Archived - Part 1:

Finishing the Fight Against COVID-19

On this page:

Chapter 1:

Keeping Canadians Healthy and Safe

For over a year, Canadians have been living through the greatest global public health challenge of our lifetime. Across Canada, governments of all orders have worked tirelessly to prevent outbreaks and protect lives.

Since day one of this crisis, the government moved quickly to provide rapid support to Canadians. Whether with the Canada Emergency Response Benefit, the Canada Emergency Wage Subsidy, or the business support measures, these programs meant that people could stay home and stay safe. At the same time, the government secured the most vaccines per capita of any country, and ensured some of the toughest border rules in the world, including with the U.S., while keeping vital supplies moving. The government also supported domestic manufacturing, including of personal protective equipment, and started to restore bio-manufacturing capabilities that have not been in Canada for decades.

Canada took further action to close its borders, encourage Canadians to avoid non-essential travel, and put in place mandatory testing and quarantine orders, including hotel quarantine when waiting on testing results after arriving by air. Continually informed by the latest evidence and advice, these are some of the toughest border measures in the world. Keeping Canadians healthy and safe has been, and continues to be, the Government of Canada’s top priority.

Nothing is more important than saving lives and keeping Canadians safe. We have witnessed the devastation this virus brought to long-term care homes. And we have seen racialized Canadians and Indigenous communities face higher infection rates.

Nurses, doctors, personal support workers, emergency medical technicians, and other front-line workers have bravely treated patients, putting themselves at risk, and experiencing some of the highest infection rates.

Canadians have made great sacrifices to try to contain the virus. The isolation, stress, economic damage, and disruption to lives has taken its toll on mental health.

While we are in the midst of the virus’ third wave here in Canada, the rollout of safe and effective vaccines is a light at the end of what has been a long, dark tunnel.

The largest immunization campaign in Canada’s history is well underway. Canada is on track to meet the commitment that every Canadian who wants to will be fully vaccinated by September.

While finishing the fight, Canada must also learn lessons and take steps so it can be prepared for future threats. Rebuilding domestic bio-manufacturing capacity is a key part of this work. Better support and protections for our seniors, particularly those in long-term care facilities, is also essential. The past year has been difficult, but better days are ahead. Until then, the Government of Canada will do whatever it takes to keep Canadians safe.

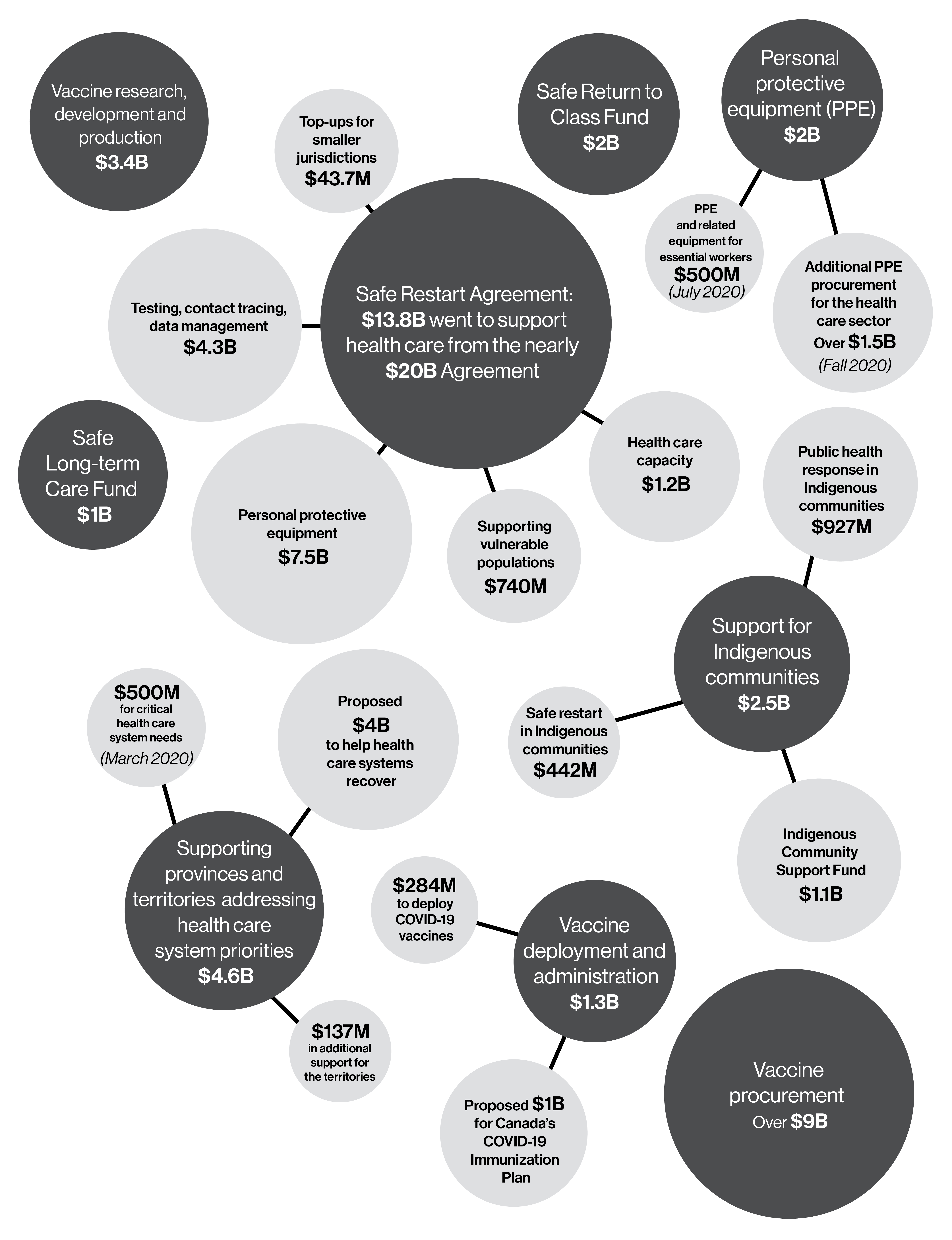

Major Federal Investments to Fight COVID-19*

1.1 Providing Access to Vaccines

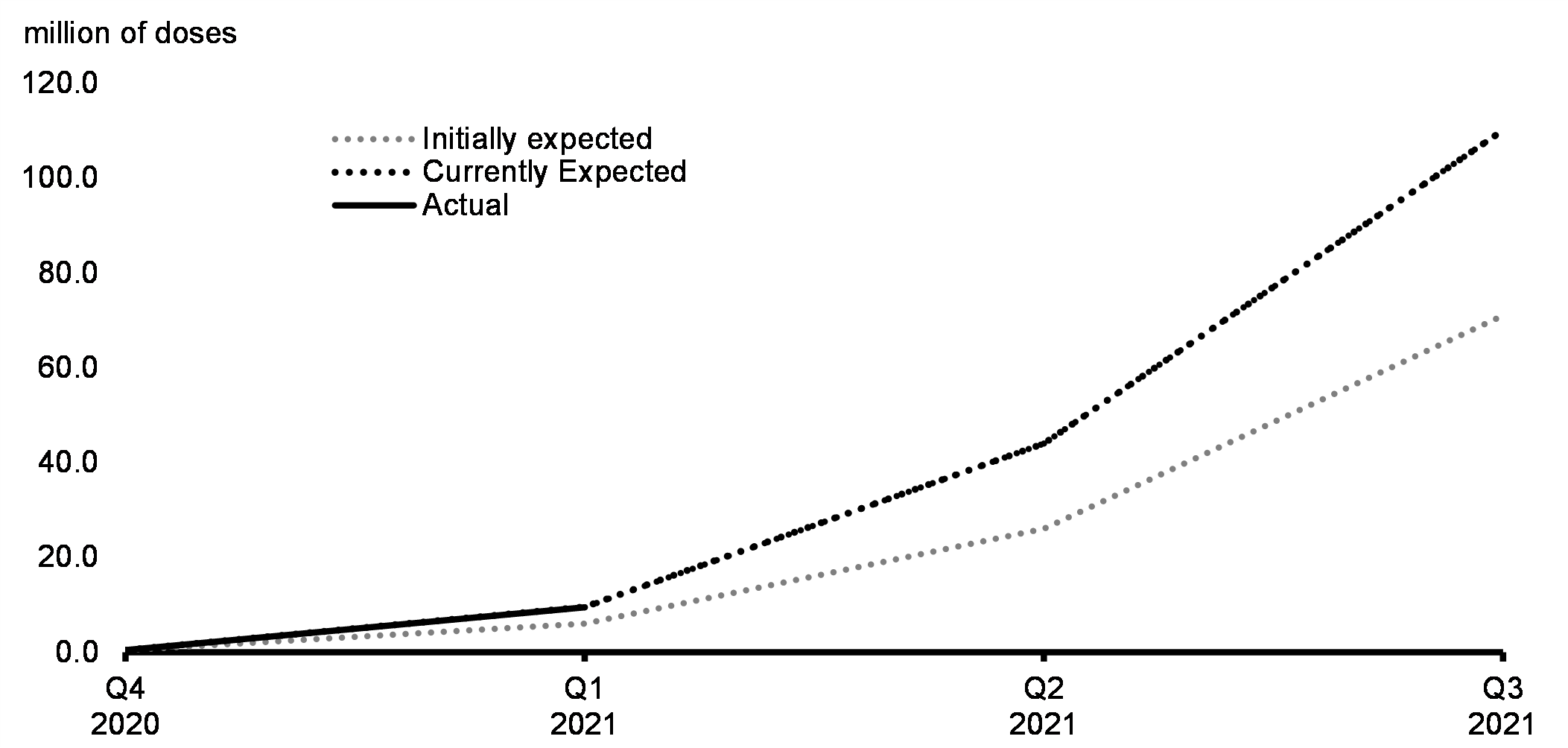

Canada has secured the most diverse portfolio of vaccines in the world. As vaccine programs accelerate across the country, the government is ensuring that provinces, territories, and Indigenous communities have the resources they need to deliver vaccine doses to people as quickly as possible. Canada is on track to meet the commitment that every Canadian who wants to will be fully vaccinated by September. As a result of the federal government's ongoing efforts to accelerate the delivery of COVID-19 vaccines, Canada received a total of 9.5 million doses by the end of March 2021, 3.5 million more than the initial target of 6 million doses. (Chart 1.1).

Expected Supply of Authorized Vaccines (Cumulative)

| Vaccines (Authorized by Health Canada) | Type of Vaccine | Number of Doses |

|---|---|---|

| Pfizer | mRNA | Up to 76 million |

| Moderna | mRNA | 44 million |

| AstraZeneca | Viral vector | 20 million |

| Verity Pharmaceuticals Canada/ Serum Institute of India (in collaboration with AstraZeneca Canada Inc) | Viral vector | 2 million |

| Janssen | Viral vector | Up to 38 million |

| Vaccines (Yet to be authorized by Health Canada) | ||

| Medicago | Virus-like particle | Up to 76 million |

| Novavax | Protein subunit | Up to 76 million |

| Sanofi and GlaxoSmithKline | Protein subunit | Up to 72 million |

| International | ||

| International COVAX Facility | - | Up to 15 million |

Canada’s COVID-19 Immunization Plan

The Government of Canada is covering the full cost of vaccines we procure, and ensuring they are free of charge to every person in Canada. On the rollout, the government is coordinating delivery with all provinces and territories, providing nationwide logistical support, warehousing services to supplement provincial and territorial capacity, and providing support for vaccine rollout campaigns. In addition, the Canadian Armed Forces are assisting with vaccination efforts in remote communities.

On March 25, 2021, the government tabled legislation in the House of Commons in order to provide a one-time payment of up to $1 billion to the provinces and territories, on an equal per capita basis, to help get shots into arms as quickly as possible.

Provinces and territories, with the support of municipalities, will be able to use this funding for a variety of vaccine-related costs, such as to recruit and train immunizers, establish mass vaccination clinics, set up mobile vaccination units, engage Indigenous communities to advance vaccine rollout, and reach vulnerable populations through community-based vaccination efforts.

International COVID-19 Response

To end this pandemic anywhere, we have to end it everywhere. Canada is part of the robust global pandemic response and has committed more than $2 billion, to date, to international efforts to fight and address the impacts of the virus. Canada is a founding member of the Access to COVID-19 Tools (ACT) Accelerator and the COVID-19 Vaccines Global Access Facility (COVAX), and plays a major role within the Advance Market Commitment initiative.

To ensure we prevail in the global fight against COVID-19:

-

Budget 2021 proposes to provide up to $375 million, in 2021-22, to Global

Affairs Canada to support Canada’s international COVID-19 response, with a focus on addressing the

health needs of developing countries. This would facilitate the world’s poorest countries to access

the tools necessary to help contain the spread of COVID-19.

Gender-Based Analysis+

Gender-Based Analysis+

1.2 Protecting Our Seniors

The COVID-19 pandemic has been devastating for Canada’s seniors.

Many have spent the past thirteen months isolated from family and friends. For far too many seniors who live in long-term care, this year has been tragic; they have been the overwhelming casualties of this pandemic. Every senior in Canada deserves to live in dignity, safety, and comfort, regardless of which province or territory they call home.

It is essential that we protect the health and well-being of our seniors, and the personal support workers who care for them—many of whom are women, many of whom are racialized—through this difficult time and into the future.

The government is taking action, including through the $1 billion Safe Long-term Care Fund announced in the 2020 Fall Economic Statement, to ensure seniors, and those who help them, are well protected and well supported through the pandemic and for years to come.

Strengthening Long-term Care and Supportive Care

The pandemic has shone a light on systemic issues affecting long-term care facilities across the country. The government welcomes the news that the Heath Standards Organization and Canadian Standards Association are launching a process to help address those issues in Canada. The Health Standards Organization’s and Canadian Standards Association’s work with governments, stakeholders, and Canadians to develop national standards will help inform our ongoing discussions with provinces and territories on improving the quality of life of seniors in long-term care.

To protect seniors across Canada and build on this work:

-

Budget 2021 proposes to provide $3 billion over five years, starting in

2022-23, to Health Canada to support provinces and territories in ensuring standards for long-term

care are applied and permanent changes are made. To keep seniors safe and improve their quality of

life, the federal government will work collaboratively with provinces and territories, while

respecting their jurisdiction over health care, including long-term care. This work would ensure

seniors and those in care live in safe and dignified conditions.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $41.3 million over six years, and $7.7 million

ongoing, starting in 2021-22, for Statistics Canada to improve data infrastructure and data

collection on supportive care, primary care, and pharmaceuticals.

Gender-Based Analysis+

Gender-Based Analysis+

Helping Seniors Age Well at Home

After a lifetime of hard work, seniors want to live healthy, safe, and independent lives. Seniors want to stay at home, in the communities that support them, for as long as possible. But that can become difficult as they age. This leads to many vulnerable seniors transitioning to supportive care before they would otherwise need to if they were better supported at home. To look at new ways to support seniors in their homes for longer:

-

Budget 2021 proposes to provide $90 million over three years, starting in

2021-22, to Employment and Social Development Canada to launch the Age Well at Home initiative. Age

Well at Home would assist community-based organizations in providing practical support that helps

low-income and otherwise vulnerable seniors age in place, such as matching seniors with volunteers

who can help with meal preparations, home maintenance, daily errands, yard work, and transportation.

This initiative would also support regional and national projects that help expand services that

have already demonstrated results in helping seniors stay in their homes. For example, knowledge

hubs can help seniors access the local services available to them or provide information, resources,

and training to community-based organizations delivering practical supports to seniors.

Gender-Based Analysis+

Gender-Based Analysis+

The government is also proposing to increase Old Age Security for seniors 75 and over, beginning in 2022. Details are outlined in Chapter 7.

1.3 Strengthening Our Health System

Throughout the pandemic, public health officials, hospital administrators, and health care workers have worked hard to protect Canadians and save lives. But the pandemic has put health care under enormous strain.

The federal government is making investments to shore up public health systems so that they can continue to provide world-class care to Canadians throughout the COVID-19 pandemic.

Every year, the federal government provides significant support to provincial and territorial health care systems through the Canada Health Transfer. For 2021-22, this amounts to $43.1 billion. This is in addition to other supports for the health care system provided during the pandemic, such as procurement of vaccines and personal protective equipment, and more (see Figure 1.1).

Helping Our Health Care Systems Recover

In the fight against COVID-19, doctors and patients have deferred many procedures. Health care systems are facing substantial backlogs that require time and resources to clear. The federal government continues to support provinces and territories, including addressing urgent health care needs.

As announced in March 2021, the federal government is proposing to provide provinces and territories with $4 billion through a one-time top-up to the Canada Health Transfer. This will help health systems ensure Canadians get the procedures and treatments they need to stay healthy and clear through the backlog of delayed procedures. The government has been clear that it will be there to support provinces’ increasing health care needs in the long term, once we get through the COVID crisis.

Regulatory Cooperation with Trusted International Partners

The government is committed to enhancing Canada’s drug approval process by promoting alignment and collaboration with trusted regulators in other countries. Regulatory cooperation with trusted authorities will make accessing life-saving medicines faster and simpler, ensuring that safe and effective drugs are available to Canadians more quickly.

Renewing the Territorial Health Investment Fund

No matter where anyone lives in Canada, they should be confident that they have access to reliable, well-funded public health care. To support the territories in overcoming the challenges of delivering health care services in the North:

-

Budget 2021 proposes to provide $54 million over two years, starting in

2021-22, to renew the Territorial Health Investment Fund. Of this amount, $27 million would be

allocated to Nunavut, $12.8 million would be allocated to Yukon, and $14.2 million would be

allocated to the Northwest Territories.

Gender-Based Analysis+

Gender-Based Analysis+

1.4 Supporting Mental Health

Forty per cent of Canadians reported that their mental health deteriorated last year, and for those with pre-existing mental health conditions that number rose to 61 per cent.

Since 2015, the government has provided funding to the provinces and territories to improve mental health services, made significant investments to support Indigenous mental health services, and has launched innovative virtual mental health care tools throughout the pandemic.

The federal government understands that supporting mental health requires a comprehensive approach. The many investments the government is making to foster a strong and inclusive recovery recognize the social and economic factors of mental health, will support better mental well-being among all Canadians, and will complement investments to improve mental health services.

Budget 2021 Measures that Address the Social and Economic Factors of Mental Health

National Standards for Mental Health Services

Before the pandemic began, almost one in ten Canadians reported that their mental health care needs were not met. A set of clear national standards is needed so that Canadians can access timely care, treatment, and support. To move forward on establishing national mental health standards:

-

Budget 2021 proposes to provide $45 million over two years, starting in

2021-22, to Health Canada, the Public Health Agency of Canada, and the Canadian Institutes of Health

Research to help develop national mental health service standards, in collaboration with provinces

and territories, health organizations, and key stakeholders.

Gender-Based Analysis+

Gender-Based Analysis+

Supporting the Mental Health of Those Most Affected by COVID-19

Young people have seen the greatest decline in good mental health compared to pre-pandemic levels. Seven in ten health care workers reported worsening mental health during the pandemic. Sixty-four per cent of Indigenous people said their mental health had worsened. Racialized and Black Canadians can also face distinct challenges with mental health including structural racism and inequities in access to care.

