Archived - Part

2:

Creating Jobs and Growth

On this page:

Chapter 3:

New Opportunities for Canadians

In planning for Canada’s economic recovery, the government’s first order of business is to heal the specific wounds of the COVID-19 recession.

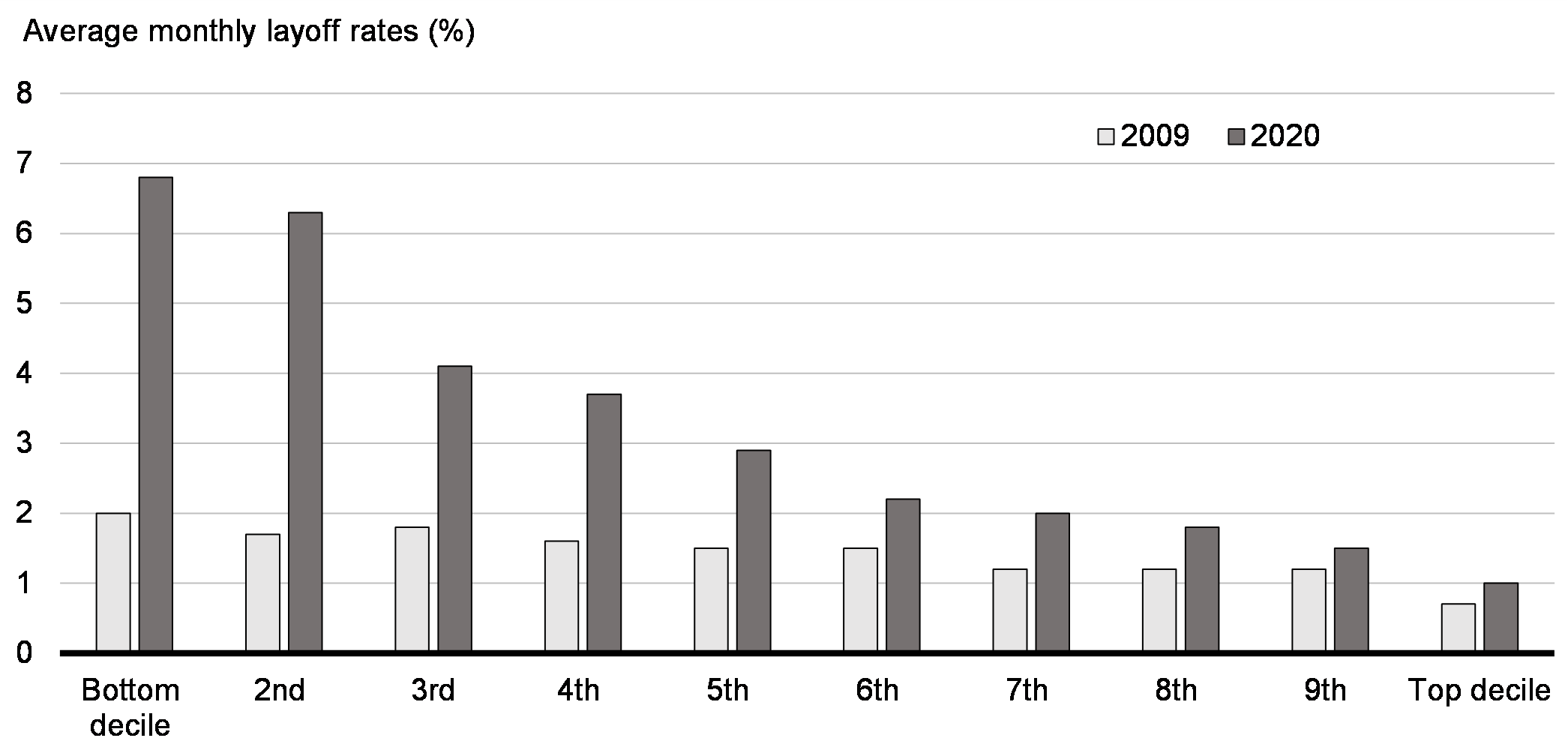

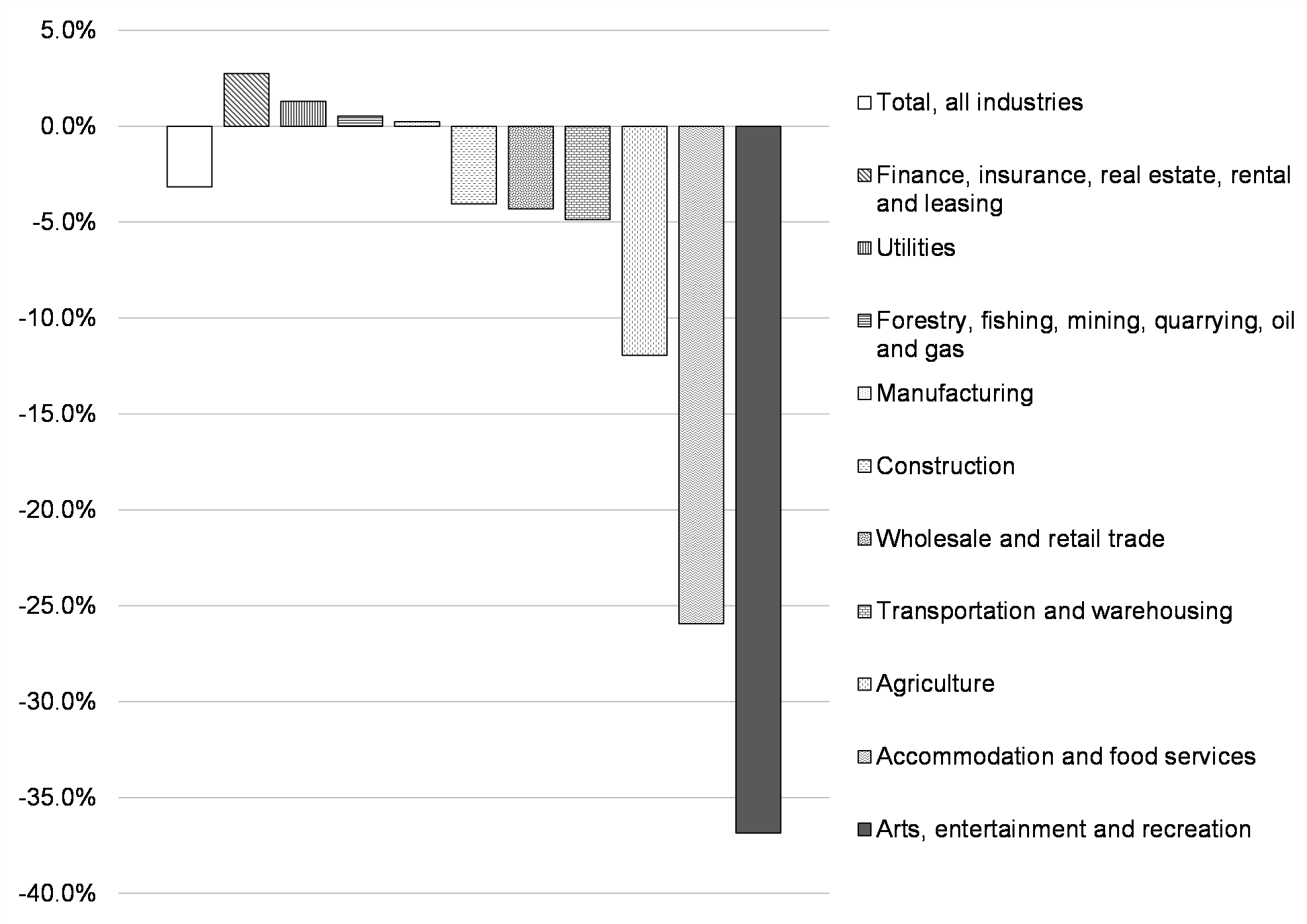

The impact has been even more uneven than previous recessions. Some sectors, many large businesses, and many wealthier Canadians have done quite well. They have managed to keep working during the pandemic, have absorbed the customers from locked-down small business competitors, and have seen their homes and other assets grow in value.

The COVID-19 recession has had its worst impact on many of the most vulnerable people in Canada—primarily low-wage workers, young people, racialized workers, and women. It has affected businesses that disproportionately employ these people.

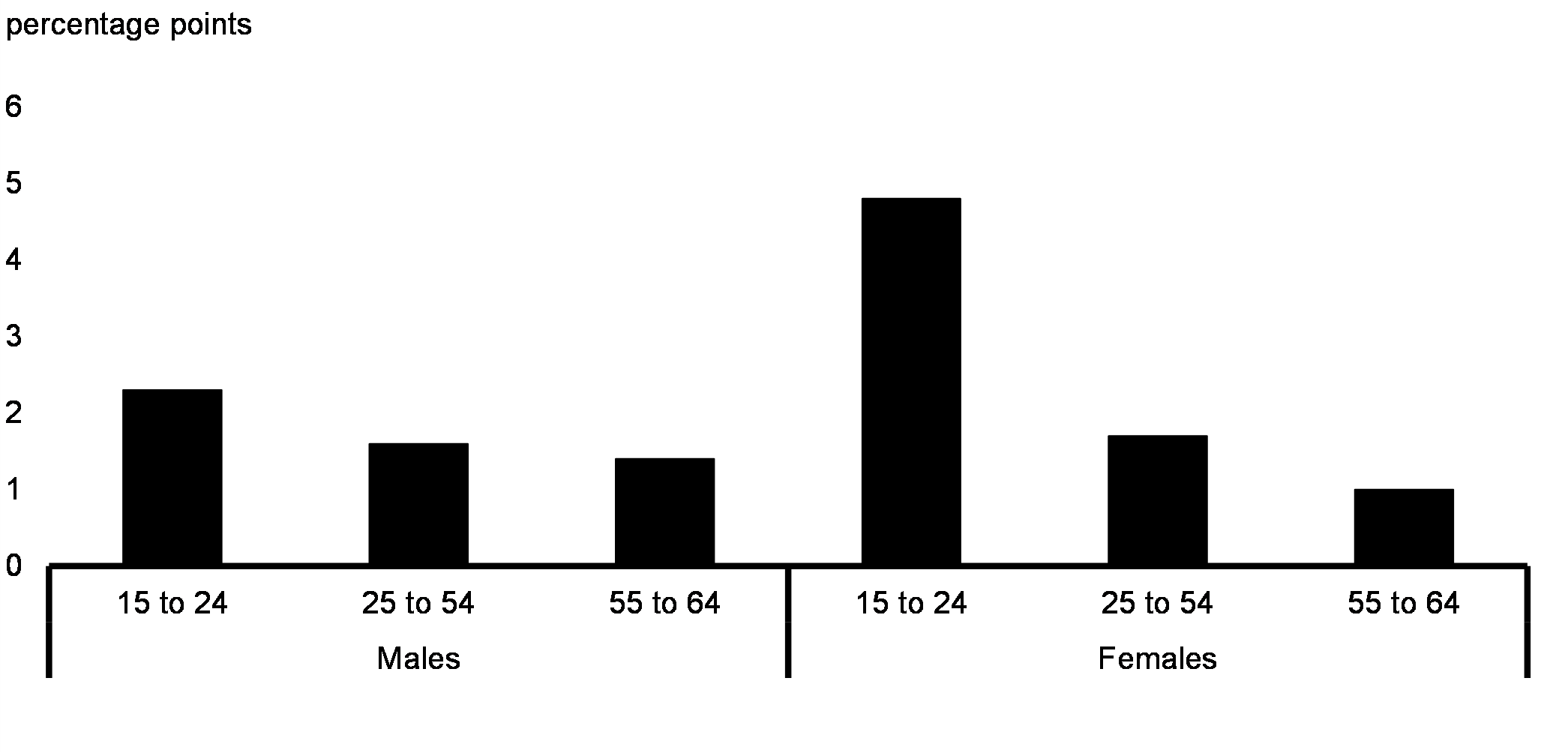

Change in the Unemployment Rate, by Age and Sex, February 2020 to March 2021

Today, about 296,000 people are still out of work, and 247,000 are facing sharply reduced work hours, and with that reduced wages, and reduced access to opportunities.

The labour market is a long way from recovery, with employment still well below pre-COVID levels. Low-wage workers, young people and women have borne the brunt of jobs losses.

Lessons from recessions of the past make it clear that a recovery that focuses on GDP alone is one that risks leaving people behind.

The government’s COVID-19 recovery plan puts people first. It is targeted at the groups that have been most affected, to make sure they are part of our recovery. It does so by making higher education more affordable and reducing the burden of student debt for more Canadians in need. It does so by improving conditions for workers struggling to make ends meet—or those trying to rejoin the workforce after a difficult time. It is about supporting the middle class and helping more people join the middle class.

In the 2020 Speech from the Throne, the Government of Canada launched a campaign to create over one million jobs, restoring employment to pre-pandemic levels including through historic investments in training that will skill up workers.

Budget 2021 will create almost 500,000 new job and training opportunities for workers over coming years—including 215,000 new opportunities for youth.

Most importantly, Budget 2021 makes a generational investment in a Canada-wide system of affordable child care.

3.1 Women in the Economy

COVID-19 has affected all Canadians, but women have been disproportionately affected.

In the labour market, women were hit earlier and harder, and their jobs continue to recover more slowly.

The closure of schools and child care centres has exacerbated work-life balance challenges for women as they have overwhelmingly borne the burdens of unpaid care work. This has made it more difficult for some women to work full time, for some to work at all, and for many women it has worsened their mental health.

For far too long, the work women do, paid and unpaid, has been systematically devalued by our economy and by our society. Long-standing gender inequities have only been amplified over the course of the pandemic—and it has put decades of hard-fought gains for women in the workplace at risk. Today, more than 16,000 women have dropped out of the labour force completely, while the male labour force has grown by 91,000. This is a she-cession.

Budget 2021 lays out an expansive jobs and growth plan that is very much a feminist plan. It seeks to build a recovery that gives all women in Canada the ability to fully participate in our economy.

The government recognizes the many different lived experiences of women—experiences shaped by racial identity, income level, disabilities, geography, and more. Budget 2021 seeks to build a recovery that acknowledges that many women start from a position of disadvantage in the workforce, in the demands placed upon them in the care economy, in their access to resources and capital as entrepreneurs, in their access to health care, and in the threat of violence they disproportionately face.

In March, the Government of Canada created a Task Force on Women in the Economy to help guide a robust, inclusive, and feminist recovery and to help address long-standing systemic barriers. Composed of a diverse group of experts and leading voices, the task force has begun advising the government on policies and measures to support women’s employment and address issues of gender equality in the wake of the pandemic. In particular, the task force has provided advice on early learning and child care, support for youth, and women who work in low-wage jobs. The members provide feedback with an intersectional lens that is instrumental in this budget and will continue to provide advice on the path forward.

The work of creating a more inclusive, sustainable, feminist, and resilient economy that values women’s work will take time. The government will continue its progress to build a feminist, intersectional Action Plan for Women in the Economy that will work to push past systemic barriers and inequities, for good. This will create an economy that works for everyone and build a stronger middle class.

A Canada-wide Early Learning and Child Care Plan

More than 50 years ago, the Royal Commission on the Status of Women in Canada called on the federal government to immediately begin working with provinces and territories to establish a national daycare plan. Generations of Canadians have waited for their government to answer this call.

The pandemic has made access to early learning and child care a universal issue that is resonating across sectors, regions, and income brackets. School and child care centre closures have been difficult for parents. Some have had to leave their jobs, or reduce their hours significantly. Without access to child care, parents cannot fully participate in our economy.

This is an economic issue as much as it is a social issue. Child care is essential social infrastructure. It is the care work that is the backbone of our economy. Just as roads and transit support our economic growth, so too does child care.

Investing in early learning and child care offers a jobs-and-growth hat trick: it provides jobs for workers, the majority of whom are women; it enables parents, particularly mothers, to reach their full economic potential; and it creates a generation of engaged and well prepared young learners.

Studies by Canadians Dr. Fraser Mustard and the Honourable Margaret McCain have shown that early learning is at least as important to lifelong development as elementary, secondary, and post-secondary education—it improves graduation rates, promotes lifelong well-being, boosts lifetime earnings, and increases social equity.

Benefits of Early Learning and Child Care for Children

Yet, early learning and child care can be more expensive than university tuition in some cities—something families have decades longer to save up for. The pandemic has shifted the public understanding of how access to child care supports children, their families, and our economy. The clear benefits of early learning and child care should not be a luxury for only the Canadian families that can afford it. Lack of access is not a choice, nor are unaffordable fees. The current system is leaving too many children and families behind, particularly low-income and racialized families. Every child deserves a fair start.

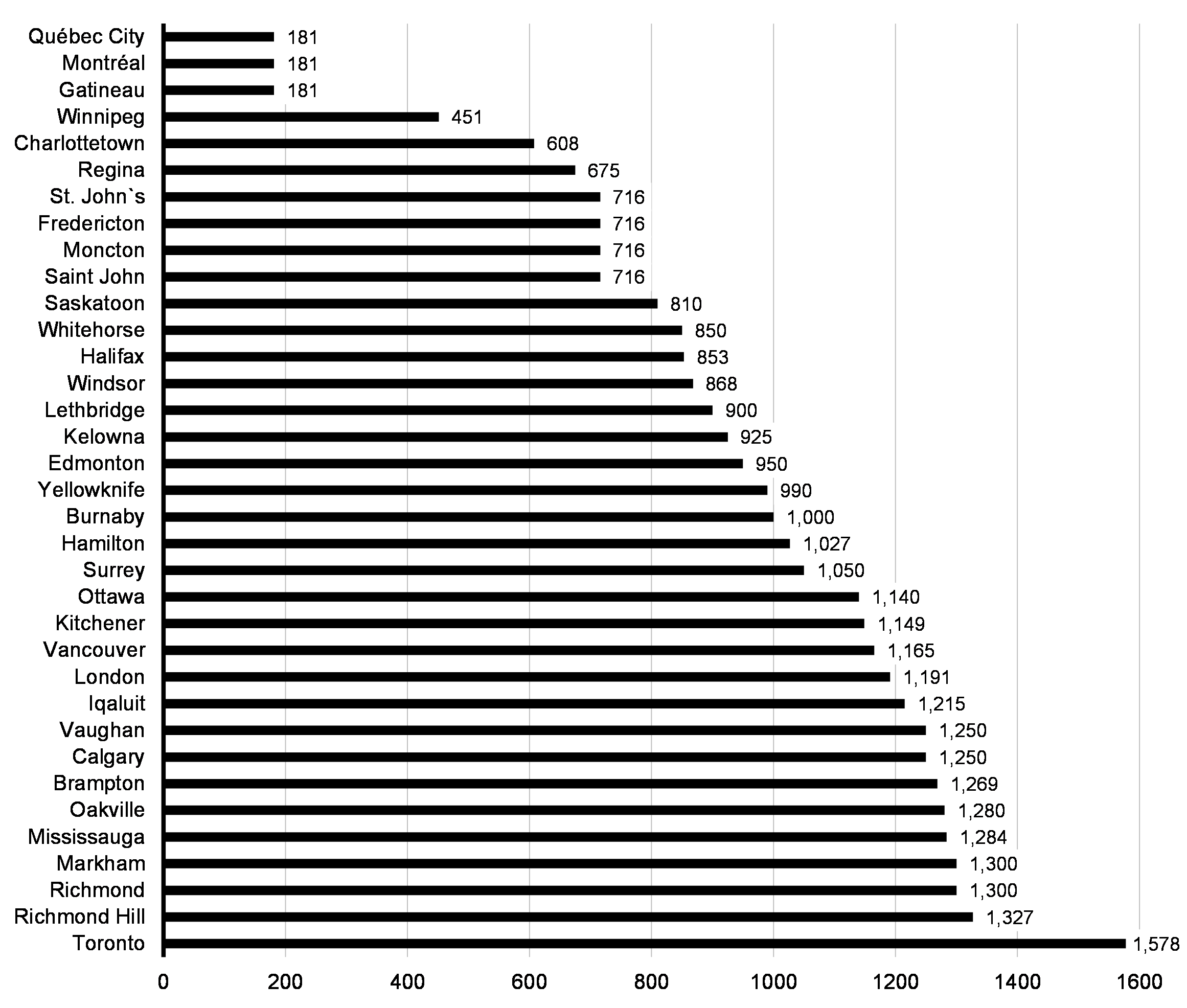

The high cost of child care—in some urban centres fees for one child can be as much as rent or mortgage payments—is a tax on a segment of the population that Canada requires to drive economic growth. Young families are juggling sky high housing costs, the increasing cost of living, expected to save up for their retirements, while managing child care fees.

Median Toddler Fees in 2020 (gross, monthly)

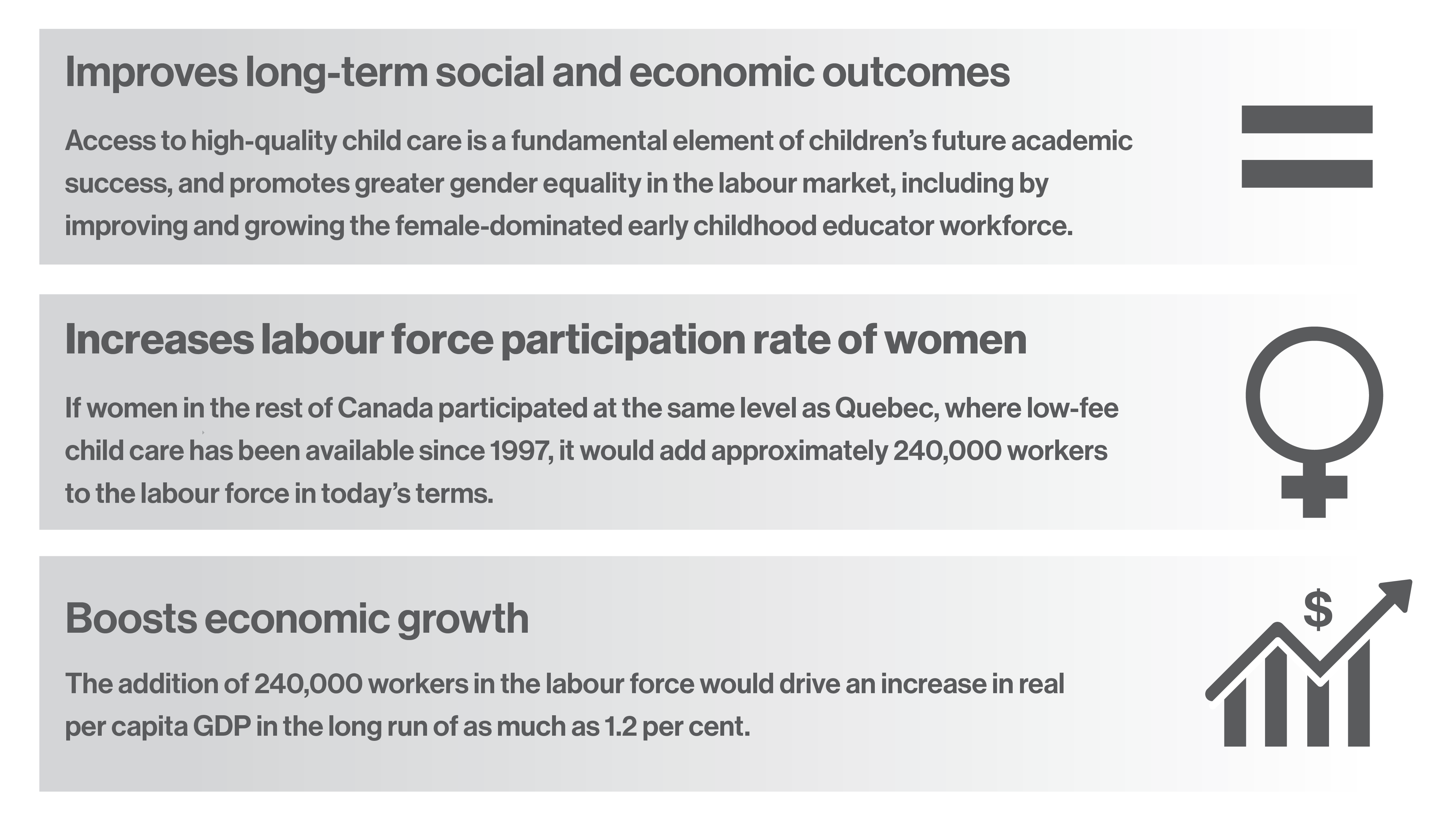

The very best example of the economic power of an affordable, well-run early learning and child care system is Quebec. At the time the Québec Educational Childcare Act was instituted in 1997, women’s labour force participation rate in Quebec was four percentage points lower than the rest of Canada. Today it is four points higher. And Quebec women with children under three have some of the highest employment rates in the world. Furthermore, studies show that child care alone has raised Quebec’s GDP by 1.7 per cent.

Furthermore, TD Economics has pointed to a range of studies that have shown that for every dollar spent on early childhood education, the broader economy receives between $1.50 and $2.80 in return.

Beyond the simple economic facts, it is also a question about the kind of Canada we want. Early learning and child care represents a chance for the country to offer each and every child the best start in life. It represents an equalizer, a way to build communities, a bold feminist policy, and the most effective step we can take to support our economy in the short, medium and long term. It is about making sure that everyone has the same access to opportunities, even from their youngest age.

It is time for the rest of Canada to learn from Quebec’s example. A Canada-wide early learning and child care plan is a plan to drive economic growth, a plan to secure women’s place in the workforce, and a plan to give every Canadian child the same head start. It is a plan to build an economy that is more productive, more competitive, and more dynamic. It is a plan to grow the middle class and help people working hard to join it.

The Dividends of Investing in Early Learning and Child Care

Establishing a Canada-Wide Early Learning and Child Care System

The federal government will work with provincial, territorial, and Indigenous partners to build a Canada-wide, community-based system of quality child care. This will be a transformative project on a scale with the work of previous generations of Canadians, who built a public school system and public health care. This is a legacy investment for today’s children who will not only benefit from, but also inherit this system.

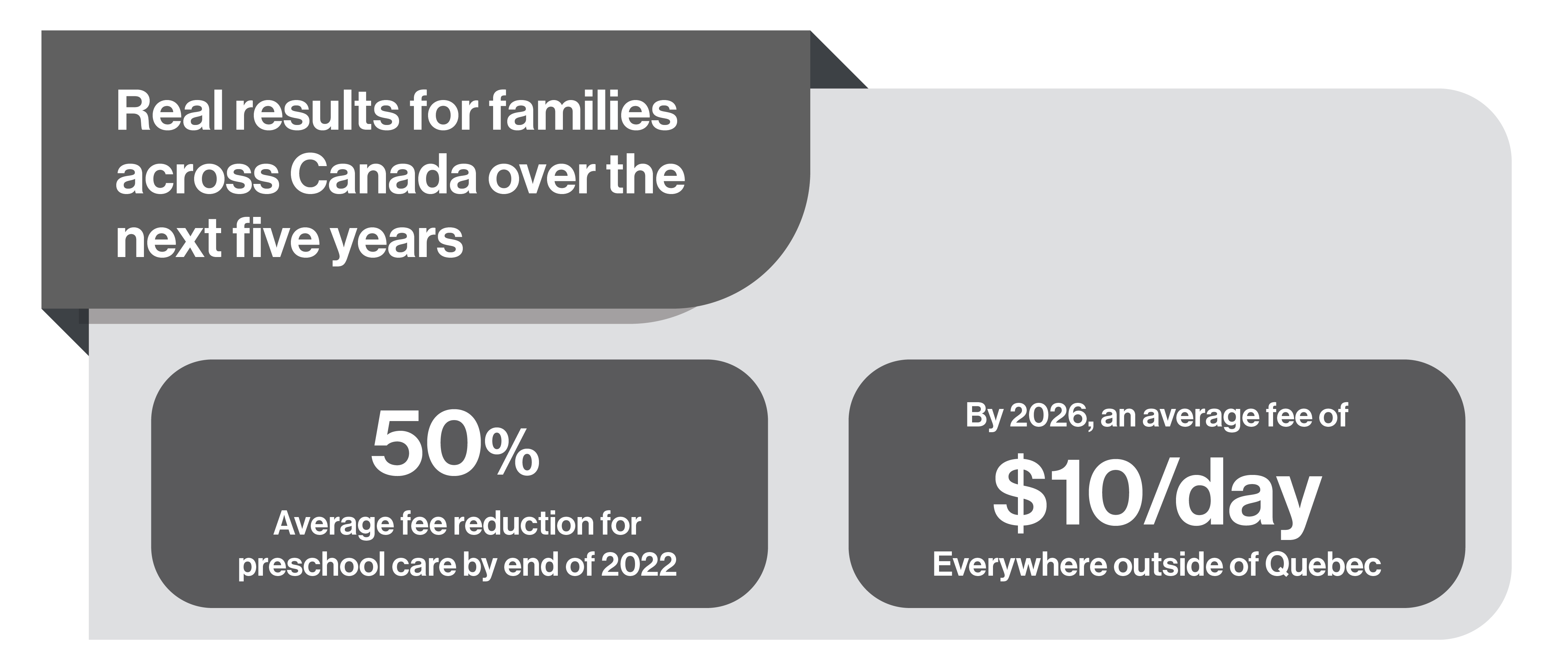

Just as public school provides children with quality education in their neighbourhoods, the government’s goal is to ensure that all families have access to high-quality, affordable and flexible early learning and child care no matter where they live. The government will also ensure that families in Canada are no longer burdened by high child care costs—with the goal of bringing fees for regulated child care down to $10 per day on average within the next five years. By the end of 2022, the government is aiming to achieve a 50 per cent reduction in average fees for regulated early learning and child care to make it more affordable for families. These targets would apply everywhere outside of Quebec, where prices are already affordable through its well-established system.

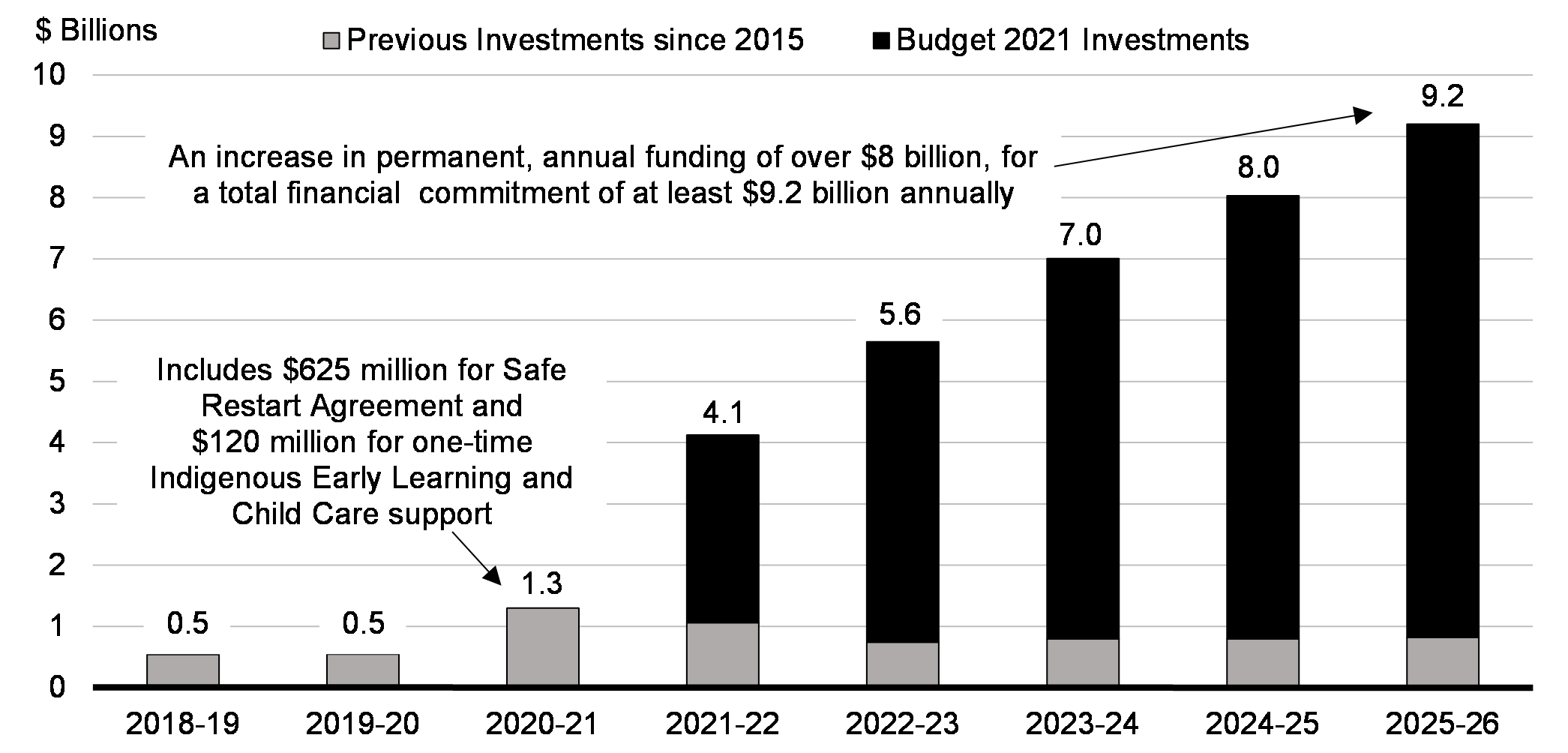

To support this vision, Budget 2021 proposes new investments totaling up to $30 billion over the next 5 years, and $8.3 billion ongoing for Early Learning and Child Care and Indigenous Early Learning and Child Care, as outlined below.

The government’s plan ensures that gains are secured for generations to come by making this historic commitment a lasting one, while also recognizing that building the quality system we want will take time.

Combined with previous investments announced since 2015, a minimum of $9.2 billion per year ongoing will be invested in child care, including Indigenous Early Learning and Child Care, starting in 2025-26.

A Historic, Permanent Federal Financial Commitment to Early Learning and Child Care

This once-in-a-generation transformation will take time and hard work from all orders of government—and that is why the next five years are focused on meaningful goals for families and setting the right foundations for success.

-

Up to $27.2 billion over five years, starting in 2021-22 will bring the federal

government to a 50/50 share of child care costs with provincial and territorial governments, as part

of initial 5-year agreements. Future objectives and distribution of funding, starting in year six,

would be determined based on an understanding of need and progress achieved as part of this initial

plan.

Gender-Based Analysis+

Gender-Based Analysis+

- A 50 per cent reduction in average fees for regulated early learning and child care in all provinces outside of Quebec, to be delivered before or by the end of 2022.

- An average of $10 a day by 2025-26 for all regulated child care spaces in Canada.

- Ongoing annual growth in quality affordable child care spaces across the country, building on the approximately 40,000 new spaces already created through previous federal investments.

- Meaningful progress in improving and expanding before- and after-school care in order to provide more flexibility for working parents.

- Working with provinces and territories to support primarily not-for-profit sector child care providers to grow quality spaces across the country while ensuring that families in all licensed spaces benefit from more affordable child care.

- A growing, qualified workforce—with provincial and territorial partners, the government will work to ensure that early childhood educators are at the heart of the system, by valuing their work and providing them with the training and development opportunities needed to support their growth and the growth of a quality system of child care. Over 95 per cent of child care workers are women, many of whom are making low wages, with a median wage of $19.20 per hour.

- A strong basis for accountability to Canadians—the government will work with provincial and territorial partners to build a strong baseline of common, publicly available data on which to measure progress, report to Canadians, and help continuously improve the system.

- Budget 2021 proposes to proceed with an asymmetrical agreement with the

province of Quebec that will allow for further improvements to their system, which the people of

Quebec are rightly proud of.

Gender-Based Analysis+

Gender-Based Analysis+ - To make immediate progress for children with disabilities, Budget 2021

proposes to provide $29.2 million over two years, starting in 2021-22, to Employment and Social

Development Canada through the Enabling Accessibility Fund to support child care centres as they

improve their physical accessibility. This funding, which could benefit over 400 child care

centres, would support improvements such as the construction of ramps and accessible doors,

washrooms, and play structures.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 builds on this framework, and on recent investments in the 2020

Fall Economic Statement, to continue the progress towards an early learning and child

care system that meets the needs of Indigenous families, wherever they live. A proposed

investment of $2.5 billion over the next five years in Indigenous Early Learning and Child Care

will include:

Gender-Based Analysis+

Gender-Based Analysis+

- $1.4 billion over five years, starting in 2021-22, and $385 million ongoing, to ensure that more Indigenous families have access to high-quality programming. Guided by Indigenous priorities and distinctions-based envelopes, this investment will build Indigenous governance capacity and allow providers to offer more flexible and full-time hours of care, build, train and retain a skilled workforce, and create up to 3,300 new spaces. This will include new investments in Aboriginal Head Start in Urban and Northern Communities.

- $515 million over five years, starting in 2021-22, and $112 million ongoing, to support before and after-school care for First Nations children on reserve.

- $264 million over four years, starting in 2022-23, and $24 million ongoing, to repair and renovate existing Indigenous early learning and child care centres, ensuring a safe and healthy environment for children and staff.

- $420 million over three years, starting in 2023-24, and $21 million ongoing, to build and maintain new centres in additional communities. The government will work with Indigenous partners to identify new infrastructure priorities.

- Building on recent investments in the 2020 Fall Economic Statement,

an additional $34.5 million over five years, starting in 2021-22, and $3.5 million ongoing,

would be provided to Employment and Social Development Canada to strengthen capacity within the

new Federal Secretariat on Early Learning and Child Care.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes a public consultation on measures that would adapt and

apply the Canada Business Corporations Act diversity requirements to federally

regulated financial institutions. This objective is to promote greater gender, racial, ethnic,

and Indigenous diversity among senior ranks of the financial sector and ensure more Canadians

have access to these opportunities. Details on the consultation will be announced in the near

future.

Gender-Based Analysis+

Gender-Based Analysis+ - The government proposes to introduce legislation that would extend the waiver

of interest accrual on Canada Student Loans and Canada Apprentice Loans until March 31, 2023.

This change has an estimated cost of $392.7 million in 2022-23.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to increase the threshold for repayment assistance to

$40,000 for borrowers living alone, so that nobody earning $40,000 per year or less will need to

make any payments on their student loans.

Gender-Based Analysis+

Gender-Based Analysis+

- This will support an estimated 121,000 additional Canadians with student loan debt each year.

- For students from larger households the threshold will be modified to match the Canada Student Grants. For example, for a household with four individuals, the 2020-21 Canada Student Grant cut-off is $63,735, which rises with inflation, while the current repayment assistance threshold is $59,508.

- Additionally, the cap on monthly student loan payments will be reduced from 20 per cent of household income to 10 per cent.

- To ensure that the eligibility for repayment assistance keeps pace with the cost of living, the new income cut-offs will be indexed to inflation.

- Beginning in 2022-23, these changes will cost an estimated $203.5 million over four years, and $64.2 million per year ongoing.

- The government is announcing its intention to extend the doubling of the

Canada Student Grants until the end of July 2023.

Gender-Based Analysis+

Gender-Based Analysis+ - The government is announcing its intention to extend disability supports

under the Canada Student Loans Program to recipients whose disabilities are persistent or

prolonged, but not necessarily permanent.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide $118.4 million over two years starting in

2021-22, for Employment and Social Development Canada to conduct a two-year pilot expansion of

federal investments in after-school programming under the Supports for Student Learning Program.

These funds would support national and local after-school organizations who work to ensure that

vulnerable children and youth can graduate high school and do not become further marginalized

because of the pandemic. Of this amount, $20 million will be reallocated from internal resources

within the department.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to invest $239.8 million in the Student Work Placement

Program in 2021-22 to support work-integrated learning opportunities for post-secondary

students. This funding would increase the wage subsidy available for employers to 75 per cent,

up to $7,500 per student, while also increasing employers’ ability to access the program. This

is expected to provide 50,000 young people (an increase of 20,000) with valuable

experience-building opportunities in 2021-22.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to invest $109.3 million in 2022-23 for the Youth

Employment and Skills Strategy to better meet the needs of vulnerable youth facing multiple

barriers to employment, while also supporting over 7,000 additional job placements for youth.

This builds on funding announced in the 2020 Fall Economic Statement, which is expected

to result in over 30,600 new placements in 2021-22. This will make it easier for young people to

get good jobs.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to invest $371.8 million in new funding for Canada

Summer Jobs in 2022-23 to support approximately 75,000 new job placements in the summer of 2022.

This is in addition to 2020 Fall Economic Statement funding for approximately 94,000

additional job placements in 2021-22. In total, the Canada Summer Jobs program will support

around 220,000 summer jobs over the next two years.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide $960 million over three years, beginning in

2021-22, to Employment and Social Development Canada for a new Sectoral Workforce Solutions

Program. Working primarily with sector associations and employers, funding would help design and

deliver training that is relevant to the needs of businesses, especially small and medium-sized

businesses, and to their employees. This funding would also help businesses recruit and retain a

diverse and inclusive workforce.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide $470 million over three years, beginning in

2021-22, to Employment and Social Development Canada to establish a new Apprenticeship Service.

The Apprenticeship Service would help 55,000 first-year apprentices in construction and

manufacturing Red Seal trades connect with opportunities at small and medium-sized employers.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to invest $298 million over three years, beginning in

2021-22, through Employment and Social Development Canada, in a new Skills for Success program

that would help Canadians at all skills levels improve their foundational and transferable

skills.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide $55 million over three years, starting in

2021-22, to Employment and Social Development Canada for a Community Workforce Development

Program. The program will support communities to develop local plans that identify high

potential growth organizations and connect these employers with training providers to develop

and deliver training and work placements to upskill and reskill jobseekers to fill jobs in

demand.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide $250 million over three years, starting in

2021-22, to Innovation, Science and Economic Development Canada for an initiative to scale-up

proven industry-led, third-party delivered approaches to upskill and redeploy workers to meet

the needs of growing industries.

Gender-Based Analysis+

Gender-Based Analysis+ - The government intends to extend the $1,600 adult learner top-up to the

full-time Canada Student Grant for an additional two school years—until July 2023. This will

ensure that benefits to adult students are not interrupted.

Gender-Based Analysis+

Gender-Based Analysis+

- Additionally, the government intends to make permanent the flexibility to use

current year income instead of the previous year’s to determine eligibility for Canada Student

Grants, so students with financial need won’t have their previous workforce participation count

against them.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide $80 million over three years, starting in

2021-22, to Innovation, Science and Economic Development Canada, to help CanCode reach 3 million

more students—with an even greater focus on underrepresented groups—and 120,000 more teachers.

Gender-Based Analysis+

Gender-Based Analysis+ - The Government of Canada is announcing its intention to introduce legislation

that will establish a federal minimum wage of $15 per hour, rising with inflation,

with provisions to ensure that where provincial or territorial minimum wages are

higher, that wage will prevail. This will directly benefit over 26,000 workers who currently

make less than $15 per hour in the federally regulated private sector.

Gender-Based Analysis+

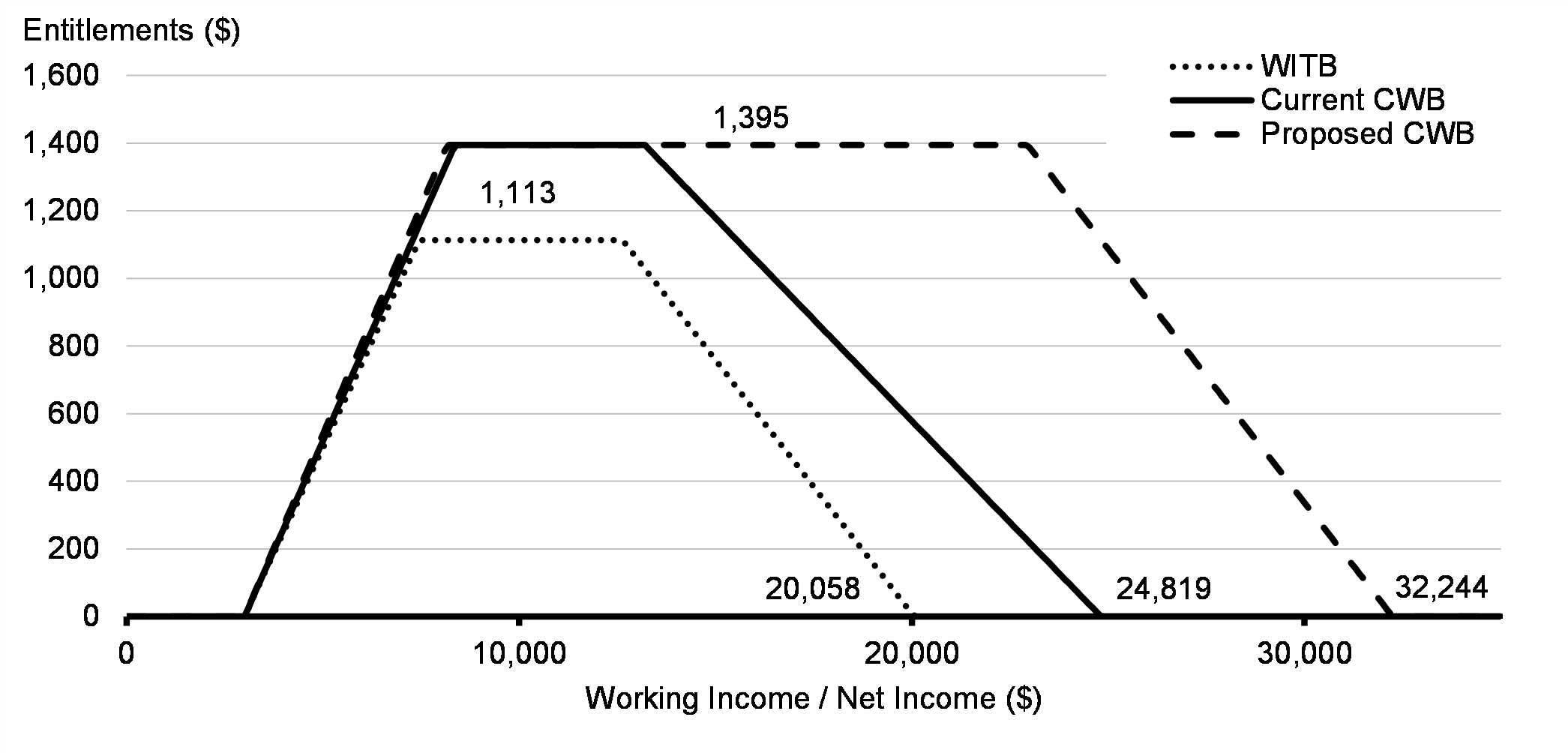

Gender-Based Analysis+ - Budget 2021 proposes to expand the Canada Workers Benefit to support about 1

million additional Canadians in low-wage jobs, helping them return to work and increasing

benefits for Canada’s most vulnerable.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to allow secondary earners to exclude up to $14,000 of

their working income when income-testing the Canada Workers Benefit.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 reiterates the government’s commitment to making legislative

changes to improve labour protection for gig workers, including those who work through digital

platforms. Following the conclusion of consultations recently launched on this topic by the

Minister of Labour, the government will bring forward amendments to the Canada Labour

Code to make these new, modernized protections a reality.

Gender-Based Analysis+

Gender-Based Analysis+ - To better protect these employees, the government is announcing its intention

to introduce legislation that would extend equal remuneration protection to more employees in

the air transportation sector. This would ensure that, when a service contract changes hands,

affected employees are not paid less, if they are laid off and rehired to do the same work they

were doing before.

Gender-Based Analysis+

Gender-Based Analysis+ - In order to simplify payments, and ensure that Canadian workers are paid more

of what they’re owed when they need it most, Budget 2021 proposes to eliminate the 6.82 per cent

deduction applied to all Wage Earner Protection Program payments. This change is estimated to

cost $16.2 million over five years, starting in 2021-22, and $3.3 million ongoing.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 proposes to provide funding of $27.6 million over three years for

my65+, a Group Tax-Free Savings Account offered by the Service Employees International Union

Healthcare.

Gender-Based Analysis+

Gender-Based Analysis+ - Budget 2021 announces that the government will engage with stakeholders to

examine what barriers exist to the creation of employee ownership trusts in Canada, and how

workers and owners of private businesses in Canada could benefit from the use of employee

ownership trusts.

Gender-Based Analysis+

Gender-Based Analysis+ - To help fight predatory lending, the Government of Canada will launch a

consultation on lowering the criminal rate of interest in the Criminal Code of Canada

applicable to, among other things, installment loans offered by payday lenders.

Gender-Based Analysis+

Gender-Based Analysis+ -

Budget 2021 proposes to introduce the new Canada Recovery Hiring Program

for eligible

employers that continue to experience qualifying declines in revenues relative to before the

pandemic. The

proposed subsidy would offset a portion of the extra costs employers take on as they reopen,

either by

increasing wages or hours worked, or hiring more staff. This support would only be available for

active

employees and will be available from June 6 to November 20, 2021. Eligible employers would claim

the higher of

the Canada Emergency Wage Subsidy or the new proposed subsidy. The aim is to make it as easy as

possible for

businesses to hire new workers as the economy reopens.

Gender-Based Analysis+

Gender-Based Analysis+

- For June 6 to July 3, their payroll is $24,000. Their business would be eligible for a wage subsidy rate of 40 per cent (based on a 50-per-cent revenue decline), resulting in a wage subsidy of $9,600. Alternatively, the business would be eligible for a hiring subsidy rate of 50 per cent, which would be applied to the difference between its current payroll and its baseline payroll, resulting in a hiring incentive of $3,600. They are better off claiming the wage subsidy of $9,600 for this period.

- For July 4 to July 31, their payroll is $26,400. Their business would be eligible for a wage subsidy rate of 8.75 per cent (based on a 20-per-cent revenue decline), resulting in a wage subsidy of $2,310. Alternatively, the business would be eligible for a hiring subsidy rate of 50 per cent, which would be applied to the difference between its current payroll and its baseline payroll, resulting in a hiring incentive of $4,800. In this instance, they are better off claiming the hiring incentive of $4,800 for this period.

-

Budget 2021 proposes to provide $708 million over five years, starting in

2021-22, to

Mitacs to create at least 85,000 work-integrated learning placements that provide on-the-job

learning and

provide businesses with support to develop talent and grow.

Gender-Based Analysis+

Gender-Based Analysis+

- To help main street businesses expand their customer bases online, they can access support to digitize and take advantage of e-commerce opportunities. Eligible businesses will receive microgrants to help offset the costs of going digital—and support to digital trainers from a network of up to 28,000 well trained young Canadians.

- Some businesses will require more comprehensive support to adopt new technology, and a second stream will be in place for “off-main street” businesses, such as small manufacturing and food processing operations. Support for these businesses will emphasize advisory expertise for technology planning and financing options needed to put these technologies to use.

- Budget 2021 proposes to provide $1.4 billion over four years, starting in 2021-22, to Innovation, Science and Economic Development Canada, to:

- Work with organizations across Canada to provide access to skills, training, and advisory services for all businesses accessing this program.

- Provide microgrants to smaller, main street businesses to support costs associated with technology adoption.

- Create training and work opportunities for as many as 28,000 young people to help small and medium-sized businesses across Canada adopt new technology.

-

Budget 2021 proposes to provide $2.6 billion on a cash basis over four

years, starting

in 2021-22, to the Business Development Bank of Canada to help small and medium-sized businesses

finance

technology adoption.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $46.9 million over two years, starting in

2021-22,

to

support additional research partnerships between colleges, CEGEPs, polytechnics, and businesses

through

the

Natural Sciences and Engineering Research Council’s College and Community Innovation Program.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to invest $5.7 million over two years, starting in

2021-22,

to

provide more businesses with access to the National Research Council’s Industrial Research

Assistance

Program’s Interactive Visits, where firms can access equipment, facilities, and expertise at

college-affiliated Technology Access Centres.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to allow immediate expensing of up to $1.5 million of eligible investments by Canadian-controlled private corporations made on or after Budget Day and before 2024. Eligible investments will cover over 60 per cent of capital investments typically made by Canadian-controlled private corporations.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to improve the Canada Small Business Financing Program through amendments to the Canada Small Business Financing Act and its regulations. These proposed amendments are projected to increase annual financing by $560 million, supporting approximately 2,900 additional small businesses. They include:

- Expanding loan class eligibility to include lending against intellectual property and start-up assets and expenses.

- Increasing the maximum loan amount from $350,000 to $500,000 and extending the loan coverage period from 10 to 15 years for equipment and leasehold improvements.

- Expanding borrower eligibility to include non-profit and charitable social enterprises.

- Introducing a new line of credit product to help with liquidity and cover short-term working capital needs.

-

Budget 2021 proposes to provide $250 million over three years, on a cash

basis,

starting in 2021-22, for the regional development agencies to deliver an Aerospace Regional

Recovery

Initiative, which would support small and medium-sized firms in improving productivity,

strengthening

commercialization, and greening their operations and products.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide up to $101.4 million over five years,

starting in

2021-22, to Innovation, Science and Economic Development Canada for the Small Business and

Entrepreneurship

Development Program.

Gender-Based Analysis+

Gender-Based Analysis+

-

To provide affordable financing, increase data, and strengthen capacity

within the

entrepreneurship ecosystem, Budget 2021 proposes to provide up to $146.9 million over four

years, starting

in

2021-22, to strengthen the Women Entrepreneurship Strategy. Women entrepreneurs would have

greater access

to

financing, mentorship, and training. Funding would also further support the Women

Entrepreneurship

Ecosystem

Fund and the Women Entrepreneurship Knowledge Hub.

Gender-Based Analysis+

Gender-Based Analysis+

-

The government will work with financial institutions to develop a

voluntary code

to

help support the inclusion of women and other underrepresented entrepreneurs as clients in the

financial

sector.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide up to an additional $51.7 million over

four years,

starting in 2021-22, to Innovation, Science and Economic Development Canada and the regional

development

agencies for the Black Entrepreneurship Program.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to provide Public Services and Procurement Canada $87.4 million over five years starting in 2021-22, and $18.6 million ongoing. This funding will be used to modernize federal procurement and create opportunities for specific communities by diversifying the federal supplier base. Specifically, Public Services and Procurement Canada would:

- Implement a program focused on procuring from Black-owned businesses.

- Continue work to meet Canada’s target of 5 per cent of federal contracts being awarded to businesses managed and led by Indigenous peoples.

- Improve data capture, analytics, and reporting.

- Incorporate accessibility considerations into federal procurement, ensuring goods and services are accessible by design. Public Services and Procurement Canada will develop new tools, guidance, awareness, and training for federal departments.

-

Budget 2021 also proposes to leverage supplier diversity opportunities

through

domestic procurement, such as running competitions open to businesses run by Canadians from

equity

deserving

groups. This would help build a more inclusive economy and boost the competitiveness of these

businesses,

and

all Canadian businesses.

Gender-Based Analysis+

Gender-Based Analysis+

-

In addition, in order to demonstrate to Canada’s trading partners the

importance

of

balanced procurement opportunities, the government will pursue reciprocal procurement policies

to ensure

that

goods and services are only procured from countries that grant Canadian businesses a similar

level of

market

access. This will protect Canadian supply chains and ensure that Canada’s trading relationships

are

mutually

beneficial economic relationships.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $500 million over five years, starting in

2021-22,

and

$100 million per year ongoing, to expand the Industrial Research Assistance Program to support

up to 2,500

additional innovative small and medium-sized firms.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to make available up to $450 million on a cash basis over five years, starting in 2021-22, for a renewed Venture Capital Catalyst Initiative that would increase venture capital available to entrepreneurs.

- $50 million of this amount would be dedicated to support venture capital investments in life science technologies.

- $50 million of this amount would support a new Inclusive Growth Stream to increase access to venture capital for underrepresented groups, such as women and racialized communities.

-

Budget 2021 proposes to provide $21.3 million over five years, starting in

2021-22,

and $4.3 million per year ongoing, to Global Affairs Canada for the continuation of the

International

Business

Development Strategy for Clean Technology.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to allocate $21 million over three years, starting in 2021-22, to:

- Work with provincial and territorial partners to enhance the capacity of the Internal Trade Secretariat that supports the Canadian Free Trade Agreement in order to accelerate the reduction of trade barriers within Canada.

- Advance work with willing partners towards creating a repository of open and accessible pan-Canadian internal trade data to identify barriers, including licensing and professional certification requirements, so that we can work together to reduce them.

- Pursue internal trade objectives through new or renewed discretionary federal transfers to provinces and territories.

- Lower the average overall cost of interchange fees for merchants

- Ensure that small businesses benefit from pricing that is similar to large businesses

- Protect existing rewards points of consumers

-

Budget 2021 proposes to provide $96 million over five years, starting in

2021-22,

and

$27.5 million ongoing, to enhance the Competition Bureau’s enforcement capacity and ensure it is

equipped

with

the necessary digital tools for today’s economy.

Gender-Based Analysis+

Gender-Based Analysis+

-

To maintain momentum on strengthening Canada’s regulatory systems, Budget

2021

proposes to provide up to $6.1 million over two years, starting in 2021-22, to renew the

External Advisory

Committee on Regulatory Competitiveness and to continue targeted regulatory reviews.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to invest $1.9 billion over four years, starting in 2021-22, to recapitalize the National Trade Corridors Fund. This funding could attract approximately $2.7 billion from private and other public sector partners, resulting in total investments of $4.6 billion. This would spur investments in much-needed enhancements to our roads, rail, and shipping routes, build long-term resilience for the Canadian economy, and support internal trade. It would make Canada’s transportation system more fluid, supporting economic recovery and increasing prosperity across Canada. Alleviating bottlenecks and congestion will also reduce greenhouse gas emissions in Canada.

- Of this total funding, 15 per cent would be dedicated to building and improving transportation networks in Canada’s North. Investments will bring growth and jobs to northern communities, and help more of our resources and goods get to markets in faster, cleaner, more cost-efficient ways. .

- Western Canada: Projects in the Lower Mainland of British Columbia, including new overpasses, upgrades to existing rail tracks, and expansion of port terminals, to improve the flow of passenger and freight traffic.

- Eastern Canada: Projects at the Port of Montreal, including construction of new roads and the development of an intelligent communications network, to increase the port’s capacity and optimize its rail network.

- Northern Canada: Improvement of the Mackenzie Valley Highway between Yellowknife and the Arctic Ocean to ensure reliable, year-round road access to isolated communities and support the economic development of the region’s mineral-rich resources.

-

Budget 2021 proposes to provide $656.1 million over five years, beginning

in

2021-22,

and $123.8 million ongoing, to the Canada Border Services Agency (CBSA) to modernize our

borders. Funding

will

transform the border experience for travellers through touchless and automated interactions,

enhance

CBSA’s

ability to detect contraband, and help protect the integrity of our border infrastructure.

Funding will

also

support three Canadian preclearance pilots in the United Sates that would enable customs and

immigration

inspections to be completed before goods and travellers enter Canada.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 announces the government’s intention to launch public

consultations on

measures to strengthen Canada’s trade remedy system and to improve access for workers and small

and

medium-sized enterprises (SMEs). This may result in proposed amendments to the Special Import

Measures

Act

and

the Canadian International Trade Tribunal Act.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $38.2 million over five years, starting in

2021–22,

and $7.9 million per year ongoing, to Global Affairs Canada, as additional resourcing to support

Canada’s

trade controls regime.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 announces the government’s intention to work with Export

Development

Canada to enhance supports to small and medium-sized exporters and to strengthen human rights

considerations

in export supports. The government may propose amendments to the Export Development Act.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to provide the Strategic Innovation Fund with an incremental $7.2 billion over seven years on a cash basis, starting in 2021-22, and $511.4 million ongoing. This funding will be directed as follows:

- $2.2 billion over seven years, and $511.4 million ongoing to support innovative projects across the economy—including in the life sciences, automotive, aerospace, and agriculture sectors.

- $5 billion over seven years to increase funding for the Strategic Innovation Fund’s Net Zero Accelerator, as detailed in Chapter 5. Through the Net Zero Accelerator the fund would scale up its support for projects that will help decarbonize heavy industry, support clean technologies and help meaningfully accelerate domestic greenhouse gas emissions reductions by 2030.

- $1.75 billion in support over seven years would be targeted toward aerospace in recognition of the longer-lasting impacts to this sector following COVID-19. This is in addition to the $250 million Aerospace Regional Recovery Initiative, outlined in section 4.2, providing a combined support of $2 billion to help this innovative sector recover and grow out of the crisis.

- $1 billion of support over seven years would be targeted toward growing Canada’s life sciences and bio-manufacturing sector, restoring capabilities that have been lost and supporting the innovative Canadian firms and jobs in this sector. This is an important component of Canada's plan to build domestic resilience and improve long-term pandemic preparedness proposed in Chapter 1, providing a combined $2.2 billion over seven years.

- $8 billion over seven years for the Net Zero Accelerator to support projects that will help reduce Canada’s greenhouse gas emissions by expediting decarbonization projects, scaling-up clean technology, and accelerating Canada’s industrial transformation. More details are in Chapter 5.

- Invest $8 billion through the Net Zero Accelerator

- Target $1.75 billion to the aerospace sector

- Target $1 billion to the bio-manufacturing and life sciences sector

- Leverage all other resources to target strategic investments in innovative and dynamic projects, including in traditional areas of Canadian strength.

- Help achieve net-zero greenhouse gas emissions by 2050 and support economic transformation

- Support sector recovery and sustainable growth

- Build domestic resilience and improve long-term pandemic preparedness

- Promote growth and the creation of good jobs across the Canadian economy

- Budget 2021 proposes to provide up to $443.8 million over ten years, starting in 2021-22, in support of the Pan-Canadian Artificial Intelligence Strategy, including:

- $185 million over five years, starting in 2021-22, to support the commercialization of artificial intelligence innovations and research in Canada.

- $162.2 million over ten years, starting in 2021-22, to help retain and attract top academic talent across Canada—including in Alberta, British Columbia, Ontario, and Quebec. This programming will be delivered by the Canadian Institute for Advanced Research.

- $48 million over five years, starting in 2021-22, for the Canadian Institute for Advanced Research to renew and enhance its research, training, and knowledge mobilization programs.

- $40 million over five years, starting in 2022-23, to provide dedicated computing capacity for researchers at the national artificial intelligence institutes in Edmonton, Toronto, and Montréal.

- $8.6 million over five years, starting in 2021-22, to advance the development and adoption of standards related to artificial intelligence.

-

Budget 2021 proposes to provide $360 million over seven years, starting in

2021-22,

to

launch a National Quantum Strategy. The strategy will amplify Canada’s significant strength in

quantum

research; grow our quantum-ready technologies, companies, and talent; and solidify Canada’s

global

leadership

in this area. This funding will also establish a secretariat at the Department of Innovation,

Science and

Economic Development to coordinate this work.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $90 million over five years on a cash

basis,

starting

in 2021-22, to the National Research Council to retool and modernize the Canadian Photonics

Fabrication

Centre. This would allow the centre to continue helping Canadian researchers and companies grow

and

support

highly skilled jobs.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $400 million over six years, starting in

2021-22,

in

support of a Pan-Canadian Genomics Strategy. This funding would provide $136.7 million over five

years,

starting in 2022-23, for mission-driven programming delivered by Genome Canada to kick-start the

new

Strategy

and complement the government’s existing genomics research and innovation programming.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $250 million over three years, starting in

2021-22,

to

the Canadian Institutes of Health Research to implement a new Clinical Trials Fund.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $60 million over two years, starting in

2021-22,

to

the Innovation Superclusters Initiative.

Gender-Based Analysis+

Gender-Based Analysis+

-

$90 million, over two years, starting in 2022-23, to create ElevateIP, a

program

to

help accelerators and incubators provide start-ups with access to expert intellectual property

services.

Gender-Based Analysis+

Gender-Based Analysis+

-

$75 million over three years, starting in 2021-22, for the National

Research

Council’s

Industrial Research Assistance Program to provide high-growth client firms with access to expert

intellectual

property services.

Gender-Based Analysis+

Gender-Based Analysis+

-

$80.2 million over eleven years, starting in 2021-22, with $14.9 million

in

remaining

amortization and $6.2 million per year ongoing, to Natural Resources Canada and Environment and

Climate

Change

Canada to replace and expand critical but aging ground-based infrastructure to receive satellite

data.

Gender-Based Analysis+

Gender-Based Analysis+

-

$9.9 million over two years, starting in 2021-22, to the Canadian Space

Agency to

plan

for the next generation of Earth observation satellites.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide additional funding of $10 million over

five years,

starting in 2021-2022, and $2 million per year ongoing, to expand opportunities for Canadian

SMEs to

engage

in

research and development partnerships with Israeli SMEs as part of the Canadian International

Innovation

Program. This will be sourced from existing Global Affairs Canada resources. The government also

intends

to

implement an enhanced delivery model for this program, including possible legislation.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide an additional $1 billion over six years,

starting

in

2021-22, to the Universal Broadband Fund to support a more rapid rollout of broadband projects

in

collaboration with provinces and territories and other partners. This would mean thousands more

Canadians

and

small businesses will have faster, more reliable internet connections.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $17.6 million over five years, starting in

2021-22,

and $3.4 million per year ongoing, to create a Data Commissioner. The Data Commissioner would

inform

government and business approaches to data-driven issues to help protect people’s personal data

and to

encourage innovation in the digital marketplace.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to provide $8.4 million over five years,

starting in

2021-22, and $2.3 million ongoing, to the Standards Council of Canada to continue its work to

advance

industry-wide data governance standards.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide up to $5 million over two years, starting

in

2021-22,

to Statistics Canada to work with partners to enhance the availability of business condition

data, better

ensuring that the government’s support measures are responsive to the needs of Canadian

businesses and

entrepreneurs.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $5 billion over seven years (cash basis),

starting in 2021-22, to the Net Zero Accelerator. Building on the support for the Net Zero

Accelerator announced in the strengthened climate plan, this funding would allow the government

to

provide up to $8 billion of support for projects that will help reduce domestic greenhouse gas

emissions across the Canadian economy.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to make up to $1 billion available on a cash basis,

over

five years, starting in 2021-22, to help draw in private sector investment for these projects.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to reduce—by 50 per cent—the general corporate and

small

business income tax rates for businesses that manufacture zero-emission technologies. The

reductions

would go into effect on January 1, 2022, and would be gradually phased out starting January 1,

2029

and eliminated by January 1, 2032. The Department of Finance Canada will regularly review new

technologies that might be eligible, in consultation with Environment and Climate Change Canada,

Natural Resources Canada, Sustainable Development Technology Canada, and other key stakeholders

across government and industry.

Gender-Based Analysis+

Gender-Based Analysis+

- Manufacturing of wind turbines, solar panels, and equipment used in hydroelectric facilities.

- Manufacturing of geothermal energy systems.

- Manufacturing of electric cars, busses, trucks, and other vehicles.

- Manufacturing of batteries and fuel cells for electric vehicles.

- Production of biofuels from waste materials.

- Production of green hydrogen.

- Manufacturing of electric vehicle charging systems.

- Manufacturing of certain energy storage equipment.

-

Budget 2021 proposes to expand the list of eligible equipment to include

equipment used in pumped hydroelectric energy storage, renewable fuel production, hydrogen

production by electrolysis of water, and hydrogen refueling. Certain existing restrictions

related

to investments in water-current, wave and tidal energy, active solar heating, and geothermal

energy

technologies would also be removed.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to update the eligibility criteria such that certain

fossil-fuelled and low efficiency waste-fuelled electrical generation equipment will no longer

be

eligible after 2024.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $9.6 million over three years, starting in

2021-22, to create a Critical Battery Minerals Centre of Excellence at Natural Resources Canada.

The

centre would coordinate federal policy and programs on critical minerals, and work with

provincial,

territorial, and other partners. The centre would also help implement the Canada-U.S. Joint

Action

Plan.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $36.8 million over three years, starting

in

2021-22, with $10.9 million in remaining amortization, to Natural Resources Canada, for federal

research and development to advance critical battery mineral processing and refining expertise.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $56.1 million over five years, starting in

2021-22, with $16.3 million in remaining amortization and $13 million per year ongoing, to

Measurement Canada to develop and implement, in coordination with international partners such as

the

United States, a set of codes and standards for retail ZEV charging and fueling stations. This

would

include accreditation and inspection frameworks needed to ensure the standards are adhered to at

Canada’s vast network of charging and refueling stations.

Gender-Based Analysis+

Gender-Based Analysis+

-

To support the Government of Canada’s commitment to power federal

buildings

with 100 per cent clean electricity by 2022, Budget 2021 proposes to provide $14.9 million over

4

years, starting in 2022-23, with $77.9 million in future years, to Public Services and

Procurement

Canada for a Federal Clean Electricity Fund to purchase renewable energy certificates for all

federal government buildings.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $104.6 million over five years, starting

in

2021–22, with $2.8 million in remaining amortization, to Environment and Climate Change Canada

to

strengthen greenhouse gas emissions regulations for light- and heavy-duty vehicles and off-road

residential equipment, establish national methane regulations for large landfills, and undertake

additional actions to reduce and better use waste at these sites.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $54.8 million over two years, starting in

2021-22, to Natural Resources Canada, to enhance the capacity of the Investments in Forest

Industry

Transformation program, including working with municipalities and community organizations ready

for

new forest-based economic opportunities.

Gender-Based Analysis+

Gender-Based Analysis+

-

The government will publish a green bond framework in the coming months in

advance of issuing its inaugural federal green bond in 2021-22, with an issuance target of $5

billion, subject to market conditions. This would be the first of many green bond issuances. The

framework will provide details on how, through green bonds, investors will have opportunities to

finance Canada’s work to fight climate change and protect the environment. Possible projects

these

green bonds could fund include green infrastructure, clean tech innovations, nature

conservation,

and other efforts to address climate change and protect our environment.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to introduce an investment tax credit for capital

invested in CCUS projects with the goal of reducing emissions by at least 15 megatonnes of CO2

annually. This measure will come into effect in 2022.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $319 million over seven years, starting in

2021-22, with $1.5 million in remaining amortization, to Natural Resources Canada to support

research, development, and demonstrations that would improve the commercial viability of carbon

capture, utilization, and storage technologies.

Gender-Based Analysis+

Gender-Based Analysis+

-

To implement and administer the Clean Fuel Standard, Budget 2021 proposes

to

provide $67.2 million over seven years, starting in 2021-22, with $0.05 million in remaining

amortization, to Environment and Climate Change Canada. This standard creates new economic

opportunities for Canada’s biofuel producers, including farmers and foresters, who are part of

the

diverse supply chain for low-carbon fuels. Making this investment now will secure Canada’s

future

competitiveness in the global transition to a low-carbon economy.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to provide $67.4 million over seven years,

starting

in 2021-22, with $5.6 million in remaining amortization and $10.7 million ongoing, for

Measurement

Canada to ensure that commercial transactions of low-carbon fuels are measured accurately just

as

they are for conventional fuels.

Gender-Based Analysis+

Gender-Based Analysis+

-

To support the long-term development of low-emission marine and aviation

fuels, Budget 2021 proposes to provide $227.9 million over eight years, starting in 2023-24, to

the

Treasury Board Secretariat to implement a Low-Carbon Fuel Procurement Program within the

Greening

Government Fund.

Gender-Based Analysis+

Gender-Based Analysis+

-

The government will also continue to use and expand federal procurement to

support the Greening Government Strategy so that public dollars prioritize the use of lower

carbon

materials, fuels, and processes.

Gender-Based Analysis+

Gender-Based Analysis+

-

The government will, in partnership with the Government of British

Columbia,

provide up to $35 million to help establish the Centre for Innovation and Clean Energy to

advance

the scale-up and commercialization of clean technologies in B.C. and across Canada.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to invest $40.4 million over three years, starting in

2021-22, to support feasibility and planning of hydroelectricity and grid interconnection

projects

in the North. This funding could advance projects, such as the Atlin Hydro Expansion Project in

Yukon and the Kivalliq Hydro-Fibre Link Project in Nunavut. Projects will provide clean power to

northern communities and help reduce emissions from mining projects.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to invest $36 million over three years, starting

in

2021-22, through the Strategic Partnerships Initiative, to build capacity for local,

economically-sustainable clean energy projects in First Nations, Inuit, and Métis communities

and

support economic development opportunities.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $94.4 million over five years, starting in

2021-22, to Environment and Climate Change Canada to increase domestic and international

capacity

and action to address climate change, enhance clean tech policy capacity, including in support

of

the Clean Growth Hub, and to fund reporting requirements under the Canadian Net-Zero Emissions

Accountability Act.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to change the delivery of Climate Action Incentive

payments from a refundable credit claimed annually on personal income tax returns to quarterly

payments made through the benefit system starting in 2022. This will deliver Canadians’ Climate

Action Incentive payments on a more regular basis. Further details will be announced later in

2021.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 announces the government’s intention to return a portion of

the

proceeds from the price on pollution directly to farmers in backstop jurisdictions (currently

Alberta, Saskatchewan, Manitoba, and Ontario), beginning in 2021-22. It is estimated farmers

would

receive $100 million in the first year. Returns in future years will be based on proceeds from

the

price on pollution collected in the prior fiscal year, and are expected to increase as the price

on

pollution rises. Further details will be announced later in 2021 by the Minister of Finance.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 also proposes to ensure the recently expanded $165.5 million

Agricultural Clean Technology program will prioritize $50 million for the purchase of more

efficient

grain dryers for farmers across Canada.

Gender-Based Analysis+

Gender-Based Analysis+

-

Provide an additional $200 million over two years, starting in 2021-22, to

launch immediate, on-farm climate action under the Agricultural Climate Solutions program. This

will

target projects accelerating emission reductions by improving nitrogen management, increasing

adoption of cover cropping, and normalizing rotational grazing.

Gender-Based Analysis+

Gender-Based Analysis+

-

Allocate $60 million over the next two years, from the Nature Smart

Climate

Solutions Fund to target the protection of existing wetlands and trees on farms, including

through a

reverse auction pilot program.

Gender-Based Analysis+

Gender-Based Analysis+

-

Allocate $10 million over the next two years, from the Agricultural Clean

Technology Program toward powering farms with clean energy and moving off diesel.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $36.2 million over five years, starting in

2021-22, to Environment and Climate Change Canada to develop and apply a climate lens that

ensures

climate considerations are integrated throughout federal government decision-making. This

includes

resources to increase economic and emissions modelling capacity.

Gender-Based Analysis+

Gender-Based Analysis+

- The government will engage with provinces and territories, with the objective of making climate disclosures, consistent with the Task Force on Climate-related Financial Disclosures, part of regular disclosure practices for a broad spectrum of the Canadian economy.

- Canada’s Crown corporations will demonstrate climate leadership by adopting the Task Force on Climate-related Financial Disclosures standards, or according to, more rigorous, acceptable standards as applicable to the public sector at time of disclosure, as an element of their corporate reporting.

- Canada’s large Crown corporations (entities with over $1 billion in assets) will report on their climate-related financial risks for their financial years, starting in calendar year 2022 at the latest.

- Crown corporations with less than $1 billion in assets will be expected to start reporting on their climate-related financial risks for their financial years beginning in calendar year 2024 at the latest, or provide justification as to why climate risks do not have material impact on their operations.

-

The government intends to launch a consultation process on border carbon

adjustments in the coming weeks. This consultation process will begin in the summer with

targeted

discussions, including with provinces and territories, importers, and exporters—especially those

who

deal in emissions-intensive goods. The broader public will be engaged this fall. Throughout this

process, the government intends to continue its international engagement with like-minded

partners.

Gender-Based Analysis+

Gender-Based Analysis+

- Replacing oil furnaces or low-efficiency systems with a high efficiency furnace, air source heat pump, or geothermal heat pump.

- Better wall or basement insulation and/or wall or roof panels.

- Installing a high-efficiency water heater or on-site renewable energy like solar panels.

- Replacing drafty windows and doors.

-

Budget 2021 proposes to provide $4.4 billion on a cash basis ($778.7

million

on an accrual basis over five years, starting in 2021-22, with $414.1 million in future years)

to

the Canada Mortgage and Housing Corporation (CMHC) to help homeowners complete deep home

retrofits

through interest-free loans worth up to $40,000. Loans would be available to homeowners and

landlords who undertake retrofits identified through an authorized EnerGuide energy assessment.

In

combination with available grants announced in the Fall Economic Statement, this would help

eligible

participants make deeper, more costly retrofits that have the biggest impact in reducing a

home’s

environmental footprint and energy bills. This program will also include a dedicated stream of

funding to support low-income homeowners and rental properties serving low-income renters

including

cooperatives and not-for-profit owned housing.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to provide $1.4 billion over 12 years, starting in 2021-22, to Infrastructure Canada to top up the Disaster Mitigation and Adaptation Fund, to support projects such as wildfire mitigation activities, rehabilitation of storm water systems, and restoration of wetlands and shorelines.

- Of this, $670 million would be dedicated to new, small-scale projects between $1 million and $20 million in eligible costs. In addition, 10 per cent of the total funding envelope would be dedicated to Indigenous recipients to benefit each distinctions-based group. Together, this would support projects that help small, rural, remote, northern, and Indigenous communities adapt to climate change impacts.

-

In addition, Budget 2021 proposes to invest $11.7 million over five years,

starting in 2021-22, through Infrastructure Canada to renew the Standards to Support Resilience

in

Infrastructure Program, so that the Standards Council of Canada can continue updating standards

and

guidance in priority areas such as flood mapping and building in the North. This would help

communities to plan and build roads, buildings, and other infrastructure that is more durable

and

resilient to a changing climate.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $63.8 million over three years, starting

in

2021-22, to Natural Resources Canada, Environment and Climate Change Canada, and Public Safety

Canada to work with provinces and territories to complete flood maps for higher-risk areas.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $100.6 million over five years, starting in

2021-22, with $4.7 million in remaining amortization, to the Parks Canada Agency to enhance

wildfire

preparedness in Canada’s National Parks.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $28.7 million over five years, starting in

2021-22, with $0.6 million in remaining amortization, to Natural Resources Canada to support

increased mapping of areas in Northern Canada at risk of wildfires. This funding would also

enhance

the capacity of the Canadian Interagency Forest Fire Centre, which is jointly funded in

partnership

with provinces and territories.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $1.9 billion over five years, on a cash

basis,

starting in 2021–22, to Public Safety Canada to support provincial and territorial disaster

response

and recovery efforts.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $25 million, in 2021-22, to the Government

of

Yukon to support its climate change priorities, in collaboration with Crown-Indigenous Relations

and

Northern Affairs Canada and Environment and Climate Change Canada.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $15 million over three years, starting in

2021-22, to accelerate archeological and conservation work of these artifacts of international

importance.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to provide $2.3 billion over five years, starting in 2021-22, with $100.5 million in remaining amortization, to Environment and Climate Change Canada, Parks Canada, and the Department of Fisheries and Oceans to:

- Conserve up to 1 million square kilometers more land and inland waters to achieve Canada’s 25 per cent protected area by 2025 target, including through national wildlife areas, and Indigenous Protected and Conserved Areas.

- Create thousands of jobs in nature conservation and management.

- Accelerate new provincial and territorial protected areas.

- Support Indigenous Guardians.

- Take action to prevent priority species at imminent risk of disappearing, including through partnerships with Indigenous peoples.

-

Budget 2021 proposes to provide $200 million over three years, starting in

2021-22, to Infrastructure Canada to establish a Natural Infrastructure Fund to support natural

and

hybrid infrastructure projects. This would help to improve well-being, mitigate the impacts of

climate change, and prevent costly natural events.

Gender-Based Analysis+

Gender-Based Analysis+

- The City of Toronto’s Ravine Strategy aims to protect, manage, and enhance the ecological services and recreational opportunities provided by an urban ravine network spanning more than 300 kilometres. The strategy focuses on ravine areas with high levels of existing use and where the surrounding neighbourhoods have limited access to public or private greenspace.

- The City of Vancouver’s Rain City Strategy uses natural solutions, such as absorbent landscaping, tree trenches, and green roofs, to prevent urban flooding and improve water quality. The strategy also aims to manage rainwater runoff from 40 per cent of impervious areas by 2050, and capture and clean 90 per cent of the city’s average annual rainfall.

- The City of Winnipeg’s Parks Strategy aims to connect people with nature, value ecological systems, promote active and outdoor living, and enhance accessibility for persons with disabilities to parks and natural spaces.

- The City of Saskatoon’s Green Strategy aims to provide a sustainable habitat for people and nature by building up urban forests, improving ecosystem health, enhancing resiliency to natural disasters, connecting people with nature, promoting active and outdoor living, and enhancing accessibility for persons with disabilities to parks and natural spaces.

- The City of Halifax’s Green Network Plan promotes the sustainable use of ecologically important green space, and enhances the use of land suited for outdoor recreation.

- The City of Montreal’s Vision 2030 Strategic Plan prioritizes nature in the city, putting biodiversity, green spaces, and the management and development of natural riverside and aquatic heritage at the heart of decision-making. The plan aims to ensure that everyone has access to local parks, and includes planting trees and plants in neighbourhoods and along the riverbanks in order to protect biodiversity.

-

Budget 2021 proposes to provide $976.8 million over five years, starting

in

2021–22, with $80.0 million in remaining amortization, to help Canada reach its 25 per cent by

2025

target to protect the health of our oceans, commercial fishing stocks, and Canadians’ quality of

life, especially in coastal communities.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes a $10 million increase, in 2021-22, to the

Sustainable

Fisheries Solutions and Retrieval Support Program, the ”Ghost Gear Fund” at Fisheries and Oceans

Canada, to assist projects that retrieve ghost gear, dispose of fishing related plastic waste,

test

new fishing technology, and support international efforts to decrease ghost gear. The program

also

contributes to job creation.

Gender-Based Analysis+

Gender-Based Analysis+

- Budget 2021 proposes to provide $647.1 million over five years, starting in 2021-22, with $98.9 million in remaining amortization to Fisheries and Oceans Canada to:

- Stabilize and conserve wild Pacific salmon populations, including through investment in research, new hatchery facilities, and habitat restoration.

- Create a Pacific Salmon Secretariat and Restoration Centre of Expertise.

- Improve management of commercial and recreational fisheries.

- Double the British Columbia Salmon Restoration and Innovation Fund with an additional $100 million.

- Further engage with First Nations and fish harvesters.

-

Budget 2021 proposes to provide $20 million over two years to Fisheries

and

Oceans Canada to expand engagement with the Province of British Columbia, Indigenous

communities,

industry, scientists, and other stakeholders. This consultation would inform the development of

a

responsible plan to transition from open net-pen salmon farming in coastal British Columbia

waters

by 2025.

Gender-Based Analysis+

Gender-Based Analysis+

-

In addition, Budget 2021 also proposes to invest $3 million over two years

to

pilot area based management approaches to planning, management, and monitoring of aquaculture

activities in priority areas on the B.C. coast—leading the way in developing aquaculture

practices

that are economically, environmentally, and socially sustainable.

Gender-Based Analysis+

Gender-Based Analysis+

-

Budget 2021 proposes to provide $17.4 million over two years, starting in

2021-22, to Environment and Climate Change Canada to support work with the provinces,

territories,

Indigenous peoples, and key stakeholders on the scope of the agency’s mandate, including

identifying

opportunities to build and support more resilient water and irrigation infrastructure. The

agency

would be headquartered outside the National Capital Region.

Gender-Based Analysis+