Chapter

1:

Building a stronger Canadian economy

Find out more about the expected gender and diversity impacts for each measure in Chapter 1: Building a stronger Canadian economy.

Canada has always been a proud nation of builders. In our earliest years, we were unified by a national railway. In the final years of the 1950s, the St. Lawrence Seaway was fully completed with 15 locks linking the Great Lakes to the Atlantic Ocean stretching over 3,700 kilometres. In the same decade, tens of thousands of blasters, steelworkers, roadworkers, and carpenters started construction on the Trans-Canada Highway.

These infrastructure projects connected our nation and built our economy. It is time we start building again at speed and scale.

The new government's core mission is to empower Canadians by building Canada's economic strength.

This call for action is more pertinent than ever with the trade war causing uncertainty and presenting economic challenges. The latest Bank of Canada Business Outlook Survey revealed that over 60 per cent of firms cited uncertainty surrounding financial, economic, and political conditions as their most pressing concern. This has been reflected in slower hiring and businesses delaying or cancelling projects, with business investment falling by 8 per cent annualised in the second quarter. Forecasters expect business investment weakness to persist throughout 2025. However, this period of global change can be our opportunity to invest in our economy and position Canada for stronger, more sustainable growth in the future.

In a rapidly shifting global landscape, we cannot control what other nations do. We can control what we choose to do—and we are choosing to build.

Budget 2025 capitalises on a generational opportunity—not seen since the economic transformation engendered by C.D. Howe in the wake of the Second World War—to transform our economy, our energy, our trade relations, and our collective defence.

To help drive this transformation, the government is focused on catalysing private sector investment in Canada—investment in machinery, equipment, and innovation that enhances long-term growth potential and will help jumpstart and sustain productivity growth.

Canada's new government is focused on creating the conditions that allow businesses to succeed—investing in strategic infrastructure, modernising regulatory and competition frameworks, and accelerating the development and adoption of critical technologies such as AI and clean technology.

And we are already making progress. In a short time, the government has launched the Major Projects Office to fast-track nation-building projects, and Build Canada Homes, which will help double the pace of construction over the next decade. As Canada's new government embarks on these missions, we are also ensuring Canadian workers and businesses have the tools they need to drive this transformation and thrive from it.

In this time of uncertainty, there is also a heightened urgency to make our economy more resilient and competitive. Through this budget, the government will tackle structural issues that are holding back Canada's economy—internal trade barriers, burdensome regulation, and weak competition intensity. Eliminating our barriers to growth will usher in a new era of economic security and prosperity for Canadians.

1.1 Accelerating Major Nation-Building Projects

For too long, the construction of major infrastructure in Canada has been stalled by arduous, inefficient approval processes. Uncertainty, red tape, and duplicated and complicated review processes have all curbed investment.

Statistics Canada estimates that federal regulatory burden rose 37 per cent between 2006 and 2021. Had it remained at 2006 levels, business investment in 2021 would have been 9 per cent higher.

Currently, to receive approval, major projects must undergo numerous reviews and assessments that often happen one after the other, instead of all running in parallel.

A core mission of Canada's new government is to accelerate the delivery of major projects. With the Building Canada Act, we are fast-tracking nation-building infrastructure projects by streamlining federal review and approval processes. This will increase regulatory certainty, helping attract capital and strengthening our industries. This is done all while maintaining strong environmental protections, upholding Indigenous rights, and creating opportunities for Indigenous Peoples to derive economic benefits from major project development. The government also undertook a review aimed at eliminating red tape. Ministers have identified approximately 500 recent improvements and forward-looking actions to reduce regulatory red tape. These include getting agricultural products to market faster and aligning transportation regulations with international standards to reduce costs and make it easier for Canadian companies do business internationally.

Launching the Major Projects Office

Delivering on a key commitment under the Building Canada Act, on August 29, 2025, the government launched the Major Projects Office (MPO) to serve as a single point of contact to get nation-building projects built faster. The Major Projects Office will help to identify projects that are in Canada's national interest and work to fast-track their development.

To be in Canada's national interest, several criteria will be considered:

- Whether a project will strengthen Canada's autonomy, resilience, and security.

- Whether a project will provide economic or other benefits to Canada.

- The likelihood of successful project execution.

- Whether a project will advance the interests of Indigenous Peoples.

- Whether a project will contribute to clean growth and addressing climate change.

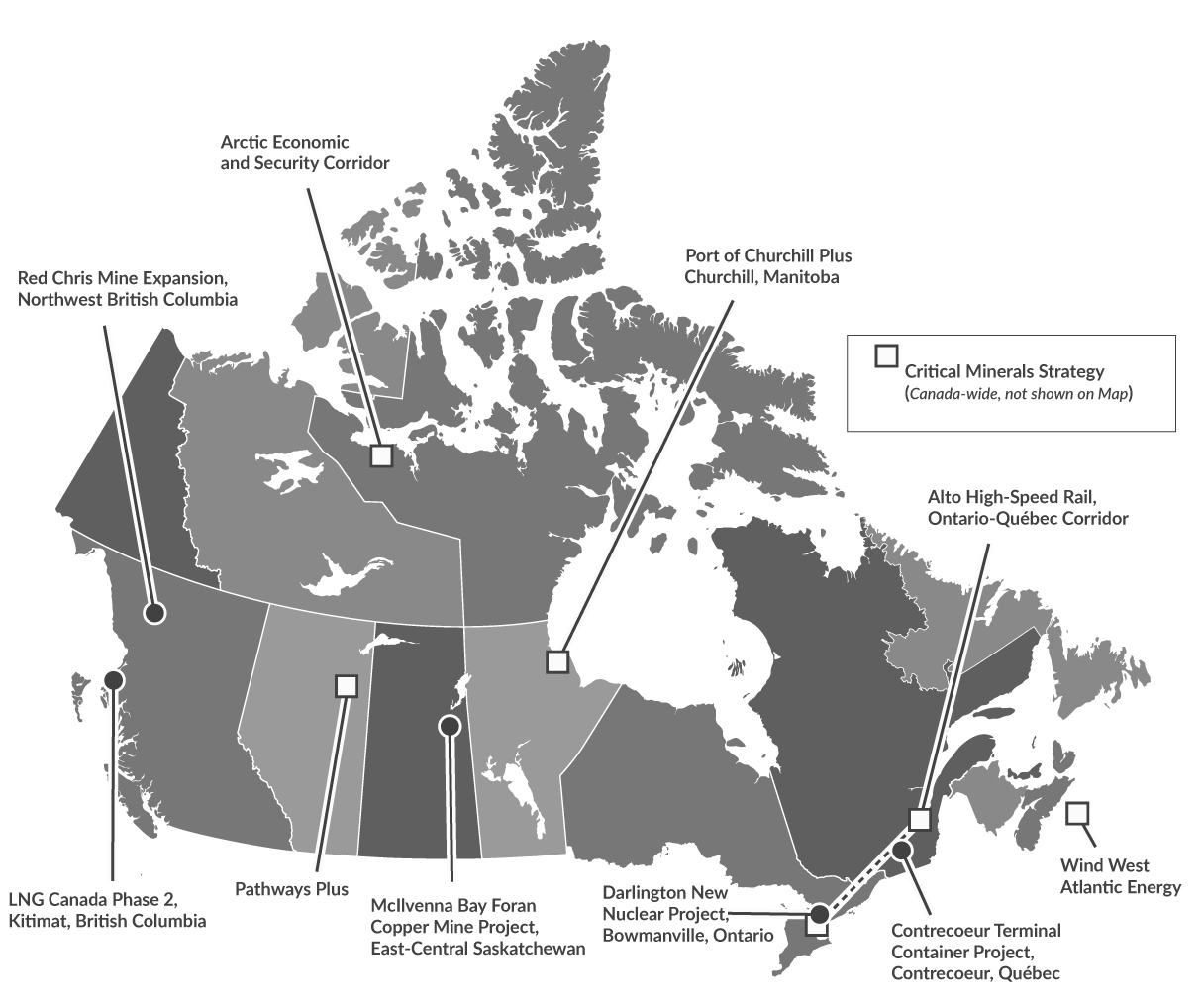

The First Major Nation-Building Projects

In September 2025, the Prime Minister announced the first series of projects being referred to the Major Projects Office for consideration:

- LNG Canada Phase 2, Kitimat, British Columbia: This project will double LNG Canada's capacity of liquefied natural gas, making it the second-largest facility of its kind in the world. It is expected to attract significant private-sector capital to Canada, contribute to our GDP growth, and support jobs and economic growth in local communities. It will diversify our trading partners and meet increasing global demand for secure, low-carbon energy with Canadian LNG, contributing to worldwide energy security by increasing the supply of available natural gas for Asian and European partners. Leveraging Canada's sustainable advantage, emissions are projected to be 35 per cent lower than the world's best-performing LNG facilities and 60 per cent lower than the global average.

- Darlington New Nuclear Project, Bowmanville, Ontario: This project will make Canada the first G7 country to have an operational small modular reactor (SMR), accelerating the commercialisation of a key technology that could support Canadian and global clean energy needs while driving $500 million annually into Ontario's nuclear supply chain. As announced in October 2025, the government will invest $2 billion through Canada Growth Fund into construction of this project. This follows an early works loan from the Canada Infrastructure Bank. Once complete, Darlington's first of four planned SMR units will provide reliable, affordable, clean power to 300,000 homes, while sustaining 3,700 jobs annually, including 18,000 during construction, over the next 65 years. The project has the potential to position Canada as a global leader in the deployment of SMR technology for use across the country and worldwide.

