Backgrounder: Continued Progress for the Middle Class

The Fall Economic Statement 2018 is a plan to invest in the economy, strengthen and grow the middle class, and offer real help to people working hard to join it. The Government is delivering on its commitments to Canadians—investing in a fiscally responsible way that will keep the economy strong and growing today, and for the long term.

Results for Canadians

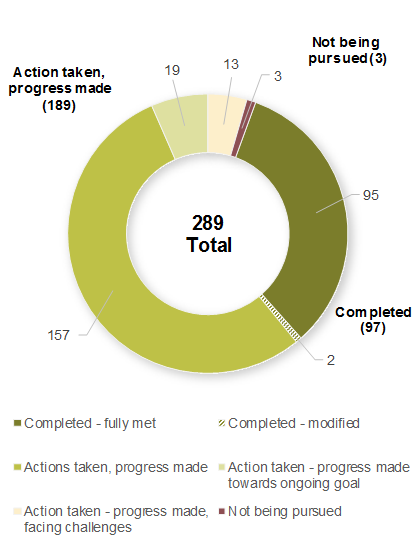

The Government has made a commitment to deliver real results for Canadians. Of the 289 commitments made in Ministers' mandate letters in November 2015, 97 have been successfully completed, and 189 have had actions taken and progress made.

Figure 1 Mandate Letter Commitments (November 2015)

The Government's plan is helping people and communities across the country, especially hard-working middle class families.

Real progress has been made, including:

- Supporting children and families by lowering taxes and introducing the Canada Child Benefit. By this time next year, a typical middle class family of four will have about $2,000 more each year to help with the high cost of raising their children, and saving for their future.

- Helping Canadians secure a safe and affordable home with the first-ever Canadian National Housing Strategy. This $40 billion, 10-year plan helps ensure that Canadians have access to affordable housing that meets their needs.

- Building strong and resilient communities through the more than 30,000 infrastructure projects approved since 2016 under the Investing in Canada plan. The vast majority are underway and creating good, middle class jobs.

- Giving more Canadians a secure and dignified retirement by increasing the Guaranteed Income Supplement top-up for low-income single seniors, restoring the eligibility age for Old Age Security and Guaranteed Income Supplement benefits to 65, and enhancing the Canada Pension Plan to improve the quality of life for seniors now and for generations to come.

The full and equal participation of women in the economy is important for economic growth and a strong middle class. However, a persistent wage gap between the average earnings of Canadian women and men is a stark reminder that there is more work to do. The Government's actions to address the gender wage gap and achieve pay equity in Canada include:

- Introducing proactive pay equity legislation for federally regulated workers to promote equal pay for work of equal value.

- Creating the Employment Insurance Parental Sharing Benefit to support greater gender equality at home and in the workplace.

- Introducing a new Women Entrepreneurship Strategy to help women entrepreneurs grow their businesses with greater access to capital, training, networking and expertise.

- Increasing women's representation in male-dominated trades through the Apprenticeship Incentive Grant for Women and the Pre-Apprenticeship Program.

- Promoting equal access to training and jobs for Indigenous women through the Indigenous Skills and Employment Training Program.

- Investing to help visible minority newcomer women in Canada enter and stay in the workforce.

New Measures for Continued Progress

While much progress has been made, more work remains to be done. With the Fall Economic Statement 2018, the Government is highlighting new measures to promote equal and full participation by all Canadians in our economy and society.

Proactive Pay Equity for Federally Regulated Workers

As part of the multi-pronged strategy to address the gender wage gap and achieve gender equality, the Government recently introduced proactive pay equity legislation for federally regulated workers.

Gender Wage Gap

For every dollar of hourly wages earned by a man working full time, a woman working full time earns on average about 88 cents. This gap places Canada in the middle of the pack compared to other developed economies.

On October 29, the Government introduced proactive pay equity legislation to address the gender wage gap. This legislation would apply to approximately 1.2 million employees in federally regulated workplaces, and is designed to ensure that women and men working in the federally regulated sector receive equal pay for work of equal value.

Highlights of the new legislation include:

- Establishment of a Pay Equity Commissioner within the Canadian Human Rights Commission to ensure that pay equity requirements are enforced.

- Requirements for employers to establish and regularly update a pay equity plan.

- Requirements that unionized and larger non-unionized employers set up a pay equity committee to develop and update the plan.

- Introduction of a monetary penalty system to ensure that pay equity plans are made, updated and followed.

To support the implementation of this new legislation, the Government proposes to provide the Minister of Employment, Workforce Development and Labour; the Minister of Justice; and the Treasury Board Secretariat with funding needed to implement, administer, and adjudicate the new proactive pay equity regime.

The Social Finance Fund

To encourage innovative approaches to persistent and complex social challenges, the Government is creating a Social Finance Fund. This will give charitable, non-profit and social purpose organizations access to new financing to implement their innovative ideas, and will connect them with non-government investors seeking to support projects that will drive positive social change.

To help accelerate that change, the Government proposes to make available up to $755 million on a cash basis over the next 10 years for a new Social Finance Fund and an additional $50 million over two years for social purpose organizations to improve their ability to successfully participate in the social finance market.

The proposed Social Finance Fund could generate up to $2 billion in economic activity, and help create as many as 100,000 jobs over the next decade. In addition to these measures, the Government will continue to work on exploring other recommendations from the Steering Group's report.

Support for Canadian Journalism

A strong and independent news media is crucial to a well-functioning democracy. It empowers citizens by providing them with the information they need to make sound decisions on important issues.

In order to ensure Canadians' continued access to informed and reliable civic journalism, the Government is announcing its intention to propose three new initiatives: allowing non-profit news organizations to receive charitable donations and issue official donation receipts; introducing a refundable tax credit to support original news content, including local news; and introducing a new temporary non-refundable tax credit to support subscriptions to Canadian digital news media.

The Fall Economic Statement also proposes to:

- Establish a permanent advisory committee on the charitable sector to ensure that the regulatory environment in which charities operate is appropriate and that it encourages their full participation in public policy dialogue and development.

- Make nutritious food more affordable in isolated northern communities, to ensure northern families have access to affordable, healthy and more culturally relevant foods.

- Ensure prompt payment for government construction contractors working on federal projects on federal land.

- Support the creation of a Francophone digital platform that will increase online French content, give higher profile to Canadian content, and enhance opportunities for Canadian artists and producers.

- Sustain Canada's wild fish stocks to support rebuilding efforts for priority Pacific salmon stocks, as well as other priority fish stocks across Canada.

- Expand on the success of the Atlantic Fisheries Fund with the creation of a Quebec Fisheries Fund and a British Columbia Salmon Restoration and Innovation Fund, which will generate good, middle class jobs in coastal communities.

- Promote avalanche safety by supporting Avalanche Canada's efforts to expand the size and scope of its programs.

With the Fall Economic Statement 2018, the Government is doing more to strengthen the middle class and build an economy that works for everyone.

- Date modified: