This page has been archived on the Web

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 4 – Tax Fairness for the Middle Class

Introduction

The Government remains concerned about income inequality and is taking action to ensure that the tax system is fair, both in its design and administration.

In 2017, the Government of Canada will continue to take concrete steps to close tax loopholes, crack down on tax evasion, improve tax relief for the middle class, and eliminate measures that are ineffective and inefficient, and that disproportionately benefit the wealthy.

Over the past year, the Government has put in place a plan to grow the economy in a way that works for the middle class and those working hard to join it. It has cut taxes for nearly 9 million middle class Canadians and targeted the Canada Child Benefit to parents who need it most.

In addition, the Government took strong action to fight tax evasion and avoidance, both at home and around the world. It boosted funding to the Canada Revenue Agency (CRA)—investing $444 million in the CRA’s ability to detect, audit and combat tax evasion and avoidance. These measures will enable the CRA to recover $2.6 billion in additional federal revenues. Initial steps have also been taken to prevent wealthy individuals from using private corporations to inappropriately reduce their tax payable.

Budget 2017 also proposes targeted measures to support a resilient financial sector that contribute to a strong and growing economy.

A Fair and Efficient Tax System for Canadians

In December 2015, the Government took decisive action to make the tax system fairer.

The Government’s first action was to raise taxes on the wealthiest one per cent, in order to cut taxes for the middle class. When middle class Canadians have more money to invest, save and grow the economy, all Canadians benefit.

Next, the Government replaced the previous child benefit system with the new Canada Child Benefit—one that is simpler, more generous, better targeted and tax-free. Because the benefit is tied to income, it provides greater support to those who need it most: single-parent families (single mothers in particular) and low-income families. Today, about 300,000 fewer children live below the poverty line and, by the end of this year, child poverty will have been reduced by 40 per cent from what it was in 2014.

In Budget 2016, the Government also committed to undertake a wide-ranging review of the increasingly complex tax expenditures that now exist. The review’s objective is to eliminate poorly targeted and inefficient tax measures, and will allow the Government to identify opportunities to reduce tax benefits that unfairly help the wealthiest Canadians rather than the middle class and those working hard to join it.

As described below, Budget 2017 takes important steps to further enhance fairness in the tax system and to improve its efficiency and effectiveness. Specifically, Budget 2017 takes action to:

- Close tax loopholes that result in unfair tax advantages for some at the expense of others.

- Crack down on tax evasion and combat tax avoidance.

- Make existing tax relief for individuals and families more effective and accessible.

- Eliminate ineffective and inefficient tax measures.

- Provide greater consistency in the tax treatment of similar types of income and with other government priorities and current economic conditions.

A Tax System That’s Fair for Middle Class Canadians

Fairness is essential to ensuring Canadians have confidence in their tax system. The commitment to tax fairness is what drives the Government to close loopholes and to ensure that no taxpayer is able to get a tax advantage at the expense of those who pay their fair share.

Fairness is also what drives the Government to ensure that the CRA has the resources to enforce tax laws, and it motivates the Government to actively participate in global efforts that combat international tax evasion and avoidance. Taken together, these efforts support an economy that works for the middle class.

Tax Planning Using Private Corporations

The review of federal tax expenditures highlighted a number of issues regarding tax planning strategies using private corporations, which can result in high-income individuals gaining unfair tax advantages. A variety of tax reduction strategies are available to these individuals that are not available to other Canadians. These strategies include:

- Sprinkling income using private corporations, which can reduce income taxes by causing income that would otherwise be realized by an individual facing a high personal income tax rate to instead be realized (e.g., via dividends or capital gains) by family members who are subject to lower personal tax rates (or who may not be taxable at all).

- Holding a passive investment portfolio inside a private corporation, which may be financially advantageous for owners of private corporations compared to otherwise similar investors. This is mainly due to the fact that corporate income tax rates, which are generally much lower than personal rates, facilitate accumulation of earnings that can be invested in a passive portfolio.

- Converting a private corporation’s regular income into capital gains, which can reduce income taxes by taking advantage of the lower tax rates on capital gains. Income is normally paid out of a private corporation in the form of salary or dividends to the principals, who are taxed at the recipient’s personal income tax rate (subject to a tax credit for dividends reflecting the corporate tax presumed to have been paid). In contrast, only one-half of capital gains are included in income, resulting in a significantly lower tax rate on income that is converted from dividends to capital gains.

A number of measures have been put in place over the years to limit the scope of some of these planning arrangements, but such measures have not always been fully effective. The Government is therefore further reviewing the use of tax planning strategies involving private corporations that inappropriately reduce personal taxes of high-income earners. In doing so, the Government will also consider whether there are features of the current income tax system that have an inappropriate, adverse impact on genuine business transactions involving family members. The Government intends to release a paper in the coming months setting out the nature of these issues in more detail as well as proposed policy responses. In addressing these issues, the Government will ensure that corporations that contribute to job creation and economic growth by actively investing in their business continue to benefit from a highly competitive tax regime.

Ensuring Tax Integrity

A fair tax system requires constant attention. Ongoing legislative adjustments are needed to ensure that the rules are functioning as intended and that they do not result in some taxpayers paying less than their fair share. Effective administration and enforcement of tax laws are also key factors in the fight to combat tax evasion and aggressive tax avoidance, both at home and abroad.

Closing Tax Loopholes

Budget 2017 proposes a number of actions to strengthen the integrity of the tax system. Specifically, it proposes to:

- Prevent the avoidance or deferral of income tax through the use of offsetting derivative positions in straddle transactions.

- Extend to Registered Education Savings Plans and Registered Disability Savings Plans anti-avoidance rules similar to the ones applicable in connection with Tax-Free Savings Accounts and Registered Retirement Savings Plans.

- Clarify the intended meaning of “factual control” under the Income Tax Act for the purpose of determining who has control of a corporation in order to prevent inappropriate access to supports such as the small business tax rate and the enhanced refundable 35-per-cent Scientific Research and Experimental Development Tax Credit for small businesses.

- Prevent the avoidance of tax on income from the insurance of Canadian risks by extending the foreign-affiliate base erosion rules to foreign branches of Canadian life insurers.

To ensure the tax system operates as fairly and effectively as possible moving forward, the Government will continue to study, identify and address tax loopholes and tax planning schemes.

Cracking Down on Tax Evasion and Combatting Tax Avoidance

Tax evasion and avoidance act to undermine the hard work of Canadian individuals and businesses that play by the rules. The Government will continue to crack down on these unfair practices to help ensure that all taxpayers pay their fair share.

Budget 2017 will invest an additional $523.9 million over five years to prevent tax evasion and improve tax compliance. The investment will be used to fund new initiatives and extend existing programs that ensure our tax system is fair and equitable for all Canadians.

The measures in Budget 2017 will build on previous investments to support the CRA in its continued efforts to crack down on tax evasion and combat tax avoidance by:

- Increasing verification activities.

- Hiring additional auditors and specialists with a focus on the underground economy.

- Developing robust business intelligence infrastructure and risk assessment systems to target high-risk international tax and abusive tax avoidance cases.

- Improving the quality of investigative work that targets criminal tax evaders.

The CRA has a proven track record of meeting expectations from targeted compliance interventions. Budget 2017 accounts for the expected revenue impact of $2.5 billion over five years from measures that crack down on tax evasion and combat tax avoidance, resulting in a return on investment of five to one. These amounts do not reflect the gain that will be realized by provinces and territories, whose tax revenues will also increase as a result of these initiatives.

Combatting International Tax Avoidance and Evasion

Canada has worked together with the other members of the Group of 20 (G20) and the Organisation for Economic Co-operation and Development (OECD) to develop recommendations that will address base erosion and profit shifting (BEPS). BEPS refers to international tax planning arrangements used by multinational enterprises to unfairly minimize their taxes. For example, some enterprises will shift their taxable profits away from the jurisdiction where the underlying economic activity has taken place in order to avoid paying their fair share.

The Government remains firmly committed to protecting Canada’s tax system, and has implemented—or is in the process of implementing—the measures agreed to as minimum standards under the BEPS project:

- Legislation was enacted in December 2016 that requires large multinational enterprises to file country-by-country reports. These reports provide information about the international distribution of the activities of a corporate group. This information will give tax authorities in each country a clearer picture of where the operations of the group in their particular jurisdiction fit into the group’s global operations. This will enable them to better assess high-level avoidance risks such as the potential for mispricing of transactions between entities of the group in different jurisdictions.

- Canada participated in the development of a multilateral instrument to streamline the implementation of tax treaty-related BEPS recommendations, including those addressing treaty abuse. The multilateral instrument is a tax treaty that many countries could sign modifying certain provisions of existing bilateral tax treaties without the need for separate bilateral negotiations. The Government is pursuing signature of the multilateral instrument and is undertaking the necessary domestic processes to do so.

- Canada has committed to the effective and timely resolution of tax treaty-related disputes by improving the mutual agreement procedure in Canada’s tax treaties.

- The CRA has begun the spontaneous exchange with other tax administrations of tax rulings that could otherwise give rise to BEPS concerns. As part of the effort to counter harmful tax practices, this helps ensure that revenue authorities are not granting to taxpayers non-transparent “private” rulings that guarantee favourable tax treatment with respect to a transaction.

With respect to other BEPS recommendations:

- Canada has robust “controlled foreign corporation” rules in the form of our foreign accrual property income regime, which helps prevent taxpayers from avoiding Canadian income tax by shifting income into foreign subsidiaries.

- Canada has implemented requirements for taxpayers, as well as promoters and advisors, to disclose specified tax avoidance transactions to the CRA.

- The CRA is applying revised international guidance on transfer pricing by multinational enterprises. These guidelines provide an improved interpretation of the requirement in the tax laws of Canada and most other countries that transactions between entities of a corporate group in different jurisdictions should be priced as if they were arm’s length transactions.

The Government will continue to work with its international partners to ensure a coherent and consistent response to fight tax avoidance through BEPS.

The Government is also strengthening its efforts to combat international tax evasion through enhanced sharing of information between tax authorities. The automatic exchange of information with respect to financial accounts held by non-residents—under the framework of the Common Reporting Standard developed by the OECD—is an important tool to promote compliance, combat international tax evasion, and ensure that taxpayers are reporting their income from all sources. To date, more than 100 jurisdictions have committed to implement the new standard. Canada recently enacted legislation to implement the standard starting on July 1, 2017, which will allow for first exchanges of information with other countries in 2018.

Businesses should pay their fair share for the services the Government provides. As part of its efforts to modernize services and deliver value to Canadians, the Government is proposing to make changes to the legislative framework governing fee setting for government services.

The proposed changes will streamline the fee setting process while ensuring continued accountability and oversight. In addition, the Government proposes to implement an automatic inflation escalator to allow existing business fees to keep pace with costs.

A modern business fee setting regime will support more cost-effective delivery of services. For example, Canadians could benefit from enhanced government business services such as approval processes for prescription drugs, medical devices and vehicles.

Consideration will also be given to modernizing the framework for recovering costs for certain northern pipeline projects, and, if appropriate, amendments would be brought forward.

A Better, More Efficient Tax System

The Government remains committed to building a fair tax system that benefits the middle class and those working hard to join it. The review of federal tax expenditures identified opportunities to make existing tax measures more effective, equitable and accessible to Canadians. The review also found a number of tax measures that could be eliminated because they are inefficient or no longer relevant. In other cases, the review identified tax changes that could improve consistency in the treatment of similar kinds of income and the consistency of tax measures with other priorities of the Government and current economic conditions. The measures proposed in Budget 2017 will lead to a simpler and fairer tax system.

Tax Relief for Individuals and Families

Budget 2017 will simplify and improve existing tax measures for caregivers, persons with disabilities and students.

Simplifying the Caregiver Credit System (2017)

Infirm Dependant Credit

Income phase-out range: $6,902-$13,785

Maximum credit amount: $6,883Caregiver Credit

Income phase-out range: $16,163-$20,895

(for persons with infirmities/disabilities: $16,163-$23,045)

Maximum credit amount: $4,732 (if infirm $6,882)Family Caregiver Tax Credit

Income phase-out range: variable

Maximum credit amount: $2,150

Canada Caregiver Credit

Income phase-out range: $16,163-$23,046

Maximum credit amount: $6,883 (spouses/common-law partners and minor children: $2,150)

Ann and Marie

Ann provides care for her sister Marie who lives nearby. Marie has chronic pain and cannot work, but she receives $14,000 per year from social assistance and has managed to save a little bit over the years. She depends on her sister Ann for help with paying her rent, buying groceries and other chores.

Ann currently doesn’t qualify for tax relief under the existing caregiver credits because of Marie’s income. But under the new Canada Caregiver Credit, Ann will be able to claim $6,883 this year, which represents $1,032 in tax relief.

Jayden and Zach

On top of her full-time job, Jayden has cared for her husband Zach since an accident left him unable to work. Zach receives $15,000 per year from the Canada Pension Plan disability benefit.

Under the new Canada Caregiver Credit, Jayden will be able to claim $2,150, which represents $323 in tax relief that she doesn’t currently qualify to receive.

A New Canada Caregiver Credit

The current caregiver credit system that applies to Canadians who are caring for their loved ones is confusing and does not serve families well. The existing Caregiver Credit, Infirm Dependant Credit and Family Caregiver Tax Credit each have different eligibility rules.

Budget 2017 proposes to simplify the existing system. It will replace the Caregiver Credit, Infirm Dependant Credit and Family Caregiver Tax Credit with a single new credit: the Canada Caregiver Credit. This new, non-refundable credit will provide better support to those who need it the most, apply to caregivers whether or not they live with their family member, and help families with caregiving responsibilities.

The new Canada Caregiver Credit will provide tax relief on an amount of:

- $6,883 (in 2017) in respect of expenses for care of dependent relatives with infirmities (including persons with disabilities)—parents, brothers and sisters, adult children, and other specific relatives.

- $2,150 (in 2017) in respect of expenses for care of a dependent spouse/common-law partner or minor child with an infirmity (including those with a disability).

The Canada Caregiver Credit will extend tax relief to more caregivers, particularly those providing care to dependent relatives with infirmities or disabilities who do not live with their caregivers, by increasing the income threshold for the dependant at which the credit begins to phase out. The Canada Caregiver Credit will start to be reduced when the dependant’s net income is above $16,163 (in 2017). This income threshold, along with the amounts for the credit, will be indexed to inflation for taxation years after 2017.

Families will be able to take advantage of the new Canada Caregiver Credit as soon as the 2017 tax year. This measure will provide $310 million in additional tax relief over the 2016–17 to 2021–22 period, and will support families struggling to take care of their loved ones.

Disability Tax Credit Certification—Adding Nurse Practitioners as Eligible Medical Practitioners

For many Canadians, nurse practitioners are the first and most frequent point of contact with the health care system, but today, these professionals are not allowed to certify application forms for individuals with impairments who are applying for the Disability Tax Credit.

Budget 2017 proposes to add nurse practitioners to the list of medical practitioners that can certify the impacts of impairments for Disability Tax Credit applicants. The measure will apply to Disability Tax Credit certifications made on or after Budget Day. This is an important step to improve access to the credit in areas where, due to a shortage of medical doctors, nurse practitioners may be the primary care provider.

Extend Eligibility for the Tuition Tax Credit

The Government is firmly committed to helping Canadians of all ages receive the training and skills they need to succeed in the economy of today and tomorrow. The Tuition Tax Credit plays an important role in this effort, and recognizes the cost of enrolling in post-secondary and occupational skills courses.

Currently, students who take occupational skills courses below the post-secondary level (e.g., training in a second language or in basic literacy and numeracy to improve job skills) at a college or university cannot claim the Tuition Tax Credit, but those who take similar courses at a non-post-secondary institution can claim it. To improve fairness, Budget 2017 proposes to expand the range of courses eligible for this credit to include occupational skills courses that are undertaken at a post-secondary institution in Canada, and to allow the full amount of bursaries received for such courses to qualify for the scholarship exemption (where conditions are otherwise met). These changes will take effect as of the 2017 tax year.

Medical Expense Tax Credit—Clarifying the Treatment of Fertility-Related Expenses

Some of life’s greatest joys come from the experiences we share as a family, but some couples have difficulties expanding their families and require assistance. In some cases, such as single individuals and same-sex couples, the use of reproductive technologies may not be directly related to a medical infertility condition.

Budget 2017 proposes to clarify the application of the Medical Expense Tax Credit so that individuals who require medical intervention in order to conceive a child are eligible to claim the same expenses that would generally be eligible for individuals on account of medical infertility. This measure will apply to the 2017 and subsequent taxation years.

Eliminating Inefficient Tax Measures

Budget 2017 takes action to address tax measures that have had a limited impact, have had low take-up or duplicate other forms of federal support. Specifically, Budget 2017 proposes to:

- Eliminate the Public Transit Tax Credit, effective in respect of transit use occurring after June 30, 2017. Available evidence suggests that this credit has been ineffective in encouraging the use of public transit and reducing greenhouse gas emissions. The Government will provide $20.1 billion over 11 years to provinces and territories, plus at least $5 billion through the Canada Infrastructure Bank, for improved public transit (see Chapter 2).

- Repeal the Goods and Services Tax/Harmonized Sales Tax (GST/HST) rebate payable to non-resident tourists and non-resident tour operators in respect of the accommodation portion of tour packages. The rebate is complex and costly to administer, and benefits only a narrow segment of the Canadian tourism industry. The Government will instead invest in enhanced tourism marketing.

- Eliminate the surtax on domestic tobacco manufacturers, which now effectively applies to only a small share of tobacco products sold in Canada. Tobacco excise duties, which apply to all tobacco products sold in the Canadian market, will be adjusted to ensure that the peak level of revenues collected under the surtax in the early 2000s will be collected under the excise duty framework. This change will reinforce the goal of reducing tobacco consumption.

- Repeal the 25-per-cent Investment Tax Credit for Child Care Spaces given that it has had very low take-up and has not been effective in increasing the number of child care spaces provided by employers. Budget 2017 also proposes to invest an additional $7 billion over 10 years, starting in 2018–19, to support and create more high-quality, affordable child care spaces across the country.

- Repeal the additional deduction available to corporations that donate medicine to eligible registered charities, given high compliance costs for charities and very low take-up. Corporations will continue to be able to deduct the fair market value of donated medicine.

In addition, Budget 2017 confirms that the First-Time Donor's Super Credit will be allowed to expire in 2017 as planned, due to its low take-up, small average amounts donated, and the overall generosity of existing tax assistance for charitable donations.

Providing Greater Consistency

Budget 2017 also makes changes to improve consistency in the treatment of similar kinds of income and the consistency of tax measures with other priorities of the Government and current economic conditions.

Employee Benefits and Allowances

In today’s workforce, many Canadians receive benefits—such as a daily food allowance or transit fare—which are counted as taxable income. Yet certain tax measures allow some individuals to pay less than their fair share of taxes on such benefits. These measures are unfair and they lack a strong policy rationale. To improve consistency, Budget 2017 proposes to:

- Eliminate the deduction in respect of employee home relocation loans. Evidence suggests that this deduction disproportionately benefits the wealthy, and does little to help the middle class and those working hard to join it.

- Remove the tax exemptions for non-accountable expense allowances paid to members of provincial and territorial legislative assemblies and to certain municipal office-holders. This exemption is only available to certain provincial, territorial and municipal office holders, and provides an advantage that other Canadians do not enjoy.

Fossil Fuel Subsidies

The Government has a strong plan to invest in clean growth that will help create middle class jobs and get the country on the path to a low-carbon economy. Consistent with this plan, Canada has made a commitment with its partners in the G20 and Asia-Pacific Economic Cooperation to phase out inefficient fossil fuel subsidies. Such subsidies can encourage wasteful consumption, impede investment in clean energy sources, and undermine efforts to combat the threat of climate change.

In recent years, Canada has phased out a number of corporate income tax preferences for oil, gas, and coal mining. To make further progress, Budget 2017 proposes to:

- Modify the tax treatment of successful oil and gas exploratory drilling. The success rates for exploratory drilling have increased substantially since the 1990s and, in a majority of cases, discovery wells now lead to production, which makes the well an asset of enduring value. Consistent with the usual treatment of enduring assets, expenses associated with oil and gas discovery wells will be treated as Canadian development expenses, which are deducted gradually over time, rather than as immediately deductible Canadian exploration expenses, unless and until they are deemed unsuccessful.

- Remove the tax preference that allows small oil and gas companies to reclassify Canadian development expenses as immediately deductible Canadian exploration expenses when they are renounced to flow-through share investors. This will ensure that these development expenses, which create an asset of enduring value, are deducted gradually over time.

Maintaining the Effectiveness of the Excise Duty on Alcohol

The Government applies excise levies to products like tobacco, alcohol and certain fuels. These levies are generally imposed at the time of production or importation, and are paid by the manufacturer or importer. Excise levies can also be used to achieve specific policy goals, such as improving health.

Excise duty rates on alcohol products have not effectively changed since the mid-1980s. Over time, they have represented a smaller and smaller proportion of the total price of alcohol products, reducing their effectiveness. Budget 2017 proposes that, to maintain their effectiveness, excise duty rates on alcohol products be increased by 2 per cent effective the day after Budget Day, 2017, and that rates be automatically adjusted to the Consumer Price Index on April 1 of every year starting in 2018.

As the Government moves forward with a new taxation regime on cannabis, it will take steps to ensure that taxation levels remain effective over time.

Updating Tax Measures to Reflect Changes in the Economy

Over time, changes in the economy have made a number of provisions in Canada’s tax statutes less relevant than when they were first introduced. To address these changes, Budget 2017 proposes to:

- Amend the definition of a taxi business under the Excise Tax Act to level the playing field and ensure that ride-sharing businesses are subject to the same GST/HST rules as taxis.

- Eliminate the use of billed-basis accounting for income tax purposes by a limited group of professionals in order to avoid giving these professionals a deferral of tax that is not available to other taxpayers.

- Eliminate the income tax exemption for insurers of farming and fishing property, which was introduced in 1954 to encourage the provision of insurance in rural districts. With the increased sophistication today of the Canadian financial sector, insurance companies—including mutual companies—are well placed to effectively underwrite farming and fishing risks.

The income tax rules provide a deferral in respect of deferred cash purchase tickets issued for deliveries of certain listed grains. Given changes in the grain marketing regime in Canada, the Government is conducting a public consultation regarding the ongoing utility of this income tax deferral.

Maintaining a Resilient Financial Sector

To help provide a well-functioning environment in which citizens and businesses thrive, the Government’s policy objectives for the financial sector are financial stability, competition, and utility for financial system users. The financial system continues to adapt to emerging developments including global economic uncertainty, increased internationalization, a changing demographic environment and evolving consumer preferences.

The Government recently launched the Review of the Federal Financial Sector Framework to allow consideration of whether the framework continues to effectively meet its objectives in light of these developments and remains technically sound. Also, the Government recently took action to reinforce the Canadian housing finance system to help protect the long-term financial security of borrowers and all Canadians, and to improve tax fairness for Canadian homeowners.

Budget 2017 proposes targeted measures to support a resilient financial sector which contributes to a strong and growing economy, and renews funding to the Department of Finance Canada to continue its work in these areas.

What Success Will Look Like

The financial sector measures proposed in Budget 2017 will lead to:

- Greater resiliency for the Canadian financial sector.

- A modernized deposit insurance framework that continues to protect the deposits of Canadians and promote financial stability.

- Strengthened ability for Canada to combat money laundering and terrorist financing.

Protecting Financial Stability in Canada

The financial sector plays an integral role in allocating capital efficiently to households and businesses across the country. A stable financial sector is critical to a healthy Canadian economy. In response to the 2008 financial crisis, the Government of Canada endorsed a G20 plan to make the global financial system more resilient in order to reduce the likelihood and potential severity of future crises and subsequently took a range of actions to implement this plan.

To further this agenda, Budget 2017 proposes to introduce targeted legislative amendments to bolster the toolkit for managing the resolution of Canada’s largest banks, modernize the deposit insurance framework, and strengthen the oversight of systemically important financial market infrastructures which clear and settle financial transactions. These changes will further protect consumers and financial stability in the unlikely event of the failure of a financial institution.

Enhancing the Bank Resolution Regime

The 2008 financial crisis highlighted that some banks are “systemically important”—so important to the functioning of the financial system and economy that they cannot be wound up under a conventional bankruptcy and liquidation process should they fail without imposing unacceptable costs on the economy. Canada has six systemically important banks.

Following the financial crisis, and in line with international standards, the Government put into place measures to reduce the likelihood of failure for these banks and provide authorities with the means to restore a bank to viability in the unlikely event that it should fail, in a manner that protects financial stability as well as taxpayers.

These measures for systemically important banks include enhanced supervision, higher capital requirements and the development of a “bail-in” regime to reinforce that bank shareholders and creditors are responsible for the bank’s risks—not taxpayers. Further, since 2015, large Canadian banks have been working with the Canada Deposit Insurance Corporation (CDIC) to prepare their own resolution plans which describe how they could be resolved in an orderly manner, while ensuring the continuity of critical financial services.

To further strengthen Canada’s bank resolution regime, the Government proposes to introduce legislative amendments to:

- Formally designate CDIC as the resolution authority for its members and require Canada’s biggest banks to develop and submit resolution plans.

- Clarify the treatment of, and protections for, eligible financial contracts—such as derivatives—in a bank resolution process.

- Reinforce the Superintendent of Financial Institutions’ powers to set and administer the requirement for systemically important banks to maintain a minimum capacity to absorb losses in a resolution.

Deposit Insurance Review

Deposit insurance protects depositors’ savings in the unlikely event that a deposit-taking institution (e.g., a bank) fails. The deposit insurance framework contributes to maintaining confidence in the financial system and promotes financial stability.

A comprehensive review of Canada’s deposit insurance framework was recently undertaken to ensure that the framework provides adequate protection for the savings of Canadians. As part of the review, consultations were held in the fall of 2016 to seek the views of Canadians on possible improvements to the deposit insurance framework, such as streamlining deposit insurance categories, improving depositor understanding, and maintaining an adequate scope and level of coverage.

The Government proposes to introduce legislative amendments to modernize and enhance the Canadian deposit insurance framework to ensure it continues to meet its objectives, including supporting financial stability.

Strengthening the Oversight of Financial Market Infrastructures

A financial market infrastructure (FMI) is a system that facilitates the clearing, settling or recording of payments, securities, derivatives or other financial transactions among participating entities. FMIs play a critical role in the financial system and economy by enabling people and firms to safely and efficiently purchase goods and services, make financial investments, manage risks and transfer funds.

FMIs that are considered to have the potential to pose systemic or payments system risk are designated FMIs subject to Bank of Canada oversight. To support the efficiency and stability of Canada’s core national clearing and settlement infrastructure, the Government proposes to introduce legislative amendments to the Payment Clearing and Settlement Act to expand and enhance the oversight powers of the Bank of Canada by further strengthening the Bank of Canada’s ability to identify and respond to risks to FMIs in a proactive and timely manner.

FMIs apply strong risk management standards; however, there remains a remote possibility of a situation where they cannot continue to operate. The failure of a designated FMI could result in severe market disruption, and to contagion to other FMIs and the financial system more broadly, ultimately having a negative impact on the Canadian economy. The Government proposes to introduce legislative amendments to the Payment Clearing and Settlement Act to also implement an FMI resolution framework so that the appropriate toolkit is in place to intervene in the unlikely event that a designated FMI fails.

Strengthening Corporate and Beneficial Ownership Transparency

The Government of Canada is committed to implementing strong standards for corporate and beneficial ownership transparency that provide safeguards against money laundering, terrorist financing, tax evasion and tax avoidance, while continuing to facilitate the ease of doing business in Canada. Understanding the ownership and control of corporations is vital for good corporate governance and to protect the integrity of the tax and financial systems.

The Government will collaborate with provinces and territories to put in place a national strategy to strengthen the transparency of legal persons and legal arrangements and improve the availability of beneficial ownership information.

The Government is also examining ways to enhance the tax reporting requirements for trusts in order to improve the collection of beneficial ownership information.

These actions will ensure that law enforcement and other authorities have timely access to the information needed to crack down on money laundering, terrorist financing and tax evasion and to combat tax avoidance.

Strengthening Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime

Legislative and regulatory provisions of Canada’s anti-money laundering and anti-terrorist financing framework are regularly reviewed to ensure they meet the objectives of detecting and deterring money laundering and terrorist financing activities, while balancing rights under the Canadian Charter of Rights and Freedoms and privacy concerns. The Government proposes to introduce legislative amendments to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act to:

- Expand the list of disclosure recipients that can receive financial intelligence related to threats to the security of Canada to include the Department of National Defence and the Canadian Armed Forces.

- Support more effective intelligence on beneficial owners of legal entities.

- Make various technical and other changes to: strengthen the framework, support compliance, improve the ability of reporting entities to operationalize the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, and ensure the legislation functions as intended.

Parliamentary Approval of Government Borrowing

The Government is committed to enhancing the transparency and accountability of federal borrowing activities to Parliament and ultimately Canadians. To this end, it took steps in Budget 2016 to restore the requirement for Parliamentary approval of government borrowing plans.

As part of Budget 2016, amendments to the Financial Administration Act have been introduced to repeal the general power for the Governor in Council to authorize the Government’s borrowings, thereby requiring Parliament to approve the borrowings. The amendments also added a requirement for the Minister of Finance to ensure that the debt of agent Crown corporations does not exceed any legislative limit.

Budget 2017 proposes to implement this new framework by introducing legislation seeking Parliamentary approval of government borrowing.

In line with international standards, the Bank of Canada is modifying its methodology for publishing daily foreign exchange rates, which are used to translate borrowings and guarantees in foreign currency authorized by Parliament into Canadian dollars. Budget 2017 proposes to amend federal legislation to reflect the new published rates.

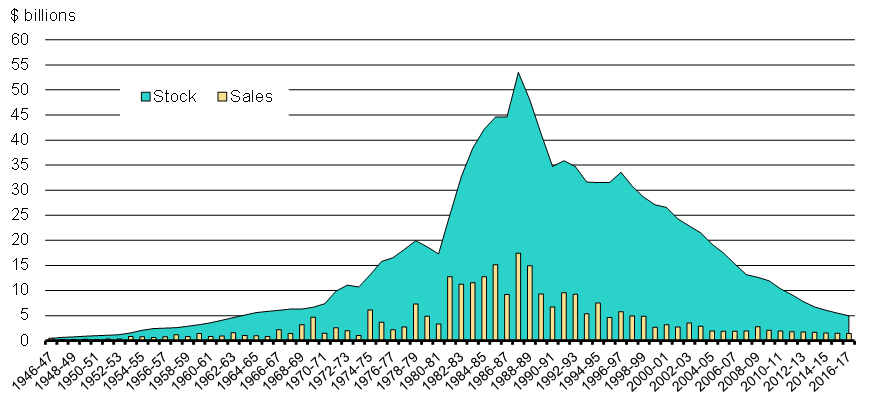

Phasing out the Canada Savings Bonds Program

The Canada Savings Bonds Program, created in 1946, has historically provided the Government of Canada with a diversified source of funds while offering Canadians a safe and easily accessible investment option. Since reaching its peak in the late-1980s, the Canada Savings Bonds Program has experienced a prolonged decline (see Chart 4.1). Canada Savings Bonds currently represent less than 1 per cent (about $5 billion) of total federal market debt. The Program is no longer a cost-effective source of funds for the Government, compared to wholesale funding options.

Evolution of Canada Savings Bonds Program Stock and Sales

Source: Bank of Canada.

This decline in the Program’s popularity can be attributed to the proliferation of higher-yielding alternative retail investment instruments, such as Government of Canada-insured retail products (including guaranteed investment certificates), mutual funds and low-commission trading accounts.

Given the decreasing popularity of Canada Savings Bonds among Canadians and following a review of the Program, the Government of Canada will discontinue the sales of new Canada Savings Bonds in 2017. The phasing out of the Program will result in cost savings from reduced Program management and administration costs and allow the Government of Canada to focus on less-costly funding options. All outstanding retail debt will continue to be honoured.

More information regarding the phasing out of the Canada Savings Bonds Program is provided in Annex 2 and on the Canada Savings Bonds website.

| 2016–2017 | 2017–2018 | 2018–2019 | 2019–2020 | 2020–2021 | 2021–2022 | Total | |

|---|---|---|---|---|---|---|---|

| A Fair and Efficient Tax System for Canadians | |||||||

| Closing Tax Loopholes | 0 | -54 | -60 | -60 | -65 | -65 | -304 |

| Cracking Down on Tax Evasion and Combatting Tax Avoidance | 0 | -122 | -232 | -335 | -511 | -733 | -1,933 |

| Modernizing Business Fees | 0 | 0 | -36 | -72 | -109 | -147 | -364 |

| Tax Relief for individuals and Families | 15 | 50 | 55 | 60 | 65 | 65 | 310 |

| Eliminating Inefficient Tax Measures | 0 | -215 | -265 | -270 | -275 | -280 | -1,305 |

| Providing Greater Consistency | 0 | -68 | -290 | -356 | -226 | -251 | -1,191 |

| Subtotal—A Fair and Efficient Tax System for Canadians | 15 | -409 | -827 | -1,033 | -1,122 | -1,411 | -4,788 |

| Maintaining a Resilient Financial Sector | |||||||

| Renewing Department of Finance Canada Funding to Support a Resilient Financial Sector | 0 | 2 | 2 | 2 | 2 | 2 | 9 |

| Subtotal—Maintaining a Resilient Financial Sector | 0 | 2 | 2 | 2 | 2 | 2 | 9 |

| Total—Chapter 4: Tax Fairness for the Middle Class | 15 | -407 | -826 | -1,032 | -1,120 | -1,409 | -4,779 |

| Less funds existing in the fiscal framework | 0 | -2 | -2 | -2 | -2 | -2 | -9 |

| Less projected savings | 0 | 0 | -1 | -2 | -4 | -23 | -31 |

| Net Fiscal Cost | 15 | -409 | -829 | -1,036 | -1,126 | -1,434 | -4,818 |