Archived - Chapter 2: Building a Better Canada

For a century and a half—and for Indigenous Peoples, millennia before that—the people who call Canada home have come together to build a better country, and a better future for themselves and their children.

Together, we built the cities and towns that have given millions of people a good start in life, and are now a welcoming place to raise our own families.

Recognizing the importance of connections, we built the roads and railways, seaways and ports that link our communities to each other, and the world.

Canadians also built our world-class public institutions—home to innovators whose ideas and inventions are making the world a healthier, cleaner, more connected place.

As our history proves, however, there is always more work to be done to build a better Canada.

Canadians want continued investments in their communities—making them even better places to live while creating good, well-paying jobs and keeping our economy strong and growing.

They want new ways to connect—so that all Canadians have access to high-speed internet and more affordable electricity, and so that no one is left out, or left behind.

They recognize the very real challenge of climate change, and embrace the opportunity to be a world leader in fighting pollution.

And they want to build a nation of entrepreneurs and scientists that will help create the better future we all want.

With Budget 2019, the Government is investing in that future, to build a better Canada.

Part 1: Building Strong Communities

Investing in infrastructure creates good, well-paying middle class jobs today, and sets the stage for long-term economic growth that benefits everyone. But there is more to infrastructure than jobs and growth. It also makes our communities better places to live.

Better public transit means busy parents can get home sooner at the end of a long day. Modern water and wastewater systems help to keep Canadians healthy and safe. Flood mitigation projects help communities cope with the damaging effects of climate change. More efficient transportation corridors mean that businesses can get their goods to customers more quickly. And better social infrastructure—things like affordable housing, community centres, and public parks—make our cities and towns places we can all be proud to call home.

The Investing in Canada Plan: An Update

In Budget 2016, the Government announced the first phase of its Investing in Canada Plan, which provided $14.4 billion for short-term investments to upgrade and repair existing infrastructure. In Budget 2017, the Government outlined the second phase of its plan, including a commitment to invest an additional $81.2 billion in long-term funding for public transit, green infrastructure, social infrastructure, and infrastructure that supports trade and transportation, and rural and northern communities. In total, the Government is investing more than $180 billion over 12 years to build infrastructure in communities across the country. Additional investment associated with the first and second phase of the Investing in Canada Plan is expected to help create or maintain an estimated 42,000 jobs by 2020–21.

Progress Since Fall 2018

- Since the last update in the 2018 Fall Economic Statement, long-term agreements have been signed with all provinces and territories that will deliver more than $33 billion in federal infrastructure investments. As a result, more priority projects identified by the provinces and territories are able to move forward, including two major Light Rail Transit projects in Edmonton that will extend service to new areas of the city, improve riders’ experience and increase accessibility.

- To reduce export bottlenecks and help Canadian businesses take advantage of new overseas markets, the Government accelerated funding available under the National Trade Corridors Fund. Organizations that are benefitting from funding from the National Trade Corridors Fund include, Gander International Airport Authority (NL), Ville de Montreal (QC) and First Air (NU).

- To help increase investments in critical public transit, trade and transportation, and green infrastructure, the Canada Infrastructure Bank is actively engaged with governments and the investor community on major project opportunities across the country, building on its $1.28 billion investment in the Réseau express métropolitain project in Montréal.

Projects Approved and Underway

Working with provinces and territories, the Government has approved more than 33,000 infrastructure projects for communities across Canada, supported by federal investments of approximately $19.9 billion. [1] The majority of these projects are already underway—creating good, middle class jobs today, and delivering long-term economic, social, and environmental benefits in communities both big and small.

At the same time, the pace of spending under the Investing in Canada Plan has been slower than originally anticipated, for reasons that include delays between construction activity and receipt by the Government of claims for payment, and by some jurisdictions being slower to prioritize projects than expected.

The Government is currently working with the provinces and territories to accelerate projects under their bilateral agreements to ensure momentum continues. The Government is taking steps to streamline the process for the provinces and territories to prioritize projects for funding, and to improve financial reporting so that it is clear when project costs are incurred, and when federal funds will flow to recipients.

Affordable Housing The federal government invested $1.5 million in the construction of 220 Terminal Avenue in Vancouver. The development includes 40 single-occupancy rental suites for Vancouver residents in need of safe and affordable housing.

Clean Wind Power The federal government is contributing $30 million towards a wind generation project in Inuvik. This innovative project will create a more efficient, more reliable and cleaner source of energy for residents.

New Azur Subway Cars Montréal’s metro system will be able to purchase 153 new subway cars, supported by a federal government investment of more than $215 million. The new cars will replace part of the existing fleet, making the system more efficient and reliable.

Water Systems The federal government invested $11.2 million to expand municipal water and wastewater systems in Lethbridge. This investment supports the planned development in the East Sherring Business and Industrial Park, services rural homes, and helps to better manage storm runoff.

New Go Transit Train Coaches Users of the seven GO Transit lines in the Greater Toronto-Hamilton Area will soon be getting to their destinations faster thanks to a federal investment of $93.5 million. This investment means that 53 new bi-level train coaches will be delivered one year earlier than planned.

Renewable Tidal Energy Halagonia Tidal Energy received $29.8 million in federal support for its $117 million marine renewable energy project to provide clean electricity to Nova Scotia. The project will create approximately 120 jobs and cut pollution from power generation in the province.

| Phase | Program name | Objective |

|---|---|---|

| Phase 1 | Public Transit Infrastructure Fund | Alleviate traffic congestion, reduce air pollution and cut long commutes that make it harder for people to get to work and for families to spend time together to strengthen communities. |

| Clean Water and Wastewater Fund | Keep our waterways clean and our communities healthy with improved reliability to drinking water, wastewater and storm water systems. | |

| Investment in Affordable Housing | Reduce the number of Canadians in need and improve access to affordable housing for vulnerable Canadians, fostering safe, independent living. | |

| Connect to Innovate | Extend high-speed Internet to rural and remote communities in Canada, with a focus on building new backbone infrastructure in communities to provide connections to institutions like schools, hospitals and libraries. | |

| Homelessness Partnering Strategy | Prevent and reduce homelessness by providing direct support and funding to designated communities. | |

| Phase 2 | Investing in Canada Infrastructure Program | Deliver funds to provinces and territories for prioritized projects in the areas of public transit, green infrastructure, community, culture and recreation infrastructure, rural and northern communities’ infrastructure. |

| Canada Infrastructure Bank | Attract private capital to enable more infrastructure to get built at a lower cost to Canadians by investing in revenue generating public infrastructure. | |

| National Trade Corridors Fund | Address transportation bottlenecks, vulnerabilities and congestion along Canada’s trade corridors, helping Canadian companies to compete in global markets and trade more efficiently with international partners. | |

| Disaster Mitigation and Adaptation Fund | Help communities better manage the increasing risks of natural disasters as a result of climate change. | |

| Canada Cultural Spaces Fund | Support cultural infrastructure projects across the country by investing in traditional arts and heritage facilities, such as museums, theatres and performing arts centres. | |

| Indigenous Community-Based Climate Monitoring Program | Build capacity within First Nation, Métis and Inuit communities to monitor climate change effects, providing the data required to inform community adaptation actions. |

Creating Jobs Through the Investing in Canada Plan

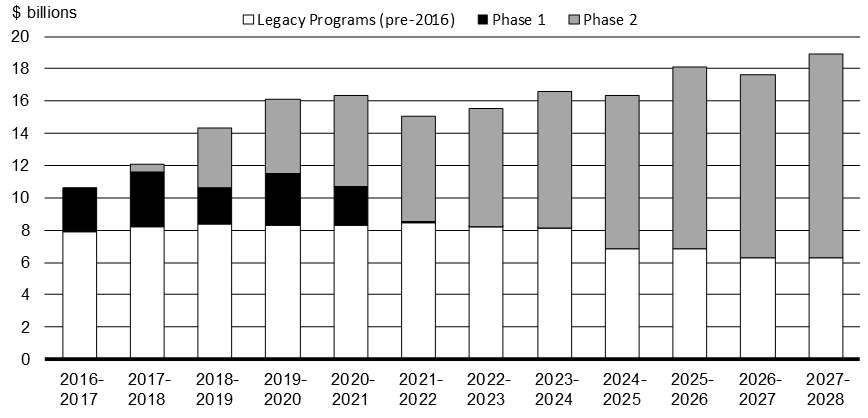

In 2015–16, the Government spent approximately $8 billion on infrastructure. With the introduction of the Investing in Canada Plan in 2016, the level of investment steadily grew, to $14.3 billion in 2018–19—an increase of 75 per cent in just three years. Over the next nine years, the Plan will invest an average of more than $16 billion per year. This dramatic increase in infrastructure investments spending has already helped to strengthen and grow Canada’s economy, and its continued rise over the next two years will support economic growth at a time when the global outlook remains uncertain.

The Department of Finance Canada estimates that the incremental increase in infrastructure spending associated with Phase 1 and Phase 2 of the Investing in Canada Plan will raise the level of real gross domestic product (GDP) by 0.4 per cent by 2020–21, compared to what would have been the case without this additional infrastructure investment. This translates into employment opportunities in highly skilled areas, with an estimated 42,000 jobs created or maintained by 2020–21.

The Investing in Canada Plan recognizes the important role infrastructure plays in building strong communities, creating employment opportunities in highly skilled areas and growing the economy. Statistics Canada’s Infrastructure Economic Account shows that the value of the overall Investing in Canada Plan—Legacy Programs funding together with Phase 1 and Phase 2—is associated with about 100,000 direct and indirect jobs in 2018–19.

Trade Infrastructure

The National Trade Corridors Fund provided $9.2 million to Ashcroft Terminal Ltd. in British Columbia to build a new rail link, extra rail track and an internal road network. These new infrastructure projects will provide producers and shippers improved efficiency in the shipment of goods, support the movement and storage of rail cars to enhance fluidity through Canada’s Pacific Gateway Trade Corridor and ensure that rail and truck operations do not interfere with each other, thereby increasing safety.

Slightly more than half of these jobs are the result of direct investment effects in well-paid industries such as construction or manufacturing, whereas the rest are in the Canadian companies that supply the equipment, supplies and services needed for large-scale infrastructure projects.

Going forward, the ongoing investments will continue to provide employment opportunities to over 100,000 Canadians on average each year throughout the remainder of the long-term infrastructure plan.

Infrastructure investments also deliver economic benefits over the long term. The International Monetary Fund[3] recently examined the long-term effect of a permanent increase in public infrastructure investments and found that for advanced economies such as Canada, permanently increasing investment in public infrastructure by 1 per cent of GDP would boost GDP by approximately 2.5 per cent after 10 years.

Given both the short- and long-term benefits of infrastructure, and the thousands of projects currently underway across Canada, it is clear that the Investing in Canada Plan is delivering real benefits for Canadians—and will continue to do so for years to come.

New Infrastructure Funding for Local Communities Through a Municipal Top-Up

In 2015, the Government made a commitment to ensure that promised infrastructure investments in communities would be kept. Prior to that time, too often, money that had been budgeted for investment in communities was left unspent and unallocated—shortchanging cities and towns that needed those funds for important projects such as road maintenance, water infrastructure, public transit and recreational infrastructure.

Since 2015, the federal government has worked in partnership with provinces and territories to protect these infrastructure dollars, to ensure that they do not lapse and are available to flow to communities when projects are ready. The Government transferred remaining uncommitted funds from older federal infrastructure programs to municipalities through the federal Gas Tax Fund, and has ensured that the $81.2 billion in long-term infrastructure funding announced in Budget 2017 is available for jurisdictions when it is needed.

Because many municipalities across Canada continue to face serious infrastructure deficits, Budget 2019 proposes a one-time transfer of $2.2 billion through the federal Gas Tax Fund to address short-term priorities in municipalities and First Nation communities.

This will double the Government’s commitment to municipalities in 2018–19 and will provide much needed infrastructure funds for communities of all sizes, all across the country.

Because many municipalities across Canada continue to face serious infrastructure deficits, Budget 2019 proposes a one-time transfer of $2.2 billion through the federal Gas Tax Fund to address short-term priorities in municipalities and First Nation communities.

This will double the Government’s commitment to municipalities in 2018–19 and will provide much needed infrastructure funds for communities of all sizes, all across the country.

|

|

Productivity and Economic Growth |

Clean Environment | Strong Cities and Communities |

| Eligible Categories |

|

|

|

| Project Examples (2014-2016) |

Communities in Saskatchewan: 344 local road and bridge projects increasing transportation capacity |

Communities in the Yukon: 28 community energy projects, such as a solar electricity generating system in a Champagne- Aishihik First Nations residence |

Communities in Ontario: 36 recreation projects enhancing facilities and encouraging over 1,200 people to make greater use of them |

Part 2: Affordable Electricity Bills and a Clean Economy

For too many Canadians, the rising cost of electricity is a source of economic anxiety. No one should have to choose between heating their home in winter and being able to afford the other things that provide a good quality of life—things like healthy, nutritious food, or clothes for family members. Yet the fact remains that in many Canadian cities, the cost of electricity is rising much faster than growth in household disposable income—making it hard for many people to make ends meet.

Budget 2019 proposes a number of measures to help hard-working Canadians more easily afford this necessity.

Investing in the Future of Transportation

Transportation accounts for about one quarter of Canada’s greenhouse gas emissions, mainly coming from gas- and diesel-powered cars and trucks. The future of transportation lies in the increased use of zero-emission vehicles—cars and trucks powered by rechargeable electric batteries or hydrogen fuel cells. While these vehicles are not yet common in communities across Canada, they can provide a cleaner, more efficient way to transport people and goods and, over the long run, help Canadians reduce the everyday cost of transportation.

That is why Canada has set a target to sell 100 per cent zero-emission vehicles by 2040, with sales goals of 10 per cent by 2025 and 30 per cent by 2030 along the way. By becoming an early adopter of this new technology, Canada will help the Canadian zero-emission vehicle market advance, making zero-emission vehicle options more readily available and affordable for more and more Canadians.

Making Zero-Emission Vehicles More Affordable

More and more Canadians are choosing to drive zero-emission vehicles as an increasing number of models become available and prices decline. Those who have already purchased these vehicles are realizing the financial savings from lower operating costs. The Government is taking action to help more Canadians choose zero-emission vehicles, which will allow Canada to transition to a low carbon economy and reduce transportation costs for the middle class. The Government also wants to encourage investment in Canada’s domestic auto industry so that it can become a global leader in zero-emission transportation manufacturing.

Budget 2019 proposes strategic investments that will make it easier and more affordable for Canadians to choose zero-emission vehicles—helping people to get from place to place, improving air quality and cutting greenhouse gas emissions at the same time.

To expand the network of zero-emission vehicle charging and refuelling stations, Budget 2019 proposes to build on previous investments by providing Natural Resources Canada with $130 million over five years, starting in 2019–20, to deploy new recharging

and refuelling stations in workplaces, public parking spots, commercial and multi-unit residential buildings, and remote locations.

To expand the network of zero-emission vehicle charging and refuelling stations, Budget 2019 proposes to build on previous investments by providing Natural Resources Canada with $130 million over five years, starting in 2019–20, to deploy new recharging

and refuelling stations in workplaces, public parking spots, commercial and multi-unit residential buildings, and remote locations.

Meeting the ambitious sales targets requires automakers to make sufficient models and numbers of zero-emission vehicles available for sale to meet Canadian needs. Budget 2019 proposes to provide $5 million over five years, starting in 2019–20 to

Transport Canada to work with auto manufacturers to secure voluntary zero-emission vehicle sales targets to ensure that vehicle supply meets increased demand.

Meeting the ambitious sales targets requires automakers to make sufficient models and numbers of zero-emission vehicles available for sale to meet Canadian needs. Budget 2019 proposes to provide $5 million over five years, starting in 2019–20 to

Transport Canada to work with auto manufacturers to secure voluntary zero-emission vehicle sales targets to ensure that vehicle supply meets increased demand.

To encourage more Canadians to buy zero-emission vehicles, Budget 2019 proposes to provide $300 million over three years, starting in 2019–20, to Transport Canada to introduce a new federal purchase incentive of up to $5,000 for electric battery or hydrogen

fuel cell vehicles with a manufacturer’s suggested retail price of less than $45,000. Program details to follow.

To encourage more Canadians to buy zero-emission vehicles, Budget 2019 proposes to provide $300 million over three years, starting in 2019–20, to Transport Canada to introduce a new federal purchase incentive of up to $5,000 for electric battery or hydrogen

fuel cell vehicles with a manufacturer’s suggested retail price of less than $45,000. Program details to follow.

To attract and support new high-quality, job-creating investments in zero-emission vehicle manufacturing in Canada, automotive manufacturers and parts suppliers can access funding through the Strategic Innovation Fund, which was recently provided $800 million

in additional funding through the 2018 Fall Economic Statement.

To attract and support new high-quality, job-creating investments in zero-emission vehicle manufacturing in Canada, automotive manufacturers and parts suppliers can access funding through the Strategic Innovation Fund, which was recently provided $800 million

in additional funding through the 2018 Fall Economic Statement.

Supporting Business Investment in Zero-Emission Vehicles

To further support businesses’ adoption of zero-emission vehicles, Budget 2019 proposes that these vehicles be eligible for a full tax write-off in the year they are put in use. Qualifying vehicles will include electric battery, plug-in hybrid (with a

battery capacity of at least 15 kWh) or hydrogen fuel cell vehicles, including light-, medium- and heavy-duty vehicles purchased by a business. This will encourage all businesses to convert to zero-emission fleets and leave more money to be invested

in other productive ways. For example, a taxi company or a school bus operator will be able to recoup their investments in eligible zero-emission vehicles in a faster manner.

To further support businesses’ adoption of zero-emission vehicles, Budget 2019 proposes that these vehicles be eligible for a full tax write-off in the year they are put in use. Qualifying vehicles will include electric battery, plug-in hybrid (with a

battery capacity of at least 15 kWh) or hydrogen fuel cell vehicles, including light-, medium- and heavy-duty vehicles purchased by a business. This will encourage all businesses to convert to zero-emission fleets and leave more money to be invested

in other productive ways. For example, a taxi company or a school bus operator will be able to recoup their investments in eligible zero-emission vehicles in a faster manner.

Immediate expensing will apply to eligible vehicles purchased on or after March 19, 2019 and before January 1, 2024. Capital costs for eligible zero-emission passenger vehicles will be deductible up to a limit of $55,000 plus sales tax. This is higher than the capital cost limit of $30,000 plus sales tax that currently applies to passenger vehicles. This new $55,000 capital cost limit reflects the comparably higher cost of zero-emission vehicles and will be reviewed annually to ensure that it remains appropriate as market prices evolve over time.

How Immediate Expensing Will Support Investment in Zero-Emission Vehicles

Anne is a travelling sales representative working as an independent contractor. She needs to replace the aging gasoline vehicle that she currently uses strictly for her business and is considering the advantages of buying an electric vehicle. Anne drives long distances every day and requires an electric vehicle with a long range. She found that a suitable electric vehicle has a cost of $48,000. With measures announced in this Budget, she could deduct the $48,000 purchase price of the electric vehicle in full in the year she starts using it. This is in addition to the fact that she would be refunded the GST or HST paid. The decision to purchase an electric vehicle would reduce Anne’s federal/provincial income taxes and GST/HST in the year she acquires the vehicle by about $13,000. This significantly reduces the impact of the higher initial price of the electric vehicle. Given the electric car’s lower operating costs, Anne concludes that opting for the electric vehicle would result in savings over time. This choice significantly reduces the carbon footprint of Anne’s business, while freeing up resources for other purposes in the year she acquires the vehicle.

Happy Transport provides transportation services to schools in a rapidly growing community. The corporation would like to acquire $1 million worth of new electric school buses to expand its operations. Over time, Happy Transport expects that the lower operating costs of the electric school buses will improve profitability and allow it to further expand its business and the employment opportunity it provides. With immediate expensing for zero-emission vehicles, Happy Transport will be allowed to deduct from income the full $1 million acquisition cost in the year the buses are acquired. This is $550,000 more than previously permitted, resulting in savings of over $145,000 in current federal and provincial corporate income taxes. This improved cash-flow will help Happy Transport secure the bank loan it requires to pay for the increased upfront costs of electric school buses.

Reducing Energy Costs Through Greater Energy Efficiency

Improving the energy efficiency of Canada’s homes and buildings will make them more comfortable and affordable by lowering energy bills.

To help reduce Canadians’ electricity bills—whether they are homeowners, renters or building operators—Budget 2019 proposes to invest $1.01 billion in 2018–19 to increase energy efficiency in residential, commercial and multi-unit buildings. These

investments will be delivered by the Federation of Canadian Municipalities (FCM) through the Green Municipal Fund. The FCM has been the national voice of municipal government since 1901 and is a trusted partner in delivering federal funds directly

to local governments. Its members include Canada’s largest cities, small urban and rural communities and 19 provincial and territorial municipal associations. Budget 2019 proposes to allocate the resources to three initiatives that would provide financing

to municipalities as follows:

To help reduce Canadians’ electricity bills—whether they are homeowners, renters or building operators—Budget 2019 proposes to invest $1.01 billion in 2018–19 to increase energy efficiency in residential, commercial and multi-unit buildings. These

investments will be delivered by the Federation of Canadian Municipalities (FCM) through the Green Municipal Fund. The FCM has been the national voice of municipal government since 1901 and is a trusted partner in delivering federal funds directly

to local governments. Its members include Canada’s largest cities, small urban and rural communities and 19 provincial and territorial municipal associations. Budget 2019 proposes to allocate the resources to three initiatives that would provide financing

to municipalities as follows:

- Collaboration on Community Climate Action ($350 million): to provide municipalities and non-profit community organizations with financing and grants to retrofit and improve the energy efficiency of large community buildings as well as community pilot and demonstration projects in Canadian municipalities, both large and small. FCM and the Low Carbon Cities Canada Initiatives will create a network across Canada that will support local community actions to reduce GHG emissions.

- Community EcoEfficiency Acceleration ($300 million) to provide financing for municipal initiatives to support home energy efficiency retrofits. Homeowners could qualify for assistance in replacing furnaces and installing renewable energy technologies. The FCM will use innovative approaches like the Property Assessed Clean Energy (PACE) model that allows homeowners to repay retrofit costs through their property tax bills.

- Sustainable Affordable Housing Innovation ($300 million) to provide financing and support to affordable housing developments to improve energy efficiency in new and existing housing and support on-site energy generation.

Budget 2019 also proposes to invest $60 million in 2018–19 in FCM’s Municipal Asset Management Capacity Fund to help small communities get skills training on how to inventory, grow and maintain infrastructure assets over five years.

This program has proven to be popular and has demonstrated results to assist communities in developing accurate data around local infrastructure for budgetary and investment decisions. To support this proposal and others, including support for coal-affected

communities and investments in the Arctic, the remaining Green Infrastructure funding identified in Budget 2017 has now been allocated.

Budget 2019 also proposes to invest $60 million in 2018–19 in FCM’s Municipal Asset Management Capacity Fund to help small communities get skills training on how to inventory, grow and maintain infrastructure assets over five years.

This program has proven to be popular and has demonstrated results to assist communities in developing accurate data around local infrastructure for budgetary and investment decisions. To support this proposal and others, including support for coal-affected

communities and investments in the Arctic, the remaining Green Infrastructure funding identified in Budget 2017 has now been allocated.

Energy Efficiency in Action

Sinton is a small business owner who owns a restaurant in Halifax. To help with the bills, he also rents out a small apartment above the restaurant to two students. Sinton received a loan for retrofits from the Halifax Regional Municipality from funding provided to the city from the Green Municipal Fund. With the money, he was able to replace the windows in the building, install a new tankless hot water system in the apartment and a high efficiency heating and cooling system for the restaurant. As a result of these investments, Sinton’s customers are more comfortable year-round, and his and his tenants’ electricity bills have been lowered.

More Connectivity = More Affordable Electricity

Canadians should have access to affordable, reliable, and clean electricity, including people living in remote and northern communities.

In Canada, the provinces and territories—rather than the federal government—are responsible for the generation, transmission, distribution and sale of electricity within their boundaries. First Ministers agreed in December 2018 to develop a framework for a clean electric future of reliable and affordable electricity, including by considering interprovincial clean energy corridors. Partners also agreed on the importance of encouraging communities to move away from using diesel to generate power in remote communities and to increase industrial electrification.

The Canada Infrastructure Bank (CIB) has identified clean hydroelectricity and electrical connectivity infrastructure as an area it will look to support in its upcoming workplans. The CIB is well positioned to work with jurisdictions, including northern communities, to plan and finance projects that improve access within Canada to affordable, reliable and clean electricity in the most effective way. This includes projects that improve interconnections between provincial electricity grids. The CIB can help jurisdictions to assess supply and demand dynamics, and to develop business cases for promising projects. It can also co-invest in projects in order to attract capital from and transfer risks to the private sector—helping to expand the reach of public infrastructure dollars. The CIB has been allocated $5 billion for investments in green infrastructure, which could include electricity projects such as interties between provinces and territories.

The Government also recognizes that small jurisdictions face unique constraints. Through improvements to the Investing in Canada Infrastructure Program, the Government will support planning efforts by jurisdictions to advance clean energy projects and other infrastructure priorities in small communities and the territories.

In addition, as noted in “Building Connections in Canada’s Arctic and Northern Regions”, Budget 2019 proposes to provide a further $18 million, over three years, starting in 2019–20, to support planning by the Government of Northwest Territories for its

proposed Taltson hydroelectricity expansion project.

In addition, as noted in “Building Connections in Canada’s Arctic and Northern Regions”, Budget 2019 proposes to provide a further $18 million, over three years, starting in 2019–20, to support planning by the Government of Northwest Territories for its

proposed Taltson hydroelectricity expansion project.

Historic Indigenous-Led Transmission Project to Connect Remote First Nations Communities to the Ontario Power Grid

On March 22, 2018, in partnership with Ontario, the Government announced $1.6 billion in federal funding for Wataynikaneyap Power to connect 16 First Nations to the provincial power grid. The federal contribution will be offset by reductions to federal funding for diesel generation in these communities that will be no longer required due to the new transmission line. Locally sourced diesel power is more expensive and produces more greenhouse gas emissions than grid-connected electricity.

The Wataynikaneyap Power project will be the largest First Nations grid connection project in the history of the province and a model for development. This investment will provide clean, safe and reliable energy and will improve the quality of life for northern Ontario’s remote communities.

Fighting Climate Change With a Price on Pollution

We have all seen the impact of climate change through extreme weather events. We need to act now to ensure that our children and grandchildren have clean air to breathe, and Canada has a strong and healthy economy.

In December 2016, Canada’s First Ministers adopted the Pan-Canadian Framework on Clean Growth and Climate Change. The Pan-Canadian Framework is this country’s plan to meet our emissions reduction targets, grow the economy and build resilience to a changing climate. The Framework is built on four pillars: pricing carbon pollution; complementary actions to further reduce emissions across the economy; measures to adapt to the impacts of climate change and build resilience; and actions to accelerate innovation, support clean technology and create jobs.

Pricing carbon pollution is central to the Framework. It is the most efficient way to send a price signal to companies, investors, and consumers to make more environmentally sustainable choices. This is the least costly way to reduce greenhouse gas emissions and foster clean innovation. Starting this year, it is no longer free to pollute in Canada. The Government is making sure that there is a price on carbon pollution across the country, while also taking steps to maintain affordability for households and ensuring that Canadian companies can compete and succeed in a competitive global marketplace.

Many provinces and territories have already implemented or are on track to implement a carbon pollution pricing system, or have asked to adopt the federal system in whole or in part. The federal carbon pollution pricing system has two components: a regulatory charge on fossil fuels and an output-based pricing system for large industrial facilities, which provides a price incentive to reduce emissions and spur innovation. The federal output-based pricing system came into effect in Ontario, New Brunswick, Prince Edward Island, Manitoba and partially in Saskatchewan in January 2019 and will apply in Yukon and Nunavut starting in July 2019. The federal fuel charge will apply in Ontario, Manitoba, New Brunswick and Saskatchewan starting in April 2019 and in Yukon and Nunavut starting in July 2019.

Today, the Department of Finance is publishing a news release, accompanied by a backgrounder and draft amendments, seeking comments on further refinements to the federal carbon pollution pricing system. The proposals include: expanded relief of the fuel charge for electricity generation for remote communities; a rebate for exports of fuel under certain conditions; integration of the Saskatchewan output-based performance standards system with the federal fuel charge; and expanded relief of the fuel charge for farmers for gasoline and light fuel oil (e.g., diesel) delivered at cardlock facilities.

The Government will not keep any direct proceeds from the federal carbon pollution pricing system.

For jurisdictions that do not meet the Canada-wide federal standard for reducing carbon pollution—Ontario, New Brunswick, Manitoba and Saskatchewan—the Government will return all direct proceeds from the fuel charge in the jurisdiction of origin, with the bulk of direct proceeds going to individuals and families residing in those provinces through Climate Action Incentive payments. Further details about the Climate Action Incentive payments can be found in the box below.

The remainder of proceeds will be directed towards providing support to sectors within these provinces that may be particularly affected by the carbon pollution price, including small and medium-sized businesses, municipalities, universities, colleges, schools, hospitals, non-profits and Indigenous communities. The Government will introduce legislation to allow proceeds from the regulatory charge to be directed towards these sectors.

For jurisdictions that voluntarily adopted the federal system—Prince Edward Island, Yukon and Nunavut—all direct proceeds will be returned to the governments of those jurisdictions.

|

|

Ontario | New Brunswick | Manitoba | Saskatchewan |

|---|---|---|---|---|

| Single adult, or first adult in a couple |

$ 154 | $ 128 | $ 170 | $ 305 |

| Second adult in a couple, or first child of a single parent |

$ 77 | $ 64 | $ 85 | $ 152 |

| Each child under 18 (starting with the second child for single parents) |

$ 38 | $ 32 | $ 42 | $ 76 |

| Example: Total amount for family of four | $307 | $256 | $339 | $609 |

Climate Action Incentive Payments

Eligible residents of Ontario, New Brunswick, Manitoba and Saskatchewan can now claim tax-free Climate Action Incentive payments for their family, through their 2018 personal income tax returns. Most households will receive more in Climate Action Incentive payments than their increased costs resulting from the federal carbon pollution pricing system.

Climate Action Incentive payment amounts are based on family composition and province of residence (see Table 2.2). A 10-per-cent supplement is available to eligible individuals and families residing in small or rural communities, in recognition of their increased energy needs and reduced access to clean transportation options.

The federal carbon pollution pricing system is about recognizing that pollution has a cost, empowering Canadians, and driving innovation. Putting a price on products that are more polluting, and returning the bulk of the direct proceeds to individuals and families in the jurisdiction of origin, enables households to make cleaner and more environmentally sustainable choices. A family that receives a Climate Action Incentive payment may choose to invest it in energy efficiency improvements. This in turn allows them to save more money.

Going forward, Climate Action Incentive payment amounts will be boosted on an annual basis until 2022, to reflect increases in the price on carbon pollution under the federal backstop system and updated levels of proceeds being generated in each jurisdiction.

A Just Transition for Canadian Coal Power Workers and Communities

We’ve seen what can happen when governments take a stand for cleaner air. In 2005, in Toronto, there were 53 smog days. A decade later, thanks in large part to the phase-out of coal-fired generating stations, there were zero smog days.

In 2016, coal generated approximately 9 per cent of electricity in Canada but was responsible for 72 per cent of greenhouse gas emissions in the electricity sector. Recognizing the costs of coal-fired electricity to human health and its impact on climate change, and supported by commitments in the 2015 Paris Agreement, the Government committed in 2016 to the phase-out of traditional coal-fired electricity across the country by 2030.

Coal-fired power plants produce almost 40 per cent of global electricity today, making carbon pollution from coal a leading contributor to climate change.

The health effects of air pollution from burning coal, including respiratory diseases and premature deaths, impose massive costs in both human and economic terms. Analysis has found that more than 800,000 people die each year around the world from the pollution generated by burning coal.

As a result, phasing out unabated coal power is one of the most important steps governments can take to tackle climate change and meet our commitment to keep global temperature increase well below 2°C, and to pursue efforts to limit it to 1.5°C.

While this phase-out is important to protect the health of Canadians and make progress on the 2030 climate change targets, the Government understands that this requirement will mean job losses for some workers, especially in communities in Alberta, Saskatchewan, New Brunswick and Nova Scotia that rely on coal production and combustion as an important source of employment. The Government is committed to helping these workers and communities prepare for, find and act on new opportunities as Canada makes a gradual transition away from the use of coal-fired power.

In 2018, the Task Force on Just Transition for Canadian Coal Power Workers and Communities was formed to consider how to support those affected in making the transition to a clean-growth economy. On March 11, 2019, the Task Force released its final report, including a series of recommendations for the Government’s consideration.

In response to the Task Force’s recommendations, the Government intends to take the following actions:

In response to the Task Force’s recommendations, the Government intends to take the following actions:

- Create worker transition centres that will offer skills development initiatives and economic and community diversification activities in western and eastern Canada. These efforts are being supported by a federal investment of $35 million over five years, funded through Budget 2018, for Western Economic Diversification Canada and the Atlantic Canada Opportunities Agency.

- Work with those affected to explore new ways to protect wages and pensions, recognizing the uncertainty that this transition represents for workers in the sector.

- Create a dedicated $150 million infrastructure fund, starting in 2020–21, to support priority projects and economic diversification in impacted communities. This Fund will be administered by Western Economic Diversification Canada and the Atlantic Canada Opportunities Agency.

The Minister of Natural Resources, with support from the Minister of Environment and Climate Change, the Minister of Employment, Workforce Development and Labour, the Minister of Innovation, Science and Economic Development and the Minister of Rural Economic Development, will be responsible for reporting on results from these activities, while continuing to engage with provinces, workers, unions, municipalities and economic development agencies, to ensure that people affected by the phase-out have access to the help they need during this period of transition.

Improving Canadian Energy Information

Canada has a diverse energy mix, and responsibility for energy data collection is fragmented and spread across multiple sources, including provincial and federal governments. Canadians benefit from comparable and consolidated energy data as it contributes towards better decision-making by governments and industry, and supports higher quality research.

Budget 2019 proposes to provide Natural Resources Canada with $15.2 million over five years, starting in 2019–20, with $3.4 million per year ongoing, to establish a virtual Canadian Centre for Energy Information delivered by Statistics Canada. This

Centre will compile energy data from several sources into a single easy-to-use website. The Centre will also support ongoing research by Statistics Canada to identify data gaps that would improve the overall quality of energy information available

to Canadians.

Budget 2019 proposes to provide Natural Resources Canada with $15.2 million over five years, starting in 2019–20, with $3.4 million per year ongoing, to establish a virtual Canadian Centre for Energy Information delivered by Statistics Canada. This

Centre will compile energy data from several sources into a single easy-to-use website. The Centre will also support ongoing research by Statistics Canada to identify data gaps that would improve the overall quality of energy information available

to Canadians.

Fulfilling Canada’s G20 Commitment

The Government believes that a clean environment and a strong economy go hand in hand—and that eliminating inefficient fossil fuel subsidies is an important step in the transition to a low-carbon economy.

In 2009, Canada and other Group of Twenty (G20) countries committed to phase out and rationalize inefficient fossil fuel subsidies, recognizing that these subsidies can encourage wasteful consumption, impede investment in clean energy sources and undermine efforts to fight the threat of climate change. For its part, Canada went one step further and committed to rationalize inefficient fossil fuel subsidies by 2025.

To date, Canada’s efforts to reform fossil fuel subsidies have resulted in the phase-out or rationalization of eight tax expenditures. The phase-out or rationalization of these eight tax expenditures have been introduced gradually to enable the industry to adapt. Actions this Government has taken to move forward in meeting our commitment include:

- Rationalizing the tax treatment of expenses for successful oil and gas exploratory drilling (announced in Budget 2017 and to be completed by 2021).

- Phasing out a tax preference that allows small oil and gas companies to reclassify certain development expenses as more favorably treated exploration expenses (announced in Budget 2017 and to be completed in 2020).

- Announcing that the accelerated capital cost allowance for liquefied natural gas facilities would expire as scheduled in 2025 (announced in Budget 2016).

Continuing the Momentum

“On the path to a low-carbon economy, Canada is a world leader. This peer review supports the commitment we made to our G20 partners to phase out inefficient fossil fuel subsidies and is another important step in the Government’s plan to invest in clean growth that helps create jobs for the middle class.”

Canada will continue to review measures that could be considered inefficient fossil fuel subsidies with a view to reforming them as necessary. As part of that work, Canada and Argentina recently committed to undergo peer reviews of inefficient fossil fuel subsidies under the G20 process. Peer reviews of inefficient fossil fuel subsidies can increase transparency, encourage international dialogue, and help develop best practices while moving toward a low-carbon economy. This voluntary process will enable both countries to compare and improve knowledge, and push forward the global momentum to identify and reduce inefficient fossil fuel subsidies.

As part of the peer review process:

- Canada will develop a self-review report, which will include a list of federal fossil fuel subsidies, including the description of the subsidies, annual costs, analysis of the subsidies and any potential plans to reform subsidies. Discussions with experts will be held to help inform the development of Canada’s self-review report, which will form the basis upon which an international expert review panel will assess Canada. This report will be made public once the peer review is finalized.

- Canada will also establish an international expert review panel to analyse the self-review report. The Organisation of Economic Co-operation and Development has agreed to chair the panel, which is expected to include our partnering country, Argentina, as well as other countries and key stakeholders. The findings and recommendations of the international panel will be made public once the review is finalized.

Part 3: Connecting Canadians

Access to High-Speed Internet for All Canadians

In 2019, fast and reliable internet access is no longer a luxury—it’s a necessity.

For public institutions, entrepreneurs, and businesses of all sizes, quality high-speed internet is essential to participating in the digital economy—opening doors to customers who live just down the street or on the other side of the world. It is also important in the lives of Canadians. It lets students and young people do their homework, stay in touch with their friends, and apply for their very first jobs. It helps busy families register for recreational programs, shop online and pay their bills and access essential services. For many seniors, the internet is a way to stay up on current events and stay connected to distant family members and friends.

Canadians have a strong tradition of embracing new technologies, and using them to help generate long-term economic growth and drive social progress. In recent years, Canada and Canadian companies built mobile wireless networks that are among the fastest in the world and made investments that are delivering next-generation digital technologies and services to people and communities across the country. Yet, unfortunately, many Canadians still remain without reliable, high-speed internet access. In this time in the 21st Century, this is unacceptable.

Bringing High-Speed Internet to Rural, Remote and Northern Communities

The Government has been steadfast in its commitment to bringing higher quality internet access to every part of Canada, especially those areas that are typically underserved, including rural, remote, and northern communities. With its first budget in 2016, the Government launched the $500 million Connect to Innovate program, which has since approved approximately 180 projects, with further investments of $554 million from the private sector and other orders of government. Once complete, these projects will add more than 20,000 kilometres of advanced fibre networks across the country, improving connectivity in over 900 communities, including 190 Indigenous communities. From homes and schools to hospitals and community centres, this investment will help deliver better connectivity to more than three times the number of communities originally expected to be helped by this program.

Connect to Innovate contributed $62.6 million to the Kativik Regional Government in Nunavik (northern Quebec) for their broadband project. The project will bring new or improved high-speed internet access to all Nunavik’s 14 Inuit communities and to a total of 28 institutions, including schools and health centres. It is the first ultra-fast fibre optic connection between Nunavik and southern Canada.

Canadians Benefit From High-Speed Internet

Catherine, 31, is an Indigenous entrepreneur in northern Quebec who operates a graphic design firm out of her home office. Before Connect to Innovate, broadband internet speeds in her rural community were quite limited, and communicating with clients and sending and receiving large files was slow and unreliable. After the expansion of a Connect to Innovate project in her community, she is now able to subscribe to a much faster and more reliable broadband internet connection that better suits the needs of her growing business. With better access, Catherine is able to take advantage of modern software programs with minimum interruption, utilize cloud-based computing and meet virtually with clients from around the world. In addition, her two school-aged children are able to take advantage of 21st century learning technologies, find information online and submit assignments electronically.

Working together, industry and governments have been able to successfully bring more people and more communities online. As a result, virtually every Canadian now has some level of access to the internet—but that access is not universally fast or reliable. A gap persists between the services available to people in rural, remote, and northern communities, compared to Canadians who live in more populated and urban towns and cities.

| Download Internet Speeds | Benefits |

|---|---|

| 1 Mbps | Insufficient speed to meaningfully participate online. Allows for basic browsing and email services. |

| 5 Mbps | Sufficient to conduct normal internet activities, such as accessing government services, social media and basic streaming videos. |

| 50 Mbps | Speed identified by the CRTC for Canadians to take advantage of cloud-based software applications, multiple government services (e.g. telehealth services, business support) online learning resources and high definition streaming videos. |

It is estimated that by the time all currently planned broadband programs are in place by 2021, about 90 per cent of Canadians will have reliable access to internet speeds of 50 megabits per second (Mbps) for downloading data and 10 Mbps for uploading data (also known as 50/10 Mbps). However, even with 90 per cent of Canadians covered, about 1.5 million Canadian households will still be underserved. That needs to change.

What Can Canadians Do With 50/10 Mbps Internet Speeds?

On a typical day, Dan, who is the father of three, enjoys preparing dinner by streaming cooking videos for new ideas while his wife Tatiana, finishes her work day, using cloud-based accounting software to manage her small business. At the same time, their eldest child, Leigha, is researching the respiratory system for a science project through an interactive and media rich website while her twin brother plays an online game with their cousin who lives abroad.

How We Will Achieve a Fully Connected Canada

Delivering universal high-speed internet to every Canadian in the quickest and most cost-effective way will require a coordinated effort involving partners in the private sector and across all levels of government. To meet this commitment, Budget 2019 is proposing a new, coordinated plan that would deliver $5 billion to $6 billion in new investments in rural broadband over the next 10 years:

- Support through the Accelerated Investment Incentive to encourage greater investments in rural high-speed internet from the private sector.

- Greater coordination with provinces, territories, and federal arm’s-length institutions, such as the CRTC and its $750 million rural/remote broadband fund.

- Securing advanced Low Earth Orbit satellite capacity to serve the most rural and remote regions of Canada.

- New investments in the Connect to Innovate program and introduction of the Government’s new Universal Broadband Fund.

- New investments by the Canada Infrastructure Bank to further leverage private sector investment.

Canada’s Commitment: Universal High-Speed Internet for Every Canadian

In Budget 2019, the Government is announcing its commitment to set a national target, in which 95 per cent of Canadian homes and businesses will have access to internet speeds of at least 50/10 Mbps by 2026 and 100 per cent by 2030, no matter where they are located in the country. This is in keeping with the broadband internet speed objective set by the Canadian Radio-television and Telecommunications Commission (CRTC) for Canadian households and businesses across Canada.

Using the Accelerated Investment Incentive

In the 2018 Fall Economic Statement, the Government introduced the Accelerated Investment Incentive—an accelerated capital cost allowance designed to encourage businesses to invest and create more good, well-paying jobs. The Incentive is available to businesses of all sizes, across all sectors of the economy, including the telecommunications sector. Response to this new Incentive has been very favourable—to date, telecommunications companies have signalled more than $1 billion worth of private sector activity, focused on providing better internet access to unserved or underserved communities. The Accelerated Investment Incentive is also expected to enhance competitiveness and help accelerate the deployment of next-generation digital technologies, such as 5G connectivity, across the country.

Working Closely With Partners

Provinces and territories are also moving forward and making their own important investments to help improve and expand access to high-speed internet. For example:

- The Government of Nova Scotia recently invested $193 million in an internet funding trust to help connect more homes, businesses, and communities across the province.

- In its 2019 budget, the Government of British Columbia announced $50 million to expand high-speed internet service to more than 200 communities in the province.

The Canadian Radio-television and Telecommunications Commission also recently launched its own five-year $750 million Broadband Fund to improve internet access in underserved areas. The CRTC’s Broadband Fund aligns with the Government’s priorities and will include a focus on providing last-mile connectivity and provision of wireless coverage in unserved areas, and where projects are not financially viable without CRTC funding

The Government recognizes that collaboration is essential to solve the challenge of bringing universal access to high-speed internet to all Canadians. To this end, the Government is committed to continue working with jurisdictions across Canada, Indigenous partners, and the private sector to enhance connectivity and to support Canadians full participation in the digital economy. This includes advancing the recent intergovernmental agreement between the federal, provincial and territorial governments to develop a long-term strategy and joined-up approach to improve access to high-speed internet for all Canadians.

Investing in Connect to Innovate and Launching the New Universal Broadband Fund

To help every Canadian gain access to high-speed internet at minimum speeds of 50/10 Mbps, Budget 2019 proposes to invest up to $1.7 billion in new targeted initiatives that will support universal high-speed internet in rural, remote and northern communities.

These investments would include:

To help every Canadian gain access to high-speed internet at minimum speeds of 50/10 Mbps, Budget 2019 proposes to invest up to $1.7 billion in new targeted initiatives that will support universal high-speed internet in rural, remote and northern communities.

These investments would include:

- Up to $1.7 billion over 13 years, starting in 2019–20, to establish a new national high-speed internet program, the Universal Broadband Fund. The Fund would build on the success of the Connect to Innovate program, and would focus on extending “backbone” infrastructure to underserved communities (“backbone” is the central channel used to transfer internet traffic at high speed—the internet equivalent of a major roadway or railway spur). For the most difficult-to-reach communities, funding may also support “last-mile” connections to individual homes and businesses.

- Included in the $1.7 billion commitment to the Universal Broadband Fund, the Government will look to top-up the Connect to Innovate program and to secure advanced, new, low-latency Low Earth Orbit satellite capacity. This process will be launched in the spring 2019 and will help bring reliable high-speed internet access to even the most challenging rural and remote homes and communities in Canada.

- Up to $11.5 million over five years, starting in 2019–20, for two Statistics Canada surveys to measure household access and use of the internet and business online behaviour. This will enhance understanding of how digital issues are impacting Canadians, and help inform next steps.

Harnessing Partnerships With the Canada Infrastructure Bank

In partnership with the Government, the Canada Infrastructure Bank is examining opportunities to apply its innovative financing tools to stimulate private sector investment in high-speed internet infrastructure in unserved and underserved communities. Working to maximize the contribution of private capital, the Bank will seek to invest $1 billion over the next 10 years, and leverage at least $2 billion in additional private sector investment to increase broadband access for Canadians. In helping to make publicly funded dollars go further, the Bank will contribute to Canada’s long-term ambition of bringing high-speed internet to every Canadian.

Technologies That Are Bringing High-Speed Internet to Canadians

Part 4: Building a Better Future for Canada’s North

Every region in Canada has unique attributes that contribute to the country’s current economic strength and future potential. The Arctic is a region that has immense opportunities for growth and needs investment to realize its potential, to the benefit of all Canadians.

Strong Arctic and Northern Communities

Though only a small number of people—including Indigenous and non-Indigenous people—call the Arctic home, all Canadians can be proud of our identity as a northern country. Part of what makes the region unique is its climate and geography. As harsh and challenging as it is beautiful and inspiring, the Arctic is on the front lines of global warming, and the cumulative effects of climate change are reshaping both the landscape and the way of life for many people in Canada’s North.

Canada has an opportunity—and a responsibility—to be a world leader in sustainably developing the North. This means making the most of emerging economic opportunities while ensuring that the people who reside in the North are able to be full participants in and beneficiaries of the region’s growth.

People living in the North have been clear: they want and deserve to be included in decisions about the future of the Arctic and other northern regions.

Meaningful action is needed so that the quality of life experienced by northern residents is, to the greatest extent possible, comparable to that experienced by people in the rest of Canada. It also means making sure that federal policies, programs, and investments take into account the unique circumstances and needs of people living in the North. This includes a greater understanding of, and respect for, the history, culture, and traditional knowledge of northern Indigenous Peoples.

Building on the Government’s ongoing support for the region, Budget 2019 announces more than $700 million over 10 years in new and focused funding to ensure that Arctic and northern communities can continue to grow and prosper. This includes new funding for more diversified post-secondary educational options in the territories, enhanced infrastructure resources to connect northern and remote communities, increased economic development programming, and more support to enable critical Arctic research.

Ongoing Support for Canada’s Arctic and Northern Regions

The large, remote regions of Canada’s North create unique infrastructure and energy challenges. The Investing in Canada Plan and the Pan-Canadian Framework on Clean Growth and Climate Change include initiatives to help address these challenges and create new connections in the Arctic and northern regions of Canada. Key investments include:

- More than $1.7 billion over 12 years, for the three northern territories, for infrastructure development through bilateral agreements under the Investing in Canada Plan, including $400 million for the Arctic Energy Fund to help people living in northern communities access more reliable and renewable energy.

- Nearly $150 million allocated to the three territories and northern Quebec through the Connect to Innovate program, which brings high-speed internet to rural and remote communities in Canada.

- $400 million over 11 years dedicated for transportation infrastructure in the three territories under the National Trade Corridors Fund.

- $84 million over five years to build knowledge of climate change impacts and to enhance the climate resiliency of northern communities by improving the design and construction of northern infrastructure.

In addition, the Government also supports a number of long-term programs and activities in the Arctic and northern regions of the country to build healthy and safe communities and contribute to a strong, diversified, sustainable and dynamic economy. For example, to support the delivery of territorial public services, including health care, education and social services, that are comparable to those in other regions of the country, the federal government provides annually escalated and unconditional Territorial Formula Financing transfers, which will be over $3.9 billion in 2019–20.

“The simple fact is that Arctic strategies throughout my lifetime have rarely matched or addressed the magnitude of the basic gaps between what exists in the Arctic and what other Canadians take for granted”

In December 2016, the Prime Minister announced the Government’s commitment to create a new vision for Canada’s Arctic and northern regions, to be co-developed in cooperation with the people who live there. Since then, the Government has been working with a number of partners, including Indigenous Peoples, territories, provinces and international stakeholders, to co-develop a new Arctic and Northern Policy Framework.

This new Framework is intended to identify shared priorities, goals, and objectives in Canada’s Arctic and North, through 2030. It is also designed to be more comprehensive in scope than previous strategies, incorporating both a domestic and international understanding of the unique opportunities and challenges that exist for these regions. Ultimately, the Framework represents a new way for Arctic and northern peoples, governments, leaders, organizations, and institutions, to come together to set a consensus-based course towards better outcomes for everyone.

The Government will continue to work with its partners to finalize the Framework, set common objectives, and reach agreements on ways to collectively invest to meet these objectives. Budget 2019 proposes a number of new measures to support the eventual Framework and complement existing efforts to strengthen Arctic and northern communities.

Support for Canada’s Arctic and Northern Communities

Helping People in Arctic and Northern Communities Succeed

Helping People in Arctic and Northern Communities Succeed

- Communities thrive—and people succeed—when educational opportunities exist. Budget 2019 proposes to provide up to $1.0 million, over two years, starting in 2019–20, to establish a Task Force to study post-secondary education in Canada’s Arctic and northern regions. The Task Force will make recommendations to the federal and territorial governments and Indigenous partners on establishing a robust system of post-secondary education in the North.

- To help Yukon College undertake its transformation into a hybrid university (an institution that offers a mix of diplomas, certificates, degrees, and continuing education), Budget 2019 proposes to provide up to $26 million over five years, starting in 2019–20, for the construction of a new campus science building in support of their efforts to become Canada’s first university in the North.

- To foster Indigenous knowledge and education, Budget 2019 proposes to provide $13 million over five years, starting in 2019–20, for the Dechinta Centre for Research and Learning in the Northwest Territories. This funding will support the delivery of culturally appropriate and community developed curricula to enhance access to and success in higher education for Indigenous and northern students.

- To address the higher cost of nutritious food in the Arctic, in the 2018 Fall Economic Statement the Government announced new investments in the Nutrition North Canada program. This ongoing investment will support several program changes, and introduces a new Harvesters Support Grant to help lower the high costs associated with traditional hunting and harvesting activities. In addition, as part of a National Food Policy, Budget 2019 proposes to provide the Canadian Northern Economic Development Agency with $15 million, over five years, starting in 2019–20, to establish a Northern Isolated Community Initiatives Fund. This fund will support community-led projects for local and Indigenous food production systems.

- The Inuit Tapiriit Kanatami’s (ITK) National Inuit Suicide Prevention Strategy was released in July 2016 and set out a series of actions and interventions at the community and regional level to address the high number of deaths by suicide among Inuit, where the suicide rate remains 5 to 25 times the national average for Canada. To continue to support Inuit peoples and communities, Budget 2019 proposes an investment of $50 million over 10 years, starting in 2019–20, with $5 million per year ongoing, to support ITK’s Inuit-specific approach through the Strategy to address deaths by suicide in Inuit communities.

- Nunavut has been without an addictions treatment centre for over 20 years. For too long, Inuit and other residents of Nunavut seeking mental health and substance use supports have had to travel south, far from their families, friends and communities to access the services that they need. The Truth and Reconciliation Commission of Canada called on the federal government to ensure funding for healing centres in Nunavut is a priority as part of Call to Action 21. Together with contributions from the Government of Nunavut and Inuit partners, as part of Budget 2019, the Government announces its commitment to support the construction and ongoing operation of a treatment facility in Nunavut.

- On February 28, 2019, the Prime Minister announced $2.05 billion, over 24 years, to ensure that Canada continues to be a leader in space robotics. This investment includes up to $14 million over five years, starting in 2019–20, to the Canadian Space Agency to identify opportunities where space, health and Indigenous partners could work together to develop approaches and innovative technology solutions to address challenges common to both deep space and remote health care environments.

Building Connections in Canada’s Arctic and Northern Regions

Building Connections in Canada’s Arctic and Northern Regions

Restoring Rail Service to Churchill, Manitoba

In the last several months the Government has provided over $100 million in funding for the acquisition, repairs and an annual operating subsidy required by the Hudson Bay Railway Company, the Hudson Bay Port Company and the Churchill Marine Tank Farm, along with financing through Export Development Canada. This has restored rail service on the Hudson Bay Railway Line, which is expected to grow into a key transportation and export hub, to both international markets and northern Canada.

- To improve and expand infrastructure in the northern regions of Canada, Budget 2019 proposes to increase the allocation of the National Trade Corridors Fund to Arctic and northern regions by up to $400 million over eight years, starting in 2020–21, bringing the total allocation to these regions to $800 million. This will help build new roads and other vital connections to and between Arctic and northern communities.

- Access to reliable and cleaner sources of energy is key to building healthier and more sustainable communities. The Government is committed to reducing community reliance on diesel for heat and electricity across the North, and presently supports the planning of clean energy projects in small communities and the territories through the Investing in Canada Infrastructure Program. To help northern communities more easily access the support they need, the Government proposes to consolidate federal programs that help reduce diesel reliance in Indigenous, northern and remote communities.

- To reduce pollution in Canada’s North resulting from electricity generation, Budget 2019 proposes to provide a further $18 million, over three years, starting in 2019–20, to Crown-Indigenous Relations and Northern Affairs Canada to support planning by the Government of Northwest Territories for its proposed Taltson hydroelectricity expansion project. The proposed expansion would more than double current hydroelectric capacity in the Northwest Territories, reducing reliance on diesel by the city of Yellowknife and the mining sector, as well as providing employment opportunities for Indigenous people and other residents of the territory.

- Budget 2019 proposes to establish a national connectivity target in which every Canadian home and small business will have access to internet speeds of at least 50/10 Mbps within the next 10 years, no matter where they are located in the country, including in the North. Delivering high-speed internet to every Canadian, especially in more rural and remote areas, will help businesses grow, create new jobs and connect more people to the resources, services and information they need to build a better future.

Supporting Northern Innovation and Economic Development

Supporting Northern Innovation and Economic Development

- The Canadian Northern Economic Development Agency helps to develop a diversified, sustainable, and dynamic economy across Canada’s three territories. To support innovation and encourage stronger business growth in the territories, Budget 2019 proposes to provide an additional $75 million over five years, starting in 2019–20, to the Canadian Northern Economic Development Agency to enhance its current economic development program. This investment would help to create a new initiative: Inclusive Diversification and Economic Advancement in the North (IDEANorth). This updated programming will allow the agency to support a wider range of initiatives, including the development of foundational economic infrastructure such as roads or visitor centres, to address the higher cost of doing business in the North.

- Resource development provides jobs and wealth in the territorial economies. The Government announced in the 2018 Fall Economic Statement the extension of the Mineral Exploration Tax Credit, which helps junior exploration companies raise capital to finance early-stage mineral exploration, including in the North, for an additional five years, until March 31, 2024.

Supporting Science and Protecting the Environment

Supporting Science and Protecting the Environment

- The Polar Continental Shelf Program provides critical logistics support—such as coordinating air charters and supplying field equipment—to Canadian researchers seeking to advance our understanding of the North. Budget 2019 proposes to provide Natural Resources Canada with up to $10 million, over two years, starting in 2019–20, to help the Program to respond to growing demand.

- To support ongoing scientific research in the High Arctic, Budget 2019 proposes to provide Environment and Climate Change Canada with up to $21.8 million over five years, starting in 2019–20, for the Eureka Weather Station on Ellesmere Island, Nunavut. This investment will support critical repairs and necessary upgrades to the station’s systems such as the aircraft runway, sewage, ventilation and plumbing and will help ensure continued safe operations of the site for weather and climate forecasting and as a key hub for Arctic research and Government military operations.

- The Government manages a number of contaminated sites in northern Canada that were formerly mines and since abandoned by their previous owners. The contamination of these properties is the result of private sector mining and oil and gas activities from many years ago, before the environmental impacts were fully understood. To clean up the largest and most high-risk of these sites, Budget 2019 proposes to provide $49.9 million over fifteen years ($2.2 billion on a cash basis), starting in 2020–21, to Crown-Indigenous Relations and Northern Affairs Canada to create the Northern Abandoned Mine Reclamation Program.

- The Government is exploring the potential creation of a marine conservation area in the High Arctic Basin or Tuvaijuittuq (which means “the ice never melts” in Inuktitut)—the last portion of the Arctic region expected to retain summer sea ice until at least 2050. The Government will work with the Government of Nunavut and Qikiqtani Inuit Association to advance this important conservation initiative, while also working to support the development of a conservation economy in the region.

- To further strengthen Canada’s leadership in the Arctic, Budget 2019 proposes to provide Natural Resources Canada with up to $7.9 million over five years, starting in 2019–20, to continue to provide scientific support for Canada’s claim to its continental shelf in both the Arctic and Atlantic Oceans. This will ensure that Canada’s sovereign rights in the Arctic Ocean are internationally recognized, with a strong claim supported by science and evidence.

Investing in Regional Priorities

Protecting Water and Soil in the Prairies

In recent years, Canada’s Prairie provinces have experienced the worsening effects of climate change, including more extreme weather events, resulting in more costly storms and floods, droughts and wildfires. Billions of dollars have been spent by all orders of government—including Indigenous governments—along with businesses, private citizens, and the insurance industry, in an attempt to recover from these events. At the federal level, the Disaster Financial Assistance Arrangement has paid out more to help offset flood and wildfire losses in the last six years than in the entire previous history of the program—stretching back to 1970.

More than just the financial impacts of recovery, the ongoing effects of climate change on the Prairies’ valuable water and soil resources threaten the ability of farmers and ranchers to continue to grow high-quality crops and raise world-class herds—putting the future of Prairie communities and Canada’s food supply at risk.

To support climate change adaptation efforts across the Prairies, the Government proposes to provide Western Economic Diversification Canada with up to $1 million, in 2019–20, to develop a new strategy to sustainably manage water and land in the

Prairies. This strategy would be developed in partnership with the provinces of Alberta, Saskatchewan and Manitoba, as well as Indigenous partners, academics and private sector groups. It would take stock of existing federal and provincial actions