Archived - Chapter 1:

Making Life More Affordable and Supporting the Middle Class

On this page:

Since 2015, the federal government's focus has been investing in the middle class, growing the economy, strengthening Canada's social safety net, and making life more affordable for Canadians.

The government introduced the Canada Child Benefit, and as a result, hundreds of thousands of children have been lifted out of poverty and millions of Canadian families have support with the costs of raising children.

Increases to the Guaranteed Income Supplement, Old Age Security, and the Canada Pension Plan mean more seniors can enjoy the secure and dignified retirements they deserve.

An historic 2021 investment in a Canada-wide system of affordable early learning and child care has already delivered a 50 per cent average reduction in fees for regulated child care, brought fees down to just $10 a day in six provinces and territories, with the rest on track to reach this milestone by 2026, and strengthened the existing child care system in Quebec.

To ensure every Canadian has a safe and affordable place to call home, the government has a plan that will help put Canada on the path to double the number of new homes that will be built in Canada within a decade, help more Canadians buy their first home, and curb the unfair practices that are driving up prices.

At a time of elevated global inflation, the government has also provided new, targeted support to the Canadians who need it most, and strengthened existing programs, such as the Canada Workers Benefit, that support millions of hardworking Canadians.

But we know that, for millions of Canadians, inflation means it is still difficult to make ends meet and put food on the table. In response, Budget 2023 delivers new, targeted inflation relief for the most vulnerable Canadians to support them with the cost of living.

Budget 2023 also announces new support for students, new measures that will make life more affordable for the middle class, and further progress on the government's plan to make housing more affordable for Canadians.

Federal Investments That Are Making Life More Affordable

This year, Canadians will continue to benefit from the federal government's efforts since 2015 to make life more affordable. For example:

-

A family with one child in Ontario, with income of $85,000, in 2023 could benefit from about $11,300 as a result of reduced child care costs, the Canada Child Benefit, the Canada Dental Benefit, tax relief from an increased Basic Personal Amount, and increased Climate Action Incentive payments.

-

A single parent with one child in Newfoundland and Labrador, with income of $40,000 in 2023, could benefit from $7,300 as a result of reduced child care costs, the Canada Child Benefit, enhancements to the Canada Workers Benefit, the Canada Dental Benefit, the proposed Grocery Rebate, tax relief from an increased Basic Personal Amount, and increased Climate Action Incentive payments.

-

A 76-year-old senior in British Columbia with a maximum Guaranteed Income Supplement (GIS) entitlement could receive more than $2,000 in additional support in 2023, thanks to the proposed Grocery Rebate, the GIS top-up increase for single seniors from 2016, and the increase in the Old Age Security pension for seniors aged 75 and older.

-

A low-income student in Manitoba could receive more than $5,600 in additional support in 2023 thanks to proposed enhancements to Canada Student Grants and Canada Student Loans, the proposed Grocery Rebate, and increased Climate Action Incentive payments. If they have a disability or dependents, they could receive an additional $12,800 in specialized student grants, plus an extra $640 per dependent. After graduating, all of their federal student loans will be interest-free, with repayment assistance if their income is below $40,000 per year.

Key Ongoing Actions

Since 2015, the federal government has made significant investments to support Canadians and make life more affordable. These have included:

-

Supporting about 3.5 million families annually through the tax-free Canada Child Benefit, with families this year receiving up to $6,997 per child under the age of six, and up to $5,903 per child aged six through 17;

-

Increasing Old Age Security benefits for seniors age 75 and older by ten per cent as of July 2022, which is providing more than $800 in additional support to full pensioners;

-

Reducing fees for regulated child care by 50 per cent on average, delivering regulated child care that costs an average of just $10 a day by 2026—with six provinces and territories reducing child care fees to $10-a-day or less by April 2, 2023—and strengthening the child care system in Quebec with more child care spaces;

-

Strengthening the Canada Pension Plan, which will eventually raise the maximum retirement benefit by up to 50 per cent;

-

Enhancing the Canada Workers Benefit for our lowest-paid—and often most essential—workers, to provide up to $1,428 for a single worker without children, up to $2,461 to a family, and an additional $737 for workers with disabilities;

-

Permanently eliminating interest on Canada Student Loans, and ensuring borrowers do not need to make payments on their loans until they earn at least $40,000 per year; and,

-

Fighting climate change while making life more affordable with a federal price on pollution that puts more money back in the pockets of eight out of every ten Canadians in the provinces where it applies.

1.1 Making Life More Affordable

Despite Canada's strong recovery from the pandemic, today, too many Canadians are struggling with the impacts of global inflation, which is making the cost of living a real challenge.

In the past year, the federal government has strengthened Canada's social safety net and provided targeted inflation relief to the Canadians who need it most. In Budget 2023, the government is introducing new, targeted measures to support Canadians. As with previous inflation relief, this new support has been carefully designed to avoid exacerbating inflation.

Budget 2023 also takes new steps to put money in the pockets of people who need it most, crack down on junk fees, save Canadians money, and make post-secondary education more affordable.

New Support for Those Who Need It Most

In the past year, the government has introduced a suite of new, targeted measures to provide support to the Canadians who need it most and help them pay the bills. This includes:

-

An enhanced Canada Workers Benefit, which means families could receive up to $2,461 this year, and a single Canadian without children could receive up to $1,428;

-

$2.5 billion for one-time inflation relief payments to about 11 million low- and modest-income Canadians, worth up to $467 for a couple with two children, and up to $234 for a single Canadian without children;

-

Direct, tax-free payments of up to $1,300 per child over two years to eligible families to cover dental expenses for their children under 12;

-

A tax-free payment of $500 to help low-income people who are struggling with the cost of rent;

-

A ten per cent increase in Old Age Security (OAS) payments for seniors who are 75 and older, which is providing over $800 in new supports to full pensioners in the first year; and,

-

A cross-Canada reduction of fees for regulated child care of 50 per cent on average, with six provinces and territories reducing child care fees to $10-a-day or less by April 2, 2023, based on Quebec's strong example.

In addition, important benefits like the Canada Child Benefit, Canada Pension Plan, OAS, and the Guaranteed Income Supplement all keep pace with inflation.

Delivering Savings for Families Through Early Learning and Child Care

The federal government's historic investment in a Canada-wide early leaning and child care system is making life more affordable for families, helping to give children across Canada the best start in life, and strengthening our workforce. Today, fewer women have to choose between their family and their career, and in February 2023, the labour force participation rate for women in their prime working years reached a record 85.7 per cent.

By April 2, 2023, six provinces and territories will be providing regulated child care for an average of just $10-a-day or less—significantly ahead of schedule. All other provinces and territories remain on track to achieve $10-a-day child care by 2026. In Quebec, federal investments are continuing to make the existing child care system more accessible through the creation of new spaces.

Province / Territory |

Status of Fee Reduction | Estimated Savings per Child (Gross, Annual)1 |

|---|---|---|

| BC | 50 per cent on average reduction achieved as of December 2022 | Savings of up to $6,600 per child |

| AB | 50 per cent on average reduction achieved as of January 2022 | Savings of up to $10,3302 per child |

| SK | $10-a-day effective April 1, 2023 | Savings of up to $6,9003 per child |

| MB | $10-a-day effective April 2, 2023 | Savings of up to $2,610 per child |

| ON | 50 per cent on average reduction achieved as of December 2022 | Savings of up to $8,5004 per child |

| NB | 50 per cent on average reduction achieved as of June 2022 | Savings of up to $3,900 per child |

| PEI | 50 per cent on average reduction achieved as of October 2022 | Savings of up to $2,000 per child |

| NS | 50 per cent on average reduction achieved as of December 2022 | Savings of up to $6,0005 per child |

| NL | $10-a-day achieved as of January 1, 2023 | Savings of up to $6,300 per child |

| YK | $10-a-day achieved in April 2021, prior to Budget 2021 | Savings of up to $7,300 per child |

| NWT | 50 per cent on average reduction achieved as of January 2022 | Savings of up to $4,950 per child |

| NU | $10-a-day achieved as of December 2022 | Savings of up to $14,300 per child |

| QC6 | Under its asymmetrical agreement, Quebec has committed to creating 30,000 new child care spaces by March 2026. | |

|

1 Estimated savings for BC, AB, SK, ON, NB, PEI, NS, NL, and NWT are provincial and territorial estimates. Remaining savings calculations (MB, YK, and NU) are Employment and Social Development Canada estimates and are illustrative only. All estimates are relative to 2019 levels unless updated data is provided by provinces and territories. All estimates are based on out-of-pocket parent fees excluding amounts that would be recovered through provincial/territorial tax credits or the federal child care expense deduction at tax time, or changes to provincial/territorial or federal benefits as a result of lower child care expenses. Actual savings for families will vary based on factors such as actual fees paid prior to reductions. Provincial and territorial methodologies and data for calculating estimated savings may vary. 2 Based on Alberta's savings scenario of a family earning $130,000/year previously paying $1,200/month for infant care and now paying $339/month. 3 Based on Saskatchewan's average savings estimate of $573/month for full-time infant care as of April 2023. 4 Based on Ontario's savings scenario of a family paying $62-a-day per child at the beginning of 2022 and $29.30-a-day effective December 31, 2022. 5 Based on Nova Scotia's savings scenario for an infant in full-time licensed child care. 6 The Government of Canada has entered into an asymmetrical agreement with the province of Quebec that will allow for further improvements to its early learning and child care system, where parents with a subsidized, reduced contribution space already pay a single fee of less than $10-a-day. |

||

A New Grocery Rebate for Canadians

View the impact assessmentGroceries are more expensive today, and for many Canadians, higher prices on essential goods are causing undue stress. In Budget 2023, the federal government is providing new, targeted inflation relief to the Canadians who need it most.

For 11 million low- and modest-income Canadians and families, the Grocery Rebate will provide eligible couples with two children with up to an extra $467; single Canadians without children with up to an extra $234; and seniors with an extra $225 on average. This will be delivered through the Goods and Services Tax Credit (GST Credit) mechanism.

By targeting the Grocery Rebate to the Canadians who need it most, the government will be able to provide important relief without making inflation worse.

-

Budget 2023 proposes to introduce a one-time Grocery Rebate, providing $2.5 billion in targeted inflation relief to the Canadians who need it most. The Grocery Rebate will be delivered through a one-time payment from the Canada Revenue Agency as soon as possible following the passage of legislation.

Alex works as a cashier at a convenience store, and Sam works part-time as a cook at a restaurant. Together, they earn $38,000 to support their two young children. Higher prices at the grocery store have strained their already tight budget, and they are struggling to make ends meet. On top of the enhanced Canada Workers Benefit, the Canada Child Benefit, and the GST Credit they already receive, the Grocery Rebate will make it easier for them to buy the healthy food their growing children need by providing them with $467.

Brandan earns $32,000 per year working at a gym. Between the higher costs of rent, car payments, and groceries, he is having a tough time paying the bills at the end of the month. The Grocery Rebate will provide him with $234, on top of the enhanced Canada Workers Benefit and the GST Credit.

Cracking Down on Junk Fees

Unexpected, hidden, and additional fees add up quickly. From internet overage charges, to roaming fees, to additional airline charges, Canadians deal with junk fees every day.

In Budget 2023, the federal government is taking action to crack down on junk fees, to continue to ensure businesses are transparent with prices, and to make life more affordable for Canadians.

-

Budget 2023 announces the government's intention to work with regulatory agencies, provinces, and territories to reduce junk fees for Canadians. This could include higher telecom roaming charges, event and concert fees, excessive baggage fees, and unjustified shipping and freight fees.

The government will strengthen existing tools or create new ones, including through new legislative amendments, to achieve this objective.

This builds on recent steps the government has taken to protect Canadians from hidden costs, including:

-

Amendments to the Competition Act to strengthen protections against hidden prices;

-

Amendments to the Bank Act and Financial Consumer Agency of Canada Act to protect Canadians' rights and interests when dealing with their banks; and,

-

A new policy direction to the Canadian Radio-television and Telecommunications Commission to ensure Canadians can affordably and easily change, downgrade, or cancel services.

Cracking Down on Predatory Lending

View the impact assessmentPredatory lenders can take advantage of some of the most vulnerable people in our communities, including low-income Canadians, newcomers, and seniors—often by extending very high interest rate loans. The current criminal rate of interest under the Criminal Code, equivalent to 47 per cent APR (annual percentage rate), can trap Canadians in a cycle of debt that they cannot afford and cannot escape. In Quebec, the maximum interest rate for consumers is currently 35 per cent.

-

Budget 2023 announces the federal government's intention to introduce changes to the Criminal Code to lower the criminal rate of interest from the equivalent of 47 per cent APR to 35 per cent APR, and to launch consultations on whether the criminal rate of interest should be further reduced.

-

Budget 2023 announces the government's intention to adjust the Criminal Code's payday lending exemption to require payday lenders to charge no more than $14 per $100 borrowed. This cap is in line with the lowest cap among provinces, in Newfoundland and Labrador.

-

Budget 2023 also announces that the government will launch consultations on additional revisions to the Criminal Code's provincial/territorial-requested payday lending exemption.

Hannah is a single mother in Guelph who makes $35,000 as a cleaner at a hospital. Her car broke down and she needs $5,000 for immediate repairs so she can get to her job. Hannah works hard, but as a result of the debts she has accumulated to support her children, traditional banks will not lend her money. In need of money quickly, Hannah turns to a lender who has been advertising across town and takes out a loan with a 46.9 per cent interest rate.

Weeks later, Hannah realizes that she will need to borrow more money to repay this loan, and has suddenly found herself trapped in a cycle of debt. With changes the federal government is making to the criminal rate of interest, the highest interest loan that Hannah could receive would be no more than 35 per cent. On a $5,000 loan with a two year amortization period at the new rate, she will have saved $775 over the life of the loan.

Lowering Credit Card Transaction Fees for Small Businesses

The pandemic brought an increase in people using credit cards when they shop. Small businesses pay fees to process credit card transactions, with the largest component being the "interchange fee" paid to credit card issuers. To support hardworking owners of small businesses, the federal government has been working closely with the payment card industry and small businesses to lower these transaction fees.

-

In Budget 2023, the government is announcing that it has secured commitments from Visa and Mastercard to lower fees for small businesses, while also protecting reward points for Canadian consumers offered by Canada's large banks.

More than 90 per cent of credit card-accepting businesses will see their interchange fees reduced by up to 27 per cent from the existing weighted average rate. These reductions are expected to save eligible small businesses in Canada approximately $1 billion over five years. Combined with the prior actions of this government in 2020, these measures amount to nearly $1.5 billion of costs savings achieved for small businesses.

Small businesses will also benefit from free access to online fraud and cyber security resources from Visa and Mastercard to help them grow their online sales, while preventing fraud and chargebacks.

The government's expectation is that the commitments by credit card networks to lower interchange fees for small businesses will not adversely impact interchange fees paid by other businesses. The government also expects other credit card companies to take similar actions to lower fees for small businesses, and that payment processors will pass these reductions through to small businesses. To achieve this, the government will be engaging with networks, acquirers, and payment service providers.

More details, including eligible businesses, will be released in the coming weeks.

Malik and Sebastian own a small local sports store in Edmonton with $300,000 in annual credit card sales. Because of the commitments secured by the federal government, they are expected to see interchange savings of $1,080 per year. This year, Malik and Sebastian can use that $1,080 to advertise and grow their business.

Supporting Your Right to Repair

When it comes to broken appliances or devices, high repair fees and a lack of access to specific parts often mean Canadians are pushed to buy new products rather than repairing the ones they have. This is expensive for people and creates harmful waste.

Devices and appliances should be easy to repair, spare parts should be readily accessible, and companies should not be able to prevent repairs with complex programming or hard-to-obtain bespoke parts. By cutting down on the number of devices and appliances that are thrown out, we will be able to make life more affordable for Canadians and protect our environment.

-

Budget 2023 announces that the government will work to implement a right to repair, with the aim of introducing a targeted framework for home appliances and electronics in 2024.

The government will launch consultations this summer, including on the right to repair and the interoperability of farming equipment, and work closely with provinces and territories to advance the implementation of a right to repair.

Bella needs to fix her phone and goes to a repair booth at her local mall. Despite it being a simple fix, copyright rules prevent third-party access to the repair she needs. This forces Bella to fix her phone directly with the phone manufacturer, which costs far more than it should. Once the federal government introduces a right to repair, the simple repair could be done at the mall for a much lower price.

Common Chargers for Your Devices

Over the past decade, multiple chargers have been developed by manufacturers for phones, tablets, cameras, laptops, and other devices. Every time Canadians purchase new devices, they need to buy new chargers to go along with them, which drives up costs and increases electronic waste. Recently, the European Union moved towards mandating USB-C charging ports for all small handheld devices and laptops by the end of 2024.

-

Budget 2023 announces that the federal government will work with international partners and other stakeholders to explore implementing a standard charging port in Canada, with the aim of lowering costs for Canadians and reducing electronic waste.

Automatic Tax Filing

View the impact assessmentUp to 12 per cent of Canadians currently do not file their tax returns—the majority of whom are low-income, and would pay little to no income tax. In fact, many of these low-income Canadians are missing out on valuable benefits and support to which they are entitled, such as the Canada Child Benefit and the Guaranteed Income Supplement.

Since 2018, the Canada Revenue Agency (CRA) has delivered a free and simple File My Return service, which allows eligible Canadians to auto-file their tax return over the phone after answering a series of short questions. Canadians with simple tax situations and lower or fixed income receive an invitation letter from the CRA to use File My Return, and in the 2022 tax filing season, approximately 53,000 returns were filed using this service.

-

To ensure more low-income Canadians have the ability to quickly and easily auto-file their tax returns, Budget 2023 announces that the federal government will increase the number of eligible Canadians for File My Return to two million by 2025—almost triple the current number. The government will report on its progress in 2024.

-

Budget 2023 also announces that, starting next year, the CRA will pilot a new automatic filing service that will help vulnerable Canadians who currently do not file their taxes receive the benefits to which they are entitled. Following consultations with stakeholders and community organizations, the CRA will present a plan in 2024 to expand this service even further.

The government will continue to explore other avenues, including potential legislative changes, to ensure vulnerable Canadians receive the benefits to which they are entitled.

Making Life More Affordable for Students

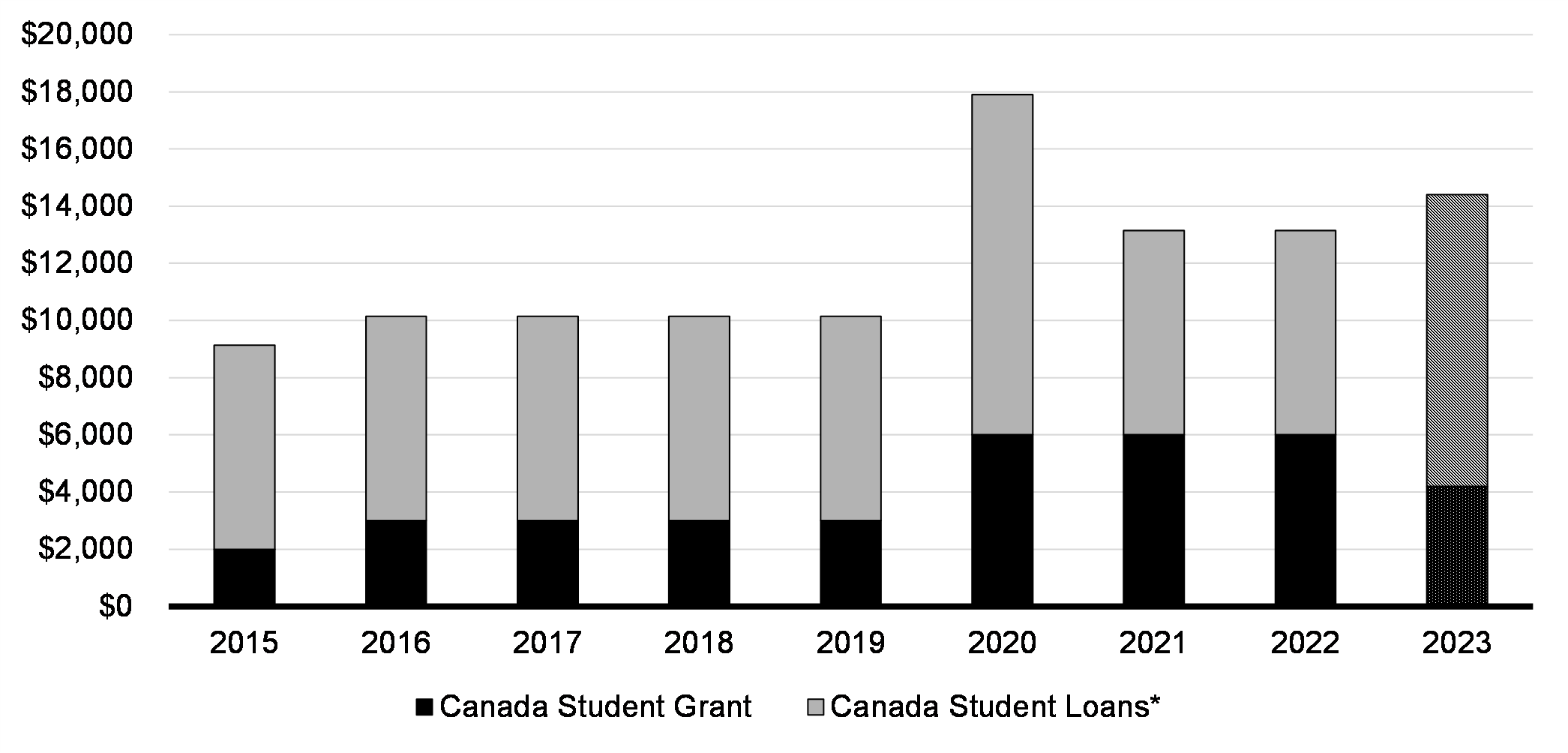

View the impact assessmentOver 750,000 post-secondary students rely on federal assistance each year to help them afford the cost of tuition, housing, and everyday essentials. To make the transition from school to working life easier, the federal government permanently eliminated interest on Canada Student Loans and Canada Apprentice Loans, and made changes to loan repayment assistance so that nobody earning less than $40,000 per year needs to make payments on their federal student loans.

When COVID-19 disrupted students' lives, the federal government responded by doubling Canada Student Grants—income-tested support that hardworking, ambitious young people receive when the cost of going to school is out of reach for them and their parents. This meant students could receive up to $6,000 in up-front, non-repayable aid each school year, for three years starting in the 2020-21 school year. This support is currently set to expire on July 31, 2023. But with life costing more and with students still in need of support to afford an education, the government knows it is important that students can afford to pursue their dreams.

-

Budget 2023 proposes to provide $813.6 million in 2023-24 to enhance student financial assistance for the school year starting August 1, 2023. This includes:

-

Increasing Canada Student Grants by 40 per cent—providing up to $4,200 for full-time students.

-

Raising the interest-free Canada Student Loan limit from $210 to $300 per week of study.

-

Waiving the requirement for mature students, aged 22 years or older, to undergo credit screening in order to qualify for federal student grants and loans for the first time. This will allow up to 1,000 additional students to benefit from federal aid in the coming year.

-

These changes will allow post-secondary students to access up to $14,400 in enhanced Canada Student Financial Assistance for the upcoming school year. Students with disabilities and students with dependents will also receive an increase in Canada Student Grants.

This builds on ongoing supports the federal government has introduced to make life more affordable for students and young people, such as extending enhanced federal student supports to include part-time students with dependents, and providing up to $20,000 per year to help students with persistent, prolonged, or permanent disabilities afford necessary services and equipment for their studies.

The federal government will work with students in the year ahead to develop a long-term approach to student financial assistance, in time for Budget 2024.

Quebec, the Northwest Territories, and Nunavut, which do not participate in the program, can receive federal funding to provide their own comparable support.

Doug is a full-time student at the University of Prince Edward Island. Despite savings from a summer job and his small scholarship, the rising cost of living means Doug is still having a hard time affording the cost of tuition, textbooks, and housing. A $1,200 increase to his $3,000 base Canada Student Grant, combined with up to $10,200 in interest-free Canada Student Loans, will help to cover those costs. Because his Canada Student Grant is paid up front, Doug is able to pay his tuition at the start of the year, purchase his textbooks, and provide the first month of rent at his new home in Charlottetown.

Total Federal Aid Available to a Full-Time Student Based on Financial Need, by School Year

Improving Registered Education Savings Plans

View the impact assessmentThe cost of attending a post-secondary school has risen in recent years. Registered Education Savings Plans (RESPs) are an important part of saving for post-secondary education. In a typical year, nearly 500,000 students withdraw funds from an RESP to support their education. However, the withdrawal limits for RESPs have not increased in 25 years. In Budget 2023, the federal government is taking steps to improve these plans for students and help them afford the costs of pursuing an education.

-

Budget 2023 proposes to increase limits on certain RESP withdrawals from $5,000 to $8,000 for full-time students, and from $2,500 to $4,000 for part-time students.

-

Budget 2023 also proposes to allow divorced or separated parents to open a joint RESP for their children, which will make it easier and more affordable for parents to save for their children's education.

Hélène is planning to start full-time studies at the University of Manitoba in the fall. She estimates that she'll need $7,000 for the first semester to help cover tuition, books, and living expenses. An increased limit on withdrawals of Educational Assistance Payments from her RESP helps her access more of the government support in the account and get through the fall.

Supporting Our Seniors

Our seniors have made Canada what it is today, and the federal government provides them with much-needed income support.

The Old Age Security (OAS) program—consisting of the OAS pension, the Guaranteed Income Supplement (GIS), and the Allowances—is Canada's largest federal program, forecasted to provide $75.9 billion in support to seniors in 2023-24. As of January 2023, there were more than seven million OAS recipients, including close to 2.4 million GIS recipients, plus about 72,000 Allowance recipients. In January, seniors received a maximum of $687.56 through OAS, with $756.32 delivered to those 75 and over. A single senior in receipt of the GIS received a maximum of an additional $1,026.96.

These benefits are adjusted each quarter to help keep up with inflation, which provides important, stable income for seniors.

Since 2016, the federal government has taken significant action to further support our seniors. This includes:

-

A ten per cent increase to the maximum GIS benefit for single seniors;

-

Reversing the previous government's announced increase to the eligibility age for OAS and GIS back to age 65 from 67, providing financial security to those aged 65 and 66;

-

As of July 2022, a ten per cent increase to the OAS pension for seniors age 75 and over, which is providing additional benefits of over $800 to full pensioners in the first year; and,

-

$6 billion over ten years to provinces and territories for the delivery of home care services for seniors who want to continue to live at home.

Because of the government's investments, the indexation of benefits to inflation, and the growing seniors population, OAS, GIS, and Allowance expenditures are projected to grow by close to 30 per cent to $96.3 billion in 2027-28 from 2023-24—an increase of more than $20 billion per year and growing.

1.2 An Affordable Place to Call Home

Everyone should have a safe and affordable place to call home. However, for too many Canadians, including young people and new Canadians, the dream of owning a home is increasingly out of reach, and paying rent has become more expensive across the country. This is undermining the financial stability of an entire generation of Canadians.

A lack of affordable housing also has an impact on our economy. Without more homes in our communities, it is difficult for businesses to attract the workers they need to grow and succeed, and when people spend more of their income on housing, it means less money is being spent in our communities.

This is a complex and longstanding issue—one that requires a real plan to address the multitude of factors that are making housing more expensive in Canada.

Budget 2022 announced significant investments to make housing more affordable, including by helping people buy their first home, tackling unfair practices that drive up costs, and working with provincial and territorial governments, municipalities, and both the private sector and non-profits to double the number of new homes that Canada will build by 2032. Budget 2023 proposes new measures to build on this progress and continue the government's work to make housing more affordable from coast to coast to coast.

Recent Action to Make Housing More Affordable

Over the past year, the federal government has taken significant steps towards making housing more affordable for Canadians. These have included:

-

Introducing a two-year ban on non-resident, non-Canadians purchasing residential property to help curb speculation and ensure that houses are used as homes for Canadians to live in, rather than as financial assets for foreign investors;

-

Introducing a one per cent annual underused housing tax on the value of non-resident, non-Canadian owned residential property that is vacant or underused;

-

Introducing a new Tax-Free First Home Savings Account to allow Canadians to save up to $40,000, tax-free, to help buy their first home;

-

Making sure that profits from flipping properties held for less than 12 months are taxed fully and fairly;

-

Doubling the First-Time Home Buyers' Tax Credit to provide up to $1,500 in direct support to home buyers to offset closing costs involved in buying a first home;

-

Introducing a new, refundable Multigenerational Home Renovation Tax Credit, which will provide up to $7,500 in support for constructing a secondary suite for a senior or an adult with a disability, starting in 2023;

-

Applying the Goods and Services Tax/Harmonized Sales Tax to all assignment sales of newly constructed or substantially renovated residential housing, to help address speculative trading in the housing market;

-

Launching a new $4 billion Housing Accelerator Fund to remove barriers and incentivize housing supply growth, with the goal of creating at least 100,000 net new homes across Canada;

-

Launching a $200 million stream under the Affordable Housing Innovation Fund to develop and scale up rent-to-own projects;

-

Launching a third round of the Rapid Housing Initiative, which is providing $1.5 billion to create 4,500 new affordable housing units for Canadians in severe housing need, with 25 per cent of investments going to housing projects targeted towards women;

-

Delivering over $500 million towards the government's goal of ending chronic homelessness, through Reaching Home, Canada's Homelessness Strategy; and,

-

Delivering a top-up to the Canada Housing Benefit in December 2022, which provided low-income renters with a $500 payment to help with the cost of housing.

Launching the New Tax-Free First Home Savings Account

Over the past several years, as house prices have continued to climb, the cost of a down payment has become increasingly out of reach for far too many young people.

In Budget 2022, the federal government committed to introducing a Tax-Free First Home Savings Account—a new registered plan to give prospective first-time home buyers the ability to save $40,000 on a tax-free basis. Like a Registered Retirement Savings Plan (RRSP), contributions will be tax-deductible, and withdrawals to purchase a first home—including from investment income—will be non-taxable, like a Tax-Free Savings Account (TFSA). Tax-free in; tax-free out.

In Budget 2023, the government is delivering on this commitment.

-

Budget 2023 announces that financial institutions will be able to start offering the Tax-Free First Home Savings Account to Canadians as of April 1, 2023.

Olivia and Amira want to buy a home. Starting April 1, 2023, they each save the maximum $8,000 per year in their Tax-Free First Home Savings Account, which they can deduct from their income at tax time. They both make between $70,000 and $100,000, and the Tax-Free First Home Savings Account allows them each to receive an annual federal tax refund of $1,640.

After four years of saving, Olivia and Amira have a combined $90,000, including tax-free investment income, in their Tax-Free First Home Savings Account, which they can use towards a down payment on their first home.

They can withdraw their down payment tax-free, saving thousands of dollars that can be put towards their new home. In addition, they will claim the First-Time Home Buyers' Tax Credit, providing an additional $1,500 in tax relief.

A Code of Conduct to Protect Canadians With Existing Mortgages

Elevated interest rates have made it harder for some Canadians to make their mortgage payments, particularly for those with variable rate mortgages. Canadians have the right to work with their mortgage lender to explore mortgage relief options that will help them stay in their home.

-

The federal government, through the Financial Consumer Agency of Canada, is publishing a guideline to protect Canadians with mortgages who are facing exceptional circumstances. Specifically, the government is taking steps to protect Canadians and ensure that federally regulated financial institutions provide Canadians with fair and equitable access to relief measures that are appropriate for the circumstances they are facing, including by extending amortizations, adjusting payment schedules, or authorizing lump-sum payments. Existing mortgage regulations may also allow lenders to provide a temporary mortgage amortization extension—even past 25 years.

This guideline will ensure that Canadians are treated fairly and have equitable access to relief, without facing unnecessary penalties, internal bank fees, or interest charges, which will help more Canadians afford the impact of elevated interest rates.

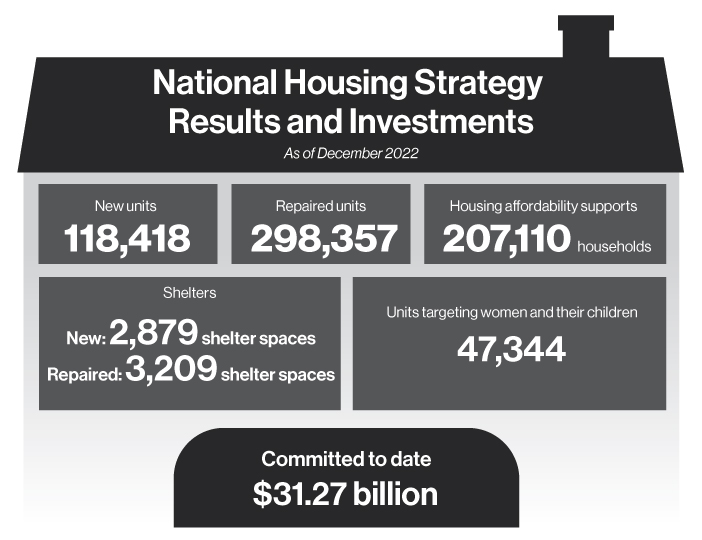

Building More Affordable Housing

View the impact assessmentRising interest rates and construction costs have made it more expensive to build housing. To ensure that Canada's National Housing Strategy programs can continue to deliver new affordable homes for Canadians, especially for the most vulnerable, the federal government is taking action.

-

Budget 2023 announces the government's intention to support the reallocation of funding from the National Housing Co-Investment Fund's repair stream to its new construction stream, as needed, to boost the construction of new affordable homes for the Canadians who need them most.

National Housing Strategy Results and Investments

Investing in an Urban, Rural, and Northern Indigenous Housing Strategy

View the impact assessmentAccess to safe and affordable housing is critical to improving health and social outcomes, and to ensuring a better future for Indigenous communities and children. That is why the federal government has committed more than $6.7 billion since 2015 to support housing in Indigenous communities.

In particular, Indigenous people living in urban, rural, and northern areas face unique challenges accessing adequate housing, and do not qualify for support that is provided to Indigenous people living on reserve. Delivering on the government's previous commitment, Budget 2022 announced $300 million towards an Urban, Rural, and Northern Indigenous Housing Strategy, which is currently being co-developed with Indigenous partners.

-

Budget 2023 proposes to commit an additional $4 billion, over seven years, starting in 2024-25, to implement a co-developed Urban, Rural, and Northern Indigenous Housing Strategy.

A Housing Market That Works for Canadians

Homes should be for Canadians to live in—not a financial asset class. The federal government remains concerned with the financialization of housing across Canada, and introduced important measures in Budget 2022 to address it, including a two-year ban on foreign investment in Canadian housing, a tax on underused foreign-owned homes, the taxing of assignment sales, and ensuring that property flippers pay their fair share.

While large corporate investors own a significant share of Canada's rental units and will play an important role in building new homes, the government recognizes that too many Canadians have experienced excessive renovictions, above-guideline rent increases, and other actions that have made rent more expensive. More needs to be done to ensure these homes are affordable for Canadians, which is why policy changes applicable to all large corporate landlords could be considered to ensure best outcomes on affordability and fair treatment of tenants.

The government is committed to ensuring that investor activity, especially among those who own a significant number of investment properties, is helping, not hurting, housing affordability in Canada and will review whether the government needs to rebalance the housing market in favour of Canadians looking for a home to live in.

The government is also working with provinces and territories on the development of a Home Buyers' Bill of Rights, which will help level the playing field for young, middle class, and new Canadians by making the process of buying a home more open, transparent, and fair. The Home Buyers' Bill of Rights could include ensuring the legal right to a home inspection, requiring that real estate agents disclose whether they are representing both sides of a potential sale, and ensuring transparency on the history of sale prices.

-

To ensure the dream of home ownership is a possibility for all Canadians, Budget 2023 announces that the government will consult on changes required to remove regulatory barriers for homebuyers from diverse communities seeking access to alternative financing products.

| 2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026-2027 | 2027-2028 | Total | |

|---|---|---|---|---|---|---|---|

| 1.1. Making Life More Affordable | 2,475 | 814 | 0 | 0 | 0 | 0 | 3,289 |

| A New Grocery Rebate for Canadians | 2,475 | 0 | 0 | 0 | 0 | 0 | 2,475 |

| Making Life More Affordable for Students | 0 | 814 | 0 | 0 | 0 | 0 | 814 |

| 1.2. An Affordable Place to Call Home | 0 | 0 | 300 | 500 | 500 | 600 | 1,900 |

| Investing in an Urban, Rural, and Northern Indigenous Housing Strategy | 0 | 0 | 300 | 500 | 500 | 600 | 1,900 |

| Additional Investments – Making Life More Affordable and Supporting the Middle Class | 0 | 6 | 24 | 25 | 0 | 0 | 55 |

| National Housing Strategy Implementation View the impact assessment | 0 | 6 | 24 | 25 | 0 | 0 | 55 |

| Operating funding for CMHC to support National Housing Strategy programs. | |||||||

| Chapter 1 - Net Fiscal Impact | 2,475 | 820 | 324 | 525 | 500 | 600 | 5,243 |

|

Note: Numbers may not add due to rounding. A glossary of abbreviations used in this table can be found at the end of Annex 1. |

|||||||

Page details

- Date modified: