Archived - Budget 2019 GBA+ Annex

Introduction

Gender-based Analysis Plus (GBA+) is an analytical process used to assess how diverse groups of women, men and non-binary people may experience policies, programs and initiatives. The “plus” in GBA+ acknowledges that GBA goes beyond biological (sex) and socio-cultural (gender) differences to consider other identity factors such as ethnicity, age, income level, and mental or physical ability.

The Government of Canada has been committed to using GBA+ in the development of policies, programs and legislation since 1995. GBA+ provides federal officials with the means to attain better results for Canadians by being more responsive to specific needs and ensuring that government policies and programs are inclusive and barrier free. The Canadian Gender Budgeting Act was passed by Parliament in December 2018, enshrining the Government’s commitment to decision-making that takes into consideration the impacts of policies on all types of Canadians. The Act legislated a commitment for the Government to publish information on the GBA+ impacts of all new budget measures, which can be found on the following pages.

The Government acknowledges that this analysis can be subjective and is often limited by the availability of data, especially for certain identify factors such as race, sexual orientation and disability. (Note: the term “visible minorities” is used because it is the official demographic category defined by the Employment Equity Act and used by Statistics Canada, which facilitates longitudinal comparisons). Budget 2019 and Budget 2018 investments in Statistics Canada, the Department for Women and Gender Equality and other federal departments will help to address these data gaps, allowing for improved quality and depth of GBA+ over time.

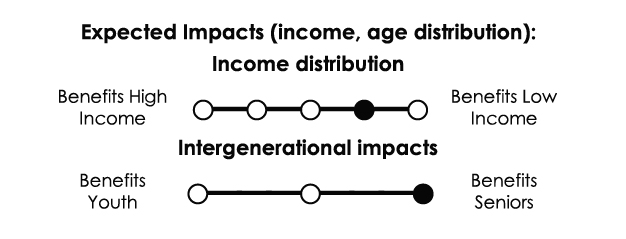

Budget 2019 introduced a new focus on youth and intergenerational impacts as well as an explicit consideration of income-distributional impacts and target population. While this annex represents a significant step forward in comprehensiveness and transparency, it is clear that there is more work to do. The Government welcomes feedback on what Canadians find valuable in this analysis and how it could be improved in future budgets.

Notes on Terms and Fields in the GBA+ Annex

The measures in this book follow the order of the Budget 2019 text. The chapter names found in the top right corner of each measure match those in the Budget 2019 book. GBA+ for Budget 2019 measures that are described in Table 4.2 of Annex 2 of the budget appear in Table 1.0 of this document.

Description of Measure: Each GBA+ includes a brief description of the measure and its fiscal cost.

Context: The main text contains information on the key impacts of the measures from a GBA+ perspective, including direct and indirect impacts, both positive and negative, where applicable. Key facts and data sources are included in this section.

GBA+ Timing: GBA+ can be conducted at various stages throughout the development of a government policy, program or initiative. This section identifies when the GBA+ analysis was conducted:

- GBA+ was performed on the existing program (in cases where a program is seeking a renewal of funding);

- early in the idea development phase (when options/proposals are being developed);

- mid-point (when options and proposals are being finalized); and/or

- later stage (after proposals are finalized, prior to submission of proposal).

Target Population: Describes the broad population the measure is primarily intended to benefit. This section is not intended to describe the expected GBA+ impacts, but rather the policy intent behind the measure. Measures were generally categorized into one of three main groups: 1) those aimed at benefitting Canadians as a whole, 2) those targeted towards specific sub-populations, based on personal characteristics, such as income or family situation, and 3) those targeted towards Canadians in particular regions and sectors of the economy.

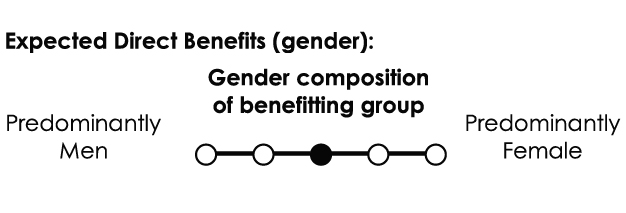

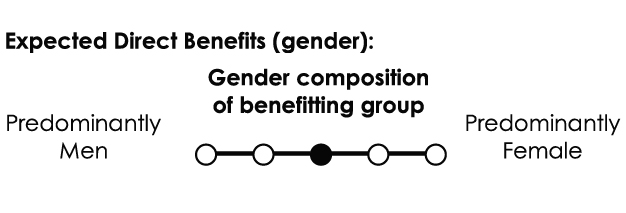

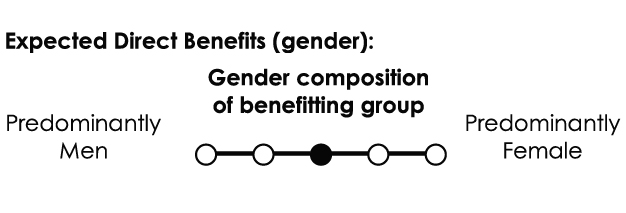

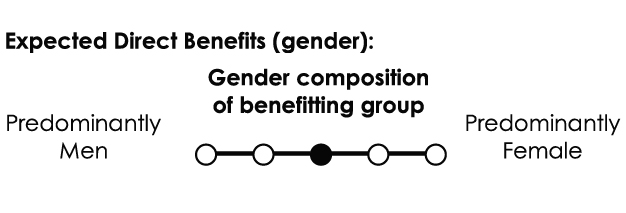

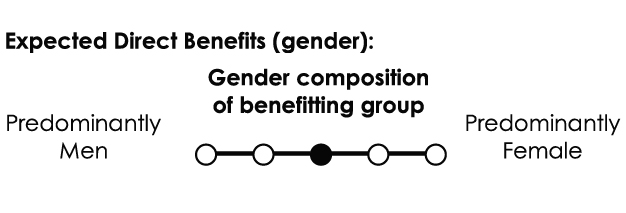

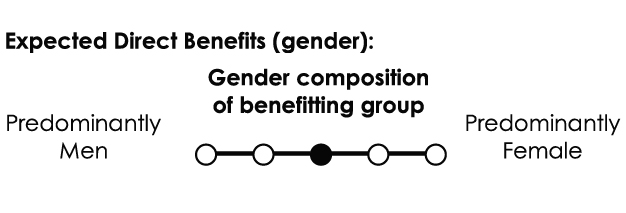

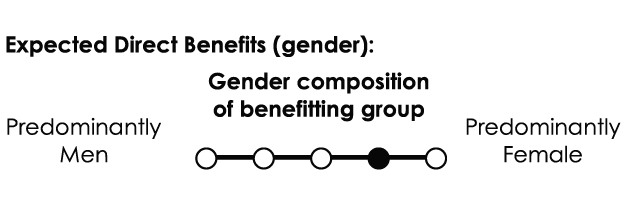

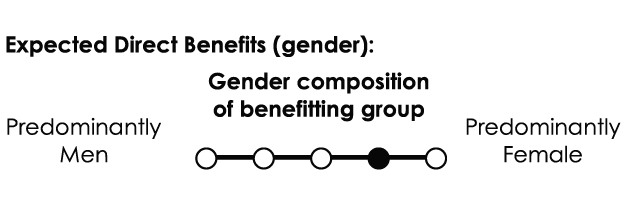

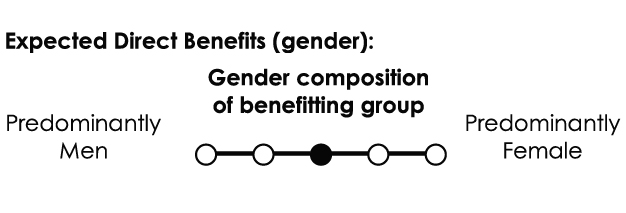

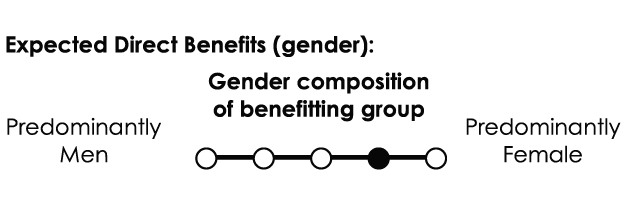

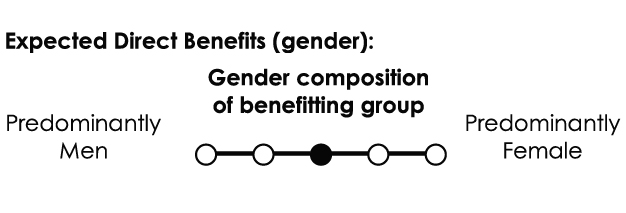

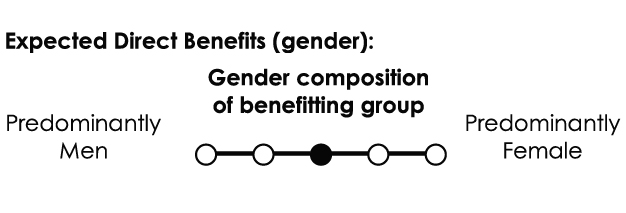

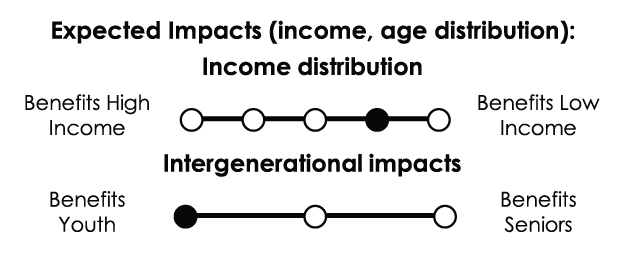

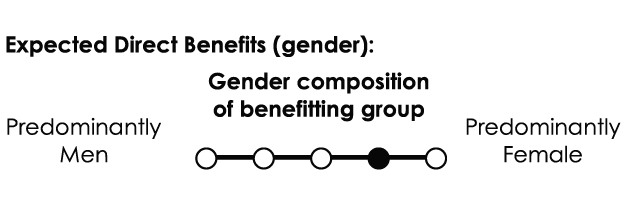

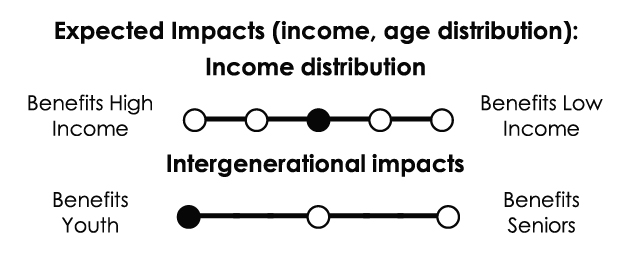

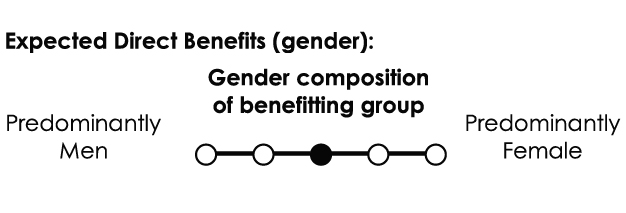

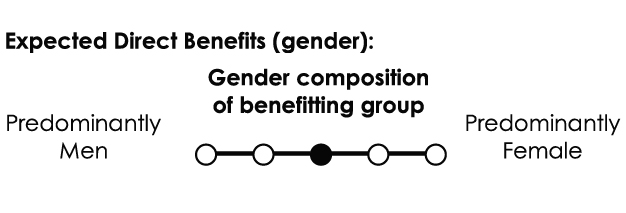

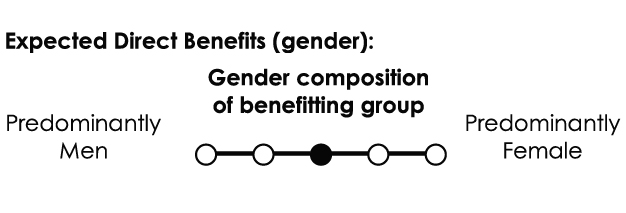

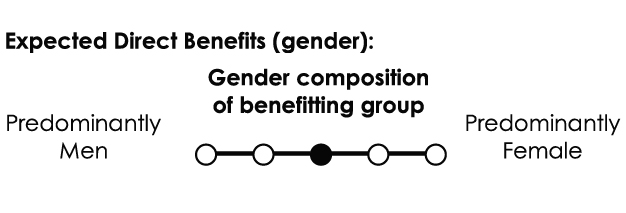

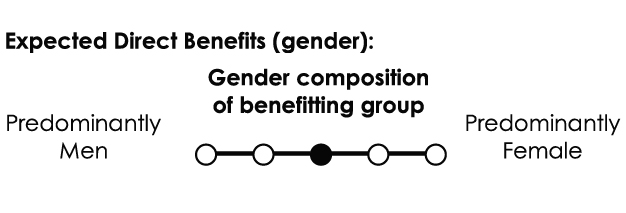

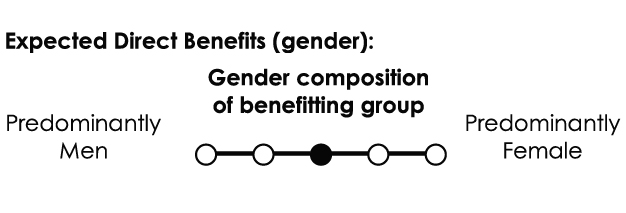

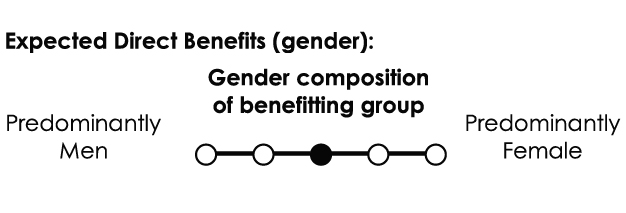

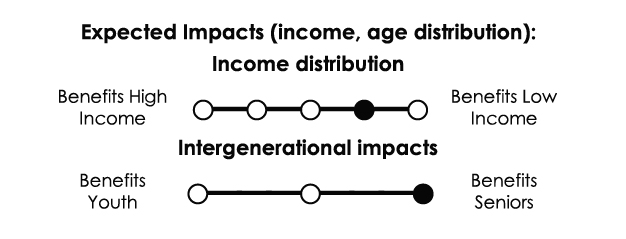

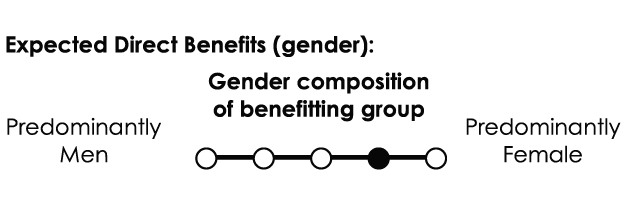

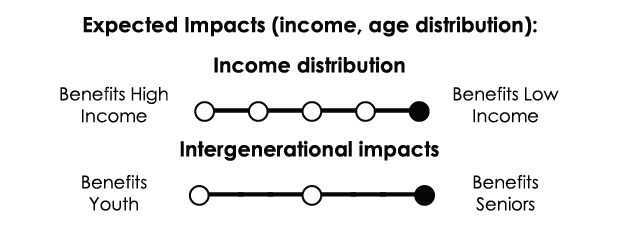

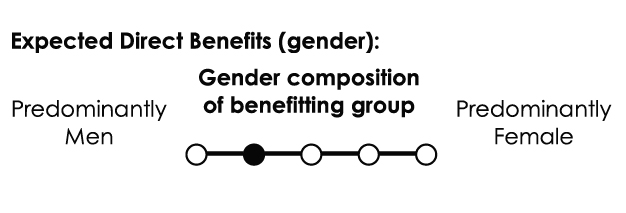

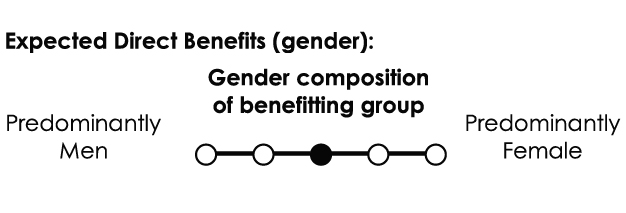

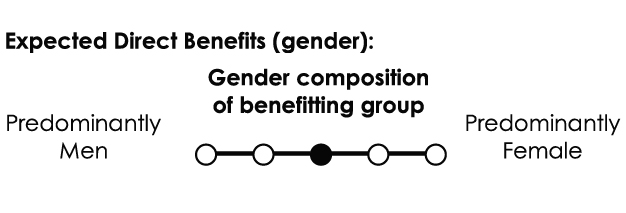

Expected Direct Benefits (gender): This section collects information on the expected gender characteristics of the benefitting group. The scale is explained as follows:

A direct benefit is defined as a positive outcome for a group or groups of people as a direct or first-order impact of the measure. This group may align with the target population or it may have different characteristics. For example, the Canada Service Corps is intended for all youth but it is anticipated that participation levels for young women may be higher than for young men, so they may ultimately benefit more.

In contrast, an indirect benefit is defined here as a second–order outcome. Examples include benefits realized by the group delivering the initiative or providing goods or services to those receiving the direct benefits, or by those benefitting from a connection with the direct beneficiaries (e.g., family members or individuals in the same region). Indirect impacts are not captured in the direct benefits graphic but are described in the text.

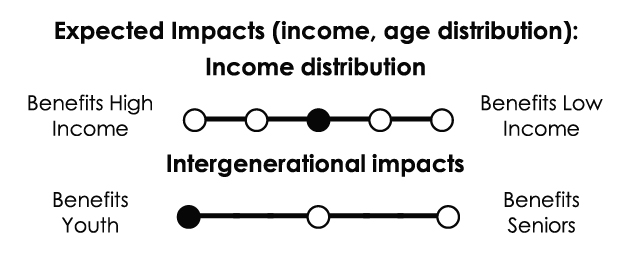

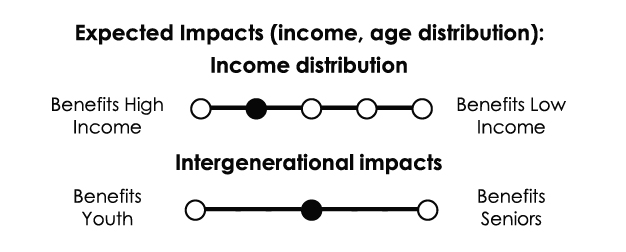

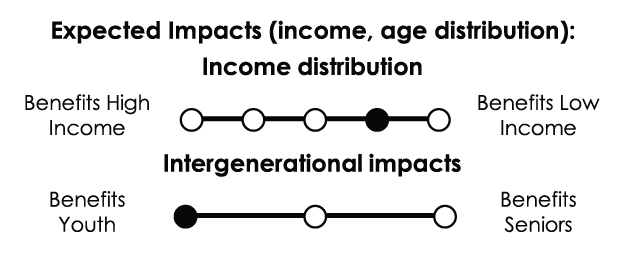

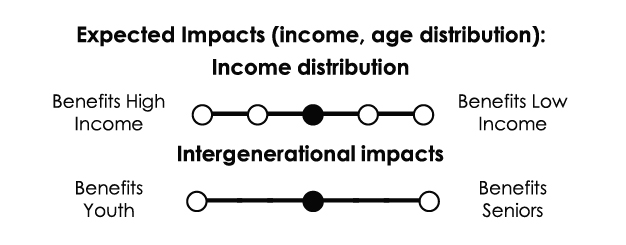

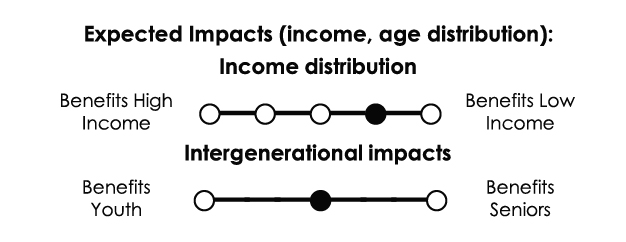

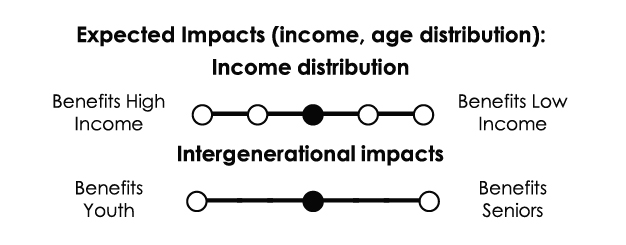

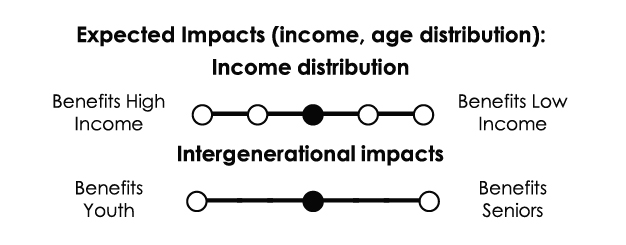

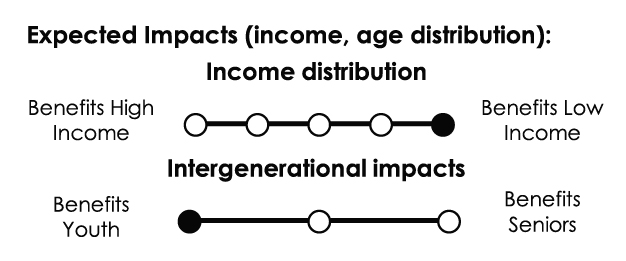

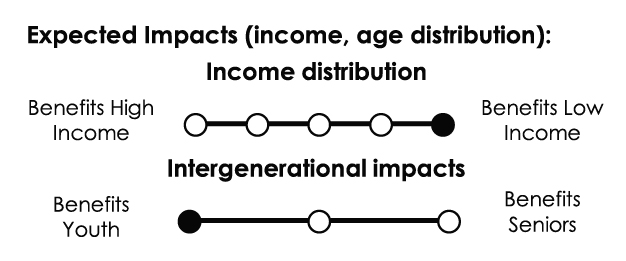

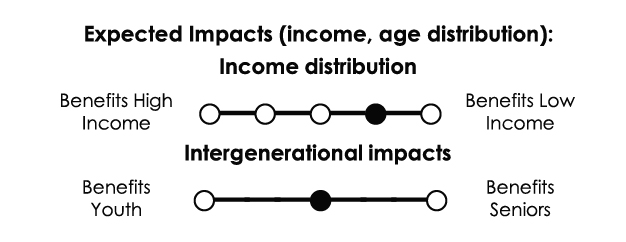

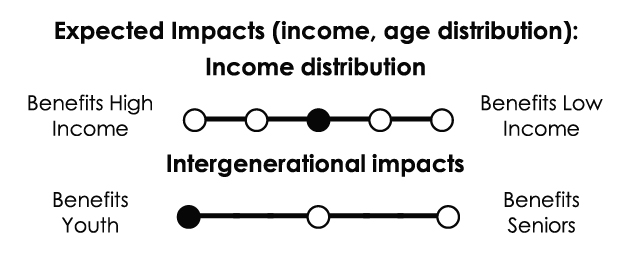

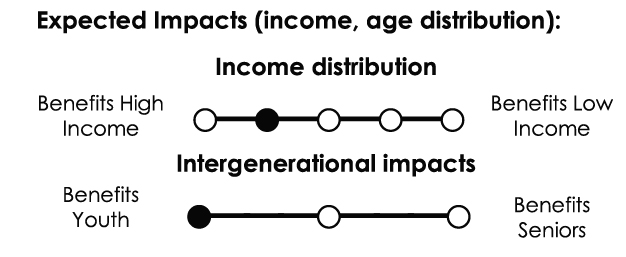

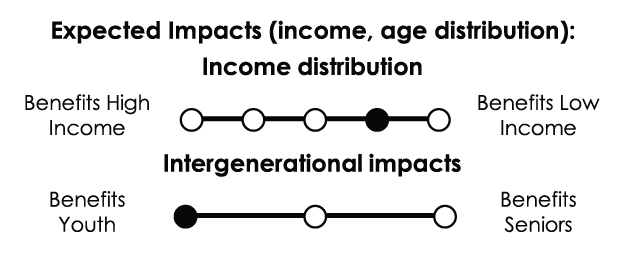

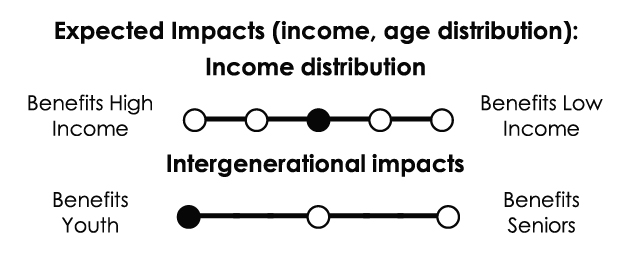

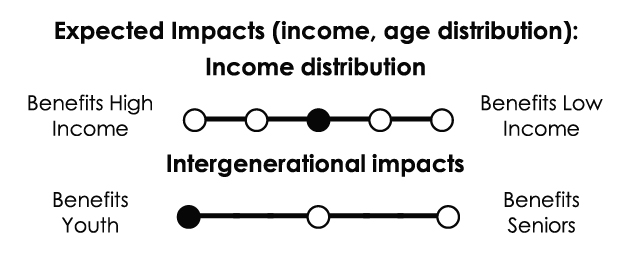

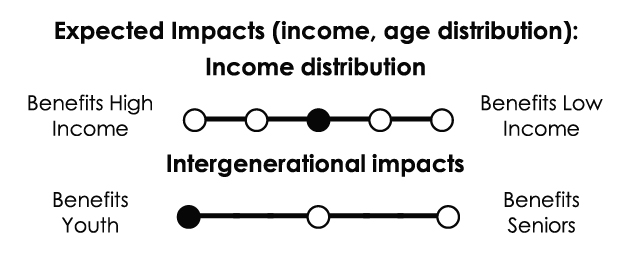

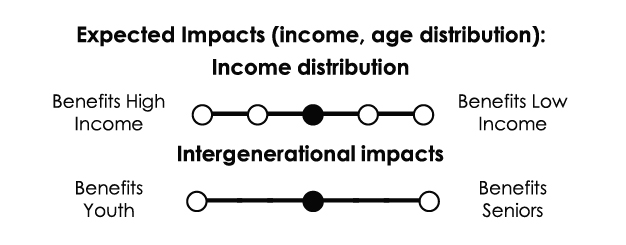

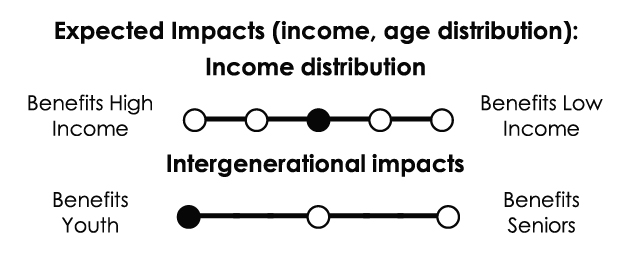

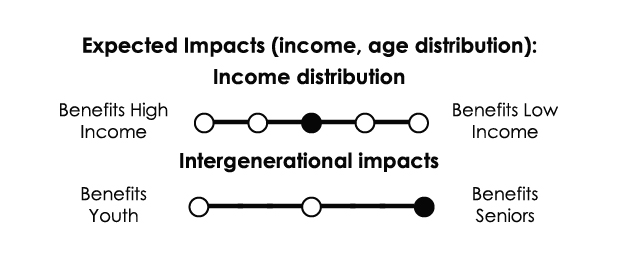

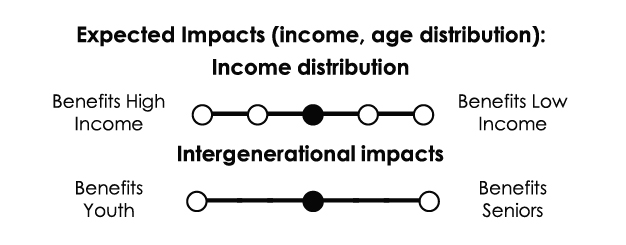

Expected Impacts (income, age distribution): This indicator describes expected direct impacts of the measure from an income distributional perspective.

These impacts are considered relative to existing incomes and tax contributions. For example, a government-funded program that provides equal per capita benefits to all Canadians would be considered progressive, that is benefitting lower-income Canadians more relative to their incomes, while an equal per capita tax on individuals would be considered regressive, because lower-income individuals would be required to contribute more (relative to their income). The scale is defined as follows:

Intergenerational impacts provide information on the distribution of expected benefits according to age cohort:

Gender Results Framework Indicators (if applicable): For measures that advance the goals of Canada’s Gender Results Framework (GRF), an icon for the GRF pillar and the goal statement to which the measure is contributing are listed.

Education and Skills Development

Equal opportunities and diversified paths in education and skills development

Economic Participation and Prosperity

Equal and full participation in the economy

Leadership and Democratic Participation

Gender equality in leadership roles and at all levels of decision-making

Gender-Based Violence and Access to Justice

Eliminating gender-based violence and harassment, and promoting security of the person and access to justice

Poverty Reduction, Health and Well-Being

Reduced poverty and improved health outcomes

Gender Equality Around the World

Promoting gender equality to build a more peaceful, inclusive, rules-based and prosperous world

For more information on the Gender Results Framework

GBA+ Responsive Approach: When applicable, this box describes any effort in place to minimize possible negative impacts of the measure on certain individuals or groups, or plans to proactively reduce barriers to participation.

GBA+: Chapter 1

An Affordable Place to Call Home

Introducing the First-Time Home Buyer Incentive

- $1.25 billion over three years to provide the Canada Mortgage and Housing Corporation First-Time Home Buyer Incentive to eligible borrowers.

- $100 million over five years to existing shared equity mortgage providers.

Millennials and new Canadians will be the main beneficiaries of these programs, as these groups are especially likely to be prospective first-time home buyers and to live in urban centres where affordability gaps are pronounced and new construction is available.

These proposals are not expected to result in negative differential impacts for particular groups of women, men and gender-diverse people.

However, these programs may favour dual-income households because they are on average more financially capable of providing a down payment and have higher net worth compared to lone-parents or single individuals.

Both proposals have the potential to spur construction, which requires local labour. Initiatives aimed at stimulating new housing supply may indirectly benefit men working in this sector as 87 per cent of construction workers were men in 2018, according to Statistics Canada.

GBA+ was performed: Later stage

Target population: Middle-income first-time home buyers

GBA+: Chapter 1

An Affordable Place to Call Home

Modernizing the Home Buyers’ Plan

- Budget 2019 proposes amendments to the Income Tax Act to increase the maximum withdrawal limit of the Home Buyers’ Plan from $25,000 to $35,000 and to allow individuals to access the Home Buyers’ Plan following a breakdown in their marriage or common-law partnership.

An increase in the withdrawal limit of the Home Buyers’ Plan will primarily benefit first-time home buyers, who tend to be younger adults. An increase in the withdrawal limit will also benefit persons with disabilities, as the Home Buyers’ Plan can be used when purchasing a home for the benefit of an individual who has a disability, even if the first-time home buyer requirement is not met.

In addition, the measure will help individuals maintain homeownership after a breakdown in their marriage or common-law partnership.

While middle income individuals are expected to be the primary beneficiaries of the measure, higher income individuals would generally be expected to benefit proportionally more given the higher tax value of the Home Buyers’ Plan withdrawal.

Women represent 44 per cent of individuals who made a Home Buyers’ Plan withdrawal in 2016 and withdrew about 42 per cent of the aggregate amount of withdrawals made. The benefits of the withdrawal limit increase are expected to be in line with this distribution.

GBA+ was performed: Mid-point

Target population: First-time home buyers, individuals with disabilities, and individuals who have separated from their spouse or common-law partner

GBA+: Chapter 1

An Affordable Place to Call Home

Enhancing the Rental Construction Financing Initiative

- $10 billion over nine years in low-cost loans to expand and extend the Rental Construction Financing Initiative (RCFI), creating more affordable rental housing for Canadians.

This measure will primarily benefit Canadians in need of affordable rental housing.

Approximately 30 per cent of Canadians rent their homes. This form of housing is especially important for seniors, young professionals, lone-parent families, immigrants and middle class Canadians.

The RCFI is expected to have a greater impact on populations located in Canada’s large cities where the rental market comprises a greater portion of the overall housing supply and where demand for affordable rental housing in urban centres is higher than availability.

Demand for rental apartments is driven by high levels of net international migration, improving employment conditions for highly mobile younger households, and the aging of the Canadian population.

Where these proposals enable stable affordable housing for families, children could be indirect beneficiaries because of the importance of long-term stable housing for children’s health, social and educational outcomes.

The RCFI is also expected to have a positive impact on Canadians with accessibility challenges, as applicants to the program must meet minimum requirements around accessibility, including the provision of accessible units in the building, in order to receive financing.

GBA+ was performed: On the existing program

Target population: Low to middle-income Canadians

Fewer vulnerable individuals lacking stable, safe and permanent housing

GBA+: Chapter 1

An Affordable Place to Call Home

Increasing Housing Supply

- $300 million over five years to launch a “Housing Supply Challenge” to competitively allocate funding for innovative solutions to address housing supply barriers.

- $4 million over two years to support the work of the Expert Panel on the Future of Housing Supply and Affordability to examine supply barriers and make recommendations.

- $5 million over two years to increase efforts at data collection and modelling for land-use planning purposes.

In general, initiatives stemming from this measure will aim at expanding supply and would be expected to benefit all Canadians, although initial efforts by the Expert Panel will be focused on British Columbia. Impacts are expected to be gender neutral.

Greater housing supply should help prospective homeowners by exerting downward pressure on prices. In 2016, approximately 70 per cent of Canadians owned their homes, although homeownership rates were significantly lower for younger adults aged 20 to 34—at around 43 per cent.

Expanding housing supply should also benefit renters—including low- and moderate-income Canadians, seniors, young professionals, lone-parent families and immigrants—for whom this form of housing is especially important.

Increasing housing supply will spur construction, which requires local labour. Initiatives aimed at stimulating new housing supply may indirectly benefit men working in this sector as 87 per cent of construction workers were men in 2018, according to Statistics Canada.

GBA+ was performed: Mid-point

Target population: All Canadians

Fewer vulnerable individuals lacking stable, safe and permanent housing

GBA+: Chapter 1

An Affordable Place to Call Home

Taking Action to Enhance Tax Compliance in the Real Estate Sector

- $50.4 million over five years for the Canada Revenue Agency (CRA) to create four new dedicated residential and commercial real estate audit teams in high-risk regions, notably in British Columbia and Ontario.

- Expected revenue impacts from these initiatives total $67.6 million over five years.

This investment will allow the CRA to create new audit teams that will work to ensure that tax provisions regarding real estate are being followed, with a particular focus on ensuring that:

- Taxpayers report all sales of their principal residence on their tax returns;

- Any capital gain derived from a real estate sale, where the principal residence tax exemption does not apply, is identified as taxable;

- Money made on real estate flipping is reported as income;

- Commissions earned are reported as taxable income; and

- For Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes, builders of new residential properties remit the appropriate amount of tax to the CRA.

Tax non-compliance negatively affects economic growth in Canada and reduces tax revenues for all levels of government, putting pressure on the government’s ability to provide services and benefits to Canadians. The incidence of tax non-compliance in the real estate sector has been a concern in recent years, particularly in the lower mainland of British Columbia. Improving tax compliance should increase revenues and support services for all Canadians, including the most vulnerable.

These compliance actions may disproportionately impact foreign nationals and temporary residents as they may not be aware of Canadian tax rules and their reporting obligations. According to Statistics Canada data, non-residents owned 2.6 per cent of all residential properties in the Toronto area and 5.0 per cent of all residential properties in the Vancouver area in 2018.

GBA+ was performed: Mid-point and on the existing program

Target population: All Canadians by creating a fairer tax system

GBA+ Responsive Approach

The CRA will establish a monitoring approach that will identify and track certain diversity factors within the segments of Canadian taxpayers that are selected for compliance actions and/or educational outreach.

GBA+: Chapter 1

An Affordable Place to Call Home

Monitoring Purchases of Canadian Real Estate

- Up to $1 million to Statistics Canada over two years to conduct a comprehensive federal data needs assessment. The assessment would seek to facilitate further streamlining of data sharing between federal and provincial governments to inform enforcement efforts on tax compliance and anti-money laundering.

Results of the assessment will be used to inform the work of the joint British Columbia-Canada Working Group on Real Estate. The federal government is interested in working with other jurisdictions in Canada to jointly improve monitoring of real estate transactions across the country.

The Government will explore options aimed at expanding data sharing and collection to improve monitoring of real estate purchases.

Efforts would initially be focused on British Columbia and would not target individuals of a particular sex, age, identity, ethnicity or income level.

GBA+ was performed: Mid-point

Target population: All Canadians

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Introducing the Canada Training Benefit

- $1.7 billion over five years, and $586.5 million per year ongoing, to introduce the Canada Training Benefit—consisting of a new Canada Training Credit, delivered through the tax system, and a new Employment Insurance (EI) Training Support Benefit—to help reduce barriers to upskilling for working Canadians. In support, the Government will consult on changes to federal, provincial and territorial labour legislation to ensure that workers can pursue training without risk to their job security.

Existing research suggests that one in ten Canadian jobs could be at risk of automation within the next 10 to 20 years. The Canada Training Benefit would provide this support to mid-career workers to help them to better prepare for their next job or advance in their current one. It will help working Canadians overcome two of the largest barriers to pursuing training—the cost of training and competing work and family responsibilities.

Men and women would have equal access to support through the Canada Training Benefit. However, as a result of differences in labour market participation (e.g., the higher percentage of women looking after young children or an adult family member), it is anticipated that more men would accumulate support through their Canada Training Credit each year (73 per cent of men in the eligible age range compared to 68 per cent of women) and would be eligible for the EI Training Support Benefit (48 per cent of men compared to 44 per cent of women, according to Labour Force Survey data).

Despite the fact that fewer women would be eligible, it is expected that the benefits of the EI Training Support Benefit would be relatively gender-balanced because women are statistically more likely than men to participate in self-initiated training.

GBA+ was performed: Mid-point

Target population: All Canadian workers

Equal lifelong learning opportunities for adults

GBA+ Responsive Approach

This initiative includes several features aimed at reducing barriers to access among lower-income individuals who may need it the most. The Training Credit balance is accumulated equally by workers at low and mid-range income levels and is refundable; benefits received for maternity and parental leave are considered earnings for the purpose of meeting the Credit’s minimum earnings threshold; the EI Training Support Benefit component is included to address the opportunity cost of time away from work; and both measures accumulate without the requirement to save or open an account.GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Making Canada Student Loans More Affordable

- $1.7 billion over five years, and $375.9 million per year ongoing, in forgone revenue to the Government to lower the interest rate on Canada Student Loans and Canada Apprentice Loans, and make the six-month non-repayment period (the “grace period”) after a student loan borrower leaves school interest-free.

Budget 2019 proposes changes to the interest rate on Canada Student Loans and Canada Apprentice Loans to increase the affordability and accessibility of post-secondary education and help youth transition successfully to the labour market after finishing their studies. In addition, the proposed measures will make it easier for adults and lifelong learners to return to school later in their lives.

Research suggests that student debt can impact decisions around pursuing further post-secondary education credentials, limiting career choices, and delaying life decisions such as starting a family and buying a house.

These changes are expected to benefit women, in particular, who participate more frequently in post-secondary education and have higher average student debt burdens than men.

Moreover, lowering the interest rates on Canada Student Loans will help encourage access to post-secondary participation and ensure that students from low- and middle-income families are not penalized for benefitting from student financial assistance.

These changes will also make student debt more manageable for the close to 1 million Canada Student Loans borrowers currently in repayment and the 200,000 borrowers who leave school every year.

GBA+ was performed: Mid-point

Target population: Students or lifelong learners, low-income individuals, middle-class individuals

More diversified educational paths and career choices

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Making Canada Student Loans More Accessible

- $15 million over five years, and $10.4 million per year ongoing, to implement a package of meaningful changes to modernize the Canada Student Loans Program (CSLP) to benefit vulnerable student loan borrowers.

This package of changes will help student loan borrowers from a range of backgrounds, including low- and middle-income families, persons with disabilities, persons with health issues, and lone parents.

Increasing grant support for students with permanent disabilities will help lower the debt burden of borrowers who rely on costly services and equipment for their post-secondary education. Removing burdensome restrictions on repayment assistance for these borrowers in 2020-21 will make the CSLP fairer to students with disabilities, who often take variable pathways to completing their educations. Expanding access to the Severe Permanent Disability Benefit will allow more people with permanent disabilities that impact their abilities to work or study to have their student loan debt forgiven.

Expanding access to loan rehabilitation will allow financially vulnerable students to more easily access repayment assistance and Canada Student Loans Program financial assistance in the future. The majority of student loan defaulters have annual incomes of less than $25,000, making them unlikely to be able to afford returning to post-secondary education without further CSLP support.

Introducing interest- and payment-free medical and parental leave in 2020-21 will help to relieve the debt burden on women and persons with disabilities in particular. Women continue to take the vast majority of parental leave in Canada, with 91.4 per cent of total parental benefits paid to women in 2016-17, reflecting the trade-off many women face between having a family and pursuing their educations and careers.

GBA+ was performed: Mid-point

Target population: Students and lifelong learners, low-income individuals, middle-class individuals, persons with disabilities, persons with health issues, lone parents

More diversified educational paths and career choices

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Enhancing Supports for Apprenticeship

- $40 million over four years, starting in 2020–21 and $10 million per year ongoing, to support Skills Canada to continue to promote trades and technology careers to encourage more youth to get into the skilled trades (e.g., construction, manufacturing, fabrication), and $6 million over two years, starting in 2019–20, to support the development and launch of an Apprenticeship Campaign.

Encouraging more Canadians to consider the skilled trades as a possible career will help ensure continued inclusive economic growth. Women continue to be significantly underrepresented in apprenticeships, particularly in higher-paying trades, and young people too often consider the skilled trades as a "second-choice" or "last-resort" career.

In 2017, women represented only 9 per cent of continuing apprentices in Red Seal trades and only 5 per cent when "traditional women's trades" (e.g., hairstylist, cook, baker) are excluded. They face specific barriers to participation, linked to misconceptions about work in the skilled trades, as well as employer misconceptions in a traditionally male-dominated sphere. These barriers are exacerbated for Indigenous women and those from visible minority groups.

For young Canadians, fewer than one in ten 15-year-old students plan to pursue a career in the skilled trades; this drops to only 2 per cent for 15-year old girls who are students. Further, the average apprentice starts at 28 years old. It is clear that young Canadians do not see the skilled trades as a first pathway to the labour market.

Budget 2019 will help by investing in the development and launch of an Apprenticeship Campaign, to raise awareness about the benefits of the skilled trades as first-choice careers, and by providing support to Skills Canada, enabling them to continue promoting the careers in the trades and technology to young Canadians. An estimated 3,600 young Canadians per year participate in events organized by Skills Canada, and more than 33,000 students are involved in presentations promoting trades and technology careers at various competitions.

GBA+ was performed:

On the existing program

Target population: Canadians, including underrepresented and disadvantaged groups who are interested in exploring or seeking apprenticeships and employment in the skilled trades.

More diversified educational paths and career choices

Increased labour market opportunities for underrepresented groups

GBA+ Responsive Approach

Skills Canada supports targeted initiatives—primarily national and provincial and territorial level competitions—that help young people, including young women, Indigenous Peoples, and new Canadians, access information about and experience careers in the skilled trades and other technology careers. It is a proud supporter of HeforShe – a UN led solidarity movement, that pushes for gender equality in vocational education and skilled professions.

The Apprenticeship Campaign will encourage more young Canadians to explore the skilled trades as first-choice careers, and put them on the path to prosperity with well-paying, in-demand jobs.

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Paid Parental Leave for Student Researchers

- $37.4 million over five years and $8.6 million per year ongoing to extend paid parental leave for student researchers and post-doctoral fellows.

A key issue for graduate students and postdoctoral fellows is support for parental leave, as the general age of this group tends to coincide with the average age of individuals welcoming a child into their family.

The federal granting councils currently offer paid parental leave supplements for a maximum duration of 6 months for student researchers and post-doctoral fellows that receive federal research funding support. The proposal would extend these supplements to a maximum duration of 12 months.

High-performing graduate students at Canadian universities will benefit directly from the proposal. There is some evidence that top students are more likely to live in cities, to have parents who have a university degree and to come from middle- or high-income homes, and are less likely to have a disability or to be Indigenous.

GBA+ was performed:

On the existing program

Target population: Post-secondary students and post-doctoral fellows in receipt of federal research funding/support

More diversified educational paths and career choices

Increased labour market opportunities for underrepresented groups

GBA+ Responsive Approach

The extension of paid parental leave benefits for student researchers and post-doctoral fellows is an important part of the granting councils’ equity, diversity and inclusion Action Plan. This proposal will provide more flexibility to integrate research training with family responsibilities and to increase the participation of women in research careers, particularly in science, technology, engineering and mathematics fields.

The granting councils will work proactively to disseminate information about the paid parental leave supplements.

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Supporting Graduate Students Through Research Scholarships

- $114 million over five years and $26.5 million per year ongoing for the Canada Graduate Scholarship program.

The federal granting councils offer a suite of scholarships that make higher education more accessible for students seeking to develop the research skills needed in the knowledge-based economy.

High-performing graduate students at Canadian universities will benefit directly from the proposal.

There is some evidence that top students are more likely to live in cities, to have parents who have a university degree and to come from middle- or high-income homes, and are less likely to have a disability or to be Indigenous.

In terms of gender, the direct beneficiaries are more likely to be women in the social sciences and humanities and health-related disciplines, and men in natural sciences and engineering.

Between 2011 and 2016, 66 per cent of the Social Sciences and Humanities Research Council and 60 per cent of the Canadian Institutes of Health Research scholarship recipients were women, while 61 per cent of the Natural Sciences and Engineering Research Council scholarship recipients were men. The portion of scholarship recipients by gender are similar to the portion of applicants by gender, suggesting there is no systemic bias towards women or men in the evaluation processes.

GBA+ was performed: On the existing program

Target population: Graduate students

More diversified educational paths and career choices

Increased labour market opportunities for underrepresented groups

GBA+ Responsive Approach

The granting councils have developed an equity, diversity and inclusion Action Plan with the objective of increased and equitable participation of underrepresented groups. The councils are also committed to tracking the success rates of applicants from underrepresented groups relative to their application rates in scholarship competitions in order to take corrective actions if specific targets are not met. The granting councils have launched a self-identification form for scholarship applicants and have also committed to ensure equitable participation of all underrepresented groups and disciplines on scholarship and fellowship review panels.

GBA+: Chapter 1

A New Approach to Helping the Middle Class Find and Keep Good Jobs

Supporting Indigenous Post-Secondary Education

- $327.5 million over five years to renew and expand the First Nations Post-Secondary Student Support Program and support continued engagement.

- $125.5 million over ten years and $21.8 million per year ongoing to support an Inuit-led post-secondary education (PSE) strategy.

- $362.0 million over ten years and $40.0 million per year ongoing to support a Métis Nation-led PSE strategy.

- $9 million over three years for bursaries and scholarships at Indspire.

This initiative will support Indigenous post-secondary education through direct student support funding, as well as Indigenous communities and organizations by enhancing their education governance capacity and provision of complementary support programs and services.

The Indigenous post-secondary attainment rate is below the non-Indigenous rate. In 2016, 49 per cent of Indigenous people (aged 25-64) had obtained a post-secondary degree, compared to 66 per cent for the non-Indigenous population. The largest gap (18.4 per cent) is at the university level, where gaps with the non-Indigenous population have increased for all Indigenous groups (Registered First Nations, Métis, Inuit and non-status First Nations). This gap was at 15.7 per cent in 2006. The proportion of registered First Nations (aged 25-64) with a post-secondary degree or university degree is lower for those living on reserve than those living off reserve. This is also the case for Inuit living inside Inuit Nunangat, who have lower rates of post-secondary degree attainment than Inuit living outside Inuit Nunangat.

By supporting Indigenous students and communities, this initiative will contribute to closing the post-secondary attainment and related income gaps. Indigenous women were more likely than men to have a university degree (14 per cent compared to 8 per cent), while Indigenous men were more likely to have an apprenticeship or trades certificate (19 per cent compared to 8 per cent).

Median total income is higher for Indigenous men than it is for Indigenous women ($37,600 vs. $30,300). However, the gender gap is actually reversed for registered First Nations women on reserve and Inuit women in Inuit Nunangat, who earn more than their male counterparts.

GBA+ was performed: Early in the idea development phase

Target population: Indigenous Peoples—First Nations, Inuit and Métis Nation youth

More diversified educational paths and career choices

Increased labour market opportunities for underrepresented groups

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Expanding the Canada Service Corps

- Up to $314.8 million over five years, and $83.8 million per year ongoing, to implement the Canada Service Corps as Canada’s signature national youth service program.

Budget 2019’s proposed expansion of the Canada Service Corps is expected to increase service opportunities for youth across the country, providing them with new skills and leadership experience that will benefit them in all aspects of their lives.

In 2016, Canada’s rate of youth volunteerism ranked third amongst Organisation for Economic Co-operation and Development nations, but Canadian youth—particularly those from underrepresented groups—continue to experience financial and non-financial barriers to participation in volunteer service.

In response, the Canada Service Corps relied on co-creation with more than 800 young Canadians during the design phase to develop flexible service opportunities that meet their needs and program supports that directly address the barriers to participation identified by underrepresented youth.

Early results from the design phase are positive: to date, approximately 80 per cent of individual grants for self-directed service have been awarded to underrepresented youth.

Young women and girls are expected to participate in Canada Service Corps opportunities in higher numbers than young men and boys. A longitudinal study of similar service initiatives in the United States found that 68 per cent of participants were women.

GBA+ was performed: On the existing program

Target population: Youth (ages 15 to 30) with particular emphasis on those from underrepresented groups (Indigenous youth, youth with disabilities, rural and remote youth, newcomer youth, and LGBTQ2 youth)

![]()

More diversified educational paths and career choices

GBA+ Responsive Approach

New incentives and program supports will be implemented to reduce barriers to participation identified by underrepresented youth.

- Dedicated funding is available for service projects focused on reconciliation with Indigenous Peoples.

- All partner organizations will be evaluated to ensure a significant portion of total participants come from underrepresented groups.

- The Canada Service Corps will engage in targeted outreach to increase participation amongst young men and boys.

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Giving Young Canadians Digital Skills

- $60 million over two years to provide coding and digital skills learning opportunities to youth.

CanCode provides funding to not-for-profit organizations so that they can offer coding and digital skills education to Canadian youth.

CanCode has a focus on reaching girls, Indigenous youth, youth with disabilities, and youth living in rural, remote and northern communities to increase their representation in science, technology, engineering and mathematics training. By ensuring that all CanCode programs are free to participants, CanCode helps to reduce income-based barriers to participation.

About 7 per cent of Canadians under the age of 24 are Indigenous and 9 per cent of CanCode participants have been Indigenous youth. However, while girls make up 48.6 per cent of the school-aged population, a slightly lesser percentage, 45 per cent, of CanCode participants were girls, falling slightly below the program’s targets.

Additionally, about 19 per cent of Canadians live in rural areas but only 16 per cent of CanCode participants were youth living in rural areas. About 4 per cent of the population aged 15 to 24 report having a disability, compared with about 1 per cent of CanCode recipients.

GBA+ was performed: On the existing program

Target population: Youth in kindergarten to grade 12

More diversified educational paths and career choices

GBA+ Responsive Approach

CanCode will maintain a focus on its target that at least 50 per cent of participants are girls. CanCode will also continue to ensure participation among Indigenous youth in line with the portion of the Canadian population and improve participation among youth living in rural areas and youth with disabilities.GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

Modernizing the Youth Employment Strategy

- $49.5 million over five years to launch a modernized Youth Employment Strategy with an increased focus on youth furthest from opportunity.

Although Canadian youth are highly educated by international standards, only 34 per cent of employers and 44 per cent of youth believe they are prepared for the workforce, highlighting the importance for youth to gain employable skills and experience.

Some youth face enduring gaps in skills and employment: the unemployment rate is higher for Indigenous youth (23 per cent in 2016), recent immigrant youth (13.2 per cent in 2017), and youth with disabilities (25.9 per cent in 2012).

The modernized Youth Employment Strategy will benefit all youth, especially youth who are furthest from opportunity (e.g., low-income, Indigenous, visible minority, identifying as LGBTQ2+, living with a disability, living in a rural or remote area, or who come from an official language minority community).

As part of the modernized Youth Employment Strategy, the Youth Digital Gateway will benefit all youth by streamlining youth employment information under one digital access point with content tailored to young job seekers, which will enable all youth, including those who are job-ready, to find employment opportunities, and employment-related services and support.

GBA+ was performed: On the existing program

Target population: All youth between the ages of 15-30

Increased labour market opportunities for underrepresented groups

GBA+ Responsive Approach

Continuous engagement with federal partners, youth-serving organizations, employers, youth allies and youth themselves will guide implementation efforts and will provide opportunities to signal check progress and solicit advice from stakeholders on how to ensure the modernized Youth Employment Strategy is meeting its intended objectives.GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

International Education Strategy

- $147.9 million over five years, and $8.0 million per year ongoing, for a new international education strategy.

International experience is associated with improved educational and labour market outcomes. However, Canadian students are less likely to participate in activities abroad than their international peers, with participation even lower among underrepresented groups, including low-income and Indigenous students.

Foreign students enhance the cultural, research and learning excellence of Canadian institutions. According to Immigration, Refugees and Citizenship Canada (IRCC), approximately 317,000 study permits were issued to international students in 2017. Approximately half of these students were women.

While Canada’s foreign student base is growing, the majority come from a small number of source countries and are concentrated in particular urban regions of Canada. According to the Canadian Bureau for International Education, about 50 per cent of all international students studying in Canada come from China and India. In addition, the IRCC indicates that about half of all foreign students in Canada study at institutions in Toronto and Vancouver.

According to Employment and Social Development Canada, only 10 per cent of Canadian undergraduate students study abroad. Of these, less than 2 per cent are Indigenous students, compared to Indigenous students representing 4 per cent of post-secondary students.

GBA+ was performed: Early in the idea development phase

Target population: Canadian and international post-secondary students

GBA+ Responsive Approach

GBA+: Chapter 1

A New Approach to Helping Canadians Find and Keep Good Jobs

On-the-Job Learning and Work Experience

- $631.2 million over five years to the Student Work Placement Program to support up to 20,000 new student work placements per year.

- $150.0 million over four years, starting in 2020–21 to create up to a further 20,000 work-integrated learning opportunities per year.

- $17 million over three years, starting in 2019–20, to support the work of the Business/Higher Education Roundtable to increase learning opportunities.

In 2011, women accounted for 39 per cent of university graduates aged 25 to 34 with a science, technology, engineering and mathematics (STEM) degree, compared with 66 per cent of university graduates in non-STEM programs.

Under the Student Work Placement Program, eligible employers can receive up to 50 per cent of the cost of wages for each new placement (up to a maximum of $5,000), and 70 per cent of the cost of wages (up to a maximum of $7,000) for each new placement for underrepresented students, including women enrolled in STEM programs, Indigenous students, students with disabilities, and newcomers.

Preliminary results from the first year of activity of the Student Work Placement Program indicate that 46 per cent of students participating were from underrepresented groups, with women in STEM accounting for the majority of these students (32.5 per cent).

The availability of work-integrated learning opportunities to include students from social sciences, arts and humanities programs will enable the Student Work Placement Program to better include women and vulnerable groups, who are typically enrolled in higher proportions in those programs.

GBA+ was performed: Early in the idea development phase and on the existing program

Target population: Canadian post-secondary students enrolled in post-secondary education institutions across Canada and recent post-secondary education graduates (up to 2 years after graduation)

![]()

More diversified educational paths and career choices

Increased labour market opportunities for underrepresented groups

GBA+ Responsive Approach

Considering that some post-secondary education students may require additional supports to successfully complete a work-integrated learning opportunity, under the Student Work Placement Program, support services may be made available for those students, including support towards purchasing work clothing and equipment, and cost of transportation to and from training or the worksite.GBA+: Chapter 1

Moving Forward on Implementing National Pharmacare

Introducing the Canadian Drug Agency

- $35 million over four years to establish a Canadian Drug Agency that will build on existing provincial and territorial successes and negotiate better prices for prescription drugs.

Brand-name medicines cost, on average, 20 per cent more in Canada than they do in other advanced economies.

The Canadian Drug Agency could reduce drug spending by billions of dollars per year, compared to baseline projections, within ten years of implementation. As a result, Canadians enrolled in a prescription drug plan could see improvements in the sustainability of their drug coverage. In addition, savings could be passed on to plan beneficiaries, such that Canadians could see expansions in their coverage and/or direct cost savings (e.g., lower plan premiums).

GBA+ was performed: Mid-point

Target population: All Canadians

GBA+: Chapter 1

Moving Forward on Implementing National Pharmacare

Making High-Cost Drugs for Rare Diseases More Accessible

- Up to $1.0 billion over two years, starting in 2022–23, with up to $500 million per year ongoing to help Canadians with rare diseases access the drugs they need.

For many Canadians who require high-cost prescription dugs to treat rare diseases, the costs of these necessary medications can be astronomically high. The list prices for high-cost drugs for rare diseases often exceed $100,000 per patient each year and are sometimes significantly more.

According to the Canadian Organization for Rare Disorders, more than 7,000 rare diseases have been identified to date, although each one affects a relatively small number of patients. Many of these diseases predominantly affect children, as they are often genetically based and appear at birth or in early childhood.

According to the Provincial/Territorial Expensive Drugs for Rare Diseases Working Group, there is variability across jurisdictions in public coverage for high-cost drugs for rare diseases.

The Government proposes to work with provinces, territories and stakeholders to establish a national strategy for high-cost drugs for rare diseases. This would improve consistency of decision-making and access across the country and help ensure that effective treatments for rare diseases reach the patients who need them.

GBA+ was performed: Mid-point

Target population: Canadians with a rare disease

GBA+: Chapter 1

A Secure Retirement

Improving the Economic Security of Low-Income Seniors

- Amend the Old Age Security Act to extend eligibility for the Guaranteed Income Supplement (GIS) earnings exemption to self-employment income; increase the full exemption to $5,000; and introduce a further partial exemption of 50 per cent on up to $10,000 of employment and self-employment income beyond $5,000. These changes will be implemented starting in the July 2020 to June 2021 benefit year, at an estimated cost of $1.76 billion over four years.

Benefits under the Old Age Security (OAS) program consist of:

- The basic OAS pension.

- The GIS for low-income seniors.

- The Allowance for Canadians aged 60 to 64 who are spouses/common-law partners of someone eligible to receive GIS; and the Allowance for the Survivor for 60-64 year olds who are widows/widowers.

About 7.5 per cent of GIS and Allowance recipients have employment income. The average annual earnings among GIS and Allowance recipients who have employment or self-employment income is about $6,000.

Estimates from the Office of the Chief Actuary indicate that, based on current hours of work, 326,000 individuals would benefit directly from the enhancement of the GIS earnings exemption by experiencing an increase in their benefits in the first full year of implementation.

Of these, more men (58 per cent or 188,000) than women (42 per cent or 138,000) would benefit directly. However, women’s benefits would increase slightly more, by an average of $1,650 annually, compared to $1,265 for men.

GBA+ was performed: Mid-point

Target population: GIS and Allowance recipients

Fewer vulnerable individuals living in poverty

GBA+: Chapter 1

A Secure Retirement

Ensuring Everyone Who Is Eligible Receives Canada Pension Plan (CPP) Benefits

- Proactively enroll CPP contributors for a CPP pension who are age 70 or older in 2020, but have not yet applied to receive their retirement benefit.

Proactive enrollment will directly benefit seniors who have not applied but are eligible for a CPP pension. The measure will provide them with additional income, thereby improving their financial situation and quality of life.

A small number of Canadians (the majority of whom are low-income seniors) currently miss out on CPP retirement pensions to which they are entitled because they apply late or not at all.

Around 40,000 individuals currently over the age of 70 have never applied for a CPP retirement pension but may be entitled to one. About 1,500 individuals who have not applied for a CPP pension will turn 70 in 2020, rising to 4,000 individuals by 2040.

About 67 per cent of current individuals age 70 or older who have never applied for a CPP retirement pension contributed for 5 years or less to the Plan.

Many of the beneficiaries will be single women living on low income. Around 63 per cent of seniors who could benefit would be women and the majority of them are aged 70 to 74 (around 54 per cent).

That being said, men are expected to receive a higher CPP pension than women given that women generally have lower lifetime earnings than men.

Some individuals might be disadvantaged by receiving their CPP retirement pension if it results in a decrease in other federal and provincial income-tested benefits (e.g., Guaranteed Income Supplement and provincial income supports for seniors).

GBA+ was performed: Early in the idea development phase

Target population: Seniors who have contributed to the Canada Pension Plan

Fewer vulnerable individuals living in poverty

GBA+ Responsive Approach

GBA+: Chapter 1

A Secure Retirement

Protecting Canadians’ Pensions

- Introduce targeted measures to the federal pension, corporate governance and insolvency frameworks to enhance the security of private-sector defined benefit pension plans.

This proposal will enhance the retirement security of Canadians belonging to a private-sector defined benefit pension plan. It will also benefit the workers and pensioners of federally incorporated firms and all parties who participate in insolvency proceedings.

The benefitting group contains workers, retirees and other pension beneficiaries, such as surviving spouses.

According to Statistics Canada, approximately 1.2 million workers participate in a private-sector defined benefit pension plan. This represents about 9.5 per cent of all employees in Canada.

Women account for approximately one-third of all workers participating in a private-sector defined benefit pension plan, while two-thirds are men.

GBA+ was performed: Mid-point

Target population: Members, retirees and beneficiaries of private-sector defined benefit pension plans.

GBA+: Chapter 1

A Secure Retirement

Global Risk Institute and National Pension Hub

- $12.5 million over 10 years to the Global Risk Institute, starting in 2021, and $150,000 over three years to the National Pension Hub, starting in 2019.

This measure renews funding to the Global Risk Institute (GRI) and provides new funding to the National Pension Hub (NPH).

The GRI funding seeks to support research and training programs in financial risk management designed to contribute to a safe, secure and resilient financial sector that will benefit all Canadians.

The NPH funding seeks to support pension research focused on improving retirement savings outcomes and developing innovative solutions to pension challenges. This research will benefit all Canadians belonging to a pension plan. According to Statistics Canada approximately 6.3 million workers participate in a registered pension plan, of which 3.2 million are women. Therefore, women make up slightly over half of all active pension plan members in Canada.

GBA+ was performed: Mid-point

Target population: All Canadians who participate in the financial sector or utilize the services of a financial institution, as well as all Canadians belonging to a pension plan.

GBA+: Chapter 1

A Secure Retirement

Empowering Seniors in Their Communities

- $100 million over five years and $20 million per year ongoing, in additional funding for the New Horizons for Seniors Program to target vulnerable seniors.

Population aging in Canada will gain momentum during the next 15 years, and it is expected that, by 2031, one in four Canadians will be over the age of 65.

Healthy aging can delay and minimize the severity of chronic diseases in later life, saving health care costs and reducing long-term care needs.

Women make up 55 per cent of the seniors’ population in Canada. Some seniors face isolation, compounded in some cases by ageism, poor health, reduced mobility, poverty, and even abuse.

The New Horizons for Seniors Program is intended to support projects that improve the quality of life for vulnerable seniors and promote their full participation in Canadian society. For example, in 2013, seniors devoted approximately 1.96 billion hours to their volunteer activities, a volume of work that is equivalent to about 1 million full time jobs.

The program supports various projects across Canada such as fitness classes, mentorship opportunities and capital improvements (e.g., renovations, equipment purchases, etc.).

GBA+ was performed: Early in the idea development phase

Target population: Vulnerable seniors

More years in good health

GBA+ Responsive Approach

The distribution of the senior population is diverse across Canada and with many seniors socially isolated it can be difficult to reach them. An equitable approach is in place to help mitigate differences. The regional distribution of New Horizons for Seniors Program funding is proportional to the provincial/territorial distribution of the seniors’ population.

- Date modified: