Chapter 3 - Confidence in Canada's Economic Future

Introduction

Canada needs an economy that works for everyone—an economy where the benefits are felt by more and more people, where Canadians have access to high-quality jobs and where Canadian businesses have greater confidence to seize new opportunities in an increasingly complex global economy.

The Canadian economy has experienced several years of heightened uncertainty. By 2014, global economic growth had started to accelerate following the Great Recession and the European debt crisis—but just as this recovery was taking hold, oil prices declined, resulting in job losses in Canada's oil producing regions and creating ripple effects throughout the Canadian economy. While the economy has recovered strongly, subsequent geopolitical events have created a number of new uncertainties for the economy, ranging from questions about the United Kingdom's future relationship with the European Union, to the potential impact of significant tax changes in the United States, to ongoing trade frictions between the United States and its major trading partners.

Despite these uncertainties, Canada continues to have significant untapped potential for stronger growth, whether driven through greater investments here at home, or greater access to markets around the world. With a rich endowment of natural resources, Canada is well positioned to satisfy emerging economies' demand for the energy and raw materials needed to sustain their growth. Further, Canada is positioned to be one of the world's cleanest suppliers of natural resources and one of the few major oil exporters with a price on carbon pollution.

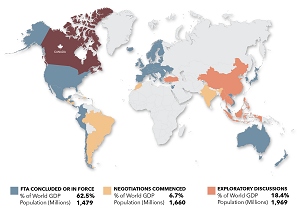

With a highly skilled workforce and a strong capacity for research, Canada is ready to take on the challenge of competing in an increasingly knowledge-based global economy. With the recent negotiation of several trade agreements including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the Comprehensive Economic and Trade Agreement and the new United States-Mexico-Canada Agreement, Canadian businesses have more opportunities to access global markets than they have ever had before. Today, Canada is the only country in the Group of Seven (G7) that has trade agreements with all other G7 nations.

The Government is committed to enhancing confidence in Canada by supporting Canadian businesses as they grow, expand into new markets, and create more good, well-paying jobs.

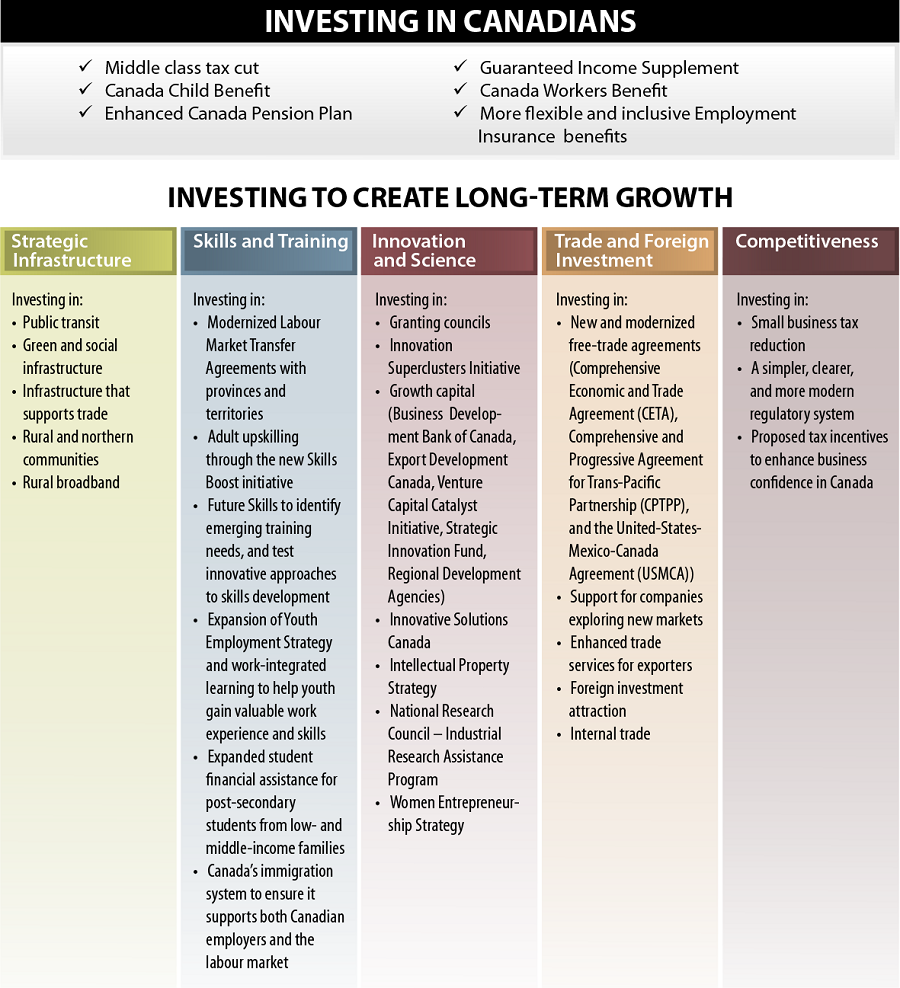

This focus on competitiveness is the fifth pillar in the Government's long-term plan to grow the economy. It joins investments in strategic infrastructure, skills and training, innovation and science, and trade and investment as a key driver of long-term growth that will benefit all Canadians for years to come.

In this Fall Economic Statement, the Government proposes to:

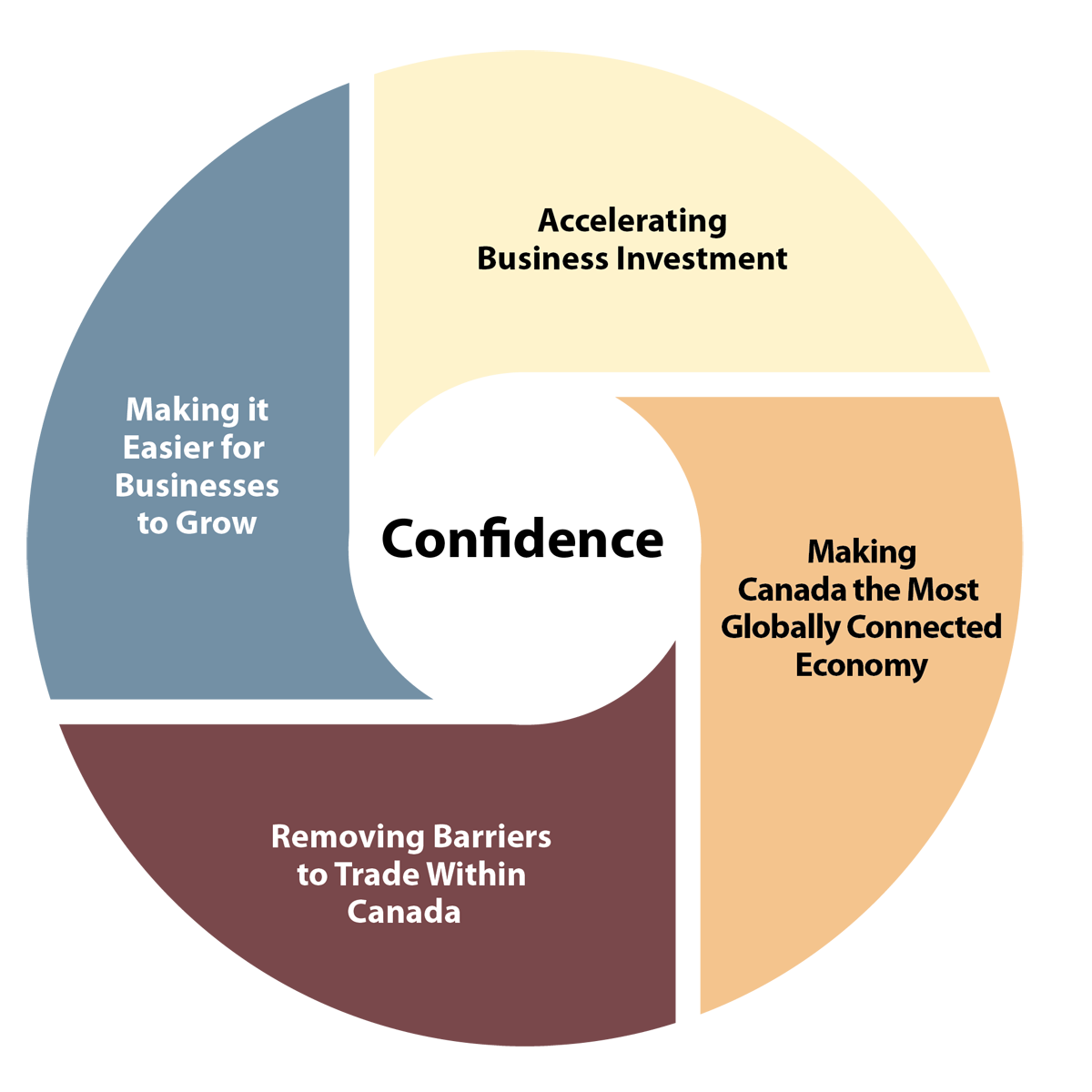

- Support business investment through new tax incentives that will increase investment in Canada.

- Set an ambitious agenda to make Canada the most globally connected economy in the world by diversifying Canada's trade with Europe and the Asia-Pacific region, helping businesses take full advantage of trade agreements, and offering continued support for Canada's innovators.

- Remove the barriers to trade within Canada, to support stronger domestic trade and growth.

- Make it easier for Canadian businesses to grow, by modernizing regulations while continuing to protect the health and safety of Canadians and the environment.

Economic Strategy Tables

One year ago, seeking to turn Canada's economic strengths into global advantages, the Government established six Economic Strategy Tables—bringing together 90 Chief Executive Officers from Canada's six sectors with the highest growth potential. These business leaders met monthly to chart an ambitious roadmap to spur innovation, increase economic growth, and make Canada more globally competitive. Their collective recommendations on how to accelerate export-driven growth and unlock innovation are contained in their report, The Innovation and Competitiveness Imperative: Seizing Opportunities for Growth. As well as sectoral roadmaps, it includes six signature initiatives:

- Agile regulations to spur innovation and growth.

- An "Own the Podium" approach to accelerate our highest growth firms to become global leaders.

- Skills and talent to prepare Canadians for the workplace of the future.

- Technology adoption centres to grow the demand for innovation and increase competitiveness.

- Digital and physical infrastructure to improve export-market access and socio-economic benefits for Canadians.

- A global Canadian economic brand to attract investors and improve market access.

The 2018 Fall Economic Statement includes several measures that will help to deliver progress on many of the recommendations made by the Economic Strategy Tables. The Government will continue to seek opportunities to implement the Tables' other recommendations, in the near and longer term, and is committed to continuing to work with industry through this collaborative model.

Accelerating Business Investment

In the face of ongoing global developments, it is essential that Canada continue to innovate so that businesses seeking to expand and grow can confidently choose to invest in Canada.

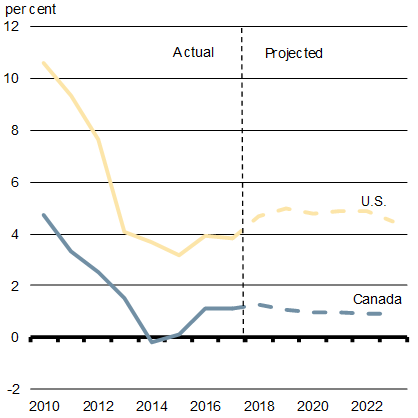

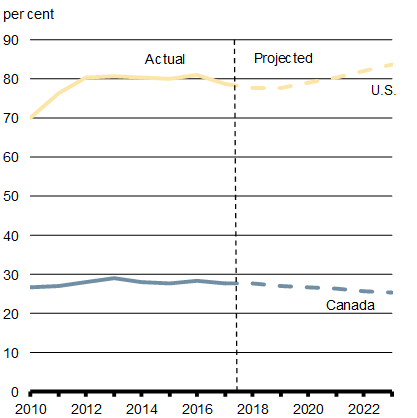

In December 2017, the United States passed a complex federal tax reform package—one that is estimated to increase the U.S. deficit by up to US$1.5 trillion over the next 10 years. It includes a significant reduction in the federal corporate income tax rate from 35 per cent to 21 per cent (to a level more in line with other industrialized countries), and the introduction of temporary 100-per-cent Bonus Depreciation for certain capital assets (effectively providing a 100-per-cent write off), both of which have significantly improved U.S. business tax competitiveness vis-à-vis the rest of the world. The U.S. tax reform also includes measures that increase taxes, such as limitations on the ability of businesses to reduce taxable income with business losses and interest expenses.

In Budget 2018, the Government committed to conduct detailed analysis of the U.S. federal tax reform to assess any potential impacts on Canada. Following through on this commitment, the Government has consulted with individuals and businesses to better understand how the U.S. tax reform and other developments are affecting businesses in Canada. The Department of Finance Canada has also conducted analysis to help identify impacts both generally and on specific industries.

Despite the significant reduction in U.S. corporate income taxes, Canada continues to have a tax system that offers businesses many tax advantages, including:

- A highly competitive corporate income tax rate for small businesses—in 2019, the combined federal-provincial-territorial average rate will be 12.2 per cent on small business income, by far the lowest in the G7.

- A value-added tax (i.e., the Goods and Services Tax/Harmonized Sales Tax) at the federal level and in many provinces that does not apply to most business purchases (unlike in the U.S., where many states impose sales taxes that apply to business purchases).

- Flexibility for firms to use business losses in order to access cash flow when they need it most by allowing for a 3-year loss carryback and 20-year carryforward, as well as a full offset of losses against taxable income.

- Favourable depreciation rules for long-lived assets such as buildings, which allow businesses to write off their investments faster.

Nonetheless, the U.S. federal tax reform has significantly reduced the overall tax advantage that Canada had built over the years, posing important challenges that, if left unaddressed, could have significant impacts on investment, jobs and the economic prospects of middle class Canadians. Specifically:

- With some businesses considering opportunities south of the border that would have previously been less profitable in the U.S. as compared to Canada, Canada is at risk of losing investment and jobs. This is especially true for businesses in sectors that are more sensitive to U.S. tax changes and most capable of moving production, such as manufacturing. Canada's business and investor community has expressed concern that the temporary Bonus Depreciation in the U.S. makes the U.S. significantly more attractive than before for businesses considering making new capital investments. The 2018 Fall Economic Statement responds to these concerns with new actions that will allow Canadian businesses to write off a larger share of the cost of newly acquired assets in the year an investment is made.

- There are also risks that firms will attempt to shift profits to the U.S.—or move expenses from the U.S. to Canada—in order to minimize their overall tax liabilities.

At the same time, the U.S. federal tax reform presents Canadian businesses with opportunity. The positive impact of the reform on the U.S. economy can be expected to increase domestic demand for goods and services—a positive development for Canadian companies that export to the U.S.

The Government is committed to ensuring that Canada continues to innovate in the face of international developments such as the recent U.S. tax reform and to responding in a fiscally responsible way. Because the full effect of U.S. tax reform on Canada's economy can only be determined over time, going forward businesses and governments will continue to consider the implications of the U.S. tax changes on the Canadian economy and the integrity of the Canadian tax system, including the details of different elements as they are established through regulation.

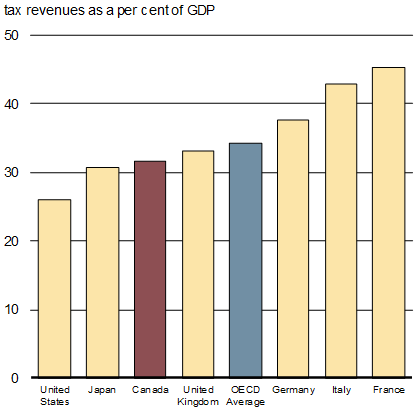

Enhancing Tax Competitiveness While Maintaining Canada's Current Fiscally Sustainable Track

Source: International Monetary Fund (IMF).

Source: IMF.

To that end, the Government is taking steps now to support Canada's competitiveness, while continuing to monitor the impact of the U.S. tax reform on Canada's business sector.

This Fall Economic Statement is proposing three important immediate changes to Canada's tax system, in order to enhance business confidence in Canada:

- Allowing businesses to immediately write off the cost of machinery and equipment used for the manufacturing or processing of goods—this will fuel new investments and support adoption of advanced technology and processes by this highly mobile sector of the economy.

- Allowing businesses to immediately write off the full cost of specified clean energy equipment to spur new investments and the adoption of advanced clean technologies in the Canadian economy.

- Introducing the Accelerated Investment Incentive, an accelerated capital cost allowance (i.e., larger deduction for depreciation) for businesses of all sizes, across all sectors of the economy, that are making capital investments. The Accelerated Investment Incentive will help to encourage investment in Canada, providing a timely boost to investor confidence.

How Will These Write-Offs Support Business Investment?

When Canadian businesses make investments in capital assets such as buildings, machinery, and equipment, current tax rules require them to deduct the cost of these investments over a time period that corresponds to the expected length of returns from the investment.

The new investment incentives proposed in this Fall Economic Statement will allow businesses to write off a larger share of their costs in the year an investment is made. The larger deduction will make it more attractive to invest in assets that will help to drive business growth, and will free up capital that businesses can use to create more good, well-paying jobs for the middle class.

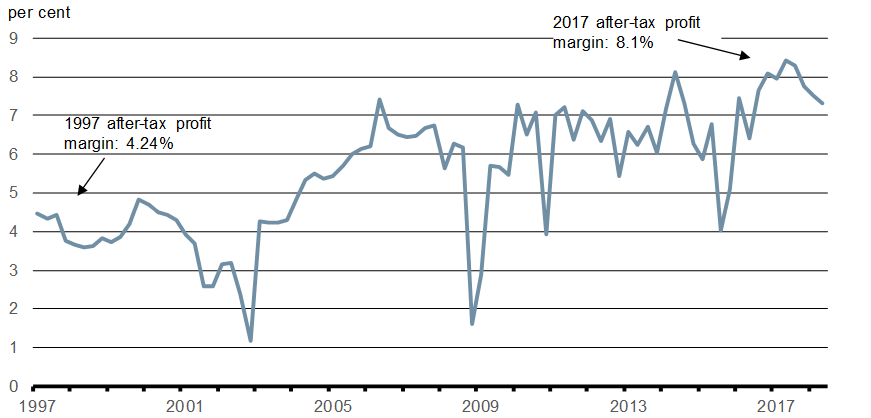

Actions being taken in this Fall Economic Statement will provide focused, fiscally-responsible support for growth-generating investments in Canada—accelerating business investment while carefully managing the impact on the federal deficit. By their nature, these measures will influence new investment decisions, instead of providing tax relief based on past investment decisions as would occur with a reduction in the general corporate income tax rate. The measures will encourage businesses to invest in Canada, while giving them the help they need to seize new export opportunities. This comes at a time when after-tax profits for Canadian businesses are near record highs, and Canadian businesses have more room to invest and create more good, well-paying jobs in communities across the country.

After-Tax Corporate Profit Margins Have Increased

Sources: Statistics Canada, Quarterly Survey of Financial Statements; Department of Finance Canada calculations.

Introducing Immediate Expensing for Manufacturers and Processors

The manufacturing and processing sector is capital-intensive and highly mobile, and may be more affected by the competitiveness pressures arising from the U.S. tax reform. To ensure that Canada maintains a strong competitive position in the manufacturing and processing sector, the Government proposes that machinery and equipment used in Canada for the manufacturing and processing of goods be eligible for immediate expensing. With this change, the cost of machinery and equipment will be eligible for a full tax write-off the year it is put in use in the business. This change will provide timely support to help fuel Canadian investments in this important sector of the economy.

Immediate expensing will apply to qualifying assets acquired after November 20, 2018. It will be gradually phased out starting in 2024, and will no longer be in effect for investments put in use after 2027.

Introducing Immediate Expensing for Clean Energy Investments

One of the ways the Government currently supports the transition to a cleaner economy is by providing an accelerated capital cost allowance for clean energy equipment. To increase investment in the clean technology sector, the Government proposes that specified clean energy equipment be eligible for immediate expensing. With this change, the cost of specified clean energy equipment will be eligible for a full tax write-off the year it is put in use in the business. This change will encourage investments that create jobs for the middle class, help Canada in achieving its climate goals, and position Canada to be globally competitive.

Immediate expensing will apply to qualifying assets acquired after November 20, 2018. It will be gradually phased out starting in 2024, and will no longer be in effect for investments put in use after 2027.

Supporting All Sectors of the Economy Through the Accelerated Investment Incentive

Building on Canada's competitive corporate tax system and Canada's other key strengths, the Government proposes to introduce an Accelerated Investment Incentive to support all businesses that make capital investments. Under the Accelerated Investment Incentive, capital investments will generally be eligible for a first-year deduction for depreciation equal to up to three times the amount that would otherwise apply in the year an asset is put in use. Tripling the current first-year rate will allow businesses to recover the initial cost of their investment more quickly—reducing risk and providing businesses in Canada with a true incentive to make capital investments. The Accelerated Investment Incentive will apply to all tangible capital assets, including long-lived investments like buildings. The Accelerated Investment Incentive will also apply to intangible capital assets, such as patents and other intellectual property. This treatment is different from that of the United States, where temporary Bonus Depreciation is generally limited to assets with a normal useful life of 20 years or less, and excludes assets such as patents.

Immediate Expensing and the Accelerated Investment Incentive Will Allow

Businesses to Recover Investment Costs Sooner

| Normal | With Proposed Measures (maximum 100%) |

|

|---|---|---|

| Immediate Expensing | ||

| Manufacturing and processing machinery and equipment | 25% | 100% |

| Clean energy equipment | 25% | 100% |

| Accelerated Investment Incentive | ||

| Computer software | 50% | 100% |

| Computers | 27.50% | 82.50% |

| Trucks and tractors for hauling freight | 20% | 60% |

| Motor vehicles | 15% | 45% |

| Earth-moving equipment | 15% | 45% |

| Data network infrastructure equipment | 15% | 45% |

| Aircraft | 12.50% | 37.50% |

| Office equipment | 10% | 30% |

| Fibre-optic cables | 6% | 18% |

| Buildings used in manufacturing and processing | 5% | 15% |

| Other non-residential buildings | 3% | 9% |

| Goodwill1 | 2.50% | 7.50% |

| Other2 | Variable | Up to 3x normal rate |

It is expected that accelerated depreciation for investments in fibre connectivity, wireless service and broadband infrastructure will particularly benefit more remote communities, while helping to strengthen Canada's economy more generally. The Government has had positive discussions with Canada's telecommunications sector with regard to investment incentives and will work with the sector to ensure that the proposed incentives result in accelerated deployment of next-generation digital technology and rural broadband/rural wireless services across the country.

The Accelerated Investment Incentive will apply to qualifying assets acquired after November 20, 2018. It will be gradually phased out starting in 2024, and no longer in effect for investments put in use after 2027.

The Expected Benefits of Accelerating Business Investment in Canada

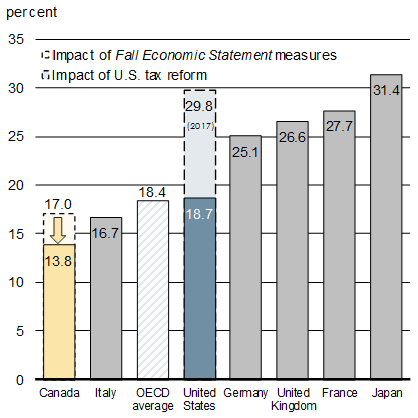

With immediate expensing and the Accelerated Investment Incentive in effect, the average overall tax rate in Canada on new business investment, as measured by the Marginal Effective Tax Rate (METR), will fall from 17.0 per cent to 13.8 per cent (see Chart 3.3). This will be the lowest rate in the G7, and significantly below the United States. The METR is important because it provides a good representation of the overall effect of the many tax factors affecting businesses in any given location. These tax factors include federal, provincial and territorial statutory corporate income tax rates as well as other features of the corporate income tax system, such as investment tax credits, key deductions like capital cost allowances, and unrecoverable sales taxes paid on capital purchases, which are particularly prevalent in the United States.

New Incentives Make Canada an Attractive Place to Invest

Source: Revenue Statistics – OECD countries: Comparative tables. Japanese data is for 2015.

Note: OECD average excludes Canada and Lithuania.

Source: Department of Finance Canada.

How Immediate Expensing and the Accelerated Investment Incentive Will Help Manufacturers and Processors

Chemical Inc. is a worldwide manufacturer of chemical products looking to establish a new manufacturing plant. With the measures proposed in this Fall Economic Statement, Chemical Inc. would see these benefits:

- Its machinery and equipment would be eligible for immediate expensing.

- Its manufacturing building would benefit from the Accelerated Investment Incentive deduction, and Chemical Inc. would be able to deduct up to 15 per cent of the cost of its new plant in the first year of operations, up from 5 per cent under current rules. In the United States, another possible location, this rate would typically be limited to less than 2.5 per cent.

In addition, thanks to Canada's generous carryover rules, should Chemical Inc. see its earnings ramp up slowly after opening the new plant, it will be able to carry forward over 20 years any losses created by these deductions in the early years of the project, without restriction. Together, these features of Canada's tax system will greatly increase the expected rate of return from this project.

Autoparts World Corporation (AWC) is a multinational automobile parts manufacturer with facilities in Canada, the U.S. and around the world. Autoparts Canada is a Canadian subsidiary of AWC. In 2019, Autoparts Canada is planning to purchase $10 million in new automotive assembly equipment to modernize its facilities. The subsidiary is expected to generate $8 million in taxable income prior to this investment. Immediate expensing would allow Autoparts Canada to fully deduct this investment, reducing its current-year taxable income to zero. Without immediate expensing, Autoparts Canada's deduction for this capital investment would be limited to $2.5 million in the first year.

Because the $10 million investment would exceed Autoparts Canada's income by $2 million in 2019, Autoparts Canada would be able to make use of Canada's generous loss carryover rules to reduce its prior-year taxable income by $2 million. This would immediately trigger a refund of federal-provincial taxes paid in prior years of about $535,000, in addition to tax benefits of about $1.47 million associated with having no tax payable in 2019.

Immediate expensing makes it more attractive for AWC to modernize the operations of its Canadian subsidiary, Autoparts Canada. The measure allows AWC to accelerate cash flows and improve returns on its investment, which in turn will help the subsidiary create good, well-paying jobs, and free up additional resources that can be invested to help the company better compete internationally.

How Immediate Expensing and the Accelerated Investment Incentive Will Help Companies Adopt Clean Technology

Community Apartments, a small apartment rental company, is seeking to invest in electric vehicle chargers for use by tenants at its two rental apartment buildings. The acquisition and installation cost for six chargers is $18,000. With immediate expensing, this amount can be deducted in full in the first year, compared to $2,700 under current rules. This will result in additional federal-provincial tax savings of about $1,900, which will allow Community Apartments to make energy efficiency improvements to its buildings. These investments will make Community Apartments' buildings more attractive to potential renters and encourage the adoption of clean technologies.

Wind Corporation is a generator of clean wind energy looking to deploy $100 million worth of wind turbines on a new wind farm. The cost of 20 per cent of the wind turbines for the project is already eligible to be fully deducted in the year incurred as Canadian Renewable and Conservation Expenses. With immediate expensing, the entire cost of Wind Corporation's wind turbines would be eligible for immediate expensing, compared to a deduction of $40 million under current rules, resulting in about $16 million in federal-provincial tax savings. Wind Corporation will hire new staff to maintain these new wind turbines. The accelerated deductions will improve Wind Corporation's rate of return, allowing it to better compete with fossil fuelled sources of energy.

Warehouse Inc. is a distributor of refrigerated goods, with a large warehouse that requires significant amounts of energy. In order to offset a portion of its electricity requirements, Warehouse Inc. invests in a solar array with solar panels costing $500,000. Immediate expensing will allow Warehouse Inc. to deduct its entire capital investment in the first year, as opposed to $125,000 under current rules, resulting in federal-provincial tax savings of about $100,000. These tax savings will allow Warehouse Inc. to invest in new forklifts for its warehouse (which will in turn be eligible for the Accelerated Investment Incentive).

How the Accelerated Investment Incentive Will Help Other Canadian Firms Compete

R&D Inc. is a quickly growing firm providing research and development services. In the last five years, it invested $8 million annually in capital assets. With the Accelerated Investment Incentive, R&D Inc.'s tax deductions for capital expenditures will rise from $1.2 million to $3.6 million, delivering about $640,000 in tax savings in the first year. With this additional cash flow, R&D Inc. will be able to finance a down payment, allowing it to acquire a newly constructed specialized building to expand its range of research activities. This would represent a $6 million investment, which had up to now been delayed. With the Accelerated Investment Incentive, a tax deduction of $540,000 will be available the first year the new building is being used, compared to $180,000 under current rules—representing federal-provincial tax savings of about $95,000 that R&D Inc. can further invest to expand its operations.

Road Group, a transportation business, will be able to use the Accelerated Investment Incentive to help purchase five new semi-trucks in 2019, with a total value of $1 million. Of that amount, Road Group will be able to deduct $600,000 for tax purposes, compared to $200,000 without the Accelerated Investment Incentive—representing about $105,000 in federal-provincial tax savings. These tax benefits will be invested in new systems software to enable Road Group to better manage trips and operate more efficiently.

Grain Farm, an oilseed and wheat producer, will benefit from the Accelerated Investment Incentive as it renews its fleet of aging tractors and combine harvesters for $2,000,000. In addition to increased efficiency and lower operating costs from the technological advances incorporated into the new equipment, Grain Farm will be able to deduct $900,000 for tax purposes in the first year the equipment is used, compared with $300,000 without the Accelerated Investment Incentive, or about $160,000 in federal-provincial tax savings. These tax benefits can be invested to enable Grain Farm to expand its acreage under production and increase exports of products to Asia and South America.

Supporting Early Stage Mineral Exploration

The 15-per-cent Mineral Exploration Tax Credit helps junior exploration companies raise capital to finance early stage mineral exploration away from an existing mine site. From 2010 to 2016, mining companies raised an average of approximately $505 million of equity annually using the Mineral Exploration Tax Credit. The tax credit is scheduled to expire March 31, 2019. Given the continuing challenges facing junior mining companies, the Government proposes to support their mineral exploration efforts by extending the credit for an additional five years, until March 31, 2024. Announcing this extension now will reduce uncertainty, facilitate planning, and help junior exploration companies raise more equity. This measure is expected to result in a net reduction in federal revenues of approximately $365 million over the 2019–20 to 2023–24 period.

Mineral exploration, as well as new mining and related processing activities that could follow from successful exploration efforts, can be associated with a variety of environmental impacts to soil, water and air and, as a result, could have an impact on the targets and actions in the Federal Sustainable Development Strategy. All such activity, however, is subject to applicable federal and provincial environmental regulations, including project-specific environmental assessments where required.

Making Canada the Most Globally Connected Economy

Over the last three years, the Government has been working steadily to achieve a key goal—securing trade opportunities that can make Canada the most globally connected economy in the world.

Canada is, and always has been, a trading nation, and today Canadians recognize that trade can be a positive force for change. It can drive economic growth, create good, well-paying jobs for the middle class, and open up opportunities for Canadian businesses to grow and export.

Canada Has Comprehensive Free Trade Agreements With Countries Representing Two-Thirds of the World's Total GDP

Strengthening Free Trade Agreements

Canada has a unique place in the world—located next to the world's largest economy to the south, with close historic and economic ties to Europe to the east, and deep connections to the fast-growing Asia-Pacific nations to the west. With the successful conclusion of the United States-Mexico-Canada Agreement, as well as the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Canada is the only G7 country to have free trade agreements with all other G7 nations.

Canada now has comprehensive free trade agreements (FTAs) with countries representing two-thirds of the world's total GDP. The Government's ongoing commitment to free trade with economies around the world—including those in emerging markets—will help to further strengthen and grow the middle class and deliver long-term economic growth that benefits all Canadians.

Accessing New Markets for Canadian Exports

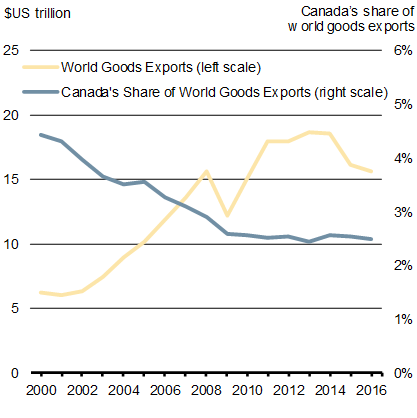

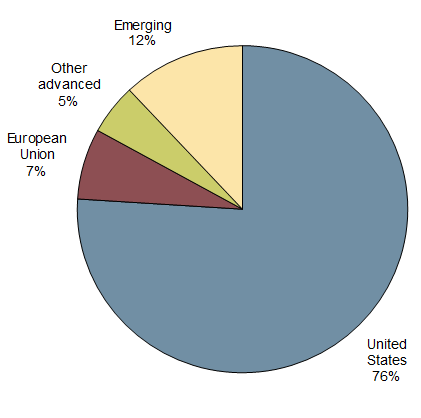

Jobs in competitive, exporting sectors pay higher wages than industries that are not trade intensive—that is good news for the middle class and the communities they call home. To maximize Canada's export opportunities, however, Canada must adapt its approach to trade. For decades, Canada has lost global trade market share, and for too long Canada has been reliant on trade with a single partner: the United States. Canada's exports to the U.S. now account for three-quarters of all goods exports, and in some cases—as with oil and automotive exports—that figure is even higher. At present, 99 per cent of Canada's oil is exported to the U.S. This near-total reliance on the U.S. market, combined with pipeline transportation constraints, makes Canadian crude oil prices particularly vulnerable to developments in the U.S. This has been evidenced recently by temporary refinery shutdowns in the U.S., which contributes to a discount on the Canadian price of crude widening to its highest level in more than a decade.

The Government is committed to better position Canada within the shifts in global trade, by increasing exports to overseas markets in the Asia-Pacific region and Europe, as well as by developing new markets in services, digital products, health technology and e-commerce.

Global Trade Is Growing, Giving Canada New Opportunities to Expand Its Trade With Emerging Markets

Source: United Nations Comtrade database.

Note: Trade data is on a customs basis.

Source: United Nations Comtrade database (IMF definition used for emerging markets).

Note: Trade data is on a customs basis.

Opening Global Markets for Businesses

Canada's economic competitiveness and success relies on building strong trade relationships with partners across the globe. Canada's extensive network of free trade agreements provides an important framework to support such relationships.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) represents a milestone agreement. It embodies Canada's trade agenda, and expands commercial opportunities that will help drive more inclusive growth in key global markets, with a particular focus on the Asia-Pacific region. The agreement covers markets representing 495 million people with a combined GDP of $13.5 trillion. Canada is among the first seven countries (including Japan, Mexico, Australia, New Zealand, Singapore and Vietnam) to ratify the CPTPP. The CPTPP is set to enter into force between the first six countries on December 30, 2018, and on January 14, 2019 for Vietnam, at which point Canada stands to benefit not only from expanded preferential market access to current CPTPP countries, but from the potential to use it as an anchor agreement, further expanding trade as additional countries join the agreement over time.

Canada is also committed to expanding and diversifying trade with large, fast-growing markets and regional groupings, such as the Pacific Alliance (Chile, Colombia, Mexico and Peru), the Mercosur trade bloc (Argentina, Brazil, Paraguay and Uruguay), and the 10 countries of the Association of Southeast Asian Nations.

In addition to pursuing new partnerships, Canada remains committed to maintaining predictable and stable trade relations with current partners and to maximizing the benefits of existing free trade agreements. This includes the Canada-European Union Comprehensive Economic and Trade Agreement implemented in the fall of 2017, as well as agreements with Israel, Chile and Ukraine, which continue to offer significant opportunities for additional growth.

Recently, Canada completed negotiations towards a modernized trade agreement for North America—the United States-Mexico-Canada Agreement (USMCA)—that will reinforce the strong economic ties between the three countries, and support good, well-paying jobs for Canada's middle class.

In recent trade negotiations, Canada has continued to make gender equality and women's economic empowerment a key priority, including playing a leadership role to integrate gender-related provisions in the USMCA and the CPTPP, as well as a dedicated Trade and Gender chapter in its FTAs with Chile and Israel. The Government of Canada has initiated discussions with Canada's dairy, poultry and egg sectors regarding the impacts of recently signed trade agreements with Asia-Pacific countries and the United States. The Government is firmly committed to working in partnership with these sectors to develop and implement appropriate supports for affected Canadian farmers.

Given the uncertainty created by recent global trade disputes, the Fall Economic Statement announces the Government's intention to significantly bolster export opportunities for Canadian businesses, and diversify Canada's overseas trade. More must be done to help Canadian exporters accelerate their presence in new markets, and take advantage of the new opportunities that exist because of the trade agreements the Government has secured in the past three years. To that end, the Government is proposing to launch an Export Diversification Strategy, with a target of increasing Canada's overseas exports by 50 per cent by 2025.

In total, the Export Diversification Strategy will invest $1.1 billion over the next six years, starting in 2018–19, to help Canadian businesses access new markets. The Strategy will focus on three key components: investing in infrastructure to support trade, providing Canadian businesses with resources to execute their export plans and enhancing trade services for Canadian exporters.

Investing in Infrastructure to Support Trade

To boost Canada's ability to trade overseas, the Government will accelerate investments in our ports and trade transportation corridors leading to Asia and Europe, including key ports on the east and west coasts. To inform these investments, the Government will be taking a comprehensive and strategic approach to reducing freight bottlenecks and seizing future opportunities along Canada's major trade corridors, by:

- Accelerating infrastructure spending—Investments in marine ports and along the busiest rail and highway corridors will help address transportation capacity constraints—providing new opportunities for Canadian businesses to get their products to international markets. To expedite projects over the next five years, the Government will establish a continuous call for proposals for the National Trade Corridors Fund. Backed by an accelerated investment of $773.9 million over five years, the Fund will prioritize projects that provide the best economic benefits, drawing on better transportation data and reviews of key challenges in businesses supply chains.

- Improving transportation data—Better access to transportation data will help shippers optimize their routes, and help governments better target investments in order to have the greatest improvement in the fluidity of supply chains. In 2017, to enhance the quality and accessibility of transport data, the Government launched a Multimodal Integrated Passenger-Freight Information System, led by Transport Canada with Statistics Canada. To accelerate the implementation of the System, the Government proposes to provide an additional $13.6 million over the next three years, starting in 2019.

Investing to Help Canadian Businesses Export and Grow

While Canada has had success in gaining preferential access to key markets via trade deals, more must be done to ensure that Canadian firms take full advantage of international growth opportunities. In particular, small businesses represent 99 per cent of all businesses in Canada and employ more than 10 million Canadians, but only 11 per cent are currently engaging in exporting. The Government proposes to invest $198 million over six years to put more resources directly in the hands of Canadian businesses seeking to develop export plans, build global partnerships, or gain skills and training for global trade by:

- Providing funding to Canadian small and medium-sized enterprises (SMEs) to help them explore new export opportunities—On June 29, 2018, the Government announced an investment of $50 million over five years to support businesses, including in the steel, aluminum and manufacturing industries, in diversifying their exports, including new export readiness grants. The Government proposes to build on this by investing a further $100 million over six years. This funding will go to CanExport and related funding programs to support businesses looking to reach new overseas markets, including providing them with funding to support participation in trade shows and trade missions, market research, legal fees and adaptation of marketing tools. This new funding will primarily target CETA and CPTPP markets.

- Creating a new mentors program—To provide high-potential exporting firms with the support they need to succeed, the Government proposes to provide new funding of $13.5 million over the next five years to establish a new mentors program, connecting Canadian entrepreneurs that are looking to move into new overseas export markets with seasoned Canadian business executives who have in-market experience.

- Expanding the Canadian Trade Commissioner Service's Canadian Technology Accelerator program globally—To provide Canadian technology firms with support, connections, and guidance in-market, the Government proposes to provide new funding of $17 million over the next five years to expand the successful Canadian Technology Accelerator in global technology hubs, such as Delhi, Hong Kong, and Tokyo.

- Making new investments in internships—To help Canadian start-ups housed in university-linked incubators scale up, the Government proposes to provide $7 million over five years to the Mitacs International Incubators Internships program, giving entrepreneurs in-person opportunities to connect with potential international clients and investors through incubators operating in Mitacs partner countries.

- Mobilizing SMEs for export initiatives—To help small and medium-sized businesses realize their export potential, the Government will provide $10 million over three years for export readiness and export capacity building initiatives. Some initiatives would be delivered in partnership with provincial/territorial governments, local organizations (such as Chambers of Commerce and Boards of Trade), incubators and accelerators, to help firms realize new international opportunities. Support will be targeted to businesses that have a high potential to export products and services in markets where Canada has gained a competitive advantage under recently implemented free trade agreements (e.g. CETA and CPTPP).

- International education strategy—To build more skills and provide training that will help support Canada's international trade and increase global ties, Global Affairs Canada and Employment and Social Development Canada will work together to develop a new international education strategy.

CanExport: Giving Businesses the Support They Need to Succeed in New Global Markets

Under the new Export Diversification Strategy, the Government will be tripling the size of the Canadian Trade Commissioner Service's CanExport program, helping more Canadian businesses move into new markets. Over the last six years, this program has provided funding for 1,000 export projects by Canadian firms in 82 countries, generating $100 million in new export sales.

A CanExport Success Story: 4Deep inwater imaging, from Halifax, Nova Scotia, has patented holographic technology to create powerful microscopes that enhance research and discovery. With the support of CanExport, the company is marketing and promoting its submersible microscope system in India, where it is used to monitor water quality in lakes, rivers and oceans.

Enhancing Trade Services for Canadian Exporters

In addition to providing direct financial support and other resources to businesses to grow their overseas exports, the Government proposes to invest $184 million over the next five years to enhance the Canadian Trade Commissioner Service (TCS) and other federal capacity at home and around the world to support the growth and diversification of Canada's exports. This investment will make it possible to:

- Expand support for emerging sectors—To help Canadian businesses take advantage of fast-growing opportunities in technology and services exports, the Government proposes to invest $25.4 million over the next five years to expand TCS advice and services in areas such as digital, e-commerce and intellectual property.

- Expand support for agricultural exporters—To better engage with international standard-setting bodies and support efforts to meet the Government's goal of growing Canada's agri-food exports to $75 billion per year by 2025, the Government proposes to invest an additional $25 million over the next five years to enhance federal capacity to address situations where Canadian agricultural producers may be prevented from selling goods in international markets. This additional funding recognizes the agriculture sector's role as a key driver of economic growth, accounting for more than 6 per cent of Canada's GDP. The Government recently completed a successful trade mission to China, further expanding market access for Canada's agricultural producers.

Canadian Technology Accelerator (CTA) Program

Over the past five years, the CTA program has introduced close to 500 Canadian technology and life sciences firms to the Boston, Philadelphia, New York City and Silicon Valley markets, helping them raise more than $570 million in private capital, generating $190 million in revenue, and creating more than 1,700 jobs in Canada. In Budget 2018, the Government provided $10 million over five years in new funding to support these successful CTA locations in the U.S., and is now moving to establish new CTAs in global technology hubs around the world.

Accelerator Program = Access to New Markets

Boston's CTA provides the companies it assists with up to six months of support, including:

- An in-market "landing pad" with desk space and services at the Cambridge Innovation Center, home to 2000+ tech and life science companies.

- Mentor teams drawing from a network of close to 100 C-level executives, successful serial entrepreneurs, and venture capital and angel investors.

- Introductions to industry leaders, venture capitalists, and other key players.

- Pitch coaches to help firms hone their messaging.

- Member privileges to world-class industry associations, giving participants access to exclusive events and networking opportunities.

“ I can't say enough about the impact that CTA Boston had for our ExpertFile. We raised additional angel investment in Boston while enrolled in the program, and the program mentors were amazing. One of their introductions resulted in a partnership with one of the largest media distribution players in the world.”

“ Ten years and 30 minutes. That's what it took for me to meet with Microsoft. Ten years of me trying to connect and only 30 minutes after arriving in Boston with an introduction from Boston's Senior Trade Commissioner. A Microsoft partnership was signed within a week. That's just one example of how your business accelerates with the CTA @ Boston.”

- Launch a pilot partnership with Canadian banks—First proposed by the Bank of Montreal, the Government will launch a pilot partnership with Canada's leading banks including Bank of Montreal (BMO), Bank of Nova Scotia (Scotiabank), Canadian Imperial Bank of Commerce (CIBC), Royal Bank of Canada (RBC), National Bank of Canada and Toronto-Dominion Bank (TD) to help connect lending and business clients with key federal government resources such as the TCS. This partnership will help to better support a pipeline of new export-ready clients.

- Update Trade Commissioner Service tools—To introduce a refreshed digital presence, including new online tools for exporters, enhanced market intelligence, and tools to facilitate seamless client referrals between other federal and provincial partners, the Government proposes to provide the TCS with new funding of $60 million over the next five years.

- Expand services abroad—To increase the number of trade commissioners available to serve Canadian businesses in key overseas markets, the Government intends to invest $44.1 million over the next five years for capacity in China, India, and major markets involved in the CETA and CPTPP trade agreements.

- Expand services at home—To help more Canadian businesses find and enter new markets abroad, including how to make use of Canada's valuable new free trade agreements, the Government intends to invest $29.5 million over the next five years to increase the number of trade commissioners across Canada.

Removing Barriers to Trade Within Canada

In the summer of 2018, the uncertainty created by recent trade disputes led the Premiers and Finance Ministers of provinces and territories across Canada to agree on the importance of removing barriers to trade within our own country. In Canada, improving regulatory cooperation between provinces and territories represents an important opportunity to increase economic growth. A critical step in this direction was made with the recent Canadian Free Trade Agreement, which entered into force in July 2017.

Removing Barriers to Internal Trade

The Canadian Free Trade Agreement (CFTA) reduced barriers to trade in goods, services, investments and worker mobility within Canada, and helped increase choice for consumers, expand access to government contracts and create more jobs for Canadians.

Since coming into force, the CFTA has also:

- Opened new public procurement opportunities to suppliers from across the country.

- Strengthened dispute resolution provisions.

- Broadened regulatory notification requirements.

- Prevented discriminatory treatment in additional sectors of Canada's economy.

These early successes have strengthened the Government's resolve to work cooperatively through the CFTA to better align federal, provincial and territorial regulatory measures and remove internal trade barriers. The CFTA's Regulatory Reconciliation and Cooperation Table recently released an ambitious two-year work plan, identifying 23 items for action. For its part, the Government has taken action within its own sphere, already completing 2 of the 23 items on the work plan by eliminating restrictions on aquaculture organic labelling and repealing grade inspection requirements for some agricultural produce.

Barriers to the movement of alcohol across borders have become a symbol of the friction in trade between provinces and territories. Eliminating these, and other barriers that are less visible to many Canadians, could improve Canada's competitiveness and help to create more good, well-paying jobs.

Recognizing the opportunity that internal trade represents, the Fall Economic Statement reaffirms the federal government's commitment to strenthening freer trade within Canada, and proposes that the federal government will work with provincial and territorial partners to accelerate action to remove regulatory and other barriers in four specific areas:

- Transporting goods between provinces and territories (see "Harmonizing Requirements for the Trucking Industry" for one example).

- Harmonizing food regulations and inspection rules across the country.

- Aligning regulations in the construction sector, including the harmonization of building codes across Canada.

- Facilitating greater trade in alcohol between provinces and territories.

Step by step, Canada can make progress on internal trade. The upcoming First Ministers' Meeting offers an opportunity to continue this important discussion on internal trade, alongside efforts to diversify international trade.

Harmonizing Requirements for the Trucking Industry

The Economic Strategy Tables note in their September 2018 report, The Innovation and Competitiveness Imperative: Seizing Opportunities for Growth, that:

"There is a patchwork of regulations and allowances, depending on province/territory, that has resulted in several barriers for the trucking industry, including on wide base single tires, spring weight limits and other restrictions … Addressing these inconsistencies across Canada would improve transportation systems to the benefit of the agri-food sector, among others."

Harmonizing requirements for the trucking industry will benefit not only trucking companies, but also businesses that ship goods across Canada and consumers through lower prices as the cost of transporting goods declines. Currently barriers are preventing the efficient movement of goods between provinces and territories. For example, due to differing regulations on tire sizes, some trucks must change their tires at certain provincial borders, meaning longer trip times to deliver goods.

The Regulatory Reconciliation and Cooperation Table, part of the Canadian Free Trade Agreement, will be examining these issues as part of its 2018–19 work plan. The Government is also committed to working cooperatively through the Canadian Council of Motor Transport Administrators, a federal-provincial-territorial governance structure, to address trade barriers related to the harmonization of regulatory requirements for the trucking industry across Canada.

Making the National Building Codes Freely Available to All Canadians

Building construction is an important part of Canada's economy, employing nearly 1.4 million Canadians. Building construction codes used throughout Canada are based on the National Building Codes, developed with the support of the National Research Council of Canada, to provide guidance for building products, design and construction.

For small businesses—which account for approximately 99 per cent of Canada's construction industry—the cost of purchasing building codes, and the lack of harmonization between provincial/territorial codes and national codes, make it harder to succeed and grow. The Government is proposing to provide $67.5 million over five years to the National Research Council of Canada, with $13.5 million ongoing, to make access to the National Building Codes free, and to provide sufficient resources for the federal government to address provincial, territorial, and other stakeholder code development priorities in a more timely way.

Building codes are Canadians' assurance that their health, safety and general welfare have been fully considered whenever their homes, places of work and other buildings are built or renovated, including the accessibility needs of people with disabilities. Harmonized and freely available building codes will also ensure that all municipalities can readily access and use the latest codes as they become available.

Having one set of rules that covers both the design of, and products that go into the construction of, buildings reduces regulatory burden and removes barriers to internal trade. Consistently applied, harmonized building codes also make it easier for designers, product manufacturers, distributors and contractors to conduct business more efficiently across the country.

The Government will continue to work with provinces and territories towards the timely adoption of the national codes in a way that ensures that the needs of provinces, territories and Canadians are met.

The Cost of Conflicting Rules

As one example, lack of consistency in water heater regulations between jurisdictions has led to additional unnecessary testing and inspections, increased compliance delays to meet various provincial and territorial regulatory requirements, and exacerbated supply chain issues (requiring some suppliers to maintain dual inventories). The Canadian Institute of Plumbing and Heating estimates that the cost of water heaters could be as much as 30 per cent higher than necessary (when compared to fully harmonized codes), because of conflicting and inconsistent regulations.

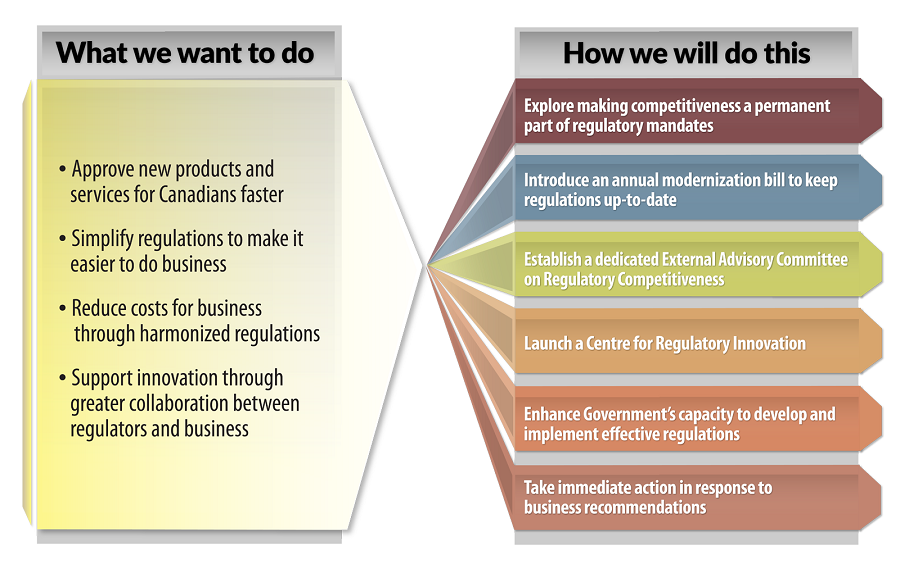

Making it Easier for Businesses to Grow

Regulations act as the "rule book" for how businesses must operate, and are an essential part of protecting consumers, ensuring the health and safety of Canadians, and safeguarding the natural environment. Over time, however, regulations can accumulate, become outdated, and result in unnecessary barriers to innovation and economic growth. The federal Economic Strategy Tables unanimously recommended that modernizing our regulatory system would materially improve Canada's ability to attract investment and growth-oriented businesses.

Budget 2018 outlined the Government's commitment to a regulatory reform agenda. This Fall Economic Statement proposes several new steps in the Government's efforts to reform and modernize federal regulations, while continuing to protect Canadians' health and safety and the environment.

What We Heard

“ Canada needs its regulatory system to move at the speed of commerce.”

“ Eliminating interprovincial regulatory barriers to trade is one of the most powerful actions our governments could take to increase long-term growth and prosperity in Canada.”

Explore Making Regulatory Efficiency and Economic Growth a Permanent Part of Regulators' Mandates

To ensure Canada's regulatory system is evergreen, nimble and effective, the Government is committing in the Fall Economic Statement to undertake important steps to modernize its regulators' mandates.

In this effort, the Government will continue to ensure Canada's regulatory system protects first and foremost the health and safety of Canadians. The Government intends to review legislation to assess whether opportunities for legislative changes exist to further solidify that regulatory efficiency and economic growth is an integral part of regulators' mandates. This would encourage implicated departments and agencies to simplify regulatory proposals, and better address other considerations when designing and implementing regulations, while continuing to prioritize health and safety and environmental responsibilities.

Enshrining this requirement in legislation would ensure that the economic impacts of new, revised or cumulative regulations are key considerations for regulators. The Government will undertake work this fall to determine where these changes may have the greatest impact.

Targeted Regulatory Reviews in High Growth Sectors

The Government has launched the first round of targeted regulatory reviews, looking for ways to reduce barriers and bottlenecks to innovation, economic development and investment. This first round of reviews is taking place across the following sectors: agri-food and aquaculture, health/bio-sciences, and transportation and infrastructure (including emerging technologies such as autonomous vehicles).

These reviews, and future rounds focused on other sectors, will ensure that the regulatory system keeps pace with emerging technologies and new business models

Introduce an Annual Modernization Bill to Keep Regulations Up-to-Date

Many federal regulations have been developed and built up over decades. Over time, some regulations can become obsolete and present a real barrier to innovation. To ensure that federal regulations continue to be reviewed and kept up-to-date, the Fall Economic Statement announces that the Government will introduce an Annual Regulatory Modernization Bill, starting in 2019, to remove outdated or duplicative regulatory requirements, and to allow for the updating of regulations.

This annual exercise would allow the Government to modernize its regulations and facilitate innovation by promoting an up-to-date regulatory environment that reflects current public policy and business realities, challenges and opportunities.

Changes to the Red Tape Reduction Act will be implemented in early 2019, encouraging better alignment with key trading partners and recognizing the role regulatory cooperation plays in lowering costs for Canadian businesses and consumers. The Government will launch a full review of the Act by 2020 to seek further opportunities to reduce administrative burden and "red tape" on Canadian businesses.

Establish a Dedicated External Advisory Committee on Regulatory Competitiveness

Recent reports from the Canadian Chamber of Commerce, as well as panels convened to advise Government, such as the Advisory Council on Economic Growth and the Economic Strategy Tables, have made it clear that businesses need to be able to engage with Government on an ongoing basis to identify ways to improve the regulatory system.

In response to these suggestions, the Government will create an External Advisory Committee on Regulatory Competitiveness, which will assist Ministers and regulators to identify regulatory changes that promote economic growth and innovation, and help to deliver growth that works for everyone.

The Committee will bring together business leaders, academics and consumer representatives from across the country who can provide an independent perspective on barriers to business success, and help identify opportunities to streamline regulations, such as through legislation or other modernization activities, in a way that balances health and safety and environmental protection with business realities. The Committee will also provide guidance on where new regulatory frameworks are required to deal with emerging technologies, and will champion the use of regulatory sandboxes and pilots, including by helping to identify areas of focus for the Centre for Regulatory Innovation.

What Is a Regulatory Sandbox?

“ Regulatory sandboxes are controlled 'safe spaces' in which innovative products, services, business models and delivery mechanisms can be tested without immediately being subject to all of the normally required regulatory requirements… If adequately implemented, they can add significant value to regulators, consumers and other stakeholders by improving the relationship among them.”

Launch a Centre for Regulatory Innovation

The Economic Strategy Tables made a number of recommendations aimed at improving the regulatory environment for business, including the need for the greater exploration and use of sandboxes and pilots to ensure the regulatory system can keep pace with advances in technology.

Based on this advice, the Government will create a Centre for Regulatory Innovation. The Centre will work as a convener and focal point that is business-facing, helping businesses connect with relevant regulators and managing a roster of sandboxes—such as a physical space with regulators onsite while new systems are being tested—that support innovation and competitiveness, while also ensuring that Canadians' expectations around the protection of health, safety and the environment continue to be met.

To support the Centre and its objectives, the Government proposes to provide up to $11.4 million over five years, and $3.2 million per year ongoing, to enable business and the Government to work together to develop and implement regulatory experimentation approaches that encourage innovation, but do not compromise consumer trust and confidence.

Enhance Government's Capacity to Develop and Implement Effective Regulations

To ensure that federal regulators are able to keep pace with new requirements, the Government proposes to provide up to $10 million, over three years, to assist federal departments and agencies in strengthening their capacity to incorporate economic and competitiveness considerations when designing and implementing regulations.

Take Immediate Action in Response to Business Recommendations

The targeted regulatory reviews in high-growth sectors have already generated many ideas that can be acted on quickly, improving the regulatory environment in several key sectors, including agri-food and aquaculture, health/biosciences, and transportation and infrastructure.

As part of the Fall Economic Statement, the Government announces its intention to enact, as quickly as possible, regulatory and policy changes that will result in a simpler, clearer and more modern regulatory system—one that will also support the development of innovative approaches and products (some illustrative examples are provided below; for a complete list of 23 early "action items," see Appendix 3.A).

- Create business efficiencies by reducing the regulatory burden and simplifying government regulations. For example:

- Integrate third-party oversight into the Canadian Food Inspection Agency's (CFIA) risk assessment and inspection model to inform inspections by CFIA inspectors. This change will recognize investments already made by the agri-food industry to implement third-party certification systems in their operations and will be done through the application of a risk-based approach to oversight that takes into account external audits.

- Amend the Canadian Aviation Regulations to allow the use of personal electronic devices on board aircraft, reducing the regulatory burden on Canadian air carriers and removing a competitive disadvantage relative to other international air carriers.

- Reduce the duration of clinical trial record retention requirements, lessening the cost burden on clinical trial sponsors and investigators, with expected savings of up to $40,000 per clinical trial.

- Update and modernize government regulations. For example:

- Amend the beer compositional standards to allow Canadian companies more flexibility in the ingredients and processes they can use to make beer, enabling the creation of new and innovative products to meet consumer demand without compromising food safety.

- Work with industry to develop new regulatory approaches in support of innovation. For example:

- Use a truck platooning system test bed (sandbox) to support the development and adoption of platooning technologies (the act of electronically hitching two or more heavy vehicles together to form a "road train"). This can improve fuel consumption and has the potential to improve the flow of traffic, helping industry to get goods to market more quickly, and at a lower cost.

- Support test ranges for remotely piloted aircraft systems to accelerate the development and adoption of drone technology by various industries, as well as other activities to develop and enhance regulations. The safe and routine deployment of drones will allow companies in various industries to perform oversight tasks more effectively, such as crop monitoring and regular safety checks on pipelines in remote locations.

- Provide greater clarity and guidance to Canadian firms. For example:

- Improve guidance on how new and novel plant varieties are regulated in Canada in order to provide clarity to Canadian and foreign firms interested in investing in Canada's biotechnology sector.

- Launch work to modernize how digital health products, such as medical device software for wearables that monitor a person's health, including artificial intelligence products and services, are approved to incentivize digital health care innovation.

- Harmonize domestic regulations and standards in Canada while promoting international regulatory cooperation. For example:

- Reduce barriers to interprovincial trade in agri-food products by addressing duplication of federal, provincial and territorial regulations, including those related to meat inspection.

To further streamline regulations and reduce regulatory burdens on Canadian businesses and innovators, work will continue at Canada's formal regulatory cooperation tables with the U.S., the European Union and provinces and territories to align regulatory approaches and activities. Through these tables, as well as with other trusted international partners, Canadian regulators will explore the potential use of joint approvals in order to accelerate market entry for safe products in Canada and other countries. Where appropriate, regulators will also pursue mutual recognition of regulatory decisions and approvals, so that products certified and deemed safe by a comparable international regulator—be it a washing machine or a new digital technology—could be approved in Canada.

Pricing Pollution and Protecting Competitiveness

Starting next year, it will no longer be free to pollute anywhere in Canada. As part of its plan to reduce greenhouse gas emissions and fight climate change, the Government is making sure there is a price on carbon pollution across the country—while also taking steps to ensure that Canadian companies can compete and succeed in a competitive global marketplace.

Many provinces and territories have already adopted comprehensive carbon pollution pricing plans of their own, or have asked to adopt the federal approach. In October 2018, the Government announced further details of the federal carbon pollution pricing system, which will apply beginning in 2019 in provinces that do not meet the Canada-wide federal standard for reducing carbon pollution—Ontario, New Brunswick, Manitoba and Saskatchewan—as well as jurisdictions that voluntarily adopted the federal system.

The federal system consists of both a charge on fossil fuels and an output-based pricing system for industrial facilities, which will give large industrial facilities facing international competition a price incentive to reduce emissions and spur innovation, while supporting their global competitiveness. Smaller facilities—those whose annual emissions fall between 10 and 50 kilotonnes—will be able to opt in to the output-based pricing system in 2019. Environment and Climate Change Canada will publish draft regulations for the output-based pricing system in late 2018, and will finalize the regulations in the spring of 2019.

The Government will not keep any direct proceeds from carbon pollution pricing. In each province that did not meet the federal standard, all direct proceeds from the fuel charge will be returned to the jurisdiction of origin, with most of the direct proceeds going to individuals and families through Climate Action Incentive payments and the remainder going to support small and medium-sized businesses, municipalities, universities and colleges, schools, hospitals, non-profits and Indigenous communities. Proceeds from the output-based pricing system in provinces that did not meet the federal standard will also be returned, but given that these proceeds would only be realized in 2020, the Government will decide in due course how best to return these proceeds in these provinces. In jurisdictions that voluntarily adopted the federal system, all direct proceeds will be returned to the government of that jurisdiction. The Government will provide an update each year on exactly how direct proceeds from pricing carbon pollution were used.

Helping Canadian Innovators Add Value, Succeed and Grow

Since 2015, the Government has been focused on investing in the things that matter most to Canadians, including making investments that help to create good, well-paying jobs. To that end, the Government has introduced a suite of innovation programs to help position Canada as a top destination for businesses to invest, innovate, grow, and create jobs that will help strengthen and grow the middle class.

One of the flagship programs is the Strategic Innovation Fund, introduced in Budget 2017. Since that time, it has proven successful in attracting and supporting high-quality and innovative business investment in Canada.

To accelerate support for business innovation in Canada, the Government is proposing to provide a further $800 million over five years to the Strategic Innovation Fund, which will continue to be available to support innovative investments across the country and in all economic sectors. Of this amount, $100 million will focus on providing support to the forest sector. Nearly 210,000 workers across Canada directly rely on the forest sector to provide quality employment and long-term prosperity. This funding will help support the ongoing transformation of the sector, through the commercialization of innovative processes and products from Canada's sustainable and significant forest resources.

Of this new funding for the Strategic Innovation Fund, $250 million is being made available in light of revenues collected through Canadian countermeasures (surtaxes) in response to unjustified U.S. tariffs on Canadian steel and aluminum products.

This new funding is in addition to the $250 million announced in June 2018 to support steel and aluminum producers and better integrate the Canadian supply chain of steel and aluminum. This measure was part of a broader package of up to $2 billion in support for the Canadian steel and aluminum industry and its workers.

Attracting High-Quality Investments to Canada

Making sure that Canada is a top destination for business to invest, grow and create jobs and prosperity is one of the Government's top priorities. Since its creation, the Strategic Innovation Fund has attracted and supported several high-quality business investments, including:

- A $110 million contribution to support Toyota Motor Manufacturing Canada's $1.4 billion investment in its Cambridge and Woodstock plants, which will support more than 8,000 jobs in southwestern Ontario and create 450 new jobs as well as 1,000 new co-op placements.

- A $60 million contribution to Elysis, a joint venture formed by Alcoa and Rio Tinto, which is investing $558 million to develop a revolutionary process to make aluminum that produces oxygen and eliminates all greenhouse gas emissions from the traditional smelting process. This new company, headquartered in Quebec, will directly employ 100 people, and has the potential to create more than 1,000 jobs by 2030, while securing 10,500 existing aluminum jobs in Canada.

- A $150 million contribution in support of CAE's $1 billion investment in research and development in Canada that will harness the power of artificial intelligence, cloud computing, big data, and augmented and virtual reality to develop the next generation of simulation and training products for the aerospace and health care sectors. This investment will help create 400 new engineering and manufacturing jobs, retrain 1,700 employees with new digital skills, and foster collaboration with 50 post-secondary institutions and research centres across Canada.

- A $49.3 million contribution to General Fusion, a clean technology company based in British Columbia seeking to transform the world's energy supply with safe, sustainable and economical fusion energy. The funding will help create 400 new jobs and support the expansion of General Fusion's collaboration with post-secondary institutions.

Supporting Canadian Clean Technology Innovators Through Venture Capital

Venture capital is a type of private equity financing that takes educated risks on great ideas and smart people, giving young companies the opportunity to take their ideas to market, and grow.

In Budget 2017, the Government announced the Venture Capital Catalyst Initiative to support the continued growth of Canada's innovative companies by increasing the availability of late-stage venture capital. Under this initiative, the Government announced this year $400 million of new investments into top-performing and emerging fund managers, to enable them to increase their support to Canada's innovative companies. Further, these managers are expected to use this seed investment from the Government to raise additional capital from private sector investors, injecting around $1.5 billion into Canada's innovation capital market.

To continue this momentum, to meet Canada's climate change goals, and to help Canada's innovative clean technology firms bring their technologies to market, the Government will make available an additional $50 million on a cash basis to increase venture capital available to clean technology firms, under the Venture Capital Catalyst Initiative. A thriving market for clean technology will also help all firms across Canada improve their efficiency and lower their carbon pollution footprint.

Supporting Business Innovation

The Government of Canada has acted to support business innovation by:

- Simplifying the support available to Canada's innovators through the creation of Innovation Canada, a new platform led by Innovation, Science and Economic Development Canada.

- Undertaking a historic reform of business innovation programs to create a suite of programs that is easy to navigate and will respond to the challenges and opportunities facing Canadian businesses today and into the future.

- Helping Canadian entrepreneurs and small business owners develop innovative technologies and successfully commercialize them in a global marketplace through flexible funding and consulting services offered by the Industrial Research Assistance Program ($700 million over five years, and $150 million per year ongoing, in additional support).

- Fostering economic growth in communities across Canada through a network of Regional Development Agencies (an additional $511 million over five years announced in Budget 2018).

- Connecting small, medium-sized and large companies, academic institutions and not-for-profit organizations to generate bold ideas through the Innovation Superclusters Initiative ($950 million over five years).

- Advancing industry-government collaboration through six Economic Strategy Tables in the advanced manufacturing, agri-food, clean technology, digital industries, health/bio-sciences and clean resource sectors.

- Supporting entrepreneurs by providing late-stage venture capital through the $400 million Venture Capital Catalyst Initiative.

- Supporting the growth of Canadian innovations through a new procurement program, Innovative Solutions Canada (ramping up to over $100 million per year).

- Helping Canadian entrepreneurs better use, protect and access intellectual property through the first-ever Intellectual Property Strategy ($83.5 million over five years, and $10 million per year ongoing).

- Attracting the best and brightest workers to help Canadian businesses grow and create more jobs, through the Global Skills Strategy ($39.4 million over five years, beginning in 2017–18, and $6.7 million per year ongoing).

- Developing the next generation of talented leaders, through work-integrated learning placements at innovative Canadian companies (including $221 million over five years in support of Mitacs and $84.3 million over four years for the Student Work Placement Program).

Gender-Based Analysis Plus of Chapter 3 Measures

Gender equality and diversity continue to be priorities for the Government, which is reflected through the incorporation of analysis related to gender and intersecting identity factors in all elements of this year's Fall Economic Statement. The measures contained in Chapter 3 are designed to stimulate investment and catalyze growth of the economy as a whole. While some initiatives, like immediate expensing for manufacturers, processors, and clean energy, are focused on certain sectors, most are broad-based, for instance regulatory reform and improvements to internal trade. Each of these measures is aimed at creating a stronger economy that will benefit all Canadians through increased government revenues, strengthened job creation and confidence. Recognizing this, the analysis below focuses on some of the additional impacts of these measures from a GBA+ perspective.

Overview of Gender-Based Analysis Plus of Chapter 3 Measures

Immediate Expensing for Manufacturers and Processors

This proposed measure can be leveraged by all businesses in the manufacturing and processing sector when making investments in machinery and equipment. Direct benefits are expected to be shared between workers and business owners in this sector, in the form of higher employment and increased profits. Statistics Canada data show that 28 per cent of manufacturing jobs in Canada are held by women, and Indigenous people account for 2 per cent of employment in the manufacturing sector.

Indirect benefits are expected in sectors that provide goods and services to the manufacturing and processing sector.

Of the investments in machinery and equipment, more than 85 per cent are made in Ontario, Quebec, Alberta and British Columbia.

Immediate Expensing for Clean Energy Equipment

This proposed measure would be available to all businesses making investments in specified clean energy equipment, such as wind turbines and solar panels, as well as energy conservation equipment. Women and men working in or owning such businesses would be expected to directly benefit from this measure. Statistics Canada data show that women made up 33 per cent of the workforce in the utilities sector, which includes clean energy generation, in 2017. According to the 2016 census, the utilities sector employed 7,415 Indigenous people in 2015.

Owing to the use of certain clean technology equipment in remote communities, the measure may also provide additional economic development and employment opportunities for northern and remote communities and specific groups living in those communities (e.g., Indigenous Peoples).

Accelerated Investment Incentive