Chapter 2 - Continued Progress For The Middle Class

For the past three years, the Government has been working to deliver on its commitments to Canadians, while helping to strengthen and grow the economy today, and for the long term.

Of the 289 commitments made in November 2015, 97 have been completed, and 189 have had action taken and progress made(for more information on results, see Annex 2: Delivering Results for Canadians).

For Canadians, these commitments represent more than promises made and fulfilled. The investments the Government has made are being felt across the country—especially by hard-working middle class families.

By this time next year, a typical middle class family of four will receive, on average, about $2,000 more each year, as a result of the middle class tax cut and the Canada Child Benefit. Because of these changes, more families will be able to pay for things like healthy food, back-to-school clothes, and new winter boots for growing kids. They will also be in a better position to invest in their children's future by contributing to Registered Education Savings Plans.

The Government's investments are also making a real difference for people who are working hard to join the middle class.

Providing more affordable housing for Canadians is a key element of the Government's plan to help strengthen the middle class, promote growth for everyone, and lift more Canadians out of poverty. That is why, for the first time, Canada has a National Housing Strategy—a $40 billion, 10-year plan to help ensure that Canadians have access to safe and affordable housing.

More than 30,000 infrastructure projects have been approved since 2016 under the Government's Investing in Canada plan, the vast majority of which are underway—creating good, middle class jobs in communities big and small, and laying the foundation for social, environmental and economic benefits for years to come.

This Government has also taken concrete steps to improve the quality of life for seniors. To enhance the retirement income security of Canadians, the Government increased the Guaranteed Income Supplement top-up for low-income single seniors, restored the eligibility age for Old Age Security and Guaranteed Income Supplement benefits to 65, and enhanced the Canada Pension Plan. In addition, the Government has made other important investments in housing, home care, accessibility and digital literacy that will improve the well-being of seniors. The Government's efforts are especially meaningful for low-income seniors, many of whom are women.

With this Fall Economic Statement, the Government is taking additional steps to fulfill the promises it made to Canadians, and making new commitments to help build a more equal, generous and sustainable Canada.

Results for Canadians

Supporting Children and Families

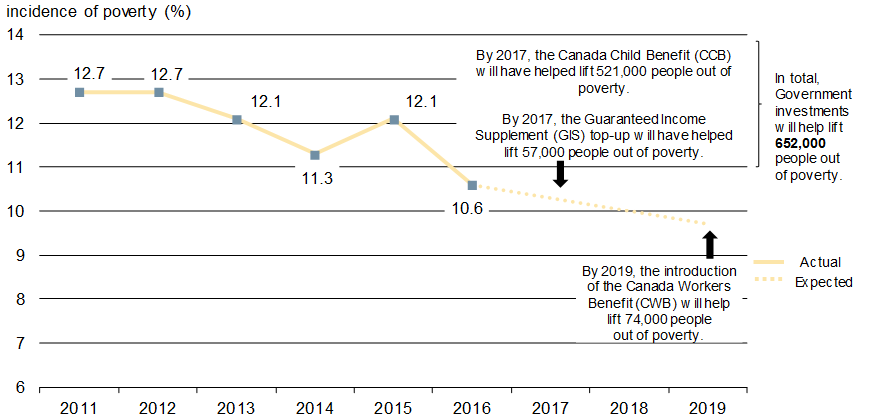

Introduced in 2016, the Canada Child Benefit (CCB) is a monthly, tax-free benefit designed to help families with the high cost of raising children. It's simpler, more generous and better targeted to give more help to families who need it most. The CCB puts more money in the pockets of nine out of ten Canadian families with children, and to date has helped lift 521,000 people—including nearly 300,000 children—out of poverty.

Sources: Canadian Income Survey, 2011 to 2016 actual figures, Market Basket Measure.

Poverty reduction impacts for CCB, GIS and CWB based on microsimulation model estimates.

The CCB is especially helpful for families led by single parents. Thanks to the CCB, a single working mother or father who has two children (one child under 6 and one child aged 6-17) and who earns $35,000 a year now receives about $3,570 more in benefits each year, compared to the previous system of child benefits.

| Family Net Income in 2017 | Previous System | CCB | Net Gain or Loss |

|---|---|---|---|

| $35,000 | $7,790 | $11,360 | ✓ $3,570 more with CCB |

| $70,000 | $4,190 | $6,950 | ✓ $2,760 more with CCB |

| $250,000 | $1,848 | 0 | X No benefits for high-income families |

In the 2017 Fall Economic Statement, the Government announced its plan to further strengthen the CCB by indexing the benefit to keep pace with the cost of living, beginning in July 2018—two full years ahead of schedule, thanks to a strong and growing economy. For the 2019–20 benefit year, for a single parent with $35,000 of income and two children, the accelerated indexation of the CCB will contribute almost $600 towards the increasing costs of raising his or her children.

To ensure that all eligible families are able to access this benefit, Budget 2018 also provided $17.3 million over three years, starting in 2018–19, to expand outreach efforts to Indigenous communities, and to conduct pilot outreach activities for urban Indigenous communities. The Government has also more than quadrupled funding to support the Community Volunteer Income Tax Program and the Income Tax Assistance – Volunteer Program (Quebec). In these community-based clinics, volunteers prepare income tax and benefit returns for low- and modest-income people, free of charge, helping their friends and neighbours access a broader range of federal programs and supports.

Helping Canadians Secure a Safe and Affordable Place to Call Home

With new, long-term investments in the National Housing Strategy, the Government is working with its partners, including the provinces and territories, municipalities, the private and non-profit sectors and others, to help more Canadians secure a safe and affordable place to call home. This includes efforts to reduce the number of households in core housing need, as well as measures to preserve existing housing stock, build new housing units across the country, and lift more Canadians out of homelessness. At least 25 per cent of National Housing Strategy investments will support projects that specifically target the unique needs of women and girls.

In May 2018, the Government launched the new 10-year, $13.2 billion National Housing Co-Investment Fund, which will provide low-cost loans and financial contributions to support and develop mixed-income, mixed-tenure and mixed-use affordable housing. This initiative alone is expected to create up to 60,000 new housing units and repair up to 240,000 units of existing affordable housing. Project applications are being accepted and reviewed continuously, and the first successful projects will be announced early next year. The National Housing Co-Investment Fund alone will create or repair at least 4,000 shelter spaces for survivors of family violence, which is in addition to the commitment to create or repair 3,000 shelter spaces in Budget 2016.

Rental Construction Financing Initiative: Horizon Housing Society

The $15.7 million Horizon Housing Society project, also supported by the Province of Alberta and the City of Calgary, will construct 183 new rental housing units in Calgary and Kitchener. The project will achieve energy-efficiency savings of 17 per cent and a reduction in greenhouse gas emissions of 15 per cent, and all units will be affordable with rents lower than 30 per cent of median household income in the area.

The Rental Construction Financing Initiative has been provisioned with $3.75 billion over four years, starting in 2017, to help fund projects like the Horizon Housing Society project.

The Rental Construction Financing Initiative was launched by the Government in 2017 to provide low-cost loans to encourage construction of new rental housing in communities across Canada where there is demonstrable need. More than 1,800 new rental units are now being built with the assistance of this initiative.

The Government has also established a new Affordable Housing Innovation Fund, which will apply innovative solutions to help address the challenges facing affordable housing through new funding models and innovative building techniques in the affordable housing sector. The Fund was launched in 2016 with an investment of $200 million over five years, and has already committed $86 million to create more than 8,400 housing units.

To further advance the National Housing Strategy, and set the foundation for federal, provincial and territorial governments to work together toward achieving a long-term shared vision for housing, a new multilateral Housing Partnership Framework was endorsed earlier this year. The Government is now working to sign bilateral agreements with all provinces and territories by March 31,2019, which will help deliver $7.7 billion in federal investments to provinces and territories over the next decade. To date, agreements have been reached with the Governments of Ontario, British Columbia, New Brunswick and Northwest Territories. The Government of Quebec is seeking an asymmetrical bilateral agreement.

As part of the National Housing Strategy, the Government is working on a nation-to-nation, Inuit-Crown and government-to-government basis to create distinctions-based housing strategies that meet the unique housing needs of First Nations, Inuit and Métis Nation partners. These strategies will be founded on the core principles of self-determination, reconciliation, respect and cooperation. In order to support the successful implementation of each distinctions-based housing strategy, the Government announced $600 million over 3 years to support housing on reserve as part of a 10-year First Nations Housing Strategy, $400 million over 10 years to support an Inuit-led housing plan in the Inuit regions of Nunavik, Nunatsiavut and Inuvialuit, and $500 million over 10 years to support the Métis Nation's housing strategy. These investments will support Indigenous communities in meeting immediate housing needs and give them the tools they need to create, control and manage their own housing.

Intergovernmental Collaboration to Combat Money Laundering

Federal, provincial and territorial governments are also working together to address housing market conditions across the country, including by gathering better information on foreign ownership and by improving corporate ownership transparency. These efforts will also support ongoing initiatives to help identify and address money laundering risks in Canada's real estate sector.

In addition, Canada has agreed to establish a joint working group with the Province of British Columbia to examine issues related to tax fraud and money laundering in British Columbia and the Metro Vancouver region.

The Government will continue to collaborate with its provincial and territorial partners to preserve the integrity and affordability of Canada's real estate market.

Investing in Infrastructure to Build Strong and Resilient Communities

Since 2015, the Government has made historic investments in infrastructure to support stronger, more inclusive communities, and create lasting economic, environmental and social benefits for years to come. Those investments are paying off.

To date, more than 30,000 infrastructure projects have been approved under the Investing in Canada plan, the vast majority of which are already underway—creating good, middle class jobs. Beyond project construction, these projects will create long-term economic, social and environmental returns for Canadians and for communities both big and small.

In Budget 2016, the Government announced Phase One of the Investing in Canada plan, which provides $14.4 billion for short-term investments in the rehabilitation, repair and modernization of existing infrastructure. To date, more than $13 billion has been committed to projects, with more than $6 billion already fully invested.

Investing in Canada

In Budget 2017, the Government announced Phase Two of the Investing in Canada plan, which is on track to provide an additional $81.2 billion in federal funding over 11 years for public transit, green infrastructure, social infrastructure, rural and northern communities, and trade and transportation. For example:

- The Government has signed long-term agreements with all provinces and territories to deliver more than $33 billion in federal funding for infrastructure priorities in communities across the country.

- The Government is investing in critical infrastructure through targeted, merit-based programs, such as the National Trade Corridors Fund and the Disaster Mitigation and Adaptation Fund.

- The Canada Infrastructure Bank is operational, has made its inaugural investment, and is working with provinces, territories, municipalities, Indigenous communities and investors to transform the way revenue-generating infrastructure is planned, funded and delivered in Canada.

Making Meaningful Investments in Communities

Improving Commute Times and Reducing Traffic Congestion in Alberta, Ontario and Quebec

- $1.53 billion for Calgary's Green Line LRT project, which will provide hundreds of thousands of transit riders with a direct route to the downtown core.

- $1.9 billion for four GO Transit Regional Express Rail projects in the Greater Golden Horseshoe Area.

- $1.28 billion loan from the Canada Infrastructure Bank for the Réseau express métropolitain project in Montréal.

Delivering Safe Drinking Water in First Nations Communities

- Over $2 billion in new investments, which have supported water and wastewater projects in 580 communities and helped lift 72 long-term drinking water advisories on reserve since November 2015.

Increasing Fresh Water Supply in Prince Edward Island

- $4 million for a new wellfield in Charlottetown, positioning the city to handle growing water demands.

Reducing Greenhouse Gas Emissions From Vehicles in Ontario and Manitoba

- $8 million to demonstrate electric vehicle charging stations along the

Trans-Canada Highway.

Building More Shelters for Survivors of Domestic Violence in Ontario

- $10 million for five new shelters in First Nations communities, including a gender-inclusive shelter for members of the Wiikwemkoong First Nation community in Manitoulin Island.

Helping Families in Nova Scotia Access Affordable Early Learning and Child Care

- In Nova Scotia, new federal investments will help families of 1,600 additional children to access more affordable child care spaces by March 2020, saving these families more than $5 million a year—roughly $3,100 on average—in child care costs.

Showcasing Inuit Art and Culture in Manitoba

- $15 million for the construction of the Winnipeg Art Gallery's Inuit Art Centre, which will offer education in Inuit history, culture and art, in partnership with Inuit.

Increasing Recreational Activities in British Columbia

- $13.6 million for the Port Coquitlam Community Recreation Complex to provide an active, social gathering place for the community.

Enhancing Transportation Links in the Northwest Territories

- $102.5 million for the Mackenzie Valley Highway project to help local businesses bring goods to market.

Improving Highway Capacity and Safety in Nova Scotia

- $90 million to twin and upgrade the Trans-Canada Highway in northeastern Nova Scotia.

Moving Goods to Market Efficiently in Saskatchewan and British Columbia

- $53.3 million to upgrade Highways 6 and 39 between Regina and Estevan, near the United States border.

- $167 million for port and rail infrastructure in Vancouver to increase efficiency and capacity for trade.

Improving Access to High-Speed Internet in Yukon, the Northwest Territories, Nunavut and Newfoundland and Labrador

- $59 million to build a fibre network between Dawson City, Yukon, and Inuvik, Northwest Territories.

- $49.9 million to improve satellite network capacity for all 25 Nunavut communities.

- $26.9 million to improve internet backbone networks, upgrade capacity and extend access to communities in Newfoundland and Labrador.

Giving More Seniors a Secure and Dignified Retirement

Canadians deserve a secure and dignified retirement, free of financial worries. To achieve this goal, the Government is committed to strengthening public pensions and improving the quality of life for seniors now, and for generations to come.

Since 2016, the Government has taken concrete steps to improve the retirement income security of Canadians by:

- Increasing Guaranteed Income Supplement top up payments by up to $947 per year for single seniors, boosting benefits for nearly 900,000 low-income seniors and lifting about 57,000 seniors out of poverty.

- Restoring the eligibility age for Old Age Security and Guaranteed Income Supplement benefits to 65, putting thousands of dollars back in the pockets of Canadians as they become seniors.

- Introducing legislative changes so that couples who receive Guaranteed Income Supplement and Allowance benefits and have to live apart for reasons beyond their control receive higher benefits based on their individual incomes.

Starting in 2019, in collaboration with our provincial partners, the Government is enhancing the Canada Pension Plan (CPP). The CPP enhancement will give Canadian workers greater income security when they retire and offers a number of advantages over other types of savings:

- It will provide a secure, predictable benefit in retirement, so Canadians can worry less about outliving their savings and be less anxious about the safety of their investments.

- Benefits will be indexed, which means that they will keep up with the cost of living.

- It will be a good fit with young workers entering Canada's changing job market, helping to fill the gap left by declining workplace pension coverage.

- It will be portable across jobs and provinces, including in Quebec where the Quebec Pension Plan has been enhanced in a similar fashion.

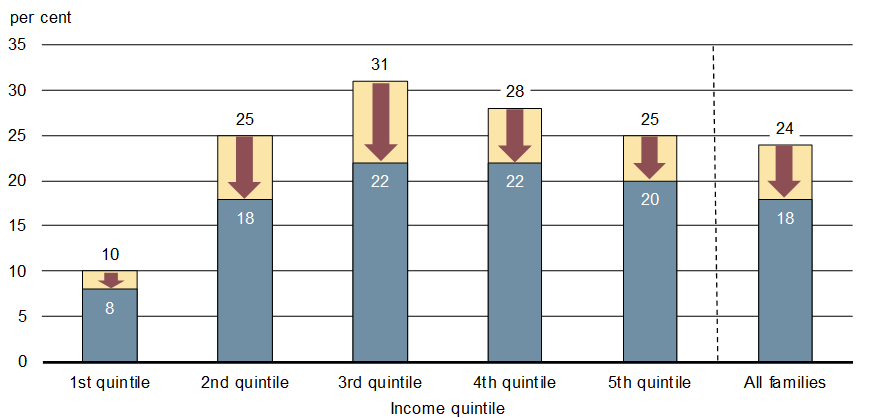

The CPP enhancement represents a major strengthening of one of the three pillars of Canada's retirement income system (along with the Old Age Security program and voluntary tax-assisted private savings). It will significantly reduce the risk of undersaving for Canadian families, and will be particularly beneficial for middle-income families and families without workplace pension plan coverage.

Notes: Chart shows the estimated impact of the CPP enhancement if it was fully mature today (i.e., workers had contributed to the enhanced Plan over their full careers). Figures represent the share of families nearing retirement age at risk of not replacing 60 per cent of their pre-retirement after-tax income when considering income from the three pillars of the retirement income system and savings from other financial and non-financial assets. Income quintiles correspond to pre-retirement after-tax income of families with a major income earner age 45-59. The 1st quintile corresponds to the bottom 20% of families in the income distribution while the 5th quintile corresponds to the top 20% of families.

Sources: Survey of Financial Security, 2012; Department of Finance Canada calculations.

The CPP enhancement will be phased in gradually, starting in January 2019, and will raise the maximum CPP retirement benefit by up to 50 per cent over time. This translates into an increase in the current maximum retirement benefit of nearly $7,300, from $13,855 to more than $21,100 in today's dollar terms.

In addition to improving the retirement income security of Canadians, the Government has also made other important investments in the lives of seniors such as:

- Launching the National Housing Strategy, a $40-billion, 10-year plan which will help ensure that vulnerable Canadians, including low-income seniors, have access to housing that meets their needs and that they can afford.

- $6 billion over 10 years for home care, to allow provinces and territories to improve access to home, community and palliative care services.

- $77 million in additional funding for the Enabling Accessibility Fund to improve the safety and accessibility of community spaces.

- Making it easier to apply for Employment Insurance caregiving benefits, and introducing a new Employment Insurance caregiving benefit of up to 15 weeks to support individuals who are providing care to an adult family member who requires significant support in order to recover from critical illness or injury.

- Appointing a Minister of Seniors to help the Government better understand the needs of Canadian seniors, and ensure that programs and services are designed to respond to those needs.

Additionally, in Budget 2018 the Government committed to taking a whole-of-Government, evidence-based approach towards addressing retirement security for all Canadians, including seeking feedback from workers, pensioners and companies. In keeping with this commitment, the Government is exploring ways to enhance retirement security and will soon be launching targeted consultations.

Martine is a 72-year-old resident of Winnipeg, Manitoba, who lives alone and has no other income apart from Old Age Security and Guaranteed Income Supplement benefits. The increase in the Guaranteed Income Supplement top-up benefit for single seniors introduced in Budget 2016 provides Martine with an additional $947 per year.

Tom is an 81-year-old widower residing in Halifax, Nova Scotia. He receives an annual CPP benefit of $5,000 in addition to Old Age Security and Guaranteed Income Supplement benefits. The increase in the Guaranteed Income Supplement top-up benefit for single seniors introduced in Budget 2016 provides Tom with an additional annual benefit of $848 per year.

Kate, age 62, and Mike, age 77, have been married for 40 years. Because Mike requires long-term care, Kate and Mike must live apart. Mike receives $3,000 of CPP benefits, and before the changes introduced in Budget 2016, Mike would have received Old Age Security and Guaranteed Income Supplement benefits of more than $12,500. Kate has annual earnings from her part-time job of $6,000 and would have received over $5,800 in Allowance benefits. Taken together, the Old Age Security program would have provided Kate and Mike with over $18,300 in annual income support. Following the changes introduced in Budget 2016, Mike receives over $14,300 in Old Age Security and Guaranteed Income Supplement benefits, and Kate receives about $8,300 in Allowance benefits. Taken together, the Old Age Security program provides annual income support of about $22,600 to Kate and Mike following the Budget 2016 changes, $4,000 more than before.

Consumer Protection Framework in Banking

The Government is committed to ensuring all Canadians benefit from strong consumer protection standards in their dealings with banks—something of particular concern to Canada's seniors.

The Government has introduced legislation to strengthen consumers' rights and interests when dealing with their banks, and to improve the Financial Consumer Agency of Canada's ability to protect consumers. Amendments are focused on three key areas: requiring new internal bank practices to further strengthen outcomes for consumers, providing the Financial Consumer Agency of Canada with additional tools to implement supervisory best practices, and further empowering consumers. The Government consulted with stakeholders, including provinces and territories, on these measures and continues to engage with Canadians on opportunities to further enhance financial consumer protection.

When Canadians have disputes with their banks, they deserve access to a fair and impartial resolution process. To that end, the Financial Consumer Agency of Canada will conduct a review by June 2019 to assess banks' complaints handling processes and the effectiveness of the external complaints bodies.

To respond to the unique needs of Canada's aging population, the Financial Consumer Agency of Canada will engage with banks and seniors' groups to create a code of conduct to guide banks in their delivery of services to Canada's seniors. The new Minister of Seniors will support this engagement.

A More Equal, Generous and Sustainable Canada

Equality in Action

Ensuring that every Canadian has an equal opportunity to participate in the economy isn't just the right thing to do, it's the smart thing to do. Canada's future prosperity depends on it.

"Canada has made significant progress on gender equality in the last few years, developing institutions, policies, tools and accountability structures that position it as a leader in an area increasingly seen as a cornerstone of inclusive growth."

Proactive Pay Equity for Federally Regulated Workers

The full and equal participation of women in the economy is essential to economic growth and a strong middle class. The persistent wage gap between what Canadian women and men earn is a stark reminder of the progress that is still needed to achieve true equality.

Greater Equality = Stronger Growth

- McKinsey Global Institute estimates that by taking steps to advance greater equality for women—such as reducing the gender wage gap by employing more women in technology and by boosting women's participation in the workforce—Canada could add $150 billion to its economy by 2026.

- Similarly, RBC Economics estimates that adding more women to the workforce could boost Canada's GDP by as much as 4 per cent.

- The Peterson Institute for International Economics has found that increasing the share of women in leadership positions from zero to 30 per cent translated into a 15 per cent boost in profits—more money for businesses to invest in new jobs that will benefit more people.

On average, for every dollar of hourly wages a man working full time earns in Canada, a woman working full time earns about 88 cents. This gap places Canada in the middle of the pack compared to other developed economies, ranked 15th out of 29 OECD countries based on the hourly gender wage gap.

The Government is moving forward with a comprehensive strategy to address the gender wage gap and achieve gender equality in Canada. As part of this approach, the Government has recently introduced proactive pay equity legislation to show federal leadership in addressing that part of the gender wage gap that is due to systemic gender discrimination and the undervaluation of work traditionally performed by women. This legislation, which would apply to approximately 1.2 million employees in federally regulated workplaces, will promote equal pay for work of equal value.

The proposed legislation and included amendments to related statutes are intended to create a proactive pay equity regime that takes away the onus on employees to make pay equity complaints and places the responsibility on employers to proactively develop plans to achieve equitable compensation for employees in female-predominant jobs in federally regulated workplaces, including the federally regulated private sector, the federal public service, parliamentary workplaces and Ministers' offices.

The proposed Act will apply to federally regulated public and private sector employers with 10 or more employees, and it will take different circumstances of employers—both large and small—into account.

Highlights of the proposed legislation include:

- The establishment of a Pay Equity Commissioner within the Canadian Human Rights Commission to administer and enforce the Act.

- Requirements for employers to establish a pay equity plan within three years of becoming subject to the Act.

- Requirements for employers to adjust compensation to ensure that they provide equal pay for work of equal value, phasing in adjustments gradually over a period of three to five years (three for employers with 100 or more employees and five years for smaller employers).

- Requirements that pay equity plans be reviewed and updated at least once every five years, in order to identify and close any gaps that emerge over time.

- Requirements for unionized employers, as well as those non-unionized employers with 100 or more employees, to establish a pay equity committee to develop or update the pay equity plan. Employer, union and non-unionized employee representatives would all be members of the committee.

- Provisions that employees be provided the opportunity to comment on a proposed pay equity plan (or update) before it is finalized.

- Requirements for employers to submit annual statements to the Pay Equity Commissioner regarding pay equity plans.

- Introduction of an administrative monetary penalty system to promote compliance.

- Mechanisms to request the review or appeal of decisions of the Pay Equity Commissioner.

- Provisions that give the Governor in Council the power to adapt the pay equity regime in its application to certain First Nation employers.

- Requirements that the Act be reviewed 10 years after coming into force, and every 5 years after that.

To ensure the effective implementation of this legislation, the Government will provide a total of $26.6 million over six years, starting in 2018–19, and $5.8 million per year ongoing to support the new Pay Equity Commissioner and the new pay equity unit within the Canadian Human Rights Commission and to implement and administer the proactive pay equity legislation for the federally-regulated public and private sectors once it comes into force. Additionally, $49.4 million will be made available to administer the proactive pay equity regime within the federal public service.

Closing the Gender Wage Gap in Canada

Factors Contributing to Canada's Gender Wage Gap

Government Actions Taken to Help Close the Gap

Fewer women in certain educational paths that lead to high-paying jobs (e.g., in science, technology and trades)

- New funding for programs like Promoscience and CanCode, to get girls (and boys) interested in coding and science (Budget 2017)

- Improving diversity in the research community through focused investments in the granting councils, data collection initiatives, opportunities for early career researchers and new gender equity planning (Budget 2018)

- Increasing women's representation in male-dominated Red Seal trades through the Apprenticeship Incentive Grant for Women and the Pre-Apprenticeship Program, including the Women in Construction Fund. (Budget 2018)

Undervaluation of work that has been predominantly performed by women

- Introduction of proactive pay equity legislation for federally regulated workers (Budget Implementation Act, 2018, No. 2)

- Commitment to introduce new pay transparency requirements in the federally regulated sector (Budget 2018)

Fewer women in full-time, high-quality jobs

- Promoting equal access to training and jobs for Indigenous women through the Indigenous Skills and Employment Training Program (Budget 2018)

- Investments to help improve the quality of career information, so that women and underrepresented groups can make better-informed career decisions (Budget 2018)

- Investments to help visible minority newcomer women in Canada get into, and stay in, the workforce (Budget 2018)

Unequal sharing of caregiving responsibilities within the home, and lack of access to affordable child care—leading to fewer hours worked, less focus on career advancement, and fewer opportunities for women to advance to positions of leadership

- Introduction of the "use-it-or-lose-it" Employment Insurance Parental Sharing Benefit to support greater gender equality in the home and in the workplace (Budget 2018)

- The agreement reached in June 2017 on the Multilateral Early Learning and Child Care Framework, to make available more affordable day care spaces, allowing more low- and modest-income mothers to enter and remain in the labour market

- Changes to Employment Insurance (EI) parental benefits, to allow parents to choose to receive up to 61 weeks of EI parental benefits over an extended period of 18 months at a lower benefit rate, giving families more flexibility as they navigate the challenges that come with a growing family (Budget 2017)

Lack of role models to encourage girls to aspire to positions of leadership

- Creation of Canada's first gender-balanced Cabinet in 2015

- New open, transparent and merit-based approach to selecting candidates for Governor-in-Council positions

- Increased funding for the Department for Women and Gender Equality, to better support initiatives that build the capacity of equality-seeking organizations, reduce gender inequality in Canada, and promote a fairer and more productive society (Budget 2018)

Limited access to capital and procurement opportunities for women-owned businesses

- Introduction of a new Women Entrepreneurship Strategy in Budget 2018 to help women entrepreneurs grow their businesses with greater access to capital, training, networking and expertise

Gender Budgeting Legislation

Budget 2018 committed to introducing new gender budgeting legislation to enshrine gender budgeting in the federal government's budgetary and financial management processes. Through this legislation, Gender-based Analysis Plus (GBA+) will be applied not only to new budgetary decisions, but to the Government's tax expenditures and existing spending base as well. The intent of the legislation is to preserve and build upon recent gains in the availability and quality of GBA+ and its integration in budget decision-making.

The Canadian Gender Budgeting Act, as set out in the recently tabled Budget Implementation Act, 2018, No. 2, will serve to strengthen Government decision-making when it comes to taxation and resource allocation, and will ensure that Parliamentarians and Canadians are better informed about the ways in which new and existing Government measures impact people differently based on gender and other intersecting factors, such as race, ethnicity, age, ability and sexual orientation.

Department for Women and Gender Equality

As committed to in Budget 2018, the Government recently introduced legislationto make Status of Women Canada an official department of the Government of Canada. The new department—renamed the Department for Women and Gender Equality—would work to advance equality for all Canadians with respect to sex, sexual orientation, and gender identity or expression, while recognizing differences among these groups.

The Government has invested significantly in Status of Women Canada in support of its broader commitment to gender equality. By 2022–23, it will have provided over $350 million in new funding, enabling the department to lead the Government's efforts to integrate a gender and diversity lens in its policies and investments, including through research and data collection in support of the Government's new Gender Equality Framework. These investments also include $100 million in support of the Women's Program and over $120 million to lead Canada's Strategy to Prevent and Address Gender-based Violence.

Better Public Policy Through Cooperation

Every day, Canadians come together to support each other, to help out friends and neighbours, to give to those most in need, to protect the environment, and build a better Canada. Canadians' generosity is also seen in the important role that charities play in our society.

Along with providing much-needed programs and services in communities all across the country, Canada's charities serve the interests of all Canadians by pressing for positive social and environmental change. They bring to public policy development a deep commitment and considerable expertise, along with experience in developing innovative solutions and reaching out to a wide range of stakeholders. This is particularly valuable in an era of complex social and environmental challenges and constrained government budgets, where all informed perspectives and ideas should be considered.

To make the most of what charities have to offer, Canada needs a regulatory environment that respects and encourages the full participation of charities in public policy dialogue and development.

A Stronger Role for Charities in Developing Public Policy

Recognizing the important contributions that charities make to public life and public policy in Canada, the Government has committed to allow charities to do their work on behalf of Canadians free from political harassment, with clearer rules governing political activity. To this end, the Government announced in August 2018 that it would amend the Income Tax Act to remove the limits on political activities, allowing charities to participate fully in public policy development. Canadians provided feedback on draft legislative proposals, and legislation to implement these measures was introduced on October 29, 2018 as part of the Budget Implementation Act, 2018, No. 2.

A Permanent Advisory Committee on the Charitable Sector

The Government is committed to engaging in a meaningful dialogue with charities, and ensuring that the regulatory environment in which they operate is appropriate and supports the important work they do. In response to the recommendations of the Consultation Panel on the Political Activities of Charities, as well as the Social Innovation and Social Finance Strategy Co-Creation Steering Group, the Government is establishing a permanent Advisory Committee on the Charitable Sector. Led by the Canada Revenue Agency, the Advisory Committee will be made up of stakeholders from the charitable sector, and will provide advice to the Government on important issues facing charities on an ongoing basis. The Government is providing $4.6 million in new funding over the 2018–19 to 2023–24 period for the Advisory Committee to strengthen the relationship between government and this important sector.

A New Tool to Help Solve Big Challenges: The Social Finance Fund

Though Canada is a prosperous country, many of our communities still face persistent and complex social challenges that make it difficult for some individuals—including Indigenous Peoples, seniors, youth, immigrants, persons with disabilities, members of LGBTQ2+ communities and women fleeing violence—to succeed and reach their full potential.

"The complex social, economic and environmental challenges facing our country—homelessness, climate change, youth employment, and the opioid crisis—demand creativity and transformative solutions."

New and innovative approaches are needed to tackle these challenges. Charitable, non-profit and social purpose organizations have generated many innovative solutions, but often need partners who are willing to invest to bring those ideas to life. A strong "social finance market" would allow potential investors to partner with social innovators and work together to solve our country's biggest social challenges.

The Social Finance Fund

What Is Social Finance?

Social Finance refers to the practice of making investments intended to create social or environmental impact, in addition to financial returns.

In June 2017, the Government created a Social Innovation and Social Finance Strategy Co-Creation Steering Group, primarily comprised of experts from the charitable and non-profit sector, to provide recommendations on the development of a social innovation and social finance strategy. The Steering Group delivered its final report, Inclusive innovation: New Ideas and New Partnerships for Stronger Communities, in August 2018. One of the report's key recommendations was to create a Social Finance Fund to help close the capital financing gap faced by organizations that deliver positive social outcomes, and to help accelerate the growth of the existing social finance market in Canada.

To help charitable, non-profit and other social purpose organizations access new financing, and to help connect them with private investors looking to invest in projects that will drive positive social change, the Government proposes to make available up to $755 million on a cash basis over the next 10 years to establish a Social Finance Fund. Additionally, the Government proposes to invest $50 million over two years in an Investment and Readiness stream, for social purpose organizations to improve their ability to successfully participate in the social finance market. It is expected that a Social Finance Fund like the one the Government is proposing could generate up to $2 billion in economic activity, and help create and maintain as many as 100,000 jobs over the next decade.

Details on the governance and parameters of the Fund will be developed further in the coming months and released in early 2019. In addition to these measures, the Government will continue to work on exploring other recommendations from the Steering Group's report.

The Social Finance Fund will:

- Support innovative solutions on a broad range of social challenges through a competitive, transparent and merit-based process.

- Attract new private sector investment to the social finance sector. It is expected that the Fund would achieve matching funding from other investors.

- Share both risks and rewards with private investors on any investments.

- Only support investments that are not yet viable in the commercial market.

- Help create a self-sustaining social finance market over time that would not require ongoing government support.

Additional details on the Social Finance Fund will be provided in early 2019.

There are several existing funds active in the social finance market. Both newly created and existing funds will be able to access this new capital. The following are examples of funds that the Social Finance Fund could support:

The First Nations Market Housing Expansion Fund (Quebec) is a proposed expansion of a loan fund managed by the Aboriginal Savings Corporation of Canada that would provide mortgage loans to residents of Indigenous communities, enabling a growing number of residents to become homeowners and improving overall housing quality in Indigenous communities.

The Chantier de L'Économie Sociale Trust (Quebec) provides patient capital financing to support start-up, expansion and real estate activities of co-operatives and non-profit businesses. The Trust has provided support for programs to help at-risk youth, including Indigenous youth, acquire skills through integrated learning opportunities, and loans to local communities to help restore services.

The Saint John Community Loan Fund (New Brunswick) works towards helping individuals and organizations create income and build assets and self-reliance using finance, training and support. For example, the Fund provided: a loan to leverage a mortgage to develop affordable housing units; support for establishing a literacy organization; and capital for an innovation hub to help launch and develop new social enterprises.

The Alberta Social Enterprise Fund (Alberta) provides access to loan capital for social entrepreneurs to address challenges in the environment, social issues, local food security, culture and other public benefit missions. For example, the Fund has provided support to mental health organizations to help provide accessible housing for clients, employment opportunities for persons with disabilities, and therapeutic programs for adults and children with physical and mental disabilities.

Support for Canadian Journalism

A strong and independent news media is crucial to a well-functioning democracy. It empowers citizens by providing them with the information they need to make informed decisions on important issues, and also serves to hold powerful institutions—including governments—to account by bringing to light information that might not otherwise be made available to the public. In short, strong and independent journalism serves the public good—for Canada, and for Canadians. Canadians have a right to a wide range of independent news sources that they can trust, and government has a responsibility to ensure that Canadians have access to these kinds of news sources.

In recent years, changes in technology and in the way that Canadians consume news have made it difficult for many news outlets to find and maintain financially sustainable business models. At a time when people increasingly get their news online, and share news and other content through social media, many communities have also been left without local news outlets to tell their stories. Concerns have been expressed that, without government intervention, there may be a decline in the quantity and quality of journalism available to Canadians, including a significant loss of local news coverage.

In November 2018, the Prime Minister, together with other world leaders, committed to take action to support a strong and independent news sector in the digital age. The Government recognizes the vital role that local journalism plays in communities all across the country, and is committed to finding ways to help keep people, and communities, connected through local news providers.

Budget 2018 announced $50 million over five years to support local journalism in under-served communities, helping to ensure that Canadians continue to have access to informed and reliable civic journalism. Starting in 2019-20, independent, not-for-profit organizations will have additional government support to create open source news content under a creative commons licence. This will allow local news organizations to access the content produced for free, helping to bolster local news coverage as organizations struggle with reduced capacity.

Budget 2018 further announced that the Government would explore new models to provide financial support for journalism in Canada. In determining its approach, the Government considered two key principles, which stipulate that any mechanism to support the news sector:

- Be arms-length and independent of the Government. To this end, an independent panel of journalists will be established to define and promote core journalism standards, define professional journalism, and determine eligibility.

- Be focused on the creation of original news content.

Guided by these principles, the 2018 Fall Economic Statement announces the Government's intention to propose three new initiatives to support Canadian journalism: allowing non-profit news organizations to receive charitable donations and issue official donation receipts, introducing a new refundable tax credit to support original news content creation, including local news, and introducing a new temporary non-refundable tax credit to support subscriptions to Canadian digital news media.

Access to Charitable Tax Incentives for Eligible News Organizations

Budget 2018 announced that the Government would explore new models that would enable private giving and philanthropic support for trusted, professional, non-profit journalism, including local news. To that end, the Government intends to introduce a new category of qualified donee, for non-profit journalism organizations that produce a wide variety of news and information of interest to Canadians. As qualified donees, eligible non-profit journalism organizations would be able to issue official donation receipts, which allows donors to benefit from tax incentives for charitable giving (including the Charitable Donations Tax Credit for individuals and deductions for corporations). As qualified donees, these organizations would also be eligible to receive funding from registered charities.

A New Refundable Tax Credit to Support News Organizations

To further support news journalism in Canada, the Government intends to introduce a new refundable tax credit for qualifying news organizations. This new measure will aim to support Canadian news organizations that produce a wide variety of news and information of interest to Canadians. The refundable credit will support labour costs associated with producing original news content and will generally be available to both non-profit and for-profit news organizations. An independent panel will be established from the news and journalism community to define eligibility for this tax credit, as well as provide advice on other measures. Once established, the effective date of the refundable tax credit will be set for January 1, 2019.

A New Non-Refundable Tax Credit for Subscriptions to Canadian Digital News Media

To support Canadian digital news media organizations in achieving a more financially sustainable business model, the Government intends to introduce a new temporary, non-refundable 15-per-cent tax credit for qualifying subscribers of eligible digital news media.

In total, the proposed access to tax incentives for charitable giving, refundable tax credit for labour costs and non-refundable tax credit for subscriptions will cost the federal government an estimated $595 million over the next five years. Additional details on these measures will be provided in Budget 2019.

Creation of a Francophone Digital Platform

At the recent 2018 Francophonie Summit, the Government indicated its support for the creation, development, and launch of an integrated multilateral French-language digital platform to help showcase French culture and protect its place in the digital world. Forging global partnerships will make Francophone communities and culture more visible throughout the world and help ensure the vitality of the French culture and language.

The Government proposes to invest $14.6 million over five years, starting in 2019–20, to support the creation of a Francophone digital platform with TV5MONDE public broadcasters. As the first global channel in French, TV5MONDE distributes its programming through cable television to more than 354 million households in 198 Francophone and Francophile countries around the world.

The Francophone digital platform will increase the online presence of French content, providing greater visibility of Canadian content and enhanced opportunities for local Canadian artists and producers. In addition, it will increase the "discoverability" of and ease of access to Francophone and Canadian programming globally.

Support to Make Nutritious Food More Affordable in Isolated Northern Communities

The Government is committed to making nutritious food more affordable for people who live in Canada's North, and is working with residents of these communities to ensure that federal programs like Nutrition North are more transparent, effective, and accountable to northerners and other Canadians.

Budget 2016 expanded the Nutrition North Canada program to include all isolated northern communities, and at that time, the Government committed to updating and expanding the program, in consultation with northern communities. Consultations highlighted the importance of being able to purchase affordable food from the grocery store, as well as having access to traditional food to support a healthy diet, community well-being and connection to local cultures and traditions.

To ensure that northern families have access to affordable, healthy food, including local food, the Government proposes to invest $62.6 million over five years starting in 2019–20, with $10.4 million ongoing, in the Nutrition North Canada program. This investment would help to support several program changes, informed by consultations with northerners, and to introduce a Harvesters Support Grant to help lower the high costs associated with traditional hunting and harvesting activities.

Prompt Payment for Government Construction Contractors

The Government is currently modernizing its procurement practices to simplify the process and make it easier for interested businesses to bid on government contracts. As part of this effort, the Government also committed in 2017 to assess and implement changes within its procurement system to ensure that construction contractors and sub-contractors that work on federal projects on federal lands are paid promptly.

Ensuring the speed and efficiency of cash flow down the construction supply chain is fundamental to a healthy construction industry. The timely flow of payments within all tiers on such construction projects is necessary to enable material and equipment suppliers, sub-contractors, and trades and labour to contribute with confidence to federal government projects.

The Government will introduce legislation to implement the prompt payment of contractors and sub-contractors for federal projects on federal lands as well as the adjudication of payment issues.

Helping to Promote Avalanche Safety

Canada's beautiful parks and cold winters make it an ideal location to enjoy winter sports. To make the most of our winter seasons, Canadians should be provided with the awareness and training required to safely enjoy winter sports, including preventing avalanche-related fatalities and injuries.

Avalanche Canada is a non-profit organization dedicated to improving avalanche awareness and safety. It provides avalanche forecasts, develops and delivers training programs, and supports research on avalanche safety.

To help Canadians safely enjoy the outdoors year-round, Avalanche Canada is committed to becoming a national organization and expanding its services to include areas such as northern British Columbia, parts of Quebec, Newfoundland and Labrador, and Yukon. To support Avalanche Canada's expansion of services, the Government is announcing a one-time endowment of $25 million in 2018–19. This funding will help ensure that more Canadians are better informed of the risks that avalanches pose and how to be safe when participating in activity in back-country areas.

Sustaining Canada's Wild Fish Stocks

From coast to coast to coast, Canada is privileged to enjoy an abundance of rich natural resources. With this privilege comes the responsibility to ensure that these resources are managed sustainably and protected wisely, to ensure that Canadians can continue to benefit from them for years to come.

In 2012, the final report of the Cohen Commission of Inquiry into the Decline of Sockeye Salmon in the Fraser River was released, including broad recommendations on how to address factors leading to the decline of that species. The Government has now taken action to address all of the report's recommendations, which represents a significant step toward protecting Fraser River sockeye salmon.

Government efforts to sustain Canada's oceans and wild fish stocks have been reinforced through significant investments, including:

- $197.1 million over five years of incremental funding for ocean and freshwater science.

- $1.5 billion over five years to launch an ambitious and wide-ranging Oceans Protection Plan.

- $284.2 million over five years to restore lost protections and incorporate modern safeguards into the Fisheries Act, which would support new legislative and regulatory tools.

- $164.7 million over five years to protect, preserve and recover endangered whales, which includes research on salmon populations.

- $61.5 million over five years to implement a suite of measures to protect and recover the Southern Resident Killer Whale, including funding that will support the conservation of wild pacific salmon.

The Government remains committed to the sustainability of wild Pacific salmon and recognizes that this commitment requires ongoing and incremental action in order to succeed. To support stock assessment and rebuilding efforts for priority Pacific salmon stocks, as well as other priority fish stocks across Canada, the Government proposes to invest $107.4 million over five years, starting in 2019–20, and $17.6 million per year ongoing, to support the implementation of stock assessment and rebuilding provisions in a renewed Fisheries Act.

Recognizing the importance of fisheries as a source of good, middle class jobs in coastal communities, as well as their importance to Canada's economy as a whole, the Government is expanding on the success of the Atlantic Fisheries Fund, and proposes to invest $105 million over six years, starting in 2018–19, to create a British Columbia Salmon Restoration and Innovation Fund, which includes a contribution to the Pacific Salmon Endowment Fund of $5 million in 2018–19, as well as $30 million over five years, starting in 2019–20 for a Quebec Fisheries Fund. The B.C. and Quebec funds will support projects focused on innovation, clean technology adoption, infrastructure investments that improve productivity, sustainability and safety, and science partnerships.

Gender-Based Analysis Plus of Chapter 2 Measures

Gender equality and diversity remain a high priority for the Government. In Budget 2018, the Government introduced Canada's first Gender Results Framework, a whole-of-government framework to help define priorities for gender equality and to measure progress going forward. It also introduced a series of measures to promote equal and full participation of all Canadians in our economy and society, and committed to new legislation to enshrine gender budgeting in the federal government's budgetary and financial management processes. On October 29, 2018, the Canadian Gender Budgeting Act was tabled in Parliament through the Budget Implementation Act, 2018, No. 2. Through this action, the Government will continue to take gender and diversity into consideration in decision-making, and Canadians will be better informed of the impacts of these decisions from a gender and diversity perspective.

This year's Fall Economic Statement reflects the Government's continued efforts to advance the gender equality agenda through the introduction of pay equity legislation, gender budgeting legislation, and legislation to create the new Department for Women and Gender Equality. New initiatives, such as the introduction of a Social Finance Fund, the establishment of the Advisory Committee on the Charitable Sector and the expansion of the Nutrition North Canada program, will help improve the well-being of vulnerable members of our society and strengthen Canada's economy and society.

Chapter 2: Advancing Canada's Gender Equality Goals

- Helping reduce the gender wage gap through proactive pay equity legislation

- Engaging Canadian charities by establishing the Advisory Committee on the Charitable Sector

- Improving the well-being of vulnerable members of our society through the Social Finance Fund

- Increasing access to food in northern and isolated communities by expanding the Nutrition North Canada program

In Budget 2018, the Government committed to publishing gender-based analysis for all budget items in Budget 2019 and beyond. The Fall Economic Statement takes a step towards this goal by publishing some of the analysis of each new initiative.

Overview of Gender-Based Analysis Plus of Chapter 2 Measures

Proactive Pay Equity Legislation

Proactive pay equity legislation is designed to address systemic gender discrimination in compensation systems and practices of federally regulated employers, resulting from the undervaluation of work that has traditionally been performed by women. Statistics Canada data show that occupations dominated by women tend to be compensated at lower wage rates than those dominated by men—even when they involve the same skill levels.

This measure is expected to yield positive wage adjustments for men and women working in certain female-predominant job classes, which are underpaid relative to value. Ensuring that women working in the federal jurisdiction are compensated fairly is expected to contribute to reducing the gender wage gap.

Proactive pay equity is more likely to benefit individuals in demographic groups that have been found to be in jobs traditionally performed by women. This includes racialized women, Indigenous women, women with disabilities and working mothers who face a larger wage gap than other women.

Permanent Advisory Committee on the Charitable Sector

Canada's charitable sector is highly diverse, with registered charities carrying out activities in service of a vast range of communities, including individuals identifying as LGBTQ2+, the impoverished, refugees, and survivors of violence.

There are approximately 86,000 registered charities in Canada. Registered charities generally fall within the following categories:

- Relief of Poverty (23 per cent).

- Advancement of Education (16 per cent).

- Advancement of Religion (38 per cent).

- Other Purposes Beneficial to the Community (23 per cent).

According to the 2017 Canadian non-profit sector salary and benefits study, women make up approximately 75 per cent of the workforce and 71 per cent of the management positions in Canada's charitable and non-profit sector.

Consulting regularly with charities on key regulatory issues is expected to improve the charitable sector's understanding of and compliance with existing rules and requirements. Over the long and medium term, the Advisory Committee could influence administrative policies and legislative rules affecting the charitable sector, resulting in positive impacts on a variety of different groups.

The Social Finance Fund

The Social Finance Fund seeks to accelerate the growth of financing for social purpose organizations, which will enable these organizations to develop solutions to complex social policy issues (e.g., housing insecurity, youth unemployment and poverty). As of 2016, 3.7 million Canadians live in poverty, with some groups, including single parents, recent immigrants, First Nations living off reserve and people with disabilities, facing much higher rates of low income on average.

Many social purpose organizations provide services to individuals and families in vulnerable situations or facing barriers to inclusion (e.g. at-risk youth, recent immigrants, persons with disabilities, Indigenous Peoples, persons facing housing insecurity, members of LGBTQ2+ communities, seniors). Improving the well-being of vulnerable members of our society and ensuring their full participation will strengthen Canada's economy and society.

Support for Canadian Journalism

These measures announce the Government's intent to allow non-profit news organizations to receive charitable donations and issue official donation receipts, as well as to introduce a new refundable tax credit to support original news content creation and a new non-refundable tax credit for subscriptions to Canadian digital news media. Direct benefits for the first two measures would accrue to non-profit news organizations and for-profit businesses, ownership of which is not evenly distributed throughout the economy. To the extent that these measures indirectly impact employment and wages in the news industry, benefits are expected to be shared by the diverse groups of men and women, including their families, working in this sector. Direct benefits from the tax credit for subscriptions would accrue to individuals claiming the credit.

According to Statistics Canada data, employment in the journalism sector is close to gender balanced, with 48 per cent of all journalists being women.It is anticipated that the same balance will be maintained in non-profit news organizations.

Indigenous people account for 2.6 per cent of employment in the information, culture and recreation sector, which includes the news industry, and 2.9 per cent of employment in all sectors of the economy.

The measures are intended to strengthen news organizations in Canada that produce a wide variety of news and information of interest to Canadians.

Creation of a Francophone Digital Platform

This measure will protect and promote the French language on a digital platform and act as a modern means to broadly share the French language and culture. French-language creators in Canada will have access to new markets for their products, and all Canadians will benefit from a raised profile internationally.

While this measure is not expected to have a significant differential impact on the basis of gender, TV5MONDE places emphasis on topics ranging from women in sport, politics and equality, women at work, and other gender issues.

According to Statistics Canada, the Information, Culture and Recreation sector employed 354,000 women in 2016, representing 45 per cent of the labour force for this sector. Approximately 25 per cent of women working in this sector were under the age of 25.

While there remains an underrepresentation of women in key creative positions in the film, television and web-based workforce, there is a positive trend for the future, with women representing between 43 and 60 per cent of students studying film and cinema at the post-secondary level in Canada.

Support to Make Nutritious Food More Affordable in Isolated Northern Communities

The expansion of the Nutrition North Canada program will help alleviate the high cost of food in northern and isolated communities, increase access to more culturally relevant foods and help reduce food insecurity. Several factors contribute to food insecurity in communities, including poverty, unemployment, limited infrastructure and the high cost of living.

Northern communities experience the highest rate of food insecurity in Canada, at 50.8 per cent in Nunavut and 17.6 per cent in the Northwest Territories, according to the Canadian Community Health Survey. For children living in food insecure households, these rates are even higher, at 72.0 per cent in Nunavut and 31.9 per cent in the Northwest Territories.

Indigenous people and members of lone-parent families headed by women are among those most vulnerable to food insecurity in Canada.

Prompt Payment for Government Construction Contractors

This measure is expected to enhance prompt payment protection for the construction industry. Modernized and efficient public sector procurement practices contribute to a competitive and efficient economy and efficient government operations, benefitting all Canadians. In addition, it is expected that this measure will carry some socio-economic benefits to some groups due to industry make-up and location of planned work.

According to Statistics Canada, women made up 14 per cent of the workers in the construction industry in 2017.

Helping to Promote Avalanche Safety

This measure will enable Avalanche Canada to provide national public avalanche safety, by expanding the size and scope of current public avalanche safety programs. According to Avalanche Canada, avalanches were the cause of 7 fatalities in 2017–18 and 12 fatalities in 2016–17.

Avalanche safety prevention is a benefit to all Canadians, particularly those who enjoy avalanche-prone areas. This measure will be a direct benefit to Francophone Canadians who will have access to more French-language safety information, as well as youth and newcomers who may be less informed of winter sport safety.

Avalanche Canada endeavours to raise awareness and offer avalanche safety training across the country.

In 2017–18, Avalanche Canada had a record number of 10,826 students enrolled in avalanche safety training programs.

Sustaining Canada's Wild Fish Stocks

This measure is expected to enhance the long-term sustainable growth of the fish and seafood industry which would create both direct and indirect positive economic impacts with the creation of more jobs available to British Columbians, including women and Indigenous members, and notably in many rural and coastal communities.

In 2015, women made up 33 per cent of the combined fishing, aquaculture and fish processing workforce in British Columbia and 31 per cent in Quebec, while men made up 67 per cent and 69 per cent respectively.

At least 28 British Columbia First Nations have salmon aquaculture operations within their traditional territory, and overall Indigenous people represent at least 36 per cent of the labour force of farmed salmon processing operations.

| 2018– 2019 |

2019– 2020 |

2020– 2021 |

2021– 2022 |

2022– 2023 |

2023– 2024 |

Total | |

|---|---|---|---|---|---|---|---|

| A More Equal, Generous and Sustainable Canada | |||||||

| Proactive Pay Equity for Federally Regulated Workers | 3 | 7 | 14 | 19 | 19 | 14 | 76 |

| Better Public Policy Through Cooperation - A Permanent Advisory Committee on the Charitable Sector |

0 | 1 | 1 | 1 | 1 | 1 | 5 |

| Social Finance Fund1 | 0 | 17 | 52 | 17 | 17 | 17 | 121 |

| Support for Canadian Journalism | 0 | 45 | 105 | 130 | 150 | 165 | 595 |

| Creation of a Francophone Digital Platform | 0 | 6 | 2 | 2 | 2 | 2 | 15 |

| Nutrition North Canada Program | 0 | 13 | 13 | 13 | 13 | 13 | 63 |

| Prompt Payment for Government Construction Contractors | 0 | 1 | 2 | 0 | 0 | 0 | 3 |

| Less: Funds Sourced from Existing Departmental Resources |

0 | -1 | -2 | 0 | 0 | 0 | -3 |

| Helping to Promote Avalance Safety | 25 | 0 | 0 | 0 | 0 | 0 | 25 |

| Sustaining Canada's Wild Fish Stocks | 10 | 41 | 44 | 49 | 49 | 49 | 242 |

| Less: Funds Sourced from Existing Departmental Resources |

0 | -6 | -6 | -6 | -6 | -6 | -30 |

| Chapter 2 - Net Fiscal Impact | 38 | 123 | 225 | 225 | 245 | 255 | 1,111 |

- Date modified: