Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 4: Sustainable Social Programs and a Secure Retirement

Highlights

- The Government is taking the necessary steps to ensure that Canada’s social programs remain sustainable over the long term.

- The Government has already set the future growth path of transfers to provinces and territories that will provide sustainable, predictable and record funding in support of health care, education and other services for Canadians.

- To ensure that Old Age Security (OAS) remains sustainable and reflects demographic realities, the Government will adjust the age of eligibility requirement for OAS, which will begin to be implemented in 2023 and will be fully implemented in 2029.

- To improve flexibility and choice, starting on July 1, 2013, the Government will allow for the voluntary deferral of the OAS pension, for up to five years, allowing Canadians the option of deferring take-up of their OAS pension to a later time and receiving a higher annual pension.

- The Government is improving the integrity and fairness of the tax system by closing tax loopholes that allow some businesses and individuals to avoid paying their fair share of tax.

- The Government is introducing measures to ensure that charities devote their resources primarily to charitable, rather than political, activities, and to enhance public transparency and accountability in this area.

Sustainable Management of Public Finances

Putting Transfers on a Long-Term, Sustainable Growth Track

Economic Action Plan 2012 reaffirms the Government’s commitment to sustainable and predictable transfers to provinces and territories in support of health care, education and other programs and services.

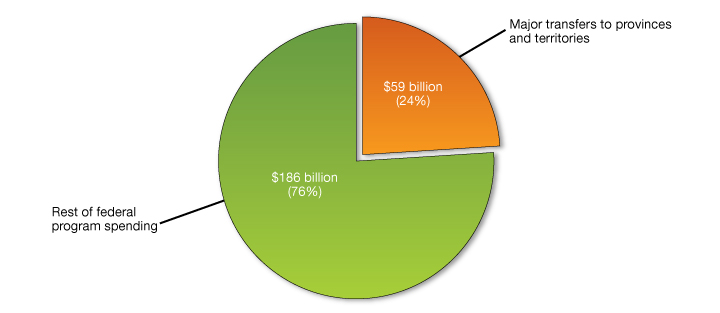

The Government of Canada provides significant financial support to provincial and territorial governments on an ongoing basis to assist them in the provision of programs and services. Major transfers to provinces and territories will reach a record level of $59 billion in 2012–13, accounting for about a quarter of the Government’s total program spending (Chart 4.1).

Major transfers to provinces and territories will total almost one quarter of federal program spending in 2012–13

The Government recognizes the important role major transfers play within the federation, and is committed to ensuring that transfers to other levels of government grow in a manner that is affordable and sustainable and reflects taxpayers’ ability to pay.

In December 2011, the Government set the future growth path of transfers to provinces and territories to provide sustainable and predictable funding in support of the provision of health care, education and other programs and services for all Canadians.

Legislation will be introduced to ensure the current 6-per-cent annual escalator for the Canada Health Transfer (CHT) will continue for five more years. Starting in 2017–18, the CHT will grow in line with a three-year moving average of nominal GDP growth, with funding guaranteed to increase by at least 3 per cent per year.

This growth path demonstrates the Government’s commitment to a publicly funded, universally accessible health care system that respects the principles of the Canada Health Act and recognizes that health care is an area of provincial jurisdiction. Funding for health care will continue to grow from $27 billion in 2011–12 to a minimum of $38 billion by 2018–19. This health care funding will provide certainty and stability to the provinces and territories as they take action to put their respective health care systems on sustainable spending paths. The CHT will be reviewed in 2024.

The Canada Social Transfer (CST) provides financial support to provinces and territories for post-secondary education, social assistance and social services, as well as programs for children. Recognizing the importance of this funding for the delivery of social programs, the Government will introduce legislation to continue the 3-per-cent escalator for the CST for 2014–15 and subsequent years. The CST will also be reviewed in 2024.

In Budget 2007, the Government legislated equal per capita cash support for both the CST and the CHT in order to provide comparable treatment for all Canadians, regardless of where they live. CST equal per capita cash allocations began in 2007–08. To provide provinces and territories the time to prepare, legislation set 2014–15 as the year when CHT equal per capita cash allocations would begin.

The Government will introduce legislation to ensure that the transition is fiscally responsible by providing protection so that no province or territory will receive less than its 2013–14 CHT cash allocation in subsequent years as a result of the move to equal per capita cash.

The Government also announced in December 2011 that Equalization will continue to grow in line with GDP and Territorial Formula Financing (TFF) will continue to grow based on its current formula. Federal-provincial-territorial officials will complete the review of the technical aspects of Equalization and TFF in time for their renewal in 2014–15.

A Strong Retirement Income System for Canadians

The Government is committed to ensuring the retirement security of Canadians.

Canada has a strong, three-pillar retirement income system (see box). Since 2006, the Government has taken many steps to strengthen the system, including increasing the Guaranteed Income Supplement for the most vulnerable seniors, introducing pension income splitting, increasing the Age Credit and creating innovative programs such as the Tax-Free Savings Account and Pooled Registered Pension Plans.

Economic Action Plan 2012 takes action to ensure the retirement security of all Canadians now and into the future by:

- Placing the first pillar, Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), on a sustainable path.

- Confirming that the Canada Pension Plan is sustainable at the current contribution rate of 9.9 per cent of pensionable earnings.

- Confirming that the Government is moving forward on the timely implementation of Pooled Registered Pension Plans.

Canada's Three-Pillar Retirement Income System

Pillar 1: Old Age Security Program

The Old Age Security (OAS) program is financed from the Government of Canada’s general revenues and provides a monthly pension to most Canadians 65 years of age or over. The maximum annual OAS pension is $6,481.

The Government provides additional support to low-income seniors through the Guaranteed Income Supplement (GIS). The maximum annual GIS benefit is $8,788 for single seniors and $11,654 for couples.

The OAS program provides approximately $38 billion per year in benefits to 4.9 million individuals.

Economic Action Plan 2012 introduces changes to the age of eligibility for OAS benefits, to be phased in gradually, starting in 2023. As well, Economic Action Plan 2012 introduces the option to defer the OAS pension and receive an actuarially adjusted pension, starting on July 1, 2013.

Pillar 2: Canada Pension Plan and Québec Pension Plan

The Canada Pension Plan (CPP) and the Québec Pension Plan (QPP) provide a basic level of earnings replacement in retirement for all Canadian workers. The CPP and the QPP are financed by contributions from workers and employers. The maximum annual CPP and QPP retirement benefits are $11,840.

The CPP and QPP also provide supplementary benefits, which include survivor benefits and disability benefits.

The CPP and QPP provide approximately $44 billion per year in benefits to 6.5 million individuals. Economic Action Plan 2012 confirms that the CPP is sustainable at the current contribution rate of 9.9 per cent of pensionable earnings.

Pillar 3: Voluntary tax-assisted savings opportunities

To help Canadians accumulate additional savings for retirement, the Government provides tax-assisted savings opportunities through Registered Pension Plans, Registered Retirement Savings Plans and Registered Retirement Income Funds. The Tax-Free Savings Account (TFSA), introduced by the Government in Budget 2008, also provides tax assisted savings opportunities. It is a general-purpose savings plan that may be used for any savings purpose, including retirement saving. The TFSA provides greater savings incentives for low- and modest-income individuals since neither TFSA investment income nor withdrawals affect eligibility for federal income-tested benefits and credits, such as OAS and GIS benefits.

The Government is adding to the pillar by introducing Pooled Registered Pension Plans, which will provide an accessible, large-scale and low-cost pension option to employers, employees and the self-employed.

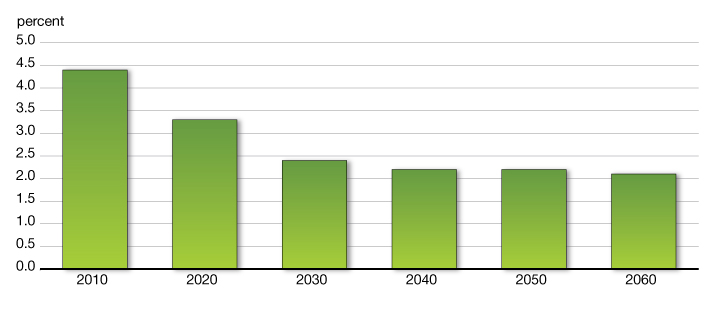

The OAS program is the single largest program of the Government of Canada. It was put in place at a time when Canadians were not living the longer, healthier lives that they are now. It was designed for a much different demographic future than Canada faces today. In the 1970s, there were seven workers for every one person over the age of 65. There are currently four workers per senior, and in 20 years, there will be only two.

The number of workers per senior will decline to nearly half its current level by 2030

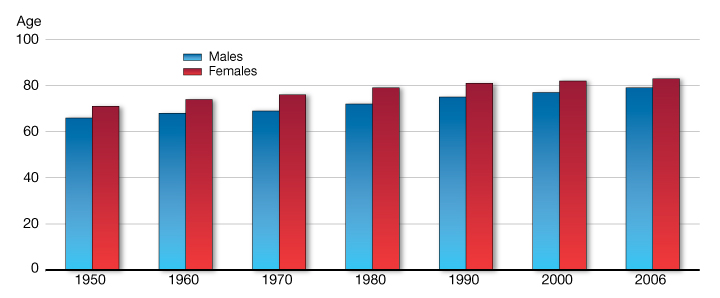

In addition, in 1970, life expectancy was age 69 for men and 76 for women. Today, it is 79 for men and 83 for women. The baby boom generation (born between 1946 and 1964) is also the largest age cohort in history. At the same time, Canada’s birth rate is falling. Given these demographic changes, the cost of the OAS program will grow from $38 billion in 2011 to $108 billion in 2030.

The life expectancy of Canadians continues to rise

Many countries are increasing the age of eligibility of their public pension programs. Of the 34 Organisation for Economic Co-operation and Development countries, the following have recently increased or announced plans to increase the eligibility ages: Australia, Austria, Belgium, the Czech Republic, Denmark, Estonia, France, Germany, Greece, Hungary, Ireland, Israel, Italy, Japan, Korea, the Netherlands, the Slovak Republic, Slovenia, Spain, Turkey, the United Kingdom and the United States.

Also, as Canadians are living longer and healthier lives, many may prefer to work longer. The OAS program should reflect this new reality and provide the option for individuals to work longer and receive higher retirement benefits.

Economic Action Plan 2012 takes action to ensure that the OAS program is on a sustainable path. These actions will ensure OAS remains strong and is there for future generations when they need it, as it is for all seniors who currently receive these benefits.

Old Age Security Age of Eligibility

Economic Action Plan 2012 puts the OAS program on a sustainable path by proposing legislation to raise the age of eligibility for OAS and GIS benefits gradually from 65 to 67 starting in April 2023. This will be fully implemented by January 2029.

The age of eligibility for OAS and GIS will be gradually increased from 65 to 67, starting in April 2023, with full implementation by January 2029. An 11-year notification period, followed by a 6-year phase-in period, is being provided to ensure that individuals have significant advance notification to plan their retirement and make adjustments.

This proposed legislative change to the age of OAS/GIS eligibility will not affect anyone who is 54 years of age or older as of March 31, 2012. Thus, individuals who were born on March 31, 1958 or earlier will not be affected. Those who were born on or after February 1, 1962 will have an age of eligibility of 67. Those who were born between April 1, 1958 and January 31, 1962 will have an age of eligibility between 65 and 67. For example, as shown in Table 4.2, someone born in April 1960 will be eligible for OAS/GIS at age 66 and one month.

| 1958 | 1959 | 1960 | 1961 | 1962 | |

|---|---|---|---|---|---|

| Month of Birth | OAS/GIS Eligibility Age | ||||

| Jan. | 65 | 65 + 5 mo | 65 + 11 mo | 66 + 5 mo | 66 + 11 mo |

| Feb. – Mar. | 65 | 65 + 6 mo | 66 | 66 + 6 mo | 67 |

| Apr. – May | 65 + 1 mo | 65 + 7 mo | 66 + 1 mo | 66 + 7 mo | 67 |

| June – July | 65 + 2 mo | 65 + 8 mo | 66 + 2 mo | 66 + 8 mo | 67 |

| Aug. – Sept. | 65 + 3 mo | 65 + 9 mo | 66 + 3 mo | 66 + 9 mo | 67 |

| Oct. – Nov. | 65 + 4 mo | 65 + 10 mo | 66 + 4 mo | 66 + 10 mo | 67 |

| Dec. | 65 + 5 mo | 65 + 11 mo | 66 + 5 mo | 66 + 11 mo | 67 |

| Note: mo = months. | |||||

In line with the increase in age of OAS/GIS eligibility, the ages at which the Allowance and the Allowance for the Survivor are provided will also gradually increase from 60-64 today to 62-66 starting in April 2023. This change will not affect anyone who is 49 years of age or older as of March 31, 2012.

The Government will ensure that certain federal programs, including programs provided by Veterans Affairs Canada and Aboriginal Affairs and Northern Development Canada that currently provide income support benefits until age 65, are aligned with changes to the OAS program. Without such an alignment, individuals receiving benefits from these programs would stop receiving them at age 65 and face an income gap until age 67 when they become eligible for OAS and GIS. The alignment will ensure that these individuals do not face a gap in income at ages 65 and 66.

The Government will discuss the impact of the changes to the OAS program on Canada Pension Plan (CPP) disability and survivor benefits with provinces and territories, who are joint stewards of the CPP, in the course of the next triennial review. The Government will compensate provinces and territories for net additional costs they face resulting from the increase in the age of eligibility for OAS benefits.

Option to Defer the OAS Pension

Economic Action Plan 2012 proposes to give individuals the option to defer take-up of their OAS pension to a later time and subsequently receive an actuarially adjusted higher pension.

To improve flexibility and choice in the OAS program, starting on July 1, 2013, the Government will allow for the voluntary deferral of the OAS pension, for up to five years, allowing Canadians the option of deferring take-up of their OAS pension to a later time and receiving a higher, actuarially adjusted, annual pension. For example, individuals could continue to work longer and defer taking up their OAS pension beyond age 65, resulting in an actuarially adjusted pension starting in a subsequent year.

The adjusted pension will be calculated on an actuarially neutral basis, as is done with the CPP. This means that, on average, individuals will receive the same lifetime OAS pension whether they choose to take it up at the earliest age of eligibility or defer it to a later year. The annual pension will be higher if they choose to defer. GIS benefits, which provide additional support to the lowest-income seniors, will not be eligible for actuarial adjustment.

Example of One-Year OAS Deferral

Michael will be turning 65 in September 2013.

Instead of taking up his OAS pension at age 65, he plans to continue working a year longer and defer the pension until age 66.

When he takes up his OAS pension at age 66, his annual pension will be $6,948 instead of $6,481 (in 2012 dollars).

Example of Five-Year OAS Deferral

Rita will be turning 65 in December 2013.

She plans to continue working as long as she can. She prefers to forgo her OAS pension for the maximum deferral period of five years so that she can have a substantially higher annual pension amount, starting at age 70.

When she takes up her OAS pension at age 70, her annual pension will be $8,814 instead of $6,481 (in 2012 dollars).

Proactive Enrolment for OAS and GIS Benefits

Economic Action Plan 2012 proposes to put in place a proactive enrolment regime for OAS and GIS.

As part of the Administrative Services Review, initiated in Budget 2010, the Government is pursuing additional standardization and consolidation opportunities to improve the way it delivers services to Canadians while generating operational savings. In the context of this initiative, the Government will improve services for seniors by putting in place a proactive enrolment regime that will eliminate the need for many seniors to apply for OAS and GIS. This measure will reduce the burden on seniors of completing application processes and will reduce the Government’s administrative costs. Proactive enrolment will be implemented in a phased-in approach from 2013 to 2015.

Canada Pension Plan

Economic Action Plan 2012 announces that the 2010–2012 triennial review of the CPP confirms the financial sustainability of the Plan for at least the next 75 years at the current contribution rate of 9.9 per cent of pensionable earnings.

Federal, provincial and territorial Ministers of Finance have completed their 2010–2012 triennial review of the CPP. In accordance with the legislation governing the CPP, Finance Ministers review the financial state of the CPP every three years and make recommendations as to whether benefits or the contribution rate or both should be changed.

Economic Action Plan 2012 announces that the 2010–2012 triennial review of the CPP confirms the financial sustainability of the Plan for at least the next 75 years at the current contribution rate of 9.9 per cent of pensionable earnings. Thus, there will be no change to the contribution rate.

Finance Ministers also agreed to a number of technical amendments to the CPP legislation and to the CPP Investment Board regulations. The proposed CPP amendments range from consequential changes to the reforms that were made to modernize the CPP in the previous 2007–2009 triennial review to amendments that will ensure consistency within the different parts of the CPP legislation. The technical amendments will not change the level of CPP benefits or have an impact on the contribution rate.

The Government's Record on Seniors

As a result of actions taken to date by the Government, seniors and pensioners will receive $2.5 billion in additional targeted tax relief for the 2012–13 fiscal year. In particular, since 2006, the Government has:

- Increased the Age Credit amount by $1,000 in 2006 and by another $1,000 in 2009.

- Doubled the maximum amount of income eligible for the Pension Income Credit to $2,000.

- Introduced pension income splitting.

- Increased the age limit for maturing pensions and Registered Retirement Savings Plans (RRSPs) to 71 from 69 years of age.

In 2012, a single senior can earn at least $19,542 and a senior couple at least $39,084 before paying federal income tax. As a result of actions taken since 2006, 380,000 seniors have been removed from the tax rolls.

In addition, the Government has strengthened the pillars of the retirement income system. The Government:

- Created a new Guaranteed Income Supplement top-up benefit for Canada’s most vulnerable seniors. Budget 2011 announced additional annual benefits of up to $600 for single seniors and $840 for couples for more than 680,000 low-income seniors.

- Increased, in Budget 2008, the amount that can be earned before the GIS is reduced to $3,500, so GIS recipients can keep more of their hard-earned money without any reduction in GIS benefits.

- In 2009, the Canada Pension Plan was modernized to make it more flexible for those transitioning out of the workforce and to better reflect the way Canadians currently live, work and retire.

- Built a better framework for federally regulated Registered Pension Plans (RPPs)—including ensuring that an employer fully funds benefits if the pension plan is terminated.

- Introduced several improvements to the tax rules for RPPs and RRSPs to support work and saving by older Canadians and to provide sponsors of defined benefit pension plans with more funding flexibility.

- Expanded pension options with the introduction of Pooled Registered Pension Plans for millions of Canadians who have not previously had access to a large-scale, low-cost, professionally administered company pension plan.

- Amended the Canadian Human Rights Act and the Canada Labour Code to prohibit federally regulated employers from setting a mandatory retirement age unless there is a bona fide occupational requirement. This allows Canadians to choose how long they wish to remain active in the labour force.

- Introduced the Tax-Free Savings Account (TFSA) in Budget 2008. The TFSA is especially beneficial to seniors as neither the income earned in a TFSA nor withdrawals from it affect eligibility for federal income-tested benefits and credits, such as the Age Credit, OAS and GIS benefits. The TFSA also benefits seniors by providing them with a savings vehicle to meet their ongoing savings needs, something to which they have only limited access once they are over age 71 and are required to begin drawing down their registered retirement savings.

Finally, the Government has also strengthened direct support to seniors:

- Budget 2011 provided $10 million over two years to increase funding for the New Horizons for Seniors Program, which funds organizations that help ensure that seniors can benefit from, and contribute to, the quality of life in their communities through active living and participation in social activities. This was in addition to $5 million per year provided in Budget 2010 and $10 million per year provided in Budget 2007.

- Budget 2009 provided $400 million over two years for the construction of new housing units for low-income seniors.

- Budget 2008 invested $13 million over three years to help seniors and others recognize the signs and symptoms of elder abuse and to provide information on what support is available.

- Since 2006, $210 million has been invested in the Targeted Initiative for Older Workers, a federal-provincial-territorial employment program that provides a range of employment activities for unemployed older workers in vulnerable communities.

Federally Regulated Pension Plans

The Government has introduced legislation to implement Pooled Registered Pension Plans, which will provide a new, accessible, large-scale and low-cost pension option to employers, employees and the self-employed.

The Government is implementing changes to Canada’s pension landscape that will make saving for retirement easier for millions of Canadians. On November 17, 2011, the Government introduced the Pooled Registered Pension Plans Act (the PRPP Act). PRPPs will provide a new, accessible, large-scale and low-cost pension option to employers, employees and the self employed.

The PRPP Act will apply to employees in industries that are federally regulated. It will also apply to all individuals employed in the Yukon, Northwest Territories and Nunavut. Provinces must introduce enabling legislation in their own jurisdictions to make PRPPs available throughout Canada.

The Government will continue to work closely with the provinces to encourage implementation of the framework in a timely manner to help Canadians reach their retirement objectives. A high level of harmonization of regulations across jurisdictions will be instrumental in increasing the availability of PRPPs and achieving lower costs.

In December 2011, the federal government also released for public comment a package of draft amendments to the Income Tax Act and Income Tax Regulations to accommodate PRPPs under the tax rules. The tax rules for PRPPs will apply to all PRPPs, whether federally or provincially regulated. Comments received during the consultation period, which ended on February 14, 2012, are being reviewed. The tax rules for PRPPs will be implemented in 2012.

The Government will also introduce technical amendments to strengthen the Pension Benefits Standards Act, 1985.

Improving Tax Fairness and Integrity

Economic Action Plan 2012 proposes new measures to close tax loopholes in order to improve the fairness and integrity of the tax system and to help keep tax rates low.

In the 2010 Speech from the Throne, the Government committed to take aggressive steps to close tax loopholes that allow a few businesses and individuals to take advantage of hard-working Canadians who pay their fair share of tax. By broadening and protecting the tax base, these actions also help to keep Canadian tax rates competitive and low, thereby improving incentives to work, save and invest in Canada.

Since 2006, the Government has introduced over 40 measures to improve the integrity of the tax system, raising over $2 billion in revenues for the federal government in both 2013–14 and 2014–15. These measures also help protect provincial tax revenues on our shared tax bases.

The Government is taking further action through Economic Action Plan 2012 to improve the fairness and integrity of the tax system by:

- Restricting the ability of foreign-based multinational corporations to transfer, or “dump”, foreign affiliates into their Canadian subsidiaries with a view to creating tax-deductible interest or distributing cash free of withholding tax, without providing any economic benefit to Canada.

- Improving the effectiveness of Canada’s thin capitalization rules, which seek to prevent Canadian corporate profits from being distributed to certain non-resident shareholders free of Canadian income tax by way of interest payments on excessive debt.

- Preventing the avoidance of corporate income tax through the use of partnerships to convert income gains into capital gains.

- Modifying the penalty for making unreported tax shelter sales to better match the penalty to the purported tax savings of the unreported tax shelter.

- Tightening the rules applicable to Retirement Compensation Arrangements to prevent certain schemes designed to inappropriately reduce tax liabilities.

- Tightening the rules applicable to Employees Profit Sharing Plans to discourage excessive contributions for employees with a close tie to their employer.

Economic Action Plan 2012 proposals to improve tax fairness and integrity will yield $120 million in savings in 2012–13, rising to $320 million by 2013–14. Further details on these proposals can be found in Annex 4.

Enhancing Transparency and Accountability for Charities

Economic Action Plan 2012 proposes measures to ensure that charities devote their resources primarily to charitable, rather than political, activities, and to enhance public transparency and accountability in this area.

The Government of Canada provides registered charities with generous assistance under the tax system in recognition of the valuable work that they perform. Registered charities are exempt from tax on their income and may issue official donation receipts for gifts received. In turn, donors can use those receipts to reduce their taxes by claiming the Charitable Donations Tax Credit (for individuals) or Charitable Donations Tax Deduction (for corporations). In 2011, federal tax assistance for the charitable sector was approximately $2.9 billion. At the request of the Government, the House of Commons Standing Committee on Finance is studying current and proposed incentives for charitable giving to ensure that the tax incentives are as effective as possible.

Canadians have shown that they are willing to donate generously to support charities, but want to be assured that charities are using their resources appropriately. In this regard, charities are required by law to operate exclusively for charitable purposes and to devote their resources exclusively to charitable activities.

Given their unique perspectives and expertise, it is broadly recognized that charities make a valuable contribution to the development of public policy in Canada. Accordingly, under the Income Tax Act charities may devote a limited amount of their resources to non-partisan political activities that are related to their charitable purposes.

Recently, concerns have been raised that some charities may not be respecting the rules regarding political activities. There have also been calls for greater public transparency related to the political activities of charities, including the extent to which they may be funded by foreign sources.

The Canada Revenue Agency (CRA), as administrator of the tax system, is responsible for ensuring that charities follow the rules. Accordingly, to enhance charities’ compliance with the rules with respect to political activities, Economic Action Plan 2012 proposes that the CRA:

- Enhance its education and compliance activities with respect to political activities by charities.

- Improve transparency by requiring charities to provide more information on their political activities, including the extent to which these are funded by foreign sources.

These administrative changes will cost $5 million in 2012–13 and $3 million in 2013–14.

It is also proposed that the Income Tax Act be amended to restrict the extent to which charities may fund the political activities of other qualified donees, and to introduce new sanctions for charities that exceed the limits on political activities, or that fail to provide complete and accurate information in relation to any aspect of their annual return.