Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Budget in Brief

![]() PDF Version [538 Kb]

PDF Version [538 Kb]

To access a Portable Document Format (PDF) file you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet.

We see Canada for what it is and what it can be—a great, good nation, on top of the world, the True North strong and free. Our government has been inspired by this vision from the beginning. Today we step forward boldly, to realize it fully—hope for our children and grandchildren; opportunity for all Canadians; a prosperous future for our beloved country.

— The Honourable Jim Flaherty,

Minister of Finance

Canada is emerging from the global economic recession. The economy’s strengths provide an opportunity for the Government to take significant actions today that will fuel the next wave of job creation and position Canada for a secure and prosperous future. Economic Action Plan 2012 sets out a comprehensive agenda to bolster Canada’s fundamental strengths and address the important challenges confronting the economy over the long term.

Canada faces a fast-changing global environment, with increasing competition from emerging market countries and a global economy that remains fragile and uncertain. For this reason, the Government remains focused on an agenda that will deliver high-quality jobs, economic growth and sound public finances. Economic Action Plan 2012 will help further unleash the potential of Canadian businesses and entrepreneurs to innovate and thrive in the modern economy to the benefit of all Canadians for generations to come.

Since 2006, the Government has supported the security and prosperity of Canadians and promoted business and investment to create jobs. When the global financial and economic crisis struck, these underlying strengths helped Canada to avoid a deep and long-lasting recession. The Government’s sound fiscal position prior to the crisis provided the flexibility to launch the stimulus phase of Canada’s Economic Action Plan, which was timely, targeted and temporary in order to have maximum impact. This plan was one of the strongest responses to the global recession among the Group of Seven (G-7) countries.

Economic output in Canada is now well above pre-recession levels, and more than 610,000 jobs have been created since the recovery began in July 2009, the best performance in the G-7.

Canadian authorities have a strong track record in managing past economic and financial crises and delivering economic growth.

— Standard & Poor’s, October 25, 2011

Canada cannot rest on this record of success. There are many challenges and uncertainties still confronting the economy. The recovery is not complete and too many Canadians are still looking for work. The global economy remains fragile and any potential setbacks would have an impact on Canada. Canadian businesses face ever-increasing competition from emerging fast-growth countries. Our aging population will put pressure on public finances and social programs.

Economic Action Plan 2012 takes important steps to address these structural challenges and ensure the sustainability of public finances and social programs for future generations. International experience shows the importance of taking action now, rather than delaying. Economic Action Plan 2012 focuses on the drivers of growth and job creation—innovation, investment, education, skills and communities. Underpinning these actions is the ongoing commitment to keeping taxes low, which is central to the Government’s long-term economic plan.

Supporting Entrepreneurs, Innovators

The global economy is increasingly competitive. The pace of technological change is creating new opportunities while making older business practices obsolete. To succeed and thrive in this environment, Canadian businesses need to innovate and create high-quality jobs. The Government has a strong record of support for research and development. But Canada can and must do better to promote innovation. The Government launched an Expert Panel in 2010 to review federal support for research and development. Informed by the advice of the Panel, the Government is taking action toward a new approach to supporting innovation in Canada.

Economic Action Plan 2012 will:

- Increase funding for research and development by small and medium-sized companies.

- Promote linkages and collaborations, including funding internships and connecting private sector innovators to procurement opportunities in the federal government.

- Refocus the National Research Council on research that helps Canadian businesses develop innovative products and services.

- Enhance access to venture capital financing by high-growth companies so that they have the capital they need to create jobs and grow.

- Streamline and improve the Scientific Research and Experimental Development tax incentive program, including shifting from indirect tax incentives to more direct support for innovative private sector businesses.

- Support research, education and training with new funding for universities, granting councils and leading research institutions, such as Genome Canada.

Responsible Resource Development

Canada’s resource sector is an asset that will increasingly contribute to the prosperity of all Canadians. Some $500 billion is expected to be invested in over 500 major economic projects across Canada over the next 10 years, driven in part by demand from emerging economies. Today, Canadian businesses in the resource sector must navigate a maze of overlapping and complex regulatory requirements and red tape. This leads to delays in investment and job creation that do not contribute to better environmental outcomes.

An efficient regulatory system provides effective protection of the interests of Canadians while minimizing the burden on businesses. It is a vital component of an attractive climate for investment and jobs. Since 2006, the Government has worked to streamline and improve regulatory processes. However, more needs to be done.

The Government is committed to reforming the regulatory system in the resource sector so that reviews are conducted in a timely and transparent manner, while safeguarding the environment. This will increase business confidence and enhance investment and job creation. The Government will continue to support responsible energy development.

Economic Action Plan 2012 will:

- Commit to bringing forward legislation to achieve the goal of “one project, one review” in a clearly defined time period.

- Make new investments to improve regulatory reviews, streamline the review process for major economic projects, support consultation with Aboriginal peoples, and strengthen pipeline and marine safety.

- Continue to support the Major Projects Management Office initiative, which has succeeded in shortening and streamlining reviews and improving accountability.

- Ensure the safety and security of Canadians and the environment as energy resources are developed.

Expanding Trade and Opening New Markets for Canadian Businesses

Free and open trade has long been a powerful engine for Canada’s economy. Canadian businesses need access to key export markets in order to take advantage of new opportunities. Over the past six years, Canada has concluded free trade agreements with nine countries as well as foreign investment promotion and protection agreements with ten countries. Since 2009, Canada has eliminated all tariffs on imported machinery and equipment and manufacturing inputs to make Canada a tariff-free zone for industrial manufacturers, the first in the G-20 to do so.

Economic Action Plan 2012 will:

- Intensify Canada’s pursuit of new and deeper trading relationships, particularly with large, dynamic and fast-growing economies.

- Implement the Action Plan on Perimeter Security and Economic Competitiveness and the Action Plan on Regulatory Cooperation, which will facilitate trade and investment flows with the United States.

- Provide support to Canadian exporters by extending the provision of domestic financing by Export Development Canada.

Investing in Training, Infrastructure and Opportunity

Canada’s well-trained and highly educated workforce represents one of our key advantages in competing and succeeding in the global economy. Too often, barriers or disincentives discourage workforce participation. Better utilizing Canada’s workforce and making Canada’s labour market more adaptable will help ensure Canada’s long-term economic growth.

Economic Action Plan 2012 will:

- Make investments to assist more young people in gaining tangible skills and experience.

- Extend and expand the ThirdQuarter project to better connect workers over the age of 50 to potential employers.

- Invest to enable more Canadians with disabilities to obtain work experience with small and medium-sized businesses.

- Introduce a number of targeted, common-sense changes to Employment Insurance (EI) to make it a more efficient program that promotes job creation, removes disincentives to work, supports unemployed Canadians and quickly connects people to jobs.

- Support small and medium-sized businesses and their workers by making EI premiums more stable and predictable, with annual increases limited to five cents.

- Extend the Hiring Credit for Small Business for one year to help small businesses to defray the costs of hiring new workers.

- Promote job creation by renewing the Canadian Coast Guard Fleet; supporting the involvement of small and medium-sized enterprises in the National Shipbuilding Procurement Strategy; investing in transportation infrastructure, including railways and ports; and providing funding for community public infrastructure facilities.

Expanding Opportunities for Aboriginal Peoples to Fully Participate in the Economy

The Government recognizes the contribution that Aboriginal peoples can make to the labour force as the youngest and fastest-growing segment of the nation’s population. Equipping First Nations people with the skills and opportunities they need to fully participate in the economy is a priority both for this Government and for First Nations people.

Economic Action Plan 2012 will:

- Invest in First Nations education on reserve, including early literacy programming and other supports and services to First Nations schools and students.

- Build and renovate schools on reserve, providing First Nations youth with better learning environments.

- Commit to introduce a First Nation Education Act and work with willing partners to establish the structures and standards needed to support strong and accountable education systems on reserve.

- Improve the incentives of the on-reserve Income Assistance Program while encouraging those who can work to access training that will improve their prospects for employment.

- Renew the Urban Aboriginal Strategy to improve economic opportunities for Aboriginal peoples living in urban centres.

Building a Fast and Flexible Economic Immigration System

Since 2006, the Government has pursued much-needed reforms to focus Canada’s immigration system on fuelling economic prosperity for Canada. The Government has placed top priority on attracting immigrants who have the skills and experience our economy needs. The Government is committed to making our immigration system truly fast and flexible in a way that will sustain Canada’s economic growth.

Economic Action Plan 2012 will:

- Realign the Temporary Foreign Worker Program to better meet labour market demands.

- Support further improvements to foreign credential recognition and identify the next set of target occupations beyond 2012.

- Move to an increasingly fast and flexible immigration system where priority focus is on meeting Canada’s labour market needs.

- Return applications and fees to certain federal skilled worker applicants who have been waiting for processing to be completed.

Sustainable Social Programs and Secure Retirement

In order to ensure the sustainability of our social programs and fiscal position for generations to come, steps are required to prepare today for the demographic pressures that the Canadian economy will face over the longer term. Canadians are living longer and healthier lives. Many older workers wish to work longer and increase their retirement income.

The Government has already taken steps to ensure sound public finances by setting a future growth path for transfers to the provinces and territories. The growth path will provide predictable, fair and sustainable funding in support of the provision of health care, education and other services for all Canadians.

Economic Action Plan 2012 will:

- Gradually increase the age of eligibility for Old Age Security (OAS) and Guaranteed Income Supplement benefits from 65 to 67. This change will start in April 2023, with full implementation by January 2029, and will not affect anyone who is 54 years of age or older as of March 31, 2012.

- Improve flexibility and choice by allowing Canadians the option of deferring take-up of their OAS benefits to a later time and receiving higher annual benefits.

- Ensure that pension plans for public servants and Parliamentarians are sustainable, fair and financially responsible.

- Support the retirement income system with Pooled Registered Pension Plans that provide an accessible, large-scale and low-cost pension option to employers, employees and the self-employed.

Responsible Expenditure Management

Canadians expect value for money from their government. Over the past year, the Government conducted a comprehensive review of approximately $75 billion of direct program spending by federal departments and agencies. The review identified a number of opportunities to enhance the efficiency and effectiveness of government operations, programs and services that will result in cost savings for the Canadian taxpayer. This will support the Government’s commitment to return to balanced budgets over the medium term. The Government is on track to meet its commitment to balance the budget without cutting transfers to Canadians or to provinces.

Fiscal policy is appropriately shifting toward consolidation in the aftermath of the effective stimulus program. The federal government is leading the initial fiscal effort, as spending is gradually being brought to pre-crisis levels as a share of GDP.

— International Monetary Fund

November 23, 2011

Reflecting Canada’s strong economic and fiscal fundamentals, Canada will undertake expenditure reductions that are modest compared to those being pursued by many countries around the world. These targeted reductions clearly contrast with the Program Review undertaken in Canada in the mid-1990s, when transfers for health care, education and social spending were cut.

Economic Action Plan 2012 will:

- Achieve ongoing savings of $5.2 billion, 6.9 per cent of the review base of approximately $75 billion. This represents less than 2.0 per cent of expected federal program spending in 2016–17, or under 0.2 per cent of Canada’s gross domestic product (GDP) in that same year.

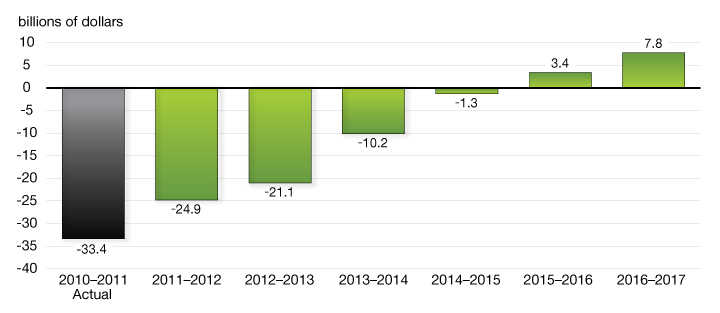

The Plan to Return to Balanced Budgets

Canadians know the importance of living within their means and expect the Government to do the same. That is why the Government is committed to managing public finances in a sustainable and responsible manner. The Government’s responsible financial management put Canada in a position of strength when it came time to combat the global recession. From 2006 to 2008, the Government paid down over $37 billion in debt, significantly contributing to Canada’s low net debt position. This enabled the Government to quickly implement the stimulus phase of Canada’s Economic Action Plan without leaving the country in a vulnerable fiscal position, like many European countries.

Balancing the budget and reducing debt cuts interest costs, helps to keep interest rates low and instills confidence in Canada’s economy, allowing families and businesses to plan for the future. It will also ensure the sustainability of Canada’s social programs for future generations.

The Government is on track to return to balanced budgets over the medium term

Budgetary Balance After Economic Action Plan 2012 Measures

Economic Action Plan 2012 is a plan for jobs, growth and long-term prosperity. By making choices now, the Government is taking the necessary steps to reinforce the fundamental strength and promise of the Canadian economy in order to sustain economic growth, create the high-quality jobs of tomorrow, preserve social programs and sound public finances, and deliver continued prosperity for generations to come.

Economic Developments and Prospects

- The global economic recovery remains fragile. The European sovereign debt and banking crisis continues to weigh on global growth.

- The Canadian economy has remained resilient despite external weakness, reflecting sustained growth in the domestic economy.

- Canada has had the strongest economic growth over the recession and recovery among Group of Seven (G-7) countries. This reflects our solid economic fundamentals and the timely support of the stimulus phase of Canada’s Economic Action Plan.

- 610,000 more Canadians are working now than in July 2009, the strongest job growth among G-7 countries over the recovery. This continues the strong performance that has resulted in over 1.1 million new jobs created since the beginning of 2006.

- However, the fragile global economic environment will continue to be reflected in modest growth in Canada over the near term.

- The Department of Finance conducted a survey of private sector economists in early March 2012. On March 5, economists met with the Minister of Finance to discuss the economic forecast as well as the risks associated with the outlook.

- Private sector economists expect real gross domestic product (GDP) growth of 2.1 per cent in 2012 and 2.4 per cent in 2013, broadly unchanged from the November 2011 Update of Economic and Fiscal Projections.

- Economists also expect the level of nominal GDP—the broadest single measure of the tax base—to be above the level anticipated over the forecast period at the time of the November Update.

- Private sector economists agreed that near-term risks to the outlook have slightly moderated since the November Update, but continue to see global economic uncertainty as the key downside risk—in particular the potential for wider contagion of the sovereign debt and banking crisis in Europe.

- To reflect the downside risks surrounding the global economic outlook, the Government is adjusting the private sector forecast for nominal GDP downward by $20 billion in each year of the 2012–2016 forecast period.

Supporting Jobs and Growth

Supporting Entrepreneurs, Innovators and World-Class Research

Creating Value-Added Jobs Through Innovation

The Government is committed to a new approach to supporting innovation that focuses resources on private sector needs. Economic Action Plan 2012 proposes:

- $400 million to help increase private sector investments in early-stage risk capital, and to support the creation of large-scale venture capital funds led by the private sector.

- $100 million to the Business Development Bank of Canada to support its venture capital activities.

- $110 million per year to the National Research Council to double support to companies through the Industrial Research Assistance Program.

- $14 million over two years to double the Industrial Research and Development Internship program.

- $12 million per year to make the Business-Led Networks of Centres of Excellence program permanent.

- $105 million over two years to support forestry innovation and market development.

- $95 million over three years, starting in 2013–14, and $40 million per year thereafter to make the Canadian Innovation Commercialization Program permanent and to add a military procurement component.

- $67 million in 2012–13 as the National Research Council refocuses on business-led, industry-relevant research.

- Streamlining and improving the Scientific Research and Experimental Development tax incentive program.

Support for Research, Education and Training

The Government is committed to providing additional resources to support advanced research at universities and other leading research institutions. Economic Action Plan 2012 proposes:

- $37 million annually starting in 2012–13 to the granting councils to enhance their support for industry-academic research partnerships.

- $60 million for Genome Canada to launch a new applied research competition in the area of human health, and to sustain the Science and Technology Centres until 2014–15.

- $6.5 million over three years for a research project at McMaster University to evaluate team-based approaches to health care delivery.

- $17 million over two years to further advance the development of alternatives to existing isotope production technologies.

- $10 million over two years to the Canadian Institute for Advanced Research to link Canadians to global research networks.

- $500 million over five years, starting in 2014–15, to the Canada Foundation for Innovation to support advanced research infrastructure.

- $40 million over two years to support CANARIE’s operation of Canada’s ultra-high speed research network.

- $23 million over two years to Natural Resources Canada to enhance satellite data reception capacity.

Improving Conditions for Business Investment

Responsible Resource Development

The Government is committed to improving the review process for major economic projects to accelerate investment and job creation. Economic Action Plan 2012 proposes:

- System-wide legislative improvements to the review process for major economic projects to achieve the goal of “one project, one review” in a clearly defined time period for major economic projects.

- $165 million over two years for responsible resource development that creates jobs while protecting the environment.

Investing in Our Natural Resources

The Government is supporting the development of Canada’s natural resource industries. Economic Action Plan 2012 proposes:

- Support for junior mineral exploration by extending the temporary 15-per-cent Mineral Exploration Tax Credit for flow-through share investors for an additional year.

- Actions to improve access to modern, reliable seismic data for offshore resource development.

- $12.3 million over two years to continue to assess diamonds in the North.

Expanding Trade and Opening New Markets for Canadian Businesses

The Government is taking action to improve Canadians’ standard of living by growing international trade and creating export opportunities for Canadian businesses. Economic Action Plan 2012 proposes:

- Intensifying Canada’s pursuit of new and deeper international trade and investment relationships, including updating the Government’s Global Commerce Strategy.

- Implementing the Action Plan on Perimeter Security and Economic Competitiveness and the Action Plan on Regulatory Cooperation, which will facilitate trade and investment flows with the United States.

- Providing support to Canadian businesses through tariff and tax measures, along with the extended provision of domestic financing by Export Development Canada.

- Increasing travellers’ exemptions to modernize existing rules and facilitate border processes for Canadians bringing goods home from abroad.

Keeping Taxes Low for Job-Creating Businesses

The Government has reduced business taxes and is committed to keeping taxes low. The Government has also taken action to enhance the neutrality of the tax system to support growth and encourage investment to flow to its most productive uses. Economic Action Plan 2012 proposes:

- Enhancing the neutrality of the tax system and further rationalizing inefficient fossil fuel subsidies by phasing out tax preferences for resource industries.

Improving Economic Conditions for Farmers and Fishermen

The Government is improving economic conditions for farmers and fishermen. Economic Action Plan 2012 proposes:

- $44 million over two years to transition the Canadian Grain Commission to a sustainable funding model.

- $10.5 million in 2012–13 to support key fisheries science activities.

Strengthening Business Competitiveness

The Government is taking action to improve the competitive position of job-creating Canadian businesses. Economic Action Plan 2012 proposes:

- Reducing red tape through the “One-for-One” Rule and implementing the Canada-United States Action Plan on Regulatory Cooperation.

- Reducing the tax compliance burden for businesses.

- Eliminating foreign investment restrictions for certain telecommunications companies.

Further Developing Canada’s Financial Sector Advantage

The Government is proposing new initiatives that will further ensure that our financial system remains strong and that it benefits all Canadians. Economic Action Plan 2012 proposes:

- Introducing legislative amendments to support central clearing of standardized over-the-counter derivative transactions, and to reinforce Canada’s financial stability framework.

- The Government will introduce enhancements to the governance and oversight framework for Canada Mortgage and Housing Corporation, and is moving forward with a legislative framework for covered bonds.

Investing in Training, Infrastructure and Opportunity

Supporting Job Creation, Small Business and Skills Training

The Government is committed to supporting job creation by small businesses and opportunities for under-represented groups in the workforce. Economic Action Plan 2012 proposes:

- Investing $205 million to extend the temporary Hiring Credit for Small Business for one year.

- Providing an additional $50 million over two years to the Youth Employment Strategy to assist more young people in gaining tangible skills and experience.

- Providing $6 million over three years to extend and expand the ThirdQuarter project to key centres across the country.

- Improving labour market opportunities for Canadians with disabilities by investing $30 million over three years in the Opportunities Fund and by creating a panel on labour market opportunities for persons with disabilities.

- Promoting the involvement of small and medium-sized enterprises in shipbuilding projects.

Improving the Employment Insurance Program

The Government is committed to making targeted, common-sense changes to make Employment Insurance (EI) a more efficient program that is focused on job creation and opportunities. Economic Action Plan 2012 proposes:

- Limiting EI premium rate increases to 5 cents each year until the EI Operating Account is balanced.

- Providing $21 million over two years to enhance the content and timeliness of the job and labour market information that is provided to Canadians who are searching for employment.

- Investing $74 million over two years to ensure that EI claimants benefit from accepting work.

- Investing $387 million over two years to align the calculation of EI benefit amounts with local labour market conditions.

Expanding Opportunities for Aboriginal Peoples to Fully Participate in the Economy

The Government is committed to expanding opportunities for Aboriginal peoples to fully participate in the labour market. Economic Action Plan 2012 proposes:

- Providing $275 million over three years to support First Nations education and build and renovate schools on reserve.

- Committing to work with willing partners toward passage of legislation that will establish the structures and standards to support strong and accountable education systems on reserve.

- Announcing the Government’s commitment to improve the incentives in the on-reserve Income Assistance Program while encouraging those who can work to access training so they are better equipped for employment.

- Providing $33.5 million in 2012–13 to extend the Atlantic Integrated Commercial Fisheries Initiative and the Pacific Integrated Commercial Fisheries Initiative.

- Providing $27 million over two years to renew the Urban Aboriginal Strategy.

Building a Fast and Flexible Economic Immigration System

The Government is committed to transitioning to a faster and more flexible economic immigration system. Economic Action Plan 2012 proposes:

- Announcing the Government’s intention to better align the Temporary Foreign Worker Program with labour market demands and to ensure that businesses look to the domestic labour force before accessing the Temporary Foreign Worker Program.

- Signalling the Government’s intention to support further improvements to foreign credential recognition and to work with provinces and territories to identify the next set of target occupations for inclusion, beyond 2012, under the Pan-Canadian Framework for the Assessment and Recognition of Foreign Qualifications.

- Proposing to return applications and refund up to $130 million in fees paid by certain federal skilled worker applicants who applied under previous criteria established prior to February 27, 2008.

Strengthening Canada’s Public Infrastructure

The Government is building on recent actions to modernize Canada’s public infrastructure. Economic Action Plan 2012 proposes:

- $150 million over two years for a new Community Infrastructure Improvement Fund to support repairs and improvements to existing community facilities.

- Amendments to the Yukon Act, the Northwest Territories Act and the Nunavut Act to create new regulations that will ensure consistent treatment of borrowing across the three territories and with their Public Accounts.

- $105 million in 2012–13 on a cash basis to support VIA Rail Canada’s operations and capital projects.

- $27.3 million over two years to support the divestiture of regional ports and the continued operation and maintenance of federally owned ports.

- $5.2 billion over the next 11 years on a cash basis to renew the Canadian Coast Guard fleet.

- $101 million over the next five years on a cash basis to restore and modernize the Esquimalt Graving Dock.

Supporting Families and Communities

Protecting the Health and Safety of Canadians

The Government is committed to promoting safe communities and protecting the health of individual Canadians. Economic Action Plan 2012 proposes:

- Expanding health-related tax relief under the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and income tax systems to better meet the health care needs of Canadians.

- $51.2 million over the next two years to strengthen Canada’s food safety system.

- Financial support for employers of Canada’s military reservists to offset costs incurred when part-time reservists sign up for full-time duty.

- Announcing enhanced support for the Victims Fund in the coming months.

Investing in Communities

The Government is committed to preserving Canada’s diverse cultural treasures and improving the quality of life in communities across the country. Economic Action Plan 2012 proposes:

- Announcing the Government’s intent to explore with interested First Nations the option of moving forward with legislation that would allow private property ownership within current reserve boundaries.

- Providing $330.8 million over two years to build and renovate on-reserve water infrastructure and support the development of a long-term strategy to improve water quality in First Nations communities.

- Providing $11.9 million in 2012–13 to support shelter services and violence prevention programming on reserves.

- Continuing to explore social finance instruments as a way to further encourage the development of government-community partnerships.

- Supporting major exhibitions at Canadian museums and galleries by modernizing the Canada Travelling Exhibitions Indemnification Program.

- Continuing support to ParticipACTION and Le Grand défi Pierre Lavoie.

- Providing up to $99.2 million over three years to assist the provinces and territories with the cost of permanent flood mitigation measures undertaken for the 2011 floods.

Supporting Families

The Government is committed to expanding government support for families, students, seniors and pensioners, and persons with disabilities. Economic Action Plan 2012 proposes:

- Providing $1.4 million annually to ensure that Wage Earner Protection Program applicants receive the benefits they are entitled to when they need them.

- Requiring federally regulated private sector employers to insure, on a go-forward basis, any long-term disability plans they offer to their employees.

- Helping Canadians with severe disabilities and their families by improving the Registered Disability Savings Plan.

Protecting Canada’s Natural Environment and Wildlife

The Government is committed to preserving Canada’s natural beauty. Economic Action Plan 2012 proposes:

- $50 million over two years to protect wildlife species at risk.

- The creation of Canada’s first national near-urban park in the Rouge Valley in Ontario.

- Expanding the eligibility for the accelerated capital cost allowance for clean energy generation equipment to include a broader range of bioenergy equipment.

Sustainable Social Programs and a Secure Retirement

- The Government is taking the necessary steps to ensure that Canada’s social programs remain sustainable over the long term.

- The Government has already set the future growth path of transfers to provinces and territories that will provide sustainable, predictable and record funding in support of health care, education and other services for Canadians.

- To ensure that Old Age Security (OAS) remains sustainable and reflects demographic realities, the Government will adjust the age of eligibility requirement for OAS, which will begin to be implemented in 2023 and will be fully implemented in 2029.

- To improve flexibility and choice, starting on July 1, 2013, the Government will allow for the voluntary deferral of the OAS pension, for up to five years, allowing Canadians the option of deferring take-up of their OAS pension to a later time and receiving a higher annual pension.

- The Government is improving the integrity and fairness of the tax system by closing tax loopholes that allow some businesses and individuals to avoid paying their fair share of tax.

- The Government is introducing measures to ensure that charities devote their resources primarily to charitable, rather than political, activities, and to enhance public transparency and accountability in this area.

Responsible Management to Return to Balanced Budgets

- In Budget 2011, the Government reiterated its commitment to generate ongoing savings from operating efficiencies and improving productivity by announcing a review of departmental spending. The results of this review are presented in this budget.

- Canada’s economic and fiscal fundamentals are strong. The scale of Canada’s efforts to reduce the deficit is modest compared to the expenditure restraint efforts being pursued by many countries around the world and relative to that undertaken in Canada in the mid-1990s, which included reduced transfers to provinces for health care and education.

- The Government’s economic management strikes the right balance between supporting economic growth and job creation and returning to budget balance over the medium term.

- That is why the Government remains committed to returning to balanced budgets at an appropriate pace as the economy continues to recover from the global economic crisis.

- The Government’s plan to return to balanced budgets over the medium term is on track.

- Measures initiated in Budget 2010 and Budget 2011 to restrain growth in federal spending have proven to be highly successful, contributing to a projected return to budgetary balance over the medium term, while ensuring continued and growing funding for the programs and services that are a priority for Canadians.

- The Government is not reducing transfers to persons, including those for seniors, children and the unemployed, or transfers to other levels of government in support of health care and social services.

- The results of the Government’s review of departmental spending will yield savings of $5.2 billion on an ongoing basis. The planned reduction in spending represents less than 2.0 per cent of federal program spending in 2016–17, or 0.2 per cent of Canada’s gross domestic product (GDP) in that same year.

Fiscal Outlook

- The Government’s plan for returning to balanced budgets over the medium term is on track.

- The deficit in 2011–12 is projected to be $8.5 billion lower than it was in 2010–11, and it is projected to decrease by an additional $3.8 billion in 2012–13. The deficit is projected to continue to decline to $1.3 billion in 2014–15.

- Over the forecast period, the budgetary balance is projected to improve by a total of $39.6 billion compared to the November 2011 Update of Economic and Fiscal Projections, reflecting both the improved economic outlook and the Government’s strong fiscal management.

- As a share of gross domestic product (GDP), program expenses are projected to decline from 14.7 per cent in 2010–11 to 12.7 per cent in 2016–17, which represents a return to pre-recession spending ratios.

- The federal debt is projected to decline to 28.5 per cent of GDP in 2016–17, in line with its pre-recession level.

- Canada expects to achieve, well ahead of schedule, its Group of Twenty (G-20) commitments to halve deficits by 2013 and stabilize or reduce total government debt-to-GDP ratios by 2016, as agreed to by G-20 leaders at their summit in Toronto in June 2010.

- Canada continues to hold a significant fiscal advantage over other G-7 countries. The International Monetary Fund projects that by 2016, Canada’s total government net debt-to-GDP ratio will remain at about one-third of the G-7 average and more than 20 percentage points of GDP below that of Germany, the G-7 country with the next-lowest ratio.