To support populations most affected by COVID-19 in dealing with mental health challenges:

-

Budget 2021 proposes to provide $100 million over three years, starting in

2021-22, to the Public Health Agency of Canada to support projects for innovative mental health

interventions for populations disproportionately impacted by COVID 19, including health care

workers, front-line workers, youth, seniors, Indigenous people, and racialized and Black Canadians.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $50 million over two years, starting in

2021-22, to Health Canada to support a trauma and post-traumatic stress disorder (PTSD) stream of

mental health programming for populations at high risk of experiencing COVID-19 trauma and those

exposed to various trauma brought about by COVID-19.

Gender-Based Analysis+

Gender-Based Analysis+

Additional support for veterans’ mental health is outlined in Chapter 7. Investments to support mental health in First Nations, Inuit, and Métis Nation communities are outlined in Chapter 8.

Investing in the Wellness Together Canada Portal

In April of last year, the Government of Canada launched the Wellness Together Canada portal to provide Canadians with free access to live support, treatment, and credible information. Wellness Together Canada is available in all provinces and territories and to date over 1.1 million individuals have accessed the portal in over 3.5 million web sessions.

-

Budget 2021 proposes to provide $62 million, in 2021-22, to Health Canada for

the Wellness Together Canada portal so that it can continue to provide Canadians with tools and

services to support mental health and well-being.

Gender-Based Analysis+

Gender-Based Analysis+

Since 2015, the federal government has invested over $8 billion to provide Canadians with better mental health care services.

Past Investments in Mental Health Care

As part of the 2017 Agreements on Home Care and Mental Health, the federal government provided $5 billion over 10 years to provinces and territories to improve access to mental health and addiction services.

Over this period, nearly $1.9 billion has been invested to support Indigenous mental health services, including $1 billion in Budget 2021 (more details can be found in Chapter 8). These investments are on top of existing mental wellness programs as well as supports available under Jordan’s Principle for Indigenous youth and the Non-Insured Health Benefits Program.

Since the start of the pandemic, the government has invested nearly $250 million to develop virtual care and mental health tools and support the Kids Help Phone. Proposed funding would provide further support to the Wellness Together Canada portal.

Working Towards a New Crisis Hotline

The COVID-19 pandemic has exacerbated existing mental health challenges for Canadians and increased the number of Canadians in crisis. Making mental health services easier to access will have substantial benefits for Canadians and help save lives. The funding for the Kids Help Line that was initially provided in 2020-21 was extended into 2021-22 to ensure that it can continue to deliver counselling services to youth during the COVID-19 pandemic.

The Public Health Agency of Canada is continuing to work with the Centre for Addiction and Mental Health and partners to implement and sustain an expanded pan-Canadian suicide prevention service. Once fully implemented, people across Canada will have bilingual access to 24 hours a day, 7 days a week, crisis support using the technology of their choice: voice, text, or online chat.

The Canadian Radio-television and Telecommunications Commission is launching a regulatory proceeding to consult on a proposed three-digit hotline so Canadians have a memorable number they can call when they need help. The government is supportive of these efforts including ensuring funds are available to support the creation of this hotline.

Support for Canadians in Distress

In addition to the Wellness Together Canada portal (wellnesstogether.ca), if you or someone you know is in distress, call the Canada Suicide Prevention Service at 1-833-456-4566. Canadians aged 5 to 29 can call the Kids Help Phone at 1-800-668-6868.

Indigenous peoples can also reach out to Hope for Wellness at 1-855-242-3310.

1.5 Investing in Research and Science

A resilient and long-lasting recovery must include a plan for future pandemic preparedness. Strategic investments in cutting edge life sciences research and biotechnology is a critical part of that. These growing fields are not only critical to our safety, but are fast-growing sectors that support well-paying jobs and attract investment.

From the start of the pandemic, the government has funded and coordinated our biomedical and scientific response. From the National Microbiology Laboratory in Winnipeg, which leads dozens of COVID-19 response projects in its Level 4 labs; to investing in AbCellera in Vancouver, which helped create a leading antibody therapeutic; to Quebec City’s Medicago working to develop a leading vaccine candidate; to building the Biologics Manufacturing Centre at the National Research Council to manufacture vaccines, Canada has been building on its strengths to respond to this pandemic.

Raising the bar on our domestic life sciences and bio-manufacturing capacity will provide Canada with a more secure pipeline for vaccines in the future.

Strengthening Canada’s Bio-manufacturing and Life Sciences Sector

Growing Canada’s life sciences and bio-manufacturing sector is a priority that goes beyond responding to COVID-19. This is a growing sector that supports thousands of good, middle class jobs.

-

Budget 2021 proposes to provide a total $2.2 billion over seven years towards

growing a vibrant domestic life sciences sector. This support would provide foundational investments

to help build Canada’s talent pipeline and research systems, and support the growth of Canadian life

sciences firms, including:

- $500 million over four years, starting in 2021-22, for the Canada Foundation for Innovation to support the bio-science capital and infrastructure needs of post-secondary institutions and research hospitals.

- $250 million over four years, starting in 2021-22, for the federal research granting councils to create a new tri-council biomedical research fund.

- $92 million over four years, starting in 2021-22, for adMare to support company creation, scale up, and training activities in the life sciences sector.

- $59.2 million over three years, starting in 2021-22, for the Vaccine and Infectious Disease Organization to support the development of its vaccine candidates and expand its facility in Saskatoon.

- $45 million over three years, starting in 2022-23, to the Stem Cell Network to support stem cell and regenerative medicine research.

Gender-Based Analysis+

Gender-Based Analysis+

Several other initiatives proposed in Budget 2021 also include targeted support for the life sciences and bio-manufacturing sector. These measures form an important part of the government’s investment in the sector and include:

- $1 billion on a cash basis over seven years, starting in 2021-22, of support through the Strategic Innovation Fund would be targeted toward promising domestic life sciences and bio-manufacturing firms. This is a key component of the total investment in the Strategic Innovation Fund proposed in Chapter 4.

- $250 million over three years, starting in 2021-22, to increase clinical research capacity through a new Canadian Institutes of Health Research Clinical Trials Fund, as proposed in Chapter 4.

- $50 million on a cash basis over five years, starting in 2021-22, to create a life sciences stream in the Venture Capital Catalyst Initiative, as part of a larger venture capital investment proposed in Chapter 4.

These investments would be reinforced by other measures proposed in Budget 2021, including: the Pan-Canadian Genomics Strategy; the Pan-Canadian Artificial Intelligence Strategy; the expansion of the Industrial Research Assistance Program; support to help firms tap intellectual property expertise; efforts to upskill and attract workers; as well as the expansion of work-integrated learning opportunities. These investments offer support to firms at various stages of maturity, and allow Canada’s research and development efforts to be more closely connected to commercialization and business development supports. More details can be found in Chapters 3 and 4.

Action to Address Antimicrobial Resistance

The World Health Organization has declared that antimicrobial resistance is one of the top 10 global public health threats facing humanity. It occurs when bacteria, viruses, fungi, and parasites mutate and no longer respond to medicines. By 2050, it is estimated that as many as 396,000 lives in Canada could be lost to antimicrobial resistance if the phenomenon is not addressed.

-

Budget 2021 proposes to provide $28.6 million over five years, beginning in

2021-22, with $5.7 million per year ongoing, to the Public Health Agency of Canada, Health Canada,

and the Canadian Food Inspection Agency, to help address antimicrobial resistance. Investments would

support efforts to prevent the inappropriate use of antimicrobials and expand efforts to monitor the

emergence of antimicrobial resistance in Canada.

Gender-Based Analysis+

Gender-Based Analysis+

1.6 A Plan for the Safe Reopening of Our Borders

The government has implemented stringent travel restrictions and strict public health measures at border crossings and airports to slow the spread of COVID-19. At this time, the government continues to strongly advise against all non-essential travel.

Ahead of any reopening of borders, the government is working to improve the safety and efficiency of our borders so that Canada is ready for a strong and safe recovery.

Supporting Safe Air Travel

Air travel has declined sharply due to the COVID-19 pandemic. To facilitate the safe restart of air travel, when conditions allow, in a way that limits transmission of COVID-19 and protects travellers:

-

Budget 2021 proposes to provide $82.5 million in 2021-22 to Transport Canada to

support major Canadian airports in making investments in COVID-19 testing infrastructure.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to provide $105.3 million over five years, starting

in 2021-22, with $28.7 million in remaining amortization and $10.2 million per year ongoing to

Transport Canada to collaborate with international partners to further advance the Known Traveller

Digital Identity pilot project, which will test advanced technologies to facilitate touchless and

secure air travel.

Gender-Based Analysis+

Gender-Based Analysis+

To improve sanitization at screening checkpoints:

-

Budget 2021 proposes to provide $6.7 million in 2021-22 to the Canadian Air

Transport Security Authority to acquire and operate sanitization equipment.

Gender-Based Analysis+

Gender-Based Analysis+

These measures would help restore Canadians’ confidence in the safety of air travel when public health restrictions and border measures are adjusted and would support the recovery of Canada’s hard-hit air and tourism sectors, which so many Canadians rely on for their jobs and livelihoods.

Continuing to Protect Air Travellers

The Canadian Air Transport Security Authority (CATSA) plays a critical role in ensuring the safety of air travel by screening travellers and their baggage (as well as airport workers). CATSA has adopted additional screening practices, such as temperature checks at Canada’s busiest airports, to help prevent the transmission of COVID-19. To help protect air travellers:

-

Budget 2021 proposes to provide $271.1 million in 2021-22 to CATSA to maintain

operations and enhanced screening services at the 89 airports where it works.

Gender-Based Analysis+

Gender-Based Analysis+

Supporting Temporary Foreign Workers while they Quarantine

Approximately 4,000 Canadian employers in the farming, fish harvesting, and food production and processing sectors rely on temporary foreign workers each year to fill up to 60,000 jobs and address domestic labour shortages. These workers are important to ensure critical operations of the agriculture sector and help to safeguard Canadian food production. These workers must follow isolation requirements under the Quarantine Act, which is a cost for employers.

-

Budget 2021 proposes to provide $57.6 million in 2021-22 to extend the

Mandatory Isolation Support for Temporary Foreign Workers Program to help employers offset costs

associated with temporary foreign workers fulfilling isolation requirements upon entering Canada.

Support of up to $1,500 per worker would be provided to employers until June 15, 2021 for costs of

the 14-day isolation period. If workers are required to quarantine at a government approved

facility, due to a lack of suitable facilities at their employers' facilities, employers can receive

up to $2,000 per worker for costs associated with mandatory isolation requirements.

Gender-Based Analysis+

Gender-Based Analysis+

This program was launched to stabilize the labour market and the food supply chain and make sure there was food on the shelves for Canadians when the pandemic first hit. It also ensures that migrant workers do not unfairly carry the costs of their quarantine period.

-

After June 15, 2021, employers would receive $750 per worker until the

wind-down of the program on August 31, 2021. After August 31st, the government intends on

phasing-out this program and will consult with employers on the transition to ensure that migrant

workers are similarly compensated through their quarantine period by their employers.

Gender-Based Analysis+

Gender-Based Analysis+

Further measures that propose to reform the Temporary Foreign Worker Program can be found in Chapter 6.

| 2020– 2021 |

2021– 2022 |

2022– 2023 |

2023– 2024 |

2024– 2025 |

2025– 2026 |

Total | |

|---|---|---|---|---|---|---|---|

| 1.1. Providing Access to Vaccines | 1,000 | 375 | 0 | 0 | 0 | 0 | 1,375 |

| Canada’s COVID-19 Immunization Plan* | 1,000 | 0 | 0 | 0 | 0 | 0 | 1,000 |

| International COVID-19 Response | 0 | 375 | 0 | 0 | 0 | 0 | 375 |

| 1.2. Protecting Our Seniors | 0 | 17 | 639 | 653 | 609 | 607 | 2,525 |

| Strengthening Long-term Care and Supportive Care | 0 | 2 | 609 | 608 | 609 | 607 | 2,435 |

| Helping Seniors Age Well at Home | 0 | 15 | 30 | 45 | 0 | 0 | 90 |

| 1.3. Strengthening Our Health System | 4,000 | 27 | 27 | 0 | 0 | 0 | 4,054 |

| Helping our Health Care Systems Recover* | 4,000 | 0 | 0 | 0 | 0 | 0 | 4,000 |

| Renewing the Territorial Health Investment Fund | 0 | 27 | 27 | 0 | 0 | 0 | 54 |

| 1.4. Supporting Mental Health | 0 | 140 | 83 | 35 | 0 | 0 | 257 |

| National Standards for Mental Health Services | 0 | 48 | 48 | 0 | 0 | 0 | 95 |

| Supporting the Mental Health of Those Most Affected by COVID-19 | 0 | 30 | 35 | 35 | 0 | 0 | 100 |

| Investing in the Wellness Together Canada Portal | 0 | 62 | 0 | 0 | 0 | 0 | 62 |

| 1.5. Investing in Research and Science | 0 | 237 | 275 | 199 | 198 | 6 | 916 |

| Strengthening Canada's Bio-manufacturing and Life Sciences Sector | 0 | 251 | 297 | 206 | 192 | 0 | 946 |

|

Less: Funds Sourced From Existing Departmental Resources

|

0 | -15 | -29 | -14 | 0 | 0 | -59 |

| Action to Address Antimicrobial Resistance | 0 | 2 | 7 | 7 | 6 | 6 | 29 |

| 1.6. A Plan for the Safe Reopening of Our Borders | 0 | 424 | 10 | 10 | 39 | 39 | 523 |

| Supporting Safe Air Travel | 0 | 96 | 10 | 10 | 39 | 39 | 194 |

| Continuing to Protect Air Travellers | 0 | 271 | 0 | 0 | 0 | 0 | 271 |

| Supporting Temporary Foreign Workers while they Quarantine | 0 | 58 | 0 | 0 | 0 | 0 | 58 |

| Additional Investments – Protecting Canadians' Health | 0 | 9 | 0 | 0 | 0 | 0 | 9 |

| Maintaining Federal COVID-19 Digital Tools to Inform Canadians | 0 | 9 | 0 | 0 | 0 | 0 | 9 |

| Funding for Health Canada to ensure the continued availability of federal digital tools for COVID-19 that provide up-to-date information and valuable resources to Canadians throughout the pandemic, including the Canada COVID-19 mobile app and the federal COVID self-assessment tool. Together, these tools help Canadians and their families to stay informed about COVID-19. | |||||||

| Chapter 1 – Net Fiscal Impact | 5,000 | 1,229 | 1,033 | 897 | 847 | 652 | 9,658 |

| Note: Numbers may not add due to rounding. *Announced in March 2021. |

|||||||

Chapter 2 :

Seeing Canadians and Businesses Through to Recovery

In the face of the COVID-19 pandemic, the government acted swiftly to protect Canadians and support people and businesses, adapting as the pandemic evolved.

The government’s broad suite of support measures has helped families, protected jobs, and supported businesses across Canada. More than eight of every ten dollars spent to fight COVID-19 and support Canadians continues to come from the federal government.

| Federal | Provincial and Territorial | Total | |

|---|---|---|---|

| Impact ($ billions) | |||

| Direct Measures to Fight COVID-19 and Support People | 345.6 | 77.6 | 423.2 |

| Tax and Payment Deferrals | 85.1 | 31.5 | 116.6 |

| Credit Support | 81.9 | 2.6 | 84.5 |

| Total | 512.6 | 111.6 | 624.2 |

| Share of Spending (per cent) | |||

| Direct Measures to Fight COVID-19 and Support People | 81.7 | 18.3 | 100 |

| Tax and Payment Deferrals | 73.0 | 27.0 | 100 |

| Credit Support | 96.9 | 3.1 | 100 |

| Total | 82.1 | 17.9 | 100 |

| Notes: Provincial and territorial government announcements; Department of

Finance Canadacalculations. As of April 9, 2021. For federal totals, the data reflects the total impact which differs from fiscal cost on an accrual basis. Totals may not add due to rounding. |

|||

Thanks to Canadians’ hard work and sacrifice over the past year, these measures have worked effectively to stabilize the economy and prevent scarring. There have been early signs that we will have a robust recovery. So far, Canada’s economic rebound has outpaced forecasters’ expectations and compares favourably with that of peers. Canada saw record gains of about 40 per cent annualized real GDP in the third quarter of 2020, and 10 per cent annualized GDP growth in the fourth quarter, which was the second highest in the G7. Canada has also recovered about 90 per cent of jobs lost during the pandemic and is outpacing the United States in this respect, where less than two-thirds of lost jobs have been recouped.

Despite these encouraging signs, the virus remains a serious threat to Canadians. Public health restrictions are ongoing and new variants of COVID-19 make economic conditions uncertain for the months ahead.

Today, over half a million Canadians who had a job before the crisis are still out of work or working sharply reduced hours, worse than in the depths of the 2008 recession. Many businesses, particularly those that rely on close in-person contact or travel, continue to struggle.

The government will do whatever it takes to see Canadians through to recovery. To this end, the government has developed a framework to guide key decisions on how temporary programs such as the recovery benefits, the wage subsidy, and the rent subsidy are transitioned as we move from crisis to recovery. These economic support measures will remain in place without change until at least July 2021, after which they will begin a gradual but purposeful transition through the early fall.

This timing is based on continued progress in vaccine roll-out through the spring and early summer, and that by September, all Canadians who want to be vaccinated, will be fully vaccinated. Should there be a change in the course of the pandemic, the government will take a flexible approach to ensure that Canadians and Canadian businesses have the support they need.

The government recognizes that some harder-hit industries will require support beyond the fall, which is why Budget 2021 proposes a series of investments to continue supporting the hardest-hit workers and employers.

2.1 Protecting Jobs and Supporting Businesses

The economic situation remains uneven in different sectors across the country.

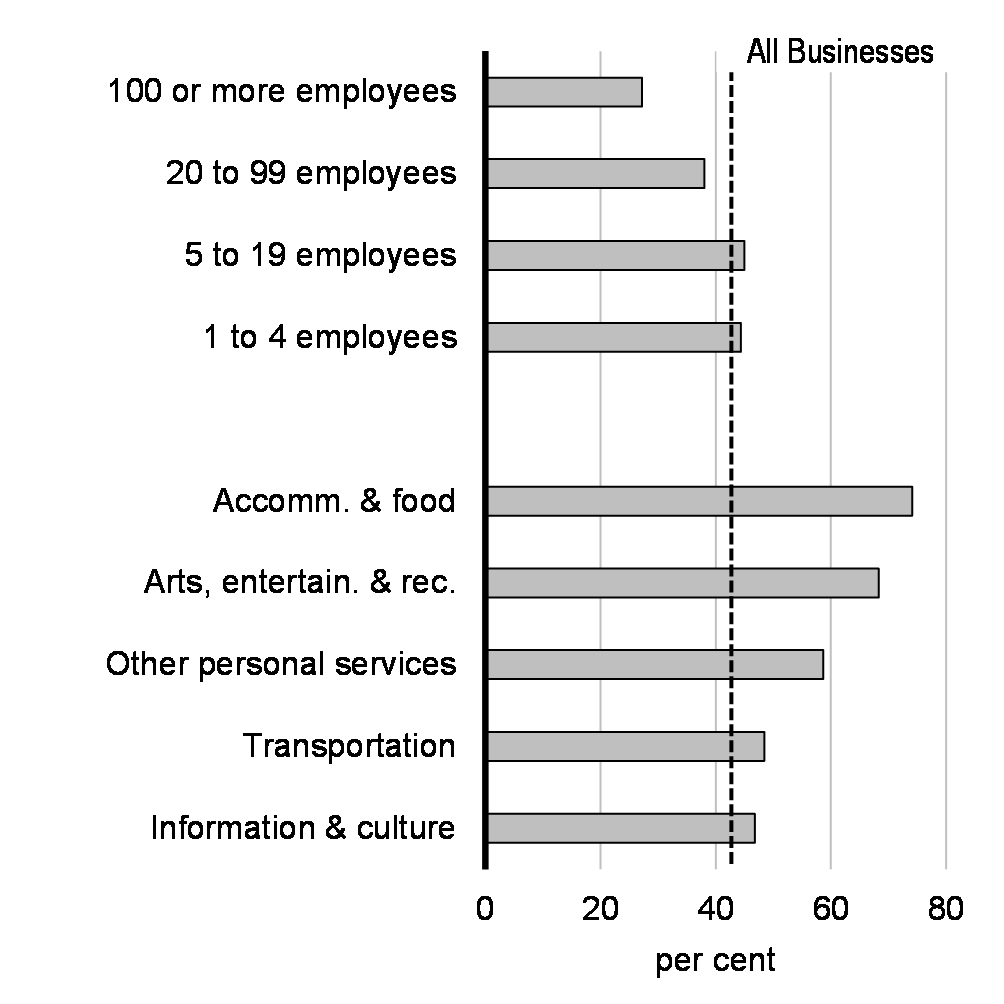

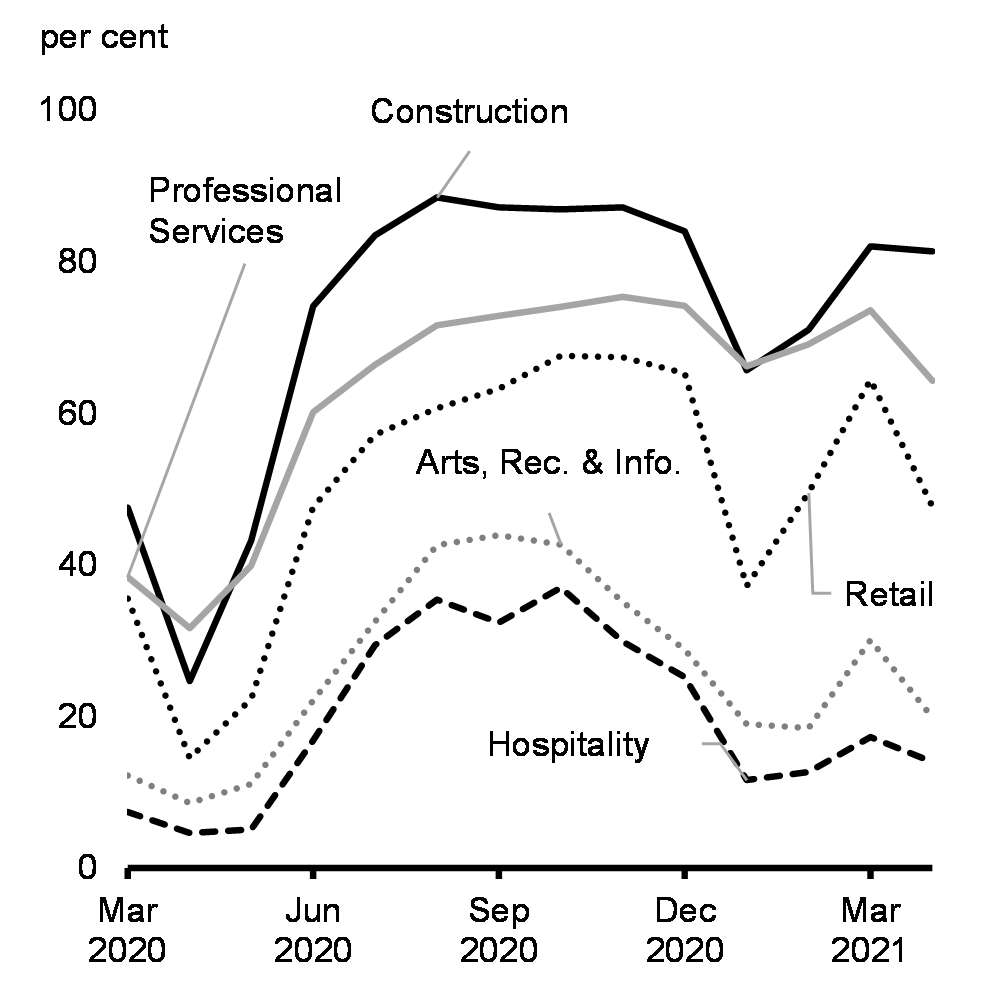

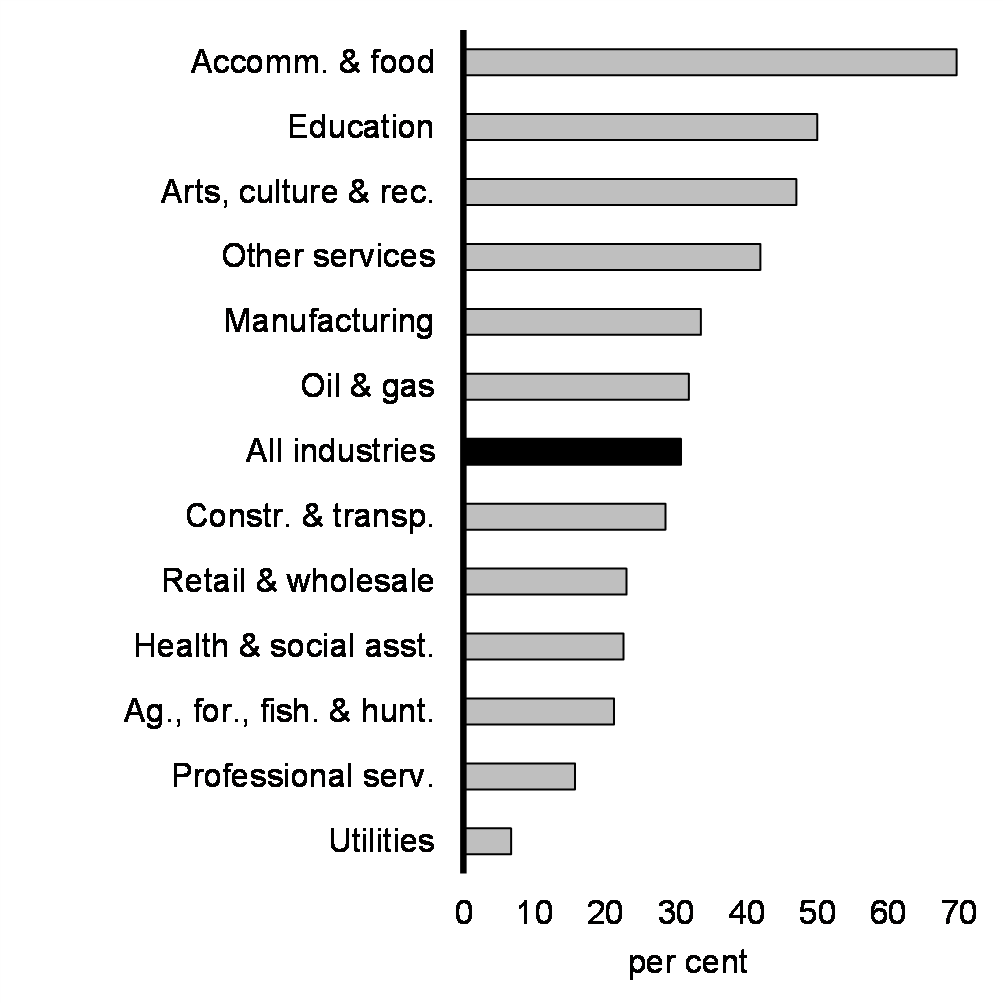

Close contact businesses, such as retail, restaurants, and performing arts face intermittent restrictions and weak demand as Canadians continue to stay home. These businesses, many of them small businesses, employ women, young people, and racialized Canadians in greater proportion—and they have faced severe and ongoing revenue declines (Chart 2.1). In sectors less affected by restrictions, such as professional services and construction, the number of fully open businesses has rebounded sharply (Chart 2.2).

Overall, business confidence is markedly up, buoyed by the prospect of mass vaccination and a gradual return to normal. But a complete recovery will take time.

Share of Businesses Losing at Least 20% of Revenue in 2020, by Firm Size and Selected Sectors

Share of Small Businesses Fully Open, Selected Industries

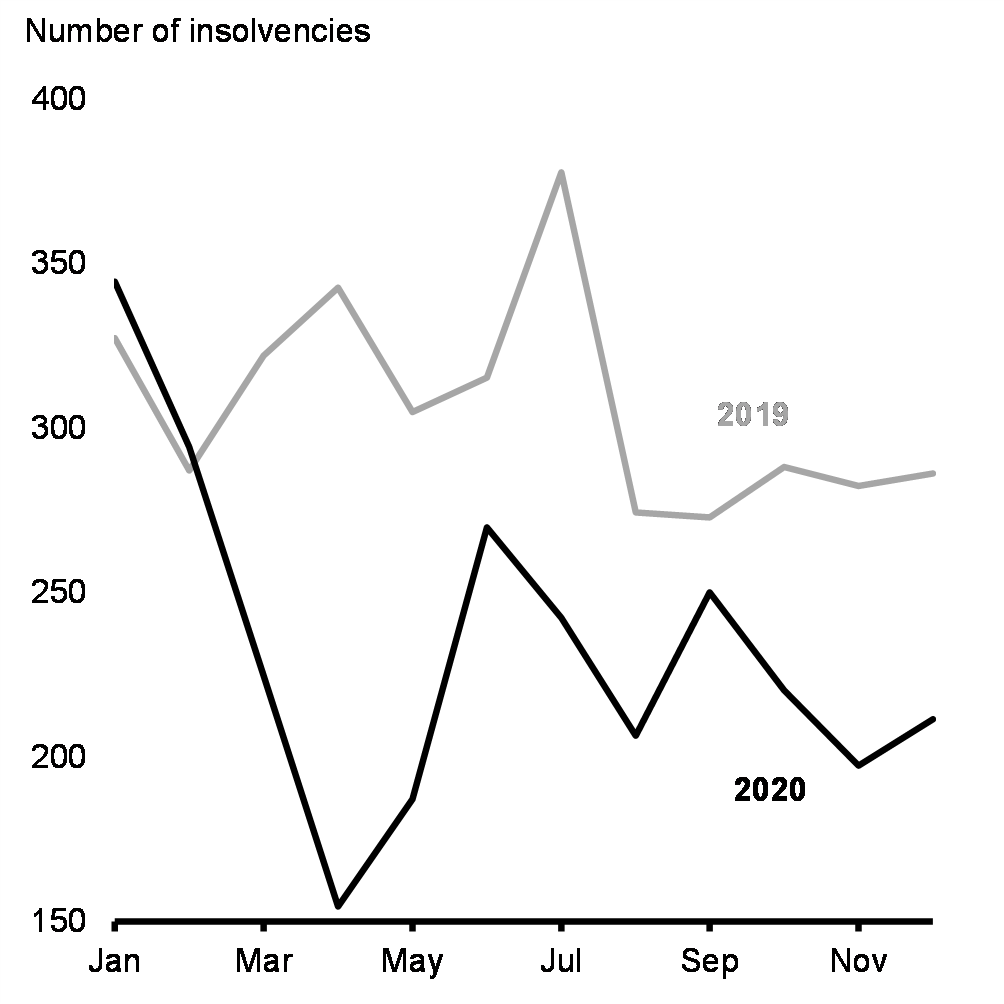

Federal support measures have protected jobs and helped limit the number of permanent business closings. By preventing scarring the government has made it easier for Canada to quickly rebound. The Canada Emergency Wage Subsidy has, at times, supported over a quarter of private sector employment, and an even higher share in some hard-hit industries like accommodation and food services (Chart 2.3). Business insolvencies have, so far, remained low and below historical levels (Chart 2.4).

Share of Private Sector Workers Covered by the Canada Emergency Wage Subsidy, by Industry, November 2020

Monthly Business Insolvencies

Extending the Canada Emergency Wage Subsidy

The Canada Emergency Wage Subsidy has helped more than 5.3 million Canadians keep their jobs and provided more than $73 billion in support to the Canadian economy.

The wage subsidy program is currently set to expire in June 2021. In order to bridge Canadians through the rest of this crisis to recovery, continued support is needed. To give workers and employers certainty and stability over the coming months:

-

Budget 2021 proposes to extend the wage subsidy until September 25, 2021. It

also proposes to gradually decrease the subsidy rate, beginning July 4, 2021, in order to ensure an

orderly phase-out of the program as vaccinations are completed and the economy reopens.

Gender-Based Analysis+

Gender-Based Analysis+

Extending this support will mean that millions of jobs will continue to be protected. In addition, the government is proposing to introduce the new Canada Recovery Hiring Program, outlined later in Chapter 4. This would provide an alternative support for businesses affected by the pandemic to help them hire more workers as the economy reopens. The hiring program would be in place from June until November 2021, allowing firms to shift from the Canada Emergency Wage Subsidy to this new support.

It is estimated that the extension of the wage subsidy will cost $10.1 billion in 2021-22.

The government will seek the legislative authority to have the ability to further extend the wage subsidy program through regulations until November 20, 2021, should the economic and public health situation require it beyond September 2021.

For more information, please see Annex 6.

Ensuring the Canada Emergency Wage Subsidy Supports Workers

The intention of the wage subsidy has always been to preserve and protect Canadians’ jobs. It was designed to do this by making sure employers who had suffered revenue declines during the pandemic had the support they needed to keep employees on the payroll and encourage them to re-hire laid off employees. Canadians expect businesses that use government support for their operations—especially at a time of widespread personal difficulty—to not increase the compensation of their top executives.

Any publicly listed corporation that decides to increase executive pay during this difficult time, while receiving taxpayer support, may have their wage subsidy funds clawed back.

-

Budget 2021 proposes to require that any publicly listed corporation receiving

the wage subsidy and found to be paying its top executives more in 2021 than in 2019 will need to

repay the equivalent in wage subsidy amounts received for any qualifying period starting after June

5, 2021 and until the end of the wage subsidy program.

Gender-Based Analysis+

Gender-Based Analysis+

This is in recognition that the program is meant to serve workers and that, during recovery, businesses boosting top executive pay have clearly demonstrated that they have the resources to support workers.

Extending the Canada Emergency Rent Subsidy and Lockdown Support

The Canada Emergency Rent Subsidy and Lockdown Support have helped more than 154,000 organizations with rent, mortgage, and other expenses. The rent subsidy provides eligible organizations with direct and easy-to-access rent support. Importantly, it is available directly to tenants. Lockdown Support provides organizations eligible for the rent subsidy with additional support if they are subject to a lockdown or must significantly restrict their activities under a public health order. To date, these measures have provided $2.6 billion in support to Canadian businesses.

The program is set to expire in June 2021. To bridge Canadians through the rest of this crisis to recovery, continued support is needed.

-

Budget 2021 proposes to extend the rent subsidy and Lockdown Support until

September 25, 2021. It also proposes to gradually decrease the rate of the rent subsidy, beginning

July 4, 2021, in order to ensure an orderly phase-out of this program as vaccinations are completed

and the economy reopens.

Gender-Based Analysis+

Gender-Based Analysis+

It is estimated the extension of the rent subsidy and Lockdown Support will cost $1.9 billion in 2021-22.

The government will seek the legislative authority to have the ability to extend further the program through regulations until November 20, 2021, should the economic and public health situation require further support beyond September 2021.

For more information, please see Annex 6.

Extending the Canada Emergency Business Account

The Canada Emergency Business Account (CEBA) has provided interest-free, partially forgivable loans to more than 850,000 Canadian small businesses. In December 2020, the government increased the value of the loan from $40,000 to $60,000 to help small businesses bridge to recovery. If a business repays their loans by December 31, 2022, up to a third of the value of their loans (meaning up to $20,000) will be forgiven. In further recognition of the ongoing pandemic, the government recently extended the application deadline for CEBA to June 30, 2021.

A small number of businesses have faced challenges accessing the program, including Indigenous and rural businesses. To make sure these businesses are not left behind, the government provides similar support through the Regional Relief and Recovery Fund and Indigenous Business Initiative. To make sure these businesses can continue to access support:

-

Budget 2021 proposes to extend the application deadline for similar support

under the Regional Relief and Recovery Fund and the Indigenous Business Initiative until June 30,

2021.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide up to $80 million in 2021-22, on a cash basis,

for the Community Futures Network of Canada and regional development agencies, and to shift

remaining funds under the Indigenous Business Initiative into 2021-22, to support an extended

application deadline for the Regional Relief and Recovery Fund and Indigenous Business Initiative

until June 30, 2021. This would support small businesses in rural communities so they can continue

to serve local populations.

Gender-Based Analysis+

Gender-Based Analysis+

2.2 Supporting Affected Workers

More than two and a half million Canadians have returned to work since the pandemic began, but the uneven and evolving public health environment means many workers continue to face challenges finding and keeping work. The virulent third wave of the virus and the unpredictable impact of new variants add to the uncertainty for Canadian workers.

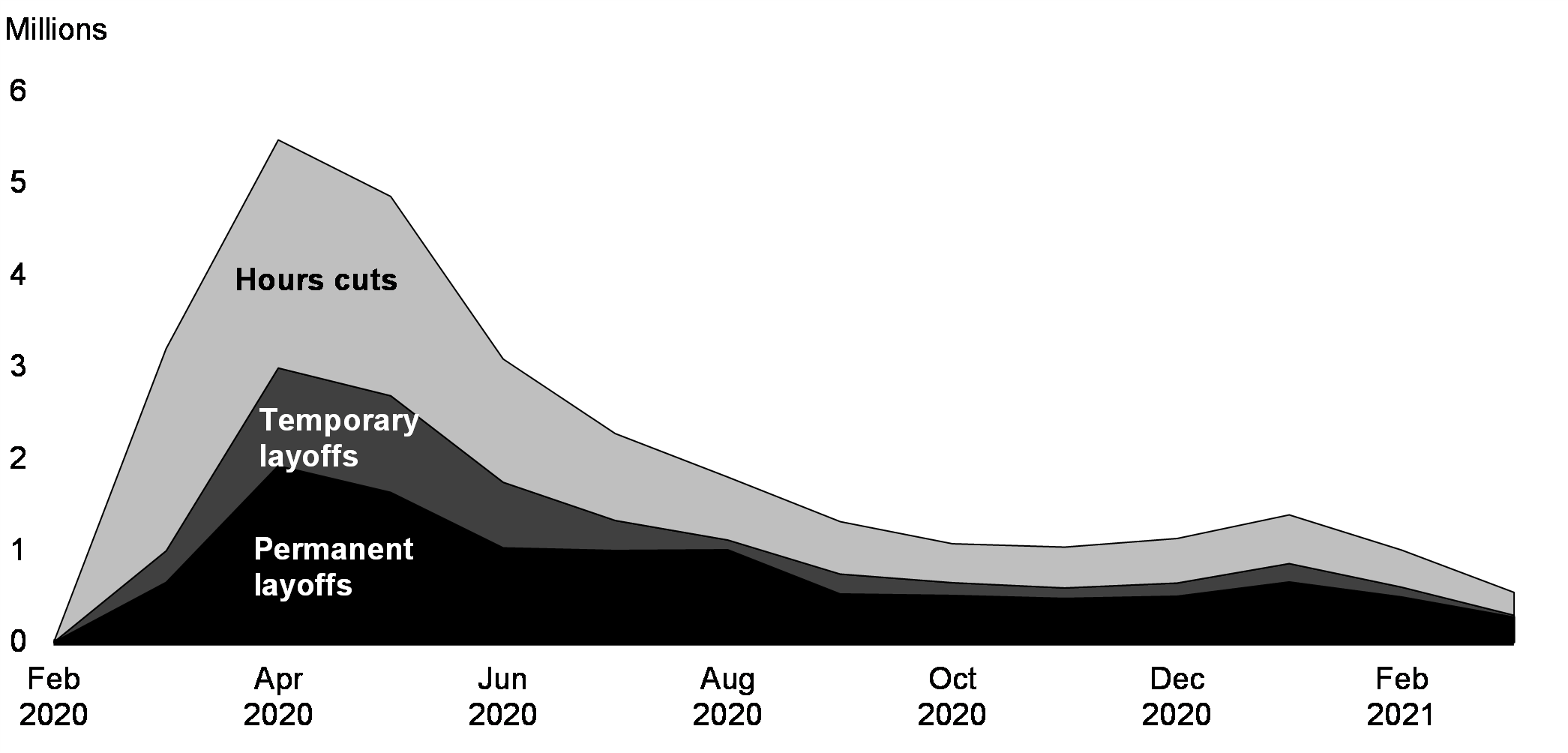

Some jobs lost during the pandemic may also be lost for good because businesses have found new ways to operate. That means that roughly half the Canadians out of work now may not be returning to their previous jobs when restrictions lift—they may have been permanently laid off (Chart 2.5). These workers are disproportionately women, young people, and racialized workers. If they are not supported, this could have long-term impacts on the economy’s potential, and, most importantly, on the livelihoods of people and their families.

Capable and willing workers are at risk of being underemployed, underpaid, or even withdrawing from the workforce entirely. Chapters 3 and 4 outline key measures the government is taking to help workers retrain, reskill, and re-establish their careers to help accelerate recovery and ensure all workers are brought along.

But until enough people are vaccinated and the economy reopens, withdrawing income support programs too rapidly would be counterproductive and costly.

Number of Canadians Laid off or Seeing Sharply Reduced Hours Since February 2020

Temporarily Waiving the One-week Waiting Period for Employment Insurance Claims

Last fall, the government made temporary changes to Employment Insurance (EI) to support Canadians during the pandemic. The changes have ensured that Canadians who continue to face challenges in finding and keeping work have the support they need.

In response to ongoing restrictions in many parts of the country this winter, the government announced that the waiting period would be waived for EI beneficiaries who establish a new claim between January 31, 2021, and September 25, 2021. This includes claims for regular, fishing, and special benefits. This temporary change allows people who apply for benefits to be paid their first week of unemployment, helping ease their financial stress.

Providing Additional Weeks of Recovery Benefits and EI Regular Benefits

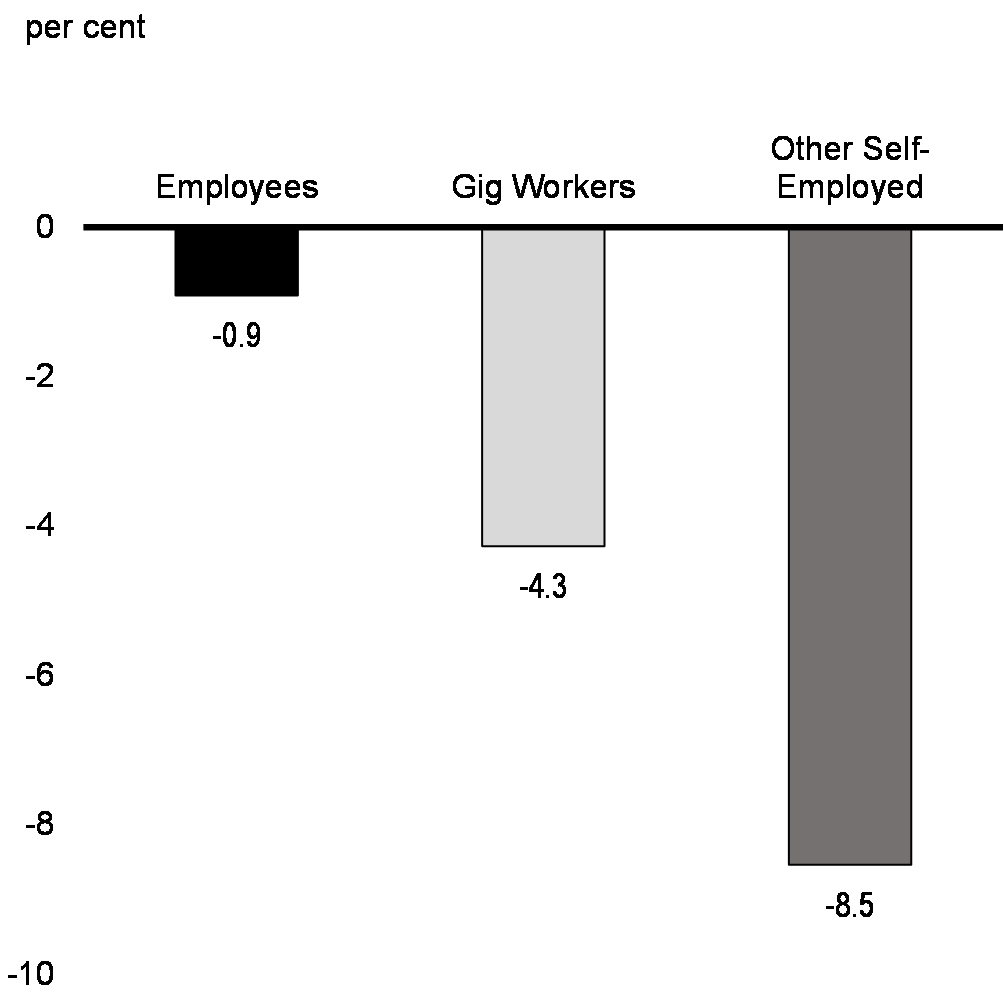

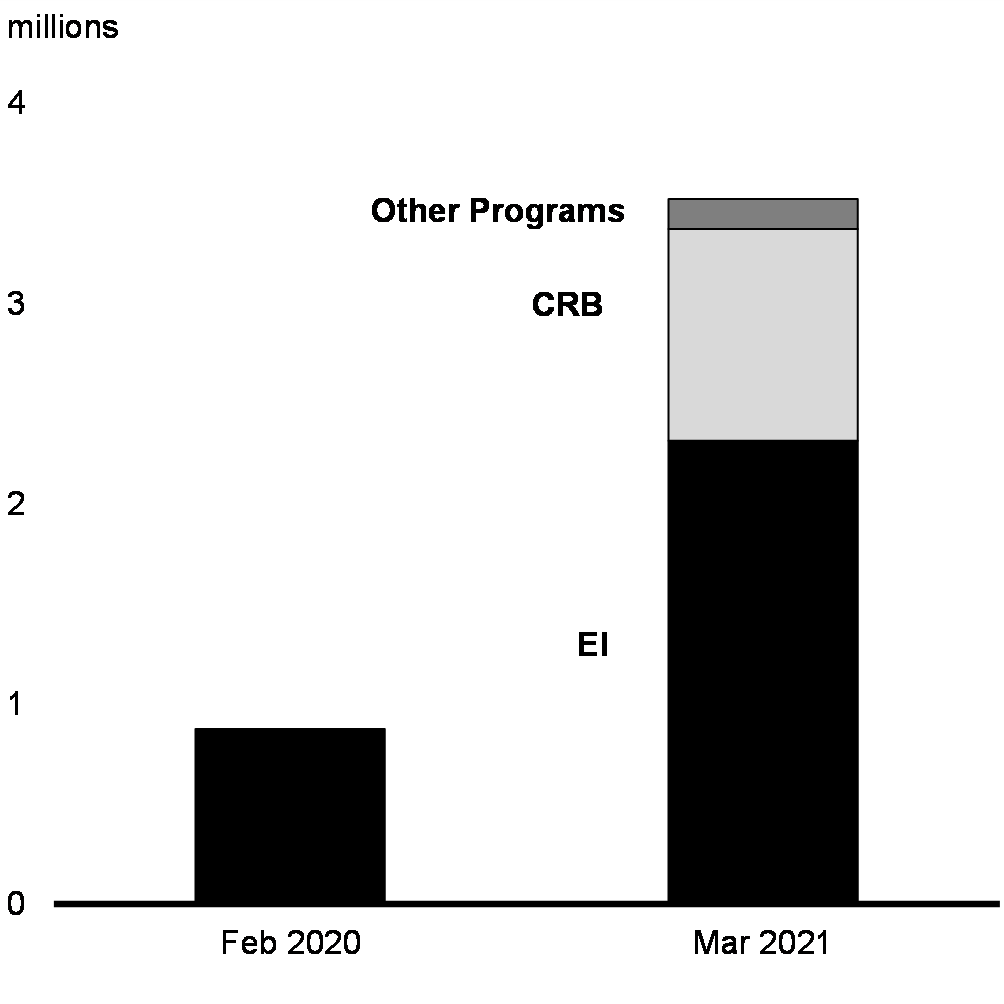

Despite temporary changes to the Employment Insurance system, the government recognized that certain workers who did not qualify for EI regular benefits needed support during the pandemic. These include self-employed workers, particularly gig workers, Canadians who have small amounts of part-time work, and those who cannot take jobs because the pandemic has forced them to shoulder greater-than-usual caregiving duties (Chart 2.6). After the creation of the Canada Emergency Response Benefit, which supported over 8 million Canadians, the government transitioned the support to a suite of new temporary benefits: the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit, and the Canada Recovery Sickness Benefit. In March 2021, about 3.5 million Canadians received income support through the recovery benefits and EI (Chart 2.7).

Change in Employment by Class of Worker, Feb 2020 to Mar 2021

Income Support Beneficiaries by Program

In February 2021, to ensure continued support for Canadians, the government increased the number of weeks available under the Canada Recovery Benefit and the Canada Recovery Caregiving Benefit by 12 weeks to a total of 38 weeks, the number of weeks available under the Canada Recovery Sickness Benefit from 2 weeks to 4 weeks, and the number of weeks of EI regular benefits available by 24 weeks up to a maximum of 50 weeks. These previously announced changes are expected to cost an estimated $12.1 billion over three years.

-

To continue to support workers through a transition away from emergency income

supports and position Canadians for the recovery, the government proposes to provide up to 12

additional weeks of Canada Recovery Benefit to a maximum of 50 weeks. The first four of these

additional 12 weeks will be paid at $500 per week. As the economy reopens over the coming months,

the government intends that the remaining 8 weeks of this extension will be paid at a lower amount

of $300 per week claimed. All new Canada Recovery Benefit claimants after July 17, 2021 would also

receive the $300 per week benefit, available up until September 25, 2021.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to extend the Canada Recovery Caregiving Benefit an

additional 4 weeks, to a maximum of 42 weeks, at $500 per week, in the event that caregiving

options, particularly for those supporting children, are not sufficiently available in the interim

as the economy begins to safely reopen.

Gender-Based Analysis+

Gender-Based Analysis+

It is estimated that the Budget 2021 extension of the Canada Recovery Benefit and the Canada Recovery Caregiving Benefit will cost $2.5 billion over two years, starting in 2021-22.

If additional flexibility is required based on public health considerations later this year, the government will continue to do whatever it takes to be there for Canadians. To ensure this flexibility:

-

Budget 2021 proposes legislative amendments to provide authority for additional

potential extensions of the Canada Recovery Benefit and its associated suite of sickness and

caregiving benefits, as well as regular EI benefits until no later than November 20, 2021, should

they be needed.

Gender-Based Analysis+

Gender-Based Analysis+

Maintaining Flexible Access to Employment Insurance Benefits

Following the end of the Canada Emergency Response Benefit last fall, over 3.3 million Canadians have accessed EI and $25.3 billion in benefits have been paid since.

As the economy reopens, the EI system must remain responsive to the needs of Canadians.

-

Budget 2021 proposes $3.9 billion over three years, starting in 2021 22, for a

suite of legislative changes to make EI more accessible and simple for Canadians over the coming

year while the job market begins to improve. The changes would:

- Maintain uniform access to EI benefits across all regions, including through a 420-hour entrance requirement for regular and special benefits, with a 14 week minimum entitlement for regular benefits, and a new common earnings threshold for fishing benefits.

- Support multiple job holders and those who switch jobs to improve their situation as the recovery firms up, by ensuring that all insurable hours and employment count towards a claimant’s eligibility, as long as the last job separation is found to be valid.

- Allow claimants to start receiving EI benefits sooner by simplifying rules around the treatment of severance, vacation pay, and other monies paid on separation.

- Extend the temporary enhancements to the Work-Sharing program such as the possibility to establish longer work-sharing agreements and a streamlined application process, which will continue to help employers and workers avoid layoffs.

Gender-Based Analysis+

Gender-Based Analysis+

As has been identified by the International Monetary Fund, the Organisation for Economic Co-operation and Development, and other experts, the pandemic has shown that Canada needs a more effective income support system for the 21st century. For this reason:

-

Budget 2021 announces forthcoming consultations on future, long-term reforms to

EI. To support this effort, the government proposes to provide $5 million over two years, starting

in 2021-22, to Employment and Social Development Canada to conduct targeted consultations with

Canadians, employers, and other stakeholders from across the country. Consultations will examine

systemic gaps exposed by COVID-19, such as the need for income support for self-employed and gig

workers; how best to support Canadians through different life events such as adoption; and how to

provide more consistent and reliable benefits to workers in seasonal industries. Any permanent

changes to further improve access to EI will be made following these consultations and once the

recovery is fully underway.

Gender-Based Analysis+

Gender-Based Analysis+

Extending Employment Insurance Sickness Benefits to Better Support Canadians Suffering From Illness or Injury

When Canadians are facing illness or injury, they should feel confident that they are supported and that their jobs are protected as they recover. However, for some Canadians, the 15 weeks of sickness benefits available under EI is simply not enough. Workers receiving cancer treatments or requiring a longer period to recover from an illness or injury can face a stressful income gap between the time they exhaust their EI sickness benefits and when they are healthy enough to return to work.

-

Budget 2021 proposes funding of $3.0 billion over five years, starting in

2021-22, and $966.9 million per year ongoing to enhance sickness benefits from 15 to 26 weeks, as

previously committed to in the Minister of Employment, Workforce Development and Disability

Inclusion’s mandate letter. This extension, which would take effect in summer 2022, would provide

approximately 169,000 Canadians every year with additional time and flexibility to recover and

return to work.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to make amendments to the Employment Insurance

Act, as well as corresponding changes to the Canada Labour Code to ensure that

workers in federally regulated industries have the job protection they need while receiving EI

sickness benefits.

Gender-Based Analysis+

Gender-Based Analysis+

The government also intends to launch consultations with employers, labour organizations and private insurers regarding improvements that may be required to the EI Premium Reduction Program. Under the Premium Reduction Program, employers who provide short-term disability plans to their employees can obtain a reduction in EI premiums.

Extending Temporary Support for Seasonal Workers Who Continue to be Affected by the Pandemic

Self-employed fishers and seasonal workers have shown incredible resilience throughout the COVID-19 pandemic. Federal income support has been a lifeline to approximately 20,000 fishers and thousands of seasonal workers since September, especially in Atlantic Canada. With restrictions ongoing and recovery only just underway, these Canadians continue to need support. To better support fishers and seasonal workers and ensure they do not lose access to needed financial support:

-

Budget 2021 proposes legislative changes to ensure that all self-employed

fishers who submit an Employment Insurance (EI) claim for the winter 2021 fishing benefit period are

treated equally, by extending temporary eligibility changes for the entire benefit period.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes legislative changes and funding of $99.9 million over

three years, starting in 2021-22, to extend the rules of an existing EI seasonal pilot project for

an additional year, until October 2022. The measure would provide up to 5 additional weeks of EI

regular benefits to seasonal claimants in 13 regions of Atlantic Canada, Quebec, and Yukon.

Gender-Based Analysis+

Gender-Based Analysis+

| 2020- 2021 |

2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

Total | |

|---|---|---|---|---|---|---|---|

| 2.1. Protecting Jobs and Supporting Businesses | -70 | 12,208 | 0 | 0 | 0 | 0 | 12,138 |

| Extending the Canada Emergency Wage Subsidy | 0 | 10,140 | 0 | 0 | 0 | 0 | 10,140 |

| Extending the Canada Emergency Rent Subsidy and the Lockdown Support | 0 | 1,920 | 0 | 0 | 0 | 0 | 1,920 |

| Extending the Application Deadline for CEBA Gap-Filling Programs | 0 | 148 | 0 | 0 | 0 | 0 | 148 |

|

Less: Funds Previously Provisioned in the Fiscal Framework

|

-70 | 0 | 0 | 0 | 0 | 0 | -70 |

| 2.2. Supporting Affected Workers | 312 | 14,622 | 4,195 | 1,006 | 662 | -683 | 20,112 |

| Temporarily Waiving the One-week Waiting Period for Employment Insurance Claims1 | 106 | 214 | 0 | 0 | 0 | 0 | 320 |

|

Less: Projected Revenues

|

0 | 0 | 0 | 0 | 0 | -36 | -36 |

| Providing Additional Weeks of Recovery Benefits and EI Regular Benefits2 | 206 | 9,596 | 2,207 | 109 | 0 | 0 | 12,118 |

|

Less: Projected Revenues

|

0 | 0 | 0 | 0 | 0 | -610 | -610 |

| Providing Additional Weeks of the Canada Recovery Benefit and Canada Recovery Caregiving Benefit | 0 | 2,449 | 27 | 0 | 0 | 0 | 2,476 |

| Maintaining Flexible Access to Employment Insurance Benefits | 0 | 2,364 | 1,898 | 864 | 866 | 915 | 6,906 |

|

Less: Funds Previously Provisioned in the Fiscal Framework

|

0 | -4 | 0 | 0 | 0 | 0 | -4 |

|

Less: Projected Revenues

|

0 | 0 | 0 | 0 | -204 | -941 | -1,145 |

| Extending Temporary Support for Seasonal Workers Who Continue to be Affected by the Pandemic | 0 | 4 | 63 | 33 | 0 | 0 | 100 |

|

Less: Projected Revenues

|

0 | 0 | 0 | 0 | 0 | -11 | -11 |

| Additional Investments – Seeing Canadians and Businesses Through to Recovery | 0 | 130 | 0 | 0 | 0 | 0 | 130 |

| Support to the Government of Quebec to align the Quebec Parental Insurance Plan with Temporary EI Changes | 0 | 130 | 0 | 0 | 0 | 0 | 130 |

| Budget 2021 proposes funding and a legislative change to support the Government of Quebec in ensuring that benefits offered under the Quebec Parental Insurance Plan reflect the temporary changes in place between September 2020 and September 2021 that have made Employment Insurance maternity and parental benefits more generous for some claimants. | |||||||

| Chapter 2 - Net Fiscal Impact | 242 | 26,960 | 4,195 | 1,006 | 662 | -683 | 32,380 |

| Note: Numbers may not add due to rounding. 1 Announced in January 2021 2 Announced in February 2021 |

|||||||

Report a problem on this page

- Date modified: