Archived - Chapter 1

Protecting Our Recovery by Finishing the Fight Against

COVID-19

On this page:

At the outset, the pandemic caused widespread economic shutdowns in Canada and around the world in order to save lives. As public health measures have been put into place and vaccination campaigns rolled out around the country, our economy has begun a strong recovery, with businesses safely reopening and over a million jobs created.

Canada’s best economic policy continues to be finishing the fight against COVID-19. Millions of Canadians have been doing their part by getting vaccinated, following public health guidelines, and delivering essential services. This has helped prevent further lockdowns. But work remains to end the pandemic.

The government continues to carefully monitor variants of concern, including the Omicron variant, and continues to make investments in vaccines, booster shots, therapeutics, and rapid tests. The health and safety of Canadians is the government’s priority. It is essential for a strong economic recovery and underpins the government’s plan to create jobs and growth and support those still affected by the pandemic. Canada currently has the second-lowest pandemic mortality rate in the G7 and one of the strongest jobs recoveries, which means that Canadians’ efforts to put saving lives ahead of all else are working. Ending the pandemic will pave the way towards a full economic recovery.

1.1 A World-leading Vaccine Campaign

Vaccines are our best line of defence against COVID-19 and widespread vaccination has helped our economy reopen and helped many people return to work. Scientists have developed safe vaccines that have proven to be very effective at preventing severe cases of COVID-19, including preventing hospitalization and death. By getting our shots, we are protecting our loved ones, vulnerable people, those who can’t get vaccinated—and preventing further lockdowns.

Canada continues to actively evaluate the Omicron variant—as with previous variants—to understand the potential implications and best ways to protect Canadians.

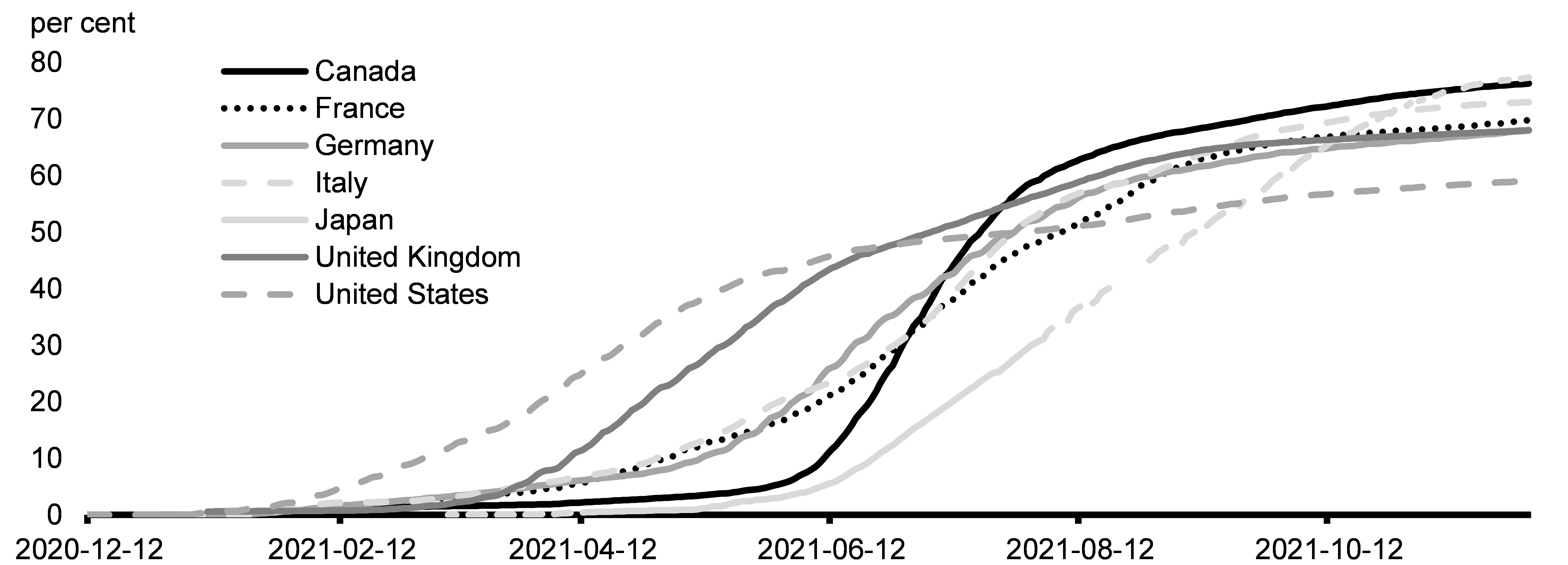

Canada’s COVID-19 immunization campaign has been highly successful thanks to an effective procurement strategy, and clear and consistent work by public health workers and governments across the country. As of November 27, about 80 per cent of eligible Canadians (5 years of age and up) are now fully vaccinated. As a share of the total population, Canada has the fourth highest vaccination rate in the G20 (after South Korea, Japan and China) and the second highest in the G7 (after Japan) (Chart 1.1). Canada was one of the first countries to prioritize the administration of first doses, recognizing that first doses provided high levels of protection in the short term. Canadians also benefited from extended timelines between first and second doses, which has proven to provide people with even stronger protection against COVID-19. Canada’s successful vaccine campaigns rolled out first doses throughout the spring and second dose administration ramped up throughout the summer.

Share of the Population Fully Vaccinated Against COVID-19

1.2 Continuing to Keep Canadians Safe from COVID-19

Since the beginning of the pandemic, keeping Canadians safe and healthy has been the government’s top priority. Canadians have sacrificed much over the last 21 months to protect themselves and their communities. When the pandemic is overcome, the government will ensure that the lessons learned from the COVID-19 pandemic underpin Canada’s pandemic preparedness in the future to make sure Canada is always ready. But there are things we can do now to keep Canadians safe and support our recovery as we finish the fight.

Protecting Lives and Protecting Our Economy

Vaccines for Children

COVID-19 is a risk at any age. By early November 2021, 20 per cent of daily COVID-19 cases detected in Canada were in those under 12, even though this age group accounts for only 12 per cent of the Canadian population. Although, to date, most children have experienced milder cases, children remain at risk of serious infection.

On November 19, 2021, Health Canada approved the first pediatric COVID-19 vaccine for children aged five to 11, developed and manufactured by Pfizer. Nearly 3 million Pfizer pediatric doses have been delivered to all provinces and territories, which is enough for all eligible children to receive their first dose. Pediatric vaccine campaigns are rolling out across the country. By mid-December, all Canadians over five will be able to register to receive their first dose. On November 16, 2021, Moderna also sought Health Canada approval of its COVID-19 vaccine for children six to 11 years of age. Manufacturers also have vaccines in clinical trials for children of various age ranges, including less than five years of age, and are expected to seek regulatory approval in the coming months.

Ensuring children can get vaccinated will help prevent outbreaks in schools, protecting children, teachers, school staff, and parents.

Free Booster Shots

On December 3, 2021, Canada’s National Advisory Committee on Immunization (NACI) officially recommended that all adults in Canada receive a booster dose of an authorized mRNA COVID-19 vaccine six months or more after their first two doses. NACI recommend that priority be given to: adults over 50; people in long-term care and other senior congregate living settings; those who received only AstraZeneca/COVISHIELD or the Janssen COVID-19 vaccine; First Nations, Inuit, and Métis adults; and frontline health care workers in close physical contact with patients.

The government is ensuring that third doses and booster shots are free for all Canadians, as was the case with first and second doses. Canada’s existing agreements with Pfizer and Moderna are such that there are enough vaccine doses for all eligible Canadians to receive first, second, and third doses.

Canada’s agreements with Pfizer and Moderna also include options to procure vaccine adaptations, such as those to protect against mutations or variants of concern. As part of its successful vaccine procurement strategy, the federal government has made investments to secure millions of booster doses for the years to come.Vaccine Mandates

Making Travel Safer

Vaccine mandates and proof of vaccination credentials protect our families, our workplaces, and our communities. They give us the confidence to have a meal at a restaurant, attend community events, and even begin to safely travel in accordance with public health guidelines. Vaccine requirements have helped increase vaccination rates across Canada, which is keeping more people safe. Vaccine mandates are helping businesses safely reopen and recover, which helps create jobs, increase workers’ hours and wages, and grow the middle class.

To protect the safety of travellers and workers, the government took action to put in place a requirement that:

- All travellers now departing from Canadian airports, on VIA Rail and Rocky Mountaineer trains, or on cruise ships (or non-essential passenger vessels on voyages of 24 hours or more) must be fully vaccinated, with very limited exceptions.

- All employers in the federally regulated air, rail and marine transportation sectors must establish vaccination policies that ensure employees are fully vaccinated against COVID-19.

-

The government proposes to provide $37.4 million over three years, starting in 2021-22, to Transport Canada to support the implementation and oversight of this vaccine mandate for federally regulated air, rail, and marine employees and passengers.

Vaccination Mandates in Federally Regulated Workplaces

The government has demonstrated leadership for employers by establishing mandatory vaccination for federal public servants, making workplaces safer and protecting all those who use federal offices or services. This fall, public servants in the core public administration, including the Royal Canadian Mounted Police, were required to disclose their vaccination status and, to date, more than 95 per cent of employees have attested to being fully vaccinated and approximately 98 per cent have had one dose. Those who have not confirmed they are fully vaccinated have been placed on administrative leave without pay.

On December 7, 2021, the government announced that it will propose regulations, under the Canada Labour Code, to make vaccination mandatory in federally regulated workplaces, including interprovincial transportation, banks, and postal and courier services, among others. The government will consult with stakeholders, including small businesses, to finalize the new regulations which would come into force early in 2022.

Support for Proof of Vaccination

The federal government is committed to a national proof of vaccination standard and is working with every province and territory to develop a standard proof of vaccination. This will help fully vaccinated Canadians to travel within the country and internationally. All provinces and territories have confirmed that they are moving forward with a standardized proof of vaccination certificate.

-

The government is putting aside the necessary funds for provinces’ and territories’ expenditures related to the implementation of their proof of vaccination programs.

The federal government has also been working with international partners so that the Canadian proof of vaccination standard is recognized widely at foreign borders, allowing fully vaccinated Canadians to travel around the world.

Rapid Tests

Rapid testing allows people to quickly, easily, and regularly monitor for COVID-19. Access to rapid tests is an important tool for breaking paths of transmission—including against emerging variants of concern—and protecting those around us. New screening programs in schools and workplaces are being implemented across the country as Canadians work hard to keep each other safe. As of November 26, 2021, Canada has purchased 94.9 million rapid tests and distributed 85.9 million to provinces, territories, and Indigenous communities free of charge.

-

The government proposes to provide $1.7 billion to Health Canada and the Public Health Agency of Canada to continue supporting provinces and territories in securing the rapid testing supplies they need to keep Canadians safe and healthy, including through expanded school and workplace testing programs. This funding would also support the procurement of additional rapid test kits for distribution to Canadians.

Additional COVID-19 Therapeutics Procurement

Although vaccination remains the most effective defence against COVID-19, new treatments, including antiviral drugs, can protect COVID-19 patients from being hospitalized, and can save lives. Recently, Merck and Pfizer submitted results from their clinical trials to Health Canada, seeking approval for use. The Public Health Agency of Canada is also monitoring several other promising therapeutics that could contribute to finishing the fight against COVID-19. On December 3, 2021, the government announced an agreement with Merck to provide 500,000 courses of treatment, with an option for 500,000 more, and an agreement with Pfizer for an initial 1 million courses of its treatment, both pending authorization from Health Canada.

-

To support the procurement of COVID-19 therapeutics, and associated logistics and operational costs, the government proposes to provide up to $2 billion over two years, starting in 2021-22, to the Public Health Agency of Canada.

Gender and Diversity Expected Impacts

Federal measures to support proof of vaccination credentials, increase the supply of rapid testing kits, and procure COVID-19 therapeutics are expected to particularly benefit people who are most at risk for contracting and succumbing to the COVID-19 virus. This includes people over the age of 60, people with chronic medical conditions, members of visible minority communities, and low-income Canadians. Increased rapid testing in schools and workplaces also indirectly supports parents and caregivers who would be affected by school closures in the event of further transmission of known or suspected cases. Those working in frontline jobs also stand to benefit from reduced transmission due to increased rapid testing.

Gender Results Framework

Women are overrepresented among the elderly, beneficiaries of this investment. In particular, on July 1, 2021, women comprised 53 per cent of those aged 60 years and over, and 66 per cent of those aged 90 to 95 years. Visible minority women also stand to benefit, as they are more likely to be in essential frontline industries. For example, in 2016, they accounted for 17 per cent of those in health care and social assistance, compared to only 10 per cent of overall employment.

Note on Terminology

In this section, the term "visible minorities" is occasionally used because it is the official demographic category defined by the Employment Equity Act and used by Statistics Canada in their surveys. With the commitment to support a task force on modernizing the Employment Equity Act, the question of appropriate terminology will be taken up by the members.

Clean and Healthy Indoor Air

Whether in a classroom, shopping mall, or a meeting room, the government is committed to helping businesses and organizations improve their ventilation and air quality and keeping Canadians safe. Proper ventilation makes indoor air healthier and safer, helping reduce the risk of COVID-19 transmission.

Small Businesses Air Quality Improvement Tax Credit

Many small businesses are on the front lines of the pandemic—enforcing vaccine mandates, installing protective barriers, and making sure workers and visitors are safe. Many want to make further improvements to their indoor air quality, but investing in equipment to improve ventilation can be costly.

-

The government proposes a refundable Small Businesses Air Quality Improvement Tax Credit of 25 per cent on eligible air quality improvement expenses incurred by small businesses to make it more affordable for them to invest in safer and healthier ventilation and air filtration. Businesses would receive the credit on eligible expenses incurred between September 1, 2021, and December 31, 2022, related to the purchase or upgrade of mechanical heating, ventilation and air conditioning (HVAC) systems and the purchase of standalone devices designed to filter air using high efficiency particulate air (HEPA) filters, up to a maximum of $10,000 per location and $50,000 in total.

By helping businesses invest in better ventilation today, the government is helping to keep Canadians safe now and in the future.

Improving Ventilation in Schools and Community Buildings

The COVID-19 pandemic has been difficult for families and educators, with school closures followed by varying degrees of reopening. This fall students across the country returned to in-person learning, reuniting with teachers and friends, and allowing parents to return to the workforce more fully. To make sure the air in our schools is as clean as possible and that classrooms are as safe as possible for students, teachers, and staff, improvements to ventilation are warranted.

-

The government proposes to provide up to an additional $100 million to provinces and territories through the existing Safe Return to Class Fund, as well as $10 million to First Nations for on-reserve schools. This funding continues the support provided through the original $2 billion Safe Return to Class Fund by specifically targeting ventilation-related improvement projects.

Canadians of all ages—children, seniors, young parents, amateur athletes, and more—are gradually returning to community spaces such as arenas, swimming pools, libraries, and community centres but these buildings also require ventilation improvements.

-

Building on the $150 million to improve ventilation in public and community buildings announced in the 2020 Fall Economic Statement, the government is providing an additional $70 million over three years, starting in 2022-23, to Infrastructure Canada to support ventilation projects in public and community buildings like hospitals, libraries, and community centres. Funding will be delivered through the COVID-19 Resilience Stream of the Investing in Canada Infrastructure Program.

Gender and Diversity Expected Impacts

Improving ventilation is expected to particularly benefit those most vulnerable to negative air quality, including seniors, children, pregnant women, and people with chronic diseases. These measures will also indirectly benefit the construction and heating, ventilation and air conditioning industries, which tend to have workforces that predominantly employ men.

Healthy and Accessible Communities

Throughout the pandemic, Canadians have found new ways to be social and connect to the outdoor spaces in their communities. Canadians should be able to access well-managed public spaces and services.

-

To support communities in adapting public spaces to allow for social distancing and outdoor gatherings as appropriate, the government is providing an additional $30 million over three years, starting in 2022-23, to Infrastructure Canada for the Canada Healthy Communities Initiative.

Gender and Diversity Expected Impacts

Projects under the Canada Healthy Communities Initiative are expected to have a particular impact on low-income people or those living in poverty, persons with disabilities, seniors, youth, and Indigenous peoples. This measure will also indirectly benefit the construction industry, which tends to predominantly employ men.

Ending Harassment of Health Care Workers and Patients

Across the country, health care workers have dedicated themselves to caring for others—saving lives and putting their own at risk. But there has been a deeply troubling rise in harassment and intimidation of health care workers—including death threats. Furthermore, those who are sick or in need of care should never fear for their safety when going to hospitals or clinics.

The government is moving forward on legislation to amend the Criminal Code to enhance protections for health care workers and ensure every Canadian has safe and unobstructed access to health services. Bill C-3, introduced on November 26, 2021, would create new offences: one that prohibits anyone from using fear to stop a health care worker or those who assist them from performing their duties or who prevent a person from obtaining health services; the other would prohibit obstructing any person from accessing health facilities. These offences would be punishable by maximum penalties of up to 10 years in prison.

Paid Sick Leave for Workers

The pandemic has exposed how many Canadians do not have access to paid sick leave. Without paid leave, workers are forced to choose between going into work sick and putting others at potential risk, or not being able to pay their bills. By helping workers stay home when sick or contagious, paid sick leave prevents outbreaks, which, in turn, prevents shutdowns, protecting jobs and operations at workplaces.

In federally regulated industries, 63 per cent of workers have fewer than 10 days of paid sick leave. The number is even higher in smaller businesses. In total, over half of Canadians do not have paid sick leave.

On November 26, 2021, the government introduced Bill C-3 to amend the Canada Labour Code to provide 10 days of paid sick leave per year to workers in the federally regulated private sector, covering almost one million workers. The government will consult with federally regulated employers and workers on implementation of this legislation.

The government will also convene provinces, territories, and other interested stakeholders to develop a national action plan to legislate paid sick leave across the country, while respecting provincial-territorial jurisdiction and clearly recognizing the unique needs of small business owners.

Gender and Diversity Expected Impacts

Men make up 61 per cent of federally regulated workers and an even larger share of employees in small companies, less likely to offer sick leave. The measure will have the greatest impact on the 44 per cent of workers who currently have no access to paid sick leave. Many of these workers may be unable to work from home or rely on an hourly wage and are therefore more vulnerable to attending work while unwell. In addition, access to paid sick leave will benefit persons with certain types of disabilities that require them to take time off for medical reasons. There are 31,300 employees with disabilities in the federally regulated private sector.

National progress on sick leave, with provinces and territories, would also benefit racialized and low-income women and youth, who are overrepresented in low-wage positions without paid sick leave.

Gender Results Framework

Overall, 60 per cent of firms with fewer than 100 employees offer no sick leave, and 80 per cent of employees at these firms are men.

International COVID-19 Response

The spread of variants of concern is yet further evidence that the pandemic will not be over until every corner of the globe is safe from COVID-19. Canada recognizes that it must play a leading role in international initiatives to distribute vaccines and therapeutics. The government recognizes that ending the pandemic is the best economic policy.

Canada has mobilized over $2.5 billion in international assistance in response to COVID-19, including over $1.3 billion for the Access to COVID-19 Tools (ACT) Accelerator to provide global access to COVID-19 vaccines, tests, and treatments. Canada is one of only six countries to have met or exceeded the independently-determined contribution requested by the ACT-Accelerator for 2021. The government continues to support the work of the ACT-Accelerator and its vaccine pillar, the COVID-19 Vaccines Global Access (COVAX) Facility.

On October 30, 2021, Canada announced it will donate, via procurement or financial support, the equivalent of at least 200 million doses to the COVAX Facility by the end of 2022, which means that more than five doses per Canadian will be donated to the world, making Canada one of the most generous donors. COVAX determines which countries receive allocations, using a transparent and equitable allocation framework, and Canada is a responsible international partner. So far, the majority of doses donated by Canada through COVAX have been delivered to countries in Africa, Latin America, and the Caribbean. Canada’s international vaccine donations can be tracked online.

1.3 Supporting Canadians and Canadian Businesses Through the Recovery

When the pandemic first hit, the federal government deployed an unprecedented economic response to protect Canadians and Canadian businesses from the worst economic shock since the Great Depression. The government did this to make sure it had Canadians’ backs and to prevent further economic scarring so Canadians could come back stronger. Income and business supports like the Canada Emergency Response Benefit and the Canada Emergency Wage Subsidy were a lifeline for Canadians and Canadian businesses. These emergency measures were appropriate to the scale and scope of the emergency Canada faced at the time and protected millions of jobs, helped millions of Canadians put food on the table, and helped hundreds of thousands of businesses keep the lights on, as we coped with the worst public health crisis of our lifetime.

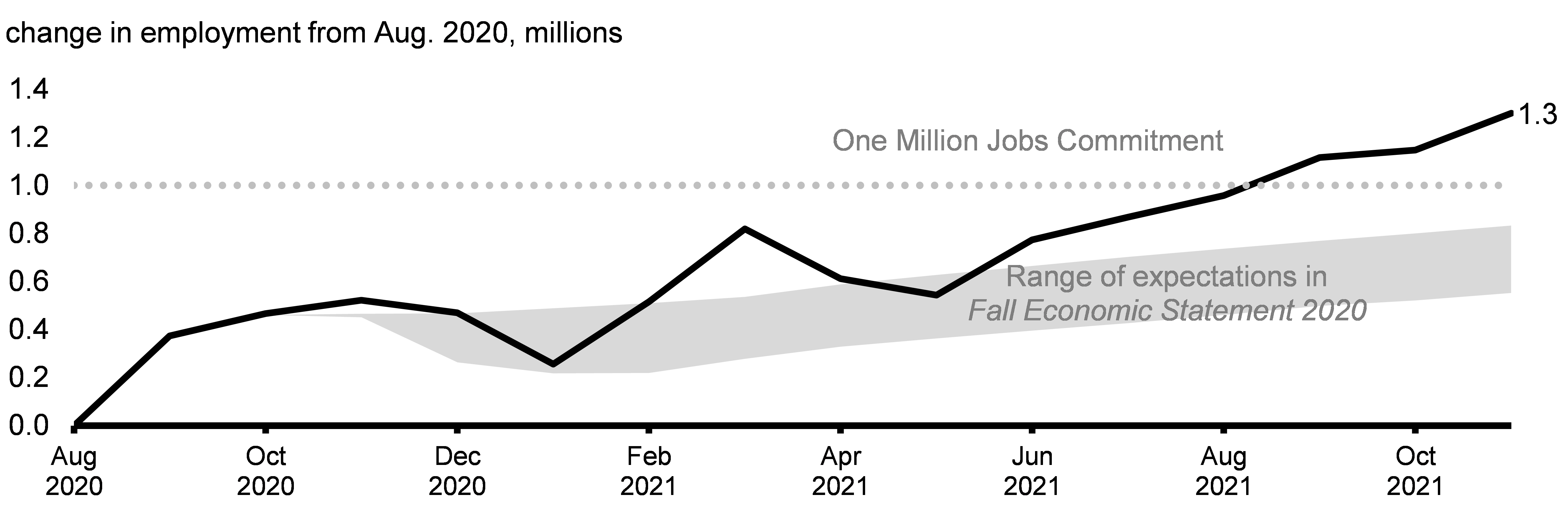

The government has now surpassed its target of creating one million jobs, well ahead of initial expectations (Chart 1.2). In fact, Canada has recovered 106 per cent of jobs lost at the outset of the pandemic, compared to 83 per cent in the United States. Children are back in school and child care, with protocols in place to keep everyone safe, and parents are able to fully return to their jobs. Vaccination rates are high and businesses have been safely reopening.

Path to One Million Jobs

On October 21, 2021, the federal government announced that it is pivoting from the broad-based support that was appropriate at the height of lockdowns to more targeted measures that would deliver help where it is needed. This pivot will also ensure that support is swiftly delivered in the case of future outbreaks.

In order to have a complete economic recovery, there is still work ahead to create jobs and growth and these adjusted measures are intended to do just that, while prudently managing government spending.

Support for Workers

Extending the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit

Over the last year, the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit provided income support to over one million Canadians who found themselves unable to work because they either had to care for a family member, were sick or needed to self-isolate due to COVID-19. Today, while significant progress has been made, workers still risk sickness and employment absences from contracting COVID-19, and outbreaks could mean school or child care closures and the need for parents to stay home with their children.

The government has introduced legislation to extend the caregiving and sickness benefit until May 7, 2022, and increase the maximum duration of benefits by two weeks. This would extend the caregiving benefit from 42 weeks to 44 weeks and the sickness benefit from four weeks to six weeks. It is estimated that the proposed extension of the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit will cost $2.1 billion over 2021-22 and the first months of 2022-23.

Tabled legislation also provides authority for additional extensions of the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit until July 2, 2022, should public health considerations warrant it.

Gender and Diversity Expected Impacts

To date, applicants to the caregiving benefit have been mostly women, 63 per cent compared to 37 per cent men, whereas applicants for the sickness benefit have been more evenly split, 52 per cent men compared to 48 per cent women. Applicants of both benefits have been mostly low-income earners. Additionally, the majority of caregiving applicants, 69 per cent, were between the ages of 25 and 44 years old whereas applicants of the sickness benefit were more evenly distributed among workers.

Gender Results Framework

In 2015, 3.3 per cent of women provided care to an adult on a given day, compared to 1.2 per cent of men, and more women participated in caring for children than men did (37.4 per cent versus 25.3 per cent). The ongoing impacts of COVID-19 disproportionately impact mothers who care for children who miss school. For example, between March 2020 and November 2021, women accounted for almost two-thirds of those who were absent from work due to the care of a child.

The Canada Worker Lockdown Benefit

The pandemic is not yet over and the government recognizes that restrictions may still be required over the coming months to limit spread of the virus. It is important that affected workers continue to get the income support they need should additional restrictions be required.

On October 21, 2021, the government announced its intention to create a new Canada Worker Lockdown Benefit, tabling the necessary legislation in Bill C-2 as soon as possible once Parliament was in session, on November 24, 2021. This proposed benefit will provide income support at a rate of $300 per week to workers whose employment is interrupted as a result of a specific government-imposed public health lockdown and who are unable to work due to such restrictions. The benefit would be available until May 7, 2022, with retroactive application to October 24, 2021, should the situation warrant it.

If needed, tabled legislation also provides authority for the government to extend the Canada Worker Lockdown Benefit until July 2, 2022.

Gender and Diversity Expected Impacts

Workers from industries that are most affected by COVID-related restrictions—including accommodation, food services, retail, and recreation—could benefit the most from the Canada Worker Lockdown Benefit. Those industries tend to employ more low-income earners compared to other industries. This measure is also expected to benefit racialized Canadians, women, and youth, who are overrepresented in lower-paying jobs and more vulnerable to work stoppages. This benefit is expected to benefit workers in regions that experience possible worsening COVID-19 health situations.

Gender Results Framework

Women represented just under half of total employment at 47 per cent in 2019, yet represented 51 per cent of those employed in arts, entertainment and recreation, 56 per cent of those employed in accommodation and food services, and 52 per cent of those in retail trade. In 2016, visible minority women were especially overrepresented in accommodation and food services, accounting for 16 per cent of employment, compared to only 10 per cent of total employment.

Help for Guaranteed Income Supplement Recipients and Students Affected by CERB Payments

The government’s unprecedented income support for Canadians throughout the pandemic was a lifeline for many as employment income was suddenly and drastically cut for many workers, especially low-income and vulnerable workers. The government is aware, however, that some financially vulnerable Canadians are facing hardship from how this emergency support is now calculated towards their much-relied-upon income benefits. Many low-income seniors who receive Guaranteed Income Supplement (GIS) or Allowance benefits have seen a decline in their benefit amount, with some facing a total loss of this support for 2021-22. Additionally, some students applied for and received the Canada Emergency Response Benefit (CERB) despite not being eligible and could find themselves facing potentially significant repayments.

-

The government proposes to provide up to $742.4 million for one-time payments to alleviate the financial hardship of GIS and Allowance recipients who received CERB or the Canada Recovery Benefit (CRB) in 2020. The government will continue to investigate ways to limit potential benefit reductions for vulnerable seniors who received emergency and recovery benefits.

-

The government proposes to provide debt relief to students who received, but were ineligible for, the CERB but were eligible for the Canada Emergency Student Benefit (CESB) by allowing their CERB-related debt to be offset by the amount they would have received from CESB during the same benefit period. The fiscal impact of this measure is estimated at $67.9 million.

Gender and Diversity Expected Impacts

Approximately 183,000 recipients of the one-time payment would be GIS recipients age 65 and older, with approximately 21,000 Allowance recipients age 60-64. About 54 per cent (110,000) of the recipients would be men, and about 46 per cent (94,000) women. The distributional impact would be strongly progressive, given the targeting of GIS and Allowance benefits to lower-income individuals.

Enhancing the Home Office Expense Deduction

Millions of Canadians were required to work from home during the pandemic. To help support this transition to working from home, in 2020 the government permitted workers to use a temporary flat rate method to calculate their deduction for home office expenses. As workplaces around the country continue to grapple with the return to the office, many Canadians continue to work from home for all or part of their jobs.

-

To continue to support Canadians working from home due to the pandemic, the government will extend the simplified rules for deducting home office expenses and increase the temporary flat rate to $500 annually. These rules will apply to the 2021 and 2022 tax years.

Support for Workers in the Live Performance Sector

Restrictions on gatherings and the closure of venues has meant that tens of thousands of workers in the live performance sector continue to face significantly reduced incomes. Despite the gradual easing of public health restrictions across the country, many of these workers continue to face financial hardship. The lag in the sector’s recovery is also due to sector-specific factors like the time it takes to finance, develop, and rehearse the performances these workers rely on for income. The government is committed to ensuring Canada’s recovery includes a vibrant live performance sector.

-

To support workers in Canada’s live performance industry, the government proposes $60 million in 2022-23 to establish the new Canada Performing Arts Workers Resilience Fund. This temporary program will aim to fund new or enhanced sector-led and -delivered initiatives that improve the economic, career, and personal circumstances of individual Canadian workers in the live performance sector. The government will provide Canadian Heritage with $2.3 million to administer the fund.

Enhanced Support for Teachers

Whether teaching from home or in the classroom, teachers have shown—throughout the pandemic, and always—that they are willing to go above and beyond to make sure that their students receive the best education. These efforts often include purchasing school supplies with money out of their own pockets.

-

To support teachers and early childhood educators in Canada, the government proposes to expand and enrich the Eligible Educator School Supply Tax Credit to allow them to claim a refundable tax credit worth 25 per cent (up from 15 per cent) of up to $1,000, and to ensure that purchased supplies may be eligible no matter where they are used.

-

The government also proposes to expand the list of eligible teaching supplies to include electronic devices such as graphing calculators, digital timers, and tools for remote learning. These enhancements would take effect starting with the 2021 tax year.

Gender and Diversity Expected Impacts

The enhanced support for teachers will benefit teachers and early childhood educators in primary schools, secondary schools, and regulated child care facilities, as well as students in their classrooms who may benefit indirectly from an enriched learning environment. In 2018, 82 per cent of educators who claimed the tax credit were women and had above-average incomes. Compared to the general adult population, educators claiming the credit are more likely to have at least some post-secondary education.

Gender Results Framework

Women are heavily employed in primary and secondary schools, accounting for 75 per cent of elementary and secondary school teachers during the 2019-2020 school year.

Support for Businesses

Extending Credit Support for Businesses

The Highly Affected Sectors Credit Availability Program has been providing government-guaranteed, low-interest loans of up to $1 million to organizations that have seen significant revenue losses as a result of the pandemic. Access to affordable liquidity support fills a gap in the credit market for hard-hit businesses and allows them to maintain operations and invest in their recovery. As of October 31, 2021, more than 11,500 loans representing almost $2.7 billion have been provided through this program.

-

The government is extending the Highly Affected Sectors Credit Availability Program to March 31, 2022. This program was set to expire on December 31, 2021.

The Business Development Bank of Canada will continue to work with lenders to support access to capital for Canadian businesses of all sizes in all sectors and regions.

Extending the Canada Recovery Hiring Program

Workers are the backbone of our economy and of every business’ success. In order for our economy to recover and grow, we need to make sure to support the creation of good jobs in sectors across the economy. In Budget 2021, the federal government created the Canada Recovery Hiring Program to do just that. By extending the Canada Recovery Hiring Program, the government can encourage employers to hire back workers and increase workers’ hours and wages.

On October 21, 2021, the government proposed extending the Canada Recovery Hiring Program until May 7, 2022, for eligible employers with current revenue losses above 10 per cent, and to increase the subsidy rate to 50 per cent. On November 24, 2021, the government introduced the necessary legislation for this extension at the first opportunity after parliament resumed.

Targeting Supports for Businesses Affected by the Pandemic

The government recognizes that while the recovery is underway, it is still uneven. Some businesses are deeply affected and have faced deep and enduring losses. In order to support these businesses and make sure they can recover and grow, the government has introduced legislation to adapt pandemic support programs and target them to organizations that have been deeply affected by the pandemic.

Support for Tourism and Hospitality Businesses

- The Tourism and Hospitality Recovery Program would provide support through wage and rent subsidies to organizations in the tourism and hospitality sectors such as hotels, tour operators, travel agencies, restaurants and organizations that plan and host festivals or live performances, with a subsidy rate of up to 75 per cent.

Support for Hard-hit Businesses in All Sectors

- The Hardest-Hit Business Recovery Program would provide support through wage and rent subsidies to organizations that have faced deep losses, with a subsidy rate of up to 50 per cent.

Support for Businesses Facing Pandemic Lockdowns

- The Local Lockdown Program would provide organizations that face new local COVID-19-related lockdowns with up to the maximum amount available through the wage and rent subsidy programs.

These programs would be available until May 7, 2022, with the proposed subsidy rates available until March 12, 2022. From March 13 to May 7, 2022, the support would decrease by half, in anticipation that the virus will be even more fully under control and our recovery will be firmly taking hold in all areas of the economy.

Lockdown Support would continue to provide additional rent support of 25 per cent and be pro-rated based on the number of days a particular location was affected by a lockdown until May 7, 2022.

Gender and Diversity Expected Impacts

Targeted support measures for deeply affected businesses are expected to directly benefit employers and employees in the hardest-hit sectors, including hospitality and tourism, and those who may be subject to future local lockdowns. Women hold half of the jobs in the tourism sector while young people hold a third of jobs. Indigenous peoples are also slightly more likely to work in the tourism industry. According to data from the Canada Emergency Wage Subsidy, the hard-hit industries with the largest number of employees covered are accommodation and food services and manufacturing. The hardest-hit employers receiving the largest share of support from the Canada Emergency Rent Subsidy and Lockdown Support are in accommodation and food services and retail trade. Women and youth are overrepresented in accommodation and food services, while men are overrepresented in manufacturing. Employees in all three hard-hit industries receive lower than average hourly wages, with employees in accommodation and food services receiving the lowest hourly wage across all industries.

Gender Results Framework

In 2019, about 14 per cent of those employed were between the ages of 15 and 24 years, but this age group was heavily overrepresented in some of the hardest-hit industries, including accommodation and food services (42 per cent), arts, entertainment and recreation (32 per cent), and retail trade (30 per cent).

Relieving Supply Chain Congestion

Supply chain disruptions around the world and shipping bottlenecks have made it harder for Canadians and businesses to get the products and supplies they need, and in many cases are contributing to rising prices. The recent devastating flooding in British Columbia has only exacerbated these pressures.

-

To help strengthen supply chains and address bottlenecks, in 2021-22, the government will launch a new, targeted call for proposals under the National Trade Corridors Fund to assist Canadian ports with the acquisition of cargo storage capacity and other measures to relieve supply chain congestion. The fund will dedicate up to $50 million to support eligible priority projects. Further details on the targeted call for proposals will be announced in the coming weeks.

This builds on the up to $4.1 million already announced by the federal government for the Vancouver Fraser Port Authority under the National Trade Corridors Fund to provide relief in the aftermath of the floods in British Columbia.

Immigration to Grow Our Economy and Welcome New Canadians

Immigration is critical for Canada’s economic growth, especially when it comes to attracting top global talent, meeting the needs of employers, and addressing labour shortages. Immigrants and temporary foreign workers help Canada meet long- and short-term labour market needs, respectively, and international students and visitors are vital to the institutions and businesses they support. They are not only essential to Canada’s economy, but also bring fresh perspectives and connect Canada to the world. The Government of Canada also prioritizes the reunification of families, a fundamental Canadian value that also builds stronger communities. However, the pandemic has caused significant processing delays and backlogs.

-

The government proposes to provide $85 million in 2022-23 so that it can process more permanent resident and temporary resident applications and reduce processing times in key areas affected by the pandemic. This will help to ensure Canada’s immigration system is well-positioned to help meet Canada’s economic and labour force goals. It will also speed up the process to citizenship for the many permanent residents already contributing to building a stronger Canada.

Expanding Resettlement Efforts to Bring More Afghans to Safety

Canadians are deeply concerned by the deteriorating situation in Afghanistan and the risks it poses for many vulnerable Afghans. Canada’s immigration programs have already brought many Afghans to Canada—and with our partners, the government continues to work around the clock to bring as many people as possible to safety.

The Government of Canada remains firm in its commitment to continue welcoming refugees and vulnerable Afghans to Canada. That is why we increased the number of eligible refugees from 20,000 to 40,000. Many of these individuals will be women, children, religious and ethnic minorities fleeing the Taliban, or people who supported Canada and our allies over the past two decades.

-

The government proposes to provide $1.3 billion over 6 years, starting in 2021-22, and $66.6 million in future years, to support this increased level of ambition and continue to facilitate the safe passage and resettlement of vulnerable Afghans to Canada. This funding would allow for the resettlement of a total of 40,000 Afghans, and their families, to come to Canada under special immigration, humanitarian and family reunification programs.

Support for Small Businesses and Farmers

A price on pollution is widely recognized as the most efficient and low-cost means of reducing emissions, while also encouraging innovations that help Canada compete in the global green transition. The federal system applies in jurisdictions that do not have their own pollution pricing system. Proceeds are returned directly to the people, communities, small businesses, farmers, and more, in the jurisdiction where they are collected. Most households receive more money back than they pay as a result of the federal carbon pollution pricing system.

In Budget 2021, the government announced its intention to return a portion of the proceeds from the price on pollution directly to farmers in backstop jurisdictions, beginning in 2021-22. It is estimated farmers would receive $100 million in the first year. (See Annex 1 and Annex 3 for further details.)

To help small businesses afford the costs of fighting climate change, the government intends to return a portion of the proceeds from the price on pollution to small and medium-sized enterprises through new federal programming in backstop jurisdictions (currently Alberta, Saskatchewan, Manitoba, and Ontario), beginning in 2022-23. It is estimated that, in 2022-23, this programming would return at least $200 million of proceeds to eligible businesses. Further details will be announced in early 2022 by the federal government.

| 2021- 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| Continuing to Keep Canadians Safe from COVID-19 | 3,046 | 4,327 | 2,857 | 498 | 489 | 489 | 11,705 |

| Spending on Vaccine Procurement and Pandemic Preparedness Since Budget 2021 | 80 | 2,983 | 2,771 | 509 | 507 | 507 | 7,357 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -1 | -1 | -1 | -1 | -1 | -7 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -16 | -16 | -16 | -16 | -16 | -82 |

| Vaccine Mandates — Making Travel Safer | 5 | 23 | 9 | 0 | 0 | 0 | 37 |

| Vaccine Mandates — Core Public Administration and the Royal Canadian Mounted Police | 92 | 120 | 0 | 0 | 0 | 0 | 212 |

Less: Funds Sourced From Existing Departmental Resources |

-6 | -7 | 0 | 0 | 0 | 0 | -13 |

| Support for Proof of Vaccination | 300 | 0 | 0 | 0 | 0 | 0 | 300 |

| Rapid Tests | 1,718 | 0 | 0 | 0 | 0 | 0 | 1,718 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-268 | 0 | 0 | 0 | 0 | 0 | -268 |

| Additional COVID-19 Therapeutics Procurement | 1,000 | 1,000 | 0 | 0 | 0 | 0 | 2,000 |

| Small Businesses Air Quality Improvement Tax Credit | 15 | 190 | 36 | 0 | 0 | 0 | 241 |

| Improving Ventilation in Schools and Community Buildings — Safe Return to Class Fund | 110 | 0 | 0 | 0 | 0 | 0 | 110 |

| Improving Ventilation in Schools and Community Buildings — Investing in Canada Infrastructure Program | 0 | 15 | 49 | 7 | 0 | 0 | 70 |

| Healthy and Accessible Communities | 0 | 20 | 10 | 0 | 0 | 0 | 30 |

| Supporting Canadians and Canadian Businesses Through the Recovery | 9,996 | 2,629 | 428 | 300 | 147 | 134 | 13,633 |

| Extension of the Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy until October 23, 2021 (as announced on July 30, 2021) | 4,490 | 0 | 0 | 0 | 0 | 0 | 4,490 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-3,410 | 0 | 0 | 0 | 0 | 0 | -3,410 |

| Extension of Canada Recovery Benefits until October 23, 2021 (as announced on July 30, 2021) | 2,257 | 59 | 0 | 0 | 0 | 0 | 2,316 |

| Extending the Canada Recovery Caregiving Benefit and the Canada Recovery Sickness Benefit | 1,639 | 417 | 0 | 0 | 0 | 0 | 2,055 |

| Help for Guaranteed Income Supplement Recipients Affected by CERB Payments | 0 | 742 | 0 | 0 | 0 | 0 | 742 |

| Help for Students Affected by CERB Payments | 68 | 0 | 0 | 0 | 0 | 0 | 68 |

| Enhancing the Home Office Expense Deduction | 270 | 115 | 0 | 0 | 0 | 0 | 385 |

| Support for Workers in the Live Performance Sector | 0 | 62 | 0 | 0 | 0 | 0 | 62 |

| Enhanced Support for Teachers | 4 | 5 | 5 | 5 | 5 | 5 | 29 |

| Extending Credit Support for Businesses | 11 | 24 | 29 | 18 | 11 | 8 | 101 |

Less: Fee Revenues |

0 | -3 | -2 | -2 | -1 | -1 | -9 |

| Extending the Canada Recovery Hiring Program | 1,575 | 615 | 0 | 0 | 0 | 0 | 2,190 |

| Targeting Supports for Businesses Affected by the Pandemic | 3,010 | 175 | 0 | 0 | 0 | 0 | 3,185 |

| Relieving Supply Chain Congestion | 50 | 0 | 0 | 0 | 0 | 0 | 50 |

Less: Funds Sourced From Existing Departmental Resources |

-50 | 0 | 0 | 0 | 0 | 0 | -50 |

| Immigration to Grow Our Economy and Welcome New Canadians | 0 | 85 | 0 | 0 | 0 | 0 | 85 |

| Expanding Resettlement Efforts to Bring More Afghans to Safety | 82 | 332 | 395 | 278 | 133 | 122 | 1,343 |

| Additional Investments — Protecting Our Recovery by Finishing the Fight Against COVID-19 | 0 | 892 | 46 | 46 | 46 | 46 | 1,077 |

| Supporting the Public Health Agency of Canada’s Operations | 0 | 405 | 1 | 1 | 1 | 1 | 409 |

| Funding proposed for the Public Health Agency of Canada to support the continuity of ongoing COVID-19 pandemic response activities, such as strengthened surveillance, laboratory research and emergency management operations. | |||||||

| Borders Testing and Operation | 599 | 0 | 0 | 0 | 0 | 0 | 599 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-599 | 0 | 0 | 0 | 0 | 0 | -599 |

| Funding proposed for the Public Health Agency of Canada to support and maintain ongoing COVID-19 border testing capacity and operations. | |||||||

| South Africa Vaccine Hub | 15 | 0 | 0 | 0 | 0 | 0 | 15 |

Less: Funds Sourced From Existing Departmental Resources |

-15 | 0 | 0 | 0 | 0 | 0 | -15 |

| Funding proposed for Global Affairs Canada in support of enhancing vaccine development capacity in Africa, as announced on October 30, 2021. Funding is sourced from existing International Assistance Envelope – Strategic Priorities Fund resources. | |||||||

| IMF Poverty Reduction and Growth Trust | 50 | 0 | 57 | 0 | 0 | 0 | 107 |

Less: Funds Sourced From Existing Departmental Resources |

-50 | 0 | -57 | 0 | 0 | 0 | -107 |

| Funding proposed for the International Monetary Fund's Poverty Reduction and Growth Trust to help meet the financing needs of low-income and vulnerable countries, as announced on October 30, 2021. Funding is sourced from existing International Assistance Envelope – Strategic Priorities Fund resources. | |||||||

| Canada's Contribution to the International Development Association | 0 | 487 | 487 | 487 | 487 | 487 | 2,435 |

Less: Funds Sourced From Existing Departmental Resources |

0 | 0 | -442 | -442 | -442 | -442 | -1,766 |

| Funding proposed for the Department of Finance to provide additional support to the 20th replenishment of the World Bank Group's International Development Association. | |||||||

| Total — | |||||||

Policy Actions since Budget 2021 |

9,726 | 4,344 | 2,753 | 491 | 489 | 489 | 18,293 |

New Measures in Chapter 1 |

3,315 | 3,503 | 577 | 353 | 194 | 180 | 8,122 |

| Chapter 1 — Net Fiscal Impact | 13,041 | 7,847 | 3,331 | 844 | 683 | 670 | 26,416 |

|

Note: Numbers may not add due to rounding. Denotes measures newly announced in this Economic and Fiscal Update. |

|||||||

Report a problem on this page

- Date modified: