Archived - Annex 2:

Debt Management

Strategy

On this page:

Impacts report

Find out more about the expected gender and diversity impacts for each measure in Annex 2: Debt Management Strategy

Introduction

The 2024-25 Debt Management Strategy sets out the Government of Canada's objectives, strategy, and borrowing plans for its domestic and foreign debt program and the management of its official international reserves.

The Financial Administration Act (FAA) requires that the Minister of Finance table, in each House of Parliament, a report on the anticipated borrowing to be undertaken in the fiscal year ahead, including the purposes for which the money will be borrowed and the management of the public debt, no later than 30 sitting days after the beginning of the fiscal year. The 2024-25 Debt Management Strategy fulfills this requirement.

Objectives

The fundamental objectives of debt management are to raise stable and low-cost funding to meet the financial requirements of the Government of Canada and to maintain a well-functioning market for Government of Canada securities.

The government is committed to managing the debt program in a prudent manner to ensure a balanced debt structure that contributes to maintaining the stability of debt costs and to reducing the risk of the debt portfolio.

Having access to a well-functioning government securities market contributes to lower costs and less volatile pricing for the government, ensuring that funds can be raised efficiently over time to meet the government's financial requirements.

The Debt Management Strategy provides transparency on the government's borrowing plans to support a liquid and well-functioning market for Government of Canada securities and ensures the long-term sustainability of the government's borrowing program.

The government closely monitors financial markets and will adjust issuance if necessary to appropriately respond to shifts in market demand or changes to financial requirements.

Outlook for Government of Canada Debt

As a result of the government's responsible fiscal management, Canada continues to have an enviable fiscal and debt position relative to international peers. Canada is projected to have the lowest net debt-to-GDP ratio and is expected to have some of the strongest fiscal outcomes of G7 countries over the next five years. Rating agencies cite Canada's effective, stable, and predictable policymaking and political institutions, economic resilience and diversity, well-regulated financial markets, and its monetary and fiscal flexibility as drivers of Canada's world-leading credit ratings: Moody's (Aaa), S&P (AAA), DBRS (AAA), and Fitch (AA+).

Planned Borrowing Activities for 2024-25

The projected sources and uses of borrowings for 2024-25 are presented in Table A2.1. The comparison of actual sources and uses of borrowings against projections will be reported in the Debt Management Report for 2024-25. This document will be released soon after the Public Accounts of Canada 2025, which will provide detailed accounting information on the government's interest-bearing debt.

Sources of Borrowings

The aggregate principal amount of money to be borrowed by the government in 2024-25 is projected to be $508 billion, 83 per cent of which will be used to refinance maturing debt. This level of borrowing is consistent with the current legislated limit of $1,831 billion set out in the Borrowing Authority Act and the government has received approval from Governor in Council for a related annual borrowing limit for 2024-25. The government proposes to introduce amendments to the Borrowing Authority Act to increase the government's total borrowing limit to ensure Canadians continue to receive the important benefits and services to which they are entitled.

Uses of Borrowings

The size of the 2024-25 gross issuance of domestic bonds and treasury bills (i.e., domestic borrowing program) totals $500 billion and reflects requirements to refinance $414 billion of maturing debt, in addition to projected financial requirements of $102 billion, which includes $30 billion to fund purchases of Canada Mortgage Bonds and a reduction of cash balances of $16 billion. The government also intends to borrow an equivalent of $8 billion in foreign currencies, solely for the purpose of funding its official international reserves (more details below).

Actual borrowings for the year may differ due to uncertainty associated with economic and fiscal projections, the timing of cash transactions, and other factors such as changes in foreign reserve needs and Crown corporation borrowings. To adjust for these unexpected changes in financial requirements, debt issuance may be altered during the year, typically first through changes in the issuance of treasury bills. The government may also adjust issuance for bonds in response to larger changes or shifts in market demand.

| Sources of borrowings | |

|---|---|

|

Payable in Canadian Currency

|

|

|

Treasury bills1

|

272 |

|

Bonds

|

228 |

|

Total payable in Canadian currency

|

500 |

|

Payable in foreign currencies

|

8 |

| Total sources of borrowings | 508 |

| Uses of borrowings | |

| Refinancing needs | |

|

Payable in Canadian Currency

|

|

|

Treasury bills

|

267 |

|

Bonds

|

147 |

|

Retail debt

|

0 |

|

Total payable in Canadian currency

|

414 |

|

Payable in foreign currencies

|

7 |

| Total refinancing needs | 421 |

| Financial requirement | |

|

Budgetary balance

|

40 |

|

Non-budgetary transactions

|

|

|

Pension and other accounts

|

-6 |

|

Non-financial assets

|

5 |

|

Loans, investments, and advances

|

|

|

Of which:

|

|

|

Loans to enterprise Crown corporations

|

42 |

|

Other

|

6 |

|

Other transactions2

|

16 |

| Total financial requirement | 102 |

| Total uses of borrowings | 523 |

| Net increase or decrease (-) in cash | -16 |

| Change in other unmatured debt transactions3 | 0 |

|

Source: Department of Finance Canada calculations. Notes: Numbers may not add due to rounding. In the uses of borrowings section, a negative sign denotes a financial source. 1 Treasury bills are rolled over, or refinanced, a number of times during the year. This results in a larger number of new issues per year than the stock of outstanding at the end of the fiscal year, which is presented in the table. 2 Other transactions primarily comprise the conversion of accrual transactions to cash inflows and outflows for taxes and other accounts receivable, provincial and territorial tax collection agreements, amounts payable to taxpayers and other liabilities, and foreign exchange accounts. 3 Includes unamortized discounts on debt issues, accrued interest, obligations related to capital leases and other unmatured debt. |

|

2024-25 Borrowing Program

In 2024-25, borrowing needs are expected to remain elevated to fund maturing debt and financial requirements, including Canada Mortgage Bond purchases. Given the uncertain path of interest rates, the borrowing program for 2024-25 is focused on reducing refinancing risk and minimizing volatility to public debt charges through the period of expected rate adjustment over the next few years.

In this context, the government plans to reduce issuance of treasury bills to 54 per cent of total domestic issuance compared to 57 per cent last year. The government is also increasing the issuance in the 10-year to $60 billion and 30‑year to $16 billion. During the Fall Debt Management consultations, market participants clearly articulated a need for more long-term debt issuance. The government will continue to monitor the functioning of this sector and may opt to adjust issuance should market conditions necessitate a change.

Composition of Market Debt

The total stock of market debt is projected to reach $1,441 billion by the end of 2024-25 (Table A2.2).

| 2020-21 Actual |

2021-22 Actual |

2022-23 Actual |

2023-24 Actual |

2024-25 Projected |

|

|---|---|---|---|---|---|

| Domestic bonds1 | 875 | 1,031 | 1,038 | 1,086 | 1,146 |

| Treasury bills | 219 | 187 | 202 | 267 | 272 |

| Foreign debt | 15 | 14 | 16 | 22 | 23 |

| Total market debt | 1,109 | 1,232 | 1,256 | 1,375 | 1,441 |

|

Sources: Bank of Canada; Department of Finance Canada calculations. Note: Numbers may not add due to rounding. 1 Includes additional debt that accrues during the fiscal year as a result of the inflation adjustments to Real Return Bonds. |

|||||

| 2022-23 Actual |

2023-24 Actual |

2024-25 Planned |

|

|---|---|---|---|

| Treasury bills | 202 | 267 | 272 |

|

2-year

|

67 | 86 | 88 |

|

3-year

|

20 | 6 | 0 |

|

5-year

|

31 | 47 | 60 |

|

10-year

|

52 | 47 | 60 |

|

30-year

|

14 | 14 | 16 |

|

Green bonds1

|

- | 4 | 4 |

|

Total bonds

|

185 | 204 | 228 |

| Total gross issuance2 | 387 | 471 | 500 |

| Share of Long Bonds (10-Year +) to Total Bonds | 36% | 30% | 33% |

| Share of Treasury bills to Total Issuance | 52% | 57% | 54% |

|

Notes: Numbers may not add due to rounding. 1 Issuance subject to expenditure availability and market conditions. 2 Total issuance includes real-return bonds and ultra-long bonds and the Ukraine Sovereignty Bond. Sources: Bank of Canada; Department of Finance Canada calculations. |

|||

Treasury Bill Program

The Government of Canada will introduce, in May, a 1-month treasury bill as a new tenor for the domestic debt program to support the Canadian money market's transition from Bankers' Acceptances where issuance will be discontinued following the cessation of the Canadian Dollar Offered Rate (CDOR) in June 2024. Refinitiv Benchmark Services (UK) Limited currently publishes CDOR and will cease this publication as of June 2024.

As noted in the 2023 Fall Economic Statement, market participants expressed a desire for the 1-month treasury bill, at least temporarily, to support the Canadian money market during the transition.

The 1-month treasury bill will be introduced on a temporary basis. Continued issuance of 1-month treasury bills will be assessed and determined based on factors such as market need and efficiency as a funding tool for the Government of Canada.

2024-25 Bond Program

Annual gross bond issuance is planned to be $228 billion in 2024-25. Issuance has been increased across the curve particularly in the long-end of the curve (10-year and 30-year). The share of issuance in the longer tenor sectors as a proportion of total bond issuance is expected to increase to 33 per cent from 30 per cent in 2023‑24.

Issuance has been increased in the 10- and 30-year sectors to respond to requests from market participants, as was highlighted in the recent Debt Management Strategy consultations. The government remains committed to supporting liquidity across all bond sectors and promoting a well-functioning market across the entire yield curve.

Outlook for Public Debt Charges

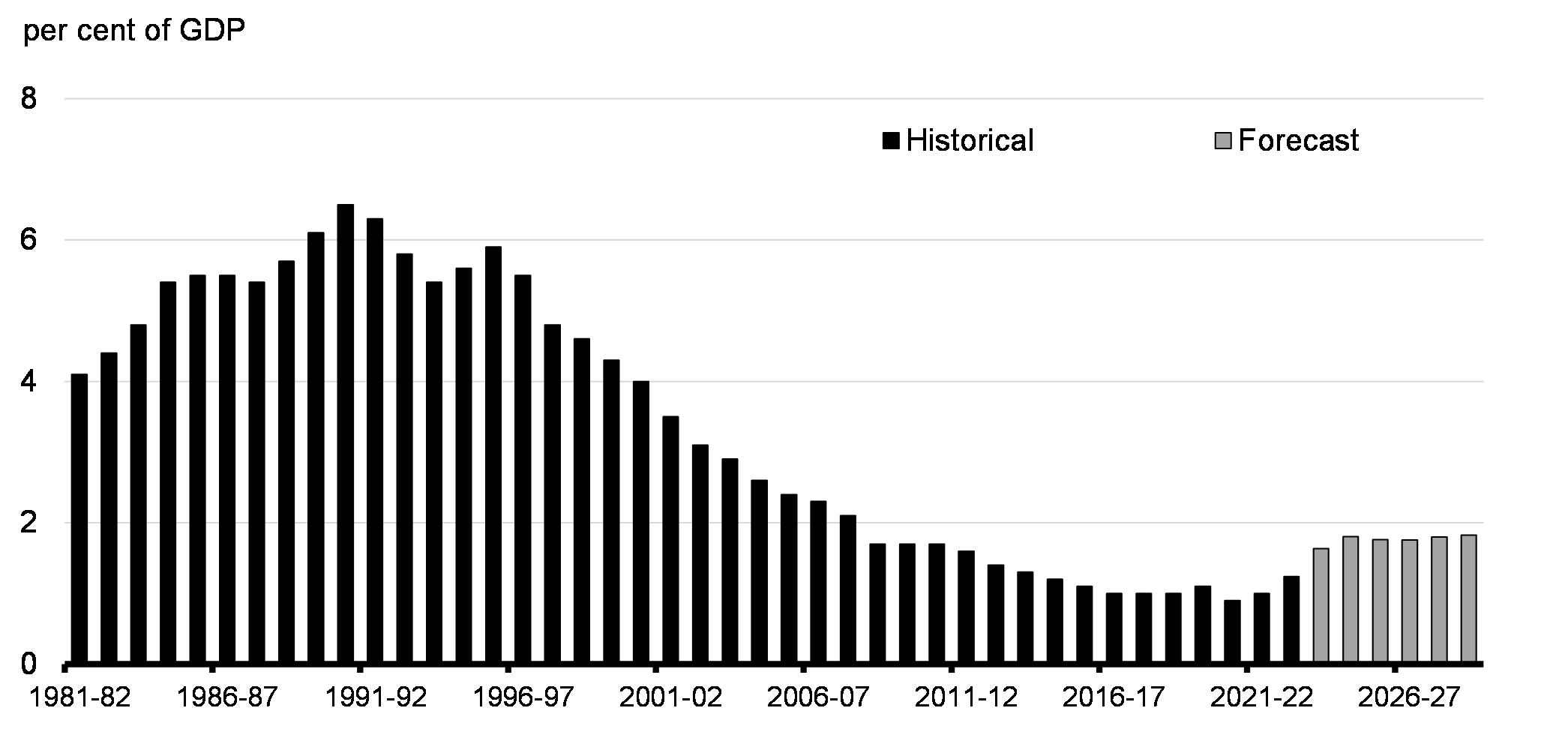

The government will continue to monitor public debt charges and is committed to maintaining stable and low debt servicing costs. The government now projects that public debt charges will amount to $54.1 billion in 2024-25, or 1.8 per cent of GDP. Over the next five years, the government projects that debt charges will remain stable as a percentage of GDP at around 1.8 per cent.

Despite the rise of interest rates since 2022, the government's debt charges as a share of GDP have only increased slightly relative to recent historical lows and remain well below the historical average over the past 40 years (Chart A2.1).

The stability of the debt charges as a percentage of GDP reflects the government's efforts over the past years to manage the debt program prudently in order to minimize debt servicing costs.

Public Debt Charges as a percentage of GDP, 1981-2029

Maturity Date Cycles and Benchmark Bond Target Range Sizes

For 2024-25, reflecting the lower allocation to treasury bills and higher allocation to bonds, benchmark target range sizes in the 5-year and 10-year sectors are higher relative to the levels announced in the 2023 Fall Economic Statement (Table A2.4).

| Feb. | Mar. | Apr. | May | June | Aug. | Sept. | Oct. | Nov. | Dec. | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2-year | 18-26 | 18-26 | 18-26 | 18-26 | ||||||

| 5-year | 26-34 | 26-34 | ||||||||

| 10-year | 26-34 | 26-34 | ||||||||

| 30-year | 20-30 | |||||||||

|

Source: Department of Finance Canada calculations. Note: These amounts do not include coupon payments. 1 Actual annual issuance may differ. |

||||||||||

Bond Auction Schedule

In 2024-25, there will be regular auctions of 2-, 5-, 10-, and 30-year bonds, with the number of planned auctions for each sector shown in Table A2.5. The actual number of auctions may be different from the planned number due to unexpected changes in borrowing requirements or shifts in market demand.

| Sector | Planned Auctions |

|---|---|

| 2-year | 16 |

| 5-year | 12 |

| 10-year | 12 |

| 30-year | 8 |

|

Source: Department of Finance Canada. |

|

The dates of each auction will continue to be announced through the Quarterly Bond Schedule, which is published on the Bank of Canada's website prior to the start of each quarter.

Green Bond Program

To support the growth of the sustainable finance market in Canada, in March 2022 the government launched the federal green bond program.

On February 27, 2024, the Government of Canada successfully issued a 10-year, $4 billion green bond — Canada's second green bond and the first under the updated Green Bond Framework, which includes certain nuclear energy expenditures. Canada is the first sovereign borrower to issue a green bond including certain nuclear expenditures, demonstrating Canada's commitment to being a global nuclear leader.

Canada's second green bond offering saw robust demand from environmentally and socially responsible investors who represented a majority of buyers (66 per cent), as well as from international investors, who made up over 33 per cent of the investor base. The final order book stood at over $7.4 billion.

Canada's green bond program is supporting the growth of the sustainable finance market in Canada, and around the world, and advancing Canada's investments in clean growth, renewable energy, climate action, and environmental protection. The government remains committed to regular green bond issuances.

Legislative Proposals to Support the Canada Mortgage Bond Program

In the 2023 Fall Economic Statement, the Government of Canada announced that, to help spur housing construction across the country, it would buy up to $30 billion of Canada Mortgage Bonds (CMBs). The government officially started these CMB purchases on February 14, 2024, and purchased a total of $7.5 billion CMBs in February and March 2024.

To support the purchases, two legislative amendments are being proposed through Budget 2024.

In the fall of 2023, the government increased the annual limit for Canada Mortgage Bonds from $40 billion to $60 billion, to unlock low-cost financing for multi-unit rental construction and help build up to 30,000 more rental apartments per year. To facilitate this and ensure the Canada Mortgage and Housing Corporation (CMHC) can continue to support multi-unit rental construction, Budget 2024 proposes to increase the insurance-in-force and guarantees-in-force legislative limits under the National Housing Act to $800 billion.

The Borrowing Authority Act specifies a maximum amount of borrowings that can be undertaken by the Government of Canada and agent Crown corporations. Under the Act, CMBs backed by the Government of Canada through CMHC and securities issued by the Government of Canada to purchase those CMBs both count towards the legislated maximum borrowing amount. This results in double-counting this exposure.

To address this double-counting issue, Budget 2024 proposes to amend the Borrowing Authority Act to deduct the amount of money borrowed by way of the issue and sale of Canada Mortgage Bonds that are guaranteed by CMHC and which have been purchased by the Minister of Finance, on behalf of the Government of Canada, from the calculation of the total amount specified in section 4.

Management of Canada's Official International Reserves

The Exchange Fund Account, managed by the Minister of Finance on behalf of the Government of Canada, represents the largest component of Canada's official international reserves. It is a portfolio of Canada's liquid foreign exchange reserves and special drawing rights (SDRs) available to aid in the control and protection of the external value of the Canadian dollar and as a source of liquidity to the government, if needed. In addition to the Exchange Fund Account, Canada's official international reserves include Canada's reserve position held at the International Monetary Fund.

The government borrows to invest in liquid reserves, which are maintained at a level at or above 3 per cent of GDP. Net funding requirements for 2024-25 are estimated to be around US$11 billion but may vary as a result of movements in foreign interest rates and exchange rates.

The mix of sources used to meet the net funding requirements for the year will depend on a number of considerations, including relative cost and market conditions. They include a short-term US-dollar paper program (Canada bills), medium-term notes, cross-currency swaps involving the exchange of Canadian dollars for foreign currency to acquire liquid reserves, and the issuance of global bonds.

Canada's issuance of foreign currency denominated debt is used exclusively to fund official international reserves.

Further information on foreign currency funding and the foreign reserve assets is available in the Report on the Management of Canada's Official International Reserves and in The Fiscal Monitor.

Bond Buyback Programs

The government announced the resumption of the Government of Canada Cash Management Bond Buyback program in November 2022. This treasury management operation is intended to effectively manage Government of Canada cash flows ahead of large bond maturities.

The government plans to continue conducting cash management bond buybacks in 2024-25.

Cash Management

The core objective of cash management is to ensure that the government has sufficient cash available at all times to meet its operating requirements.

To effectively manage cash balances, the Government of Canada reintroduced morning Receiver General auctions on February 21, 2024.

At this time, the government's cash is on deposit with the Bank of Canada, including operational balances and balances held for prudential liquidity. Periodic updates on the liquidity position are available in The Fiscal Monitor.

Prudential Liquidity

The government holds liquid financial assets in the form of domestic cash deposits and foreign exchange reserves to safeguard its ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed. The government's overall liquidity levels are managed to normally cover at least one month of net projected cash flows, including coupon payments and debt refinancing needs.

Page details

- Date modified: