ADVANCEMENT

No matter what challenges they faced, Canadians have always looked to the future—working hard to build a more prosperous and more just world for themselves, their children and their grandchildren.

That starts with a clean environment here at home. Canadians understand that our quality of life today—and our economic success tomorrow—rests on the commitments we make to protect Canada’s nature, parks and wild spaces and preserve a clean environment so that future generations of Canadians can continue to hike in our forests, swim in our lakes, watch for birds and whales, and spend time with family and friends in the natural places that mean so much to all of us.

Beyond our borders, Canadians are proud of our history of helping vulnerable people around the world. We lend a hand to those in need because we know that a safer, more prosperous world means a safer and more prosperous Canada. We understand that we are at our best and most effective when we focus our efforts. That’s the approach the Government is taking to international assistance. By focusing our assistance on the full empowerment of women and girls, we are helping to change the world for the better.

Canadians are also connected through shared values. Helping to keep each other healthy, taking care of each other when we are sick, looking out for the people in our communities who need the most help, honouring our veterans and celebrating our cultural diversity—those are the shared values Canadians uphold each and every day.

And Canadians also understand that every person deserves to feel safe and protected in a rapidly changing world, secure in the knowledge that their rights will be protected and their dignity respected. All Canadians should feel confident that they will be treated fairly under the law, and the Government will work hard to make that so.

Key Chapter 4 initiatives that advance objectives of Canada’s new Gender Results Framework:

- Providing new, innovative tools to support Canada’s Feminist International Assistance Policy.

- Improving the quality of life of people with dementia and ensuring that caregivers have the support they need.

- Taking action to prevent and address gender-based violence, harassment and discrimination.

- Enhancing diversity of the judiciary so it better represents Canadian society.

- Moving towards an inclusive sport system by setting a target to achieve gender equality in sport by 2035.

Part 1: Canada’s Natural Legacy

A Clean Environment for Future Generations

As Canadians, our quality of life and our present and future prosperity are deeply connected to the environment in which we live—and more than that, the extraordinary beauty of Canada’s nature, parks, and wild spaces are central to our identity as Canadians. Whether it’s building a campfire with our kids, hiking with friends and family, or swimming in cool, clean waters, spending time in nature—and protecting it for future generations—is important to us all.

At the same time, Canadians understand that a clean environment and a strong economy go hand in hand. That is why the Government has made significant investments to protect our air, water and natural areas for our children and grandchildren, while also investing to create a world-leading clean economy.

Responding to the critical and urgent need to take action on climate change, Canada’s First Ministers, in consultation with Indigenous Peoples, adopted the Pan-Canadian Framework on Clean Growth and Climate Change in December 2016. To support the implementation of this historic national plan, the Government has allocated $5.7 billion over 12 years, including $2 billion for the Low Carbon Economy Fund, to combat climate change. In November 2016, the Government also launched a $1.5 billion national Oceans Protection Plan to improve marine safety and responsible shipping, protect Canada’s marine environment and offer new possibilities for Indigenous and coastal communities.

In Budget 2018, the Government is making further investments to help grow a healthy and sustainable clean economy—one that creates growth and middle class jobs, and preserves Canada’s natural heritage for generations to come.

Protecting Canada’s Nature, Parks and Wild Spaces

Whether the place we call home is a city in Southern Ontario or a small community in Canada’s Far North, the beauty that is part of Canada’s natural landscape is a gift to us all. To ensure that our children and grandchildren can continue to hike in our majestic forests and swim in our beautiful lakes, rivers and streams, Canada has committed to conserving at least 17 per cent of its land and inland waters by 2020, through networks of protected areas and other effective area-based conservation measures. Both protected and conserved areas will ensure healthier habitats for species at risk and improve biodiversity.

As almost 90 per cent of Canada’s land and inland waters are provincial and territorial Crown or Indigenous lands, achieving this goal requires open collaboration with other orders of government. To support Canada’s biodiversity and protect species at risk, the Government of Canada proposes to make historic investments totalling $1.3 billion over five years, one of the most significant investments in nature conservation in Canadian history—a true legacy for our children and grandchildren.

This investment will contribute $500 million from the federal government to create a new $1 billion Nature Fund in partnership with corporate, not-for-profit, provincial, territorial and other partners. In collaboration with partners, the Nature Fund will make it possible to secure private land, support provincial and territorial species protection efforts, and help build Indigenous capacity to conserve land and species, for our benefit and the benefit of future generations.

The remaining funding will:

- Increase the federal capacity to protect species at risk and put in place new recovery initiatives for priority species, areas and threats to our environment.

- Expand national wildlife areas and migratory bird sanctuaries.

- Increase the federal capacity to manage protected areas, including national parks.

- Continue implementation of the Species at Risk Act by supporting assessment, listing, recovery planning and action planning activities.

- Establish a coordinated network of conservation areas working with provincial, territorial and Indigenous partners.

Protecting Marine Life

Whales are vital to healthy marine ecosystems, and an important part of eco-tourism in Canada’s Pacific and Atlantic coastal regions, and in the St. Lawrence Estuary.

A complex mix of threats—such as the availability of prey, increased noise levels from passing ships and pollution in the water—are endangering many whale populations, notably the southern resident killer whale, the North Atlantic right whale and the St. Lawrence Estuary beluga.

To better protect, preserve and recover endangered whale species in Canada, the Government proposes to make available $167.4 million over five years, starting in 2018–19, to Fisheries and Oceans Canada, Transport Canada and Environment and Climate Change Canada. This includes funding for research to help us better understand the factors affecting the health of these whales, as well as actions that we can take now to help address threats arising from human activities.

Establishing Better Rules to Protect the Environment and Grow the Economy

The Government is delivering on its promise to protect the environment, restore public trust in federal environmental assessment and regulatory processes and provide predictability for businesses. Legislation was recently tabled in Parliament to establish better rules for the review of major projects that will protect our environment, fish and waterways, rebuild public trust, and help create new jobs and economic opportunities. The proposed changes include:

- Maintaining one project, one review.

- Revising the project list.

- Undertaking more comprehensive impact assessments.

- Making timely decisions.

- Ensuring transparent, science-based decisions.

- Protecting water, fish and navigation.

The Government has announced that it will invest about $1 billion over five years to support the proposed new impact assessment system and Canadian Energy Regulator; increase scientific capacity in federal departments and agencies; implement the changes required to protect water, fish and navigation; and increase Indigenous and public participation.

Pricing Carbon Pollution and Supporting Clean Growth

Central to Canada’s plan to fight climate change and grow the economy is the understanding that pollution has a real, tangible cost. It puts stress on the health of our communities, our economy and on Canadians themselves. That is why the Government of Canada is committed to putting a price on carbon pollution.

To ensure that a price on carbon pollution is in place across Canada, the Government is developing a federal carbon pollution pricing system that would apply in provinces and territories upon request, and in provinces and territories that do not have a pricing system in place that meets the federal standard by the end of 2018. The direct revenue from the carbon price on pollution under the federal system will be returned to the province or territory of origin.

Provinces and territories requesting that the federal system apply, in whole or in part, in their jurisdiction should confirm this by March 30, 2018. Provinces and territories establishing or maintaining their own system need to outline how they are implementing pricing on carbon pollution by September 1, 2018. The Government will review each system and implement the federal system in whole or in part on January 1, 2019 in any province or territory that does not have a carbon pollution pricing system that meets the minimum standard.

The Government recently released draft legislative proposals on the federal carbon pollution pricing system, as well as a regulatory framework outlining the approach to carbon pollution pricing for large industrial facilities, and intends to introduce legislation to establish that system.

To support the development and implementation of the federal carbon pollution pricing system, the Government will provide $109 million over five years, starting in 2017–18, to the Canada Revenue Agency and Environment and Climate Change Canada to implement, administer and enforce the federal carbon pollution pricing system.

In addition, to ensure that the actions established in the Pan-Canadian Framework on Clean Growth and Climate Change are transparent and informed by science and evidence, the Government proposes to make available $20 million over five years, starting in 2018–19, through Environment and Climate Change Canada to fulfill the Framework’s commitment to engage external experts to assess the effectiveness of its measures and identify best practices.

Government leadership is critical for Canada to achieve its goals for environmental and sustainable development. Introduced in 2017 under the oversight of the Treasury Board of Canada Secretariat, the Greening Government Strategy sets an ambitious target to reduce direct and indirect greenhouse gas emissions from Government of Canada operations by 40 per cent below 2005 levels by 2030, and by 80 per cent below 2005 levels by 2050—consistent with world-leading jurisdictions. The Strategy also outlines a broader scope for the Government’s greening efforts, including actions on water and waste.

The Department of National Defence owns and operates more than 20,000 buildings, representing about 60 per cent of the Government of Canada’s reported greenhouse gas emissions. Canadian Forces Base Halifax alone represents 10 per cent of the Government’s reported emissions.

To reduce emissions at CFB Halifax, a planned project to refurbish the antiquated heating plant on base will be expanded to include the rehabilitation of attached buildings and distribution systems. In total, this project is expected to reduce annual emissions at the base by up to 7 per cent.

The Government, through the Low Carbon Economy Leadership Fund, is investing $1.4 billion in projects that will generate clean growth and reduce greenhouse gas emissions, while creating jobs for Canadians for years to come.

The Low Carbon Economy Leadership Fund provides funding to make buildings more energy efficient, help industries innovate to reduce emissions, and help the forestry and agriculture sectors increase stored carbon in forests and soils. All provinces that have signed the Pan-Canadian Framework on Clean Growth and Climate Change can apply for support through the Fund. The first round of funding agreements was announced in December 2017, with six provinces receiving funding for project proposals.

British Columbia: $162 million to support projects including the reforestation of public forests, which absorb carbon from the atmosphere and store it.

Alberta: Almost $150 million to help Albertans, including farmers and ranchers, use less energy and save money. Alberta will work with Indigenous communities to install renewable energy solutions, and will also invest in restoring forests affected by wildfires.

Ontario: $420 million to support projects such as renovating buildings, retrofitting houses and helping farmers reduce emissions from their operations.

Quebec: Over $260 million to help expand actions under the province’s 2013–2020 Climate Change Action Plan. These new investments will allow more farmers and foresters to adopt best practices, more businesses to retrofit their buildings and more industries to find innovative ways to reduce emissions.

New Brunswick: $51 million, in partnership with NB Power, to help New Brunswickers improve the energy efficiency of their homes and businesses.

Nova Scotia: $56 million to expand an existing home retrofit partnership with Efficiency Nova Scotia. Today, only those homes heated with electricity are eligible for retrofit funding. The new funding will open up the retrofit program so that any Nova Scotian home could be eligible, allowing Nova Scotians to lower their heating bills and help reduce emissions.

Announcements for the remaining jurisdictions that have signed onto the Pan-Canadian Framework will be forthcoming as project proposals are approved.

Further details regarding the competitively based Low Carbon Economy Challenge will be announced in the near future. The objective of the fund will be to maximize greenhouse gas reductions in 2030, and it will be open to all provinces and territories, municipalities, Indigenous governments and organizations, businesses, and not-for-profit organizations.

Adapting Canada’s Weather and Water Services to Climate Change

Climate change is already having an impact on Canadians. Extreme weather events, such as flooding and wildfires, can have a devastating impact on our people, our communities and our economy.

The Government maintains Canada-wide networks to collect data and monitor changes in weather, climate, water, ice and air. These networks enable the weather, water and environmental predictions that help keep people safe. The Government is proposing through Budget 2018 the following activities and investments to improve weather and water services, through Environment and Climate Change Canada:

- Complete the modernization of Canada’s weather forecast and severe weather warning systems, and maintain direct support to the emergency management organizations that prepare for and respond to severe weather ($40.6 million over five years, starting in 2018–19, with $0.2 million in remaining amortization).

- Revitalize water stations, improve services for long-range water forecasts, test and implement new technologies and expand technical and engineering capacity ($69.5 million over five years, starting in 2018–19, with $7.3 million in remaining amortization).

- Support the operation of water stations that are cost-shared with provinces and territories ($9.8 million over five years, starting in 2018–19, with remaining amortization of $3.1 million).

Extending Tax Support for Clean Energy

The Government of Canada works with businesses to encourage investment in clean energy generation, and to promote the use of energy efficient equipment. Tax support, such as allowing accelerated deductions of the cost of eligible capital assets, can help us achieve this shared goal. The existing accelerated deduction of these assets is scheduled to expire in 2020. Through Budget 2018, the Government proposes to extend the preference to property acquired before 2025, which represents an investment of $123 million over the 2017–18 to 2022–23 period.

This renewed support will increase the after-tax income of about 900 businesses. This represents on average an additional $27,000 annually over the next five years that these companies will be able to use to invest in and grow their operations while reducing their carbon footprint. Increased adoption of clean technology will help Canada’s efforts to reduce the emission of greenhouse gases and air pollutants.

- More protected and conserved areas for Canadians—and future generations of Canadians—to enjoy.

- A modern ecosystem-based approach for multi-species recovery that improves species at risk conservation.

- Pricing carbon pollution will contribute to achieving Canada’s international greenhouse gas reduction targets at the lowest cost, while providing an incentive for clean growth and innovation.

- More investment in clean energy and a clean economy

Part 2: Canada and the World

Advancing Gender Equality Around the World

Canada recognizes the importance of investing in ways that can help those in need around the world. In June 2017, the Government released its Feminist International Assistance Policy, focusing on six interlinked areas: gender equality and the empowerment of women and girls, human dignity, peace and security, inclusive governance, environment and climate action, and growth that works for everyone.

To strengthen the impact of Canada’s new Feminist International Assistance Policy, and advance our international leadership in key areas, the Government proposes to provide an additional $2 billion over five years, starting in 2018–19, to the International Assistance Envelope. These new resources will be dedicated to support humanitarian assistance and Canada’s core development priorities, in particular supporting women and girls, and will reinforce Canada’s commitment to reduce poverty and to do its part to support a more inclusive, peaceful and prosperous world. Further details on the allocation of this funding will be announced in the coming year.

Canada’s new Feminist International Assistance Policy represents a turning point for the Government’s approach to international assistance. Through it, Canada has made clear its commitment to contribute to eradicating poverty and building a more peaceful, inclusive and prosperous world. In support of the United Nations 2030 Agenda for Sustainable Development, the Feminist International Assistance Policy puts women and girls at the centre of its plan as agents of positive change for their families, communities and countries. Gender equality will be a focus of all of Canada’s international assistance investments to address economic, political and social inequalities that prevent individuals from reaching their full potential.

- $180 million over three years for the Global Partnership for Education to support girls’ education and help strengthen education systems in developing countries.

- $15 million over four years to Marie Stopes Tanzania to provide girls and women with improved access to family planning information and services.

- The launch of the Elsie Initiative on Women in Peace Operations, which includes:

- $6 million to designated United Nations missions to improve their ability to support and benefit women’s increased participation in peace operations.

- $15 million to launch a global fund to support the deployment of women peacekeepers.

To advance gender equality around the world, the Government will:

- Champion the voice and participation of women and girls, including supporting local women’s organizations to defend women’s rights and address barriers.

- Ensure that Canada’s assistance integrates and targets gender equality and the empowerment of women and girls.

- Support the full spectrum of health programming, including comprehensive sexual and reproductive health and rights.

- Address climate change and mitigate its impacts by investing in renewable energy and environmental practices that support healthy, resilient and adaptive communities.

- Focus on growth that works for everyone by helping to increase women’s economic participation.

- Ensure institutions, policies and processes are more accessible and responsive to the poorest and most vulnerable, including women and girls.

- Pursue a gender-responsive approach during humanitarian crises to better respond to the unique needs of women and girls.

- Support inclusive approaches to building sustainable peace and security by helping women to participate in resolving conflicts and political crises, and by ensuring that responses to transnational threats account for and meet the needs of women and girls.

The Government will track and report on progress to Canadians based on a clear framework with targets for action and indicators for results, aligned with the 17 goals of the United Nations 2030 Agenda for Sustainable Development. The Feminist International Assistance Policy establishes baselines and sets clear targets to:

- Shift its programming with no gender equality focus from 30 per cent to 5 per cent to ensure that at least 95 per cent of Canada’s bilateral international development assistance will either target or integrate gender equality and the empowerment of women and girls by 2021–22.

- Strengthen its focus on sexual and reproductive health and rights by doubling its commitment to $650 million over the next three years.

- Target the poorest and most vulnerable by boosting bilateral assistance to Sub-Saharan African countries from 46 to 50 per cent by 2021–22.

Additional Support for the Feminist International Assistance Policy

Taking more innovative approaches to international assistance will also be an essential part of Canada’s Feminist International Assistance Policy. In addition to the new international assistance resources announced in Budget 2018, the Government proposes to provide $1.5 billion over five years, starting in 2018–19, on a cash basis ($553 million on an accrual basis), and $492.7 million per year thereafter, from existing unallocated International Assistance Envelope resources, to support innovation in Canada’s international assistance through the following two new programs:

- The International Assistance Innovation Program. This program will give the Government greater flexibility for financing arrangements and partnerships and ensure Canada remains at the leading edge of development financing. The Government proposes to commit $873.4 million over five years on a cash basis, and $290.5 million per year thereafter, for this new program.

- The Sovereign Loans Program. This pilot program will diversify the tools Canada has to engage partner countries and international development organizations. It will also better align Canada’s international assistance toolkit with that of other donors. The Government proposes to commit up to $626.6 million over five years on a cash basis, and up to $202.2 million per year thereafter, for the Sovereign Loans Program.

These measures will complement existing core international assistance activities, and will increase the impact of Canada’s international assistance by allowing the Government to explore new and innovative ways to engage internationally, including exploring the use of guarantees, equity and conditionally repayable contributions. These new measures are expected to double Canada’s international assistance provided through innovative tools over the next five years. The Government proposes to introduce any necessary legislative measures to enable Global Affairs Canada to carry out these new programs.

Protecting Vulnerable Women and Girls

Half of the world’s 22.5 million refugee population is made up of women and girls, making this population a significant segment of those fleeing war, violence or persecution in their home countries. Refugee women and girls face increased risks due to their gender, and are at risk of, or have suffered from, sexual violence and exploitation, physical abuse and marginalization.

Since 2015, Canada has demonstrated global leadership in providing protection to the world’s most vulnerable refugees. As of January 2017, more than 40,000 Syrian refugees were welcomed in Canada, where they have built new lives for themselves and their families. In addition, Budget 2017 announced funding of $27.7 million over three years, beginning in 2017–18, to resettle Yazidi women and girls, who were being targeted for abduction and enslavement by Daesh fighters in northern Iraq and Syria.

Building on these efforts, the Government commits to increase the number of vulnerable refugee women and girls to be resettled in Canada as government-assisted refugees. Specifically, Budget 2018 proposes funding of $20.3 million over five years, beginning in 2018–19, to welcome an extra 1,000 refugee women and girls from various conflict zones around the world. Providing additional support to this particularly vulnerable group will allow Canada to continue to show global leadership in helping the world’s most at-risk people.

In the world’s poorest and most vulnerable communities, women and girls are particularly at risk when it comes to climate change. Women and girls are often the primary producers of food and providers of water, heating and cooking fuel for households. When the resources become more unpredictable and scarce due to, for example, extreme weather, women and girls have to spend more time and efforts attending to basic needs such as growing food and collecting water and fuel.

Canada has been an international champion in bringing a gender lens to climate change. Canada was a leader in securing the first ever Gender Action Plan under the United Nations Framework Convention on Climate Change, adopted by countries at COP23 last year. The plan aims to bring more women to the negotiation table, promoting more responsive climate policies at both the grassroots and global levels.

Canada is leading by example in this regard, through its own Chief Negotiator and her team, with Canada’s climate negotiators also providing training to women negotiators from Caribbean countries to strengthen their voices at international climate talks. The Government is also integrating a gender lens in the delivery of its historic $2.65 billion commitment to support climate action in developing countries, including through its contribution to the National Adaptation Plans Global Network.

In addition, as part of Canada’s focus on climate action and gender in the Group of Seven (G7), the Minister of Environment and Climate Change, Catherine McKenna, will host a summit of women climate leaders in the spring of 2018 to help accelerate global momentum for climate action.

Enhancing Transparency in Canada’s International Assistance Programming

Over the last number of years, the international assistance community has called on Canada to further improve communications around its international assistance budget. Previously, public commitments did not always include comprehensive details, including the total size and allocations of federal international assistance. To address this, the Feminist International Assistance Policy has committed to clarify Canada’s federal contributions to international assistance.

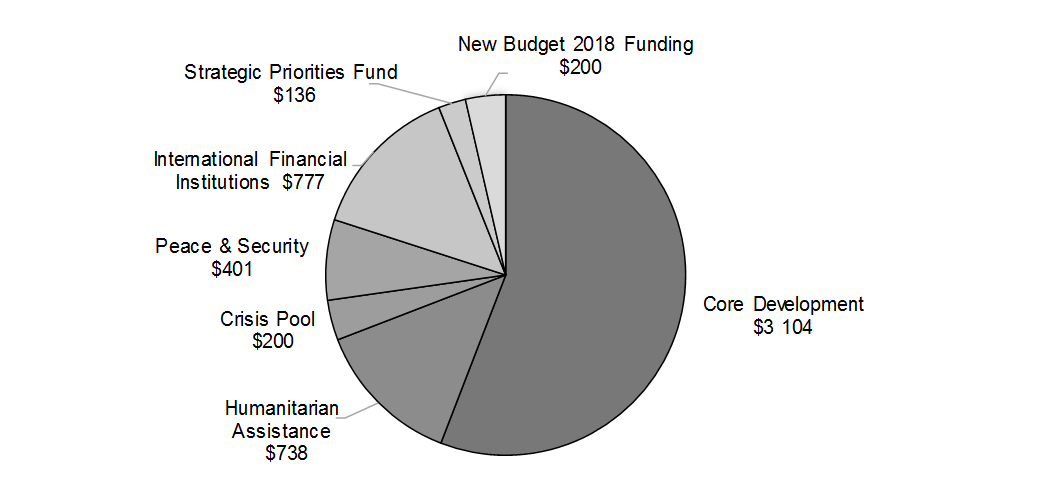

New International Assistance Resources and Allocations

(millions)

| 2018–2019 | 2019–2020 | 2020–2021 | 2021–2022 | 2022–2023 | 5-Year Total |

|

|---|---|---|---|---|---|---|

| New Resources | $200 | $300 | $400 | $500 | $600 | $2,000 |

| Allocation of Existing Resources | ||||||

| New Innovation Program | $55 | $114 | $177 | $237 | $291 | $873 |

| New Sovereign Loans Program | $2 | $63 | $157 | $202 | $202 | $627 |

| Ongoing Program Funding (e.g. Peace and Security, Global Fund) | $143 | $303 | $376 | $376 | $376 | $1,573 |

The Government is also bringing forward a reform to the International Assistance Envelope funding structure regarding humanitarian assistance and core development assistance. For many years, the Minister of International Development has had to manage a single pool of funding to address core development priorities, as well as humanitarian assistance priorities. With the increasing scope of conflicts around the world, demand for humanitarian assistance has increased, and under the current funding structure, this has led to reductions in resources for other programs. With this reform, the Government will create a dedicated pool of funding for humanitarian assistance, and a separate dedicated pool of funding for core development assistance. These changes will help to achieve the goals of the Feminist International Assistance Policy.

Canada is committed to ensuring information on its international assistance funding is open and transparent, and is pleased to chair the International Aid Transparency Initiative. The Government will explore further enhancing its international assistance reporting, including consideration of legislative updates as appropriate. Over the coming year, the Government will determine how it can better communicate international assistance efforts to Canadians, non-governmental organizations and the international community from a historical perspective as well as the size and distribution of assistance planned for the coming year.

Implementing the 2030 Agenda for Sustainable Development

Canadians can be proud of our history of helping others around the world, including providing emergency and development assistance to the poorest and most vulnerable. We understand that a safer, more prosperous world means a safer and more prosperous Canada.

In 2015, Canada, along with all other United Nations member states, committed to implementing the 2030 Agenda for Sustainable Development, which set 17 goals (known as Sustainable Development Goals or SDGs) to eliminate poverty, protect the planet and ensure prosperity by the year 2030.

These goals are universal, and apply to all countries. This means working to end all forms of poverty, fight inequalities, tackle climate change and support sustainable economic growth here at home, and helping other countries through our diplomacy, trade, peace and security, and international assistance efforts.

To reach these goals, in 2016, the Government of Canada began a comprehensive review of its international assistance support to improve the effectiveness of Canada’s international assistance. The result was a new Feminist International Assistance Policy, unveiled in June 2017, and centred around SDG 5: Gender Equality.

The Government is working hard to make progress on the goals for sustainable development here in Canada, and around the world, including work on:

- Strengthening and growing the middle class: The middle class tax cut, the Canada Child Benefit, improvements to Employment Insurance, investments in skills that will help Canadians succeed in the new economy, and efforts to ensure the affordability of post-secondary education all contribute to SDG 1 (No Poverty) and SDG 8 (Decent Work and Economic Growth).

- Gender equality: The Government’s leadership both at home and on the world stage on gender equality, through measures aimed at promoting pay equity, encouraging greater workforce participation among women, helping to combat gender-based violence and implementing the Feminist International Assistance Policy, is helping to make headway on SDG 5 (Gender Equality).

- Innovation, infrastructure and clean economic growth: Support for innovation in key growth industries such as clean technology, digital and agri-food, support for innovation networks and clusters, and the Investing in Canada plan including investments in green infrastructure, support for safe and clean drinking water in First Nations communities and the creation of the Canada Infrastructure Bank, help to achieve SDG 6 (Clean Water and Sanitation), SDG 7 (Affordable and Clean Energy), SDG 8 (Decent Work and Economic Growth), SDG 9 (Industry, Innovation and Infrastructure) and SDG 11 (Sustainable Cities and Communities).

- Inclusiveness and fairness for all Canadians: Better supports for veterans, help for seniors and future retirees, programs to help those who are underrepresented in the workforce find good jobs, and renewed partnerships with Indigenous Peoples all contribute to SDG 1 (No Poverty), SDG 3 (Good Health and Well-being) and SDG 10 (Reduced Inequalities).

- Combatting climate change: Support for the Pan-Canadian Framework on Clean Growth and Climate Change, investments in clean economic growth, and investments in international climate finance all contribute to SDG 7 (Affordable and Clean Energy), SDG 11 (Sustainable Cities and Communities), SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action).

Budget 2018 continues Canada’s efforts to reach the 2030 Agenda for Sustainable Development:

- Supporting equal parenting: Introducing a new Employment Insurance (EI) Parental Sharing Benefit that will increase the number of weeks of EI parental benefits by up to eight weeks for parents who agree to share parental leave will advance SDG 5 (Gender Equality) by encouraging greater equality when it comes to child care and the distribution of unpaid work within the family, while allowing flexibility for earlier returns to work.

- More help for the middle class and people working hard to join it: Introducing the Canada Workers Benefit—a strengthened and more accessible benefit based on the Working Income Tax Benefit—and strengthening the Canada Child Benefit contribute to SDG 1 (No Poverty).

- Building a healthy environment for future generations: Implementing the Pan-Canadian Approach to Pricing Carbon Pollution, including the federal carbon pollution pricing system, contributes to Canada’s plan to address climate change and grow the economy, and supports SDG 13 (Climate Action) and SDG 8 (Decent Work and Economic Growth). Extending tax support for clean energy to 2025 from 2020 will contribute to SDG 7 (Affordable and Clean Energy).

- Supporting the Feminist International Assistance Policy: New resources and tools for international assistance will help partner countries work towards achieving all of the SDGs, with achieving SDG 5 (Gender Equality) at the core of our support.

- Enhancing access to justice and reinforcing public safety: To achieve SDG 16 (Peace, Justice and Strong Institutions), various investments will be made in support of the judiciary, the court system and legal support services to help empower Canadians to better understand and exercise their legal rights. For example, the Government is continuing to support Canadian families that are experiencing separation and divorce by expanding the Unified Family Courts system. The Government is also reinforcing Canada’s public safety institutions, supporting frontline operations.

To support reporting and ensure continued progress and coordination of our efforts on the Sustainable Development Goals both domestically and internationally, the Government proposes to provide $49.4 million over 13 years, starting in 2018–19, to establish a Sustainable Development Goals Unit, and fund monitoring and reporting activities by Statistics Canada. This will enable better coordination among all levels of government, civil society organizations and the private sector on Canada’s efforts on the 2030 Agenda for Sustainable Development. It will also support the monitoring and reporting of Canada’s domestic and international efforts to ensure that all of the Sustainable Development Goals are achieved by 2030 and that no one is left behind. The Government is also proposing to provide, from existing departmental resources, up to $59.8 million over 13 years, starting in 2018–19, for programming to support the implementation of the Sustainable Development Goals.

The G7 Presidency offers Canada an opportunity to bring its people-first approach to growing a strong middle class to the international stage. By engaging other G7 countries on pressing global challenges, we can demonstrate how taking care of each other can lead to stronger growth and better outcomes.

In this coming year, Canada will use its G7 Presidency to advance the following five key priorities:

- Investing in growth that works for everyone—building a system that is fair and open, so that people have the needed support, resources and confidence to succeed.

- Preparing for jobs of the future—helping everyone get the skills they need to find and keep good jobs—not just today, but in tomorrow’s economy as well.

- Advancing gender equality and women’s empowerment—integrating gender equality and women’s empowerment considerations in all of Canada’s G7 activities, to ensure our priorities are truly inclusive.

- Working together on climate change, oceans and clean energy—investing in clean energy and technologies to protect vulnerable ecosystems and manage limited resources properly.

- Building a more peaceful and secure world—reaching out to our partners to build solutions that can deliver lasting peace while accounting for the changing nature of conflicts.

In addition, the Gender Equality Advisory Council for Canada’s G7 Presidency—co-chaired by Melinda Gates and Ambassador Isabelle Hudon—will ensure that gender equality and women’s empowerment are integrated across all themes, activities and initiatives of Canada’s G7 Presidency.

As G7 partners, we share a responsibility to ensure that all citizens benefit from our global economy, and that we leave a healthier, more peaceful, and more secure world for our children and grandchildren.

Part 3: Upholding Shared Values

Supporting the Health and Wellness of Canadians

A strong publicly funded health care system is not just a point of pride for Canadians, it is also an essential foundation for a strong, fair and prosperous country in the years to come.

In 2018–19, the Government will provide nearly $38.6 billion to the provinces and territories under the Canada Health Transfer, an increase of $1.4 billion over the previous year, to help provincial and territorial health care systems adapt, innovate and address new challenges. In addition to the Canada Health Transfer, the Government is committed to working with the provinces and territories to tackle issues that affect the health of Canadians, to improve the responsiveness of our health care system, and to close gaps where the quality or availability of health care is not at the high standard Canadians expect and deserve. Recently, federal, provincial and territorial governments worked together to find ways to strengthen the health care system in Canada, reaching new funding agreements that will provide $11 billion over 10 years to provincial and territorial governments in support of home care and mental health.

Addressing the Opioid Crisis

Canada is in the midst of an opioid crisis. In 2016 alone, more than 2,800 Canadian lives were lost to apparent opioid overdoses. British Columbia has been at the forefront of this crisis, declaring a public health emergency nearly two years ago. However, the impact of the crisis is now being felt in many communities across the country—from inner cities to suburbs as well as in northern and rural communities and in Indigenous communities. The Government is committed to taking action.

While problematic substance use has long been a reality in Canada, circumstances have fundamentally changed. Fentanyl is a highly toxic synthetic opioid which can have medical uses, but has also been introduced into Canada’s illegal drug supply. Fentanyl is being added to a variety of street drugs, without the knowledge of the people buying them.

Most illicit fentanyl in Canada is illegally diverted from China. Canada is working closely with China, the United States and other international partners to disrupt the export of illegally produced fentanyl and to better detect it if it arrives at the border.

Increased opioid use is not limited to illegal drugs. Canada is the second-highest per capita consumer of opioids in the world. Reducing prescription opioid use presents challenges since limiting access to prescription opioids may encourage people to seek more dangerous alternative sources.

People turn to illegal drugs for many reasons. Some people habitually use illegal drugs as an escape from pain and trauma. Some use illegal drugs on a recreational basis. Others began using prescription opioids, developed a dependence, and then turned to illegal drugs when prescription opioids were insufficient or unavailable. As a result, a broad range of people are being affected by Canada’s opioid crisis.

* British Columbia reports unintentional deaths related to all illicit drugs including, but not limited to, opioids.

† Information for Nunavut is not available as the territory decided to suppress all counts less than five.

‡ Expected to rise

Source: National report: Apparent opioid-related deaths in Canada (December 2017).

The former Minister of Health has described the opioid crisis as “the most serious public health issue we’re facing right now”—one that affects people of all ages and backgrounds, devastating communities and tearing apart families.

In an effort to save lives, governments, non-governmental organizations, health and public safety professionals, and individual Canadians across the country have been responding to the crisis. Since early 2016, the Government has been working with provinces and territories as well as a range of partners to address this crisis. The Government recognizes that the opioid crisis has had a significant effect on many communities. The crisis has claimed the lives of thousands of Canadians from all walks of life and has had a devastating impact on many Canadian families. The Government is committed to protecting the health and safety of all Canadians through a compassionate and collaborative approach to addressing problematic substance abuse. To help address this crisis, the Government has made new investments, introduced new legislation, and fast-tracked regulatory action in an attempt to prevent further deaths. These investments and actions are helping to support individuals, families and communities that are directly affected by the crisis.

- $100 million over five years to support the Canadian Drugs and Substances Strategy to support national measures and actions to respond to the opioid crisis

- Over $20 million in emergency financial assistance for British Columbia, Alberta and Manitoba to help these provinces respond to the overwhelming effects of the opioid crisis and address the critical needs of their citizens

- To help protect Canadians from dangerous opioids, changes were made to the Controlled Drugs and Substances Act and other Acts, to allow the Minister of Health to quickly control a new and hazardous substance and to allow border officials to open small mail items, in order to detain or seize illegal substances such as fentanyl

- To ensure that supervised consumption sites could be established in a timely manner so that treatment services are more readily available for Canadians, including streamlining the approval process for sites

- Passed the Good Samaritan Drug Overdose Act, which provides some legal protection for individuals who seek emergency help during an overdose

- Significantly reduced barriers for communities that wish to establish safe consumption sites. Building on successful harm reduction models such as Vancouver’s InSite clinic, these sites will save lives.

- Enabled access to drugs or medications authorized in other countries to respond to urgent public health needs

- Made naloxone more widely available and expedited approval of the nasal spray version

- Scheduled fentanyl precursors under the Controlled Drugs and Substances Act

Despite these significant efforts and those of many others, the number of opioid-related deaths continues to rise. It is projected that in 2017, more than 4,000 Canadians will have died as a result of opioid use.

Building on the federal actions to date, the Government proposes to provide $231.4 million over five years, starting in 2018–19, with $1.9 million in remaining amortization and $13.5 million per year ongoing, for additional measures to help address the opioid crisis. Key measures include:

- Providing one-time emergency funding of $150 million for provinces and territories for multi-year projects that improve access to evidence-based treatment services.

- Launching a public education campaign to address stigma that creates barriers for those seeking treatment.

- Improving access to public health data and analysis to better understand the opioid crisis and inform strategies to address it.

- Equipping border agents with detection and identification tools to intercept fentanyl and other substances at ports of entry.

- Expanding the Substance Use and Addictions Program to develop innovative approaches to treatment and prevention.

In addition, as noted in Chapter 3, Budget 2018 also proposes targeted and specific investments in First Nations communities with high needs to address problematic substance use, including opioids.

Taken together, these investments will help to cut off the supply of dangerous drugs by preventing the illegal import of substances, will help people living with addiction and substance abuse disorders get the help they need, and will help educate more Canadians about the need to support those who seek treatment.

Advisory Council on the Implementation of National Pharmacare

The Government has published proposed changes to the Patented Medicines Regulations, representing the first major update to the regulations in more than 20 years. These proposed amendments to the regulations are estimated to lower drug prices for Canadians by $12.6 billion over 10 years.

In addition, the Government is collaborating with the provinces and territories in the pan-Canadian Pharmaceutical Alliance (pCPA). The Alliance negotiates on behalf of Canada’s public drug plans to lower prices on brand name drugs and works to reduce the cost of generic medications as well. The pCPA's efforts to date have led to over $1.2 billion a year in savings for Canadians.

Canadians are proud of our publicly funded, universal medicare system which is based on need and not on ability to pay. Yet, we know that at least one in ten Canadians cannot afford the prescription drugs they need. Every year, almost one million Canadians give up food and heat to afford medicines. And those who can pay for their drugs face some of the highest costs among the world’s most advanced countries. The unaffordability of many medications leads to Canadians being less healthy, with significantly higher health care costs for us all.

The Government has demonstrated its commitment to improving access to necessary prescription medications, by taking concrete steps to lower drug prices, streamline regulatory processes for drug approval, support better prescribing practices and explore a national drug formulary. These steps will significantly improve the accessibility and affordability of prescription medications, but there is an opportunity to do even more.

As part of Budget 2018, the Government is announcing the creation of an Advisory Council on the Implementation of National Pharmacare. We are appointing Dr. Eric Hoskins, who recently served as the Minister of Health of Ontario, to chair this initiative. He and board members will begin a national dialogue that will include working closely with experts from all relevant fields as well as with national, provincial, territorial and Indigenous leaders. The Advisory Council will report to the federal Minister of Health and the Minister of Finance and will conduct an economic and social assessment of domestic and international models, and will recommend options on how to move forward together on this important subject.

A Community-Based Approach to Dementia

More than 400,000 Canadian seniors live with dementia, including Alzheimer’s disease. Women are disproportionately affected, making up two-thirds of this population. Many women also take on the caregiving responsibilities for family members living with dementia. Budget 2018 proposes to provide $20 million over five years, starting in 2018–19, and $4 million per year ongoing, to the Public Health Agency of Canada to support community-based projects that address the challenges of dementia. Projects could include programs that provide mental health supports and information about self-care for family caregivers, or initiatives that help Canadians locate resources in their communities quickly, including information about best practices for providing care for people living with dementia. This new funding will help to improve the quality of life of people living with dementia and ensure that caregivers—who are predominantly women—have access to the resources they need, including mental health supports.

Supporting a Healthy Seniors Pilot Project in New Brunswick

Canada’s population is aging—the most recent demographic information from Statistics Canada shows that approximately 17 per cent of the Canadian population are age 65 or older, up from about 15 per cent five years earlier.

Notably, women make up the majority of the Canadian population over the age of 65. Senior women face different challenges than senior men—women tend to live longer than men, and as such more senior women live alone than their male counterparts. In addition, the responsibility of care for aging spouses and parents predominantly falls on women.

As Canada’s population continues to age, we need to be prepared for the challenges that seniors, especially senior women, face. That is why Budget 2018 proposes to provide $75 million in 2018–19 through the Public Health Agency of Canada to support the Healthy Seniors Pilot Project in New Brunswick. New Brunswick is uniquely suited to undertake this pilot project as its population is aging faster than the rest of Canada. A higher proportion of New Brunswick’s population is over the age of 65—compared to other provinces—and the province is home to a measurably higher proportion of women over the age of 65, relative to the Canadian average.

The Healthy Seniors Pilot Project will support a range of research initiatives to examine how governments can better support seniors in their home, communities and care facilities. This project will help us better understand the gendered impacts of an aging population, improve the quality of life for our senior citizens, and help us lay the groundwork for the dissemination of best practices in supporting healthy aging for all Canadians.

Expanding Eligibility Under the Thalidomide Survivors Contribution Program

The Thalidomide Survivors Contribution Program was established in 2015 to provide financial assistance for thalidomide survivors. The program includes a tax-free, lump sum payment to each survivor to help cover urgent health care needs, ongoing annual payments based on level of disability, and an Extraordinary Medical Assistance Fund to support survivors with extraordinary medical expenses such as specialized surgery not otherwise covered by provincial/territorial health care plans or home or vehicle adaptations.

There is a concern that some thalidomide survivors may have been excluded by current eligibility criteria since, given the passage of time, it is difficult for claimants to obtain documentary proof that they are survivors. To address this concern, the program will be expanded to help ensure that all eligible thalidomide survivors receive the financial support they need. Additional details will be announced later this spring. All payments to eligible individuals will continue to be tax-free and annual payments will continue to keep pace with the cost of living.

Support for Canadians Impacted by Autism Spectrum Disorder

Autism spectrum disorder is a complex, lifelong neurodevelopmental disorder that can have serious health, social and financial consequences for Canadian families.

Through Budget 2018, the Government proposes to provide $20 million over five years for two new initiatives to better support the needs of Canadians experiencing autism spectrum disorder and their families. This will include the creation an Autism-Intellectual-Developmental Disabilities National Resource and Exchange Network (AIDE) to develop online resources, an inventory of services, employment opportunities and local programming for families across the country, based on their specific needs. The Network would be led by the Pacific Autism Family Network and the Miriam Foundation. Funding of $9.1 million will also be provided to the Public Health Agency of Canada to support community-based projects that will support innovative program models, help reduce stigma, and support the integration of health, social and educational programs to better serve the complex needs of families.

Expanding the Medical Expense Tax Credit for Psychiatric Service Dogs

The Government recognizes that psychiatric service dogs can play an important role in helping Canadians cope with conditions like post-traumatic stress disorder. Through Budget 2018, the Government proposes to expand the Medical Expense Tax Credit to recognize costs for these animals for the 2018 and future tax years.

This measure will directly benefit veterans and others in the disability community who rely on psychiatric service dogs, and complements the work of organizations that support them, such as the Royal Canadian Legion, and Paws Fur Thought, which provides service dogs to veterans and first responders with invisible disabilities.

Improving Compliance with the Canada Health Act

The Government contributes to the delivery of Canada’s publicly funded health care system through the Canada Health Transfer, which will provide nearly $38.6 billion to provinces and territories in 2018–19. Under the Canada Health Act, the Minister of Health may direct deductions from Canada Health Transfer payments if a province or territory permits extra-billing and user fees in the delivery of public health care. To encourage provinces and territories to take corrective action to align their public health care systems with the principles of the Canada Health Act, as well as to recognize those that have addressed issues of non-compliance, the Government is proposing legislative amendments to allow Canada Health Transfer deductions to be reimbursed when provinces and territories have taken the steps necessary to eliminate extra-billing and user fees in the delivery of public health care.

Taking Action to Reduce Smoking

Tobacco use is the leading preventable cause of disease and premature death in Canada. Combined federal/provincial/territorial tobacco control efforts over the last several years have contributed to a decline in smoking rates. Despite this progress, over 5 million Canadians continue to use tobacco products. Every day, Canadians are getting sick or dying because of tobacco use and exposure to second hand smoke. The Government is committed to helping Canadians with an addiction to tobacco, and to protecting the health of young people and nonsmokers.

Renewing and Enhancing the Federal Tobacco Control Strategy

The Federal Tobacco Control Strategy is a comprehensive, integrated and sustained tobacco control program aimed at reducing tobacco-related disease and death.

Building on existing funding, the Government will renew and enhance the Strategy by proposing to provide $80.5 million over five years, starting in 2018–19, with $17.7 million per year ongoing. Public Safety Canada will renew agreements with the Akwesasne Mohawk Police Service and the Kahnawake Peacekeepers to address organized crime activities at or near community lands, including contraband tobacco, and funding will also be provided to the Royal Canadian Mounted Police to support ongoing law enforcement efforts to reduce contraband tobacco. Funding will also be provided to Health Canada and the Public Health Agency of Canada to support targeted actions, including in Indigenous communities, to encourage the prevention of tobacco use and help Canadians quit smoking. This enhanced funding builds on the $43 million spent annually for the Federal Tobacco Control Strategy and will help to replace previous cuts in spending over the last decade so that Canada can remain a leader in tobacco control.

Tobacco Taxation

Every 14 minutes, a Canadian dies from a tobacco-related illness; that's 37,000 Canadians per year. Despite our efforts, there are still millions of Canadians who use tobacco and about 115,000 Canadians start smoking every year.

Tobacco taxation is known to be one of the most effective ways to reduce smoking, and to keep tobacco products out of the hands of young people. To that end, the Government proposes to advance the inflationary adjustments for tobacco excise duty so that they occur on an annual basis rather than every five years.

The Government also proposes to increase the excise duty by an additional $1 per carton of 200 cigarettes, along with corresponding increases to the excise duty rates on other tobacco products.

Cannabis Taxation, Regulation and Public Protection: Legalizing Cannabis in 2018

- Made strategic investments of $546 million over five years to implement and enforce the new federal legislative and regulatory framework.

- Made significant investments of $150 million over six years to train and equip law enforcement to detect and deter drug-impaired driving.

- Launched public education and awareness activities, having invested $46 million, on drug-impaired driving and health risks.

- Communicated the new laws and enforcement framework to police, including online information and training materials, to ensure law enforcement is well informed to apply the new legislation, if approved.

- Launched and released the results of the new Canadian Cannabis Survey to monitor patterns of use in Canada.

The Government has committed to legalize and strictly regulate and restrict access to cannabis in order to keep it out of the hands of young Canadians, and keep profits away from criminals and organized crime. To that end, in 2017 the Government introduced Bill C-45, the Cannabis Act, to establish a strict system for the cultivation, production, distribution, sale and possession of cannabis in Canada, and made strategic investments to implement and enforce the new federal legislative framework.

Impaired driving is the leading criminal cause of death and injury in Canada. To strengthen our impaired driving laws to keep Canada’s roads safe, the Government has also introduced legislation to better protect the public from both drug- and alcohol-impaired drivers.

Cannabis Taxation

To keep cannabis out of the hands of youth and profits out of the hands of criminals, the Government is proposing an excise duty framework for cannabis products.

Under the framework, excise duties will be imposed on federally licensed producers at the higher of a flat rate applied on the quantity of cannabis contained in a final product, or a percentage of the sale price of the product sold by a federal licensee.

The excise duty framework will generally apply to cannabis products that contain Tetrahydrocannabinol (THC), the primary psychoactive compound of cannabis. Recognizing the non-addictive, potentially therapeutic role of low-THC cannabidiol oils, which are sometimes used with children facing certain medical conditions, products that contain low amounts of THC will generally not be subject to the excise duty. Pharmaceutical products derived from cannabis will also be exempt, provided that the cannabis product has a Drug Identification Number and can only be acquired through a prescription. Work will be undertaken by Health Canada to evaluate the drug review and approval process so that Canadians in need have better access to an array of medicinal options. As part of this work, the Government will also examine options for establishing a rebate program to retroactively reimburse Canadians an amount in recognition of the federal portion of the proposed excise duty that was imposed on equivalent products prior to them being given a Drug Identification Number.

In December 2017, the federal government reached an agreement with most provincial and territorial governments to keep duties on cannabis low, the higher of $1 per gram or 10 per cent of a product price, through a federally administrated coordinated framework. This tax room will be shared on a 75/25 basis, with 75 per cent of duties going to provincial and territorial governments and the remaining 25 per cent to the federal government. The federal portion of cannabis excise duty revenue will be capped at $100 million annually for the first two years after legalization. Any federal revenue in excess of $100 million will be provided to provinces and territories. As part of this arrangement, it is the federal government’s expectation that a substantial portion of the revenues from this tax room provided to provinces and territories will be transferred to municipalities and local communities, who are on the front lines of legalization.

The excise duty framework would come fully into effect when cannabis for non-medical purposes becomes accessible for retail sale.

Cannabis Public Education

The experience of other jurisdictions that have legalized cannabis has underlined the importance of ensuring that Canadians are well informed about cannabis. The Government proposes to provide $62.5 million over five years, starting in 2018–19, for public education initiatives. This funding will support the involvement of community-based organizations and Indigenous organizations that are educating their communities on the risks associated with cannabis use. The Government also proposes to provide $10 million over five years for the Mental Health Commission of Canada to help assess the impact of cannabis use on the mental health of Canadians, and $10 million over five years to the Canadian Centre on Substance Use and Addiction to support research on cannabis use in Canada. These two investments will help inform future policy development, building on earlier significant public education investments of $46 million that have helped inform Canadians. With these investments, Canada’s spending on public education related to cannabis will be on par with the per-capita amounts spent by the State of Washington in its own experience with the legalization and strict regulation of cannabis.

Support for Canada’s Veterans

The Government of Canada is committed to supporting Canada's veterans and their families. Canada owes an enormous debt of gratitude to the women and men who have served in uniform and it is our responsibility to make sure that they are taken care of. On December 20, 2017, the Government unveiled its Pension for Life plan, a program designed to reduce the complexity of support programs available to veterans and their families. It proposes a broader range of benefits, including financial stability, to Canada's veterans, with a particular focus on supports for veterans with the most severe disabilities.

A monthly, tax-free payment for life of up to $1,150 for ill and injured veterans.

A monthly, tax-free payment for life of up to $1,500 for veterans whose injuries greatly impact their quality of life.

Monthly income replacement at 90 per cent of a veteran’s pre-release salary.

The Government will introduce legislation for the Pension for Life plan, which will include the choice of tax-free monthly payments for life to recognize pain and suffering caused by a service-related disability up to a maximum monthly amount of $2,650 for those most severely disabled; and income replacement for veterans who are facing barriers returning to work after military service at 90 per cent of their pre-release salary.

Pension for Life means that a 25-year-old retired corporal who is 100 per cent disabled would receive more than $5,800 in monthly support. For a 50-year-old retired major who is 100 per cent disabled, monthly support would be almost $9,000.

These new elements represent an additional investment of almost $3.6 billion to support Canada's veterans. When combined with services and benefits to help veterans in a wide-range of areas—including education, employment, caregiver support and physical and mental health—already announced in previous budgets, the Government of Canada’s investments since 2016 add up to nearly $10 billion.

Jamal spent 25 years in service as a combat engineer in a field squadron. While deployed on Operation ATHENA, he was critically injured when his vehicle hit an improvised explosive device. Both his legs were amputated above the knee. After stabilizing with the Canadian Armed Forces Joint Personnel Support Unit, Jamal was medically released. His sister, Nadyia, moved in with him to act as his caregiver.

With a disability assessment of 100 per cent, Jamal will receive monthly tax-free Pain and Suffering Compensation and Additional Pain and Suffering Compensation of $2,550 (in 2017 dollars), or about $30,000 annually. This will be paid for life. He will also receive a tax free lump sum Critical Injury Benefit of about $72,000 to address the immediate impacts of his traumatic injury.

In addition, Jamal will receive an Income Replacement Benefit of 90 per cent of his salary at release, equalling about $6,400 per month, or about $77,000 annually after-tax. Once Jamal reaches the age of 65, his Income Replacement Benefit will continue at a reduced rate.

Jamal is still coming to terms with both his life after service and his new physical reality. His Veterans Affairs Canada case manager arranges for an occupational therapist, a social worker and a psychologist to work with him. Jamal has both a wheelchair and a motor scooter to give him greater independence; the cost of both is covered by Veterans Affairs Canada. He also receives grants through the Veterans Independence Program to cover house cleaning and work around his property, as well as snow removal in the winter. He has also arranged for Nadyia to receive the $1,000 per month Caregiver Recognition Benefit to recognize her contribution in support of his well-being.

Cemetery and Grave Maintenance

Veterans Affairs Canada is committed to honouring the sacrifice of our veterans by maintaining the graves and grave markers for Canadians who were buried or had grave markers erected by the Government of Canada. These sites and markers recognize the bravery and commitment of those who served our country and they must be maintained. There are about 110,000 Canadians buried overseas as a result of the two World Wars, as well as 200,000 graves in Canada for veterans who were low income or whose death was related to their military service.

In 2017, an evaluation by Veterans Affairs Canada (VAC) found that there was a backlog of 45,000 graves cared for by VAC in Canada requiring repairs. With existing levels of funding, the evaluation found that it would take more than 17 years to complete the needed repairs. To eliminate the current backlog of repairs in the next 5 years, the Government proposes to provide funding $24.4 million over five years, starting in 2018–19. The funding will be used for cleaning, restoring or replacing headstones, and fixing foundation issues.

Better Services for Veterans

Since 2016, the Government has put in place substantial improvements to the benefits and services available for veterans. For example, the Government has raised financial supports for veterans and caregivers, introduced new education and training benefits and expanded a range of services available to the families of medically released veterans.

With additional benefits and services now becoming available, more and more veterans are coming forward to get the help they need. For example, over the past two years, Veterans Affairs Canada has seen a 32 per cent increase in the number of applications for disability benefits. To keep up with the rise in demand and ensure that veterans get services and benefits when they need them, the Government proposes to provide $42.8 million over two years, starting in 2018–19, to increase service delivery capacity at Veterans Affairs Canada.

Supporting Canada’s Heritage and Cultural Diversity

Canada’s heritage and culture plays a vital part in the day-to-day lives of Canadians. To support this important sector of our economy, Budget 2018 proposes investments that will ensure that Canada’s heritage can be celebrated and shared by more Canadians in more communities across the country.

Supporting Canada’s Official Languages

Canada’s linguistic duality, which for 50 years has been enshrined in the Official Languages Act, is an integral part of Canada’s history and identity. Strong official language minority communities not only celebrate our shared history and identity, they are essential to Canada’s competitiveness in an increasingly globalized world. The Government understands the challenges that official language minority communities are facing, and has developed an Action Plan for Official Languages 2018-2023 to help address some of these challenges. In addition to serving existing communities, providing services and initiatives in both official languages is key to improving the integration and settlement of new immigrants. By promoting official bilingualism and empowering our communities to tell their stories, we strengthen Canada’s diversity, strengthen our communities and increase our influence around the world.

The Government proposes to provide $400.0 million in new funding over five years, starting in 2018–19, with $88.4 million per year ongoing, in support of the Action Plan for Official Languages 2018-2023. Key measures will be implemented by Canadian Heritage, Employment and Social Development Canada, Health Canada, the Public Health Agency of Canada, Statistics Canada, and Immigration, Refugees and Citizenship Canada and will include funding for:

- Community organizations to ensure that they are able to continue to provide important services for individuals in their communities, to welcome newcomers, and to foster early childhood development.

- Cultural, artistic and heritage activities, including community theatre, art workshops, and activities showcasing local heritage or history.

- French- and English-language minority community radio stations and newspapers.

- Development of an interactive application to make it easy for Canadians to learn English or French as a second language.

- Improved access to services for English-speaking communities of Quebec in their official language.

- The recruitment and retention of teachers who teach French and English as a second language.

- Minority official language schools, $20 million for a variety of early learning and child care initiatives.

Taken together, the Action Plan will help improve services in official language minority communities and promote bilingualism across Canada.

Strengthening Multiculturalism and Addressing the Challenges Faced by Black Canadians

Diversity is Canada’s strength and a cornerstone of Canadian identity. Recent domestic and international events, like the rise of ultranationalist movements, and protests against immigration, visible minorities and religious minorities, remind us that standing up for diversity and building communities where everyone feels included are as important today as they ever were.

To provide support for events and projects that help individuals and communities come together, the Government proposes to provide $23 million over two years, starting in 2018–19, to increase funding for the Multiculturalism Program administered by Canadian Heritage. This funding would support cross-country consultations on a new national anti-racism approach, would bring together experts, community organizations, citizens and interfaith leaders to find new ways to collaborate and combat discrimination, and would dedicate increased funds to address racism and discrimination targeted against Indigenous Peoples and women and girls.

As a first step toward recognizing the significant and unique challenges faced by Black Canadians, the Government also proposes to provide $19 million over five years that will be targeted to enhance local community supports for youth at risk and to develop research in support of more culturally focused mental health programs in the Black Canadian community. In addition, with the creation of the new Centre for Gender, Diversity and Inclusion Statistics, announced in Chapter 1, the Government is committed to increase the disaggregation of various data sets by race. This will help governments and service providers better understand the intersectional dimensions of major issues, with a particular focus on the experience of Black Canadians.

Investing in Canadian Content

The Canada Media Fund is a non-profit organization that fosters, promotes, develops and finances the production of Canadian content for all audiovisual media platforms. The Canada Media Fund receives financial contributions from the Government and Canada’s cable, satellite and Internet protocol television distributors.

With Canadians increasingly watching content online, contributions from the broadcasting sector to the Canada Media Fund have started to decrease in step with their declining revenues. To address this issue, the Government has committed to increase its contribution in order to maintain the level of funding in the Canada Media Fund.

The Government proposes to provide $172 million over five years, starting in 2018–19, with $42.5 million per year ongoing, to maintain the level of funding in the Canada Media Fund at the 2016–17 level. While the actual Government contributions will fluctuate depending on the broadcasting sector revenues, this approach will provide a stable source of funding to develop Canadian content and support good jobs, including for our writers, producers, directors, actors and crews.

Supporting Local Journalism

As more and more people get their news online, and share their interests directly through social media, many communities have been left without local newspapers to tell their stories.

To ensure trusted, local perspectives as well as accountability in local communities, the Government proposes to provide $50 million over five years, starting in 2018–19, to one or more independent non-governmental organizations that will support local journalism in underserved communities. The organizations will have full responsibility to administer the funds, respecting the independence of the press.

Further, consistent with the advice laid out in the Public Policy Forum’s report on news in the digital age, over the next year the Government will be exploring new models that enable private giving and philanthropic support for trusted, professional, non-profit journalism and local news. This could include new ways for Canadian newspapers to innovate and be recognized to receive charitable status for not-for-profit provision of journalism, reflecting the public interest that they serve.

More Women and Girls in Sport

Canada’s women and girl athletes do us proud at high-performance sport events, and regularly achieve podium success at Senior World Championships, and Olympic and Paralympic Games. However, fewer Canadian women and girls participate in sport and physical activity than men and boys—Statistics Canada estimates that in 2010 approximately one-third of Canadian men and one-sixth of Canadian women regularly participated in sport. Men are also approximately two to three times more likely to be coaches, officials or in other leadership positions than women.

We need to create an environment where women and girls feel comfortable engaging in physical activity and sport—at all ages and all levels. To do so, we need to better understand why women and girls choose not to participate in sport, or move into the senior ranks of coaching or management of sports, and then work to remove the barriers that exist.

This is why through Budget 2018, the Government is setting a target to achieve gender equality in sport at every level by 2035, and proposes to provide an initial $30 million over three years to support data and research and innovative practices to promote women and girls’ participation in sport, and provide support to national sports organizations to promote the greater inclusion of women and girls in all facets of sport.

Supporting ParticipACTION

Inactivity is now the fourth leading cause of death worldwide, responsible for an estimated 3.2 million deaths each year. In Canada, the vast majority of Canadians do not meet recommended levels of physical activity, with 9 out of 10 children and youth not meeting Canadian Physical Activity Guidelines. ParticipACTION is a national non-profit organization, originally established in 1971, whose mission is to make physical activity a vital part of everyday life.

The Government proposes to provide $25 million over five years, starting in 2018–19, for ParticipACTION to increase participation in daily physical activity among Canadians.

Supporting Special Olympics

Special Olympics is a global grassroots movement, bringing community programs and competition opportunities to more than 4.5 million children, youth and adults with intellectual disabilities across 170 countries. Special Olympics Canada is dedicated to enriching the lives of Canadians with an intellectual disability through sport.