- Contrecœur Terminal Container Project, Contrecœur, Québec: This project will expand the Port of Montréal's capacity by approximately 60 per cent, to give Eastern Canada the trading infrastructure it needs to keep goods moving, meet growing demand, and diversify trade routes. It will strengthen supply chains, create thousands of jobs, and generate approximately $140 million annually in local and national economic benefits across Québec and Canada. Currently, the Species at Risk Act permit has been approved and preliminary work on the project is underway.

- McIlvenna Bay Foran Copper Mine Project, East-Central Saskatchewan: Situated in one of Canada's richest mineral belts and working in close collaboration with the Peter Ballantyne Cree Nation, this project will supply copper and zinc to strengthen Canada's position as a global supplier of critical minerals for clean energy, advanced manufacturing, and modern infrastructure. It will create 400 jobs, boost local economies in Saskatchewan and Québec, where the copper will be smelted, and is expected to be the first net-zero copper project in Canada.

- Red Chris Mine expansion, Northwest British Columbia: This major expansion project will extend the lifespan of the mine by over a decade, increase Canada's annual copper production by over 15 per cent, employ about 1,500 workers during operations, with a peak of approximately 1,800 workers during construction, and reduce greenhouse gas emissions by over 70 per cent when operational. Working in close collaboration with the Tahltan Nation, it is an important step in reconciliation and further developing the potential of Northern British Columbia and will strengthen Canada's role as a reliable supplier of copper and other resources essential for global manufacturing and clean energy technologies. This mine is part of the proposed Northwest Critical Conservation Corridor. This corridor is being moved to the MPO for consideration as a new transformative strategy, as it presents opportunities for critical minerals development, clean power transmission, Indigenous project leadership, and a potential new conservation area the size of Greece.

Together, these projects represent investments of more than $60 billion in our economy and will create thousands of well-paying jobs for Canadians.

Nation-Building Projects and Strategies

In addition to the first five projects, Canada's new government also believes that there are several strategies for projects that could be truly transformative for this country, which are at an earlier stage and require further development:

- Critical Minerals Strategy: Canada can be a powerhouse in the extraction and upgrading of critical minerals. A priority for the MPO will be to help more critical minerals projects get to final investment decisions within a two-year window. This will ensure that our critical minerals industry can grow, and that Canada and our global partners can benefit from our value chains for clean technologies and defence. These opportunities exist in many of Canada's regions—including Ontario's Ring of Fire, British Columbia's Golden Triangle, and the Slave Geological Province in the Northwest Territories and Nunavut.

- Wind West Atlantic Energy: Projects that will leverage over 60 gigawatts of wind power potential in Nova Scotia, and more across Atlantic Canada, connecting that renewable, emissions-free energy to Eastern and Atlantic Canada to meet rapidly growing demand—with the potential for exports to the Northeastern United States. The MPO will develop the regulatory certainty that attracts private investment and sets the course for long-term wind resources development in the Atlantic provinces. This Eastern Energy Partnership could include important projects like interties between New Brunswick and Nova Scotia, transmission cables between Prince Edward Island and New Brunswick, as well as Québec's and Newfoundland and Labrador's further development of Churchill Falls and Gull Island.

- Pathways Plus: An Alberta-based carbon capture and storage network and pipeline project that will substantially reduce emissions with additional energy infrastructure that will support a strong conventional energy sector while driving down emissions from the oil sands. Pathways will facilitate low-carbon oil exports from the Alberta oil sands to a range of markets that demand Canadian energy.

- Arctic Economic and Security Corridor: A set of all-weather, dual-use, land and port-to-port-to-port infrastructure projects that will contribute to Canada's defence and northern development. The project will support Northern critical mineral projects, create new opportunities for sustainable development, and connect communities to the rest of Canada, while increasing capability for the Canadian Armed Forces in the North.

- Port of Churchill Plus: Rooted in partnership with Indigenous Peoples, including in co-operation with Manitoba's Crown-Indigenous Corporation, this set of projects will upgrade the Port of Churchill and expand trade corridors with an all-weather road, an upgraded rail line, a new energy corridor, and marine ice-breaking capacity. The approach will prioritise Indigenous equity ownership in developing the projects needed to turn the Port of Churchill into a major four season and dual-use gateway for the region. Expanded export capacity in the North through Hudson Bay will contribute to increased and diversified trade with Europe and other partners, while more strongly linking Churchill to the rest of Canada.

- Alto High-Speed Rail: Canada's first high-speed railway, spanning approximately 1,000 km from Toronto to Québec City and reaching speeds of up to 300 km/hour to cut travel times in half and connect close to half of Canada's population. This is a project that could create 51,000 jobs during construction and inject up to $35 billion into our GDP—with a target of 25 million tonnes in emissions savings. The MPO will work to accelerate engineering, regulatory, and permitting work to enable construction of the project to start in four years, cutting the original eight-year timeline in half.

The Major Projects Office represents a shift in how government will advance regulatory approvals and coordinate financing to supercharge major project development in Canada. The Office is drawing on public and private sector financial, legal, regulatory, and project management experts to coordinate financing and regulatory approvals across federal departments—acting as a streamlined "single window" for proponents.

The Major Projects Office will also lead a review of all regulatory processes and approvals needed to build major projects to reduce red tape and fast-track key nation-building projects.

-

Budget 2025 proposes to provide $213.8 million over five years, starting in 2025-26, for the Major Projects Office. Funding will also support the Indigenous Advisory Council. Of this amount, $19.8 million will be sourced from existing departmental resources.

-

Budget 2025 proposes to provide $10.1 million over three years, starting in 2025-26, to Crown-Indigenous Relations and Northern Affairs Canada to continue leading the Federal Initiative on Consultation to support the meaningful participation of Indigenous rightsholders in consultation processes throughout the review cycle of national interest projects listed under the Building Canada Act, including through Indigenous-led resource centres and consultation protocols.

Further, as previously announced in August, the government is providing $40 million over two years, starting in 2025-26, to Indigenous Services Canada through the Strategic Partnerships Initiative to support Indigenous capacity building and consultation on nation-building projects prior to designation under the Act.

One Project, One Review

In the Speech from the Throne, the Government of Canada committed to realising the goal of "one project, one review" by reaching cooperation agreements under the Impact Assessment Act with every interested province and territory within six months. On June 2, 2025, Canada's First Ministers agreed to "work together toward efficiently and effectively implementing 'one project, one review' with the goal of a single assessment for all projects."

Cooperation agreements will set out how federal and provincial governments will work together on assessments of major projects, providing greater transparency and certainty for proponents, Indigenous Peoples, and stakeholders. This will help ensure accelerated assessments for major projects, including projects of national interest, and signal to investors that Canada's federal, provincial, and territorial governments are committed to working together to enable development, while protecting Indigenous rights and the environment.

Leveraging new authorities under sections 16 and 31 of the Impact Assessment Act, introduced in 2024, cooperation agreements can provide for substitution to a single harmonised process that draws on the best available provincial and federal expertise. Cooperation agreements can also allow for early assessment decisions and full substitution to a provincial process that meets both federal and provincial requirements. They do not affect the duty of proponents, provinces, territories, and the federal government to fully consult with Indigenous Peoples whose rights may be affected.

The Major Projects Office will benefit from the leadership and guidance of the Indigenous Advisory Council (IAC)—eleven representatives from First Nations, Inuit, Métis, and Modern Treaty and Self-Governing communities. These leaders bring deep expertise and experience, and they will help guide the MPO's work to ensure that major projects create opportunities for equity ownership and responsible resource management through meaningful participation with Indigenous Peoples.

Meaningful consultation with Indigenous Peoples is embedded in the Building Canada Act, both in the process of determining which projects are in our collective interest and in the development of the conditions for those projects going forward. To that end, in Summer 2025, the Prime Minister convened the First Nations Major Projects Summit with over 430 First Nations leaders and representatives, and held two similar meetings with Inuit and Métis leaders. The focus was to engage all Indigenous distinctions-based groups on the Building Canada Act and how to most effectively build major projects in partnership with Indigenous Peoples.

The government will uphold Section 35 of our Constitution and the duty to consult, and the government's commitment to implementing the United Nations Declaration on the Rights of Indigenous Peoples, including free, prior, and informed consent, as we build Canada strong. The government will also empower and support opportunities for proactive partnerships with Indigenous Peoples, including through the Canada Infrastructure Bank's Indigenous Equity Initiative, and the Indigenous Loan Guarantee Program—which we doubled from $5 billion to $10 billion, enabling more Indigenous communities to become owners of major projects.

Boosting Major Project Financing

The government has an ambitious agenda to build a stronger, more competitive, and more prosperous economy by getting major projects built in Canada. Crown corporations help incentivise and maximise private investment. For example, Canada Growth Fund fosters clean growth investment, the Canada Infrastructure Bank gets infrastructure projects built, and Export Development Canada helps exporters reach new markets. These Crown corporations invest on behalf of Canadians for the economic benefit of Canadians.

As the government embarks on its mission to maximise investment in Canada and realise our full potential in global markets, with over $40 billion in capital ready to invest under current authorities, Crown corporations will help bring in the multiples of private investment that are necessary to grow our economy.

-

Budget 2025 announces the government's intention for the Major Projects Office to help structure and co-ordinate financing from the private sector, provincial and territorial partners, and the federal government, including through the Canada Infrastructure Bank, Canada Growth Fund, and the Canada Indigenous Loan Guarantee Corporation.

-

Budget 2025 announces the government's intention to provide guidance to Crown corporations through the application of a strategic financing framework that will advance a unified and coordinated approach to financing across the government's Crown corporations, departments, and agencies. This will help ensure that Crown corporations are prioritising nation-building projects where possible and coordinating their support to unlock projects while delivering value for money for taxpayers.

-

Budget 2025 announces the government's intention to amend the Canada Infrastructure Bank Act to increase the Canada Infrastructure Bank's statutory capital envelope from $35 billion to $45 billion and to enable the Canada Infrastructure Bank to make investments in any nation-building projects that have been referred to the Major Projects Office, regardless of sector or asset class, as long as they fall within the Bank's legal mandate. This will unlock more projects with the partnership of private investment.

-

Budget 2025 announces the government's intention for the Canada Indigenous Loan Guarantee Corporation to work with Indigenous investors on greenfield (new build) projects that will generate economic prosperity for Indigenous communities for generations to come.

1.2 Supercharging Growth

Unleashing economic growth and productivity is the foundation of Canadian prosperity. To build the strongest economy in the G7, our entrepreneurs, businesses, and researchers need the right conditions for growth. We can supercharge Canada's growth and global competitiveness by enhancing Canada's tax regime, doubling down on artificial intelligence, investing in talent, and attracting private capital.

Productivity Super-Deduction

1. Accelerated Investment Incentive and Immediate Expensing

To boost productivity and attract investment, this new government is introducing a Productivity Super-Deduction—a set of enhanced tax incentives covering all new capital investment that allows businesses to write off a larger share of the cost of these investments right away. These will also make it easier for businesses to invest and grow.

Under this measure, companies can recover their investment cost faster through the tax system. This makes it more attractive to invest in machinery, equipment, technology, and other productivity-enhancing assets and improves Canada's competitiveness for attracting investment.

-

Budget 2025 announces the government's intention to move forward with all previously announced measures that would allow businesses to write off the cost of their investments more quickly:

- Reinstatement of the Accelerated Investment Incentive, which provides an enhanced first-year write-off for most capital assets.

- Immediate expensing (i.e., 100-per-cent first-year write-off) of manufacturing or processing machinery and equipment.

- Immediate expensing of clean energy generation and energy conservation equipment, and zero-emission vehicles.

- Immediate expensing of productivity-enhancing assets, including patents, data network infrastructure, and computers.

- Immediate expensing of capital expenditures for scientific research and experimental development.

2. Immediate Expensing for Manufacturing and Processing Buildings and Accelerated Capital Cost Allowances for Low-Carbon Liquefied Natural Gas Facilities

Building on these measures, the government is making further strategic investments in tax incentives that promote capital investment and long-term economic growth. The new government is taking action to make Canada's investment environment more competitive than the U.S.

-

Budget 2025 proposes to introduce immediate expensing for manufacturing or processing buildings that are acquired on or after Budget Day and that are used for manufacturing or processing before 2030. This measure would be phased out over a four-year period between 2030 and 2033.

The accelerated capital cost allowances (CCAs) for liquefied natural gas (LNG) equipment and related buildings expired at the end of 2024. The measures increased the CCA rate for liquefaction equipment from 8 per cent to 30 per cent and for non-residential buildings used in LNG facilities from 6 per cent to 10 per cent.

-

Budget 2025 proposes reinstating accelerated CCAs for LNG equipment and related buildings, but only for low-carbon LNG facilities.

To be eligible for an accelerated CCA, a facility would need to meet new high standards of emissions performance. Two levels of support would be available, which will depend on the emissions performance of a facility:

- Facilities that are in the top 25 per cent in terms of emissions performance would be eligible for accelerated CCAs with the same rates as the previous measures (30 per cent for liquefaction equipment and 10 per cent for non-residential buildings used in LNG facilities).

- Facilities that are in the top 10 per cent in terms of emissions performance would be eligible for accelerated CCAs of 50 per cent for liquefaction equipment and 10 per cent for non-residential buildings used in LNG facilities.

Details regarding the new emissions performance requirements for these additional allowances will be provided at a later date. These measures would apply to property acquired on or after Budget Day and before 2035.

Collectively, these new and previously proposed measures form a Productivity Super-Deduction that will accelerate the type of business investment that will drive productivity growth in Canada.

3. Canada's Corporate Tax Advantage

The marginal effective tax rate (METR) provides a comprehensive indicator of how one dollar of additional business investment is taxed—a comparable indicator of tax competitiveness across countries that considers national and sub-national corporate tax rates, as well as investment tax credits, capital cost allowances, and sales and capital taxes.

The productivity super-deduction will reduce Canada's METR by more than two percentage points, strengthening our competitiveness with the U.S. following measures implemented in the One Big Beautiful Bill Act (OBBBA). Moreover, Canada will have the lowest METR in the G7 and below the OECD average. This means that businesses can invest and scale more easily and that Canada will remain an attractive destination for investment.

Budget 2025 reinforces Canada as the country with the lowest marginal effective tax rate in the G7

With the productivity super-deduction, Canada's METRs are competitive with those in the U.S. across most sectors, particularly in manufacturing and processing.

Canada's sectoral marginal effective tax rates are highly competitive with those in the U.S., 2025

Canada has a lower METR than the U.S., reflecting the value-added taxes employed federally and in most provinces in Canada, rather than retail sales taxes that apply in the U.S. Canadian provinces also fully align with federal expensing policies and in some cases employ investment tax incentives of their own, which contribute to competitiveness.

Canada's METR is below the average of OECD countries, resulting from generous expensing policies in Canada and lower statutory rates compared to some other countries.

Investing Where It Counts: Catalysing Private Investment Through Accelerated Depreciation and Immediate Expensing

Private investment in new machinery, buildings, and technology is one of the most effective ways to increase productivity, helping workers produce more in less time and boosting Canada's long-term growth.

Immediate expensing and other forms of accelerated depreciation make it easier and more attractive for businesses to invest by allowing them to deduct the full cost of new assets more quickly. This lowers the cost of capital, strengthens the business case for modern equipment, and encourages companies to invest and expand in Canada.

The $2.7 billion in average annual support for investment provided through the accelerated depreciation and immediate expensing measures included in Budget 2025 will crowd-in private capital investment and could generate an economic output of up to about $9 billion annually over the next ten years. These measures would mean most assets in the manufacturing sector would be eligible for immediate expensing—lowering the cost of capital and unlocking billions in private investment.

Enhancing the Scientific Research and Experimental Development Tax Incentives

Innovation and scientific discovery are the foundation of long-term economic growth. Science fuels innovation, and innovation fuels productivity, helping Canada stay competitive in a fast-changing global economy.

The Scientific Research and Experimental Development (SR&ED) tax incentive program has helped Canadian businesses of all sizes conduct new and advanced research. Small businesses have benefited the most, accounting for 64 per cent of all claims filed and receiving roughly $1.5 billion in support in 2024-25.

To support Canadian businesses' ability to conduct innovative research, the government is proceeding with the following previously proposed enhancements to the SR&ED program:

- Increasing the prior-year taxable capital phase-out thresholds for the SR&ED program's enhanced 35-per-cent tax credit.

- Increasing the annual expenditure limit on which the enhanced credit can be earned, from $3 million to $4.5 million.

- Extending the enhanced credit to eligible Canadian public corporations.

- Restoring the eligibility of SR&ED capital expenditures.

-

To encourage investment in Canadian innovation, Budget 2025 also proposes to further increase the annual expenditure limit on which the SR&ED program's enhanced credit can be earned from $4.5 million (as previously announced) to $6 million, effective for taxation years that begin on or after December 16, 2024.

Investing Where It Counts: Economic Benefits of Supporting R&D

Investments in research and development (R&D) are known to improve firm performance. Firms undertaking R&D to innovate consistently achieve higher productivity growth, and these benefits are amplified for firms making complementary investments in other technologies or adopting better business strategies. Firms conducting R&D are also more likely to enter export markets. The benefits of R&D are not limited to within firms. Studies have documented broad benefits from R&D that spread across the economy.

The Scientific Research and Experimental Development (SR&ED) tax incentive program, already providing $4.2 billion in annual support, is the federal government's single most important tool to encourage business R&D.

Budget 2025 confirms the implementation of previously announced SR&ED enhancements and proposes to further increase the enhanced rate expenditure limit, to help innovative businesses scale up and grow. This additional government investment of $440 million on an ongoing basis is expected to catalyse private sector R&D investment, generating an economic output of $1.2 billion a year—about a three-time return for Canada's economy. These enhancements are on top of revamping the SR&ED administration process—providing businesses with greater certainty and speed when making investment and R&D decisions.

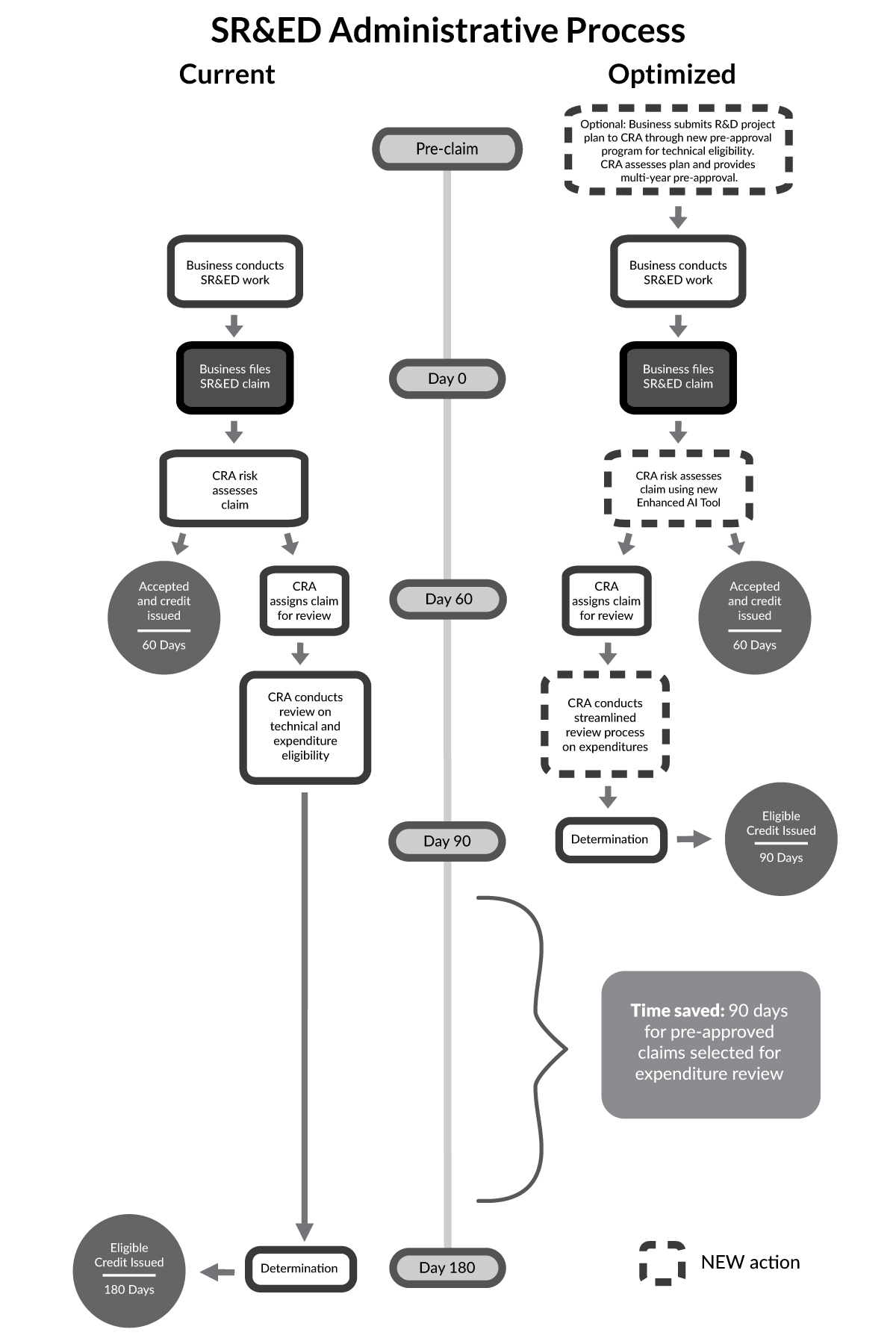

The government has listened to innovators and builders that a burdensome administrative process for applying to the SR&ED program has limited its impact in driving investment in Canada. The Canada Revenue Agency (CRA) will implement transformational reforms to the administration of the SR&ED program. The reforms will provide businesses with greater confidence to invest in R&D projects, enhancing Canada's innovation strategy.

-

Budget 2025 announces, to improve predictability and streamline administration of the SR&ED program, the government's intention for the CRA to:

- Implement an elective pre-claim approval process to provide businesses with an up-front technical approval of their eligible SR&ED projects, before businesses undertake any work or incur costs. For claims submitted through this elective process that require an expenditure review, processing time will be cut in half to 90 days from 180 days.

- Increase the use of artificial intelligence in the program's administration, which will enable the CRA to avoid subjecting low risk claims to unnecessary audit interventions, allowing them to be processed faster.

- Streamline the review process by eliminating unnecessary steps and reducing burdensome information requirements that can delay the final determination of claims.

These improvements do not carry a fiscal cost and will be implemented into SR&ED program operations as of April 1, 2026.

Additionally, the CRA intends to engage in targeted consultations to further improve the administration of the SR&ED program, including by reviewing the SR&ED claim form (Form T661).

SR&ED Administrative Process

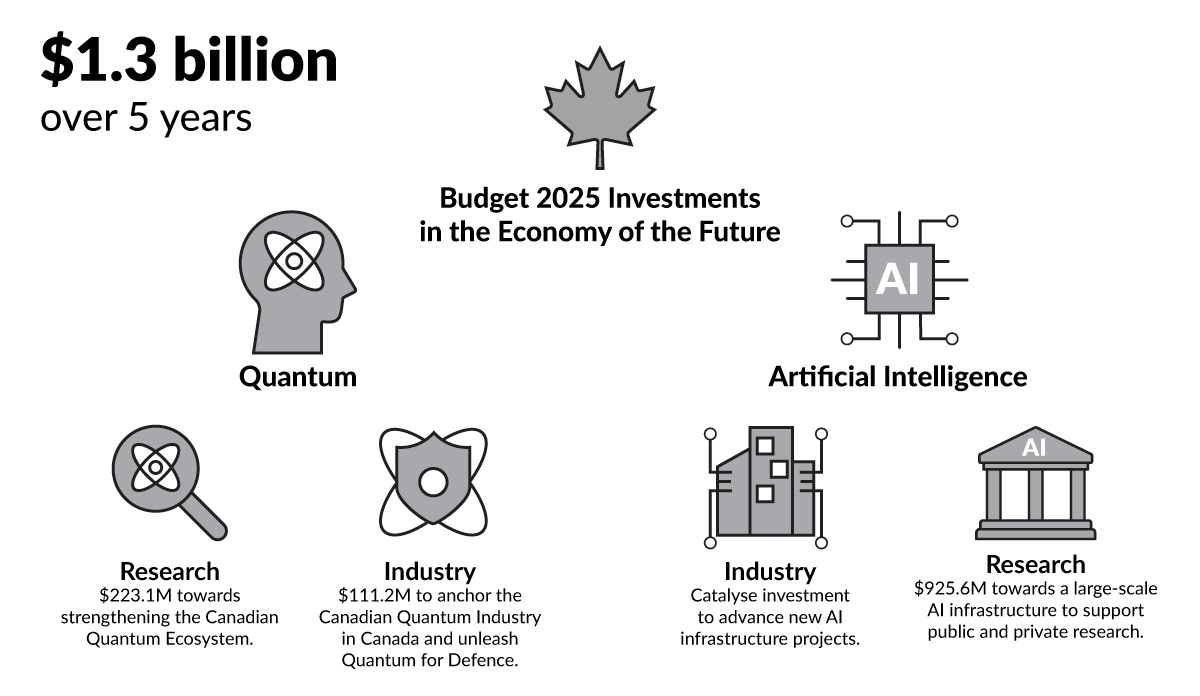

Seizing the Full Potential of Artificial Intelligence

The transformative nature of artificial intelligence (AI) can create opportunities for millions of Canadians, businesses, and the economy. Budget 2025 helps Canada build necessary AI compute infrastructure, including the development of a Sovereign Canadian Cloud. This will help businesses seize the opportunities from AI, creating new jobs and economic growth.

-

Budget 2025 proposes to provide $925.6 million over five years, starting in 2025-26, to support a large-scale sovereign public AI infrastructure that will boost AI compute availability and support access to sovereign AI compute capacity for public and private research. The investment will ensure Canada has the capacity needed to be globally competitive in a secure and sovereign environment. Of this amount, $800 million will be sourced from funds previously provisioned in the fiscal framework.

-

Budget 2025 announces that the Minister of Artificial Intelligence and Digital Innovation will engage with industry to identify new promising AI infrastructure projects and enter into Memoranda of Understanding with those projects.

-

Budget 2025 also announces the government's intention to enable the Canada Infrastructure Bank to invest in AI infrastructure projects.

Understanding the broader effects of AI is also essential, helping to guide our efforts to maximise its benefits.

-

Budget 2025 proposes to allocate $25 million over six years, starting in 2025-26, and $4.5 million ongoing for Statistics Canada to implement the Artificial Intelligence and Technology Measurement Program (TechStat). TechStat will use data and insights to measure how AI is used by organisations, and understand its impact on Canadian society, the labour force, and the economy. This amount will be fully sourced from existing departmental resources.

The government will also explore options for the National Research Council of Canada's Canadian Photonics Fabrication Centre to best position it to attract private capital, scale its operations, and serve as a platform for Canadian innovation and new photonic applications, including in the face of the rise of AI and related compute infrastructure.

Budget 2025 Investments in the Economy of the Future

Investing Where It Counts: Economic Benefits of AI and Quantum

AI has the potential to revolutionise business processes in all manner of industries, allowing for increased automation and significant increases in productivity. The OECD estimates that adoption of AI adoption could raise productivity growth by 1.1 percentage points annually over the next 10 years. Quantum is a similarly transformative technology: computing problems that are currently considered to be intractable even with the most powerful classical computers could be solved using quantum computers, including in such areas as cybersecurity, finance, and logistics.

Countries that lead in game-changing technologies such as these can unlock significant economic benefits through commercialising the associated intellectual property and being among the first to put it to use.

With an investment of $925.6 million over five years to build a large-scale sovereign compute capacity, Budget 2025 is providing AI infrastructure to further support sovereign AI capacity in Canada and ensure a successful Canadian AI ecosystem. Budget 2025 also proposes to provide, through the Defence Industrial Strategy, $334.3 million over five years to strengthen Canada's quantum ecosystem.

This fall, the government launched consultations to inform the next chapter of Canada's AI leadership and will develop a new AI strategy by the end of 2025. The government will also consider whether new AI incentives and supports should be provided.

Protecting Canadian Intellectual Property

Intellectual property output and ownership is central to Canada's innovation agenda. Clear pathways to generate and retain intellectual property in Canada and transparency in the intellectual property system are essential to Canada's innovators and academic community.

To ensure Canada's innovation ecosystem is equipped to protect Canadian intellectual property, and support Canadian SMEs to commercialise and leverage their intangible assets to compete in the global marketplace:

-

Budget 2025 proposes to provide $84.4 million over four years, starting in 2026-27, to Innovation, Science and Economic Development Canada to extend the Elevate IP program, as well as $22.5 million over three years, starting in 2026-27, to renew support for the Innovation Asset Collective's Patent Collective.

-

Budget 2025 proposes to provide $75 million over three years, starting in 2026-27, to the National Research Council to extend the IP Assist Program.

To further strengthen the intellectual property ecosystem in Canada, the government will conduct an intellectual property performance review to identify new ways to partner with emerging and scaling intellectual property-intensive firms, increase domestic investment in leading and high-potential firms, retain and commercialise intellectual property in Canada, and help firms to protect and commercialise their intellectual property in foreign markets to advance trade diversification.

Finally, the government is committed to improving legal certainty and transparency in the intellectual property system to help facilitate more intellectual property-backed lending and limit abusive behaviour.

Investing to Build High-Growth Companies and Emerging Fund Managers

Investing in Canada's venture capital sector is essential to empowering entrepreneurs with the capital and networks they need to launch and scale resilient, high-impact companies. These venture funds drive innovation and are shaping the next generation of Canadian anchor firms and fund managers that will support economic growth and strengthen Canada's economic resilience.

To better align with emerging priorities, Budget 2025 proposes to realign previous venture capital and mid-cap commitments to support access to capital that meets current market needs.

-

Budget 2025 proposes to provide $1 billion on a cash basis over three years, starting in 2026-27, for the Business Development Bank of Canada to launch the new Venture and Growth Capital Catalyst Initiative, a fund-of-funds that would leverage more private venture capital by incentivising pension funds and other institutional investor participation. The initiative will also support new and emerging fund managers and important sectors such as the life sciences sector.

-

Strategic investment is essential to bolster innovation and drive long-term growth. Budget 2025 announces the government's intention to develop a strategy to support Canadian firms facing early growth-stage funding gaps, and proposes to provide $750 million, on a cash basis, in support of those firms. Details on the strategy will be announced in 2026.

2026-2028 Immigration Levels Plan

Throughout Canada's history, we have welcomed people from around the world—those fleeing persecution, war and strife, those seeking to work hard and build a better life for their families, those seeking to study at our world-class universities, experts wanting to drive innovation in Canada. The fabric of our nation is woven with this tradition.

As we have welcomed the world, we had the promise that if someone came to Canada they would contribute to our prosperity, and in return they would get all Canada offered—a country that is generous, fair, and diverse.

Our immigration system was built to standardise and evaluate newcomers so that admission was based on a person's merits. Over time, this system has evolved—its complexity has grown and its efficiency has waned. In recent years, the system became even harder to manage and less functional, and the pace of arrivals began to exceed Canada's capacity to absorb and support newcomers in the way we are used to doing.

In 2018, 3.3 per cent of Canada's population were temporary residents. By 2024, that number had more than doubled to 7.5 per cent, an unprecedented rate of growth that put pressure on housing supply, the healthcare system, and schools. Canada's new government recognises that this system is no longer sustainable, and we are determined to make it so, for everyone who lives in and comes to this country.

We are taking back control over the immigration system and putting Canada on a trajectory to bring immigration back to sustainable levels—allowing us to fulfill the promise of Canada to those who call it home. At the same time, Canada will continue its long tradition of welcoming those fleeing violence, persecution and displacement.

The results of the government's focus are already becoming apparent. Asylum claims are down by a third, and new temporary foreign worker arrivals are down by approximately 50 per cent this year. New international student arrivals have also declined by approximately 60 per cent compared to 2024. This is a start, but we recognise there is more work to do.

-

Budget 2025 announces that the 2026-2028 Immigration Levels Plan will stabilise permanent resident admission targets at 380,000 per year for three years, down from 395,000 in 2025, while increasing the share of economic migrants from 59 per cent to 64 per cent. The new plan will also reduce the target for new temporary resident admissions from 673,650 in 2025 to 385,000 in 2026, and 370,000 in 2027 and 2028. The fiscal cost of this measure is $168.2 million over four years, starting in 2026-27, and $35.7 million ongoing. These costs primarily represent the net loss in fee revenue, driven by fewer temporary resident admissions.

- The government recognises the role temporary foreign workers play in some sectors of the economy and in some parts of the country. To that end, the 2026-2028 Immigration Levels Plan will consider industries and sectors impacted by tariffs and the unique needs of rural and remote communities.

-

In addition, Budget 2025 proposes a one-time initiative to recognise eligible Protected Persons in Canada as permanent residents over the next two years. This practical step is a reflection of the fact that the vast majority of these people cannot return to the country of their origin. It will also ensure that those in genuine need of Canada's protection have their permanent status recognized, accelerating their full integration into the Canadian society and their path to citizenship. The fiscal cost of this measure is $120.4 million over four years, starting in 2026-27. This represents the costs for Immigration, Refugees and Citizenship Canada and the Canada Border Services Agency to process the additional applications, which are partially offset by higher fee revenues.

-

Budget 2025 also proposes to undertake a one-time measure to accelerate the transition of up to 33,000 work permit holders to permanent residency in 2026 and 2027. These workers have established strong roots in their communities, are paying taxes, and are helping to build the strong economy Canada needs. The fiscal cost of this measure is $19.4 million over four years, starting in 2026-27. This also represents the costs for Immigration, Refugees and Citizenship Canada and other departments to process the additional applications, which are partially offset by higher fee revenues.

These targets keep permanent resident arrivals at less than one per cent of the population beyond 2027 and will reduce the total number of temporary residents to less than five per cent of Canada's population by the end of 2027.

Our plan will restore control, clarity, and consistency to the immigration system, while maintaining compassion in our choices and driving competitiveness in our economy.

Additional details on the 2026-2028 Immigration Levels Plan will be provided when the Minister of Immigration, Refugees and Citizenship tables the 2025 Annual Report to Parliament on Immigration.

Temporary Resident Admissions 2026 – 2028

| 2026 | 2027 | 2028 | |

|---|---|---|---|

| Overall Projected Admissions & Ranges | 385,000 (375,000–395,000) |

370,000 (360,000–380,000) |

370,000 (360,000–380,000) |

| Workers (1) | 230,000 | 220,000 | 220,000 |

| Students (2) | 155,000 | 150,000 | 150,000 |

|

(1) Projected number of new work permits for foreign nationals entering Canada under one of two programs, the Temporary Foreign Worker Program (TFW Program) or the International Mobility Program (IMP) including work permits issued under humanitarian public policies. (2) Projected number of new study permits issued to foreign nationals studying for six (6) months or more in Canada at a Designated Learning Institution (DLI). |

|||

| 2026 | 2027 | 2028 | ||||

|---|---|---|---|---|---|---|

| Overall Projected Admissions & Ranges | 380,000 (350,000 – 420,000) |

380,000 (350,000 – 420,000) |

380,000 (350,000 – 420,000) |

|||

| Economic Immigration (3) | 239,800 | 244,700 | 244,700 | |||

| Low | High | Low | High | Low | High | |

| 224,000 | 264,000 | 229,000 | 268,000 | 229,000 | 268,000 | |

| Family Reunification | 84,000 | 81,000 | 81,000 | |||

| Low | High | Low | High | Low | High | |

| 78,500 | 92,000 | 75,000 | 90,000 | 75,000 | 90,000 | |

| Refugees, Protected Persons, Humanitarian and Compassionate, and Other | 56,200 | 54,300 | 54,300 | |||

| Low | High | Low | High | Low | High | |

| 48,000 | 64,000 | 46,000 | 62,000 | 46,000 | 62,000 | |

| French-speaking admissions outside of Quebec (overall) | 9% (30,267) | 9.5% (31,825) | 10.5% (35,175) | |||

|

(3) Under the Canada-Quebec Accord, Quebec has responsibility for the selection of economic immigrants destined to Quebec. |

||||||

Improving Foreign Credential Recognition

Many newcomers to Canada already have extensive training in sectors where we are experiencing labour shortages, including doctors, nurses, and other healthcare professionals. However, many face challenges in getting their training and experience recognised in Canada. Over half of immigrants with a bachelor's degree or higher are overqualified for their jobs, which is costing Canada's economy billions of dollars every year.

Improvements to foreign credential recognition are essential to ensure that immigration can effectively help address labour shortages and support the Canadians that rely on goods and services from those sectors.

As announced on October 27, 2025, Budget 2025 proposes to provide $97 million over five years, starting in 2026-27, to Employment and Social Development Canada to establish the Foreign Credential Recognition Action Fund to work with the provinces and territories to improve the fairness, transparency, timeliness, and consistency of foreign credential recognition, with a focus on health and construction sectors. This funding will be sourced from existing departmental resources.

Recruiting International Talent

A resilient Canadian economy depends on a highly skilled workforce. Immigration helps fill critical labour gaps in priority industries where there is not enough domestic talent.

The International Talent Attraction Strategy and Action Plan will position the immigration system to meet strategic labour market needs, ensuring Canada has the talent required to drive innovation and growth in our strategic industries, while respecting immigration targets to ensure a sustainable immigration rate.

As an early measure, the government proposes a targeted, one-time initiative to recruit over a thousand highly qualified international researchers to Canada. The expertise of these researchers will help advance our global competitiveness and contribute to the economy of the future. To contribute to research excellence in Canada, Budget 2025 proposes to provide up to $1.7 billion for a suite of recruitment measures:

-

Budget 2025 proposes to provide $1 billion over 13 years, starting in 2025-26, to the Natural Sciences and Engineering Research Council, Social Sciences and Humanities Research Council, and Canadian Institutes of Health Research to launch an accelerated research Chairs initiative to recruit exceptional international researchers to Canadian universities.

-

Budget 2025 proposes to provide $400 million over seven years, starting in 2025-26, to the Canada Foundation for Innovation to establish a complementary stream of research infrastructure support to ensure these recruited Chairs have the equipment they need to conduct research in Canada.

-

Budget 2025 proposes to provide $133.6 million over three years, starting in 2026-27, to the Natural Sciences and Engineering Research Council, Social Sciences and Humanities Research Council, and Canadian Institutes of Health Research to enable top international doctoral students and post-doctoral fellows to relocate to Canada.

-

Budget 2025 proposes to provide up to $120 million over 12 years, starting in 2026-27, to the granting councils to support universities' recruitment of international assistant professors, as appropriate.

Additional details on the launch of recruitment processes will be announced in the coming weeks.

The government will also examine whether Canada's research ecosystem requires further support to retain talent, and work to implement the capstone research organisation as announced in Budget 2024. In addition, reflecting the foundational importance of research and innovation to growing the Canadian economy, the Comprehensive Expenditure Review savings targets for the three granting councils will be adjusted to two per cent.

To strengthen Canada's innovation ecosystem, address labour shortages and attract top talent in healthcare, research, advanced industries and other key sectors, in the coming months the government will also launch an accelerated pathway for H1-B visa holders.

Catalysing Investment in Airports and Ports

Canada's new government is taking action to catalyse investment in our airports and ports—so that we build transportation infrastructure that can meet growing demand, encourage more tourism into Canada, bring down travel costs for Canadians, and help diversify our trade to the rest of the world. Airports and ports are central to diversifying Canada's trade. They connect our economy to the world: around 20 per cent of Canada's exports and 23 per cent of imports pass through ports. Airports support high-value cargo exports, such as fish and lobster exported to Asia.

-

Budget 2025 announces the government's intention to unlock more of the economic potential of Canada's airports and consider new ways to attract private sector investment, including by negotiating lease extensions with airport authorities, enabling more economic development activities on airport lands, and examining the existing airport ground lease rent formulas. The government's objective is to ensure the long-term sustainability and competitiveness of Canada's airports. Investing in Canada's airports delivers cross-sectoral benefits, from enhancing safety and transportation, improving affordability for Canadians, strengthening regional access and connectivity, and driving trade and economic growth. The government will also consider options for the privatisation of airports.

-

Budget 2025 also proposes to provide $55.2 million over four years, starting in 2026-27, with $72.5 million in remaining amortisation, and $15.7 million ongoing thereafter, to Transport Canada to support safety-related infrastructure projects and upgrades, including those that support dual-use priorities, at local and regional airports. Funding will be delivered through the Airports Capital Assistance Program, and will also support a priority project to extend the runway at the Transport Canada-owned Îles-de-la-Madeleine Airport.

The government will also continue to examine and engage with investors on opportunities to cultivate more private investment at marine ports.

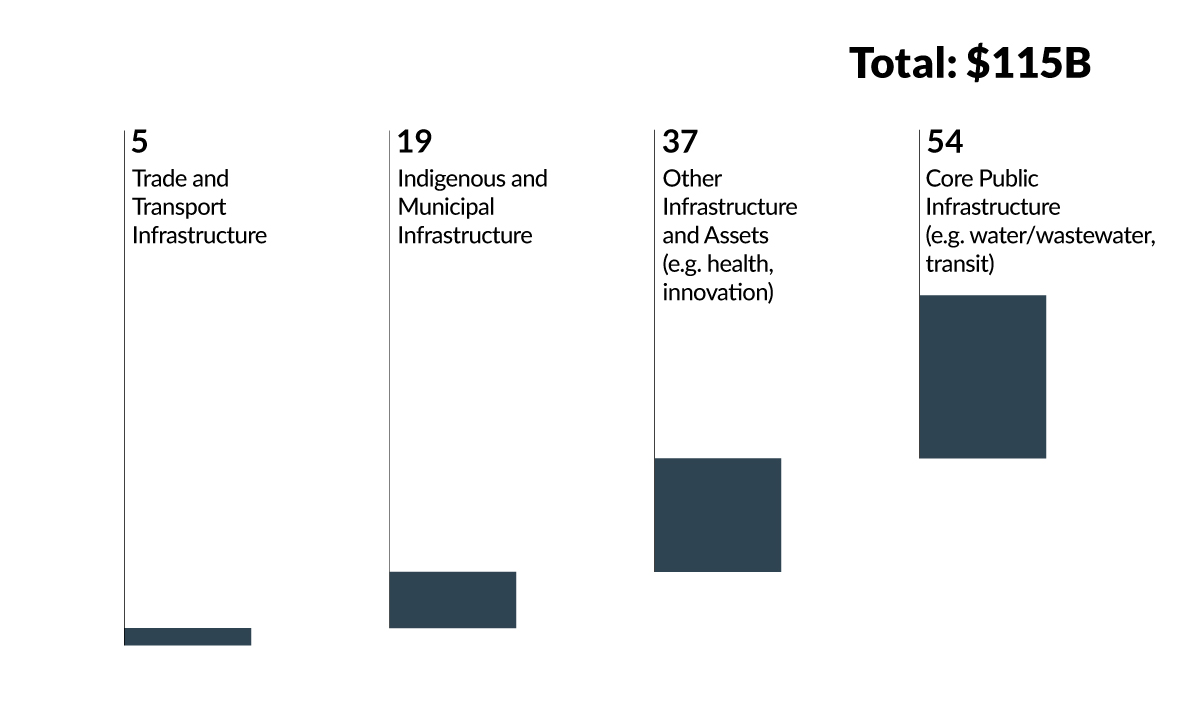

Generational Infrastructure Investments

The federal government is making significant investments in infrastructure, including trade and transportation infrastructure, public infrastructure like roads, bridges, water, and public transit, as well as other infrastructure. New and upgraded infrastructure helps businesses run more smoothly, makes it easier for people to get to work, and supports new jobs. All of this helps the economy grow and become more productive. Planned federal infrastructure investments are expected to reach $115.2 billion over the next five years.

Planned Investments in Building Canada

Upcoming Federal Expenditure on Infrastructure – 5-Year Horizon

(billions of dollars, accrual)

Communities and regions across Canada are facing high costs to improve and expand important infrastructure. These upgrades are needed to support growing populations and replace aging systems. Improving infrastructure can unlock greater productivity and expand trade opportunities for Canada, and can also play a key role in addressing the housing shortage and creating more homes for Canadians.

-

Budget 2025 announces the government's intention to launch a new Build Communities Strong Fund, to be administered by Housing, Infrastructure and Communities Canada, and proposes to provide $51.0 billion over 10 years, starting in 2026-27, and $3.0 billion per year ongoing in new and existing funding for this initiative, including through funding to provincial and territorial governments—and through them to municipalities—to support a wide range of infrastructure projects and help our local communities build Canada strong.

-

These projects will grow a stronger economy and create thousands of good jobs and federal project selection will consider factors such as use of unionised labour, and use of Community Employment Benefits agreements. The program would be comprised of three streams:

- A Provincial and Territorial Stream that will provide $17.2 billion over

10 years, starting in 2026-27, to support provincial and territorial

infrastructure projects and priorities. Funding will support housing-enabling

infrastructure (e.g., roads, water/wastewater), health-related infrastructure (e.g.,

hospitals), and infrastructure at colleges and universities. To access funds,

provinces and territories must agree to cost-match federal funding and to

substantially reduce development charges and not levy other taxes that hinder the

housing supply.

- Of the above amount, $5 billion over three years, starting in 2026-27, will be dedicated for a Health Infrastructure Fund. This fund will complement existing health-related support provided to provinces and territories by helping to ensure their health infrastructure, such as hospitals, emergency rooms, urgent care centres, and medical schools, will be able to respond to the health care needs of Canadians. Recognising the critical need to strengthen health infrastructure across the country, the requirement related to development charges and other taxes noted above will not apply to this fund.

- A Direct Delivery Stream, delivered by Housing, Infrastructure and Communities Canada, that will provide $6 billion over 10 years, starting in 2026-27, to support regionally significant projects, large building retrofits, climate adaptation, and community infrastructure. Proponents of regionally significant projects would be required to seek private sector investment, including private investment leveraged through Canada Infrastructure Bank financing, before being eligible for funding under this stream.

- The existing Canada Community-Building Fund will be rebranded as the initiative's Community Stream. This stream will, as planned, provide $27.8 billion over 10 years, starting in 2026-27, and $3.0 billion per year ongoing to support local infrastructure projects.

- Funding for the Build Communities Strong Fund includes repurposed resources from the Canada Housing Infrastructure Fund.

- A Provincial and Territorial Stream that will provide $17.2 billion over

10 years, starting in 2026-27, to support provincial and territorial

infrastructure projects and priorities. Funding will support housing-enabling

infrastructure (e.g., roads, water/wastewater), health-related infrastructure (e.g.,

hospitals), and infrastructure at colleges and universities. To access funds,

provinces and territories must agree to cost-match federal funding and to

substantially reduce development charges and not levy other taxes that hinder the

housing supply.

-

As examples of projects that will help build strong communities with improved local infrastructure, Budget 2025 announces support for the following projects:

- Filipino Community and Cultural Centre in Metro Vancouver, British Columbia;

- White Rock Pier in White Rock, British Columbia;

- Newton Athletic Park Artificial Turf, Practice Field, Tennis Court, and Walking Path in Surrey, British Columbia;

- Royal Athletic Park in Victoria, British Columbia;

- Rapid Fire Theatre in Edmonton, Alberta;

- Bissell Centre in Edmonton, Alberta;

- Lac La Ronge Indian Band – Kitsaki Hall in La Ronge, Saskatchewan;

- RCMP Heritage Centre in Regina, Saskatchewan;

- Riverview Community Centre in Winnipeg, Manitoba;

- Dakota Community Centre in Winnipeg, Manitoba;

- Victims of Flight PS752 Memorial in Unity Park in Richmond Hill, Ontario;

- Hamilton Downtown Family YMCA in Hamilton, Ontario;

- Bob MacQuarrie Recreation Complex in Orleans, Ontario;

- Toronto Metropolitan University Medical School in Brampton, Ontario;

- Exploramer Shark Pavilion in Sainte-Anne-des-Monts, Quebec;

- L'Espace Hubert-Reeves in Charlevoix, Quebec;

- Chantier Naval Forillon in Gaspé, Quebec;

- Centre sportif de Montreal-Nord in Montreal, Quebec;

- Place Marcel-François-Richard in Ville de Beaurivage, New Brunswick;

- SeaRoots Alliance Wellness Centre in Souris, Prince Edward Island;

- Breakwater Installation in Petty Harbour-Maddox Cove, Newfoundland and Labrador;

- Baddeck Recreation Facility in Baddeck, Nova Scotia, and;

- Inuit Nunangat University

Funding for these projects will be sourced from the Direct Delivery stream of the Build Communities Strong Fund or from other existing federal programs, where appropriate. Further details, including final commitments, on each project will be shared in the coming months.

1.3 Canada's Climate Competitiveness Strategy

Climate action is not just a moral obligation—it's an economic necessity. The world economy is undergoing a historic transformation towards low-carbon energy and clean technology. In 2024, global investments in clean energy reached USD $2 trillion—nearly double the level of investment in fossil fuels—and the global clean technology market is expected to triple by 2035. On the other hand, the Canadian Climate Institute estimates that climate disruption, if left unchecked, could cut median Canadian household income by nearly 20 per cent by the end of the century, disrupting many elements of the economy, from food supply chains to financial markets.

To compete internationally, Canada will need to reduce its carbon intensity to meet the growing demand from global markets for products with low associated greenhouse gas emissions. Buyers of Canada's resources—oil and gas, steel, and aluminum—are increasingly looking for low-carbon sourcing. Fortunately, Canada is well positioned to take advantage of these new growth opportunities. For example, our electricity grid, one of the cleanest in the world, guarantees access to the clean power businesses around the world are looking for, in sectors ranging from aluminum to steel to AI. In conventional energy too, Canada is one of very few large-scale suppliers committed to strong environmental, social, and governance standards, and we have reduced the emission intensity of overall oil production by 8 per cent, and the emission intensity of oil sands operations by almost 40 per cent between 1990 and 2022.

Canada's power sector has a clear emissions advantage compared to peer countries

Canada's oil and gas production has an emissions advantage compared to some peer countries but has room to improve

Lowering our emissions is critical to protecting the competitiveness of Canada's oil and gas and steel sectors. Reducing emissions is not only essential for environmental reasons, but also a key factor in securing access to markets that prioritise sustainability. By becoming a global leader in clean technology and clean energy, Canada can strengthen its competitive advantage and expand its exports, particularly in sectors where low-carbon solutions are increasingly seen as a requirement rather than a bonus.

Canada's natural resources, workforce, and commitment to fighting climate change position us to surpass economies that fail to adapt. We will build new infrastructure and capitalise on projects that further Canada's standing as a clean energy superpower. We will explore initiatives such as nuclear energy, electricity grid interties, and investments in low-carbon fuels such as hydrogen, renewable energy projects, high-speed rail, and critical mineral development.

As the new government moves decisively to build major nation-building projects and millions more homes, we are doing so while reducing emissions and growing our economy. Our investments in clean growth technologies will propel Canada's competitive advantage. For example, the Darlington New Nuclear Project will support the construction of small nuclear reactors, while LNG Canada Phase 2 will supply cleaner energy compared to other LNG facilities worldwide. We will continue to prioritise clean growth and climate objectives as new projects are considered.

Budget 2025 outlines the new government's Climate Competitiveness Strategy, creating the conditions for the investment needed to build an affordable net-zero future in which Canadian businesses are well-positioned to compete and succeed in the global economy.

The strategy is a central pillar of the government's plan for Canada to become the strongest economy in the G7. It is based on driving investment, not on prohibitions, and on results, not objectives. It aims to maximise carbon value for money, prioritising measures that will result in the greatest emissions reductions and competitiveness benefits at the lowest cost for Canadians.

Strengthening Industrial Carbon Pricing

An effective industrial carbon pricing system, underpinned by a long-term price trajectory, is essential to providing certainty to businesses looking to invest and compete internationally.

Industrial carbon pricing drives investment to reduce emissions and build the competitiveness of Canadian business. It is expected to deliver more emission reductions than any other policy, with negligible impacts on affordability for Canadians.

However, carbon markets are not functioning as well as they should be. The government will improve the effectiveness of carbon markets to provide confidence that credit prices will be predictable and sufficient to support clean growth investments without adversely affecting competitiveness or leading to carbon leakage.

Improving the effectiveness of industrial carbon pricing will ensure every dollar spent delivers maximum impact. Industrial carbon pricing rewards innovation and spurs investment in cleaner technologies—helping Canada's industrial sectors to grow and compete.

To improve the effectiveness of Canada's industrial carbon pricing system, the government will take the following actions:

- Develop a post-2030 carbon pricing trajectory: The government will engage provincial and territorial (PT) governments in setting a multi-decade industrial carbon price trajectory that targets net-zero by 2050. Setting a long-term trajectory will allow businesses to make investment decisions with confidence now and into the future. Securing pan-Canadian agreement on this trajectory will increase certainty.

- Fix the benchmark and improve the backstop: The government will improve its application of the benchmark—the tool that ensures all PT industrial pricing systems are harmonised across the country in providing a common, strong price signal. The government will promptly and transparently apply the federal backstop whenever a PT system falls below the benchmark. The government will engage with PT governments about improvements to the benchmark and to PT pricing systems such as harmonising or linking carbon credit markets.

- Carbon contracts for difference: Canada Growth Fund will continue to issue contracts as a means of further improving future carbon price certainty for investors making large, long-duration capital investments.

Clarity on Greenhouse Gas Regulations

Greenhouse gas (GHG) emissions increase the Earth's temperature, causing climate change and its associated effects—extreme weather events, intense wildfires, and rising sea levels. Canada has been working to reduce its emissions, and from 2005 to 2023, Canada's GHG emissions decreased by 8.5 per cent—even as our population grew from 32 to 40 million and our GDP expanded by 38 per cent. As we transition to a net-zero economy, Canada's new government is committed to reducing GHG emissions.

Buyers of Canada's resources are increasingly demanding they be sourced and produced in a way that reduces emissions and promotes sustainability. Reducing our emissions will make our industries more competitive and gives them an advantage in the global economy.

The government will take the following approach to ensure its regulations complement industrial pricing:

- Electricity: The transition to net-zero by 2050 will require clean, reliable power. The Clean Electricity Regulations will aim to reduce emissions to protect the environment and human health from the threat of climate change. The government will work with provinces and territories to advance these goals and ensure that Canada's grid is clean as electricity demand grows.

-

To enable long-term agreements with provinces and territories, Budget 2025 announces the government's intention to propose legislative amendments to the Canadian Environmental Protection Act.

- Methane: Methane emissions are potent greenhouse gas emissions that are not effectively covered by carbon pricing. The government will finalise enhanced methane regulations for the oil and gas sector and landfills, and intends to work with provinces and territories to negotiate equivalency agreements as appropriate.

- Update on the Oil and Gas Emissions Cap: Canada is committed to bringing down the emissions associated with the production of oil and gas. Effective carbon markets, enhanced oil and gas methane regulations, and the deployment at scale of technologies such as carbon capture and storage would create the circumstances whereby the oil and gas emissions cap would no longer be required as it would have marginal value in reducing emissions.

- Electric Vehicles: In September, the government announced its intent to make targeted regulatory adjustments to help the automotive sector stay competitive during a period of upheaval and uncertainty in response to immediate challenges from U.S. trade and policy actions. This included the initial step of removing the 2026 target from the Electric Vehicle Availability Standard and launching a 60-day review of the overall regulation. Following this review, the government will announce next steps on electric vehicles in the coming weeks.

- Clean Fuel: Targeted updates to the Clean Fuel Regulations will help reduce reliance on imported fuels, strengthen domestic supply chains, and support jobs in agriculture, forestry, and waste sectors.

Boosting Clean Economy Investment Through Tax Credits

A substantial increase in energy supply is required to support the growth of Canada's population and economy. In Canada, a major driver of this demand growth will come from several large, energy-intensive economic sectors as they expand and electrify, including manufacturing, pulp and paper, oil and gas extraction, and metal and non-metallic mineral product manufacturing sectors, including steel and aluminum, and emerging drivers such as AI data centres and electric transportation.

To meet this growing demand for clean energy, Canada will need to modernise its electrical grids. To achieve this, we will attract significant new investments to the sector, enabling infrastructure upgrades, energy storage, and new technologies, while also expanding wind and solar investments. Expanding interprovincial interties can also lower costs while ensuring grid reliability. The degree of investment needed in that timeframe will be significant. Forecasts indicate that the annual pace of investment needs to nearly triple from current levels to meet anticipated future demand.

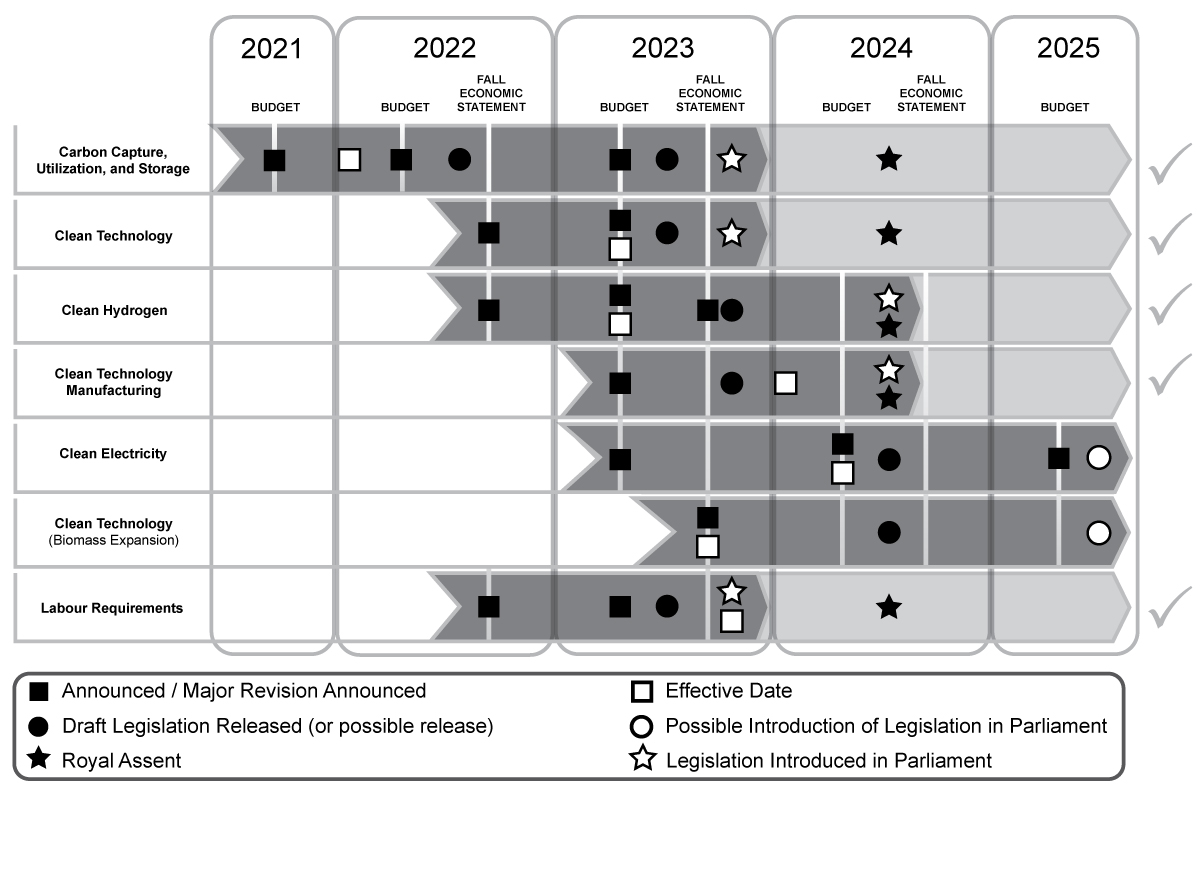

To seize the investment opportunities from this, the government has now delivered four of its clean economy investment tax credits. These are now available to be claimed with the Canada Revenue Agency and investors are starting to avail themselves of those tax credits.

- The refundable investment tax credits available include the:

- 37.5 to 60-per-cent Carbon Capture, Utilization, and Storage investment tax credit, available as of January 1, 2022.

- 30-per-cent Clean Technology investment tax credit, available as of March 28, 2023.

- 15 to 40-per-cent Clean Hydrogen investment tax credit, available as of March 28, 2023.

- 30-per-cent Clean Technology Manufacturing investment tax credit, available as of January 1, 2024.

With these investment tax credits now set out in law, businesses can move forward with the certainty they need to make final investment decisions to invest and build in Canada.

The government will soon be introducing legislation to deliver the Clean Electricity investment tax credit and enhancements to the investment tax credits that have already been implemented. While legislation progresses, investors already have the certainty of retroactive eligibility:

- The Clean Electricity investment tax credit would be available as of April 16, 2024, for projects that did not begin construction before March 28, 2023.

- Expanded eligibility to include systems that produce electricity, heat, or both electricity and heat from waste biomass and changed the eligibility requirements for small nuclear energy property under the Clean Technology investment tax credit, both measures would be available retroactively as of November 21, 2023, and March 28, 2023, respectively.

- Expanded eligibility to include qualifying equipment used in eligible polymetallic mining projects under the Clean Technology Manufacturing investment tax credit would be retroactively available as of January 1, 2024.

- Expanded eligibility to include hydrogen produced from methane pyrolysis under the Clean Hydrogen investment tax credit would be available as of December 16, 2024.

Delivering on Clean Economy Investment Tax Credits

Building on these existing measures, the government is announcing further changes to the clean economy investment tax credits to ensure that they remain competitive and effective in attracting projects and high-paying careers to Canada.

-

Budget 2025 confirms the government's intention to proceed with the implementation of the Clean Electricity investment tax credit and proposes to remove the conditions imposed on provincial and territorial governments for their Crown corporations to be eligible. Removing the conditions will ensure that provincial and territorial Crown corporations can access the investment tax credit and effectively and efficiently support clean electricity investment while reducing administrative burden.

-

Budget 2025 proposes to extend, by five years, the availability of the full credit rates for the Carbon Capture, Utilization, and Storage (CCUS) investment tax credit, that would apply from 2031 to 2035. Credit rates would remain unchanged from 2036 to 2040.

-

Budget 2025 proposes to expand the list of critical minerals eligible for the Clean Technology Manufacturing investment tax credit to include antimony, indium, gallium, germanium, and scandium, in order to support investments in the extraction, processing, and recycling of co-product and by-product critical minerals.

The government will also consult on the possibility of introducing a domestic content requirement under the Clean Technology and Clean Electricity investment tax credits.

Supporting Critical Mineral Projects

Critical minerals are used to build modern technology, and Canada is rich in these resources. Canada's new government is making it easier and more affordable for businesses to mine for critical minerals—supporting local industries and developing domestic and global value chains. To that end, at this year's G7 Summit in Kananaskis, Alberta, the Prime Minister introduced the Critical Minerals Production Alliance—a Canadian-led initiative that leverages trusted international partnerships to enhance critical mineral supply chains for collective defence and advanced technology. As part of the work of the Alliance, on October 31, 2025, the Government of Canada announced new investments, partnerships and measures to accelerate and unlock critical minerals projects essential in defence, clean energy and advanced manufacturing supply chains, including entering into offtake agreements with two critical minerals projects in Canada.

Critical minerals are an important part of Canada's Climate Competitiveness Strategy, as essential resources are needed for clean energy technologies and renewable energy infrastructure, including solar panels, electric vehicle batteries, and energy storage systems.

-

Budget 2025 proposes to provide $2 billion over five years, on a cash basis, starting in 2026-27, to Natural Resources Canada to create the Critical Minerals Sovereign Fund. The fund will make strategic investments in critical minerals projects and companies, including equity investments, loan guarantees, and offtake agreements. Budget 2025 also proposes to provide $50 million over five years, starting in 2026-27, to Natural Resources Canada to support the delivery of this fund.

-

Budget 2025 proposes to provide $371.8 million over four years, starting in 2026-27, to Natural Resources Canada to create the First and Last Mile Fund. This new fund would support the development of critical minerals projects and supply chains at the upstream and midstream segments of value chains, with a focus on getting near-term projects into production. The First and Last Mile Fund would absorb the Critical Minerals Infrastructure Fund and leverage its existing funding envelope to provide up to $1.5 billion in support through 2029-30. The fund would also continue to support clean energy and transportation infrastructure projects related to critical minerals development.

-

Budget 2025 proposes to expand eligibility for the Critical Mineral Exploration Tax Credit (CMETC) to include an additional 12 critical minerals necessary for defence, semiconductors, energy, and clean technologies: bismuth, cesium, chromium, fluorspar, germanium, indium, manganese, molybdenum, niobium, tantalum, tin, and tungsten. The expansion of the CMETC would apply to certain exploration expenditures targeted at these minerals and renounced as part of a flow-through share agreement entered into after Budget Day and on or before March 31, 2027.

Mobilising Capital for Transition to Net-Zero

Canada has the resources and talent to develop technology that can deliver low-carbon energy. As the global demand for low-carbon goods and processes rises, Canada's new government is seizing this opportunity by mobilising public and private capital that promotes investment in sustainability.

To accelerate the flow of private capital into sustainable activities across priority economic sectors:

-

Budget 2025 reconfirms the government's support for the arm's length development of made-in-Canada sustainable investment guidelines (also known as a taxonomy) by the end of 2026. These investment guidelines will become an important, voluntary tool for investors, lenders, and other stakeholders navigating the global race to net-zero, by credibly identifying "green" and "transition" investments. The government will select and announce, by the end of 2025, an external organisation with the expertise to develop the sustainable investment guidelines.

-

To finance government spending that helps industrial and agricultural sectors get cleaner and more competitive, Budget 2025 announces the government's intention to explore the development of a Sustainable Bond Framework that would allow for the issuance of both green and transition bonds to be aligned with a Canadian taxonomy, and to expand the Framework to incorporate economic sectors as the taxonomy is being developed.

-

Budget 2025 announces that the government will work with provinces and territories to improve climate disclosure across the economy. This work will seek alignment with international standards and harmonised rules across federal-provincial-territorial jurisdictions.

Updating Greenwashing Legislation

The Competition Act was recently amended to create new enforcement provisions for false claims of environmental benefit. These "greenwashing" provisions are creating investment uncertainty and having the opposite of the desired effect with some parties slowing or reversing efforts to protect the environment.

-