |

| Improving the Temporary Foreign Worker Program | 0 | 63 | 49 | 45 | 1 | 1 | 159 |

| Completing the Employment Equity Act Review | 0 | 2 | 0 | 0 | 0 | 0 | 2 |

| 4.5. Towards a Better Employment Insurance System | 0 | 3 | 56 | 51 | 0 | 0 | 110 |

| Extending Temporary Support for Seasonal Workers | 0 | 3 | 56 | 51 | 0 | 0 | 110 |

| Additional Investments – Creating Good Middle Class Jobs | 0 | 8 | 0 | 0 | 0 | 0 | 8 |

| COVID-19 Benefit Integrity |

0 | 8 | 0 | 0 | 0 | 0 | 8 |

| Budget 2022 proposes to amend the Canada Emergency Response Benefit Act and the Canada Emergency Student Benefit Act to provide the Canada Revenue Agency with authority to establish and collect debts, on a weekly basis, for situations where a worker has accessed more than one benefit at once. Proposed funding would support related administration. | |||||||

| Chapter 4 - Net Fiscal Impact | 25 | 781 | 1,314 | 1,403 | 1,219 | 1,230 | 5,972 |

|

Note: Numbers may not add due to rounding.

|

|||||||

Report a problem on this page

- Date modified: