Archived - Chapter 3:

Clean Air and a Strong Economy

Climate change is real and the path forward is clear. To protect our planet—and to build a stronger economy—we must do even more on climate action.

The climate crisis is more urgent than ever. Canada is already experiencing an increase in heat waves, wildfires, and heavy storms. These impacts—and the economic and health repercussions that come with them—will continue to accelerate if we do not act now.

Since 2015, the federal government has invested more than $100 billion to help lead the way in fighting climate change and protecting the environment. We have introduced a world-leading price on pollution, and on March 29, 2022, the federal government unveiled its Emissions Reduction Plan, which set out an ambitious and achievable plan to reduce greenhouse gas emissions by 40 per cent by 2030 compared to 2005 levels, and puts Canada on a path to reach net-zero emissions by 2050.

Even still, we need to do more. And that is what we will do.

Smart climate investments today are good for Canadian workers, good for the Canadian economy, and good for the planet. With the largest mobilization of global capital since the Industrial Revolution already underway, Canada has the chance to become a leader in the clean energy of the future.

Our allies have been clear: their short-term focus is on eliminating their reliance on Russian oil and gas, while they shift to renewables and clean hydrogen as quickly as they can. Canada is working with our partners in Europe and around the world to assist them in doing so.

Budget 2022 will help Canada continue to lead in global efforts to fight climate change, to protect our nature, and to build a clean economy that will create the good-paying middle class jobs of today and tomorrow.

Key Ongoing Actions

Through major investments since 2015, the federal government has announced a range of important programs and initiatives that will support Canada’s efforts to fight climate change and protect the environment, such as:

-

Establishing a world-leading price on pollution that puts money back in the pockets of Canadians;

-

Issuing Canada’s inaugural, $5 billion green bond to help finance investments in green infrastructure and other projects that will fight climate change;

-

Investing $8 billion for the Net Zero Accelerator to support projects that reduce greenhouse gas emissions;

-

$4.4 billion to help homeowners save on their energy bills through energy efficient home retrofits under the Canada Greener Homes Loan Program;

-

$2.3 billion to protect nature and wildlife;

-

$976.8 million to help protect 25 per cent of Canada’s marine and coastal areas by 2025;

-

Planting two billion trees by 2031, 30 million of which have already been planted;

-

$647.1 million to preserve wild Pacific salmon populations;

-

$3.4 billion for the Disaster Mitigation and Adaptation Fund to make communities more resilient to the natural disasters caused by climate change;

-

$476.7 million to renew the Chemicals Management Plan;

-

$319 million to spur the development of carbon capture, utilization, and storage technologies;

-

$385 million under the Agricultural Climate Solutions program;

-

$165 million under the Agricultural Clean Technology program;

-

Working with provinces and territories toward a goal of zero plastic waste by 2030, including the elimination of certain single-use plastics; and,

-

Cutting tax rates in half for businesses that manufacture zero-emission technologies.

3.1 Reducing Pollution to Fight Climate Change

Canada is taking significant steps towards reducing our emissions by 40-45 per cent below 2005 levels by 2030, and towards reaching net-zero by 2050.

Budget 2022 introduces new measures that will make it easier and more affordable for Canadians and Canadian businesses to adopt clean technologies. The measures below build upon important investments announced in Chapter 1 to green our housing stock and support net-zero new builds in communities across Canada. Measures announced in Chapter 2 will also help position Canada as a leader in the critical minerals that will power the clean technologies required for our net-zero emissions future.

Reducing Emissions on the Road

On-road transportation accounts for 20 per cent of Canada’s greenhouse gas emissions.

-

To accelerate the manufacturing and adoption of cleaner cars, the federal government will put in place a sales mandate to ensure at least 20 per cent of new light-duty vehicle sales will be zero-emission vehicles (ZEVs) by 2026, at least 60 per cent by 2030 and 100 per cent by 2035.

-

To reduce emissions from medium- and heavy-duty vehicles (MHDVs), the federal government will aim to achieve 35 per cent of total MHDV sales being ZEVs by 2030.

-

In addition, the federal government will develop a medium- and heavy-duty ZEV regulation to require 100 per cent MHDV sales to be ZEVs by 2040 for a subset of vehicle types based on feasibility, with interim 2030 regulated sales requirements that would vary for different vehicle categories based on feasibility, and explore interim targets for the mid-2020s.

Making the Switch to Zero-Emission Vehicles More Affordable

To help make ZEVs more affordable for Canadians, the federal government has offered purchase incentives of up to $5,000 for eligible vehicles since 2019. This program has helped Canadians purchase or lease over 136,000 new ZEVs, but more support is needed to help Canadians get behind the wheel of zero-emission vehicles.

-

Budget 2022 proposes to provide $1.7 billion over five years, starting in 2022-23, with $0.8 million in remaining amortization, to Transport Canada to extend the Incentives for Zero-Emission Vehicles (iZEV) program until March 2025. Eligibility under the program will also be broadened to support the purchase of more vehicle models, including more vans, trucks, and SUVs, which will help make ZEVs more affordable. Further details will be announced by Transport Canada in the coming weeks.

Building a National Network of Electric Vehicle Charging Stations

Since 2015, the federal government has helped build almost 1,500 charging stations across the country. As more and more Canadians adopt zero-emission vehicles, we need to build the charging infrastructure that drivers can rely on, no matter where they’re going.

-

Budget 2022 announces that the Canada Infrastructure Bank will invest $500 million in large-scale urban and commercial ZEV charging and refuelling infrastructure. Funding will be sourced from the Canada Infrastructure Bank’s existing resources under its green infrastructure investment priority area.

-

Budget 2022 proposes to provide $400 million over five years, starting in 2022-23, to Natural Resources Canada to fund the deployment of ZEV charging infrastructure in sub-urban and remote communities through the Zero-Emission Vehicle Infrastructure Program (ZEVIP).

-

Budget 2022 proposes to provide $2.2 million over five years, starting in

2022-23, to Natural Resources Canada to renew the Greening Government Operations Fleet Program, which will continue to conduct readiness assessments of federal buildings required to facilitate the transition of the federal vehicle fleet to ZEVs.

Helping Businesses Switch to Medium- and Heavy-Duty Zero-Emission Vehicles

Businesses across Canada want to upgrade their fleets to be part of the solution to climate change. However, those upgrades can be expensive, and businesses need to be confident that ZEVs can reliably transport their goods to market.

-

Budget 2022 proposes to provide $547.5 million over four years, starting in 2022-23, to Transport Canada to launch a new purchase incentive program for medium- and heavy-duty ZEVs.

-

Budget 2022 proposes to provide $33.8 million over five years, starting in 2022-23, with $42.1 million in remaining amortization, to Transport Canada to work with provinces and territories to develop and harmonize regulations and to conduct safety testing for long-haul zero-emission trucks.

-

To help decarbonize vehicles already on the road, Budget 2022 proposes to provide $199.6 million over five years, starting in 2022-23, and $0.4 million ongoing, to Natural Resources Canada to expand the Green Freight Assessment Program, which will be renamed the Green Freight Program. This will support assessments and retrofits of more vehicles and a greater diversity of fleet and vehicle types.

With these investments, the government is taking a significant step towards reducing pollution on our roads, and is on track to meet its commitment to add 50,000 new ZEV chargers and hydrogen stations across Canada.

Sustainable Agriculture to Fight Climate Change

Agriculture plays an essential role in Canada’s economy, and our farmers help feed the world. At a time of geopolitical uncertainty and rising costs, ensuring that Canada’s agricultural production continues to grow will be vitally important.

However, agriculture also represents approximately 10 per cent of our greenhouse gas emissions. Farmers across the country are experiencing the impacts of climate change like floods and droughts, and have already been leading the adoption of climate-friendly practices, like precision agriculture technology and low-till techniques. These technologies can help reduce emissions and save farmers both time and money.

-

Budget 2022 proposes to provide a further $329.4 million over six years, starting in 2022-23, with $0.6 million in remaining amortization, to triple the size of the Agricultural Clean Technology Program.

-

Budget 2022 proposes to provide $469.5 million over six years, with $0.5 million in remaining amortization, starting in

2022-23, to Agriculture and Agri-Food Canada to expand the Agricultural Climate Solutions program’s On-Farm Climate Action Fund. -

Budget 2022 proposes $150 million for a resilient agricultural landscape program to support carbon sequestration, adaptation, and address other environmental co-benefits, to be discussed with provinces and territories.

-

Budget 2022 proposes to provide $100 million over six years, starting in

2022-23, to the federal granting councils to support post-secondary research in developing technologies and crop varieties that will allow for net-zero emission agriculture.

Expanding the Nature Smart Climate Solutions Fund

Investing in protecting nature is among the most affordable climate action that governments can take. The existing Nature Smart Climate Solutions Fund provides $631 million from 2021-22 to 2031-32 to support projects that conserve, restore and enhance wetlands, peatlands, and grasslands to capture and store carbon.

-

To enhance the potential for the natural environment to store carbon and reduce emissions, Budget 2022 proposes to provide $780 million over five years, starting in 2022-23, to Environment and Climate Change Canada to expand the Nature Smart Climate Solutions Fund.

A New Tax Credit for Investments in Clean Technology

The expansion of clean technology will need to accelerate if Canada’s economy is going to reach net-zero. Helping Canadian companies adopt clean technologies will create jobs, keep Canadian businesses competitive, and reduce Canada’s emissions at the same time.

-

Budget 2022 announces that the Department of Finance Canada will engage with experts to establish an investment tax credit of up to 30 per cent, focused on net-zero technologies, battery storage solutions, and clean hydrogen. The design details of the investment tax credit will be provided in the 2022 fall economic and fiscal update.

Returning Fuel Charge Proceeds to Small and Medium- Sized Enterprises

Since 2019, it has no longer been free to pollute anywhere in Canada, and provincial and territorial governments have been able to design and implement their own pollution pricing systems that meet a standard, federal benchmark. Most have done so. But in provinces that have decided not to implement a system that meets the benchmark—specifically Alberta, Saskatchewan, Manitoba, and Ontario—a federal backstop applies.

In these provinces, all direct proceeds of pollution pricing are returned to households, small businesses, Indigenous groups, and farmers.

In the 2021 Economic and Fiscal Update, the government announced its intention to return a portion of the proceeds from the price on pollution to small and medium-sized businesses through new federal programming in backstop jurisdictions. Beginning in 2022-23, these businesses will receive an estimated $1.5 billion in fuel charge proceeds collected between 2020-21 and 2022-23. This new program will also be used to return outstanding 2019-20 fuel charge proceeds, amounting to approximately $120 million, that have not already been returned through the Climate Action Incentive Fund.

-

Budget 2022 proposes to provide up to $30 million over two years, starting in 2022-23, to Environment and Climate Change Canada to administer direct payments to support emission-intensive, trade-exposed small and medium-sized enterprises in those jurisdictions.

Expanding the Low Carbon Economy Fund and Supporting Clean Energy in Yukon

Greater collaboration on climate action between all orders of government is important for helping to build a clean economy and create good jobs. Through the Low Carbon Economy Fund, the federal government has worked with provinces and territories on funding projects that are reducing emissions from coast-to-coast-to-coast.

The Low Carbon Economy Fund currently provides up to $2 billion to provinces and territories to reduce emissions, build resilient communities, and generate good jobs for Canadians. It has supported the installation of emission-reducing technologies like wind power, solar power, and electric heating in buildings. Since 2017, the Low Carbon Economy Fund has supported approximately 132 projects across Canada.

-

Budget 2022 proposes to provide $2.2 billion over seven years, starting in 2022-23, to Environment and Climate Change Canada to expand and extend the Low Carbon Economy Fund.

-

Budget 2022 announces $32.2 million over two years, starting in 2022-23, from the expanded Low Carbon Economy Fund to support the Atlin Hydro Expansion project in British Columbia, which will provide clean electricity to the Yukon and help reduce greenhouse gas emissions. The federal government has previously committed $83.9 million to this project.

Support for Business Investment in Air-Source Heat Pumps

Buildings account for 12 per cent of Canada’s greenhouse gas emissions, arising mostly from space and water heating. Air-source heat pumps are an energy efficient, zero-emission heating alternative that can help support Canada’s climate goals if widely adopted.

-

Budget 2022 proposes to expand the accelerated tax deductions for business investments in clean energy equipment to include air-source heat pumps.

-

To support job creation and growth in clean technology manufacturing in Canada, the government proposes to extend the 50 per cent reduction of the general corporate and small business income tax rates for zero-emission technology manufacturers to include manufacturers of air-source heat pumps.

These measures are expected to reduce federal revenues by $53 million over five years starting in 2022-23.

Building Capacity to Support Green Procurement

With more than $20 billion in purchasing requirements every year, the federal government can use its significant buying power to accelerate the transition to a net-zero economy by purchasing goods and services with a reduced environmental impact, and by adopting new, clean technologies.

-

In Budget 2022, the federal government is announcing that Public Services and Procurement Canada (PSPC) will develop new tools, guidelines, and targets to support the adoption of green procurement across the federal government. Additional details will be announced by PSPC in the months ahead.

Industrial Energy Management

Helping industrial sectors adopt clean technology will play an important role in the transition to a low carbon economy and in achieving Canada’s goal of net zero emissions by 2050.

-

Budget 2022 proposes to provide $194 million over five years, starting in 2022-23, to Natural Resources Canada to expand the Industrial Energy Management System program. This will to support ISO 50001 certification, energy managers, cohort-based training, audits, and energy efficiency-focused retrofits for key small-to-moderate projects that fill a gap in the federal suite of industrial programming.

3.2 Building a Clean, Resilient Energy Sector

Since 2015, Canada has begun an ambitious green transformation of our energy sector—an important sector of our economy that directly represents 7.6 per cent of our GDP and 257,000 jobs for Canadians.

Canada has already introduced a carbon-pricing system and a commitment to phase out unabated coal-fired electricity by 2030. In addition to these measures, the federal government recently committed to achieving a net-zero electricity system by 2035 and to introducing a cap on emissions from the oil and gas sector.

Budget 2022 proposes new measures to increase investments in clean power, to support clean electricity projects, to encourage the decarbonization of our energy sector, and to mobilize new capital to establish hydrogen hubs.

Investment Tax Credit for Carbon Capture, Utilization, and Storage

Carbon capture, utilization, and storage (CCUS) is a suite of technologies that capture carbon dioxide (CO2) emissions—whether from fuel combustion, industrial processes, or directly from the air—to either store the CO2 typically deep underground, or to use it in other industrial processes such as permanent mineralization in concrete.

CCUS technologies are an important tool for reducing emissions in high-emitting sectors where other pathways to reduce emissions may be limited or unavailable. Examples of industries where CCUS has helped to reduce emissions include oil and gas, chemical production, and electricity generation.

In Budget 2021, the federal government proposed an investment tax credit for CCUS with the intention of both securing Canada’s place as a leader in CCUS and supporting the Canadian innovators and engineers advancing the technology. By lowering the carbon footprints of Canada’s traditional energy producers, the credit aims to ensure that they are a stable source of cleaner energy both domestically and internationally.

The CCUS investment tax credit is a key part of the government’s broader plan to work with industry towards the goal of decarbonization, including through initiatives like the Canada Growth Fund in Chapter 2 and the Net-Zero Accelerator.

The government has consulted the public, stakeholders, and provinces on the design of the investment tax credit for CCUS, and used the input received to inform its final design.

-

Budget 2022 proposes a refundable investment tax credit for businesses that incur eligible CCUS expenses, starting in 2022. The investment tax credit would be available to CCUS projects to the extent that they permanently store captured CO2 through an eligible use. Eligible CO2 uses include dedicated geological storage and storage of CO2 in concrete, but does not include enhanced oil recovery.

-

From 2022 through 2030, the investment tax credit rates would be set at:

- 60 per cent for investment in equipment to capture CO2 in direct air capture projects;

- 50 per cent for investment in equipment to capture CO2 in all other CCUS projects; and

- 37.5 per cent for investment in equipment for transportation, storage and use.

-

To encourage the industry to move quickly to lower emissions, these rates will be reduced by 50 per cent for the period from 2031 through 2040.

The proposed refundable tax credit is expected to cost $2.6 billion over five years starting in 2022-23, with an annual cost of about $1.5 billion in 2026-27. Going forward, it is expected that the measure will continue to cost approximately $1.5 billion annually until 2030.

The government will engage with relevant provinces in the expectation that they will further strengthen financial incentives to accelerate the adoption of CCUS technologies by industry.

The government will also undertake a review of investment tax credit rates before 2030 to ensure that the proposed reduction in the level of tax support from 2031 to 2040 aligns with the government’s environmental objectives.

Other CO2 uses could be made eligible in the future, if permanence of storage can be demonstrated and no incremental CO2 emissions result from the use of the product that is produced.

Clean Electricity

Canada has one of the cleanest electricity power grids in the world, but the clean energy it generates does not reach all parts of the country. To achieve the government’s commitment to a net-zero electricity system by 2035, approximately $15 billion has been made available since 2016 to support investments in clean power generation and transmission, with Budget 2022 announcing further investments to support the expansion of clean electricity in Canada.

-

Budget 2022 proposes to provide $250 million over four years, starting in

2022-23, to Natural Resources Canada to support pre-development activities of clean electricity projects of national significance, such as inter-provincial electricity transmission projects and small modular reactors. The federal government is already advancing similar work on the Atlantic Loop and Prairie Link projects. Projects like the Atlantic Loop will be critical as we move towards a net-zero emissions electricity system, while also supporting economic development through investments in new infrastructure and the enhanced security and reliability of our clean energy supply. -

Budget 2022 proposes $600 million over seven years starting in 2022-2023 to Natural Resources Canada for the Smart Renewables and Electrification Pathways Program to support additional renewable electricity and grid modernization projects.

-

Budget 2022 proposes to provide $2.4 million in 2022-23 to Natural Resources Canada to establish a Pan-Canadian Grid Council, which would provide external advice in support of national and regional electricity planning.

-

Budget 2022 provides $25 million starting 2022-23, to Natural Resources Canada to establish Regional Strategic Initiatives to work with provinces, territories, and relevant stakeholders to develop net-zero energy plans.

Small Modular Reactors

Small modular reactors offer a promising pathway to support Canada’s low-carbon energy transition and they are less complex, easier to operate, and more cost effective than current nuclear technology. For example, a 300-megawatt small modular reactor could supply enough clean power for an estimated 300,000 homes. With approximately 76,000 hard-working Canadians employed across its supply chain, Canada's nuclear industry is well positioned to leverage its more than 60 years of science and technology innovation to become a leader in the development and deployment of small modular reactor technology.

Support to develop this technology can position Canada as a clean energy leader; support the decarbonization of provincial electricity grids in places like New Brunswick and Saskatchewan; facilitate the transition away from diesel power in remote communities; and help decarbonize heavy emitting industries.

-

Budget 2022 proposes to provide $120.6 million over five years, starting in 2022-23, and $0.5 million ongoing, as follows:

- $69.9 million for Natural Resources Canada to undertake research to minimize waste generated from these reactors; support the creation of a fuel supply chain; strengthen international nuclear cooperation agreements; and enhance domestic safety and security policies and practices; and,

- $50.7 million, and $0.5 million ongoing, for the Canadian Nuclear Safety Commission to build the capacity to regulate small modular reactors and work with international partners on global regulatory harmonization.

Phasing Out Flow-Through Shares for Oil, Gas, and Coal Activities

The federal government committed to phase out or rationalize inefficient fossil fuel subsidies—and has recently accelerated the previous timeline for doing so from 2025 to 2023.

-

Budget 2022 proposes to eliminate the flow-through share regime for fossil fuel sector activities. This will be done by no longer allowing expenditures related to oil, gas, and coal exploration and development to be renounced to flow-through share investors for flow-through share agreements entered into after March 31, 2023.

This measure is expected to increase federal revenues by $9 million over five years, starting in 2022-23.

3.3 Protecting Our Lands, Lakes, and Oceans

Canada’s nature is central to our national identity. However, Canada is warming twice as fast as the global average, and three times faster in the North. The impact of this warming on our natural environment will be significant. Northern, coastal, Indigenous, and remote communities are significantly more vulnerable to climate change, and the recent floods, droughts, and fires in British Columbia, Alberta, Saskatchewan, and Manitoba are examples of a growing number of costly and devastating climate-related challenges.

Since 2015, Canada has gone from having less than 1 per cent of our oceans protected to almost 14 per cent. The federal government has committed to protecting 25 per cent of our land, oceans, and freshwater by 2025, while working towards protecting 30 per cent by 2030.

In Budget 2022, the federal government is proposing to undertake significant efforts to further protect our natural environment and to help mitigate the financial and ecological costs associated with biodiversity loss and climate change.

Adaptation actions in Budget 2022 will build on the significant environment and climate-related investments of more than $100 billion since 2015 and support a National Adaptation Strategy that will be published later this year.

Renewing and Expanding the Oceans Protection Plan

In 2016, the government announced the Oceans Protection Plan to protect Canada’s coasts and waterways and enable their safe and responsible commercial use. Under the Plan, the government has improved monitoring of marine traffic across Canada and restored the health of over 60 aquatic habitats nationally. Today, marine traffic continues to increase in support of Canada’s growing economy, and the federal government is taking additional steps to strengthen marine safety, protect marine ecosystems, and create stronger partnerships with Indigenous and coastal communities.

-

Budget 2022 proposes to provide an additional $2.0 billion over nine years, starting in 2022-23, with $78.7 million in remaining amortization, and $136.4 million per year ongoing, to renew and expand the Oceans Protection Plan. This builds on ongoing funding announced in 2016, and will result in an overall increase in federal funding for oceans protection over the next five years.

-

Budget 2022 also announces the government’s intention to propose amendments to the Canada Shipping Act and other acts, including to enable the proactive management of marine emergencies and to cover more types of pollution.

These measures will help ensure that Indigenous communities, industry, investors, and all Canadians can have confidence in marine safety and will allow for marine activity to continue safely and sustainably.

Protecting Our Freshwater

Canada holds 20 per cent of the world’s freshwater supply. Protecting our freshwater is critically important to Canadians, to our environment, and to our economy. In 2019, the government committed to establish a federal Canada Water Agency to work with provinces, territories, Indigenous communities, and other stakeholders in order to find the best ways to keep Canada’s water safe, clean, and well-managed.

-

Budget 2022 proposes to provide $43.5 million over five years, starting in 2022-23, and $8.7 million ongoing to Environment and Climate Change Canada to create a new Canada Water Agency, which will be stood-up in 2022. The headquarters of the new Agency will be located outside of the National Capital Region.

-

Budget 2022 proposes to provide $19.6 million in 2022-23 to Environment and Climate Change Canada to sustain the Freshwater Action Plan. The future of this initiative will be communicated at a later date. This funding will support clean-up efforts in the Great Lakes, the St. Lawrence River, Lake Winnipeg, Lake of the Woods, the Fraser River, the Saint John River, the Mackenzie River, and Lake Simcoe.

-

Budget 2022 proposes to provide $25.0 million over five years, starting in 2022-23, to Environment and Climate Change Canada to support the Experimental Lakes Area.

-

Budget 2022 proposes to provide $44.9 million over five years, starting in 2022-23, and $9.0 million ongoing to Fisheries and Oceans Canada to support the Great Lakes Fishery Commission. This funding will help coordinate Canada-U.S. invasive sea lamprey control activities, manage fisheries, and conduct scientific research in the Great Lakes.

Taking More Action to Eliminate Plastic Waste

No one wants to see trash on the beach where their children play, or on the trail where they hike. The federal government has already taken significant steps—working with all orders of government, industry, and other stakeholders to take action on plastic waste and pollution and to work towards a goal of zero plastic waste by 2030. A significant step towards this goal is the government’s intent to enact regulations prohibiting certain single-use plastics in 2022.

Under Canada’s G7 presidency in 2018, Canada championed the development of the Ocean Plastics Charter and later worked with provincial and territorial governments to develop a Canada-wide Strategy on Zero Plastic Waste.

-

Budget 2022 proposes to provide $183.1 million over five years, starting in 2022-23, to Environment and Climate Change Canada, Fisheries and Oceans Canada, Health Canada, Transport Canada, Crown-Indigenous Relations and Northern Affairs Canada, Statistics Canada, and the National Research Council. This investment will reduce plastic waste and increase plastic circularity by developing and implementing regulatory measures, and conducting scientific research to inform policy-making. This funding will also help better understand effects of micro-plastics on human health, monitor plastic contaminants in the North, inform ship plastic waste management, and monitor plastic pollution in water systems.

-

Budget 2022 also proposes to provide $10 million in 2022-23 to Fisheries and Oceans Canada to renew the Ghost Gear Fund for one year to continue to assist projects that retrieve ghost gear, dispose of fishing-related plastic waste, test new fishing technology, and support international efforts to remove ghost gear from our oceans.

Fighting and Managing Wildfires

Last summer, Canadians again saw the devastating and tragic impact of wildfires in British Columbia. Communities like Lytton saw homes and businesses lost to fire. People across the country spent days under a haze of smoke. Canada is experiencing more frequent and more extreme wildfires and this trend will continue as the climate changes. The risk of wildfire is especially serious for remote and Indigenous communities and fires come with significant economic and environmental costs.

-

Budget 2022 proposes additional action to counter the growing threat of wildfires in Canada, including by providing support to provinces, territories, and Indigenous communities for wildfire mitigation, response, and monitoring through the following:

- $269 million over five years, starting in 2022-23, to Natural Resources Canada as exceptional, time-limited support to help provinces and territories procure firefighting equipment such as vehicles and aircrafts;

- $39.2 million over five years, starting in 2022-23, to Indigenous Services Canada to support the purchase of firefighting equipment by First Nations communities;

- $37.9 million over five years, starting in 2022-23, with $0.6 million ongoing, to Natural Resources Canada to train 1,000 additional firefighters and incorporate Indigenous traditional knowledge in fire management; and,

- $169.9 million over 11 years, starting in 2022-23, with $6.9 million in remaining amortization, to the Canadian Space Agency, Natural Resources Canada, and Environment and Climate Change Canada to deliver and operate a new wildfire monitoring satellite system.

Growing Canada’s Trail Network

The Trans Canada Trail is a national initiative that began in 1992 with the goal of developing a network of recreational trails that would stretch across Canada. At 27,000 kilometres, the Trans Canada Trail is now the longest trail network in the world, connecting Canadians to nature from coast-to-coast-to-coast.

-

To maintain and enhance Canada’s trail network, Budget 2022 proposes to provide $55 million over five years, starting in 2022-23, to the Parks Canada Agency for the Trans Canada Trail.

-

To improve access and promote tourism and recreational activities around Rouge National Urban Park, Budget 2022 proposes to provide $2 million over two years, starting in 2022-23, to the Parks Canada Agency to contribute to building new trails outside and connecting to trails inside the Urban Park.

British Columbia Old Growth Nature Fund

British Columbia’s iconic old growth forests have deep-rooted cultural significance to Indigenous communities and are important to all British Columbians. They are also critical habitats for dozens of species at risk and migratory birds and are important natural stores of carbon.

-

To conserve and protect these forests, Budget 2022 proposes to provide $55.1 million over three years, starting in 2022-23, to Environment and Climate Change Canada and Natural Resources Canada to establish an Old Growth Nature Fund in collaboration with the Province of British Columbia, non-governmental organizations, and Indigenous and local communities. This funding will be conditional on the Government of British Columbia making a matching investment.

3.4 Building Canada’s Net-Zero Economy

Governments around the world will not be able to finance the transition to a net-zero economy and fight climate change alone. Thankfully, the transition to net-zero represents a significant opportunity for businesses and investors looking to invest in the economy of the future and trillions of dollars in private capital have already been assembled for investments in green infrastructure and technology around the world.

Budget 2022 takes a number of important steps to mobilize the substantial private capital that will build a cleaner economy, fight climate change, and create new, good-paying middle class jobs for Canadians.

A major component of building Canada’s net-zero economy is the Canada Growth Fund—a significant new $15 billion government investment fund that will accelerate the investment of private capital into decarbonization and clean technology projects; help to promote the diversification of Canada’s economy; play a key role in helping to meet Canada’s climate targets; and strengthen both Canada’s economic resilience and capacity. More information on the Canada Growth Fund can be found in Chapter 2.

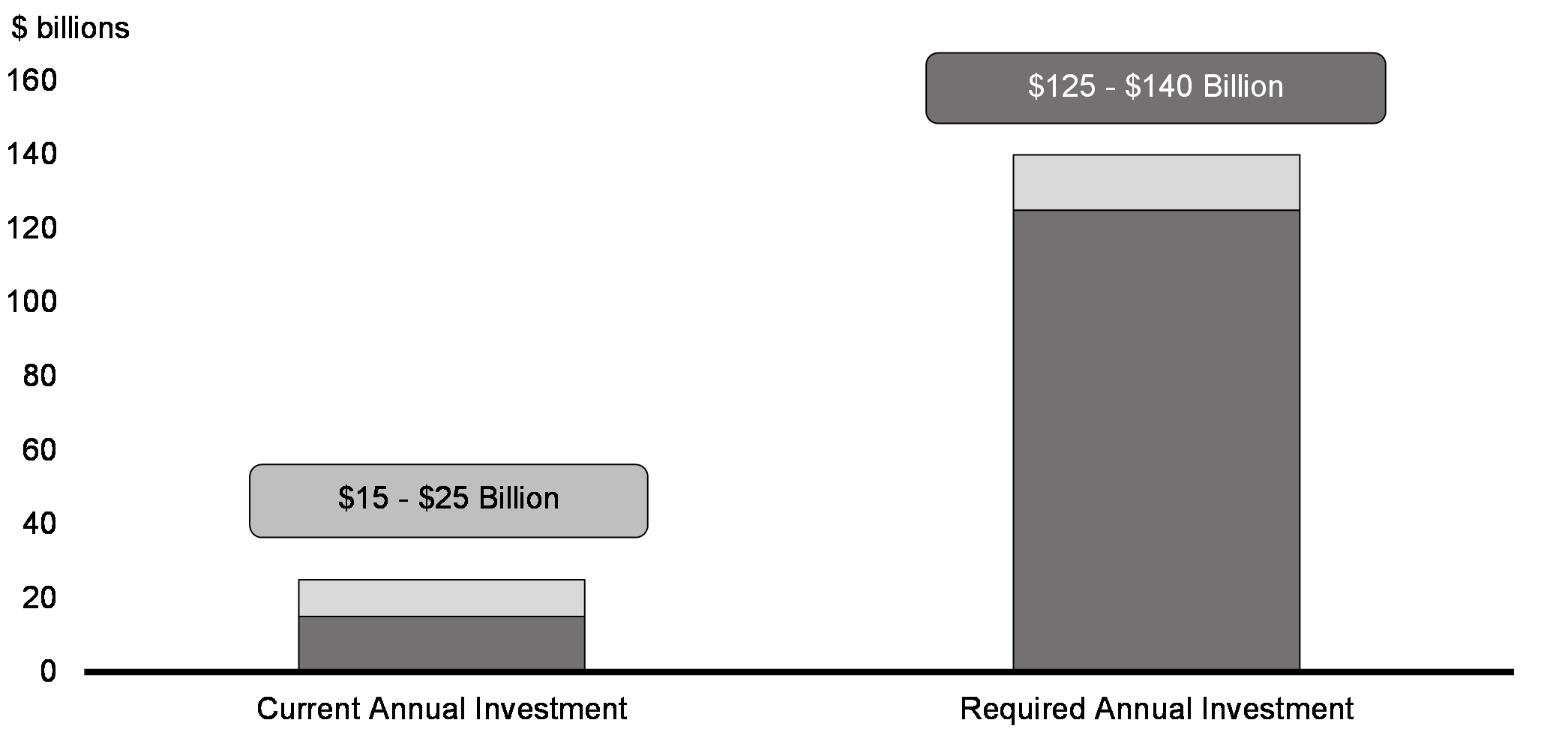

Annual Investment to Attain Net-Zero Emissions in Canada by 2050

(Total Private and Government Investment)

Increasing the Impact of the Canada Infrastructure Bank

The Canada Infrastructure Bank (CIB) was created in 2017 to attract private capital to major infrastructure projects and help build more of the infrastructure that we need across the country.

In 2020, the CIB announced its three-year, $10 billion Growth Plan, which included a goal of helping Canada achieve its emissions reduction targets. Since then, the CIB has identified opportunities to work with private sector and institutional investors to do even more to help Canada reach a net-zero emissions future.

-

To increase the CIB’s impact, Budget 2022 announces a broadened role for the CIB to invest in private sector-led infrastructure projects that will accelerate Canada’s transition to a low-carbon economy. This will allow the CIB to invest in small modular reactors; clean fuel production; hydrogen production, transportation and distribution; and carbon capture, utilization and storage. These new areas fall under the CIB’s existing clean power and green infrastructure investment areas. The CIB will continue to invest in its public transit, broadband, and trade and transportation investment areas.

As noted in section 3.1, the CIB will also invest $500 million in large-scale, zero-emission vehicle (ZEV) charging and refueling infrastructure to help accelerate the adoption of ZEVs and reduce Canada’s transportation emissions.

By investing in public and private-sector led infrastructure projects, the CIB will complement the Canada Growth Fund to reduce emissions, fight climate change, and build Canada’s net-zero economy.

Net-Zero Capital Allocation Strategy

Last year, the government created the Sustainable Finance Action Council, convening 25 of Canada’s largest financial institutions and pension funds, which together represent more than $10 trillion in assets. While public investment can provide some of the capital required to support the net-zero transition, the massive spending power of the private sector—both in Canada and around the world—will play a vital role in the transition to a low-carbon global economy.

-

Budget 2022 announces that the Sustainable Finance Action Council will develop and report on strategies for aligning private sector capital with the transition to net-zero, with support from the Canadian Climate Institute and in consultation with the Net-Zero Advisory Body.

Climate Disclosures for Federally Regulated Institutions

The federal government is committed to moving towards mandatory reporting of climate-related financial risks across a broad spectrum of the Canadian economy, based on the international Task Force on Climate-related Financial Disclosures (TCFD) framework.

The Office of the Superintendent of Financial Institutions (OSFI) will consult federally regulated financial institutions on climate disclosure guidelines in 2022 and will require financial institutions to publish climate disclosures—aligned with the TCFD framework—using a phased approach, starting in 2024.

OSFI will also expect financial institutions to collect and assess information on climate risks and emissions from their clients.

As federally regulated banks and insurers play a prominent role in shaping Canada’s economy, OSFI guidance will have a significant impact on how Canadian businesses manage and report on climate-related risks and exposures.

Separately, the government will move forward with requirements for disclosure of environmental, social, and governance (ESG) considerations, including climate-related risks, for federally regulated pension plans.

Supporting the International Sustainability Standards Board’s Montreal Office

The federal government welcomed the International Financial Reporting Standards (IFRS) Foundation’s selection of Montreal to host one of the two central offices of the new International Sustainability Standards Board (ISSB). The ISSB will develop global sustainability standards to enhance the quality and comparability of international corporate reporting on environmental, social and governance (ESG) factors. The government is committed to supporting the start-up of the Montreal office and positioning Canada as a leader in sustainability reporting.

-

Budget 2022 proposes to provide $8 million over three years, starting in

2022-23, to Canada Economic Development for Quebec Regions to support the start-up of the ISSB's Montreal office. This investment builds on significant industry and public sector funding from across Canada that helped to bring the ISSB to Canada.

Section Number |

Measure Title | Funding Amount | ERP Page Reference |

|---|---|---|---|

| 1.1 | Canada Green Buildings Strategy | $150 million | p. 36 |

| Deep Retrofit Accelerator Initiative | $200 million | p. 37 | |

| Greener Neighbourhoods Pilot Program | $33.2 million | p. 37 | |

| Innovative construction materials R&D/Building standards | $183.2 million | p. 37 | |

| Low-interest loans (Canada Greener Homes Loan program) | $458.5 million | p. 37 | |

| 3.1 | Incentives for Zero-Emission Vehicles (iZEV) program | $1.7 billion | p. 61 |

| Zero-Emission Vehicle Infrastructure Program | $400 million | p. 61 | |

| Greening Government Operations Fleet Program | $2.2 million | p. 61 | |

| Incentives for medium- and heavy-duty ZEVs | $547.5 million | p. 61 | |

| Long-haul zero-emission trucks regulations/Safety testing | $33.8 million | p. 61 | |

| Green Freight Assessment Program | $199.6 million | p. 61 | |

| Agricultural Clean Technology Program | $329.4 million | p. 66 | |

| On-Farm Climate Action Fund | $469.5 million | p. 65 | |

| Resilient Agricultural Landscape Program | $150 million | p. 65 | |

| Federal granting councils | $100 million | p. 66 | |

| Nature Smart Climate Solutions Fund | $780 million | p. 73 | |

| Low Carbon Economy Fund | $2.2 billion | p. 31 | |

| Industrial Energy Management System program | $194 million | p. 46 | |

| 3.2 | Clean electricity projects pre-development activities | $250 million | p. 42 |

| Smart Renewables and Electrification Pathways Program | $600 million | p. 42 | |

| Pan-Canadian Grid Council | $2.4 million | p. 42 | |

| Regional Strategic Initiatives | $25 million | p. 42 | |

| 7.3 | Indigenous Climate Leadership Agenda | $29.6 million | p. 101 |

| Total | $9.1 billion | ||

| Note:The entries in the “Funding Amount” column have different durations and do not include remaining amortization amounts. Please refer to budget text for complete funding information. Funding amounts may not add up to total due to rounding. | |||

| 2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| 3.1. Reducing Pollution to Fight Climate Change | 0 | 827 | 1,530 | 2,022 | 1,485 | 946 | 6,810 |

| Reducing Emissions on the Road - Making the Switch to Zero- Emission Vehicles More Affordable1 |

0 | 422 | 549 | 723 | 4 | 2 | 1,699 |

| Reducing Emissions on the Road – Investing in ZEV Charging Infrastructure in Sub- Urban and Remote Communities1 |

0 | 80 | 80 | 80 | 80 | 80 | 400 |

| Reducing Emissions on the Road – Greening Government Operations Fleet Program1 | 0 | 0 | 0 | 0 | 0 | 0 | 2 |

| Reducing Emissions on the Road – Incentives for Medium- and Heavy-Duty ZEVs1 | 0 | 11 | 97 | 149 | 290 | 0 | 548 |

| Reducing Emissions on the Road – Long- Haul ZEV Trucking Regulations and Safety Testing1 | 0 | 4 | 8 | 8 | 7 | 6 | 34 |

| Reducing Emissions on the Road – Green Freight Assessment Program1 | 0 | 23 | 45 | 53 | 49 | 29 | 200 |

| Sustainable Agriculture to Fight Climate Change1 | 0 | 66 | 168 | 235 | 229 | 189 | 887 |

| Expanding the Nature Smart Climate Solutions Fund1 | 0 | 156 | 156 | 156 | 156 | 156 | 780 |

| Returning Fuel Charge Proceeds to Small and Medium Sized Enterprises |

0 | 15 | 15 | 0 | 0 | 0 | 30 |

| Expanding the Low Carbon Economy Fund1 | 0 | 18 | 360 | 560 | 607 | 440 | 1,985 |

| Support for Business Investment in Air- Source Heat Pumps | 0 | 9 | 15 | 10 | 10 | 9 | 53 |

| Industrial Energy Management1 | 0 | 24 | 36 | 47 | 51 | 35 | 194 |

| 3.2. Building a Clean, Resilient Energy Sector | 0 | 133 | 226 | 493 | 956 | 1,581 | 3,389 |

| Investment Tax Credit for Carbon Capture, Utilization, and Storage | 0 | 35 | 70 | 285 | 755 | 1,455 | 2,600 |

| Clean Electricity1 | 0 | 88 | 133 | 181 | 175 | 100 | 677 |

| Small Modular Reactors | 0 | 10 | 24 | 29 | 29 | 29 | 121 |

| Phasing Out Flow- Through Shares for Oil, Gas, and Coal Activities | 0 | 0 | -1 | -2 | -3 | -3 | -9 |

| 3.3. Protecting Our Land, Lakes, and Oceans | 0 | 324 | 475 | 511 | 477 | 462 | 2,248 |

| Renewing and Expanding the Oceans Protection Plan | 0 | 237 | 314 | 344 | 354 | 342 | 1,590 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -34 | -30 | -30 | -30 | -30 | -153 |

| Protecting Our Freshwater | 0 | 42 | 23 | 23 | 23 | 23 | 133 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -4 | 0 | 0 | 0 | 0 | -4 |

| Taking More Action to Eliminate Plastic Waste | 0 | 39 | 37 | 36 | 42 | 43 | 197 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -1 | -1 | -1 | 0 | 0 | -4 |

| Fighting and Managing Wildfires |

0 | 30 | 101 | 102 | 77 | 72 | 383 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -1 | -1 | -1 | -1 | -1 | -6 |

| Growing Canada’s Trail Network | 0 | 10 | 11 | 11 | 12 | 13 | 57 |

| British Columbia Old Growth Nature Fund | 0 | 6 | 22 | 27 | 0 | 0 | 55 |

| 3.4. Building Canada's Net-Zero Economy | -3 | 0 | 0 | 3 | 0 | 0 | 0 |

| Supporting the International Sustainability Standards Board’s Montreal Office | 0 | 3 | 3 | 3 | 0 | 0 | 8 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-3 | -3 | -3 | 0 | 0 | 0 | -8 |

| Chapter 3 - Net Fiscal Impact | -3 | 1,284 | 2,231 | 3,030 | 2,918 | 2,988 | 12,448 |

|

Note: Numbers may not add due to rounding.

|

|||||||

Report a problem on this page

- Date modified: