Archived - Chapter 3:

Lowering Everyday Costs

On this page:

Impacts report

Find out more about the expected gender and diversity impacts for each measure in Chapter 3: Lowering Everyday Costs

The global rise in the cost of living has left people here in Canada struggling to keep up with the bills. While inflation has come down significantly, the government is taking action to lower everyday costs for Canadians and hold corporations to account.

Too many Canadians today are feeling like their hard work isn't paying off; that they can't get ahead. No matter how hard you save or how much more you work, your paycheques aren't going as far as costs go up, and saving enough to go after your dreams seems out of reach. It doesn't have to be this way.

Whether enabling young people to save more of their money for an education or first home, or helping families to make ends meet, the government is fighting to help Canadians keep more of their money.

To do this, the government is taking action to hold to account those who are charging Canadians unnecessarily high prices, whether it is grocers inflating their profit margins, corporations charging junk fees, or unnecessary banking fees. This budget will help ensure that corporations aren't taking advantage of Canadians and will make sure the economy is fair, affordable, and set up to make it easier to get a good deal.

Budget 2024 builds on these efforts and gives people back control over their personal finances and banking choices, with action to cap banking fees and give Canadians better access to digital banking, lower-cost accounts, and stronger consumer protection.

3.1 Affordable Groceries

The government is taking action to lower the cost of groceries and make life more affordable.

The cost pressures Canadians are facing start with the price of food. No matter if your house is paid off or you've managed to hang on to an affordable apartment for years, everyone is paying more money for groceries. That's why Budget 2024 launches a National School Food Program, which will help ensure more than 400,000 children have the nutritious meals they need to learn and grow, as announced in Chapter 2.

Budget 2024 also advances work to cut costs for farmers through greater interoperability of their equipment, regardless of the name brand.

Key Ongoing Actions

-

Delivering the enhanced, quarterly Canada Workers Benefit payments four times a year to our lowest-paid—and often most essential—workers, with a family receiving up to $2,739 this year, plus an additional $821 for workers with disabilities.

-

Making life more affordable and cutting pollution with the Canada Carbon Rebate, which ensures eight out of ten families in provinces where the federal fuel charge applies get more back than they pay, with lower-income families benefitting the most. This year, the Canada Carbon Rebate will return up to $2,160 to a family of four, as detailed in Chapter 5.

-

Delivering the Goods and Services Tax (GST) Credit every three months to support lower- and modest-income Canadians with up to $496 this year for a single individual without children, and up to $992 for a family of four, and temporarily doubling the GST Credit for six months in fall 2022.

-

Delivering the Grocery Rebate, which provided up to $467 for a family of four, to 11 million Canadians and families in July 2023.

-

Tackling shrinkflation, to uphold the food sizes and qualities that Canadians expect. The Office of Consumer Affairs is leading this work and has launched research projects to investigate and reveal price inflation and harmful business practices that reduce the quantity and quality of groceries.

-

Passing the Affordable Housing and Groceries Act, which included amendments to the Competition Act to enhance competition and help stabilize prices for Canadians, particularly in the grocery sector, by:

- Giving more power to the Competition Bureau to crack down on unfair practices by large, dominant companies which drive up prices;

- Removing the efficiencies defence, in order to end anti-competitive mergers that raise prices and limit choices for Canadians; and,

- Empowering the Competition Bureau to block collaborations that stifle competition and consumer choice, including in situations where large grocers prevent smaller competitors from establishing operations nearby.

Stabilizing the Cost of Groceries

The cost of food has gone up in recent years. Too many Canadians are struggling with the price of groceries. In a country as wealthy as Canada, no one should go hungry. That's why the government has been taking action to stabilize the price of groceries, and delivering targeted support for those who need it most.

But a lack of competition in Canada's grocery sector means Canadians are paying higher prices. That is why the government has been reforming competition law, to create a grocery market where grocers compete to attract customers by offering the best prices.

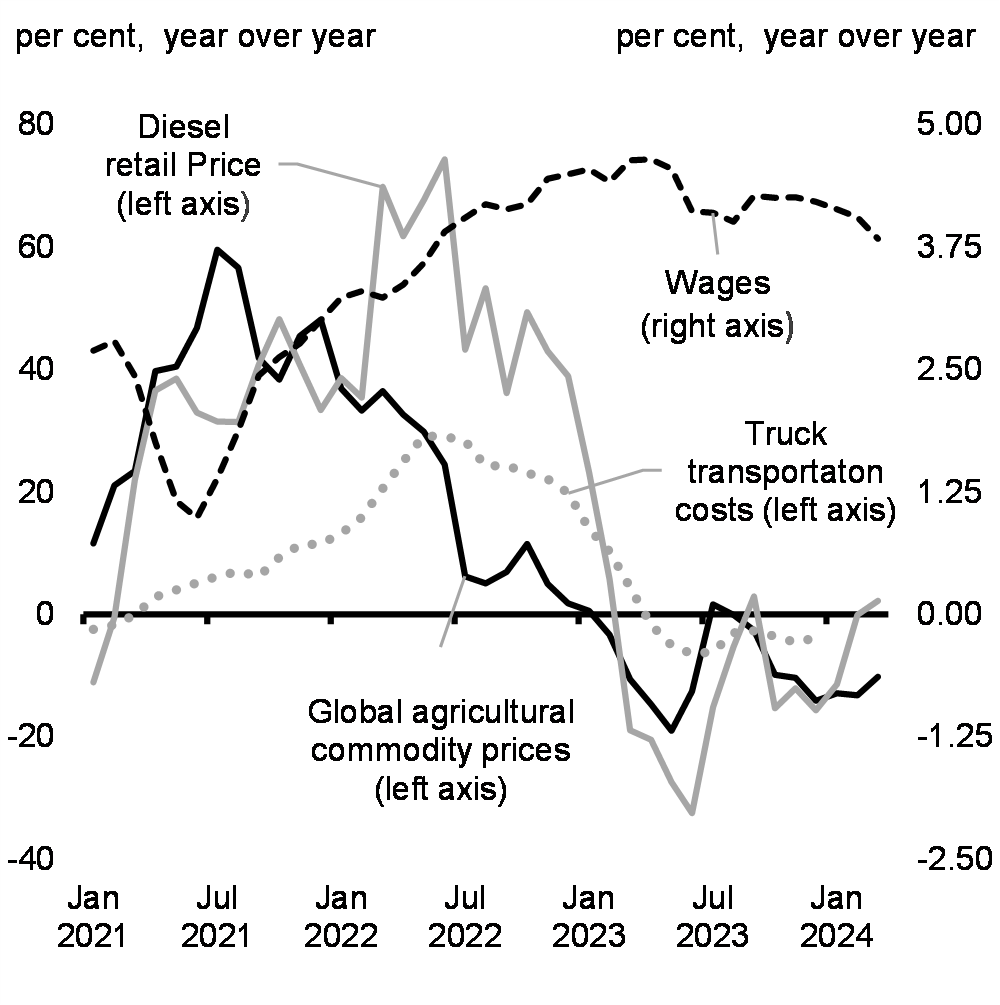

Prices have been driven up by global factors like Russia's full-scale invasion of Ukraine, grain blockades, and climate impacts on agriculture. Canadian grocery companies are also making record profits. The government is fighting to stabilize the price of groceries for Canadians.

Costs for Key Food Price Inputs

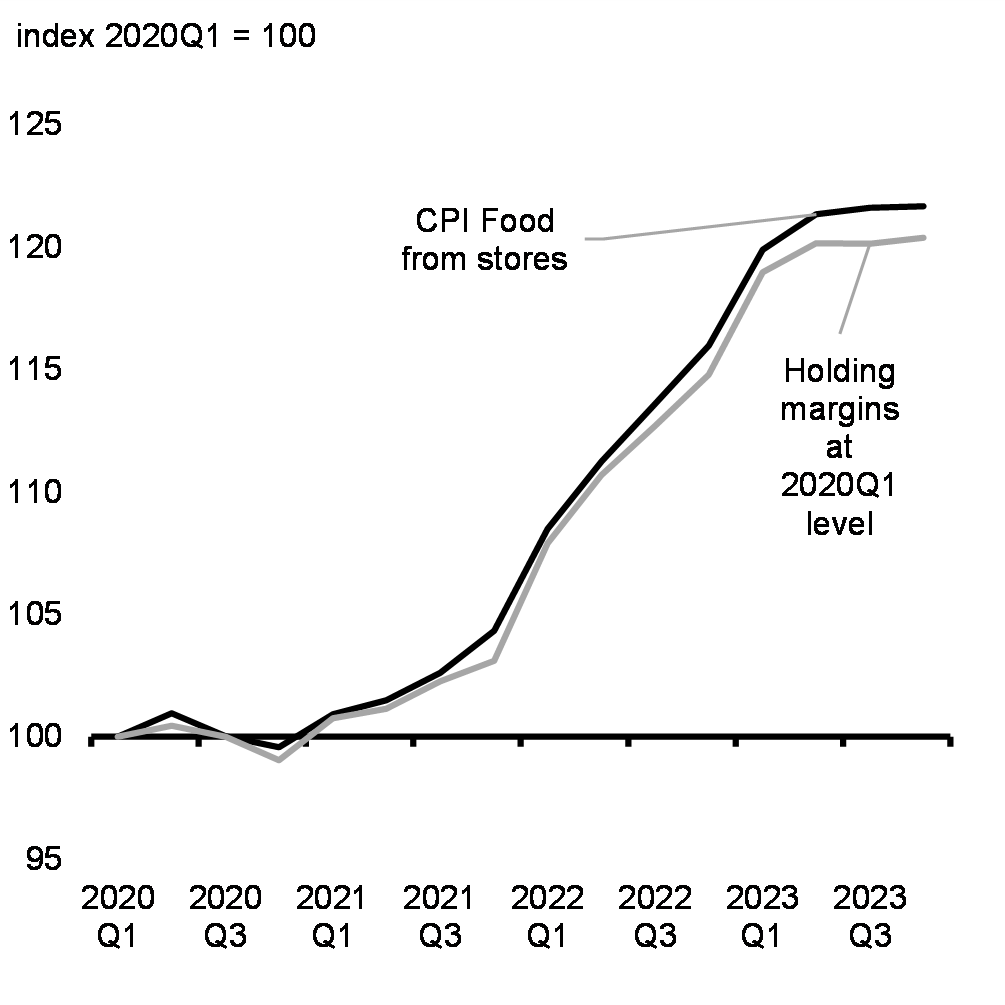

Impact of Higher Grocery Retail Margins on Food Prices

Since the pandemic, the profits of Canada's three largest grocers have collectively increased by 46 per cent—a substantial increase. Canadians deserve fair prices. By strengthening competition, the government is combatting the oligopolies, including among major grocery chains.

A recent Competition Bureau study of the grocery sector found that profit margins have increased since 2017, and concluded there is room for more competition in the Canadian grocery sector. The government has already strengthened competition to make it easier for more grocers to set up shop and compete to bring down prices for Canadians, and will keep working to do this.

To support competitive prices for groceries and other essentials, and give Canadians more choices, the government is:

-

Monitoring the grocers' work to help stabilize prices, as well as investigating other price inflation practices in the grocery sector, through the Grocery Task Force.

-

Maintaining the Food Price Data Hub to give Canadians detailed information on food prices that helps them make informed decisions about their grocery options.

-

Tackling shrinkflation and dequalification, including through the Office of Consumer Affairs, which has launched research projects to investigate and reveal price inflation and harmful business practices that reduce the quantity and quality of groceries.

-

Enhancing competition through the Affordable Housing and Groceries Act, which amended the Competition Act to enhance competition, including in the grocery sector, by giving more power to the Competition Bureau to crack down on unfair practices; removing the efficiencies defence; and empowering the Competition Bureau to block corporations from stifling competition.

The government will continue to fight for fair prices so every Canadian can afford to put good food on the table for themselves and their families.

Strengthening Local Food Security

Food insecurity is a persistent problem in Canada, with higher rates among Indigenous, racialized people, and persons with disabilities. Local food programs enable communities to grow, process, store, and distribute food to those in need within the community, improving the availability of and access to nutritious, local food and reducing the need to shop at major grocery chains.

People should be able to grow food in their communities. It helps them save money on groceries, and it helps them build stronger connections with their communities. For children, an understanding of where food comes from is best learned by growing it in their own neighbourhood. And studies have shown that access to healthy, locally-grown food increases health outcomes. Growing local is good economic policy, and it is good social policy.

-

As part of the government's work to end food insecurity, Budget 2024 proposes to provide $62.9 million over three years, starting in 2024-25, to renew and expand the Local Food Infrastructure Fund to support community organizations across Canada to invest in local food infrastructure, with priority to be given to Indigenous and Black communities, along with other equity-deserving groups. Part of the expansion will support community organizations to improve infrastructure for school food programs as a complement to the National School Food Program.

Lower Costs and Fairer Treatment for Farmers

Whether on the farm, on the jobsite, or in the backyard, Canadians deserve greater interoperability of the equipment they purchase—regardless of the brand. Farmers should be able to connect their John Deere Tractor or New Holland combine, to the specialized equipment they need from third parties, including short-line manufacturers, for various farming tasks. Farmers should be able to use the costly equipment they purchase however it is needed to run their farm.

When farmers have to purchase new, more expensive equipment to grow our food, it can drive up their costs, which get passed on at the checkout. Helping farmers keep costs low is a key component of ensuring the sustainability of our food supply chains. It also helps keep grocery prices in check.

To make it easier for farmers to use the tools and technology essential to running their farms, the government is supporting efforts to amend the Copyright Act to help achieve interoperability between devices and equipment.

To build on this important work to modernize legislation to reflect the realities of farming:

-

Budget 2024 announces the government will launch consultations this June on interoperability, so that farmers can use their equipment in the way that is best for their farm. This is part of broader work the government is undertaking to support the right to repair and interoperability.

-

Budget 2024 also announces the federal government is calling on provinces and territories to amend their contract laws to support interoperability, while commending the progress of Quebec on their work to support consumer protection, including for farmers.

Further details on the upcoming consultations will be announced shortly.

Interest Relief for Farmers

To ensure that Canadian farmers have access to the cash flow needed to continue producing food and supporting national food security, the government increased the $100,000 interest-free limit on loans temporarily under the Advance Payments Program to $250,000 in 2022 and to $350,000 in 2023. These changes have supported over 10,000 farmers with the increased costs for agricultural inputs, such as fertilizers and fuel, triggered by Russia's illegal war against Ukraine, global supply chain disruptions, and rising interest rates.

-

Budget 2024 proposes to provide $64 million in 2024-25 to Agriculture and Agri-Food Canada to support a $250,000 interest-free limit on Advance Payments Program loans for the 2024 program year. The government will continue to review the Advance Payments Program to improve program delivery and reduce the administrative burden for producers.

Protecting Farmers from the Costs of Climate Change

Farmers have faced immense destruction in recent years. The intensifying effects of climate change are particularly wreaking havoc on farmers' abilities to earn a stable income, and to contribute to our food security.

The Livestock Tax Deferral serves as crucial instrument for the government in mitigating the financial burden on farmers during natural disasters, such as drought or floods. This reliable, predictable support helps farmers build resilience as they face the increasingly severe effects of climate change.

The federal government is committed to working with industry partners, such as the Canadian Cattle Association, to explore avenues to ensure farmers get support quicker and more efficiently in times of need.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 3.1 Affordable Groceries

3.2 Fairer Prices, Fewer Fees

No one likes surprise fees. But it seems that every day, Canadians are paying extra fees over and above base prices, such as checked and carry-on baggage fees or international roaming charges. These extra fees are on top of what Canadians already paid for their airline ticket and monthly phone plan. Transparency on all fees up-front is essential so that businesses do not deceptively advertise lower prices than what Canadians will actually pay.

Junk fees are their own source of frustration. From high service fees or charges, to surprise event ticketing fees, to non-sufficient funds and transaction fees charged by banks, these costs add up. And, they disproportionately impact lower- and middle-income Canadians. The federal government is taking action to cut junk fees everywhere it can, and is launching a call to action to provinces and territories to reduce the junk fees under their jurisdiction.

The government has made significant progress to crack down on junk fees and help middle class Canadians keep more of their money in their pockets, and will keep going further. The new Team Canada effort will ensure Canadians in every province and territory can save money by getting fairer prices and paying fewer fees.

Key Ongoing Actions

-

Modernizing the Competition Act to further strengthen the law against hidden fees from drip pricing, ensuring they are not legal anywhere in Canada, and to allow for private parties to bring certain deceptive marketing cases directly to the Competition Tribunal.

-

Investigating international mobile roaming charges through a Canadian Radio-television and Telecommunications Commission study, to ensure the cell phone fees Canadians pay are fair and affordable.

-

Lowering telecom prices by issuing a new directive for the Canadian Radio-television and Telecommunications Commission to improve competition, make it easier to cancel services, and strengthen the protections Canadians have from unfair business practices, such as paying unlocking fees for their cell phone—now, all phones come unlocked.

-

Leading a Canada-wide effort to crack down on junk fees, through the Office of Consumer Affairs, including through support towards consumer groups' independent research and advocacy against junk fees.

Cracking Down on Junk Fees

To lower the cost of everyday goods and services for Canadians, from monthly bills to the costs of air travel, the government launched an effort to crack down on junk fees. The federal government is using all legislative and regulatory levers at its disposal to reduce the unnecessary fees Canadians pay, including through reforming competition law, directing federal agencies to strengthen protections for Canadians, and introducing new caps to reduce bank fees. The federal government is making significant progress to deliver on its commitments to crack down on junk fees:

- Amending the Competition Act to strengthen protections against hidden prices: Through Bill C-59, the government is further cracking down on drip pricing (when additional charges or fees affect consumers' abilities to make informed decisions about prices) by strengthening prohibitions against the digital marketing of unattainable prices without the inclusion of mandatory fees. The proposed amendments will also enable Canadians to bring deceptive marketing claims directly to the Competition Tribunal.

- Directing the Canadian Radio-television and Telecommunications Commission (CRTC) to improve competition and support consumers: Last year, the government issued a new directive to put in place new rules and improve competition in the telecom sector to protect Canadians from unfair businesses practices and to lower prices. In the time since, the CRTC has already increased choice and affordability of high-speed internet services for more than five million Canadian families by requiring large telecom companies to provide competitors with access to their fibre optic networks.

- Introducing the Financial Consumer Protection Framework Regulations to help Canadians avoid fees: Since June 2022, updated regulations have helped Canadians avoid non-sufficient funds fees by requiring banks to send Canadians electronic alerts when their chequing or savings account, or credit card or line of credit balance falls below $100, and allow Canadians to set a different amount; and requiring advance notice before renewal of products or services to ensure you only pay for the services you need.

- Amending the Air Passenger Protection Regulations:To ensure that airlines seat all children under the age of 14 next to their accompanying adult at no extra cost, the government is developing regulatory amendments, which will be introduced this year. The government is also taking further action to strengthen transparency of optional fees charged by airlines, for everything from baggage to seat selection to in-flight meals.

In addition to delivering on previous commitments, the federal government is taking further action to help Canadians avoid junk fees wherever possible.

Cheaper Internet, Home Phone, and Cell Phone Plans

Canadians who want to switch to a cheaper internet or phone plan often encounter discouraging practices from telecom companies, such as cancellation fees which can prevent Canadians from saving money, or making them wait on the phone for hours to speak with customer service. Canadians can also face the end of promotional periods, and higher monthly bills without full awareness of their options.

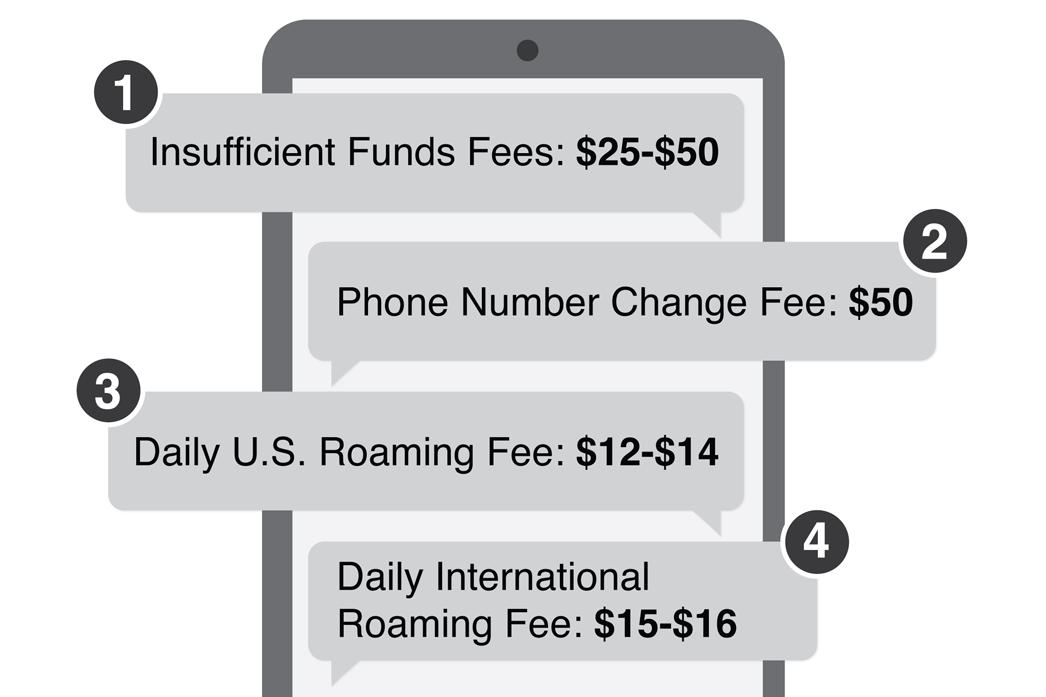

Whether travelling abroad, changing your phone number, or being late on a payment, the extra fees charged by telecom companies add up, too. Canadians need to be aware of the potential junk fees they could face, and companies need to lower these fees to ensure Canadians can accurately plan how much their cell phone and other telecom services will cost them.

All Canadians should be able to access these essential services at affordable prices.

Additional Cell Phone Fees Are Too High and Add Up

Canadians face all types of fees, over and above typical base costs, from insufficient funds fees to mobile roaming fees to even a fee to change your phone number. These fees add up.

As announced in the 2023 Fall Economic Statement, the Canadian Radio-television and Telecommunications Commission has launched an investigation into international mobile roaming fees and is working with experts to analyze how roaming rates charged by Canadian companies compare to those charged by international telecom companies. The findings of this investigation will be published later this year.

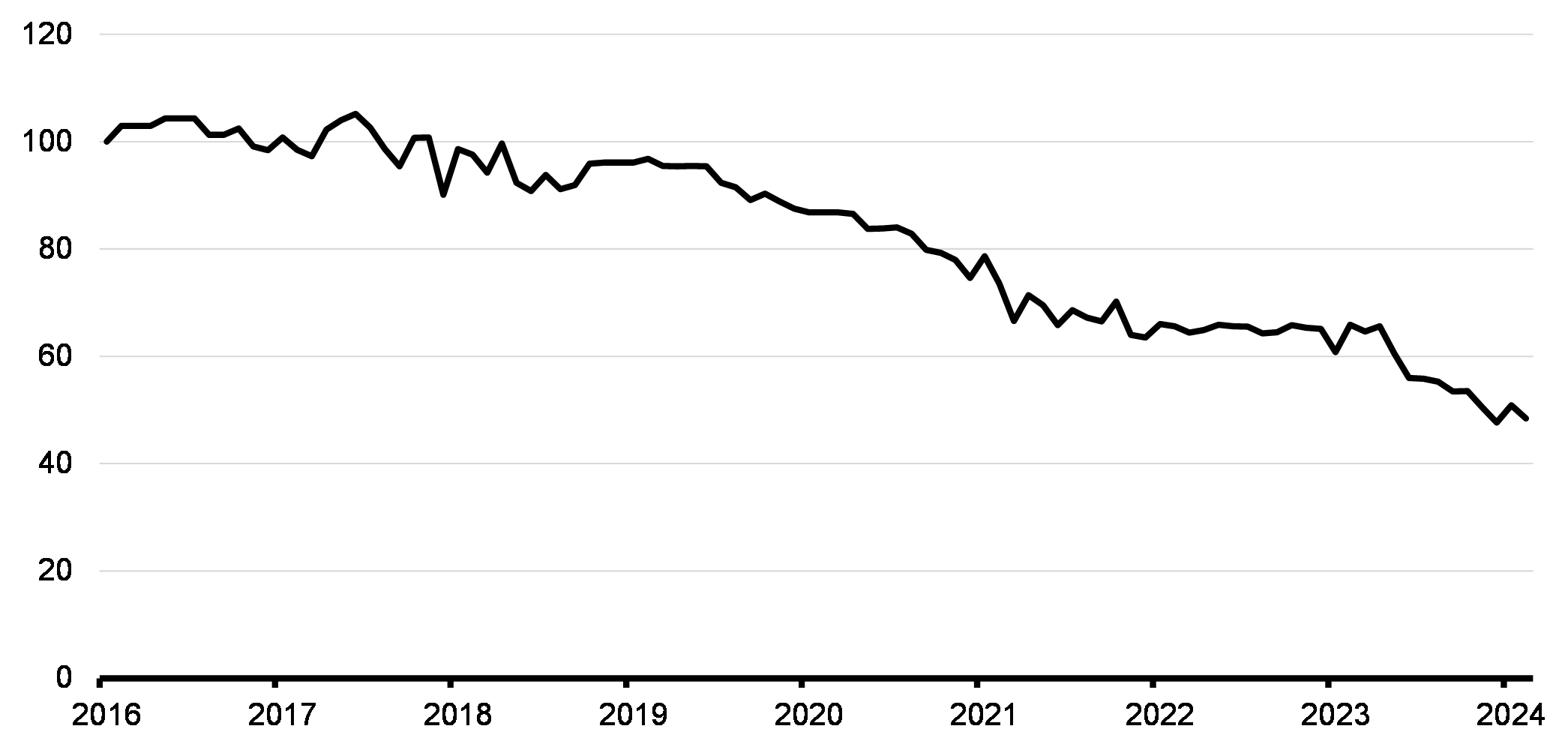

The government has taken significant action to lower the cost of cell phone plans by 25 per cent—a commitment that has now been surpassed. In December 2023, Statistics Canada reported that cell phone plan costs declined by 50 per cent since December 2018.

The Cost of Cell Phone Plans has Fallen 52 per cent, 2016-2024

The government has also made unprecedented investments to ensure Canadians in all parts of the country, including in rural communities, have access to high-speed internet. The government has committed over $3.7 billion to more than 600 projects to help bring high-speed internet (50 Mbps download/10 Mbps upload) to over 1 million rural and remote households across Canada, including 35,000 Indigenous households.

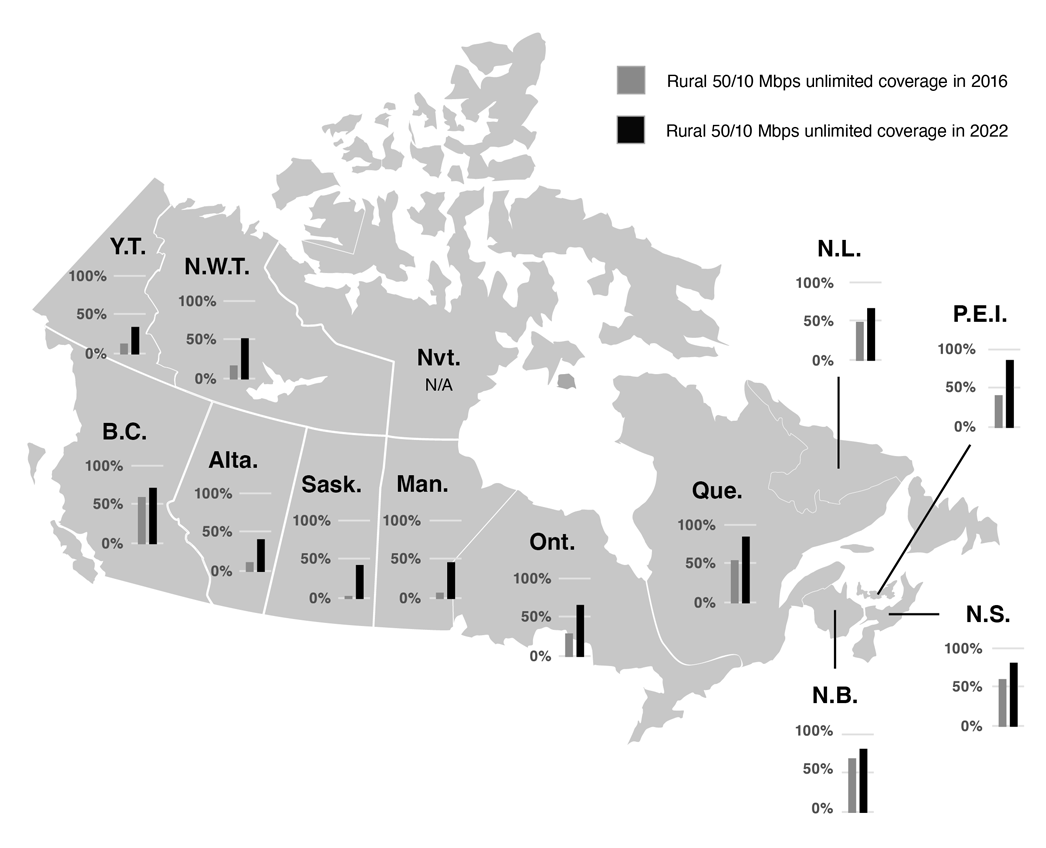

Expanding High-Speed Internet to Rural Communities

Since 2015, the government has supported the expansion of high-speed internet access for Canadians, including rural communities which have slower and less reliable internet access than in urban centres.

In 2016, 84 per cent of Canadians had access to high-speed internet. By 2022, this figure increased to almost 94 per cent. This has been possible in part because of a significant increase in access in rural areas, moving from 39 per cent to 67 per cent over this period. The government remains committed to its target of ensuring 98 per cent of Canadians have access to high-speed internet by 2026 and 100 per cent of Canadians by 2030.

Expansion of High-Speed Internet to Rural Communities

The government has made significant progress to reduce the cost of internet, home phone, and cell phone plans, and to increase access to these services. We are focusing the next phase of our work on reducing the costs and barriers to switching providers, so Canadians can find better deals:

-

Budget 2024 announces the government's intention to amend the Telecommunications Act to better allow Canadians to renew or switch between home internet, home phone, and cell phone plans:

- Carriers will be prohibited by the CRTC from charging consumers extra fees to switch carriers.

- Carriers will be required to help consumers identify plans, which may include lower-cost plans, in advance of the end of a contract.

- Carriers will also be required to provide a self-service option, such as an online portal, for customers to easily switch between or end plans with a provider.

The CRTC will be responsible for implementing these measures and will consult on specific requirements.

No-fee switching to cheaper telecom plans

Yash is a student who works part-time. When he started school nearly two years ago, he signed up for a promotional cell phone plan for students at $40 per month.

The promotional offer is nearing the end of its term. With these amendments, Yash receives a notification from his carrier that his promotion is about expire, and that his plan would be renewed at $65 per month—for the same features. Alternatively, his carrier suggests he could switch to a new plan, but that option comes with only half the data compared to his current plan.

Yash does some research and finds the same plan for $40 per month from a different carrier. He signs up with the new provider and then logs on to his existing carrier's website to cancel his service. With the click of a button, he cancels his service and will be able to transfer his phone number to the new carrier—at no cost, and in just a few minutes.

Yash secures a new contract at the same price as his old one, and with his phone already paid off, is able to switch carriers without any extra fees.

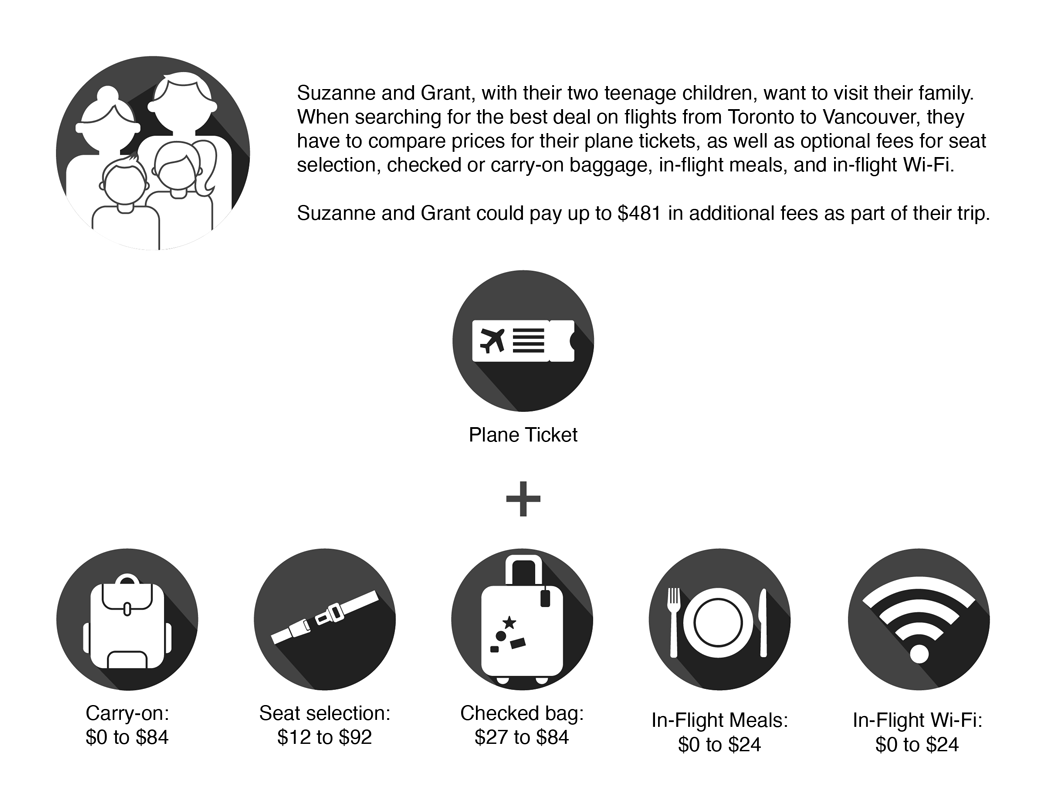

Transparency for Airline Fees

When booking a flight, every Canadian wants to get the best deal possible, but they are often surprised to find out there are additional costs on top of the advertised fare.

Extra Fees Charged by Airlines Can Add Up

Even though airlines must show a ticket price that includes taxes, fees, and charges, Canadians can still face additional fees for optional services at different steps of the journey. From selecting seats, to checking bags, to meals on board, it is only fair that Canadians have full transparency about the full cost of their flight.

-

Budget 2024 announces the government will strengthen transparency of fees for optional services charged by airlines, such as for seat selection, checked and carry-on baggage, meals on board, and in-flight entertainment. The government will do this by working with the Canadian Transportation Agency and airlines to ensure these fees are clearly laid out. This will help Canadians select fares based on the full price of the travel options that best meet their needs.

Calling on Provinces and Territories to Cut Junk Fees

Where junk fees fall under federal jurisdiction, the federal government is taking action. Many of the junk fees that frustrate Canadians are under provincial and territorial jurisdiction. That's why the federal government is calling on all orders of government to do their part to cut junk fees, so that Canadians can keep more of the money they worked hard to earn.

To advance this work with provinces and territories on unfair fees and practices, Budget 2024 announces:

-

The federal government will work with provinces and territories to identify and target junk fees charged in Canada.

-

The federal Office of Consumer Affairs will help reveal deceptive junk fee practices—wherever they exist in Canada—by advancing research and advocacy projects.

The federal government encourages all provinces and territories to work together to prioritize these important issues for Canadians. Priority action areas will include:

Concert and Sport Ticket Fairness

When it comes to sporting and event tickets, Canadians are looking for transparent, up-front pricing, and fair practices to keep costs low. The federal government, including the Competition Bureau, is doing its part to enforce federal protections against deceptive marketing practices, including hidden fees and charges.

Some provinces have taken steps to help their residents, such as Ontario's Ticket Sales Act which implemented protections for consumers buying event tickets.

Some other provinces need to do more to strengthen their consumer protection laws to safeguard the interests of Canadians. To make entertainment prices fair for everyone, Budget 2024 announces that:

-

The federal government will work with provinces and territories and encourage them to adopt best practice requirements for ticket sales, with three priority goals:

- Ticket sales transparency, to continue to protect Canadians from unexpected charges through upfront, all-in pricing;

- Stronger protections for Canadians, including against excess fees and better ensuring they get timely refunds when events are cancelled; and,

- Cracking down on fraudulent resellers and reseller practices which unfairly drive up prices, such as using bot technology to maliciously buy and resell tickets.

Cracking down on resellers to keep tickets for Canadians

Shannon and her friends were some of the lucky Canadians able to secure the access code for Taylor Swift's concert in Vancouver this December. As soon as Shannon got through the online waiting room she was excited to buy tickets for herself and three friends.

After Shannon tried to add her tickets to her cart, she was greeted by a message that the tickets she was interested in were no longer available—this is something she knew all too well. Each of her friends was trying to buy tickets, too, and had the same experience—the tickets they were hoping for had been sold to someone else.

While getting a ticket to the most popular concerts is always tough, it is even harder to get a ticket when resellers seek to make a profit by driving up prices for Canadians.

With new action in Budget 2024 to identify ways to address ticket resellers' practices that unfairly drive up prices, including the use of bot technology, Shannon and her friends will have a better chance at getting tickets the next time Taylor is performing in Canada.

Calling for stronger consumer protections across Canada

Nick can't wait to see his favourite hockey team—the Toronto Maple Leafs—in the playoffs. As soon as he hears the Leafs qualified for the first round, he heads online to buy tickets to the four games scheduled in Toronto.

While buying his tickets, Nick is pleased to see he is no longer charged extra fees beyond the advertised price, as required by the Competition Act and further reinforced by the Ontario's Ticket Sales Act. Previously, Nick used to pay about $20 more, per ticket, due to extra fees and surcharges.

He attends the first two home games. The Leafs excitedly win the series after game four of the first playoff round, so the last two games that Nick has tickets for are cancelled.

Nick waits a week for his refund to be processed, but he still hasn't received a payment from the ticket provider on his credit card. He then reaches out to the ticket provider to resolve the issue. If, after three weeks, the ticket provider does not get back to Nick, he can file a formal complaint with Consumer Protection Ontario.

By working with provinces and territories, the federal government will work to ensure that all Canadians can access the consumer protections that Nick was afforded.

The Competition Bureau is an independent law enforcement agency that has a crucial role in enforcing the Competition Act and defends Canadians against junk fees, which has led to a total of $12.6 million in penalties paid by Ticketmaster, StubHub, and TicketNetwork, as well as by car rental companies Avis and Budget, Hertz, Enterprise, and Discount.

The government recognizes the Competition Bureau's critical role in the economy, and this is why the government has taken several steps to provide the Competition Bureau with the resources and the tools it needs to more effectively achieve its mandate.

As an example of the work of the Competition Bureau, in 2019, Ticketmaster paid a $4 million penalty and $500,000 for the Competition Bureau's costs for investigating allegedly misleading pricing claims in online ticket sales. The Bureau's legal action against Ticketmaster, in defence of Canadian consumers, concluded that Ticketmaster's advertised prices were not attainable because they added mandatory fees during the later stages of a purchasing process.

Ticketmaster's junk fees were found to often add more than 20 per cent, and in some cases, over 65 per cent, to the advertised prices. The Competition Bureau's actions also led to a binding 10-year compliance agreement with Ticketmaster to ensure Canadians are not subject to junk fees and deceptive advertising.

In 2023, the Competition Bureau announced legal action against Cineplex for advertising movie tickets at a lower price than what many consumers actually have to pay.

In its application to the Competition Tribunal, the Bureau argues that the $1.50 online booking fee is misleading and means consumers can't buy tickets online at advertised prices. In that same application, the Bureau is seeking the Tribunal to order Cineplex to stop this form of advertising, pay a penalty, and issue restitution to affected consumers.

The Competition Bureau has been empowered to independently defend Canadians through an increased budget and legislative amendments to the Competition Act that has enabled more robust enforcement of competition law in Canada. In addition, the government's proposed amendments to the Competition Act will pave the way for private parties to bring challenges to anti-competitive conduct.

A Right to Repair Your Devices

From cell phones to computers to washers and dryers, it is frustrating—and expensive—to replace, rather than repair, your devices and appliances when they break. The current disposable lifecycle of many modern electronics and appliances is bad for the environment, and it is costly for Canadians.

Canadians expect the expensive devices they purchase to work well and last for years. And if these items fail, Canadians should be able to repair their broken appliances or devices—and at a fair price—rather than being forced to purchase a new product when one component fails.

To ensure Canadians can keep their devices working longer, and reduce harmful electronic waste in the process, the federal government is advancing a right to repair to increase product durability and repairability.

Important progress is already being made to secure these rights for Canadians, including:

-

Amending the Copyright Act to allow the circumvention of digital locks to diagnose, maintain, or repair a product. This will enable consumers to repair their devices where they choose.

-

Amending the Competition Act, as announced in the 2023 Fall Economic Statement, to prevent manufacturers from refusing, in an anti-competitive manner, to provide the parts, tools, or software needed to fix devices and products.

Building on this progress, Budget 2024 announces:

-

The government will launch consultations this June to develop a right to repair framework, which will focus on durability, repairability, and interoperability.

-

The federal government is also calling on provinces and territories to amend their contract laws to support a right to repair and interoperability. Quebec's Bill 29 is an example of how provinces can protect consumers by promoting right to repair.

Further details on the right to repair framework on home appliances and electronic devices will be announced in the coming months. The federal government is exploring how to address:

- Planned obsolescence, which is when manufacturers intentionally create products that break quickly;

- The merits of a durability index, which could help Canadians better understand how long their device is expected to last; and

- If there is the need for further federal legislative changes to support right to repair.

More affordable repairs for electronic devices

Aaina cracked the screen on her new iPhone. Apple quotes her $499 to replace the screen. Aaina finds a third-party repair shop offering repair for $329. However, Apple's warranty policies mean the cheaper repair could void her warranty.

To avoid the risk of voiding her warranty, Aaina begrudgingly pays $170 more for Apple to repair it.

With further actions to support the right to repair, including provincial and territorial reforms, Aaina could get her screen fixed at the third-party repair shop without voiding the warranty on her new iPhone, saving her $170.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 3.2 Fairer Prices, Fewer Fees

3.3 Lower Banking Fees, Better Finances

Every Canadian deserves access to affordable, modern banking tools. These tools help them pay their bills, save money, receive their government benefits, and build their credit. Ensuring every Canadian has access to affordable banking services is about fairness for every generation, because hard work isn't paying off like it used to. Hard working, middle class Canadians deserve to keep more of their money. They need it to get ahead.

While Canadians face a rising cost of living, bank profits have continued to grow—in part due to Canadians paying higher fees. Some banks have even recently increased the minimum balance required to waive monthly fees, making it even harder for people to keep their banking fees low. This is unfair. That's why the government is taking action to lower banking fees.

The federal government is using the regulatory and legislative tools at its disposal to cut the banking fees Canadians pay and help them improve their financial circumstances. No one should face steep penalties when they are just trying to get ahead.

Budget 2024 takes action to lower banking fees by capping non-sufficient funds fees, modernizing free and affordable bank account options, launching new consumer-driven banking tools, expanding financial help services, and doing more to crack down on predatory lending.

Key Ongoing Actions

-

Cracking down on predatory lending by lowering the criminal rate of interest to 35 per cent APR (annual percentage rate).

-

Introducing the Canadian Mortgage Charter, which details the tailored mortgage relief that the government expects banks to provide borrowers who are facing financial difficulty with the mortgage on their principal residence.

-

Ensuring Canadians have an independent and transparent complaints body to help resolve banking issues, by designating the Ombudsman for Banking Services and Investments, as the single external complaints body for Canadians, effective November 1, 2024.

-

Requiring banks to automatically notify Canadians when their bank account or credit card balance falls below a set amount, set by default at $100, and requiring advance notice before renewing services.

Capping Non-Sufficient Funds Fees at $10

Non-sufficient funds (NSF) fees are charged when there is not enough money in a bank account to cover a cheque or pre-authorized debit transaction. These fees charged by banks can reach almost $50, disproportionately affecting low-income Canadians and people with poor credit history. Charging steep fees on people already struggling to stay on top of their bills only makes it more difficult for them to get ahead.

-

To help Canadians who are struggling to make payments to improve their financial situation, the government is announcing its intent to cap the NSF fees charged by banks to $10 per instance, as well as:

- Requiring banks to alert consumers that they are about to be charged an NSF fee, and providing a grace period to deposit additional funds to avoid the fee;

- Prohibiting multiple NSF fees when the same transaction reoccurs;

- Restricting the number of NSF fees that may be charged to one in every 72-hour period; and,

- Prohibiting NSF fees for small overdrawn amounts under $10.

The government will release draft NSF fees regulations in the coming months.

Enhancing Free and Affordable Bank Accounts

Canadians' banking needs have changed as more and more transactions happen online. The $0 per month and up to $4 per month bank accounts, currently offered by some of Canada's banks, need to reflect the reality of banking today, including more transactions to pay bills and transfer money—without extra fees.

To ensure affordable banking options meet the needs of Canadians, the government directed the Financial Consumer Agency of Canada (FCAC) to secure new agreements from financial institutions for enhanced free and affordable banking accounts.

-

Budget 2024 announces that FCAC is in negotiations with banks to secure enhanced agreements to offer modernized $0 per month and up to $4 per month bank accounts that reflect the realities of banking today, including more transactions, as well as expanded eligibility for $0 accounts.

-

The government hopes that FCAC can reach a positive outcome and secure an agreement that serves the interests of the wider Canadian public.

Anyone can get a low-cost bank account—but features are limited

While FCAC continues to encourage banks to upgrade their affordable bank account offerings, low-cost bank accounts are available to all Canadians.

These basic chequing accounts offer at least:

-

A free debit card;

-

12 free debit transactions per month, including at least 2 in-branch transactions;

-

The ability to write cheques;

-

Free monthly printed statements;

-

The ability to set up pre-authorized payments; and,

-

Cheque image return or online cheque image viewing.

Today, banking has evolved and people need access to more transactions, without fees. This is especially important to help vulnerable groups avoid falling into debt and incurring avoidable fees, by offering more free debit transactions.

Select groups can get $0 bank accounts

The existing agreement with ten banks offers the same features as low-cost accounts to the following groups for free:

-

Youth;

-

Students;

-

Seniors receiving the Guaranteed Income Supplement (GIS); and,

-

Registered Disability Savings Plan (RDSP) beneficiaries.

More people need access to financial services, but cost remains a barrier for many other vulnerable groups. FCAC is actively working to expand eligibility for the $0 per month account to more groups.

How do I sign up?

Visit a branch of one of the ten banks, with required paperwork and ID. Proof of eligibility is required for free accounts, such as proof of age for youth, proof of enrollment for students, or proof of benefit payments for seniors.

Consumer-Driven Banking

Consumer-driven banking, also known as open banking or consumer-driven finance, provides a way for people and businesses to securely transfer their financial data to different service providers, including banks, credit unions, and accredited fintechs.

Fintech companies have been limited in their ability to develop new financial tools largely due to a reliance on unsecure screen scraping, which pulls data from a bank account by reading the account information. This requires Canadians to share their banking credentials with fintech companies.

With consumer-driven banking, fintechs will be able to offer Canadians a way to securely share select data with the fintech tools of their choice—without sharing access to their bank account. The potential of consumer-driven banking includes new apps and tools to help Canadians' better keep track of bills, track a budget, collect and compare information to allow for better decisions when exchanging currencies or investing in the stock market, secure a loan, find a better deal on insurance, or track monthly rent payments to build up credit scores. These innovations can help make life more affordable, and even help young Canadians when it is time to buy a first home.

Before these new financial tools can become available, Canada needs a framework that makes sure this technology is secure for Canadians and that eliminates the risky practice of screen scraping.

To drive an innovative consumer-driven banking ecosystem in Canada, the 2023 Fall Economic Statement announced that the federal government would introduce legislation to establish Canada's Consumer-Driven Banking Framework. This Framework will regulate access to financial data, providing Canadians and small businesses with safe and secure access to financial services and products that help them manage and improve their finances.

-

Budget 2024 announces that the Financial Consumer Agency of Canada (FCAC) will be mandated to oversee, administer, and enforce Canada's Consumer-Driven Banking Framework.

-

Budget 2024 proposes to provide $1 million in 2024-2025 for FCAC to support preparation for its new responsibilities and to begin development of a consumer awareness campaign. The FCAC will transition to a full cost-recovery basis once the framework is in place.

-

Budget 2024 also proposes to provide $4.1 million over three years starting in 2024-25 for the Department of Finance to complete policy work necessary to establish and maintain a consumer-driven banking oversight entity and framework, including the implementation of a national security regime.

The government will soon table framework legislation that will expand FCAC's mandate and establish foundational framework elements related to scope, system participation, criteria and process for the technical standard, safeguards in respect of personal financial data security and integrity, and common rules.

For more details, see Canada's Consumer-Driven Banking Framework, released today, which provides details on the forthcoming legislative package.

Building your credit to get a mortgage

Through consumer-driven banking, people without established credit, such as young people and new Canadians, could build their credit scores through services that use transaction data or other payment data, rather than being limited to traditional ways to build credit history, which is not equally available to every generation. Tools that enable Canadians to use confirmation of timely rental payments to build a credit score are an example.

New tools coming to help you manage your subscriptions

To keep track of recurring bills and subscriptions, a consumer-driven banking system would provide Canadians secure access to services that would enable them to easily track payments and monitor subscriptions in one place. This would help them make budgeting decisions and improve their financial well-being by avoiding or eliminating unused or unwanted monthly payments.

More Free Financial Advice

Financial literacy is one of the keys to financial security. Many Canadians in difficult financial circumstances have benefitted from financial help services that provide advice and options. More of these services are needed to ensure all vulnerable people, especially those with low incomes, have access to the tools and information they need to achieve financial security. National charities, like Prosper Canada, provide these services, with a focus on expanding economic opportunity and economic empowerment for every Canadian.

-

Budget 2024 proposes to provide $60 million over five years, starting in 2024-25, to Prosper Canada to expand the community‑delivered financial help services available to Canadians. These enhanced services are expected to reach one million low- to moderate-income Canadians over five years, helping them receive nearly $2 billion in unclaimed tax and benefit income.

This support will enable Prosper Canada, working with community organization partners, to expand free programming and free advice services. These free programs help Canadians do their taxes and find the benefits they are entitled to, find affordable ways to build their savings, and improve their financial situations so they can get ahead. As announced in Chapter 8, the government is also advancing automatic tax filing to help more Canadians easily receive the benefits to which they are entitled.

Doing More to Crack Down on Predatory Lending

Predatory lenders can take advantage of the most vulnerable Canadians in our communities. Predatory loans, including high-interest installment loans, are a fast growing and widely held type of debt in Canada, and are disproportionately accessed by low-income Canadians, newcomers, and those with limited credit history. Some consumer groups have indicated that lenders often refinance high-cost loans to keep borrowers in a cycle of debt.

To protect financially at-risk Canadians, in Budget 2023, the government committed to lowering the criminal rate of interest, from the equivalent of 48 per cent APR to 35 per cent APR, following Quebec in setting the lowest maximum interest rate in Canada. The government also committed to limit the costs of payday loans to no more than $14 per $100 borrowed. The government is reinforcing its efforts to crack down on predatory lending, and moving forward with these reforms to protect Canadians on a priority basis.

To further protect the most financially at-risk Canadians, the government is going further to lower borrowing costs, limit the risk of harmful debt cycles, and help Canadians keep more of their money in their pockets.

-

To protect vulnerable Canadians from harmful illegal lenders, such as loan sharks, who try to circumvent the criminal rate of interest, Budget 2024 announces the government's intention to amend the Criminal Code to enhance enforcement of the criminal rate of interest. These amendments will include empowering law enforcement by prohibiting offering credit at a criminal rate of interest, and allowing for prosecutions of illegal and predatory lenders without the approval of the Attorney General.

-

Budget 2024 also announces the government's intention to strengthen its crackdown on predatory lending by working with provinces and territories to harmonize and enhance consumer protections across Canada, which could include legislative action on the part of the federal government, if required. These include:

- Capping the costs of optional insurance products for high-cost loans, including payday loans;

- Enhancing transparency and marketing practices for high-cost and payday loans, including limiting advertising of these products;

- Strengthening payday loan regulations, including disclosure requirements to protect Canadians from harmful terms and conditions, including adding a minimum number of days for the loan terms, a requirement for borrowers to repay in installments, and prohibiting loan rollovers;

- Increasing action and harmonization on proactive approach towards lead generators; and,

- Enhancing monitoring and data collection practices in the high-cost loan market, including payday loans.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 3.3 Lower Banking Fees, Better Finances

| 2023-2024 | 2024-2025 | 2025-2026 | 2026-2027 | 2027-2028 | 2028-2029 | Total | |

|---|---|---|---|---|---|---|---|

| 3.1. Affordable Groceries | 0 | 84 | 21 | 21 | 0 | 0 | 127 |

| Strengthening Local Food Security | 0 | 20 | 21 | 21 | 0 | 0 | 63 |

| Interest Relief for Farmers | 0 | 64 | 0 | 0 | 0 | 0 | 64 |

| 3.3. Lower Banking Fees, Better Finances | 0 | 14 | 14 | 13 | 12 | 12 | 65 |

| Consumer-Driven Banking | 0 | 2 | 2 | 1 | 0 | 0 | 5 |

| More Free Financial Advice | 0 | 12 | 12 | 12 | 12 | 12 | 60 |

| Chapter 3 - Net Fiscal Impact | 0 | 98 | 35 | 35 | 12 | 12 | 192 |

| Note: Numbers may not add due to rounding. A glossary of abbreviations used in this table can be found at the end of Annex 1. | |||||||

Page details

- Date modified: